b26862c0c82c80de7a50be7c3bb1846e.ppt

- Количество слайдов: 64

“Everything You Wanted to Know About the Current Financial/Economic Crisis, but were Afraid to Ask” Or: Where are we, how did we get here and where are we headed? Professor Michael Palmer Leeds School of Business Presentation to Eastside Residential Brokers Bellevue, Washington December 5, 2008

Quick Bio • Michael Palmer, Professor of Finance, Leeds School of Business, University of Colorado. • Education: Ph. D. University of Washington, 1967 (Finance and Macro-economics) • Visiting Professor Status: Kansai Gaidai University, Osaka, Japan; Jiao Tong University, Shanghai, China; Semester at Sea • Academic Director: London Seminar in International Finance

Ben Bernanke’s View and My View • Ben Bernanke (April 10, 2008): – "We now know the lessons from [the Depression]. We are certainly going to make sure that the financial system remains in good functioning order. “ • My view: – We are in an unprecedented economic slowdown, caused by a combination of (1) a historically financial market freeze, (2) a massive negative wealth effect resulting from a dual real estate and stock market collapse and (3) a collapse of consumer confidence. – In this unique environment, the past is probably not a particularly good road map for the present nor the future. • True for policy makers and forecasters.

Goal of this Presentation • Three primary issues to be covered today: – (1) The Past: How did we get here; aka How Did we Get into this Mess in the First Place? – (2) The Present: Where Are we Today? – (3) The Future: Where Might we be Going? • With focus on the national and global economies.

Theme of Presentation • The country is caught in an unprecedented crisis involving a: • (1) lack of confidence in its financial markets and financial institutions. – Affecting interbank and external lending and essentially freezing these critical markets. • (2) a collapse of stock prices and real estate prices. – Resulting in massive negative wealth effects. • (3) a collapse of confidence of consumers in the economy and in their situation. – Affecting household spending

What we Must do • We cannot let the financial system fail. – The financial system is the grease that keeps the economy going. – We need to shore up financial market liquidity and provide direct lending where markets are not functioning. • We need to address mounting home foreclosures. – Currently in foreclosure (2. 97% of all mortgages) and 30 days overdue 6. 99% – both figures at the highest level since data was collected 29 years ago. • We need to restore consumer confidence. – No magic bullet here, but it is likely a combination of political and fiscal stimulus.

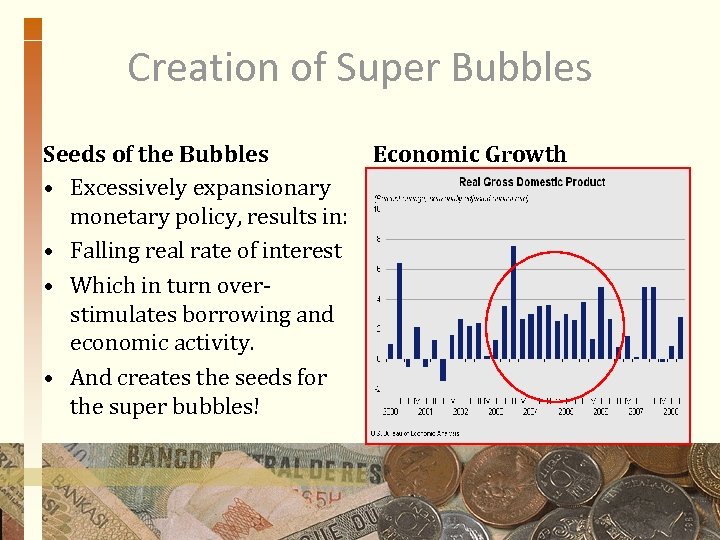

Issue #1: How Did We Get Here • How did this happen? – The 2002 -2006 period was characterized by over-stimulative monetary and fiscal policies which contributed to a surge in (1) financial and real asset prices along with (2) skyrocketing consumer debt. • And created unsustainable “Super Bubbles” – The first bubble to burst was the housing bubble.

Housing Leads the Way • August 2007, the sub-prime mortgage market surfaces as a potential issue. • A combination of economic and financial factors results in rising home foreclosures. – Foreclosures in 3 Q 06: 223, 223 – Foreclosures in 3 Q 07: 446, 726 (+100%) – Foreclosures in 3 Q 08: 765, 558 (+71%) and the highest since records began in January 2005.

And Housing Continues to Suffer • Housing prices, starts and sales slide. – New house prices 3 Q 08: -16. 6% from 3 Q 07 (Median price of $218, 000 in Oct is lowest since September 2004) – Existing house prices: Oct 08: Median price $183, 000, down 11. 1% from a year ago. – Housing starts: Oct 08: 791, 000 annual rate (lowest since records began in 1959). – Sales of new homes: Oct 08: -5. 3% annual rate to 433, 000 annual units (lowest since January 2001 and 40% lower than a year ago) – Sales of existing homes: Oct 08: -3. 1% annual rate to 4. 98 million units

Enter Securitization • Financial institutions were also involved in the “securitization” (i. e. , pooling and distribution) of loans (sub-prime mortgage loans, commercial real estate loans, consumer loans, student loans). – This took place at the same time that rating services were unable (or unwilling) to successfully evaluate the risk associated with these loan packages. • Regulations, unfortunately, did not keep pace with changing financial structure.

Financial Market Freeze • While there were “sub-prime market” danger signs as far back as August 2007, U. S. financial markets really began to “freeze up” in early to mid. September 2008 around the time of: – – – the Fannie Mae/Freddie Mac bailout (Sept 8), Lehman Brothers failure (Sept 12), Merrill Lynch take-over by Bof. A (Sept 15), AIG $85 billion rescue plan (Sept 16 th) Washington Mutual take-over by JPMorgan (Sept 25 th) Federal Reserve rescue of commercial paper markets (Oct 7).

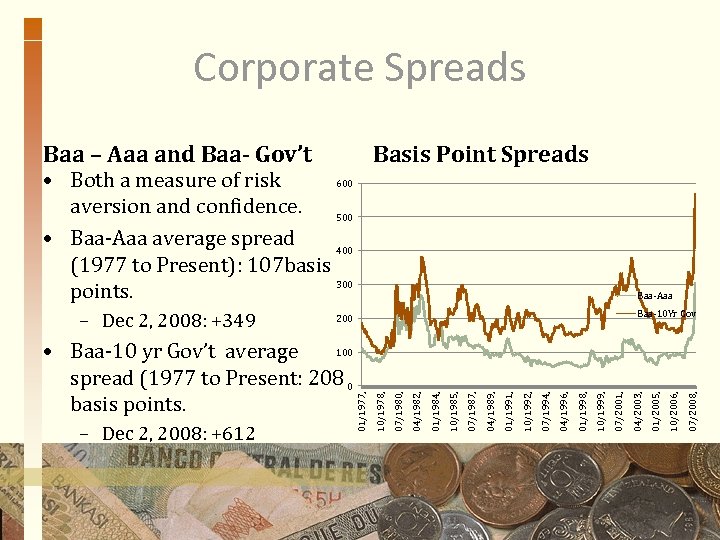

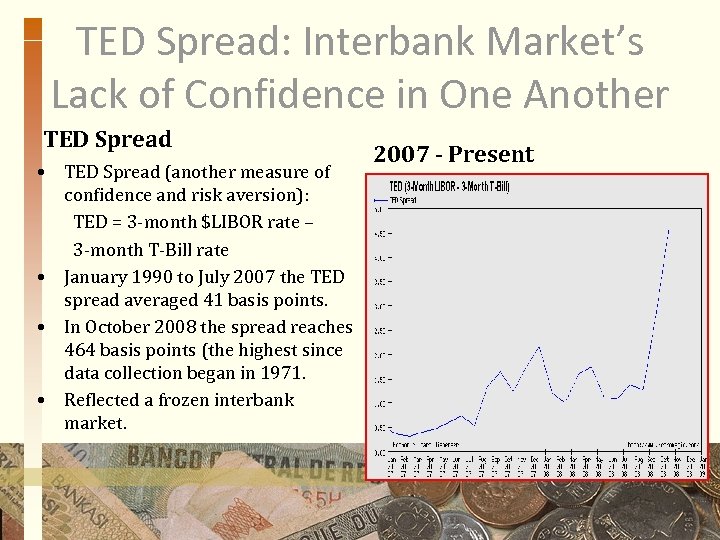

Manifestations of Financial Market Freeze • Freeze was manifested in: – Spreads of investment grade corporate bonds (e. g. , Aaa and Baa) over Treasury bonds rising to record levels. – Commercial paper market and investment grade bond markets shutting down. – Money market fund outflows (some “broke the buck”). – Increasing interbank lending spreads to default free returns (in the Fed funds and LIBOR markets) • Reflecting a lack of confidence in financial institutions and over-all risk aversion

