8021e802ee5465ace32748c6f3df0f27.ppt

- Количество слайдов: 20

Exam 1 Review

Exam 1 Review

Things You Should Know l Time Value of Money problems l All the readings including WSJ ‘little’ book n Stocks: trading, calculating returns n Mutual Funds n Stock Indexes

Things You Should Know l Time Value of Money problems l All the readings including WSJ ‘little’ book n Stocks: trading, calculating returns n Mutual Funds n Stock Indexes

TVM l How to work your calculator n Setting different compounding periods l PV and FV of single cash flow l PV and FV of multiple cash flows n Annuities due n Perpetuities l Translating word problems into TVM

TVM l How to work your calculator n Setting different compounding periods l PV and FV of single cash flow l PV and FV of multiple cash flows n Annuities due n Perpetuities l Translating word problems into TVM

TVM l Finding the single unknown n PV, l FV, N, I/YR, PMT Different ways of stating interest rates n APR, l EAR, Add-on, Points Combining PV and FV problems n Saving l for retirement Comparing different choices using TVM n e. g. Lease vs. Buy

TVM l Finding the single unknown n PV, l FV, N, I/YR, PMT Different ways of stating interest rates n APR, l EAR, Add-on, Points Combining PV and FV problems n Saving l for retirement Comparing different choices using TVM n e. g. Lease vs. Buy

TVM Problems l Five main keys: n PV n FV n PMT n I/YR n. N l Setting Key: P/YR

TVM Problems l Five main keys: n PV n FV n PMT n I/YR n. N l Setting Key: P/YR

Before you begin TVM l Read the problem and determine compounding period l Find out what is asked l Check and set P/YR and BEG/END keys l Clear all memory

Before you begin TVM l Read the problem and determine compounding period l Find out what is asked l Check and set P/YR and BEG/END keys l Clear all memory

Example 1 l First Simple Bank pays 6% compounded quarterly whereas First Complex Bank pays 6% compounded continuously. You deposit $15, 000 for 3 years in each bank, which account will have more and by how much more? l Answer: $23. 98

Example 1 l First Simple Bank pays 6% compounded quarterly whereas First Complex Bank pays 6% compounded continuously. You deposit $15, 000 for 3 years in each bank, which account will have more and by how much more? l Answer: $23. 98

Example 1 (contd. ) l What are the EARs on the two accounts? Answer: Quarterly: l Answer: Continuously: l 6. 13% 6. 18%

Example 1 (contd. ) l What are the EARs on the two accounts? Answer: Quarterly: l Answer: Continuously: l 6. 13% 6. 18%

Note: l When you have continuous compounding problem, you must use the formula (unless your calculator has continuous compounding function - e. g. 17 B) l When you use any formula, enter interest rate in decimals!

Note: l When you have continuous compounding problem, you must use the formula (unless your calculator has continuous compounding function - e. g. 17 B) l When you use any formula, enter interest rate in decimals!

Example 2 l At 9% interest rate compounded monthly, how many years does it take to quardruple your money? l Answer: 15. 46 years

Example 2 l At 9% interest rate compounded monthly, how many years does it take to quardruple your money? l Answer: 15. 46 years

Example 3 l You are scheduled to receive $17, 000 in two years. When you receive it, you will invest it for six more years at 6 percent per year. How much will you have in eight years? l Answer: $24, 114. 82

Example 3 l You are scheduled to receive $17, 000 in two years. When you receive it, you will invest it for six more years at 6 percent per year. How much will you have in eight years? l Answer: $24, 114. 82

Example 4 Calculate the interest rate charged by a car dealer when you buy a $14, 000 car and are asked to make $349 monthly payments for four years. l Answer: 9. 09% per year APR l What is the EAR on the loan? l Answer: 9. 48% EAR l

Example 4 Calculate the interest rate charged by a car dealer when you buy a $14, 000 car and are asked to make $349 monthly payments for four years. l Answer: 9. 09% per year APR l What is the EAR on the loan? l Answer: 9. 48% EAR l

