07c7e2fba7d77303fcd814533325eb6d.ppt

- Количество слайдов: 19

Everything You Need to Know About Managing Active ETFs Guest Speaker: Darlene De. Remer (Grail Partners) K&L Gates Hosts: Boston (3/26/08) Stacy Fuller (DC), Francine Rosenberger (DC) and George Zornada (BO) New York (4/10/08): Stacy Fuller (DC), Beth Kramer (NY) and Francine Rosenberger (DC) San Francisco (4/15/08): Stacy Fuller (DC), Mark Perlow (SF) and Richard Phillips (SF)

Everything You Need to Know About Managing Active ETFs ETF Basics 2007 Growth: 42% increase to $580 billion Key Concepts Arbitrage mechanism Exchange Listing Transparency Development Index-based ETFs Actively managed ETFs Quant techniques/Large-cap securities Transparency – changing requirements

Everything You Need to Know About Managing Active ETFs Overview Background: The ETF Business SEC’s Proposed ETF Rules Launch Basics ETF Distribution Looking Ahead Q&A

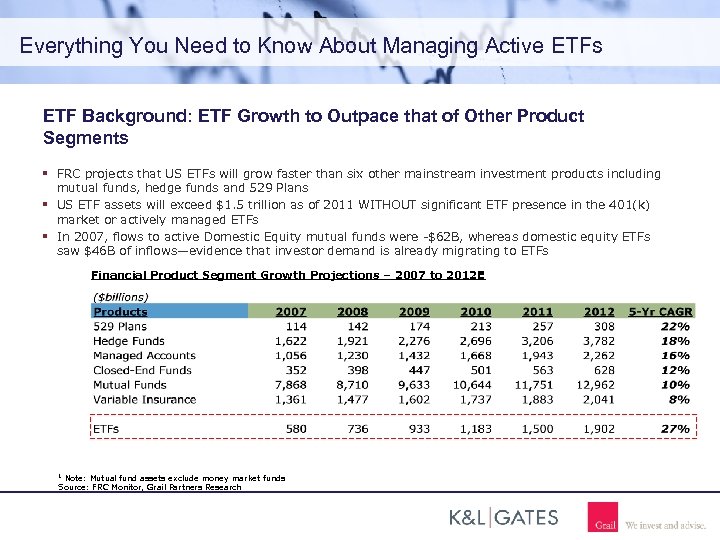

Everything You Need to Know About Managing Active ETFs ETF Background: ETF Growth to Outpace that of Other Product Segments FRC projects that US ETFs will grow faster than six other mainstream investment products including mutual funds, hedge funds and 529 Plans US ETF assets will exceed $1. 5 trillion as of 2011 WITHOUT significant ETF presence in the 401(k) market or actively managed ETFs In 2007, flows to active Domestic Equity mutual funds were -$62 B, whereas domestic equity ETFs saw $46 B of inflows—evidence that investor demand is already migrating to ETFs Financial Product Segment Growth Projections – 2007 to 2012 E Note: Mutual fund assets exclude money market funds Source: FRC Monitor, Grail Partners Research 1

