78583a5ef980fb6083ec4f96ec8560d1.ppt

- Количество слайдов: 21

Evolving Bank Regulation: Basel III & Liquidity

Agenda § Basel III • What does this mean to you? • Background • Current Environment • Liquidity – Deposits – Lines of credit • “Basel III Friendly” Product Opportunities – Specialized Products 2

What does this mean for you? Liquidity Rules: § Forces banks to reevaluate customer deposits and put a greater emphasis on customer balances: • with longer terms OR; • as part of a their larger relationship with the bank § U. S. regulators established an accelerated conformance period, during which banks will be expected to work toward 100% compliance on the Liquidity Coverage Ratio § Final rules were released September 3, 2014 and banks are moving aggressively to achieve full compliance. § Working with customers to create or modify products to be more “Basel III friendly” 3

Basel Committee § Bank for International Settlements (BIS) Mission is to serve central banks in their pursuit of monetary and financial stability, to foster international cooperation in those areas and to act as a bank for central banks. • Established 1930 • 58 member central banks or monetary authorities • Headquartered: Basel, Switzerland § Basel Committee on Banking Supervision (BCBS) A committee of banking supervisory authorities who’s objective is to enhance understanding of key supervisory issues and improve the quality of banking supervision worldwide. • Established by the BIS in 1974 4

Basel Accords (Basel I, III) § Basel I (1988) • Initial Bank Capital Framework • Published a set of minimal capital requirements for banks § Basel II (2004) • More comprehensive bank capital guidelines • “created an international standard that banking regulators can use when creating regulations about how much capital banks need to put aside to guard against the types of financial and operational risks” § Basel III (2009) • Strengthened capital requirements & introduced liquidity requirements • Promotes a more robust banking system, worldwide, resulting from weaknesses exposed during the global financial crisis that began in late 2007. 5

Liquidity 101 Liquidity Defined: • The capability to meet all required outflows of cash with available cash OR borrowing against or selling assets. Historical Approach: • Banks provide customers with forms of cost effective liquidity: – Demand Deposits – Committed Lines of Credit • Banks managed liquidity needs internally: – Reserves held against deposits – Off-Balance Sheet Sources of Liquidity: – Collateralized Borrowing Capacity (Lines of Credit for other institutions, FHLB system, Fed Discount Window) 6

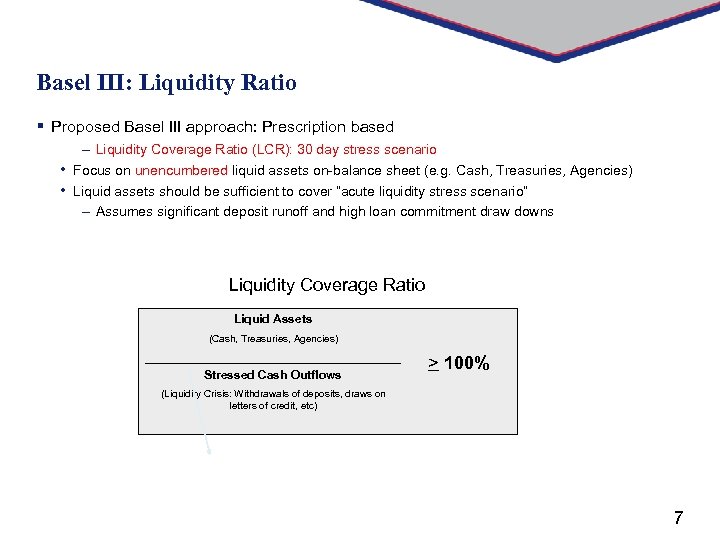

Basel III: Liquidity Ratio § Proposed Basel III approach: Prescription based – Liquidity Coverage Ratio (LCR): 30 day stress scenario • Focus on unencumbered liquid assets on-balance sheet (e. g. Cash, Treasuries, Agencies) • Liquid assets should be sufficient to cover “acute liquidity stress scenario” – Assumes significant deposit runoff and high loan commitment draw downs Liquidity Coverage Ratio Liquid Assets (Cash, Treasuries, Agencies) Stressed Cash Outflows > 100% (Liquidity Crisis: Withdrawals of deposits, draws on letters of credit, etc) 7

