53c47f314a6579ff9e17e62d66cdb0f3.ppt

- Количество слайдов: 67

Exam II Review Session State Farm Car Policy Review U of I Student Health Policy Review Assignment 7 Assignment 8 Assignment 9 Assignment 10

Exam II Review Session State Farm Car Policy Review U of I Student Health Policy Review Assignment 7 Assignment 8 Assignment 9 Assignment 10

State Farm Car Policy

State Farm Car Policy

Brian’s Special Rules First decide what type of car it is and if it is covered Insurance follows the car, driver pays excess Spouse’s car is never covered Rental cars are covered up to 21 days Replacement cars covered for up to 30 days Additional Cars covered up to 30 days or until effective date of policy Know the flow chart for non-owned cars

Brian’s Special Rules First decide what type of car it is and if it is covered Insurance follows the car, driver pays excess Spouse’s car is never covered Rental cars are covered up to 21 days Replacement cars covered for up to 30 days Additional Cars covered up to 30 days or until effective date of policy Know the flow chart for non-owned cars

Problem #1 On September 30 th, 2007, you trade in your 2001 Sebring (with an Actual Cash Value of $12, 000) for a new 2007 Range Rover that costs $85, 000. On October 26 th, 2007, you let your spouse borrow your car. Your spouse has his/her own policy with Allstate with the same coverage limits as you have. On the highway, your spouse swerves off the road to avoid hitting a deer and crashes into a road sign, totaling your brand new Range Rover. Your policy will pay: A. $0 B. $11, 900 C. $84, 900 D. $85, 000 E. None of the above

Problem #1 On September 30 th, 2007, you trade in your 2001 Sebring (with an Actual Cash Value of $12, 000) for a new 2007 Range Rover that costs $85, 000. On October 26 th, 2007, you let your spouse borrow your car. Your spouse has his/her own policy with Allstate with the same coverage limits as you have. On the highway, your spouse swerves off the road to avoid hitting a deer and crashes into a road sign, totaling your brand new Range Rover. Your policy will pay: A. $0 B. $11, 900 C. $84, 900 D. $85, 000 E. None of the above

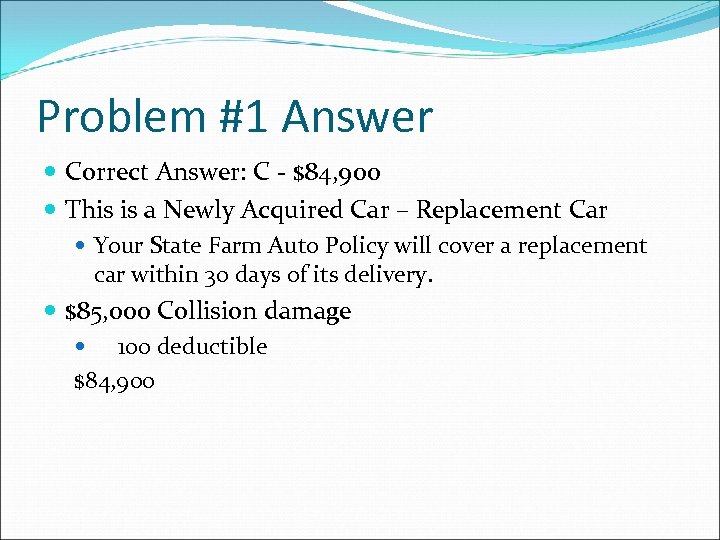

Problem #1 Answer Correct Answer: C - $84, 900 This is a Newly Acquired Car – Replacement Car Your State Farm Auto Policy will cover a replacement car within 30 days of its delivery. $85, 000 Collision damage 100 deductible $84, 900

Problem #1 Answer Correct Answer: C - $84, 900 This is a Newly Acquired Car – Replacement Car Your State Farm Auto Policy will cover a replacement car within 30 days of its delivery. $85, 000 Collision damage 100 deductible $84, 900

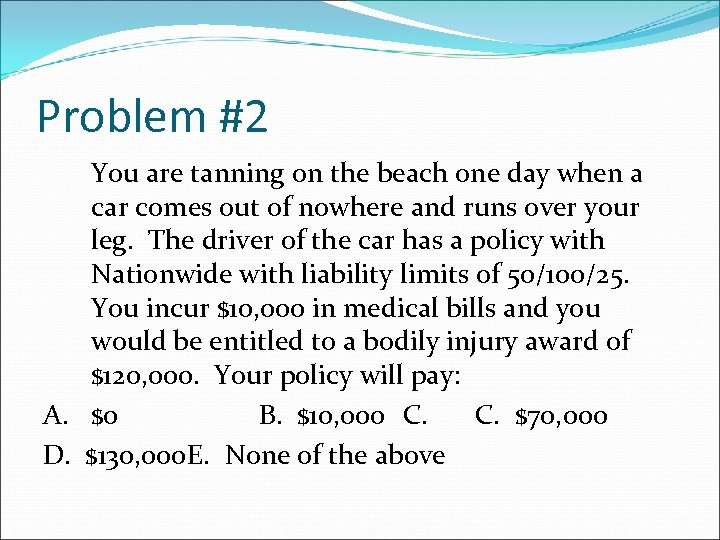

Problem #2 You are tanning on the beach one day when a car comes out of nowhere and runs over your leg. The driver of the car has a policy with Nationwide with liability limits of 50/100/25. You incur $10, 000 in medical bills and you would be entitled to a bodily injury award of $120, 000. Your policy will pay: A. $0 B. $10, 000 C. $70, 000 D. $130, 000 E. None of the above

Problem #2 You are tanning on the beach one day when a car comes out of nowhere and runs over your leg. The driver of the car has a policy with Nationwide with liability limits of 50/100/25. You incur $10, 000 in medical bills and you would be entitled to a bodily injury award of $120, 000. Your policy will pay: A. $0 B. $10, 000 C. $70, 000 D. $130, 000 E. None of the above

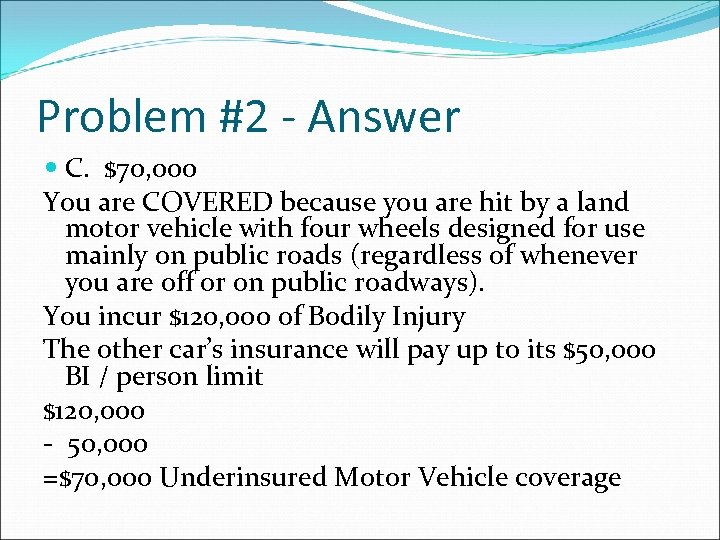

Problem #2 - Answer C. $70, 000 You are COVERED because you are hit by a land motor vehicle with four wheels designed for use mainly on public roads (regardless of whenever you are off or on public roadways). You incur $120, 000 of Bodily Injury The other car’s insurance will pay up to its $50, 000 BI / person limit $120, 000 - 50, 000 =$70, 000 Underinsured Motor Vehicle coverage

Problem #2 - Answer C. $70, 000 You are COVERED because you are hit by a land motor vehicle with four wheels designed for use mainly on public roads (regardless of whenever you are off or on public roadways). You incur $120, 000 of Bodily Injury The other car’s insurance will pay up to its $50, 000 BI / person limit $120, 000 - 50, 000 =$70, 000 Underinsured Motor Vehicle coverage

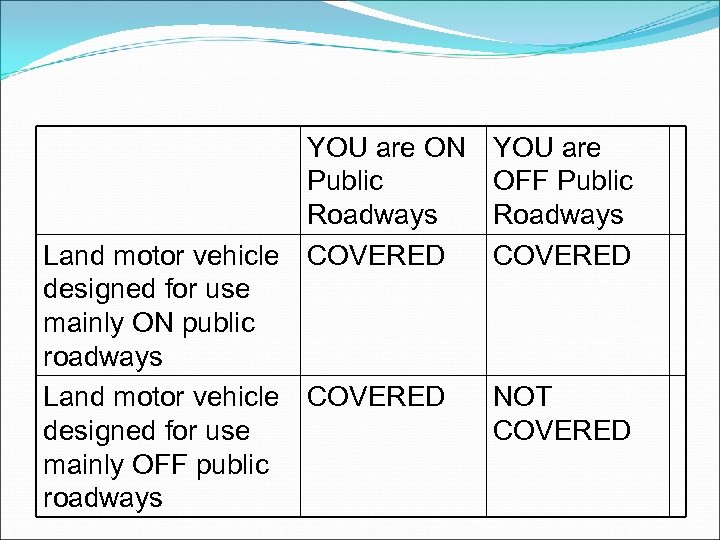

YOU are ON Public Roadways Land motor vehicle COVERED designed for use mainly ON public roadways Land motor vehicle COVERED designed for use mainly OFF public roadways YOU are OFF Public Roadways COVERED NOT COVERED

YOU are ON Public Roadways Land motor vehicle COVERED designed for use mainly ON public roadways Land motor vehicle COVERED designed for use mainly OFF public roadways YOU are OFF Public Roadways COVERED NOT COVERED

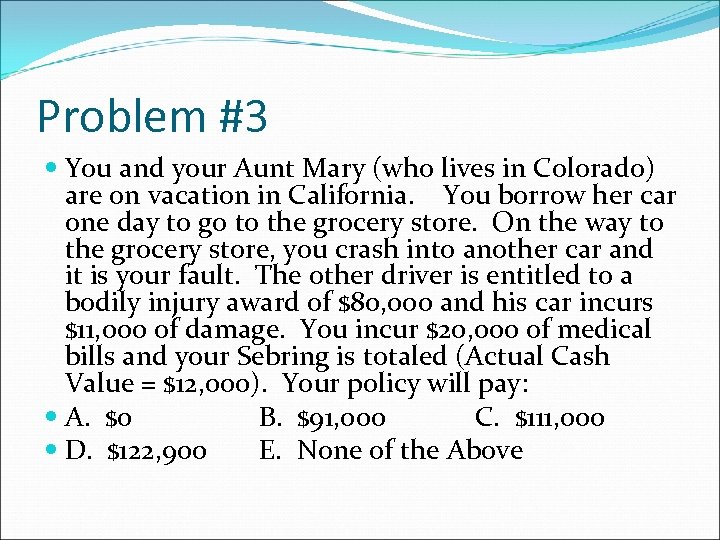

Problem #3 You and your Aunt Mary (who lives in Colorado) are on vacation in California. You borrow her car one day to go to the grocery store. On the way to the grocery store, you crash into another car and it is your fault. The other driver is entitled to a bodily injury award of $80, 000 and his car incurs $11, 000 of damage. You incur $20, 000 of medical bills and your Sebring is totaled (Actual Cash Value = $12, 000). Your policy will pay: A. $0 B. $91, 000 C. $111, 000 D. $122, 900 E. None of the Above

Problem #3 You and your Aunt Mary (who lives in Colorado) are on vacation in California. You borrow her car one day to go to the grocery store. On the way to the grocery store, you crash into another car and it is your fault. The other driver is entitled to a bodily injury award of $80, 000 and his car incurs $11, 000 of damage. You incur $20, 000 of medical bills and your Sebring is totaled (Actual Cash Value = $12, 000). Your policy will pay: A. $0 B. $91, 000 C. $111, 000 D. $122, 900 E. None of the Above