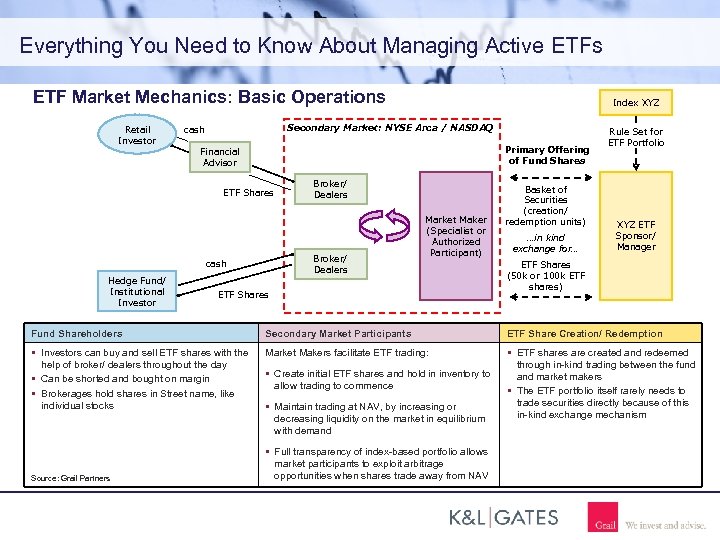

Everything You Need to Know About Managing Active ETFs ETF Market Mechanics: Basic Operations Retail Investor Index XYZ Secondary Market: NYSE Arca / NASDAQ cash Primary Offering of Fund Shares Financial Advisor ETF Shares Broker/ Dealers cash Hedge Fund/ Institutional Investor Broker/ Dealers Market Maker (Specialist or Authorized Participant) ETF Shares Basket of Securities (creation/ redemption units) …in kind exchange for… Rule Set for ETF Portfolio XYZ ETF Sponsor/ Manager ETF Shares (50 k or 100 k ETF shares) Fund Shareholders Secondary Market Participants ETF Share Creation/ Redemption Investors can buy and sell ETF shares with the help of broker/ dealers throughout the day Can be shorted and bought on margin Brokerages hold shares in Street name, like individual stocks Market Makers facilitate ETF trading: ETF shares are created and redeemed through in-kind trading between the fund and market makers The ETF portfolio itself rarely needs to trade securities directly because of this in-kind exchange mechanism Source: Grail Partners Create initial ETF shares and hold in inventory to allow trading to commence Maintain trading at NAV, by increasing or decreasing liquidity on the market in equilibrium with demand Full transparency of index-based portfolio allows market participants to exploit arbitrage opportunities when shares trade away from NAV

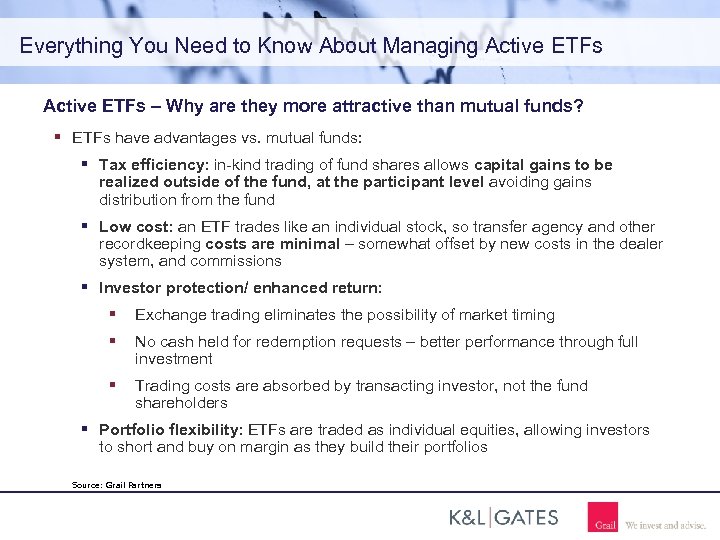

Everything You Need to Know About Managing Active ETFs – Why are they more attractive than mutual funds? ETFs have advantages vs. mutual funds: Tax efficiency: in-kind trading of fund shares allows capital gains to be realized outside of the fund, at the participant level avoiding gains distribution from the fund Low cost: an ETF trades like an individual stock, so transfer agency and other recordkeeping costs are minimal – somewhat offset by new costs in the dealer system, and commissions Investor protection/ enhanced return: Exchange trading eliminates the possibility of market timing No cash held for redemption requests – better performance through full investment Trading costs are absorbed by transacting investor, not the fund shareholders Portfolio flexibility: ETFs are traded as individual equities, allowing investors to short and buy on margin as they build their portfolios Source: Grail Partners