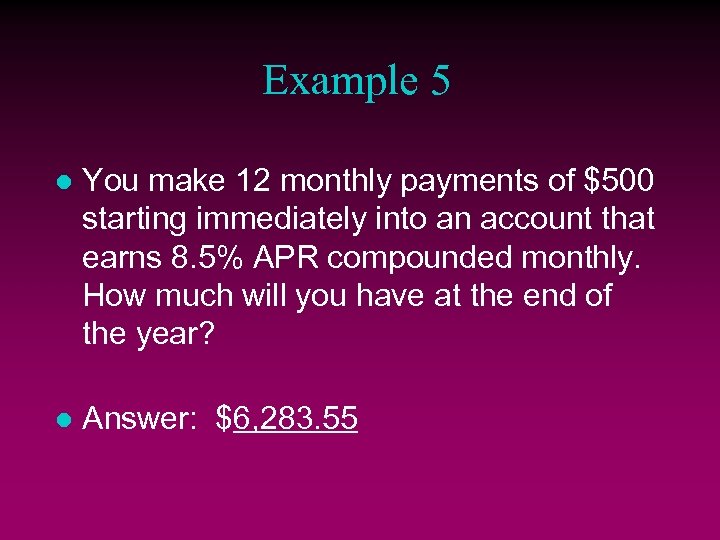

Example 5 l You make 12 monthly payments of $500 starting immediately into an account that earns 8. 5% APR compounded monthly. How much will you have at the end of the year? l Answer: $6, 283. 55

Example 5 l You make 12 monthly payments of $500 starting immediately into an account that earns 8. 5% APR compounded monthly. How much will you have at the end of the year? l Answer: $6, 283. 55

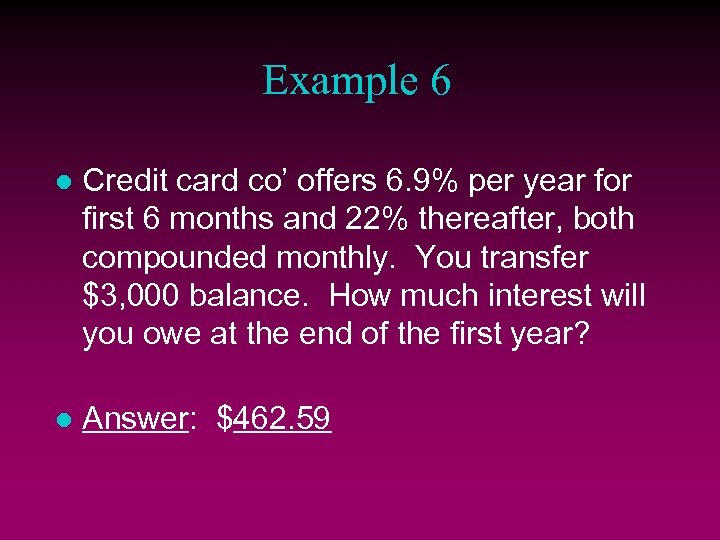

Example 6 l Credit card co’ offers 6. 9% per year for first 6 months and 22% thereafter, both compounded monthly. You transfer $3, 000 balance. How much interest will you owe at the end of the first year? l Answer: $462. 59

Example 6 l Credit card co’ offers 6. 9% per year for first 6 months and 22% thereafter, both compounded monthly. You transfer $3, 000 balance. How much interest will you owe at the end of the first year? l Answer: $462. 59

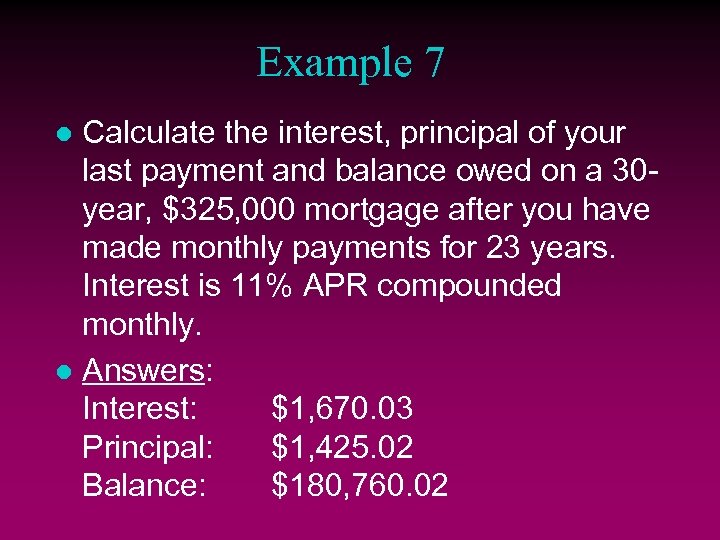

Example 7 Calculate the interest, principal of your last payment and balance owed on a 30 year, $325, 000 mortgage after you have made monthly payments for 23 years. Interest is 11% APR compounded monthly. l Answers: Interest: $1, 670. 03 Principal: $1, 425. 02 Balance: $180, 760. 02 l