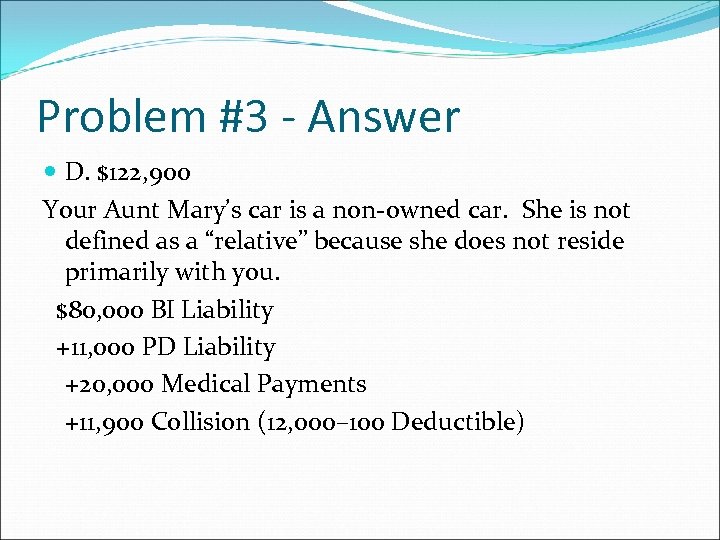

Problem #3 - Answer D. $122, 900 Your Aunt Mary’s car is a non-owned car. She is not defined as a “relative” because she does not reside primarily with you. $80, 000 BI Liability +11, 000 PD Liability +20, 000 Medical Payments +11, 900 Collision (12, 000– 100 Deductible)

Problem #3 - Answer D. $122, 900 Your Aunt Mary’s car is a non-owned car. She is not defined as a “relative” because she does not reside primarily with you. $80, 000 BI Liability +11, 000 PD Liability +20, 000 Medical Payments +11, 900 Collision (12, 000– 100 Deductible)

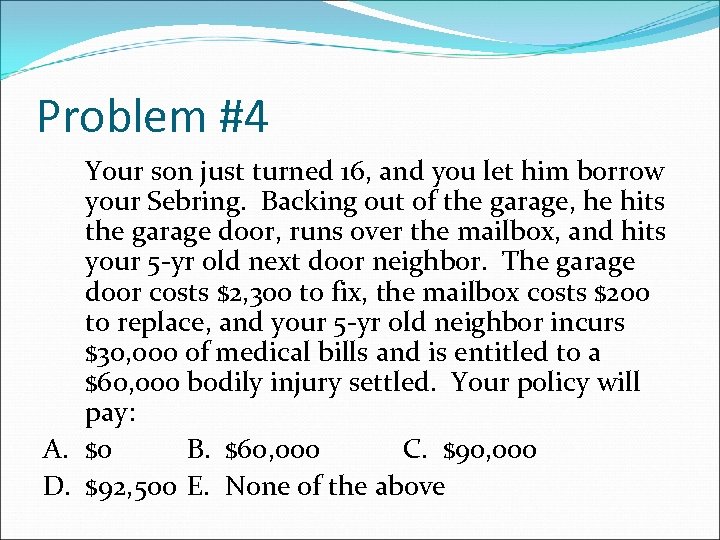

Problem #4 Your son just turned 16, and you let him borrow your Sebring. Backing out of the garage, he hits the garage door, runs over the mailbox, and hits your 5 -yr old next door neighbor. The garage door costs $2, 300 to fix, the mailbox costs $200 to replace, and your 5 -yr old neighbor incurs $30, 000 of medical bills and is entitled to a $60, 000 bodily injury settled. Your policy will pay: A. $0 B. $60, 000 C. $90, 000 D. $92, 500 E. None of the above

Problem #4 Your son just turned 16, and you let him borrow your Sebring. Backing out of the garage, he hits the garage door, runs over the mailbox, and hits your 5 -yr old next door neighbor. The garage door costs $2, 300 to fix, the mailbox costs $200 to replace, and your 5 -yr old neighbor incurs $30, 000 of medical bills and is entitled to a $60, 000 bodily injury settled. Your policy will pay: A. $0 B. $60, 000 C. $90, 000 D. $92, 500 E. None of the above

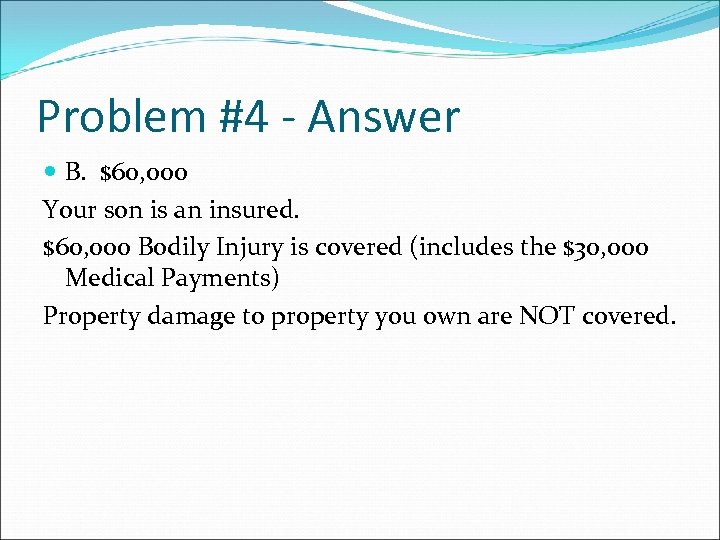

Problem #4 - Answer B. $60, 000 Your son is an insured. $60, 000 Bodily Injury is covered (includes the $30, 000 Medical Payments) Property damage to property you own are NOT covered.

Problem #4 - Answer B. $60, 000 Your son is an insured. $60, 000 Bodily Injury is covered (includes the $30, 000 Medical Payments) Property damage to property you own are NOT covered.

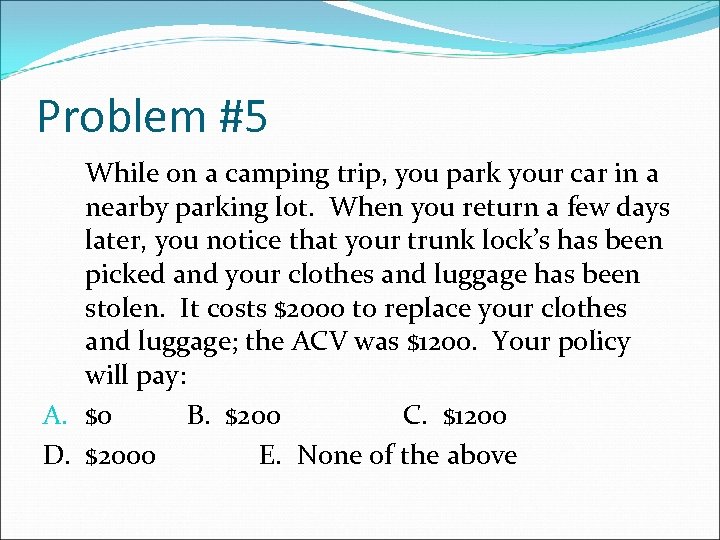

Problem #5 While on a camping trip, you park your car in a nearby parking lot. When you return a few days later, you notice that your trunk lock’s has been picked and your clothes and luggage has been stolen. It costs $2000 to replace your clothes and luggage; the ACV was $1200. Your policy will pay: A. $0 B. $200 C. $1200 D. $2000 E. None of the above

Problem #5 While on a camping trip, you park your car in a nearby parking lot. When you return a few days later, you notice that your trunk lock’s has been picked and your clothes and luggage has been stolen. It costs $2000 to replace your clothes and luggage; the ACV was $1200. Your policy will pay: A. $0 B. $200 C. $1200 D. $2000 E. None of the above

Problem #5 - Answer A. $0 The clothes and luggage are not covered. Clothes and luggage are only covered for theft if your entire car has been stolen.

Problem #5 - Answer A. $0 The clothes and luggage are not covered. Clothes and luggage are only covered for theft if your entire car has been stolen.

Health Policy

Health Policy

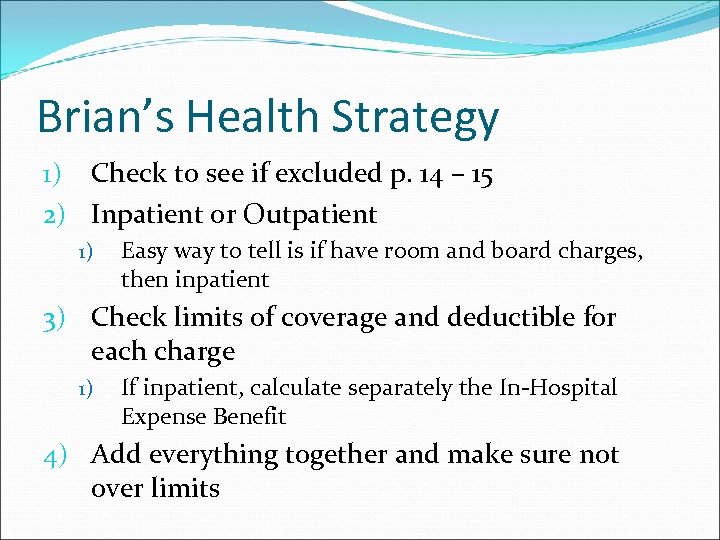

Brian’s Health Strategy 1) Check to see if excluded p. 14 – 15 2) Inpatient or Outpatient 1) Easy way to tell is if have room and board charges, then inpatient 3) Check limits of coverage and deductible for each charge 1) If inpatient, calculate separately the In-Hospital Expense Benefit 4) Add everything together and make sure not over limits

Brian’s Health Strategy 1) Check to see if excluded p. 14 – 15 2) Inpatient or Outpatient 1) Easy way to tell is if have room and board charges, then inpatient 3) Check limits of coverage and deductible for each charge 1) If inpatient, calculate separately the In-Hospital Expense Benefit 4) Add everything together and make sure not over limits

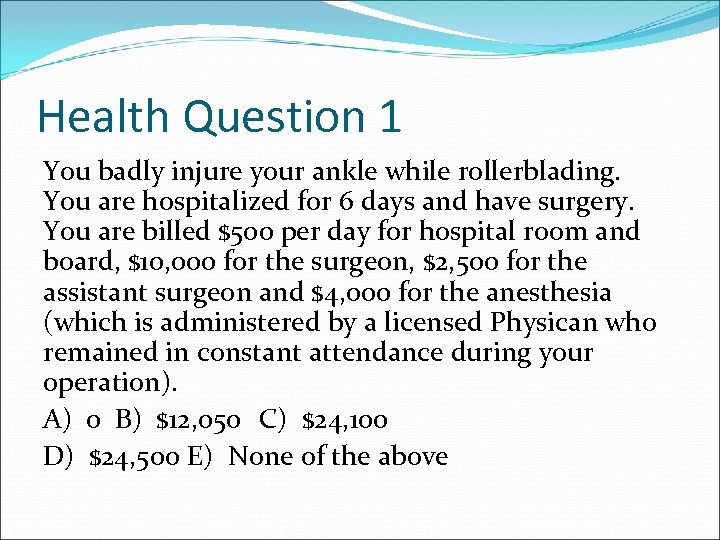

Health Question 1 You badly injure your ankle while rollerblading. You are hospitalized for 6 days and have surgery. You are billed $500 per day for hospital room and board, $10, 000 for the surgeon, $2, 500 for the assistant surgeon and $4, 000 for the anesthesia (which is administered by a licensed Physican who remained in constant attendance during your operation). A) 0 B) $12, 050 C) $24, 100 D) $24, 500 E) None of the above

