BTA bank-Madina, final version.pptx

- Количество слайдов: 41

Evaluating of Bank performance of Prepared by: Abilkhanov Nursultan Akhtanova Madina S

History S Prombank (1925 -1991) October 15, 1925 a branch of Promyshlenny (Industrial) Bank (Prombank) was launched in Kazakhstan. July 17, 1987 was reorganized into Kazakh Nationwide Bank Promstroybank. March 4, 1991 Kazakh Nationwide Bank Promstroybank was transformed into Kazakh Nationwide Bank of State-Owned Commercial Industrial Construction Bank Turanbank and Alembank (1991 -1997) July 24, 1991 the Cabinet of Ministers of the Kaz. SSR established Kazakh Joint-Stock Bank Turanbank. August 28, 1992 Vnesheconombank of the RK was renamed to Bank of Foreign Economic Activities of the RK ALEM BANK KAZAKHSTAN Bank Turan. Alem (1997 -2008) January 15, 1997 as a result of merger between Kazakh Bank Turanbank with Bank Alem. Bank Kazakhstan, there emerged Bank Turan. Alem BTA Bank (Since 2008) In February 2008 "Bank. Turan. Alem" has undergone through registration process and got new name and look, BTA Bank. 2008. BTA Bank is recognized as the largest bank in Kazakhstan by assets, capital and net profit according to the annual TOP 100 World Banks Rating, published by The Banker international business edition.

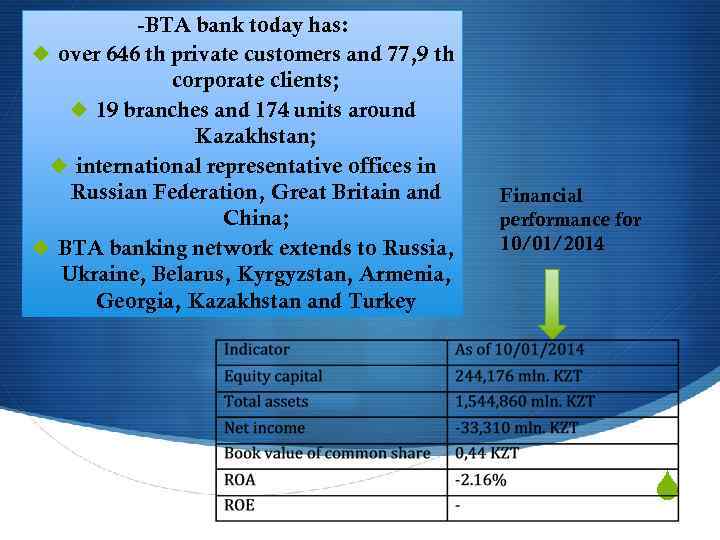

-BTA bank today has: u over 646 th private customers and 77, 9 th corporate clients; u 19 branches and 174 units around Kazakhstan; u international representative offices in Russian Federation, Great Britain and China; u BTA banking network extends to Russia, Ukraine, Belarus, Kyrgyzstan, Armenia, Georgia, Kazakhstan and Turkey Financial performance for 10/01/2014 S

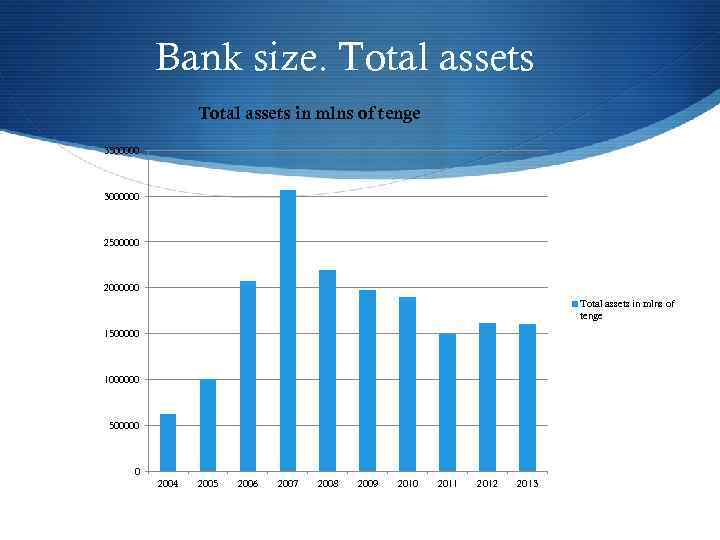

Bank size. Total assets in mlns of tenge 3500000 3000000 2500000 2000000 Total assets in mlns of tenge 1500000 1000000 500000 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