Basel III: Liquidity Ratio Timeline: § U. S. Regulators finalized rules for domestic implementation in September § Conformance Timeline: – Minimum ratio of 80% required by January 1, 2015 then increasing annually by 10% until full implementation by January 1, 2017. – This schedule seeks compliance a full two years sooner than required by Basel 8

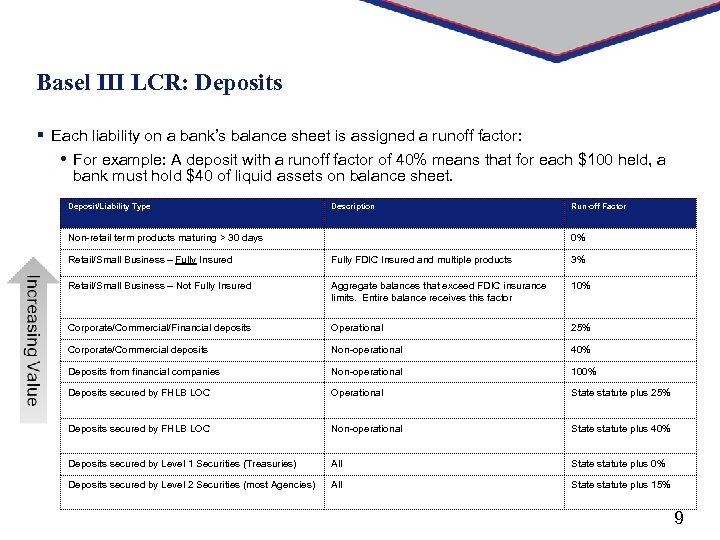

Basel III LCR: Deposits § Each liability on a bank’s balance sheet is assigned a runoff factor: • For example: A deposit with a runoff factor of 40% means that for each $100 held, a bank must hold $40 of liquid assets on balance sheet. Deposit/Liability Type Description Non-retail term products maturing > 30 days Run-off Factor 0% Retail/Small Business – Fully Insured Fully FDIC Insured and multiple products 3% Retail/Small Business – Not Fully Insured Aggregate balances that exceed FDIC insurance limits. Entire balance receives this factor 10% Corporate/Commercial/Financial deposits Operational 25% Corporate/Commercial deposits Non-operational 40% Deposits from financial companies Non-operational 100% Deposits secured by FHLB LOC Operational State statute plus 25% Deposits secured by FHLB LOC Non-operational State statute plus 40% Deposits secured by Level 1 Securities (Treasuries) All State statute plus 0% Deposits secured by Level 2 Securities (most Agencies) All State statute plus 15% 9

Basel III LCR: Deposits § Deposits with a lower run-off will be more highly valued • Higher Value (better deposit rates): – Operational Balances – Multiple Relationships / Multiple Products – FDIC Insured / Retail • Lower Value (lower deposit rates): – Non-operational deposits (particularly from Financial Companies or deposits requiring collateral) § U. S. Rules set a very high bar for qualification as an operational deposit. The rule limits the characteristics of operational accounts and requires a bank to identify excess balances beyond those held for operational purposes and assign them the higher runoff factor. § New products which offer comparatively higher rates, but come with lower flexibility for early withdrawal 10

“Basel III Friendly” Product Opportunities

Specialized Products Banks are developing products to help manage Basel III Liquidity Ratios Convertible Investment Offering • A term product (i. e. no withdrawal within 31 -days allowed) where the customer can add balances • • at any time and has an option which will allow them access the funds after 31 -days. Since the term of the product is always greater than 30 days the product has a 0% run off factor from a Basel III perspective, until the conversion option is exercised Also referred to as “evergreen” structures by some Long-Term Sweep • Allows customers with large and stable funds to obtain a higher yield with a blend of short- and • long-term yields while retaining a portion of funds for daily liquidity Example below: – Customer has $100 mm of daily liquid balances, from multiple accounts, paying 0. 10% – Customer needs to keep $20 mm available for daily needs – Able to place $80 mm in term products (i. e. 3 -years at 1. 00%) – Customer’s all-in rate is 0. 82% on entire balance (80 mm*1. 00% + 20*0. 10%) – Bank keeps $80 mm out of the LCR ratio as that portion is termed out U. S. Bank Confidential - Internal Only 12