Health Question 1 You badly injure your ankle while rollerblading. You are hospitalized for 6 days and have surgery. You are billed $500 per day for hospital room and board, $10, 000 for the surgeon, $2, 500 for the assistant surgeon and $4, 000 for the anesthesia (which is administered by a licensed Physican who remained in constant attendance during your operation). A) 0 B) $12, 050 C) $24, 100 D) $24, 500 E) None of the above

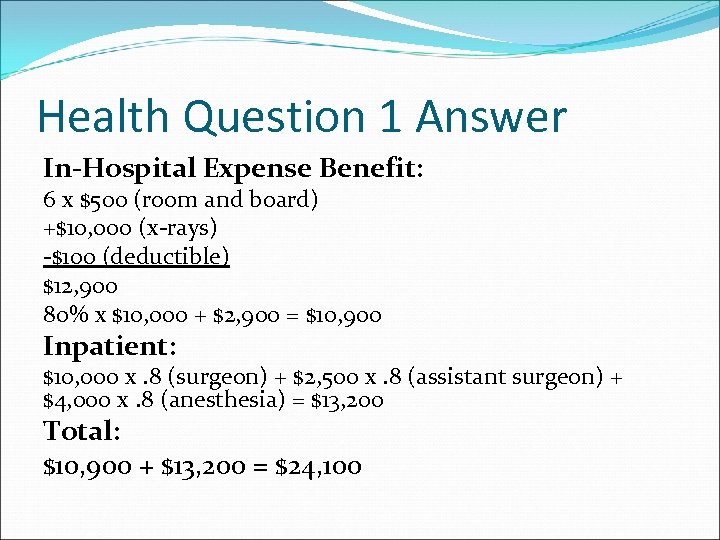

Health Question 1 Answer In-Hospital Expense Benefit: 6 x $500 (room and board) +$10, 000 (x-rays) -$100 (deductible) $12, 900 80% x $10, 000 + $2, 900 = $10, 900 Inpatient: $10, 000 x. 8 (surgeon) + $2, 500 x. 8 (assistant surgeon) + $4, 000 x. 8 (anesthesia) = $13, 200 Total: $10, 900 + $13, 200 = $24, 100

Health Question 1 Answer In-Hospital Expense Benefit: 6 x $500 (room and board) +$10, 000 (x-rays) -$100 (deductible) $12, 900 80% x $10, 000 + $2, 900 = $10, 900 Inpatient: $10, 000 x. 8 (surgeon) + $2, 500 x. 8 (assistant surgeon) + $4, 000 x. 8 (anesthesia) = $13, 200 Total: $10, 900 + $13, 200 = $24, 100

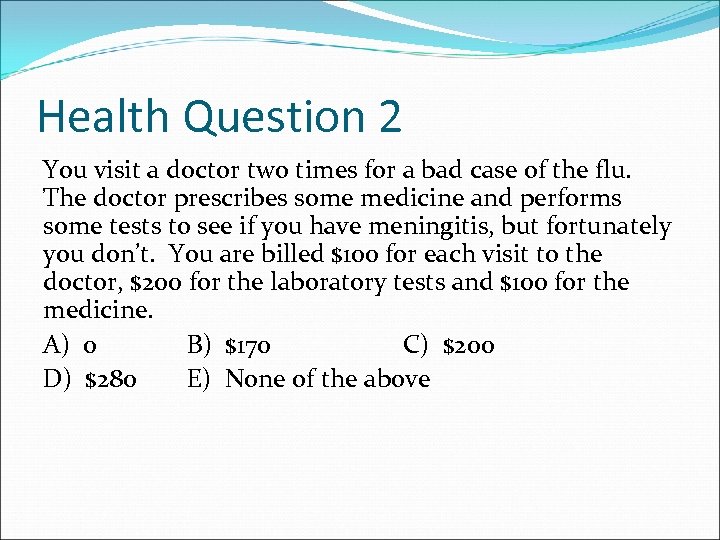

Health Question 2 You visit a doctor two times for a bad case of the flu. The doctor prescribes some medicine and performs some tests to see if you have meningitis, but fortunately you don’t. You are billed $100 for each visit to the doctor, $200 for the laboratory tests and $100 for the medicine. A) 0 B) $170 C) $200 D) $280 E) None of the above

Health Question 2 You visit a doctor two times for a bad case of the flu. The doctor prescribes some medicine and performs some tests to see if you have meningitis, but fortunately you don’t. You are billed $100 for each visit to the doctor, $200 for the laboratory tests and $100 for the medicine. A) 0 B) $170 C) $200 D) $280 E) None of the above

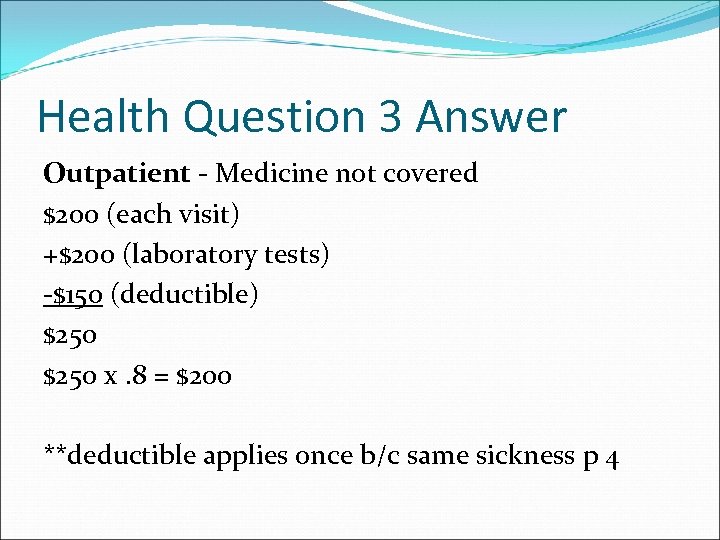

Health Question 3 Answer Outpatient - Medicine not covered $200 (each visit) +$200 (laboratory tests) -$150 (deductible) $250 x. 8 = $200 **deductible applies once b/c same sickness p 4

Health Question 3 Answer Outpatient - Medicine not covered $200 (each visit) +$200 (laboratory tests) -$150 (deductible) $250 x. 8 = $200 **deductible applies once b/c same sickness p 4

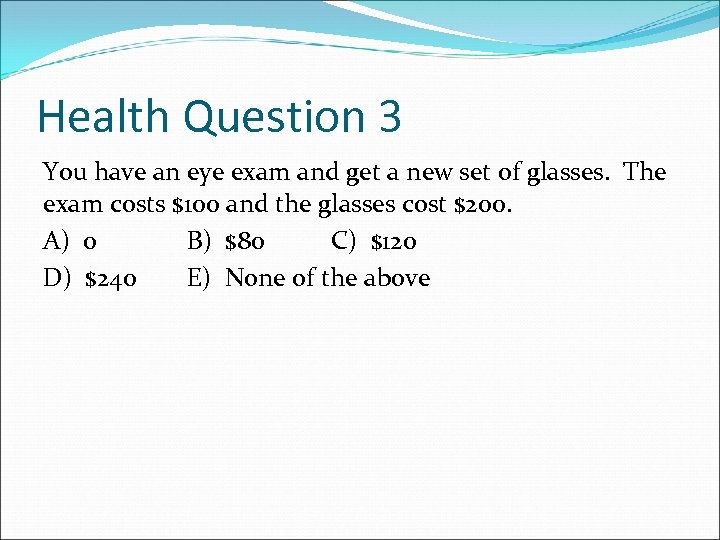

Health Question 3 You have an eye exam and get a new set of glasses. The exam costs $100 and the glasses cost $200. A) 0 B) $80 C) $120 D) $240 E) None of the above

Health Question 3 You have an eye exam and get a new set of glasses. The exam costs $100 and the glasses cost $200. A) 0 B) $80 C) $120 D) $240 E) None of the above

Health Question 3 Answer Exclusion: Eye examinations and eyeglasses p 14 #9 Total: 0

Health Question 3 Answer Exclusion: Eye examinations and eyeglasses p 14 #9 Total: 0

HW #7 Coordination of Benefits Introduction to Life Insurance

HW #7 Coordination of Benefits Introduction to Life Insurance

Use for questions 1 & 2 You are driving your car along Green Street when a squirrel darts out in front of your car. You swerve to avoid hitting the animal, but you lose control and crash into a light pole. An ambulance races you to Carle Hospital where you are hospitalized for 20 days and undergo extensive surgery. The surgeon charges you $40, 000 for the surgery, the assistant surgeon charges $9, 000 and the anesthesia costs $20, 000. The anesthetist personally administered the anesthesia and remained in constant attendance during the surgery. You are billed $500 per day for the hospital room and board, $5, 000 for the operating room expenses and $2, 500 for medicine while in the hospital. You are billed $500 for the ambulance ride. It costs $9, 000 to repair your car, which had a $15, 000 cash value at the time of the loss.

Use for questions 1 & 2 You are driving your car along Green Street when a squirrel darts out in front of your car. You swerve to avoid hitting the animal, but you lose control and crash into a light pole. An ambulance races you to Carle Hospital where you are hospitalized for 20 days and undergo extensive surgery. The surgeon charges you $40, 000 for the surgery, the assistant surgeon charges $9, 000 and the anesthesia costs $20, 000. The anesthetist personally administered the anesthesia and remained in constant attendance during the surgery. You are billed $500 per day for the hospital room and board, $5, 000 for the operating room expenses and $2, 500 for medicine while in the hospital. You are billed $500 for the ambulance ride. It costs $9, 000 to repair your car, which had a $15, 000 cash value at the time of the loss.

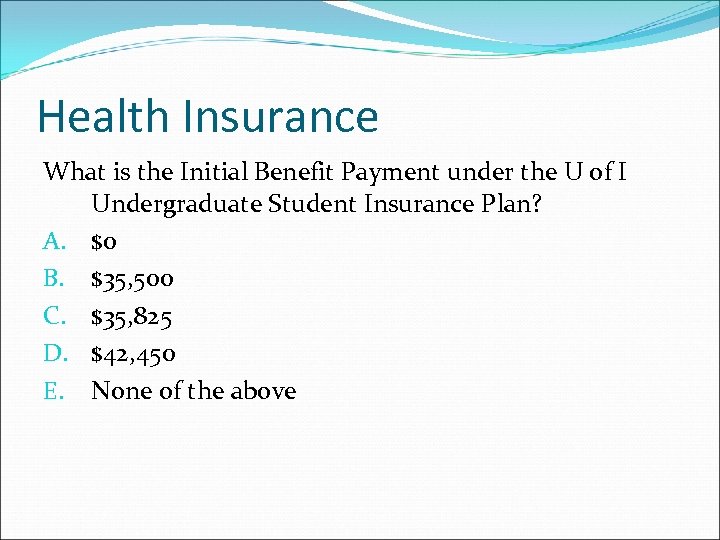

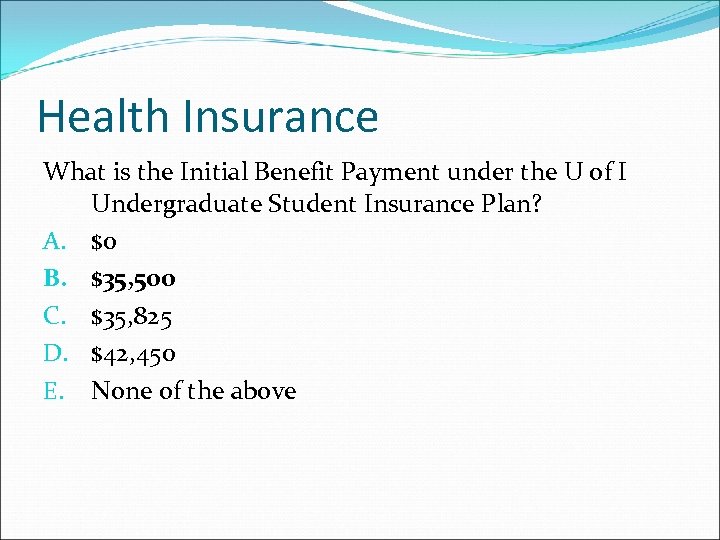

Health Insurance What is the Initial Benefit Payment under the U of I Undergraduate Student Insurance Plan? A. $0 B. $35, 500 C. $35, 825 D. $42, 450 E. None of the above