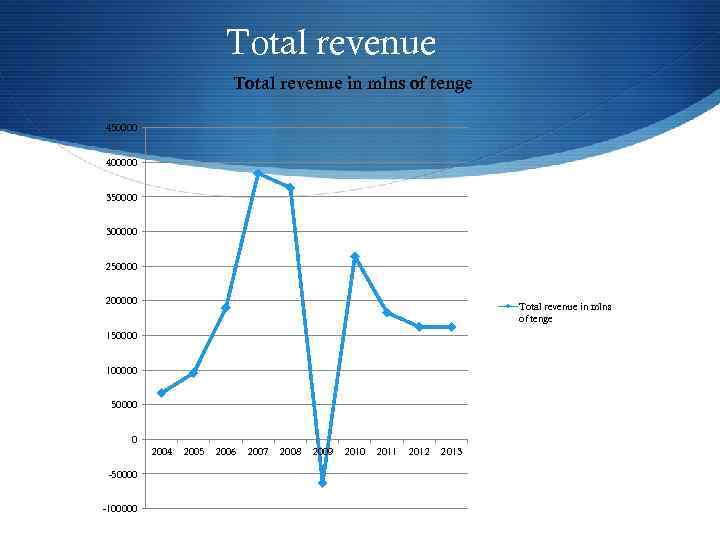

Total revenue in mlns of tenge 450000 400000 350000 300000 250000 200000 Total revenue in mlns of tenge 150000 100000 50000 0 2004 -50000 -100000 2005 2006 2007 2008 2009 2010 2011 2012 2013