Corporate Spreads Baa – Aaa and Baa- Gov’t Basis Point Spreads 600 • Both a measure of risk aversion and confidence. 500 • Baa-Aaa average spread 400 (1977 to Present): 107 basis 300 points. 07/2008, 10/2006, 01/2005, 04/2003, 07/2001, 10/1999, 01/1998, 04/1996, 07/1994, 10/1992, 01/1991, 04/1989, 07/1987, 10/1985, 01/1984, 04/1982, 07/1980, 10/1978, • Baa-10 yr Gov’t average 100 spread (1977 to Present: 208 0 basis points. – Dec 2, 2008: +612 Baa-10 Yr Gov 200 01/1977, – Dec 2, 2008: +349 Baa-Aaa

TED Spread: Interbank Market’s Lack of Confidence in One Another TED Spread • TED Spread (another measure of confidence and risk aversion): TED = 3 -month $LIBOR rate – 3 -month T-Bill rate • January 1990 to July 2007 the TED spread averaged 41 basis points. • In October 2008 the spread reaches 464 basis points (the highest since data collection began in 1971. • Reflected a frozen interbank market. 2007 - Present

Response of U. S. to Freeze • U. S. responded with $700 billion bailout package (Troubled Asset Relief Program, Oct 3 rd ) and Federal Reserve interest rate reductions and Federal Reserve emergency loans/liquidity injections. – TARP program has thus far injected $350 billion ($250 billion to buy equity states in banks and $100 billion to AIG). • On November 24, the Government announces it (Treasury and Fed) is prepared to lend more than $7. 4 trillion to rescue financial markets. – This is roughly equal to 50% of nominal U. S. GDP

Result of U. S. Credit Freeze on Financial Players and Markets • Bailouts or sales of financial institutions (Fannie Mae, Freddie Mac, AIG, Merrill Lynch, Citigroup) – Disappearance of stand-alone U. S. investment banking firms. • Bankruptcies of long standing financial institutions (Lehman Brothers and Bear Sterns) • And, within a short period of time, the U. S. credit freeze spreads to overseas financial markets.

Freeze Spreads to Real Economy • The ripple effects of the credit freeze quickly spread to the consumer sector where we saw a rapid decline in consumer spending. – The combined freezing of credit and the decline in consumer spending become the main drivers in pushing down the real economy. • At the same time, and in response to the crisis, an erosion of confidence in the financial system and in the economy itself takes hold. – Further affecting consumer and business spending.

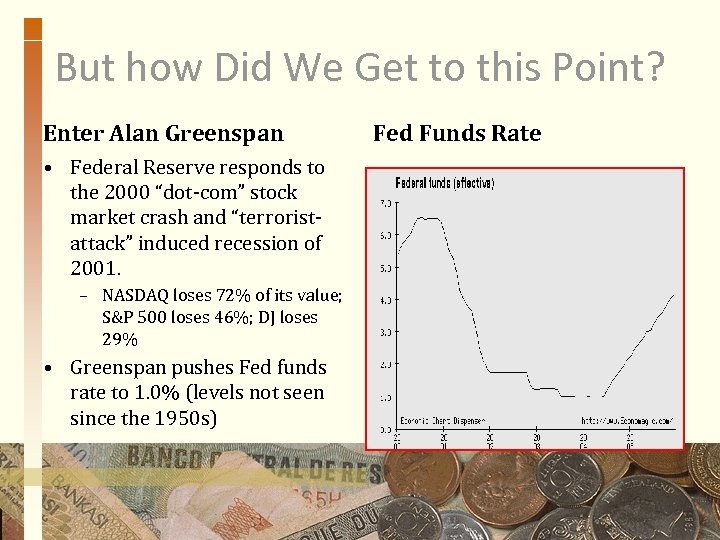

But how Did We Get to this Point? Enter Alan Greenspan • Federal Reserve responds to the 2000 “dot-com” stock market crash and “terrorist- attack” induced recession of 2001. – NASDAQ loses 72% of its value; S&P 500 loses 46%; DJ loses 29% • Greenspan pushes Fed funds rate to 1. 0% (levels not seen since the 1950 s) Fed Funds Rate

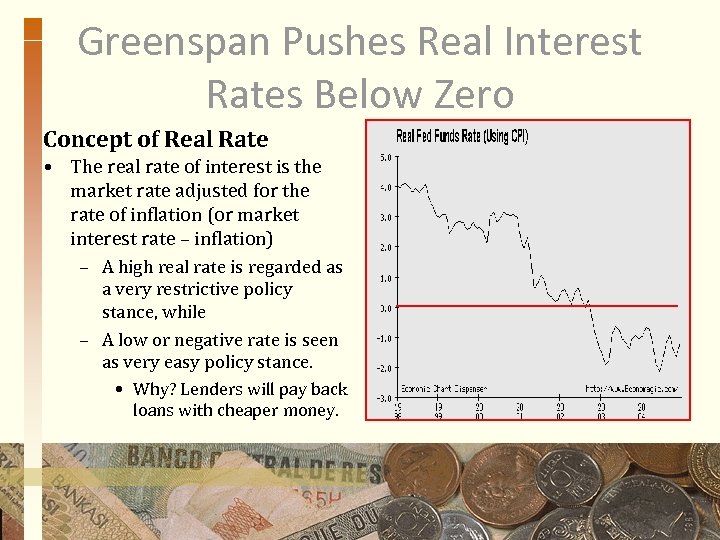

Greenspan Pushes Real Interest Rates Below Zero Concept of Real Rate • The real rate of interest is the market rate adjusted for the rate of inflation (or market interest rate – inflation) – A high real rate is regarded as a very restrictive policy stance, while – A low or negative rate is seen as very easy policy stance. • Why? Lenders will pay back loans with cheaper money. Real Fed Funds Rate

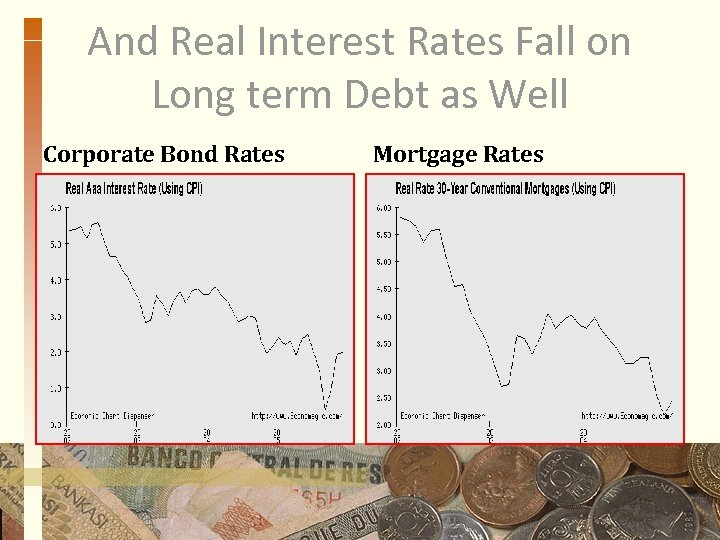

And Real Interest Rates Fall on Long term Debt as Well Corporate Bond Rates Mortgage Rates

Creation of Super Bubbles Seeds of the Bubbles • Excessively expansionary monetary policy, results in: • Falling real rate of interest • Which in turn overstimulates borrowing and economic activity. • And creates the seeds for the super bubbles! Economic Growth

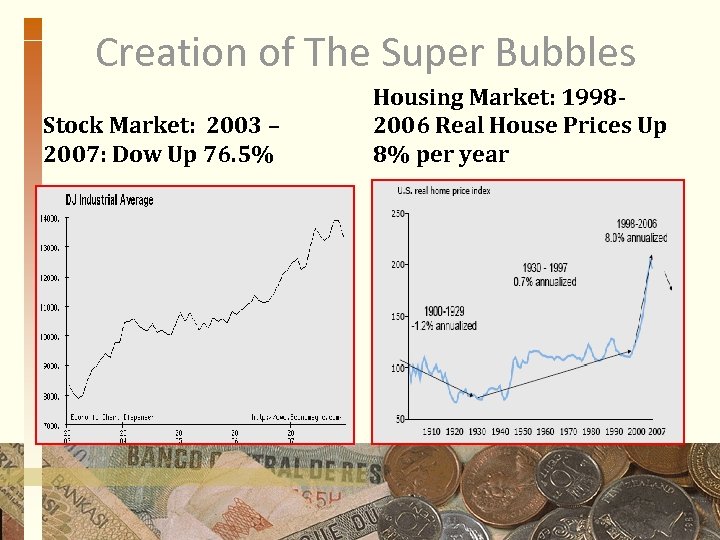

Creation of The Super Bubbles Stock Market: 2003 – 2007: Dow Up 76. 5% Housing Market: 19982006 Real House Prices Up 8% per year