Health Insurance What is the Initial Benefit Payment under the U of I Undergraduate Student Insurance Plan? A. $0 B. $35, 500 C. $35, 825 D. $42, 450 E. None of the above

Health Insurance What is the Initial Benefit Payment under the U of I Undergraduate Student Insurance Plan? A. $0 B. $35, 500 C. $35, 825 D. $42, 450 E. None of the above

Health Insurance What is the Initial Benefit Payment under the U of I Undergraduate Student Insurance Plan? A. $0 B. $35, 500 C. $35, 825 D. $42, 450 E. None of the above

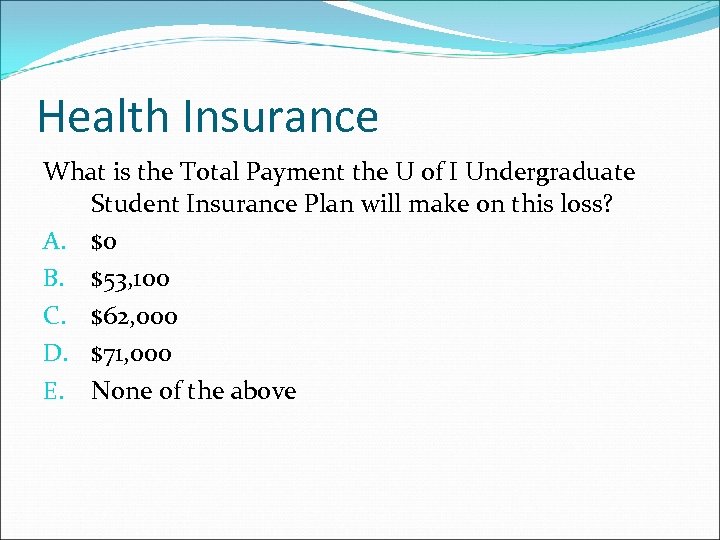

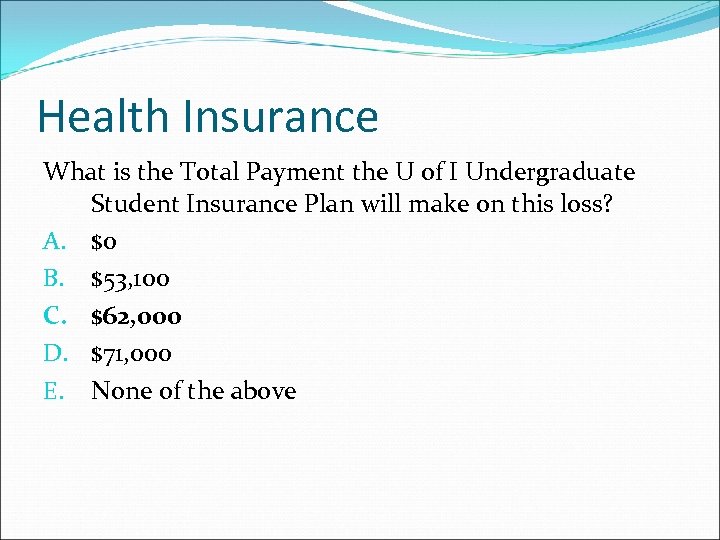

Health Insurance What is the Total Payment the U of I Undergraduate Student Insurance Plan will make on this loss? A. $0 B. $53, 100 C. $62, 000 D. $71, 000 E. None of the above

Health Insurance What is the Total Payment the U of I Undergraduate Student Insurance Plan will make on this loss? A. $0 B. $53, 100 C. $62, 000 D. $71, 000 E. None of the above

Health Insurance What is the Total Payment the U of I Undergraduate Student Insurance Plan will make on this loss? A. $0 B. $53, 100 C. $62, 000 D. $71, 000 E. None of the above

Health Insurance What is the Total Payment the U of I Undergraduate Student Insurance Plan will make on this loss? A. $0 B. $53, 100 C. $62, 000 D. $71, 000 E. None of the above

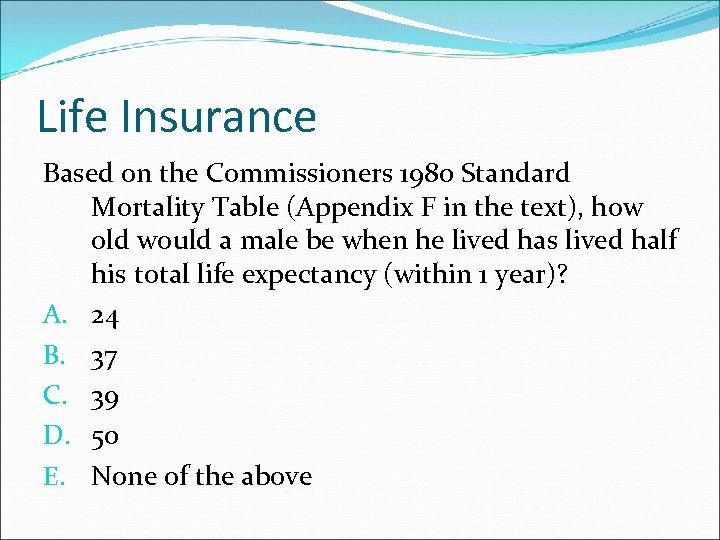

Life Insurance Based on the Commissioners 1980 Standard Mortality Table (Appendix F in the text), how old would a male be when he lived has lived half his total life expectancy (within 1 year)? A. 24 B. 37 C. 39 D. 50 E. None of the above

Life Insurance Based on the Commissioners 1980 Standard Mortality Table (Appendix F in the text), how old would a male be when he lived has lived half his total life expectancy (within 1 year)? A. 24 B. 37 C. 39 D. 50 E. None of the above

Life Insurance Based on the Commissioners 1980 Standard Mortality Table (Appendix F in the text), how old would a male be when he lived has lived half his total life expectancy (within 1 year)? A. 24 B. 37 C. 39 D. 50 E. None of the above

Life Insurance Based on the Commissioners 1980 Standard Mortality Table (Appendix F in the text), how old would a male be when he lived has lived half his total life expectancy (within 1 year)? A. 24 B. 37 C. 39 D. 50 E. None of the above

Life Insurance A 30 -year-old female purchased a $100, 000 whole life policy for $1, 500 a year. She receives dividends of $5, 000 over time. At age 60, she surrenders that policy for $70, 000. If this individual is in the 28% tax bracket at that point, how much does she have to pay in taxes when she surrenders the policy? A. $0 B. $5, 600 C. $8, 400 D. $30, 000 E. None of the above

Life Insurance A 30 -year-old female purchased a $100, 000 whole life policy for $1, 500 a year. She receives dividends of $5, 000 over time. At age 60, she surrenders that policy for $70, 000. If this individual is in the 28% tax bracket at that point, how much does she have to pay in taxes when she surrenders the policy? A. $0 B. $5, 600 C. $8, 400 D. $30, 000 E. None of the above

Life Insurance A 30 -year-old female purchased a $100, 000 whole life policy for $1, 500 a year. She receives dividends of $5, 000 over time. At age 60, she surrenders that policy for $70, 000. If this individual is in the 28% tax bracket at that point, how much does she have to pay in taxes when she surrenders the policy? A. $0 B. $5, 600 C. $8, 400 D. $30, 000 E. None of the above

Life Insurance A 30 -year-old female purchased a $100, 000 whole life policy for $1, 500 a year. She receives dividends of $5, 000 over time. At age 60, she surrenders that policy for $70, 000. If this individual is in the 28% tax bracket at that point, how much does she have to pay in taxes when she surrenders the policy? A. $0 B. $5, 600 C. $8, 400 D. $30, 000 E. None of the above

Life Insurance Which of the following would be the most appropriate for an individual who is looking for a tax sheltered investment and is willing to accept risk in hopes of a higher return? A. Re-entry term B. Endowment life C. Whole life D. Yearly renewable term E. Variable life

Life Insurance Which of the following would be the most appropriate for an individual who is looking for a tax sheltered investment and is willing to accept risk in hopes of a higher return? A. Re-entry term B. Endowment life C. Whole life D. Yearly renewable term E. Variable life

Life Insurance Which of the following would be the most appropriate for an individual who is looking for a tax sheltered investment and is willing to accept risk in hopes of a higher return? A. Re-entry term B. Endowment life C. Whole life D. Yearly renewable term E. Variable life

Life Insurance Which of the following would be the most appropriate for an individual who is looking for a tax sheltered investment and is willing to accept risk in hopes of a higher return? A. Re-entry term B. Endowment life C. Whole life D. Yearly renewable term E. Variable life

Assignment 8 Life Insurance

Assignment 8 Life Insurance

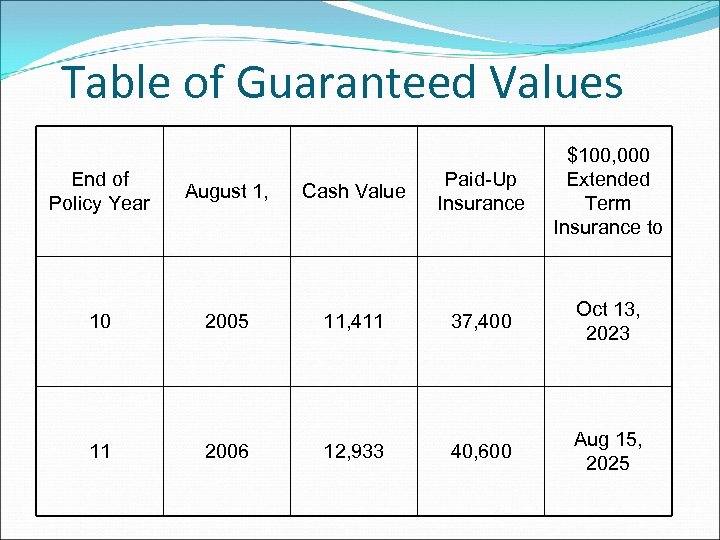

Table of Guaranteed Values End of Policy Year August 1, Cash Value Paid-Up Insurance $100, 000 Extended Term Insurance to 10 2005 11, 411 37, 400 Oct 13, 2023 11 2006 12, 933 40, 600 Aug 15, 2025

Table of Guaranteed Values End of Policy Year August 1, Cash Value Paid-Up Insurance $100, 000 Extended Term Insurance to 10 2005 11, 411 37, 400 Oct 13, 2023 11 2006 12, 933 40, 600 Aug 15, 2025

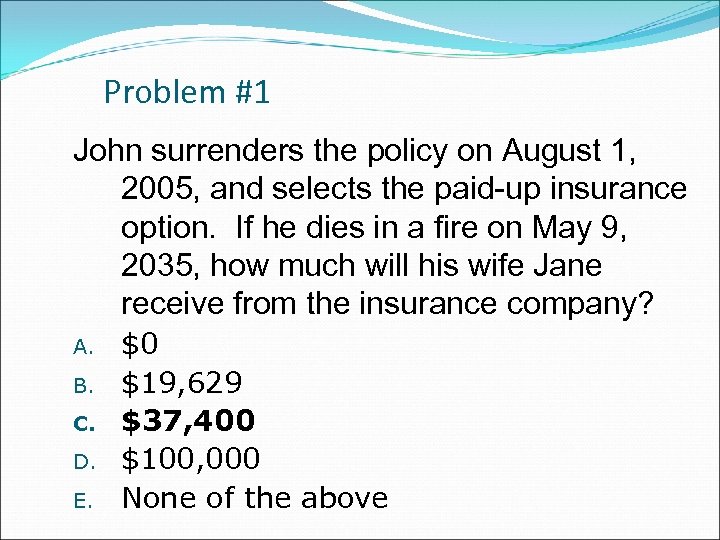

Problem #1 John surrenders the policy on August 1, 2005, and selects the paid-up insurance option. If he dies in a fire on May 9, 2035, how much will his wife Jane receive from the insurance company? A. B. C. D. E. $0 $19, 629 $37, 400 $100, 000 None of the above