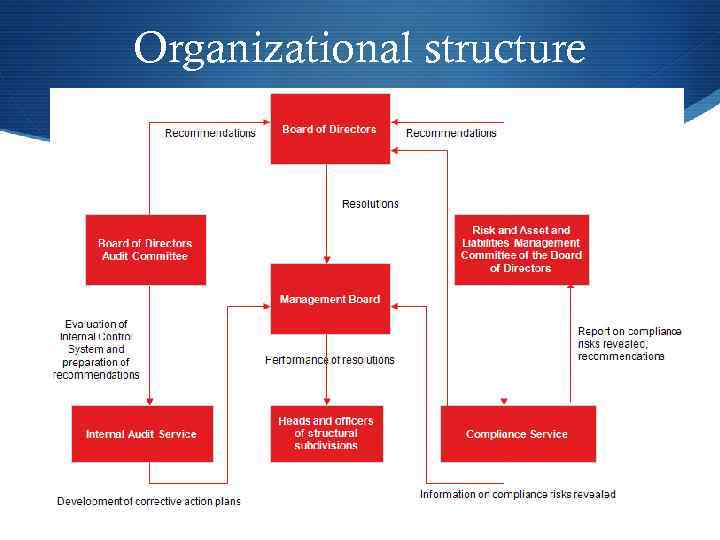

Organizational structure

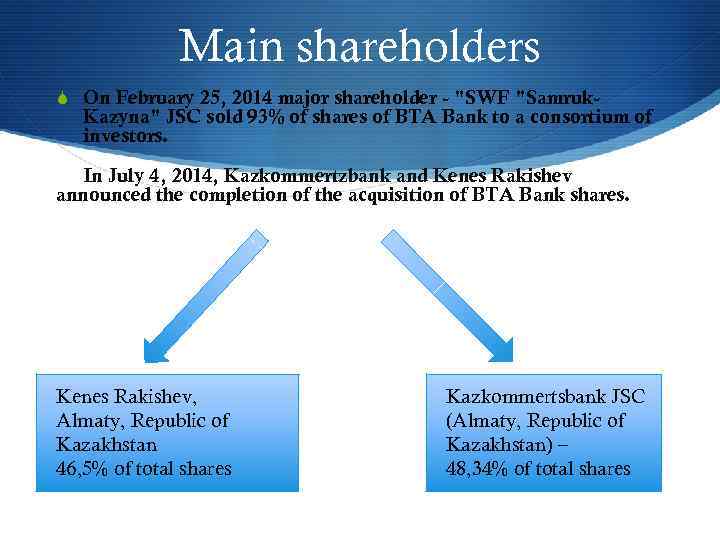

Main shareholders S On February 25, 2014 major shareholder - "SWF "Samruk- Kazyna" JSC sold 93% of shares of BTA Bank to a consortium of investors. In July 4, 2014, Kazkommertzbank and Kenes Rakishev announced the completion of the acquisition of BTA Bank shares. Kenes Rakishev, Almaty, Republic of Kazakhstan 46, 5% of total shares Kazkommertsbank JSC (Almaty, Republic of Kazakhstan) – 48, 34% of total shares

Mr. Yury Voicehovsky (Member of the Bo. D, Independent Director, since Feb 14, 2013) Nina Zhussupova (Member of the Bo. D, since Feb 14, 2014) Kenes Rakishev (Chairman of the Bo. D, since 14 Feb, 2014) Board of directors Mr. Konstantin Korischenko (Member of the Bo. D, Independent Director, since Feb 14, 2013) Kadyrzhan Damitov (Member of the Bo. D, representative of Samruk. Kazyna JSC, since Sep 26, 2013) Ms. Raikhan Imambayeva (Member of the Bo. D, representative of Samruk-Kazyna JSC, since Feb 14, 2014)

Management board Chairman of the Management Board Magzhan Auezov Deputy Chairman of the Management Board Zhanibek Saurbek Managing Director - Member of the Management Board Zhuldyz Akhmetkaliyeva Managing Director - Member of the Management Board Aigerym Zhaparova Managing Director - Member of the Management Board Kairzhan Mimikenov Managing Director - Member of the Management Board Askarbek Nabiev Managing Director - Member of the Management Board Viktor Romanyuk Managing Director - Member of the Management Board Lyazzat Satieva

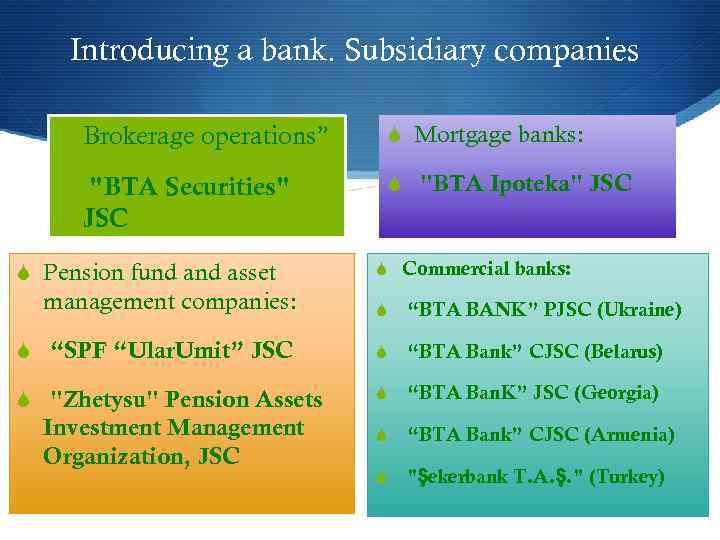

Introducing a bank. Subsidiary companies S Brokerage operations” S Mortgage banks: S "BTA Securities" S "BTA Ipoteka" JSC S Pension fund asset S Commercial banks: management companies: S “BTA BANK” PJSC (Ukraine) S “SPF “Ular. Umit” JSC S “BTA Bank” CJSC (Belarus) S "Zhetysu" Pension Assets S “BTA Ban. K” JSC (Georgia) Investment Management Organization, JSC S “BTA Bank” CJSC (Armenia) S "Şekerbank T. A. Ş. " (Turkey)

