Event Processing Use Case: Automated Security Pricing § § Event Processing Symposium November 2006 § www. alerilabs. com

Event Processing Use Case: Automated Security Pricing § § Event Processing Symposium November 2006 § www. alerilabs. com

The Problem § Need: Automate pricing, currently a manual process, thereby: – reducing latency (i. e. market responsiveness) – support for electronic/automated trading § The Challenges: – – – High data rates Demand for ultra-low latency Input data prone to erroneous data points Need for flexible model Very short time to deploy www. alerilabs. com

The Problem § Need: Automate pricing, currently a manual process, thereby: – reducing latency (i. e. market responsiveness) – support for electronic/automated trading § The Challenges: – – – High data rates Demand for ultra-low latency Input data prone to erroneous data points Need for flexible model Very short time to deploy www. alerilabs. com

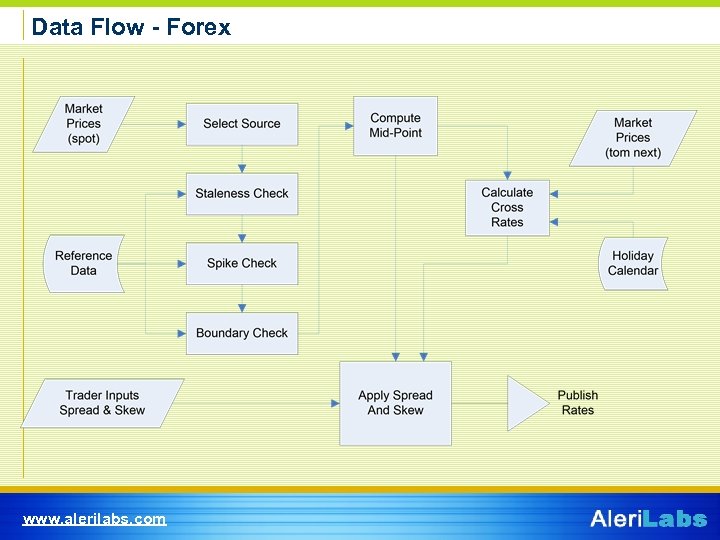

The Approach § Inputs: Market Data prices from multiple sources § Logic (forex): – – – – Compare sources; select source Check for “staleness” Filter spikes Boundary checks Calculate mid-point Calculate cross rates Apply spread and skew Publish rates www. alerilabs. com

The Approach § Inputs: Market Data prices from multiple sources § Logic (forex): – – – – Compare sources; select source Check for “staleness” Filter spikes Boundary checks Calculate mid-point Calculate cross rates Apply spread and skew Publish rates www. alerilabs. com

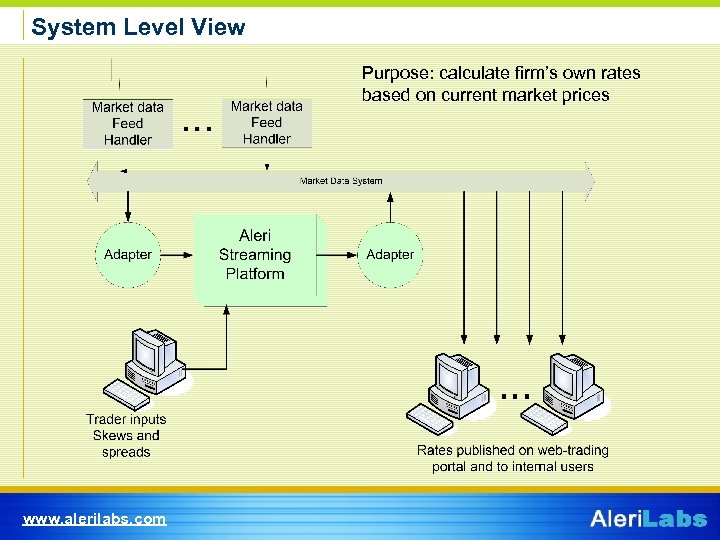

System Level View Purpose: calculate firm’s own rates based on current market prices www. alerilabs. com

System Level View Purpose: calculate firm’s own rates based on current market prices www. alerilabs. com

Data Flow - Forex www. alerilabs. com

Data Flow - Forex www. alerilabs. com

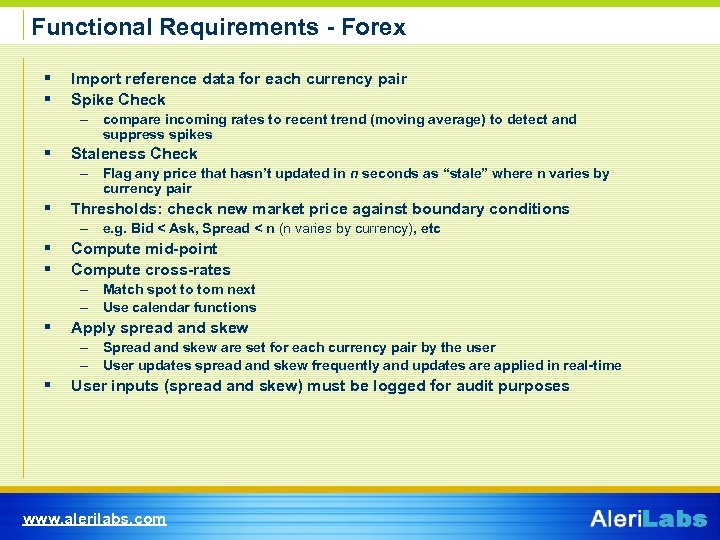

Functional Requirements - Forex § § Import reference data for each currency pair Spike Check – compare incoming rates to recent trend (moving average) to detect and suppress spikes § Staleness Check – Flag any price that hasn’t updated in n seconds as “stale” where n varies by currency pair § Thresholds: check new market price against boundary conditions – e. g. Bid < Ask, Spread < n (n varies by currency), etc § § Compute mid-point Compute cross-rates – Match spot to tom next – Use calendar functions § Apply spread and skew – Spread and skew are set for each currency pair by the user – User updates spread and skew frequently and updates are applied in real-time § User inputs (spread and skew) must be logged for audit purposes www. alerilabs. com

Functional Requirements - Forex § § Import reference data for each currency pair Spike Check – compare incoming rates to recent trend (moving average) to detect and suppress spikes § Staleness Check – Flag any price that hasn’t updated in n seconds as “stale” where n varies by currency pair § Thresholds: check new market price against boundary conditions – e. g. Bid < Ask, Spread < n (n varies by currency), etc § § Compute mid-point Compute cross-rates – Match spot to tom next – Use calendar functions § Apply spread and skew – Spread and skew are set for each currency pair by the user – User updates spread and skew frequently and updates are applied in real-time § User inputs (spread and skew) must be logged for audit purposes www. alerilabs. com

Just the facts: § Event processing style: – Relational – Cross-reference, compare streams, aggregate, filter, compute § Language used: – Aleri SQL Or – XML (with Aleri DTD) § Destination/Use of Results: – rates published in real-time and distributed throughout the bank § Commercial tools applied: – Rates delivered by Reuters RMDS – Results published on Reuters RMDS – MS Visual Studio. NET (for trader interface) www. alerilabs. com

Just the facts: § Event processing style: – Relational – Cross-reference, compare streams, aggregate, filter, compute § Language used: – Aleri SQL Or – XML (with Aleri DTD) § Destination/Use of Results: – rates published in real-time and distributed throughout the bank § Commercial tools applied: – Rates delivered by Reuters RMDS – Results published on Reuters RMDS – MS Visual Studio. NET (for trader interface) www. alerilabs. com