Problem #1 John surrenders the policy on August 1, 2005, and selects the paid-up insurance option. If he dies in a fire on May 9, 2035, how much will his wife Jane receive from the insurance company? A. B. C. D. E. $0 $19, 629 $37, 400 $100, 000 None of the above

Problem #1 John surrenders the policy on August 1, 2005, and selects the paid-up insurance option. If he dies in a fire on May 9, 2035, how much will his wife Jane receive from the insurance company? A. B. C. D. E. $0 $19, 629 $37, 400 $100, 000 None of the above

Problem #1 John surrenders the policy on August 1, 2005, and selects the paid-up insurance option. If he dies in a fire on May 9, 2035, how much will his wife Jane receive from the insurance company? A. B. C. D. E. $0 $19, 629 $37, 400 $100, 000 None of the above

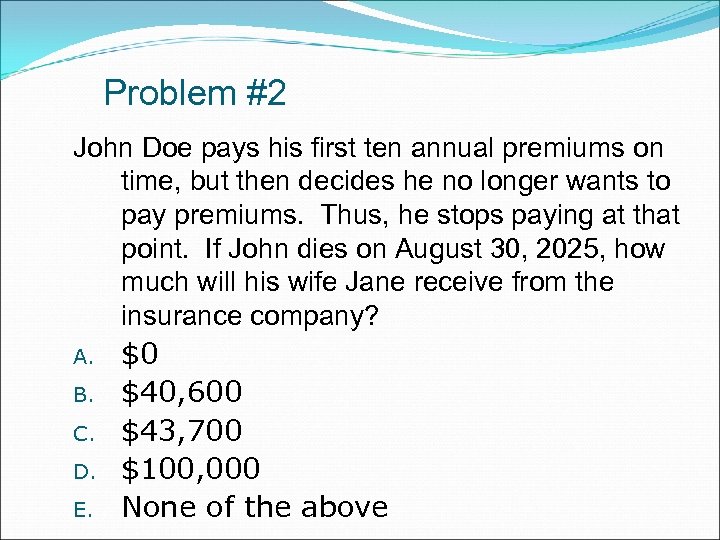

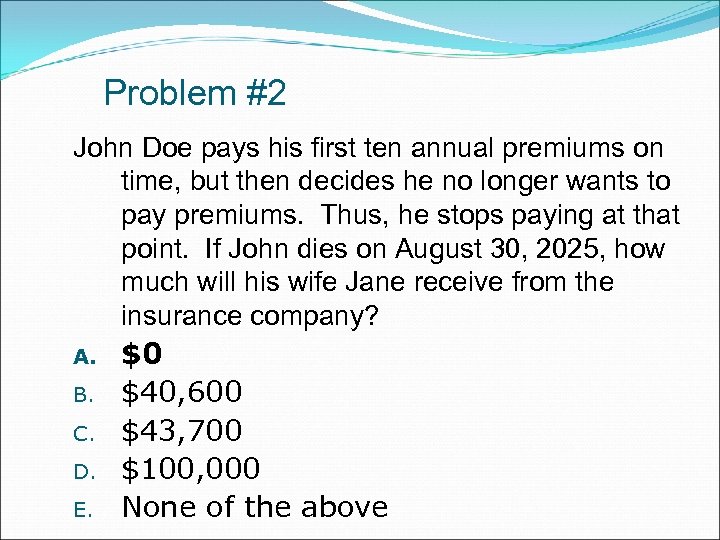

Problem #2 John Doe pays his first ten annual premiums on time, but then decides he no longer wants to pay premiums. Thus, he stops paying at that point. If John dies on August 30, 2025, how much will his wife Jane receive from the insurance company? A. $0 B. $40, 600 C. $43, 700 D. $100, 000 E. None of the above

Problem #2 John Doe pays his first ten annual premiums on time, but then decides he no longer wants to pay premiums. Thus, he stops paying at that point. If John dies on August 30, 2025, how much will his wife Jane receive from the insurance company? A. $0 B. $40, 600 C. $43, 700 D. $100, 000 E. None of the above

Problem #2 John Doe pays his first ten annual premiums on time, but then decides he no longer wants to pay premiums. Thus, he stops paying at that point. If John dies on August 30, 2025, how much will his wife Jane receive from the insurance company? A. $0 B. $40, 600 C. $43, 700 D. $100, 000 E. None of the above

Problem #2 John Doe pays his first ten annual premiums on time, but then decides he no longer wants to pay premiums. Thus, he stops paying at that point. If John dies on August 30, 2025, how much will his wife Jane receive from the insurance company? A. $0 B. $40, 600 C. $43, 700 D. $100, 000 E. None of the above

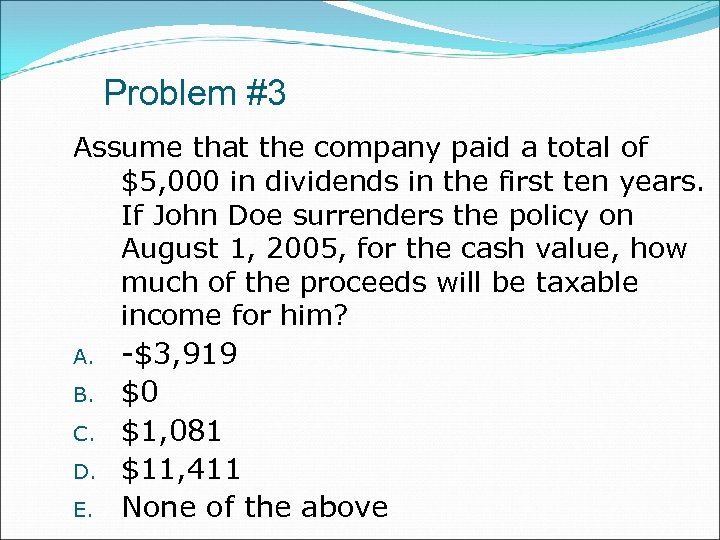

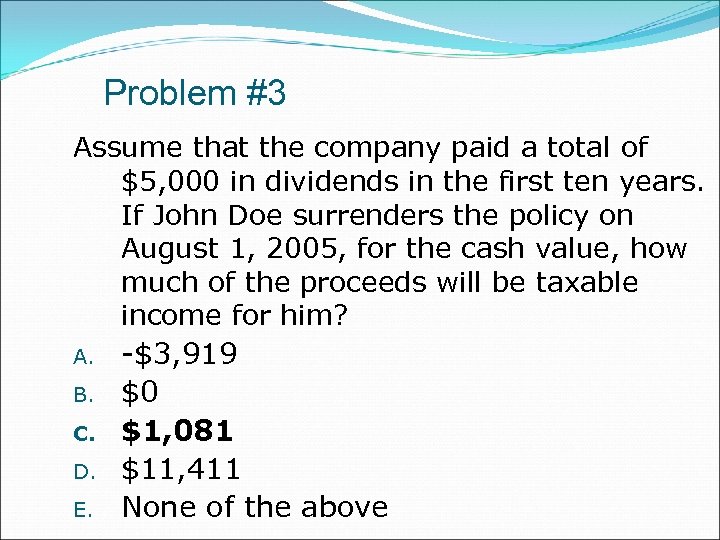

Problem #3 Assume that the company paid a total of $5, 000 in dividends in the first ten years. If John Doe surrenders the policy on August 1, 2005, for the cash value, how much of the proceeds will be taxable income for him? A. -$3, 919 B. $0 C. $1, 081 D. $11, 411 E. None of the above

Problem #3 Assume that the company paid a total of $5, 000 in dividends in the first ten years. If John Doe surrenders the policy on August 1, 2005, for the cash value, how much of the proceeds will be taxable income for him? A. -$3, 919 B. $0 C. $1, 081 D. $11, 411 E. None of the above

Problem #3 Assume that the company paid a total of $5, 000 in dividends in the first ten years. If John Doe surrenders the policy on August 1, 2005, for the cash value, how much of the proceeds will be taxable income for him? A. -$3, 919 B. $0 C. $1, 081 D. $11, 411 E. None of the above

Problem #3 Assume that the company paid a total of $5, 000 in dividends in the first ten years. If John Doe surrenders the policy on August 1, 2005, for the cash value, how much of the proceeds will be taxable income for him? A. -$3, 919 B. $0 C. $1, 081 D. $11, 411 E. None of the above

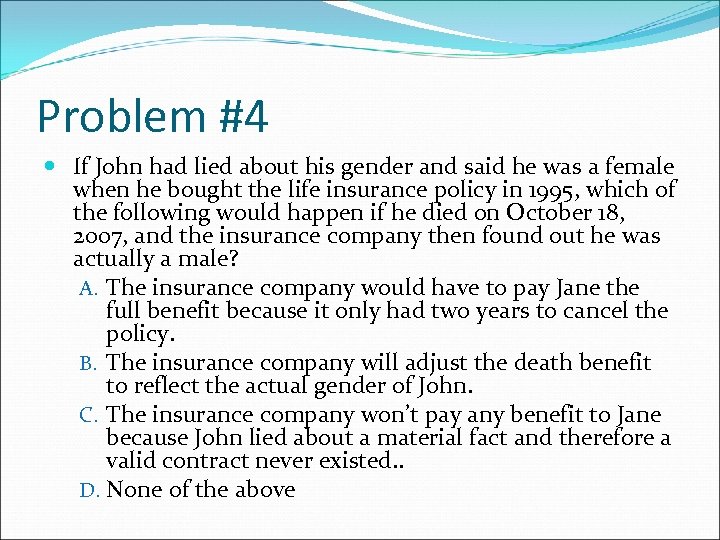

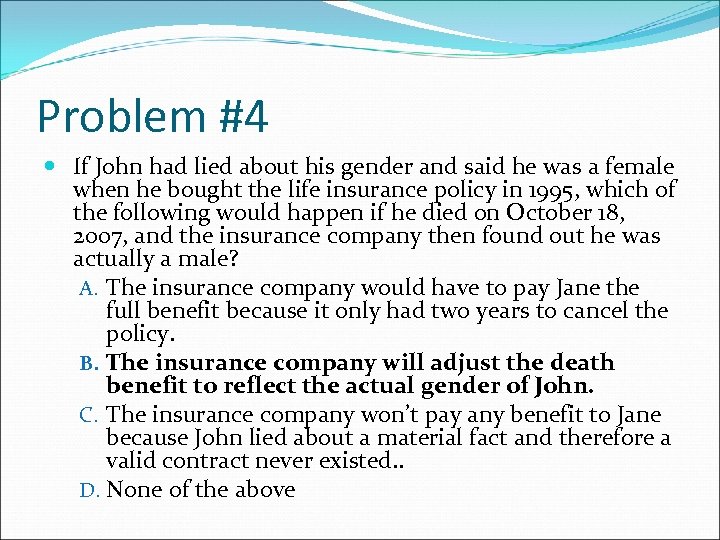

Problem #4 If John had lied about his gender and said he was a female when he bought the life insurance policy in 1995, which of the following would happen if he died on October 18, 2007, and the insurance company then found out he was actually a male? A. The insurance company would have to pay Jane the full benefit because it only had two years to cancel the policy. B. The insurance company will adjust the death benefit to reflect the actual gender of John. C. The insurance company won’t pay any benefit to Jane because John lied about a material fact and therefore a valid contract never existed. . D. None of the above