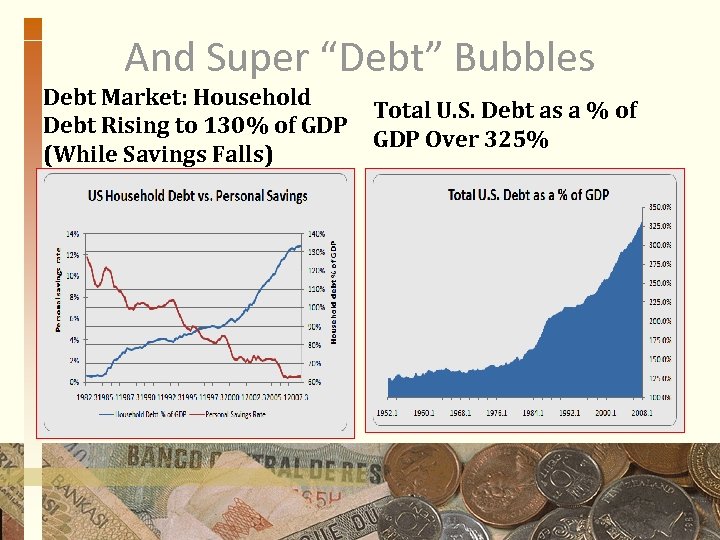

And Super “Debt” Bubbles Debt Market: Household Debt Rising to 130% of GDP (While Savings Falls) Total U. S. Debt as a % of GDP Over 325%

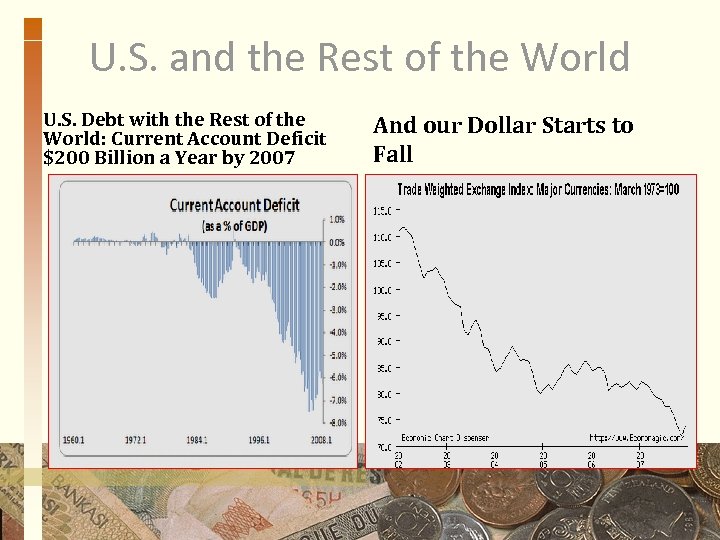

U. S. and the Rest of the World U. S. Debt with the Rest of the World: Current Account Deficit $200 Billion a Year by 2007 And our Dollar Starts to Fall

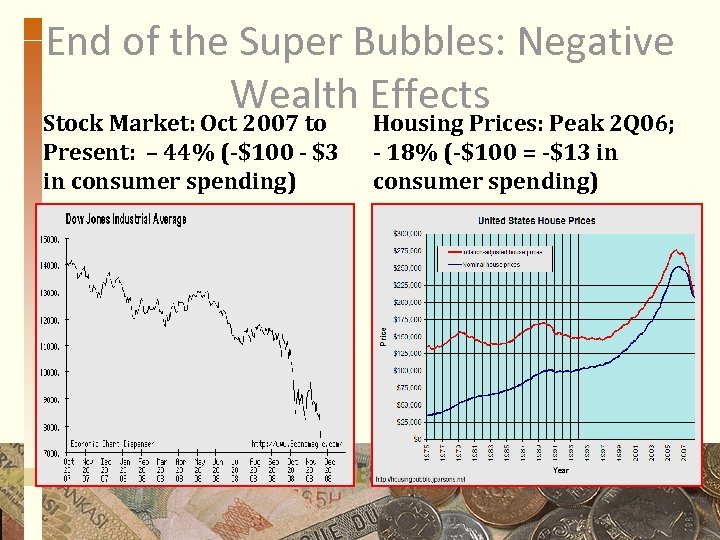

End of the Super Bubbles: Negative Wealth Effects Stock Market: Oct 2007 to Present: – 44% (-$100 - $3 in consumer spending) Housing Prices: Peak 2 Q 06; - 18% (-$100 = -$13 in consumer spending)

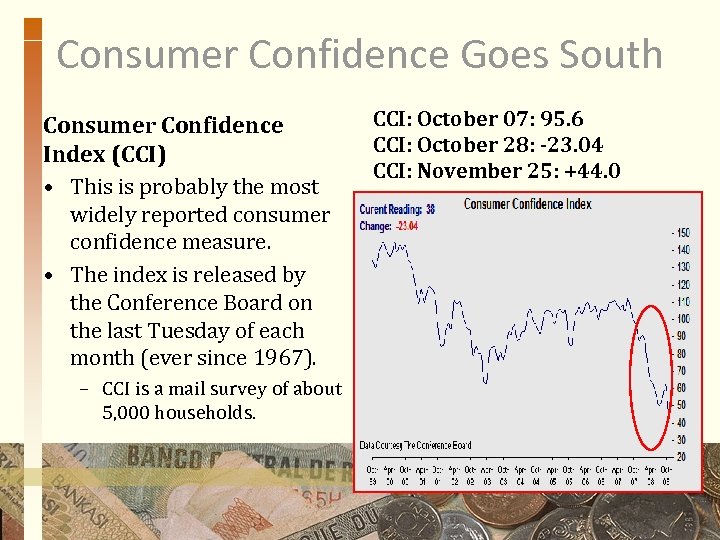

Consumer Confidence Goes South Consumer Confidence Index (CCI) • This is probably the most widely reported consumer confidence measure. • The index is released by the Conference Board on the last Tuesday of each month (ever since 1967). – CCI is a mail survey of about 5, 000 households. CCI: October 07: 95. 6 CCI: October 28: -23. 04 CCI: November 25: +44. 0

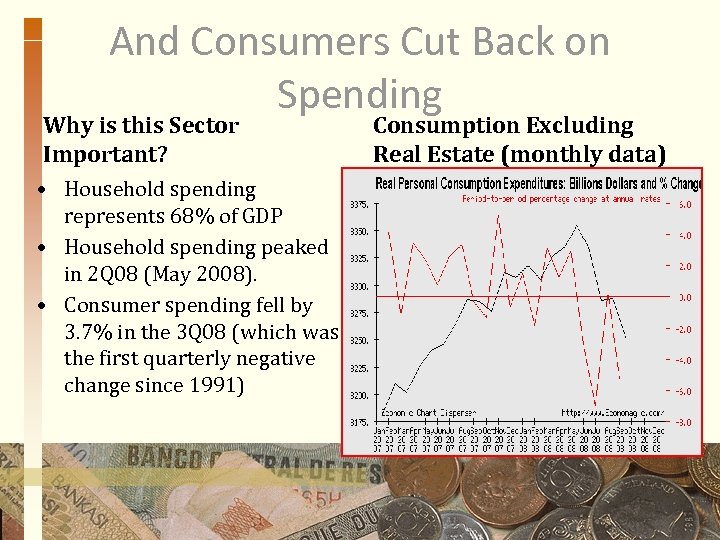

And Consumers Cut Back on Spending Why is this Sector Important? • Household spending represents 68% of GDP • Household spending peaked in 2 Q 08 (May 2008). • Consumer spending fell by 3. 7% in the 3 Q 08 (which was the first quarterly negative change since 1991) Consumption Excluding Real Estate (monthly data)

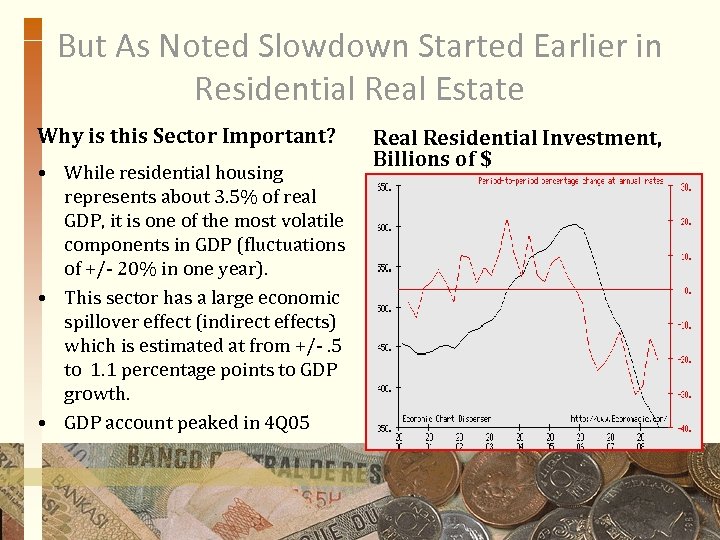

But As Noted Slowdown Started Earlier in Residential Real Estate Why is this Sector Important? • While residential housing represents about 3. 5% of real GDP, it is one of the most volatile components in GDP (fluctuations of +/- 20% in one year). • This sector has a large economic spillover effect (indirect effects) which is estimated at from +/-. 5 to 1. 1 percentage points to GDP growth. • GDP account peaked in 4 Q 05 Real Residential Investment, Billions of $