Subsidiary companies S Insurance companies: S "SLIC "BTA Bank" "BTA Zhizn" JSC S Processing operations on bank cards: S Alem. Card" LLP S «BTA Insurance SC of the BТА Bank» JSC S Insurance company "London -Almaty” S JSC National Joint-Stock Insurance Company "Oranta" S Cash-in-transit (CIT) service providers: S “Titan-Inkassatsia” LLP

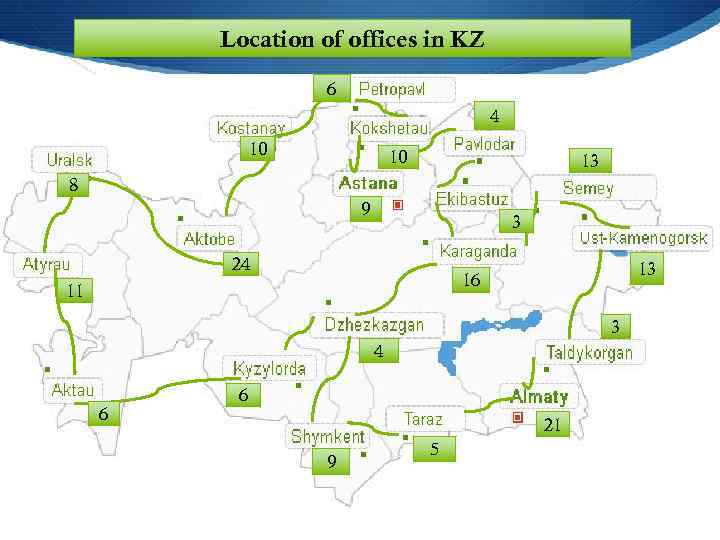

Location of offices in KZ 6 4 10 10 13 8 9 3 24 13 16 11 3 4 6 6 21 9 5

Representative offices S Russian Federation S Head of the representative office- Mukhit A. Abdrasilov S The People’s Republic of China S Head of the representative office- Anatoliy Chzhan S UAE, Dubai S Head of the representative office- Gulnara R. Galyamova S Great Britain, London S Head of the representative office- Nariman G. Zharkinbayev

Services. Retail banking S Credits S Safe depositary S Deposits S Kamkor program S Money transfers S Custody S Payment cards S Internet banking S Payment of population S SMS- banking S Payroll card program

Services. SME S Financing S Bank guarantees S Deposit operations S Current account operations S Remote banking servising S Salary projects S Escrow account S Payment cards

Services. Corporate banking S Deposit banking S Remote banking S Investment products S Tender guarantee S Salary projects S Financing S Treasury S Custody