Problem #4 If John had lied about his gender and said he was a female when he bought the life insurance policy in 1995, which of the following would happen if he died on October 18, 2007, and the insurance company then found out he was actually a male? A. The insurance company would have to pay Jane the full benefit because it only had two years to cancel the policy. B. The insurance company will adjust the death benefit to reflect the actual gender of John. C. The insurance company won’t pay any benefit to Jane because John lied about a material fact and therefore a valid contract never existed. . D. None of the above

Problem #4 If John had lied about his gender and said he was a female when he bought the life insurance policy in 1995, which of the following would happen if he died on October 18, 2007, and the insurance company then found out he was actually a male? A. The insurance company would have to pay Jane the full benefit because it only had two years to cancel the policy. B. The insurance company will adjust the death benefit to reflect the actual gender of John. C. The insurance company won’t pay any benefit to Jane because John lied about a material fact and therefore a valid contract never existed. . D. None of the above

Problem #4 If John had lied about his gender and said he was a female when he bought the life insurance policy in 1995, which of the following would happen if he died on October 18, 2007, and the insurance company then found out he was actually a male? A. The insurance company would have to pay Jane the full benefit because it only had two years to cancel the policy. B. The insurance company will adjust the death benefit to reflect the actual gender of John. C. The insurance company won’t pay any benefit to Jane because John lied about a material fact and therefore a valid contract never existed. . D. None of the above

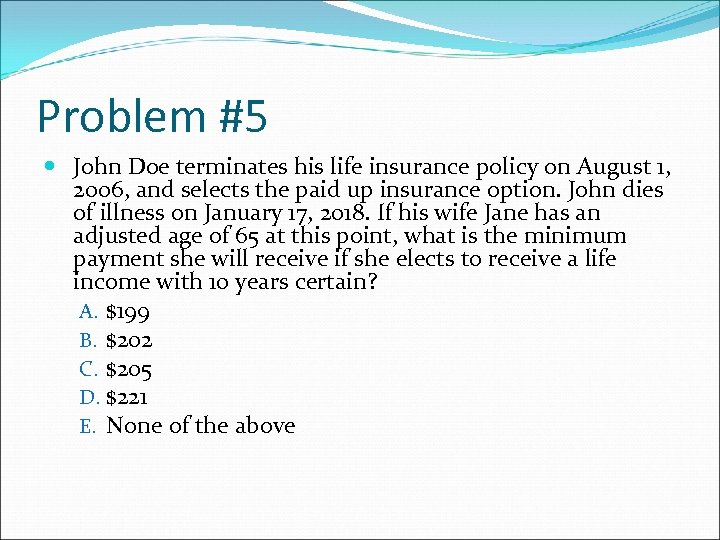

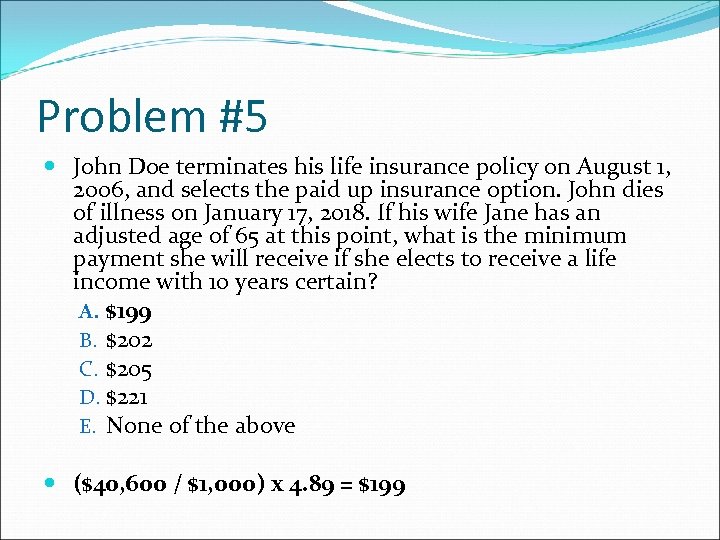

Problem #5 John Doe terminates his life insurance policy on August 1, 2006, and selects the paid up insurance option. John dies of illness on January 17, 2018. If his wife Jane has an adjusted age of 65 at this point, what is the minimum payment she will receive if she elects to receive a life income with 10 years certain? A. $199 B. $202 C. $205 D. $221 E. None of the above

Problem #5 John Doe terminates his life insurance policy on August 1, 2006, and selects the paid up insurance option. John dies of illness on January 17, 2018. If his wife Jane has an adjusted age of 65 at this point, what is the minimum payment she will receive if she elects to receive a life income with 10 years certain? A. $199 B. $202 C. $205 D. $221 E. None of the above

Problem #5 John Doe terminates his life insurance policy on August 1, 2006, and selects the paid up insurance option. John dies of illness on January 17, 2018. If his wife Jane has an adjusted age of 65 at this point, what is the minimum payment she will receive if she elects to receive a life income with 10 years certain? A. $199 B. $202 C. $205 D. $221 E. None of the above ($40, 600 / $1, 000) x 4. 89 = $199

Problem #5 John Doe terminates his life insurance policy on August 1, 2006, and selects the paid up insurance option. John dies of illness on January 17, 2018. If his wife Jane has an adjusted age of 65 at this point, what is the minimum payment she will receive if she elects to receive a life income with 10 years certain? A. $199 B. $202 C. $205 D. $221 E. None of the above ($40, 600 / $1, 000) x 4. 89 = $199

Homework 9 Life Insurance Cost Comparisons Liability Exposures

Homework 9 Life Insurance Cost Comparisons Liability Exposures

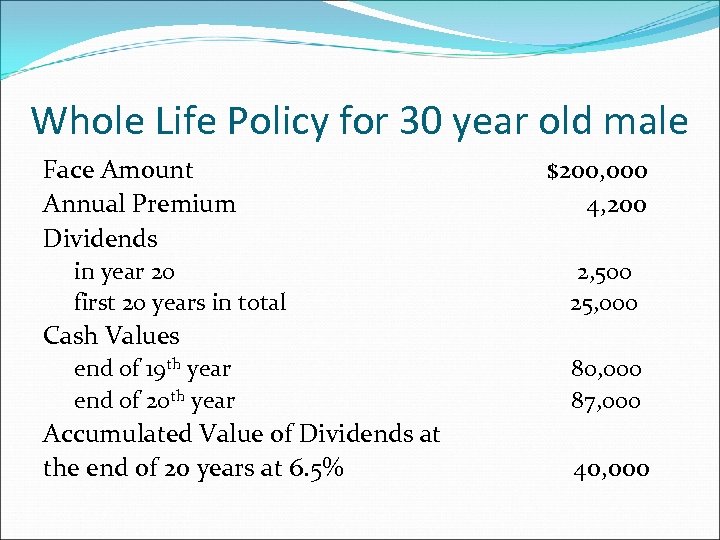

Whole Life Policy for 30 year old male Face Amount Annual Premium Dividends in year 20 first 20 years in total $200, 000 4, 200 2, 500 25, 000 Cash Values end of 19 th year end of 20 th year Accumulated Value of Dividends at the end of 20 years at 6. 5% 80, 000 87, 000 40, 000

Whole Life Policy for 30 year old male Face Amount Annual Premium Dividends in year 20 first 20 years in total $200, 000 4, 200 2, 500 25, 000 Cash Values end of 19 th year end of 20 th year Accumulated Value of Dividends at the end of 20 years at 6. 5% 80, 000 87, 000 40, 000

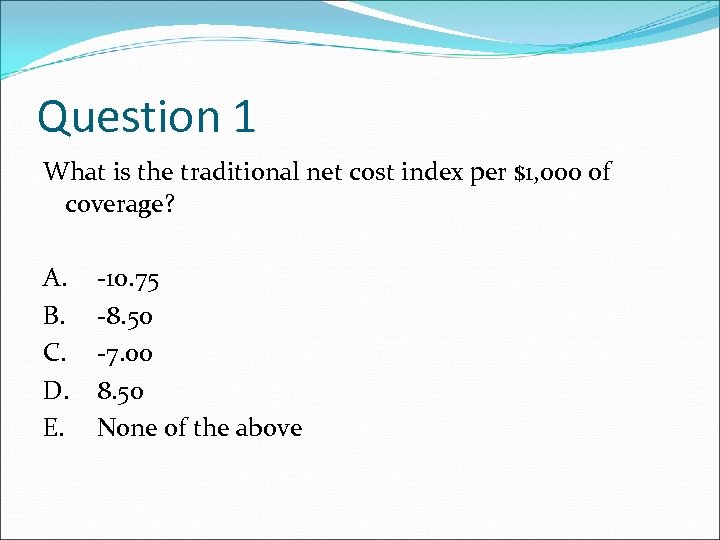

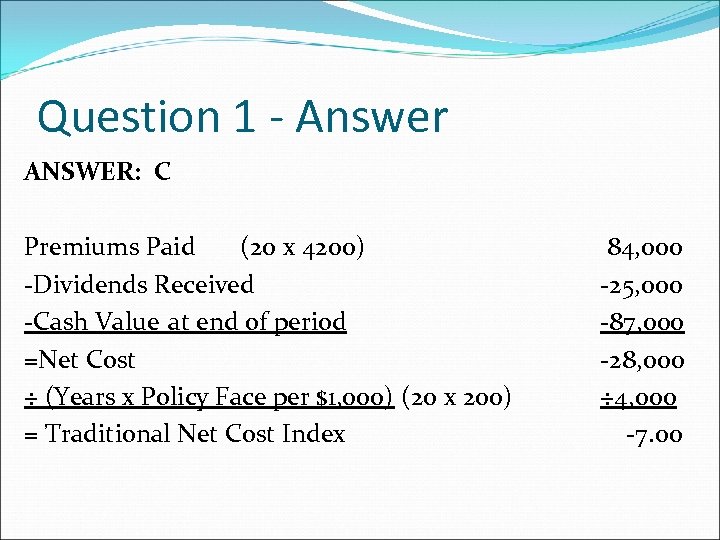

Question 1 What is the traditional net cost index per $1, 000 of coverage? A. B. C. D. E. -10. 75 -8. 50 -7. 00 8. 50 None of the above

Question 1 What is the traditional net cost index per $1, 000 of coverage? A. B. C. D. E. -10. 75 -8. 50 -7. 00 8. 50 None of the above

Question 1 - Answer ANSWER: C Premiums Paid (20 x 4200) -Dividends Received -Cash Value at end of period =Net Cost ÷ (Years x Policy Face per $1, 000) (20 x 200) = Traditional Net Cost Index 84, 000 -25, 000 -87, 000 -28, 000 ÷ 4, 000 -7. 00

Question 1 - Answer ANSWER: C Premiums Paid (20 x 4200) -Dividends Received -Cash Value at end of period =Net Cost ÷ (Years x Policy Face per $1, 000) (20 x 200) = Traditional Net Cost Index 84, 000 -25, 000 -87, 000 -28, 000 ÷ 4, 000 -7. 00

Question 2 What is the 20 year interest adjusted surrender cost index per $1, 000 of coverage based on a 6. 5 percent interest rate? A. B. C. D. E. 1. 71 5. 64 7. 46 11. 67 None of the above

Question 2 What is the 20 year interest adjusted surrender cost index per $1, 000 of coverage based on a 6. 5 percent interest rate? A. B. C. D. E. 1. 71 5. 64 7. 46 11. 67 None of the above