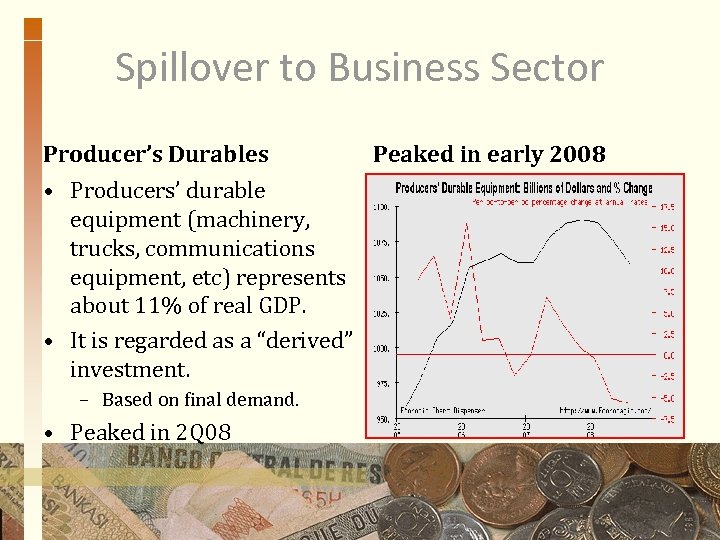

Spillover to Business Sector Producer’s Durables • Producers’ durable equipment (machinery, trucks, communications equipment, etc) represents about 11% of real GDP. • It is regarded as a “derived” investment. – Based on final demand. • Peaked in 2 Q 08 Peaked in early 2008

Quick Review of Current Situation • U. S. in a housing lead slowdown • Financial crisis spilling over to real economy through: – Growing loss of confidence resulting in: – Frozen financial markets • Falling asset prices (Good-bye Super Bubbles) – Negative wealth effects from equities and real estate continue. • Consumers cutting back and, • Negative GDP growth (NBER 12 month to date recession) • Now nicknamed the “Great Recession. ” • Weakened financial institutions requiring ongoing government assistance. • Weak household balance sheets (too much debt). • Global contagion effect (economic slowdowns in Europe and Asia) which complicate U. S. recovery

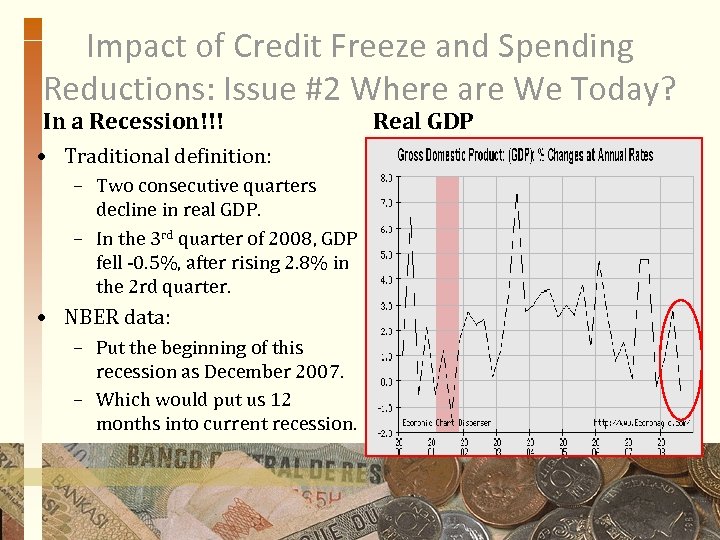

Impact of Credit Freeze and Spending Reductions: Issue #2 Where are We Today? In a Recession!!! • Traditional definition: – Two consecutive quarters decline in real GDP. – In the 3 rd quarter of 2008, GDP fell -0. 5%, after rising 2. 8% in the 2 rd quarter. • NBER data: – Put the beginning of this recession as December 2007. – Which would put us 12 months into current recession. Real GDP

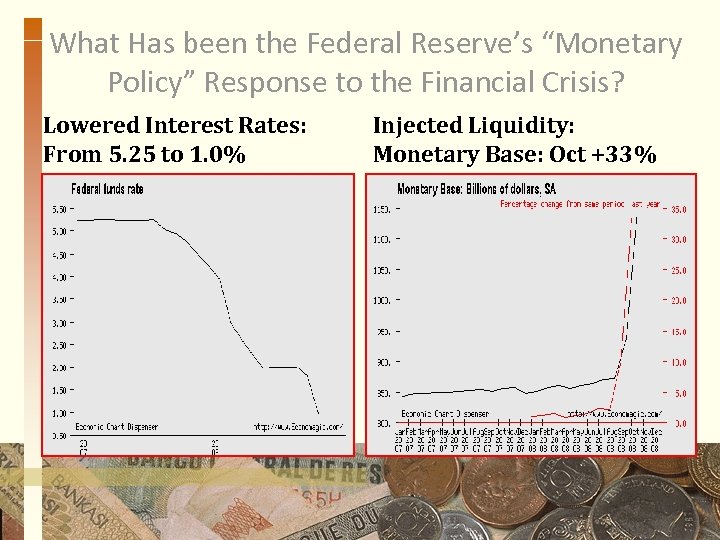

What Has been the Federal Reserve’s “Monetary Policy” Response to the Financial Crisis? Lowered Interest Rates: From 5. 25 to 1. 0% Injected Liquidity: Monetary Base: Oct +33%

Observations on Interest Rate Changes • While lower interest rates might make us “feel better” -- they have done little up to now to stimulate buying or lending or to restore confidence. • Questions regarding interest rate policy: – (1) Are we getting dangerously close to a “Keynesian liquidity trap” where low interest rate discourage lending? And if so, – (2) Has the Fed really adopted a “quantitative easing policy” whereby injecting financial markets with liquidity become the overriding policy? And if so, – (3) Is the Fed setting the stage for the next bubble?

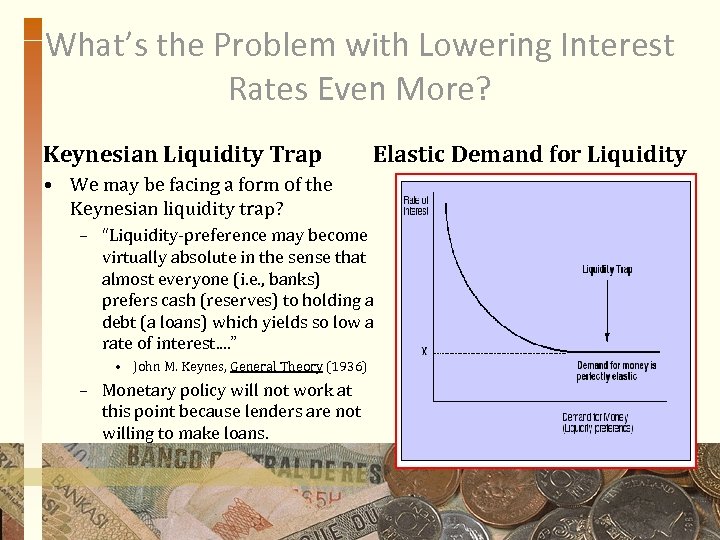

What’s the Problem with Lowering Interest Rates Even More? Keynesian Liquidity Trap Elastic Demand for Liquidity • We may be facing a form of the Keynesian liquidity trap? – “Liquidity-preference may become virtually absolute in the sense that almost everyone (i. e. , banks) prefers cash (reserves) to holding a debt (a loans) which yields so low a rate of interest. . ” • John M. Keynes, General Theory (1936) – Monetary policy will not work at this point because lenders are not willing to make loans.

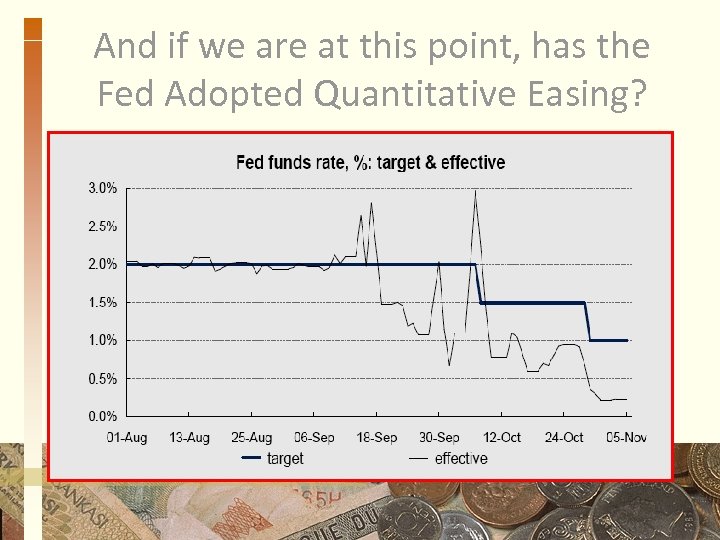

And if we are at this point, has the Fed Adopted Quantitative Easing?