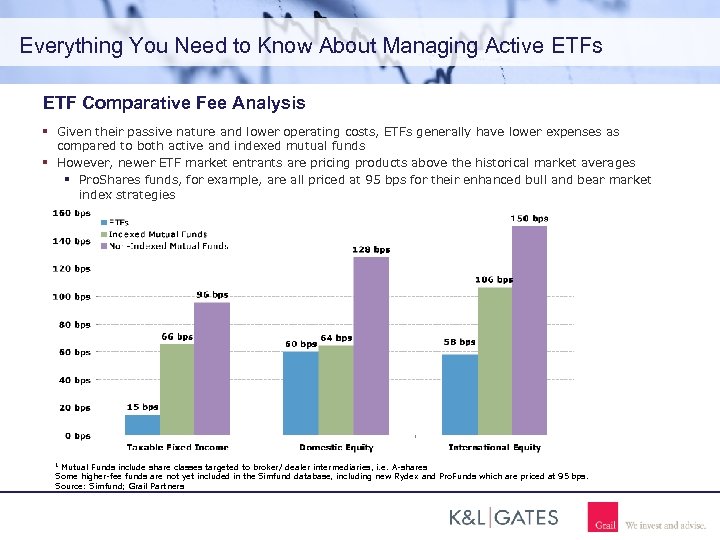

Everything You Need to Know About Managing Active ETFs ETF Comparative Fee Analysis Given their passive nature and lower operating costs, ETFs generally have lower expenses as compared to both active and indexed mutual funds However, newer ETF market entrants are pricing products above the historical market averages Pro. Shares funds, for example, are all priced at 95 bps for their enhanced bull and bear market index strategies Mutual Funds include share classes targeted to broker/ dealer intermediaries, i. e. A-shares Some higher-fee funds are not yet included in the Simfund database, including new Rydex and Pro. Funds which are priced at 95 bps. Source: Simfund; Grail Partners 1

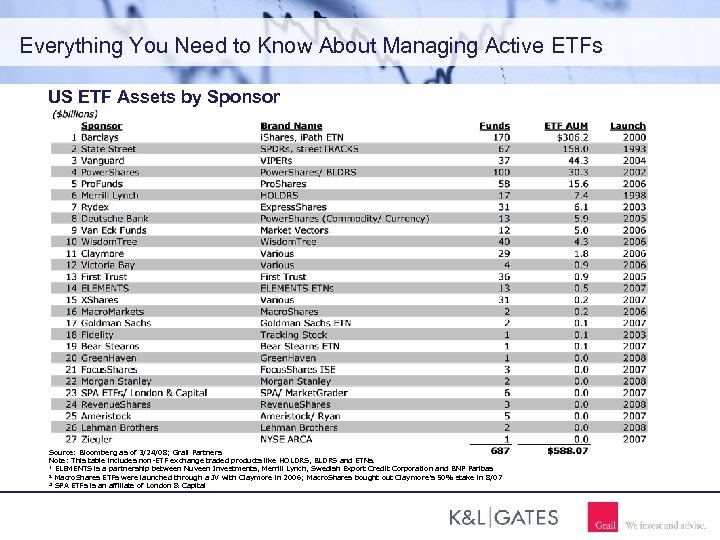

Everything You Need to Know About Managing Active ETFs US ETF Assets by Sponsor Source: Bloomberg as of 3/24/08; Grail Partners Note: This table includes non-ETF exchange traded products like HOLDRS, BLDRS and ETNs. 1 ELEMENTS is a partnership between Nuveen Investments, Merrill Lynch, Swedish Export Credit Corporation and BNP Paribas 2 Macro. Shares ETFs were launched through a JV with Claymore in 2006; Macro. Shares bought out Claymore’s 50% stake in 8/07 3 SPA ETFs is an affiliate of London & Capital