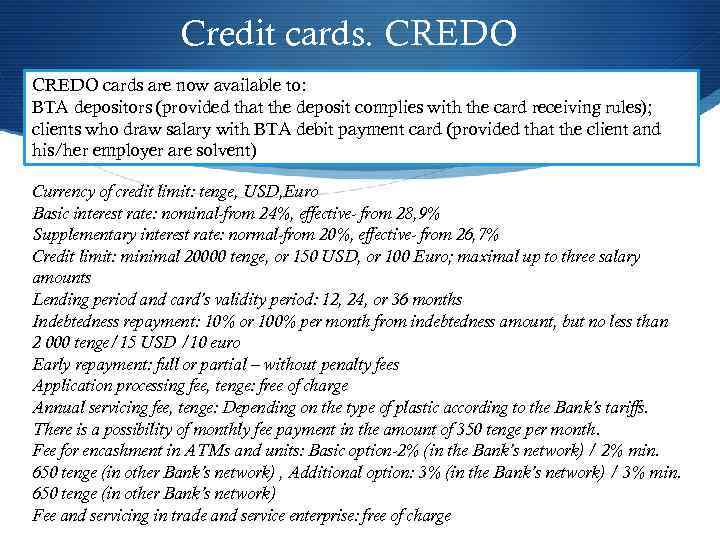

Credit cards. CREDO cards are now available to: BTA depositors (provided that the deposit complies with the card receiving rules); clients who draw salary with BTA debit payment card (provided that the client and his/her employer are solvent) Currency of credit limit: tenge, USD, Euro Basic interest rate: nominal-from 24%, effective- from 28, 9% Supplementary interest rate: normal-from 20%, effective- from 26, 7% Credit limit: minimal 20000 tenge, or 150 USD, or 100 Euro; maximal up to three salary amounts Lending period and card’s validity period: 12, 24, or 36 months Indebtedness repayment: 10% or 100% per month from indebtedness amount, but no less than 2 000 tenge/15 USD /10 euro Early repayment: full or partial – without penalty fees Application processing fee, tenge: free of charge Annual servicing fee, tenge: Depending on the type of plastic according to the Bank’s tariffs. There is a possibility of monthly fee payment in the amount of 350 tenge per month. Fee for encashment in ATMs and units: Basic option-2% (in the Bank’s network) / 2% min. 650 tenge (in other Bank’s network) , Additional option: 3% (in the Bank’s network) / 3% min. 650 tenge (in other Bank’s network) Fee and servicing in trade and service enterprise: free of charge

Type of payment cards S Electronic: Visa Electron Instant, Visa Electron, Maestro International S Classic: Visa Classic, Master. Card Standard S Platinum: Visa Platinum, Master. Card Platinum S Gold: Visa Gold, Master. Card Gold S Virtual Card S Salary cards S Smart Alem card

Marketing campaigns 2014 Slogan of all marketing campaigns is: «Time for new opportunities» KAZKOM and BTA Bank integrate ATM network Kazkommertsbank and BTA Bank launched the process of intergration of their ATMs, by cancelling additional fees for withdrawal of cash for cardholders of both banks as from June 25, 2014. In total, two banks have 2028 ATMs. A special offer of Master. Card for BTA Bank card holders At the offer period pay railway tickets by the means of website JSC "Kazakhstan Темiр Жолы" by Master. Card or Maestro and win one of 30 LCD - TV, one of 9 train tickets or a smartphone. Winners are defined once a month by lottery conducting New opportunities in the online unit of BTA 24: SLOGAN: «The bank is close at hand» round-the-clock online-consulting of the bank specialists. Phone-call order service making payments to various suppliers of mobile and landline communications, cable television, city utility services, financial organizations and educational institutions Favorable offer from BTA Bank and Global Building Contract Construction Company Arrangement of mortgages in BTA Bank on favorable. Apartments, which participate in the program: «Kausar» , «Altyn Bulak» , «Zhagalau» , «AFD Plaza» , «Shakhristan» , «Ush-Tobe» , «Quarter 29» residential complexes.