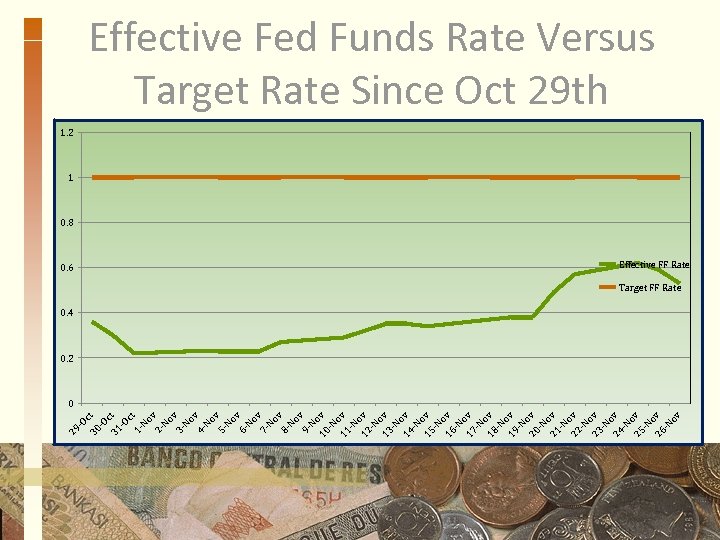

30 -O ct -O c 31 t -O ct 1 No v 2 No v 3 No v 4 No v 5 No v 6 No v 7 No v 8 No v 9 No 10 v -N o 11 v -N o 12 v -N o 13 v -N o 14 v -N o 15 v -N o 16 v -N o 17 v -N o 18 v -N o 19 v -N o 20 v -N o 21 v -N o 22 v -N o 23 v -N o 24 v -N o 25 v -N o 26 v -N ov 29 Effective Fed Funds Rate Versus Target Rate Since Oct 29 th 1. 2 1 0. 8 0. 6 Effective FF Rate Target FF Rate 0. 4 0. 2 0

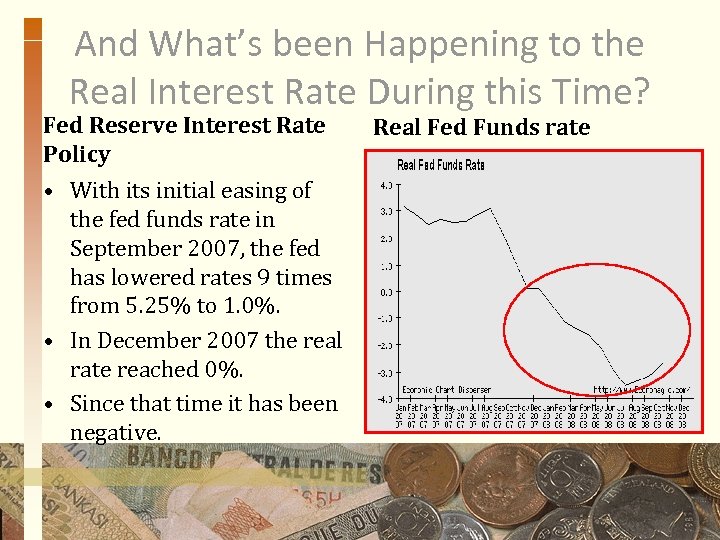

And What’s been Happening to the Real Interest Rate During this Time? Fed Reserve Interest Rate Policy • With its initial easing of the fed funds rate in September 2007, the fed has lowered rates 9 times from 5. 25% to 1. 0%. • In December 2007 the real rate reached 0%. • Since that time it has been negative. Real Fed Funds rate

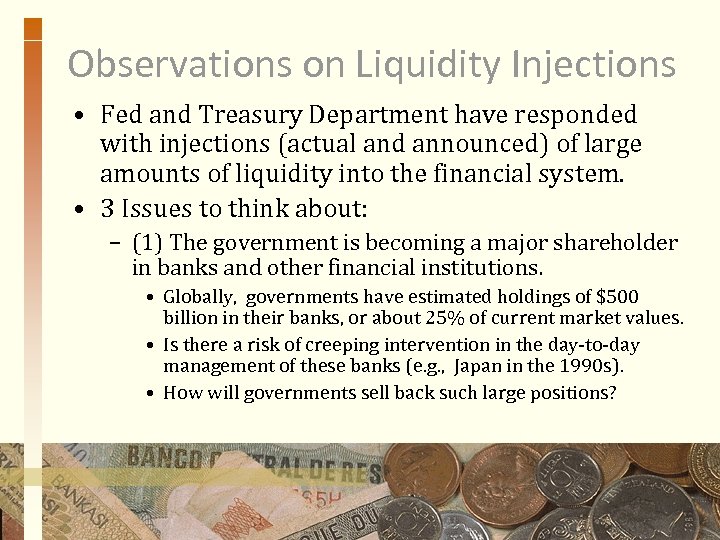

Observations on Liquidity Injections • Fed and Treasury Department have responded with injections (actual and announced) of large amounts of liquidity into the financial system. • 3 Issues to think about: – (1) The government is becoming a major shareholder in banks and other financial institutions. • Globally, governments have estimated holdings of $500 billion in their banks, or about 25% of current market values. • Is there a risk of creeping intervention in the day-to-day management of these banks (e. g. , Japan in the 1990 s). • How will governments sell back such large positions?

Observations on Liquidity Injections • (2) How does the government prevent banks and other financial institutions from simply choosing to shore up their capital base as opposed to making loans to sound business firms and households. – This is bank-lending liquidity trap. • U. S. position thus far has been to “encourage lending” -- but there is not much accountability. • France has actually mandated lending quotas to their banks. – Should the U. S. do this?

Observations on Liquidity Injections • (3) There is the danger that the Fed and Treasury Department will go too far, setting the stage for a big rise in inflation or more asset bubbles in the future. – At this point, however, the downside risk with this massive liquidity injection is overshadowed by the risk that the economy could spiral into a deflationary nosedive. – But at some point, this liquidity will have to be neutralized (“sterilized” or withdrawn).

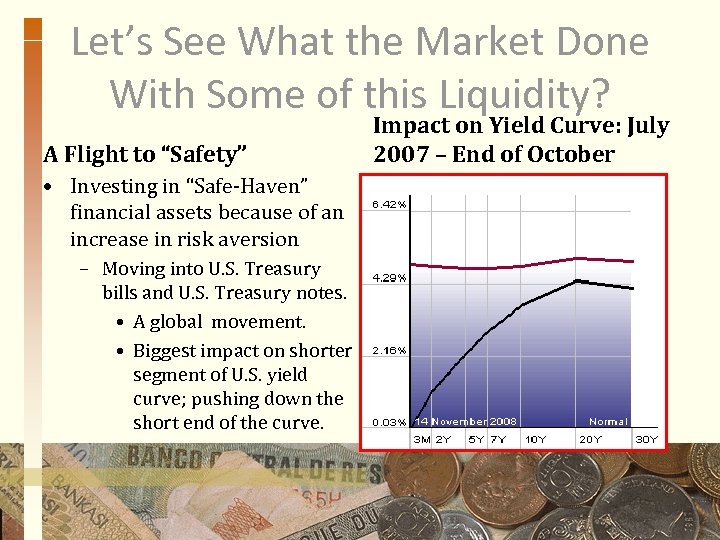

Let’s See What the Market Done With Some of this Liquidity? A Flight to “Safety” • Investing in “Safe-Haven” financial assets because of an increase in risk aversion – Moving into U. S. Treasury bills and U. S. Treasury notes. • A global movement. • Biggest impact on shorter segment of U. S. yield curve; pushing down the short end of the curve. Impact on Yield Curve: July 2007 – End of October

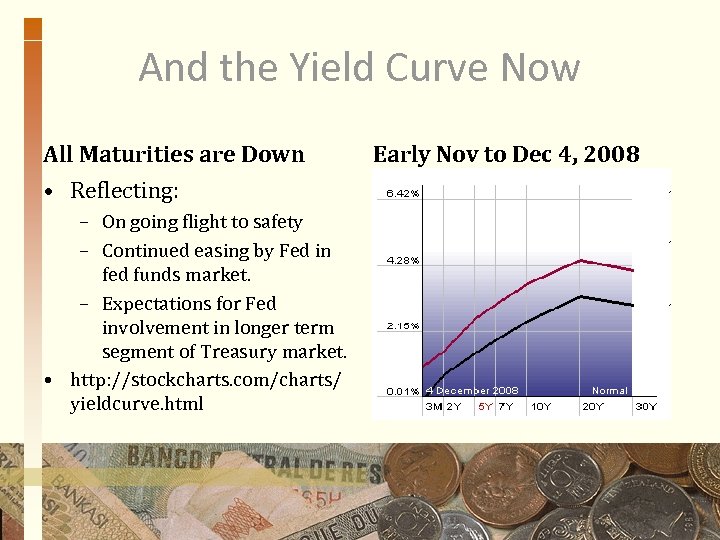

And the Yield Curve Now All Maturities are Down • Reflecting: – On going flight to safety – Continued easing by Fed in fed funds market. – Expectations for Fed involvement in longer term segment of Treasury market. • http: //stockcharts. com/charts/ yieldcurve. html Early Nov to Dec 4, 2008