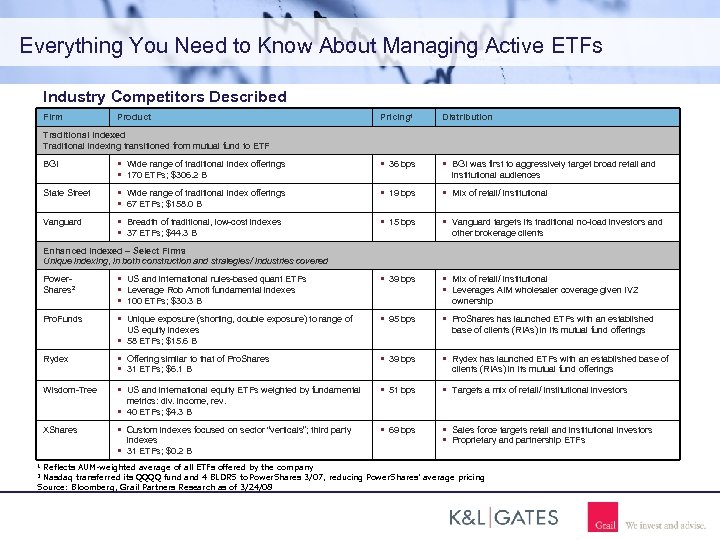

Everything You Need to Know About Managing Active ETFs Industry Competitors Described Firm Product Pricing 1 Distribution Wide range of traditional index offerings 170 ETFs; $306. 2 B 36 bps BGI was first to aggressively target broad retail and State Street Wide range of traditional index offerings 67 ETFs; $158. 0 B 19 bps Mix of retail/ institutional Vanguard Breadth of traditional, low-cost indexes 37 ETFs; $44. 3 B 15 bps Vanguard targets its traditional no-load investors and Traditional Indexed Traditional indexing transitioned from mutual fund to ETF BGI institutional audiences other brokerage clients Enhanced Indexed – Select Firms Unique indexing, in both construction and strategies/ industries covered Power. Shares 2 Pro. Funds US and international rules-based quant ETFs Leverage Rob Arnott fundamental indexes 100 ETFs; $30. 3 B 39 bps Unique exposure (shorting, double exposure) to range of 95 bps ownership US equity indexes 58 ETFs; $15. 6 B Rydex Wisdom-Tree Mix of retail/ institutional Leverages AIM wholesaler coverage given IVZ Pro. Shares has launched ETFs with an established base of clients (RIAs) in its mutual fund offerings Offering similar to that of Pro. Shares 31 ETFs; $6. 1 B 39 bps Rydex has launched ETFs with an established base of US and international equity ETFs weighted by fundamental 51 bps Targets a mix of retail/ institutional investors 69 bps Sales force targets retail and institutional investors Proprietary and partnership ETFs clients (RIAs) in its mutual fund offerings metrics: div. income, rev. 40 ETFs; $4. 3 B XShares Custom indexes focused on sector “verticals”; third party indexes 31 ETFs; $0. 2 B Reflects AUM-weighted average of all ETFs offered by the company Nasdaq transferred its QQQQ fund and 4 BLDRS to Power. Shares 3/07, reducing Power. Shares’ average pricing Source: Bloomberg, Grail Partners Research as of 3/24/08 1 2

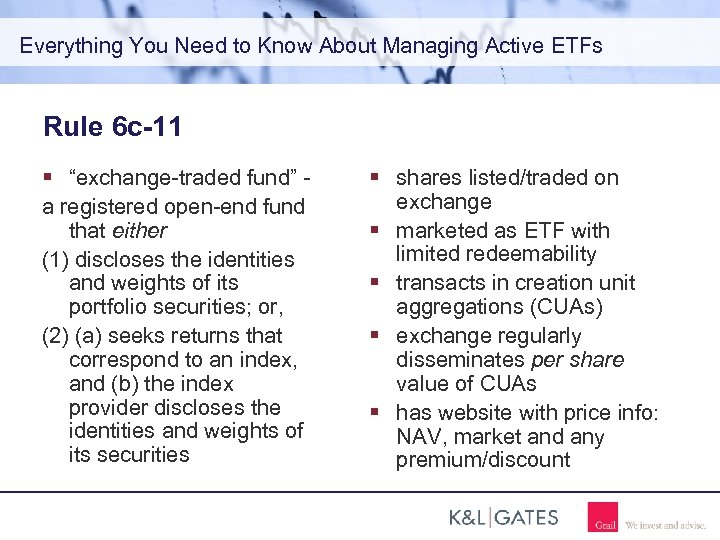

Everything You Need to Know About Managing Active ETFs Rule 6 c-11 “exchange-traded fund” a registered open-end fund that either (1) discloses the identities and weights of its portfolio securities; or, (2) (a) seeks returns that correspond to an index, and (b) the index provider discloses the identities and weights of its securities shares listed/traded on exchange marketed as ETF with limited redeemability transacts in creation unit aggregations (CUAs) exchange regularly disseminates per share value of CUAs has website with price info: NAV, market and any premium/discount