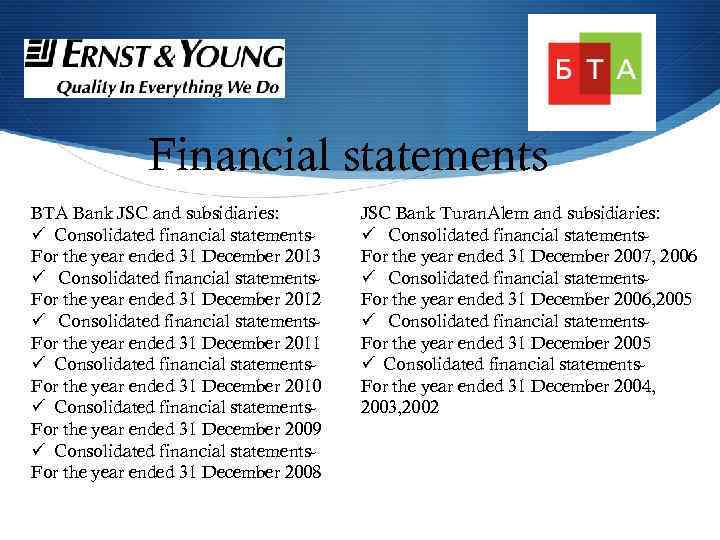

Financial statements BTA Bank JSC and subsidiaries: ü Consolidated financial statements. For the year ended 31 December 2013 ü Consolidated financial statements. For the year ended 31 December 2012 ü Consolidated financial statements. For the year ended 31 December 2011 ü Consolidated financial statements. For the year ended 31 December 2010 ü Consolidated financial statements. For the year ended 31 December 2009 ü Consolidated financial statements. For the year ended 31 December 2008 JSC Bank Turan. Alem and subsidiaries: ü Consolidated financial statements. For the year ended 31 December 2007, 2006 ü Consolidated financial statements. For the year ended 31 December 2006, 2005 ü Consolidated financial statements. For the year ended 31 December 2004, 2003, 2002

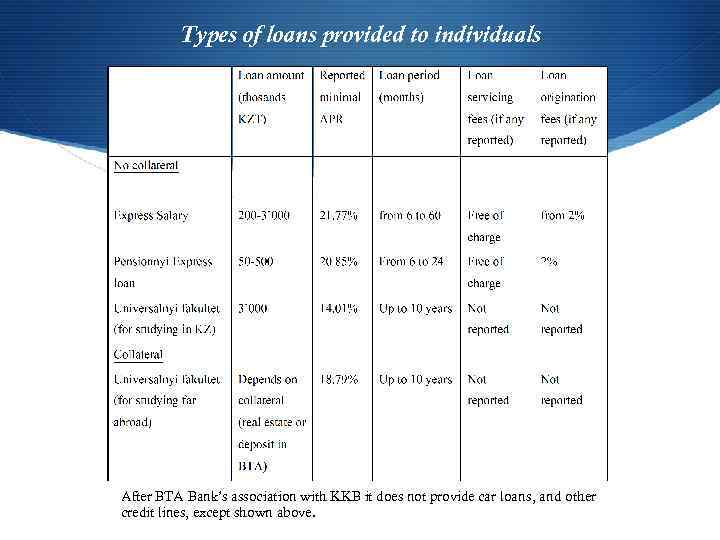

Types of loans provided to individuals After BTA Bank’s association with KKB it does not provide car loans, and other credit lines, except shown above.

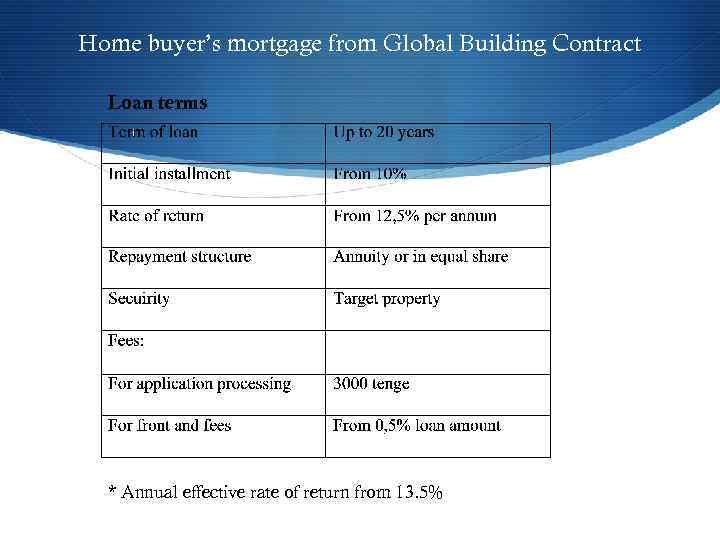

Home buyer’s mortgage from Global Building Contract Loan terms * Annual effective rate of return from 13. 5%