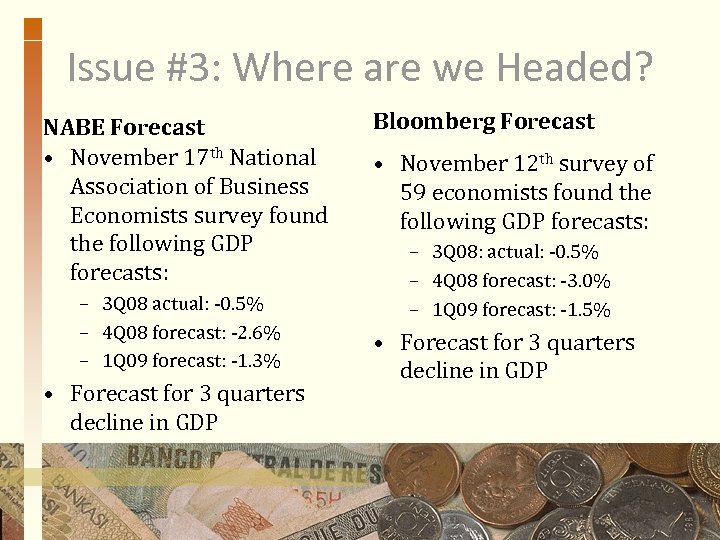

Issue #3: Where are we Headed? NABE Forecast • November 17 th National Association of Business Economists survey found the following GDP forecasts: – 3 Q 08 actual: -0. 5% – 4 Q 08 forecast: -2. 6% – 1 Q 09 forecast: -1. 3% • Forecast for 3 quarters decline in GDP Bloomberg Forecast • November 12 th survey of 59 economists found the following GDP forecasts: – 3 Q 08: actual: -0. 5% – 4 Q 08 forecast: -3. 0% – 1 Q 09 forecast: -1. 5% • Forecast for 3 quarters decline in GDP

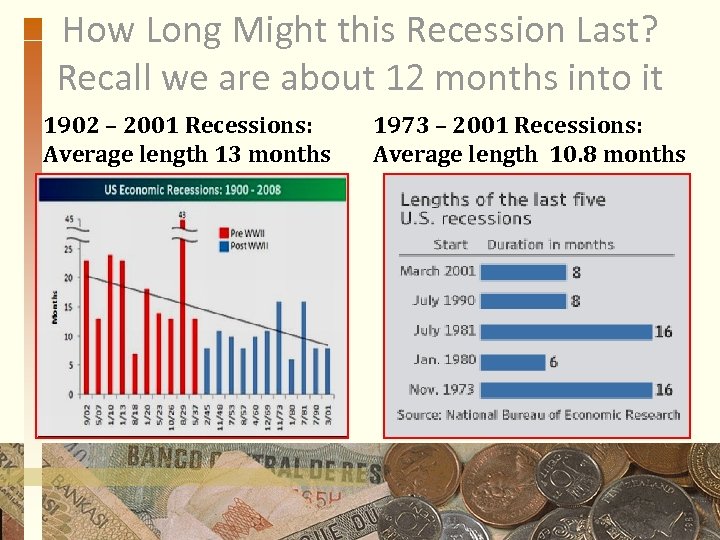

How Long Might this Recession Last? Recall we are about 12 months into it 1902 – 2001 Recessions: Average length 13 months 1973 – 2001 Recessions: Average length 10. 8 months

Consumer is an Important Key to the Future of this Economy • Consumer spending will be affected by: – Confidence (thus far a negative effect of the financial and economic crisis on consumer confidence) – Income levels (thus far negative effects from income and unemployment trends) – Wealth effects (thus far negative effects of declining stock market and housing prices) • Look for signal from upcoming holiday season: – Will the recent reduction in gas prices provide a boost to retail sales? • Black Friday sales up a “decent” 3% from a year ago (smallest since. 9% decline in 2005; 6. 0% in 2006; 8. 3% in 2007). • Cyber Monday (Dec 1) sales were up 15%, the second biggest increase on record.

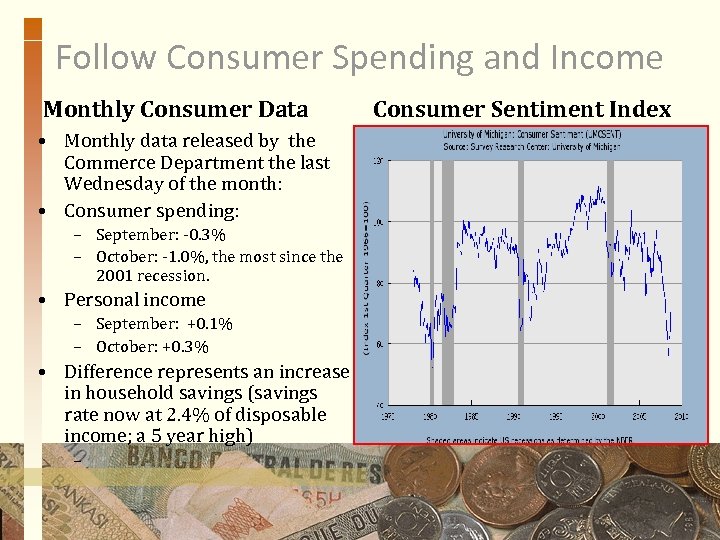

Follow Consumer Spending and Income Monthly Consumer Data • Monthly data released by the Commerce Department the last Wednesday of the month: • Consumer spending: – September: -0. 3% – October: -1. 0%, the most since the 2001 recession. • Personal income – September: +0. 1% – October: +0. 3% • Difference represents an increase in household savings (savings rate now at 2. 4% of disposable income; a 5 year high) – Consumer Sentiment Index

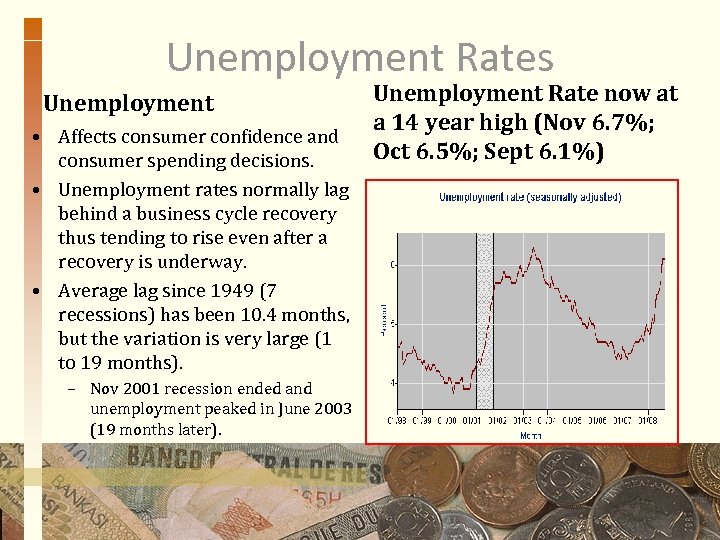

Unemployment Rates Unemployment • Affects consumer confidence and consumer spending decisions. • Unemployment rates normally lag behind a business cycle recovery thus tending to rise even after a recovery is underway. • Average lag since 1949 (7 recessions) has been 10. 4 months, but the variation is very large (1 to 19 months). – Nov 2001 recession ended and unemployment peaked in June 2003 (19 months later). Unemployment Rate now at a 14 year high (Nov 6. 7%; Oct 6. 5%; Sept 6. 1%)