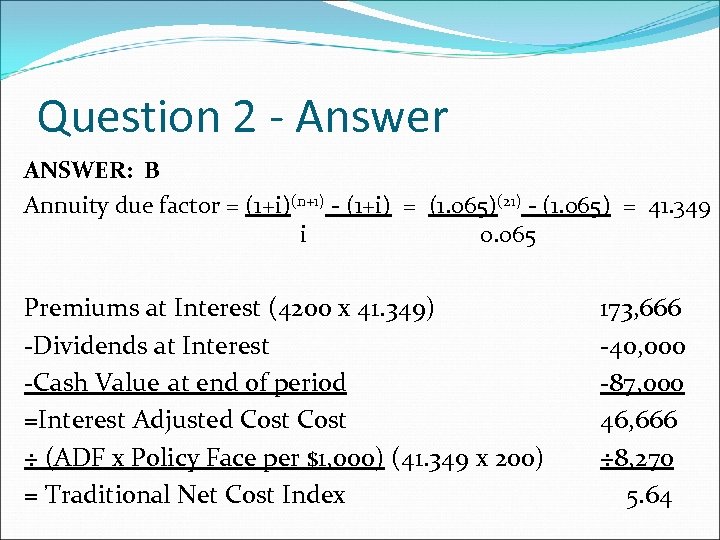

Question 2 - Answer ANSWER: B Annuity due factor = (1+i)(n+1) - (1+i) = (1. 065)(21) - (1. 065) = 41. 349 i 0. 065 Premiums at Interest (4200 x 41. 349) -Dividends at Interest -Cash Value at end of period =Interest Adjusted Cost ÷ (ADF x Policy Face per $1, 000) (41. 349 x 200) = Traditional Net Cost Index 173, 666 -40, 000 -87, 000 46, 666 ÷ 8, 270 5. 64

Question 2 - Answer ANSWER: B Annuity due factor = (1+i)(n+1) - (1+i) = (1. 065)(21) - (1. 065) = 41. 349 i 0. 065 Premiums at Interest (4200 x 41. 349) -Dividends at Interest -Cash Value at end of period =Interest Adjusted Cost ÷ (ADF x Policy Face per $1, 000) (41. 349 x 200) = Traditional Net Cost Index 173, 666 -40, 000 -87, 000 46, 666 ÷ 8, 270 5. 64

Question 3 What is the yearly rate for the 20 th policy year if the annual renewable term rate for this individual is $2. 00 per $1, 000? A. B. C. D. E. 1. 1% 6. 6% 6. 8% 10. 6% None of the above

Question 3 What is the yearly rate for the 20 th policy year if the annual renewable term rate for this individual is $2. 00 per $1, 000? A. B. C. D. E. 1. 1% 6. 6% 6. 8% 10. 6% None of the above

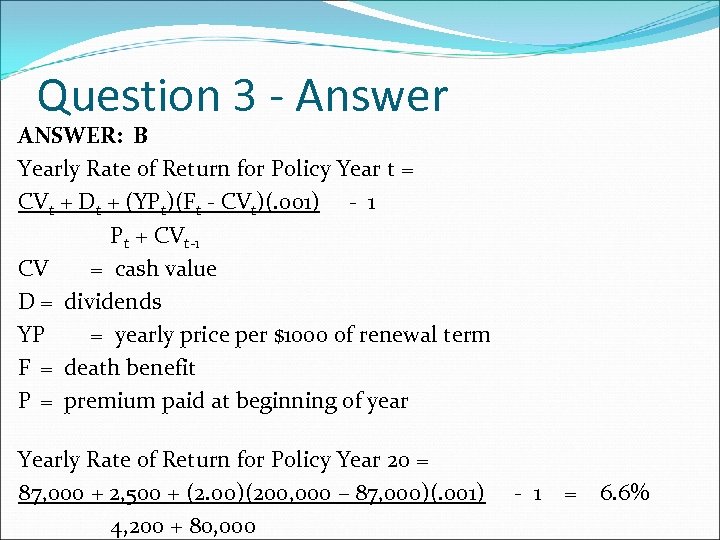

Question 3 - Answer ANSWER: B Yearly Rate of Return for Policy Year t = CVt + Dt + (YPt)(Ft - CVt)(. 001) - 1 Pt + CVt-1 CV = cash value D = dividends YP = yearly price per $1000 of renewal term F = death benefit P = premium paid at beginning of year Yearly Rate of Return for Policy Year 20 = 87, 000 + 2, 500 + (2. 00)(200, 000 – 87, 000)(. 001) - 1 = 6. 6% 4, 200 + 80, 000

Question 3 - Answer ANSWER: B Yearly Rate of Return for Policy Year t = CVt + Dt + (YPt)(Ft - CVt)(. 001) - 1 Pt + CVt-1 CV = cash value D = dividends YP = yearly price per $1000 of renewal term F = death benefit P = premium paid at beginning of year Yearly Rate of Return for Policy Year 20 = 87, 000 + 2, 500 + (2. 00)(200, 000 – 87, 000)(. 001) - 1 = 6. 6% 4, 200 + 80, 000

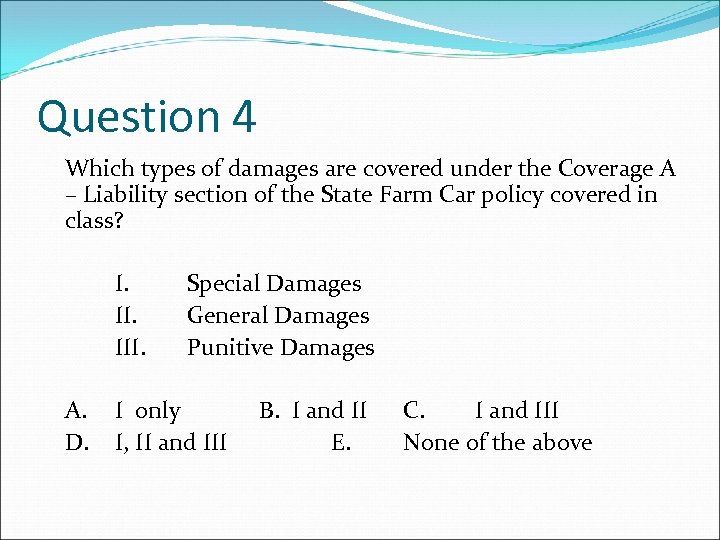

Question 4 Which types of damages are covered under the Coverage A – Liability section of the State Farm Car policy covered in class? I. III. Special Damages General Damages Punitive Damages A. I only D. I, II and III B. I and II E. C. I and III None of the above

Question 4 Which types of damages are covered under the Coverage A – Liability section of the State Farm Car policy covered in class? I. III. Special Damages General Damages Punitive Damages A. I only D. I, II and III B. I and II E. C. I and III None of the above

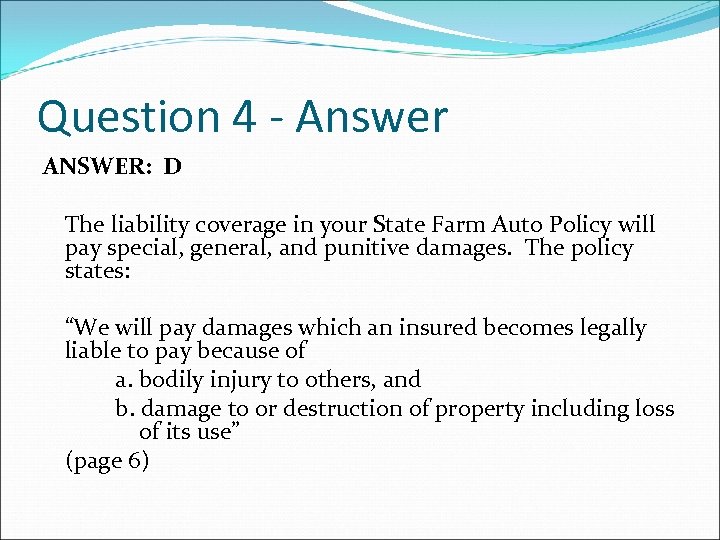

Question 4 - Answer ANSWER: D The liability coverage in your State Farm Auto Policy will pay special, general, and punitive damages. The policy states: “We will pay damages which an insured becomes legally liable to pay because of a. bodily injury to others, and b. damage to or destruction of property including loss of its use” (page 6)

Question 4 - Answer ANSWER: D The liability coverage in your State Farm Auto Policy will pay special, general, and punitive damages. The policy states: “We will pay damages which an insured becomes legally liable to pay because of a. bodily injury to others, and b. damage to or destruction of property including loss of its use” (page 6)

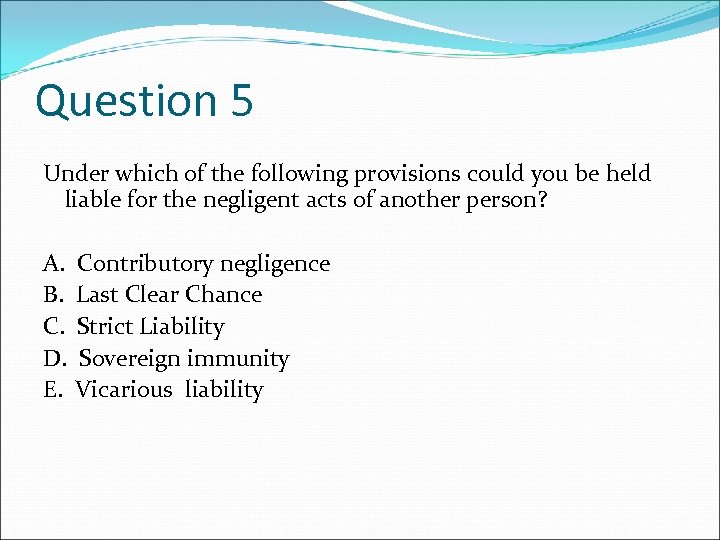

Question 5 Under which of the following provisions could you be held liable for the negligent acts of another person? A. Contributory negligence B. Last Clear Chance C. Strict Liability D. Sovereign immunity E. Vicarious liability

Question 5 Under which of the following provisions could you be held liable for the negligent acts of another person? A. Contributory negligence B. Last Clear Chance C. Strict Liability D. Sovereign immunity E. Vicarious liability

Question 5 CORRECT ANSWER: E Vicarious liability is, by definition, one person being held liable for the acts of another

Question 5 CORRECT ANSWER: E Vicarious liability is, by definition, one person being held liable for the acts of another

Homework #10 Review By: Bill

Homework #10 Review By: Bill

Problem #1 Your son and his friends are playing basketball in your backyard. One of your son’s friends fragrantly fouls another friend, resulting in a broken arm. The hurt friend incurs $3, 000 in medical bills. Your son’s friend sues you as owner of the house, but you are not found liable. A. $0 B. $750 C. $1, 000 D. $3, 000 E. None of the above

Problem #1 Your son and his friends are playing basketball in your backyard. One of your son’s friends fragrantly fouls another friend, resulting in a broken arm. The hurt friend incurs $3, 000 in medical bills. Your son’s friend sues you as owner of the house, but you are not found liable. A. $0 B. $750 C. $1, 000 D. $3, 000 E. None of the above

Problem #1 - Answer Correct Answer: C. $1, 000 Explanation: Your son’s friend incurred $3, 000 in medical bills. Therefore, he will receive $1, 000 because this is the maximum amount your medical payments coverage will pay person per incident.

Problem #1 - Answer Correct Answer: C. $1, 000 Explanation: Your son’s friend incurred $3, 000 in medical bills. Therefore, he will receive $1, 000 because this is the maximum amount your medical payments coverage will pay person per incident.