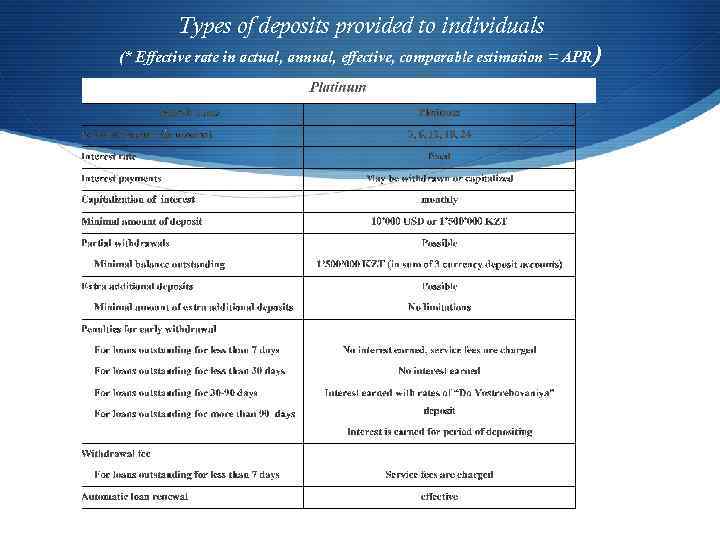

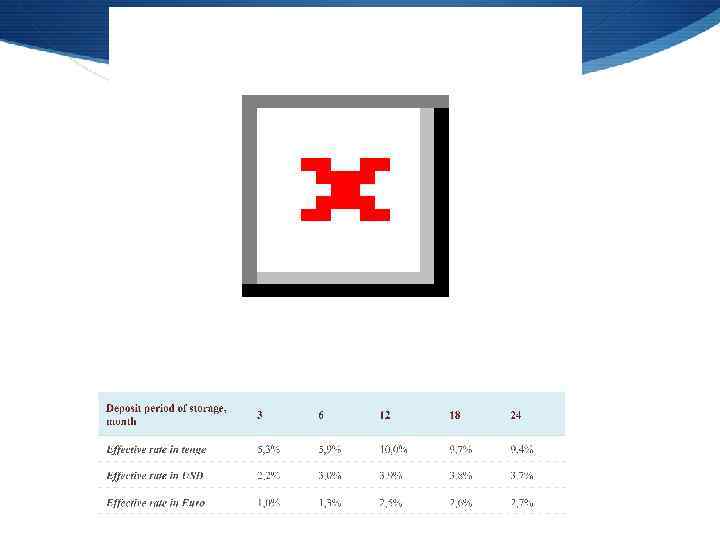

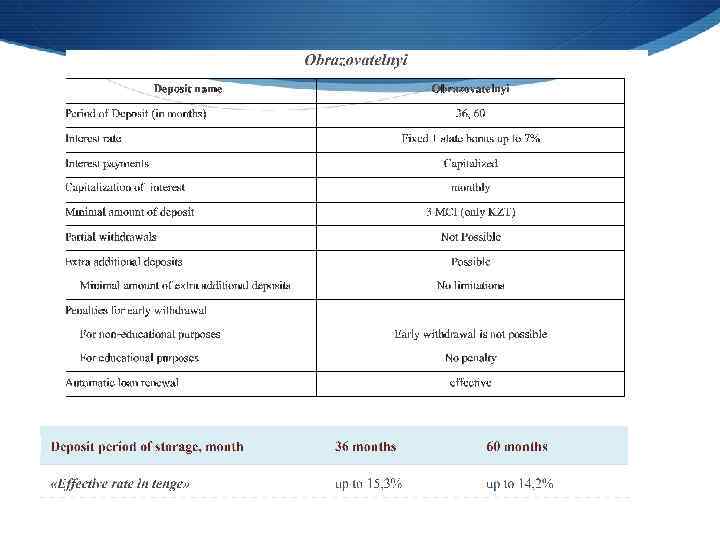

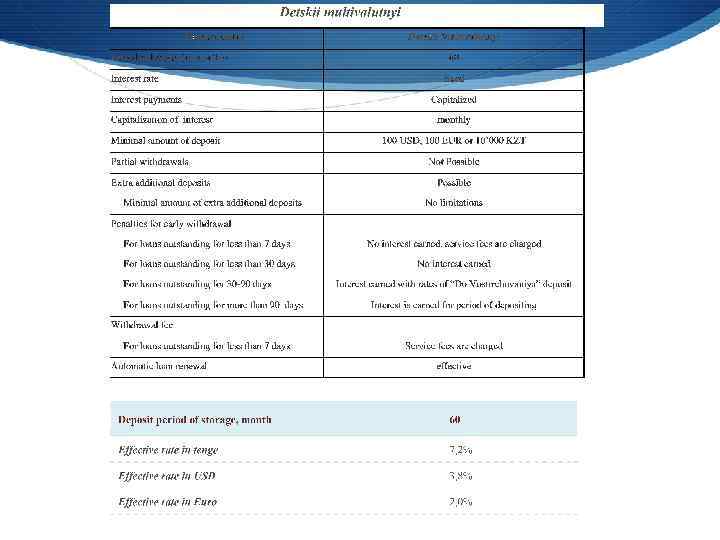

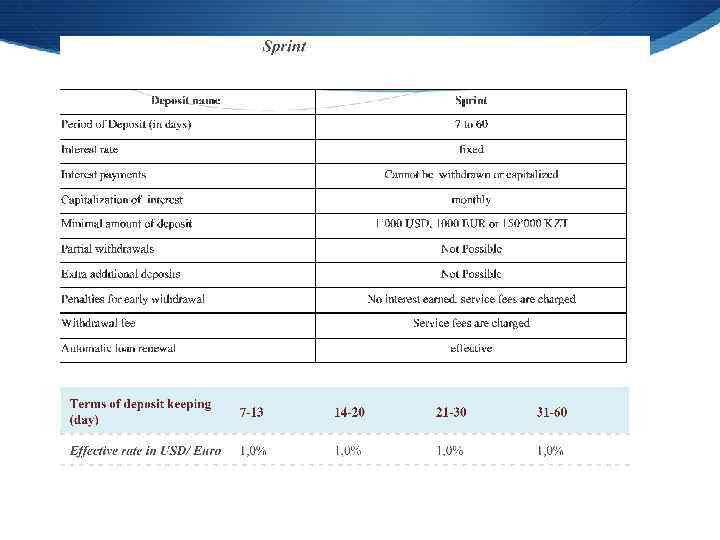

Types of deposits provided to individuals (* Effective