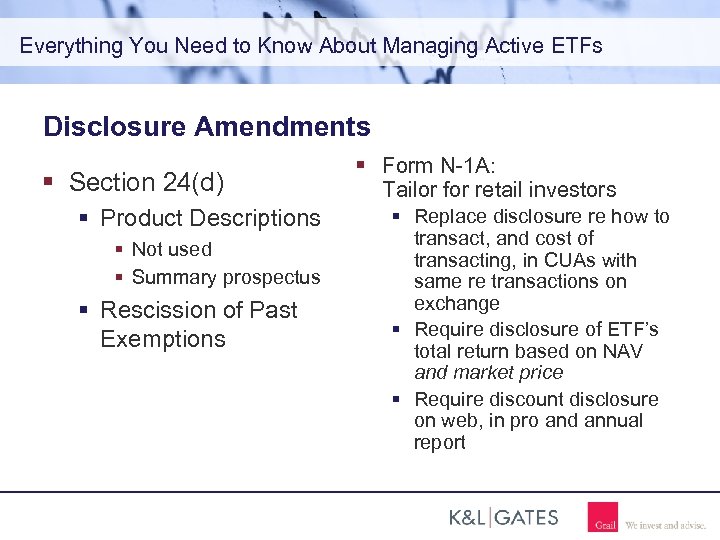

Everything You Need to Know About Managing Active ETFs Disclosure Amendments Section 24(d) Product Descriptions Not used Summary prospectus Rescission of Past Exemptions Form N-1 A: Tailor for retail investors Replace disclosure re how to transact, and cost of transacting, in CUAs with same re transactions on exchange Require disclosure of ETF’s total return based on NAV and market price Require discount disclosure on web, in pro and annual report

Everything You Need to Know About Managing Active ETFs Liberalization of Orders Sampling Affiliated index-based ETFs Section 48(a) Asset basket requirements

Everything You Need to Know About Managing Active ETFs Rule 12 d 1 -4 Investments by registered and private funds 4 Conditions Limitation on control of underlying fund by investing fund ETF is not a “fund of funds” Fees comply with NASD Conduct Rule 2830 No redemptions by investing fund with more than 3% of ETF Compare traditional funds of funds Investments by registered funds only 12 Conditions

Everything You Need to Know About Managing Active ETFs Conditions for Traditional Funds of Funds Limitation on control of underlying fund by investing fund Underlying fund is not a “fund of funds” Fees comply with NASD Conduct Rule 2830 Waiver by investing fund of certain fees based on other fees received from underlying fund Limitation on investing fund’s influence over underlying fund Limitation on investments by underlying fund in underwritings involving affiliate of investing fund (“affiliated underwriting”) Finding by underlying fund board re any investment by underlying fund in affiliated underwriting Finding by underlying fund board that any payments to investing fund were reasonable for services received in return Finding by investing fund board that consideration received by investing fund from underlying fund did not influence investment Finding by investing fund board that no duplicative advisory fees Requirement of Participation Agreement (to provide notice of conditions involving board findings)

Everything You Need to Know About Managing Active ETFs Launch Basics Choose Asset Class ETN / Grantor Trust – Corp Fin ETF – IM Exemptive Application Rule 6 c-11 Market Maker / Specialist Prepare Timeline: Precedented v. Novel Relief Register Product ETN / Grantor Trust – S-1 and 8 -A ETF – N-8 A, N-1 A and 8 -A Prospectus / PD v. Disclosure Amendments & Summary Prospectus Approach T&M / Exchange No action relief Listing

