13ca2c6d8fbc1d8438b87af7b2fdc4a9.ppt

- Количество слайдов: 26

Evaluating Your Insurance Needs Insurance Basics for Students Heading Out on Their Own

Evaluating Your Insurance Needs n Auto Insurance Parts of an auto policy n Factors that determine what auto insurance costs n Auto insurance laws in Ohio n n Renters Insurance n Types of homeowners policies

Evaluating Your Insurance Needs n Your Insurance Needs Shopping for insurance n Insurance premiums n Insurance cost saving tips n Settling an insurance claim n

Parts of an Auto Insurance Policy n Declarations n Your Information – Who’s insured (name and address) – Vehicle(s) covered (V. I. N. ) n Your policy specifics – Amount of insurance - Policy Limits – Premium (the price of insurance coverage)

Parts of an Auto Insurance Policy n Coverages Bodily Injury Liability n Property Damage Liability n Medical Payments n Uninsured Motorists n Underinsured Motorists n Uninsured Motorists Property Damage n Damage to Your Auto n – Collision – Other Than Collision (Comprehensive)

Parts of an Auto Insurance Policy n Definitions – Terms of policy defined n Exclusions – What’s Not Covered in the policy n Conditions – Responsibilities of the contract are specified for you and the company

Auto Insurance Cost Factors n Factors that determine cost of insurance Use of car (to & from work, pleasure) n Value / Type of car (make & model) n Repair costs for car & occupants (crashworthiness) n Where you live and how car is parked n Your driving record n Coverage limits n Sex & Marital status n Good Student Discount n Age of drivers n

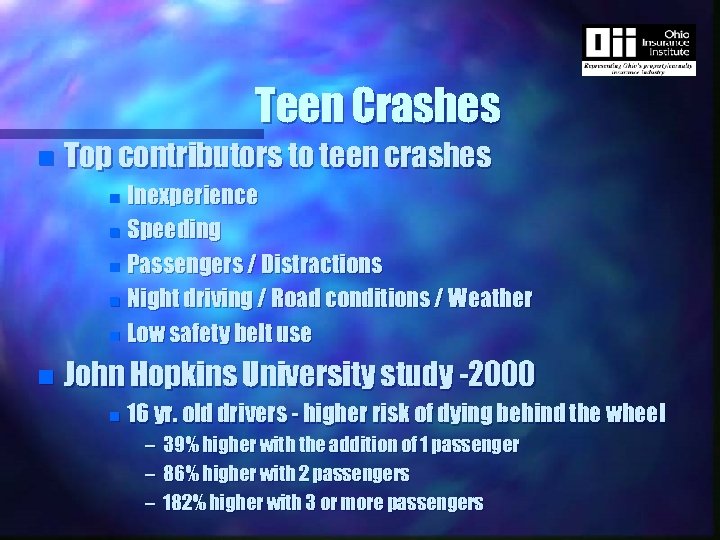

Teen Crashes n Top contributors to teen crashes Inexperience n Speeding n Passengers / Distractions n Night driving / Road conditions / Weather n Low safety belt use n n John Hopkins University study -2000 n 16 yr. old drivers - higher risk of dying behind the wheel – 39% higher with the addition of 1 passenger – 86% higher with 2 passengers – 182% higher with 3 or more passengers

Auto Insurance Laws n Ohio’s Financial Responsibility law n Requirements met by having one of the following: – – – Auto Liability insurance (12, 500/25, 000 BI; 7, 500 PD) Surety bond of $30, 000 BMV Certificate - bond of $30, 000 on file with BMV Certificate - bond of $60, 000 in real estate on file Certificate of Self Insurance - those w/ 25 or more cars

Auto Insurance Laws n Ohio’s Financial Responsibility law n Required to show proof of FR when: – A moving violation requires a court appearance – When stopped by law enforcement officials for a traffic violation, vehicle safety inspection or involved in a crash and asked to provide it – Contacted via mail through the BMV random verification program n Auto insurers provide an Auto Insurance ID Card – Keep it in car - satisfies FR proof when asked by law enforcement officials

Auto Insurance Laws n Financial Responsibility law Penalties Lose Drivers License @ least 90 days up to 2 years n Petition court for limited driving privileges n License plate & vehicle registration suspension n License reinstatement fees of $75 -$500 n Requirement to obtain insurance for five years monitored by insurers and BMV n Vehicle immobilization and confiscation of license plates for 30 -60 days for violation FR suspension n – 3 rd and subsequent offenses - could mean vehicle forfeiture + 5 -year moratorium on vehicle registrations

Auto Insurance Laws n Ohio’s Graduated Licensing law n Temporary permits can be obtained at 15 1/2 – Drivers training component n Drivers Education Training n Plus 50 hours behind the wheel with Mom & Dad n Probationary drivers license – At least 16 years old – Must pass BMV driving and maneuverability test – Probationary license held until 18 when full privileges without restrictions granted n n Curfew restrictions Penalties – Driving under the influence – Moving violations

Renters Insurance n A “package” policy Personal belongings n Liability coverage n Medical payments to others n Damage to property of others n Additional living expenses n Buildings & structures (with a homeowners policy) n

Renters Insurance n Types of homeowners policies n Renter – Covers belongings and provides liability coverage n Condo Owner – Covers belongings, some improvements to interior walls and provides liability coverage n Home Owner – Covers belongings, the building and structures and provides liability coverage

Your Insurance Needs n Shopping for insurance n Agent, toll-free numbers, internet – Have agent/company representative explain what’s NOT COVERED in the policy - this avoids surprises after a loss – Many prefer to investigate coverage options and prices via the web, then contact an agent or company n Evaluate your need for an agent - is it important to you to have an insurance professional for advice? n Insurance premiums Paid monthly, quarterly, semiannually, or yearly n Homeowners - watch for PITI in your mortgage n – Principal, Interest, Taxes, Insurance

Your Insurance Needs n Insurance cost saving tips n Ask about discounts n n Good student, more than one car, carrying other types of insurance with the same company Increase deductibles n Generally, the higher the deductible, the lower the premium Avoid filing frivolous and/or excessive claims n Comparison shop n Keep property (car and home) well maintained n Use credit wisely and only as needed n

Your Insurance Needs n Settling an insurance claim Contact insurance agent/company ASAP n Take steps to prevent future losses to property n Gather as much info as possible about the loss n – witnesses, videotape/photo damaged property n An insurance company representative will contact you (claims adjuster) asking details about the loss – Adjuster may want to record your conversation n Work with adjuster to an agreeable negotiation – If not satisfied, you have the option to contact Ohio Dept. of Insurance - Consumer Services Division - for info or to file a complaint (www. ohioinsurance. gov)

OII Mission Statement n To strengthen public understanding of and confidence in Ohio’s property/casualty insurance industry. n The OII is a public information and trade association representing insurance companies and agent groups for the property/casualty insurance industry. A primary objective of the OII is to help Ohioans achieve a better understanding of insurance and related safety issues.

How to reach OII Phone: 614. 228. 1593 n Fax: 614. 228. 1678 n Email: info@ohioinsurance. org n www. ohioinsurance. org n US Mail: n – OHIO INSURANCE INSTITUTE – P. O. Box 816 – Columbus, OH 43216 -0816

13ca2c6d8fbc1d8438b87af7b2fdc4a9.ppt