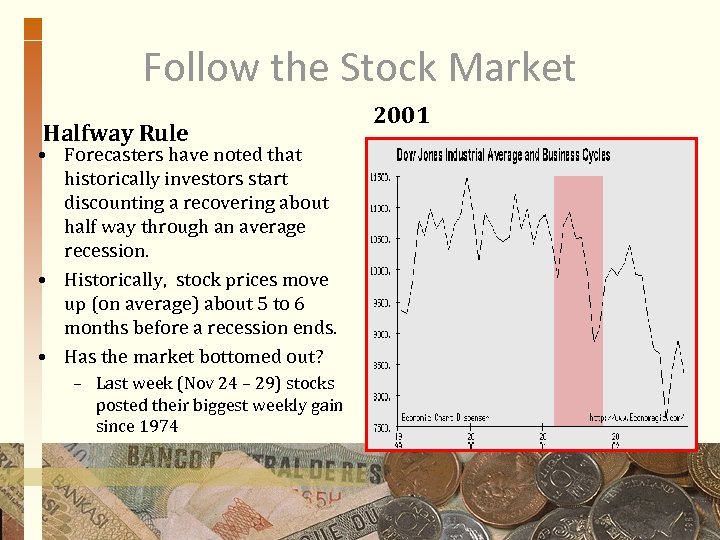

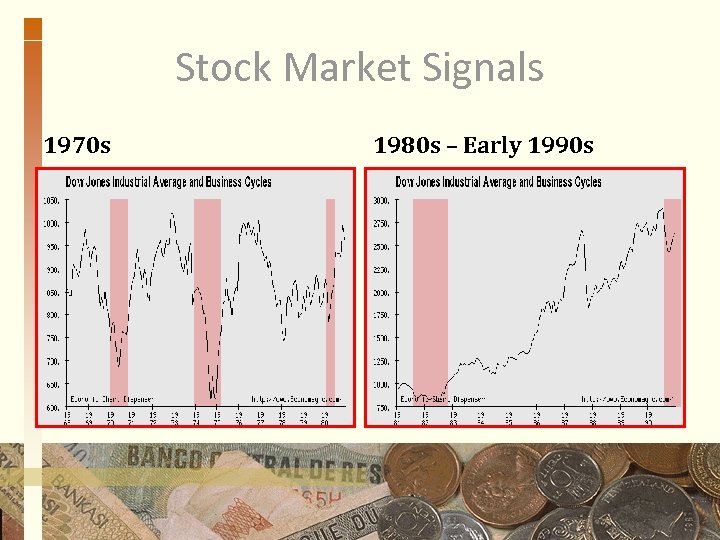

Follow the Stock Market Halfway Rule • Forecasters have noted that historically investors start discounting a recovering about half way through an average recession. • Historically, stock prices move up (on average) about 5 to 6 months before a recession ends. • Has the market bottomed out? – Last week (Nov 24 – 29) stocks posted their biggest weekly gain since 1974 2001

Stock Market Signals 1970 s 1980 s – Early 1990 s

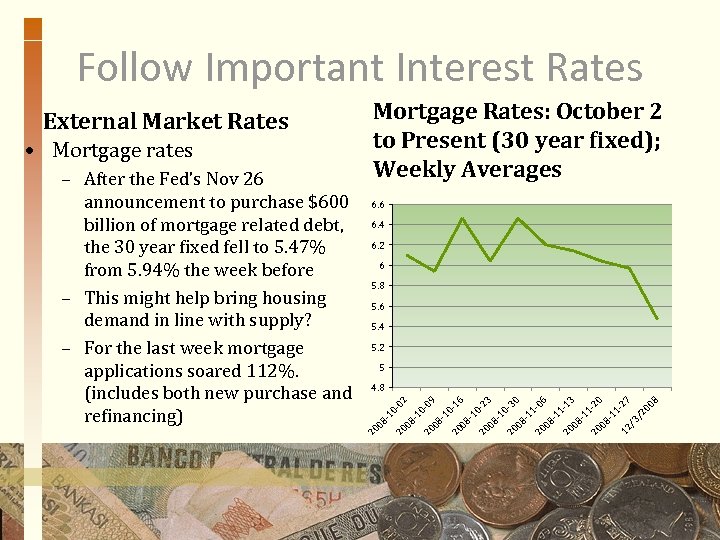

Follow Important Interest Rates Interbank Rates • Measure the confidence in the interbank markets and possible “thawing” • TED Spread (3 -month LIBOR – 3 -Month T-bill) – Dec 3: down to 218 Bpts – Link to daily data at: – http: //www. bloomberg. co m/apps/quote? ticker=. TED SP%3 AIND TED +464 in October; Has TED Peaked?

Follow Important Interest Rates 6. 6 6. 4 6. 2 6 5. 8 5. 6 5. 4 5. 2 5 00 8 27 3/ 2 12 / -1 1 - 20 20 08 -1 1 - 13 20 08 -1 1 - 06 20 08 0 -1 1 - 08 - 10 -3 23 20 20 08 16 20 08 -1 0 - 09 -1 0 - 20 08 -1 0 - 02 4. 8 -1 0 - – After the Fed’s Nov 26 announcement to purchase $600 billion of mortgage related debt, the 30 year fixed fell to 5. 47% from 5. 94% the week before – This might help bring housing demand in line with supply? – For the last week mortgage applications soared 112%. (includes both new purchase and refinancing) 20 08 • Mortgage rates Mortgage Rates: October 2 to Present (30 year fixed); Weekly Averages 20 08 External Market Rates

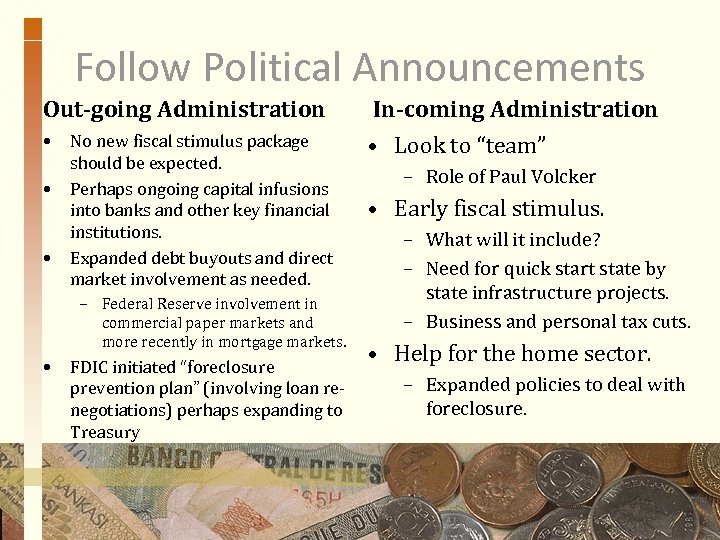

Follow Political Announcements Out-going Administration • • • No new fiscal stimulus package should be expected. Perhaps ongoing capital infusions into banks and other key financial institutions. Expanded debt buyouts and direct market involvement as needed. – Federal Reserve involvement in commercial paper markets and more recently in mortgage markets. • FDIC initiated “foreclosure prevention plan” (involving loan renegotiations) perhaps expanding to Treasury In-coming Administration • Look to “team” – Role of Paul Volcker • Early fiscal stimulus. – What will it include? – Need for quick start state by state infrastructure projects. – Business and personal tax cuts. • Help for the home sector. – Expanded policies to deal with foreclosure.

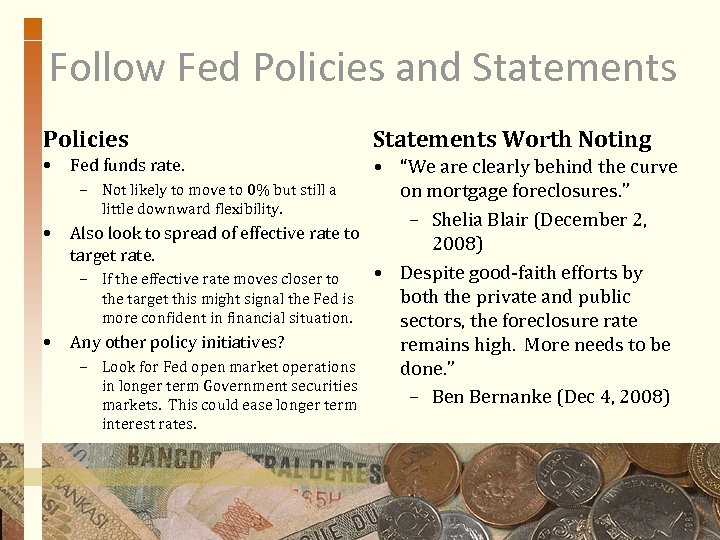

Follow Fed Policies and Statements Policies • Statements Worth Noting • “We are clearly behind the curve – Not likely to move to 0% but still a on mortgage foreclosures. ” little downward flexibility. – Shelia Blair (December 2, • Also look to spread of effective rate to 2008) target rate. • Despite good-faith efforts by – If the effective rate moves closer to both the private and public the target this might signal the Fed is more confident in financial situation. sectors, the foreclosure rate • Any other policy initiatives? remains high. More needs to be – Look for Fed open market operations done. ” in longer term Government securities – Ben Bernanke (Dec 4, 2008) markets. This could ease longer term Fed funds rate. interest rates.