Example 7 Calculate the interest, principal of your last payment and balance owed on a 30 year, $325, 000 mortgage after you have made monthly payments for 23 years. Interest is 11% APR compounded monthly. l Answers: Interest: $1, 670. 03 Principal: $1, 425. 02 Balance: $180, 760. 02 l

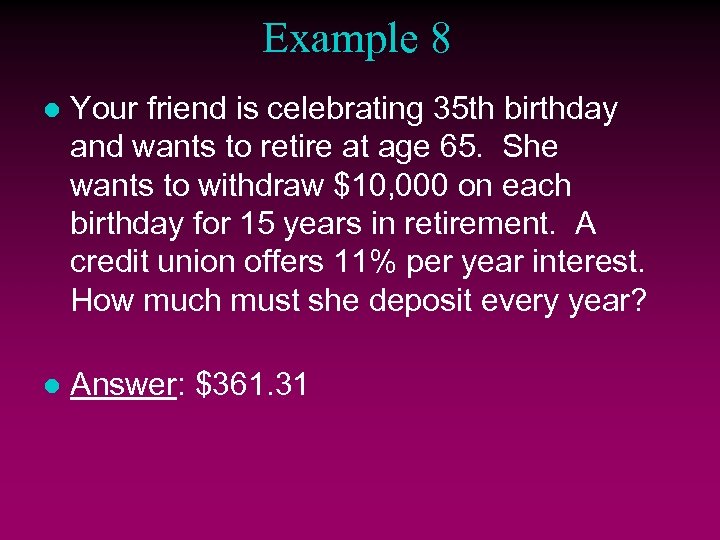

Example 8 l Your friend is celebrating 35 th birthday and wants to retire at age 65. She wants to withdraw $10, 000 on each birthday for 15 years in retirement. A credit union offers 11% per year interest. How much must she deposit every year? l Answer: $361. 31

Example 8 l Your friend is celebrating 35 th birthday and wants to retire at age 65. She wants to withdraw $10, 000 on each birthday for 15 years in retirement. A credit union offers 11% per year interest. How much must she deposit every year? l Answer: $361. 31

Example 8 continued l If she just inherited money and wants to make one lumpsum deposit today, what amount must she deposit? l Answer: $3, 141. 17

Example 8 continued l If she just inherited money and wants to make one lumpsum deposit today, what amount must she deposit? l Answer: $3, 141. 17

Example 8 (contd. ) l Your friend’s employer will contribute $100 every year. Also, she expects $15, 000 from family trust on her 55 th birthday which she will put into retirement a/c. What amount must she deposit annually to meet her goals? l Answer: $47. 31

Example 8 (contd. ) l Your friend’s employer will contribute $100 every year. Also, she expects $15, 000 from family trust on her 55 th birthday which she will put into retirement a/c. What amount must she deposit annually to meet her goals? l Answer: $47. 31

Example 9 l A check cashing store makes a 1 -year ‘discount’ loan of $12, 000 by deducting interest at 13% per year immediately. Interest deducted: 12, 000 *. 13 = $1, 560 You get: 12, 000 - 1, 560 = $10, 440 What is the EAR on the loan? l Answer: 14. 94% l

Example 9 l A check cashing store makes a 1 -year ‘discount’ loan of $12, 000 by deducting interest at 13% per year immediately. Interest deducted: 12, 000 *. 13 = $1, 560 You get: 12, 000 - 1, 560 = $10, 440 What is the EAR on the loan? l Answer: 14. 94% l

Example 10 l What is the APR and EAR on a 10 -year, $170, 000 monthly payment loan quoted as 9% + 2 points? l Answers: n APR = 9. 47% n EAR = 9. 89%

Example 10 l What is the APR and EAR on a 10 -year, $170, 000 monthly payment loan quoted as 9% + 2 points? l Answers: n APR = 9. 47% n EAR = 9. 89%