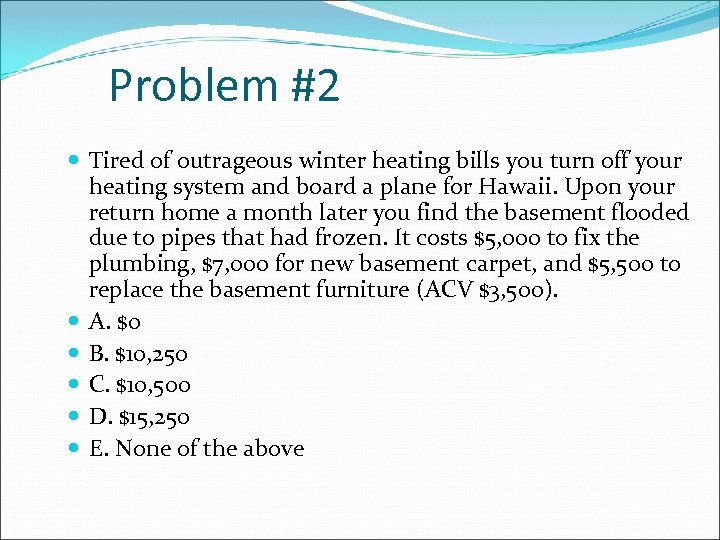

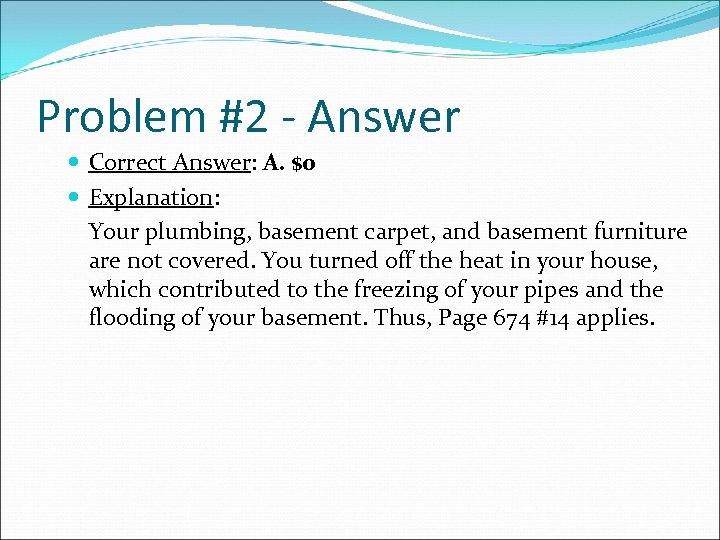

Problem #2 Tired of outrageous winter heating bills you turn off your heating system and board a plane for Hawaii. Upon your return home a month later you find the basement flooded due to pipes that had frozen. It costs $5, 000 to fix the plumbing, $7, 000 for new basement carpet, and $5, 500 to replace the basement furniture (ACV $3, 500). A. $0 B. $10, 250 C. $10, 500 D. $15, 250 E. None of the above

Problem #2 Tired of outrageous winter heating bills you turn off your heating system and board a plane for Hawaii. Upon your return home a month later you find the basement flooded due to pipes that had frozen. It costs $5, 000 to fix the plumbing, $7, 000 for new basement carpet, and $5, 500 to replace the basement furniture (ACV $3, 500). A. $0 B. $10, 250 C. $10, 500 D. $15, 250 E. None of the above

Problem #2 - Answer Correct Answer: A. $0 Explanation: Your plumbing, basement carpet, and basement furniture are not covered. You turned off the heat in your house, which contributed to the freezing of your pipes and the flooding of your basement. Thus, Page 674 #14 applies.

Problem #2 - Answer Correct Answer: A. $0 Explanation: Your plumbing, basement carpet, and basement furniture are not covered. You turned off the heat in your house, which contributed to the freezing of your pipes and the flooding of your basement. Thus, Page 674 #14 applies.

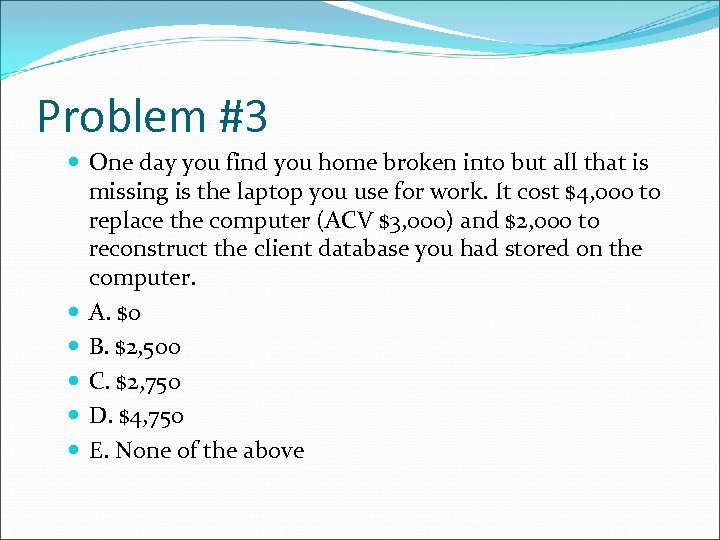

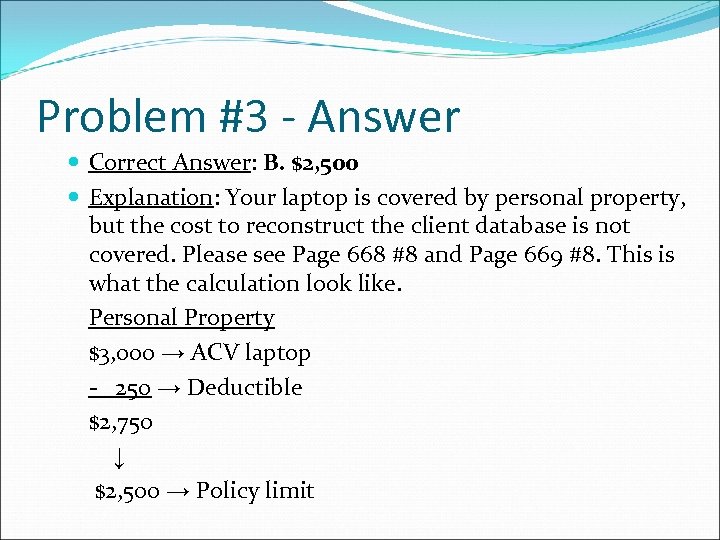

Problem #3 One day you find you home broken into but all that is missing is the laptop you use for work. It cost $4, 000 to replace the computer (ACV $3, 000) and $2, 000 to reconstruct the client database you had stored on the computer. A. $0 B. $2, 500 C. $2, 750 D. $4, 750 E. None of the above

Problem #3 One day you find you home broken into but all that is missing is the laptop you use for work. It cost $4, 000 to replace the computer (ACV $3, 000) and $2, 000 to reconstruct the client database you had stored on the computer. A. $0 B. $2, 500 C. $2, 750 D. $4, 750 E. None of the above

Problem #3 - Answer Correct Answer: B. $2, 500 Explanation: Your laptop is covered by personal property, but the cost to reconstruct the client database is not covered. Please see Page 668 #8 and Page 669 #8. This is what the calculation look like. Personal Property $3, 000 → ACV laptop - 250 → Deductible $2, 750 ↓ $2, 500 → Policy limit

Problem #3 - Answer Correct Answer: B. $2, 500 Explanation: Your laptop is covered by personal property, but the cost to reconstruct the client database is not covered. Please see Page 668 #8 and Page 669 #8. This is what the calculation look like. Personal Property $3, 000 → ACV laptop - 250 → Deductible $2, 750 ↓ $2, 500 → Policy limit

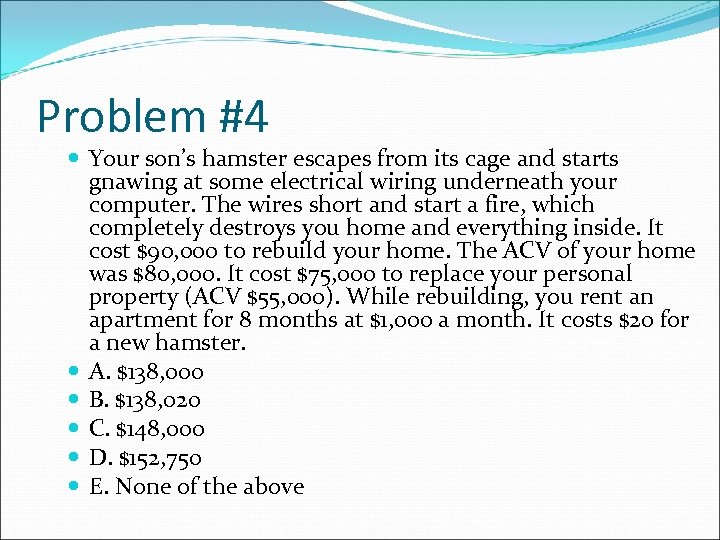

Problem #4 Your son’s hamster escapes from its cage and starts gnawing at some electrical wiring underneath your computer. The wires short and start a fire, which completely destroys you home and everything inside. It cost $90, 000 to rebuild your home. The ACV of your home was $80, 000. It cost $75, 000 to replace your personal property (ACV $55, 000). While rebuilding, you rent an apartment for 8 months at $1, 000 a month. It costs $20 for a new hamster. A. $138, 000 B. $138, 020 C. $148, 000 D. $152, 750 E. None of the above

Problem #4 Your son’s hamster escapes from its cage and starts gnawing at some electrical wiring underneath your computer. The wires short and start a fire, which completely destroys you home and everything inside. It cost $90, 000 to rebuild your home. The ACV of your home was $80, 000. It cost $75, 000 to replace your personal property (ACV $55, 000). While rebuilding, you rent an apartment for 8 months at $1, 000 a month. It costs $20 for a new hamster. A. $138, 000 B. $138, 020 C. $148, 000 D. $152, 750 E. None of the above

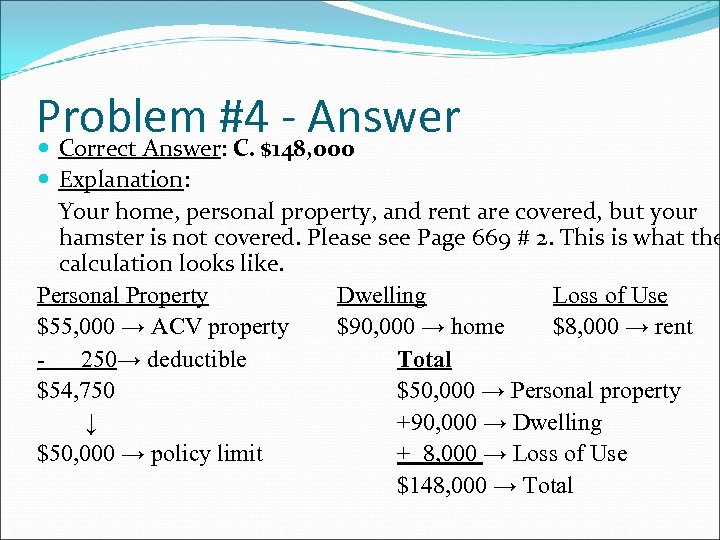

Problem #4$148, 000 - Answer Correct Answer: C. Explanation: Your home, personal property, and rent are covered, but your hamster is not covered. Please see Page 669 # 2. This is what the calculation looks like. Personal Property Dwelling Loss of Use $55, 000 → ACV property $90, 000 → home $8, 000 → rent 250→ deductible Total $54, 750 $50, 000 → Personal property ↓ +90, 000 → Dwelling $50, 000 → policy limit + 8, 000 → Loss of Use $148, 000 → Total

Problem #4$148, 000 - Answer Correct Answer: C. Explanation: Your home, personal property, and rent are covered, but your hamster is not covered. Please see Page 669 # 2. This is what the calculation looks like. Personal Property Dwelling Loss of Use $55, 000 → ACV property $90, 000 → home $8, 000 → rent 250→ deductible Total $54, 750 $50, 000 → Personal property ↓ +90, 000 → Dwelling $50, 000 → policy limit + 8, 000 → Loss of Use $148, 000 → Total