Now Add this to the Mix: Recession is Becoming a Global Phenomenon Europe Asia and the Americas • Iceland is bankrupt • Japan is in a recession having • Germany and the rest of the Euro experienced 2 consecutive -zone (with the exception of quarters decline in real GDP. France) have experienced 2 – First recession since 2001. consecutive quarters decline in • China is slowing real GDP. – World Bank 2009 estimates • The United Kingdom has its own 7. 5% down from 9. 2% housing mess (house prices have – Also experiencing a deflating fallen for 13 straight months). housing bubble – Forecasting worse recession in 30 years with a turnaround not expected until 2010. • Russia is in trouble. • Canada is forecasting a recession through 2 Q 09

Foreign Central Banks Have Also Lowered their Interest Rates Previous Rates • • • Canada: 2. 50% England: 3. 0% Japan: 0. 5% ECB: 3. 25% Switzerland: 2. 0% Australia: 5. 25% New Zealand 6. 5% Korea: 4. 25% China: 6. 66% Current Rates/Change • • • Canada: 2. 25%; Oct 21/08 England: 2. 0%; Dec 04/08 Japan: 0. 3%; Oct 31/08 ECB: 2. 50%; Dec 04/08 Switzerland: 1. 0%; Nov 20/08 Australia: 4. 25%; Dec 02/08 New Zealand: 5. 0%; Dec 04/08 Korea: 4. 0%; Nov 07/08 China: 5. 58%; Nov 26/08

Are there Foreign Countries that We Should Monitor? Europe • Nothing here to help global economy. – U. K. expected to suffer its worse recession in 30 years. – Germany in recession and government running a fiscal surplus. • Both U. K. and Eurozone have introduced their own stimulus packages. – These will take time to turn these economies around. Perhaps Asia • Japan – In recession (consumer spending has fallen for 8 straight months), but the least G 7 affected by credit freeze. • China and India – GDP slowing (still positive) but recent fiscal and monetary stimulus may improve growth. – Possible kick-starters for global economy (through import demand)

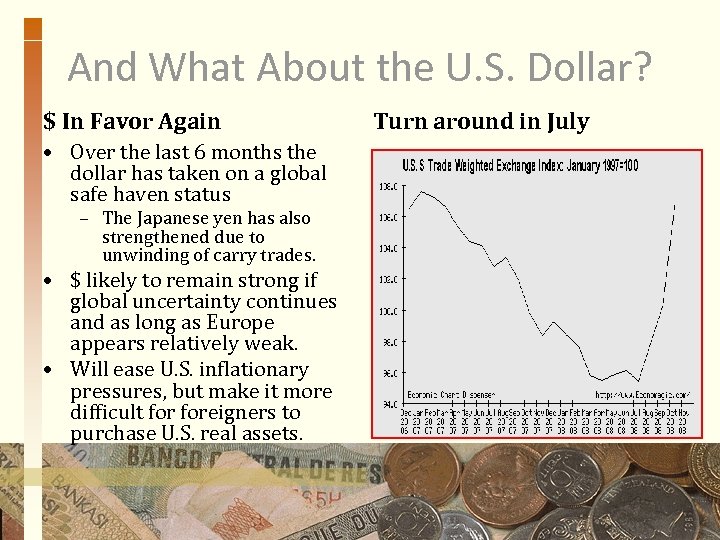

And What About the U. S. Dollar? $ In Favor Again • Over the last 6 months the dollar has taken on a global safe haven status – The Japanese yen has also strengthened due to unwinding of carry trades. • $ likely to remain strong if global uncertainty continues and as long as Europe appears relatively weak. • Will ease U. S. inflationary pressures, but make it more difficult foreigners to purchase U. S. real assets. Turn around in July

Possible Macro-Economic Scenarios Scenario 1: V shape Scenario 2: U, W or L shape • Quick recovery • Now we are thinking about other possibilities: – Within 2 quarters • Three of the last 5 recession have ended within 2 quarters. • Early on optimism for quick turnaround resulted from: – Assumed positive lagged response of Fed interest rate cuts and Spring 08 tax rebates. – U: More gradual recovery (e. g. , 18+ months), or – W: Recovery followed closely by another recession (aka “double dip” e. g. , in 1981, or – L: Prolonged recession (e. g. , 43 months in 1929 or Japan in the 1990 s).

My View: U-Shaped 18/21 -Month Recovery Most Likely Scenario • Caveat: The factors underlying a U-shaped scenario are notoriously difficult to predict. – Specifically, exactly when and to what degree factors impacting household and business behavior will kick in and when they will translate into GDP. • However, a U-Shaped recovery scenario is likely based on: – Severity of the financial/real asset bubble collapse and the financial market freeze and their affect on the real economy. • Announced anticipated layoffs (140, 000 in the financial sector plus lagged unemployment effect) • Falling retail sales. – Large household debt burdens – Little, if any, help from the foreign sector. • I see this recession ending in the 2 Q 09/3 Q 09 (Summer 09).

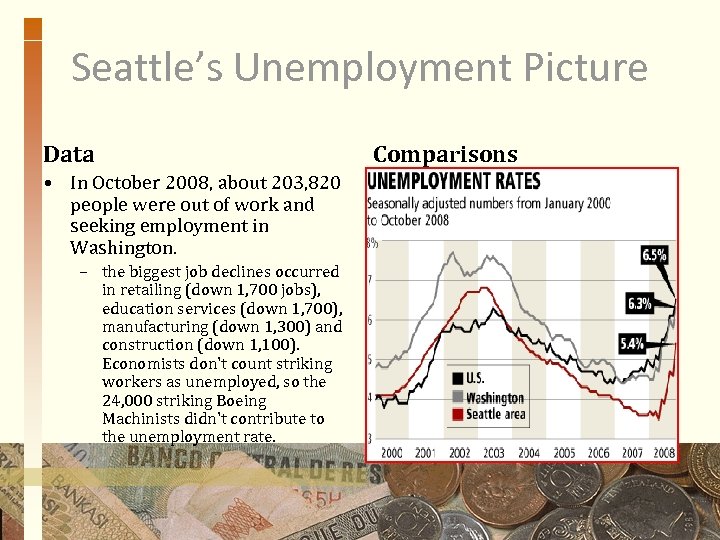

And What About Seattle? • Seattle Housing Data: – House prices down 17% a year ago and sales down 17. 5% a year ago (35. 8% down from last month) • Seattle Economic Base: – Increasing unemployment • October 2008: State unemployment rate: 6. 3% (4. 8% a year ago); Seattle area: 5. 4% (4. 0% a year ago). (see second slide) • Negative: Impacts of recent layoffs (Wa. Mu cutting 3, 400 Seattle jobs) – Positive: Global links • Exporting – Bellevue-Seattle-Tacoma Metropolitan Area is the fourth largest export market in the nation (2007 data) with Japan, China, and Canada the leading export destinations.

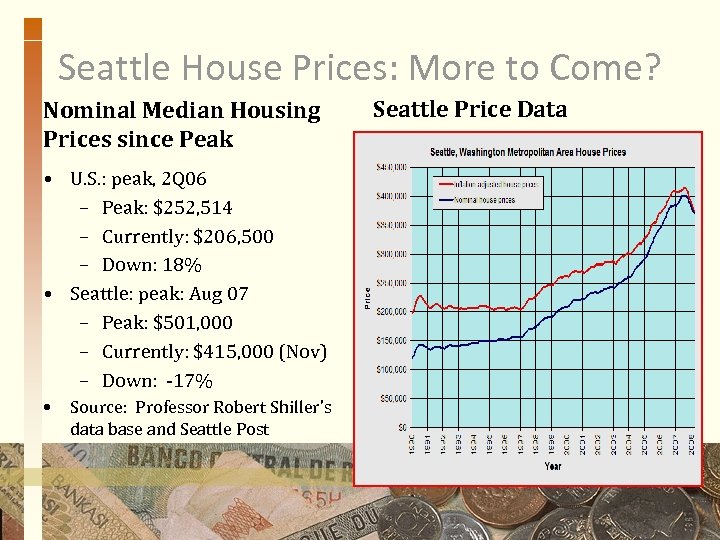

Seattle House Prices: More to Come? Nominal Median Housing Prices since Peak • U. S. : peak, 2 Q 06 – Peak: $252, 514 – Currently: $206, 500 – Down: 18% • Seattle: peak: Aug 07 – Peak: $501, 000 – Currently: $415, 000 (Nov) – Down: -17% • Source: Professor Robert Shiller’s data base and Seattle Post Seattle Price Data

Seattle’s Unemployment Picture Data • In October 2008, about 203, 820 people were out of work and seeking employment in Washington. – the biggest job declines occurred in retailing (down 1, 700 jobs), education services (down 1, 700), manufacturing (down 1, 300) and construction (down 1, 100). Economists don't count striking workers as unemployed, so the 24, 000 striking Boeing Machinists didn't contribute to the unemployment rate. Comparisons

![Final Quotes • “An economic [forecaster] is an expert who will know tomorrow why Final Quotes • “An economic [forecaster] is an expert who will know tomorrow why](https://present5.com/presentation/b26862c0c82c80de7a50be7c3bb1846e/image-63.jpg)

Final Quotes • “An economic [forecaster] is an expert who will know tomorrow why the things he/she predicted yesterday didn't happen today. ” – Laurence J. Peter • “If past history was all there was to the game, the richest people would be librarians. ” – Warren Buffett

Questions and Answers and Comments and Discussion Follow-up Questions/Comments Michael. Palmer@colorado. edu

b26862c0c82c80de7a50be7c3bb1846e.ppt