Everything You Need to Know About Managing Active ETFs Seed Capital: Tempering the Pace of Proliferation To support the secondary market, launching an ETF requires a minimum market inventory be established to facilitate trading and market liquidity Exchanges typically require at least two ETF “creation units” be issued (generally 200, 000 shares) prior to fund launch. If a fund’s NAV starts at $25, this equals $5 million in AUM This initial seed capital is typically provided by market specialists—often using borrowed securities in their effort to support a product that will yield secondary trading activity But for those market makers, seeding ETFs is becoming a much less attractive proposition The drag or costs of providing seed capital are real: Cost of borrowing (up to 200 bps or more) to fund and hedge ETF expense ratio (~50 bps and higher); ETF fees are increasing as more niche and quasi-active ETFs are launched The proposition of acting as an ETF specialist itself has become less attractive: Spreads in ETF trading have tightened Given the merger of NYSE and Am. Ex, electronic trading will become the dominant method for ETF specialists, in turn diffusing the share of volume that the specialist can capture Therefore, the lack of seed capital in the ETF market is expected to be a major industry “choke point” and inhibitor of product proliferation, particularly among smaller ETF sponsors Source: Grail Partners

Everything You Need to Know About Managing Active ETFs ETF Distribution Specialists Other institutional investors Rule 12 b-1 Plans IPOs Rule 12 d 1 -4 Funds

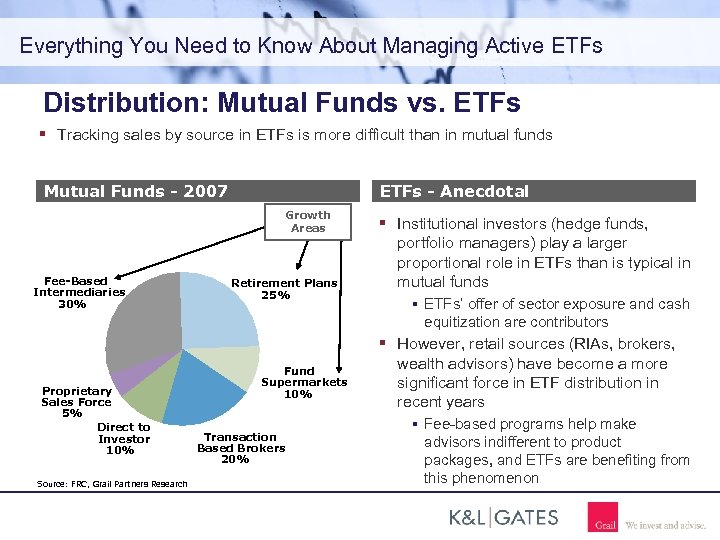

Everything You Need to Know About Managing Active ETFs Distribution: Mutual Funds vs. ETFs Tracking sales by source in ETFs is more difficult than in mutual funds ETFs - Anecdotal Mutual Funds - 2007 Growth Areas Fee-Based Intermediaries 30% Proprietary Sales Force 5% Direct to Investor 10% Source: FRC, Grail Partners Research Retirement Plans 25% Fund Supermarkets 10% Transaction Based Brokers 20% Institutional investors (hedge funds, portfolio managers) play a larger proportional role in ETFs than is typical in mutual funds ETFs’ offer of sector exposure and cash equitization are contributors However, retail sources (RIAs, brokers, wealth advisors) have become a more significant force in ETF distribution in recent years Fee-based programs help make advisors indifferent to product packages, and ETFs are benefiting from this phenomenon

Everything You Need to Know About Managing Active ETFs Looking Ahead Trends Next-generation ETFs Semi-transparent ETFs Tracking Baskets Value Transparency Black Box “‘Is it critical that arbitrage be tight and strong? ’ We think that’s an important question that the Commission will need to consider going forward as we face applications for nontransparent ETFs. ” Timing

07c7e2fba7d77303fcd814533325eb6d.ppt