Other Investment Options § U. S. Treasuries § Government Agencies § FDIC Program Options 13

Money Market Fund Reform

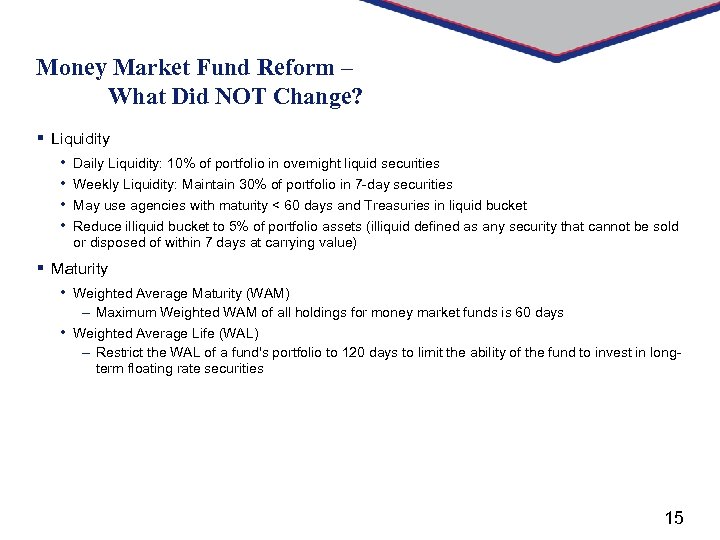

Money Market Fund Reform – What Did NOT Change? § Liquidity • Daily Liquidity: 10% of portfolio in overnight liquid securities • Weekly Liquidity: Maintain 30% of portfolio in 7 -day securities • May use agencies with maturity < 60 days and Treasuries in liquid bucket • Reduce illiquid bucket to 5% of portfolio assets (illiquid defined as any security that cannot be sold or disposed of within 7 days at carrying value) § Maturity • Weighted Average Maturity (WAM) – Maximum Weighted WAM of all holdings for money market funds is 60 days • Weighted Average Life (WAL) – Restrict the WAL of a fund's portfolio to 120 days to limit the ability of the fund to invest in longterm floating rate securities 15

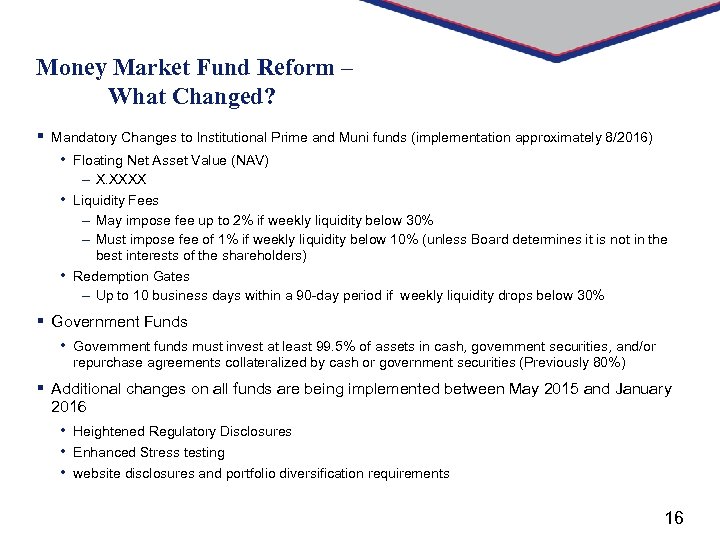

Money Market Fund Reform – What Changed? § Mandatory Changes to Institutional Prime and Muni funds (implementation approximately 8/2016) • Floating Net Asset Value (NAV) – X. XXXX • Liquidity Fees – May impose fee up to 2% if weekly liquidity below 30% – Must impose fee of 1% if weekly liquidity below 10% (unless Board determines it is not in the best interests of the shareholders) • Redemption Gates – Up to 10 business days within a 90 -day period if weekly liquidity drops below 30% § Government Funds • Government funds must invest at least 99. 5% of assets in cash, government securities, and/or repurchase agreements collateralized by cash or government securities (Previously 80%) § Additional changes on all funds are being implemented between May 2015 and January 2016 • Heightened Regulatory Disclosures • Enhanced Stress testing • website disclosures and portfolio diversification requirements 16

Summary

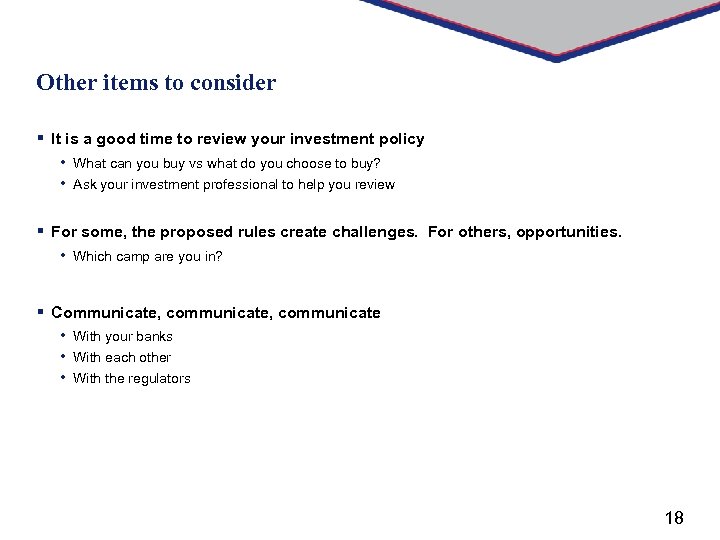

Other items to consider § It is a good time to review your investment policy • What can you buy vs what do you choose to buy? • Ask your investment professional to help you review § For some, the proposed rules create challenges. For others, opportunities. • Which camp are you in? § Communicate, communicate • With your banks • With each other • With the regulators 18

Questions? 19

Contact Information § Bryan Schell Money Center (866) 669 -6951 bryan. schell@usbank. com § Joan Ingram Money Center (866) 669 -6951 joan. ingram@usbank. com § Greer Almquist Government Banking Relationship Manager (402) 536 -5101 greer. almquist@usbank. com 20

Disclosures For purposes of Section 15 B of the Securities Exchange Act of 1934 (the “Act”) (SEC Rule 15 Ba 1 -1 et seq. ) (the “Rule”), the Money Center Department within the U. S. Bank Corporate Treasury Division (the “Money Center”): (1) is not recommending and will not recommend an action to you; (2) is not providing and will not provide “advice” to you as defined in the Rule, and any information or communication from the Money Center in respect of your accounts with the Money Center or the Safekeeping Department within the U. S. Bank Corporate Treasury Division (the “Account(s)”) or in respect of any securities transaction or potential securities transaction to be executed via the Account(s) is not intended to be and should not be construed as “advice” as defined in the Rule; (3) the Money Center is not acting as an advisor to you and does not owe you any fiduciary duty pursuant to Section 15 B of the Act or otherwise with respect to any such Account(s), information, communication, transaction or potential transaction; and (4) subject to FINRA Rules 2111 and 2121, the Money Center is acting for its own interest with respect to the Account(s) and with respect to any securities transactions to be executed via the Account(s). You should discuss any information or material provided to you by the Money Center in connection with trading, investing or other activity in the Account(s) with any and all of your internal or external advisors and experts that you deem appropriate before acting on any such information or material. Investment products are: Deposit products offered by U. S. Bank National Association. Member FDIC. This discussion is intended to be informational only and is not exhaustive or conclusive. The factual information provided has been obtained from sources believed to be reliable, but is not guaranteed as to accuracy or completeness. U. S. Bank and its representatives do not provide tax or legal advice. © 2014 U. S. Bank National Association. All trademarks are the property of their respective owners. 21

78583a5ef980fb6083ec4f96ec8560d1.ppt