rate in actual, annual, effective, comparable estimation = APR )

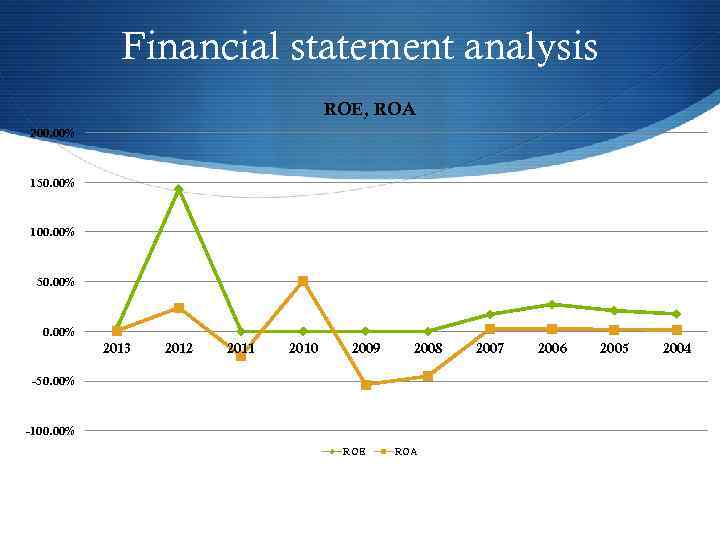

Financial statement analysis ROE, ROA 200. 00% 150. 00% 100. 00% 50. 00% 2013 2012 2011 2010 2009 2008 -50. 00% -100. 00% ROE ROA 2007 2006 2005 2004

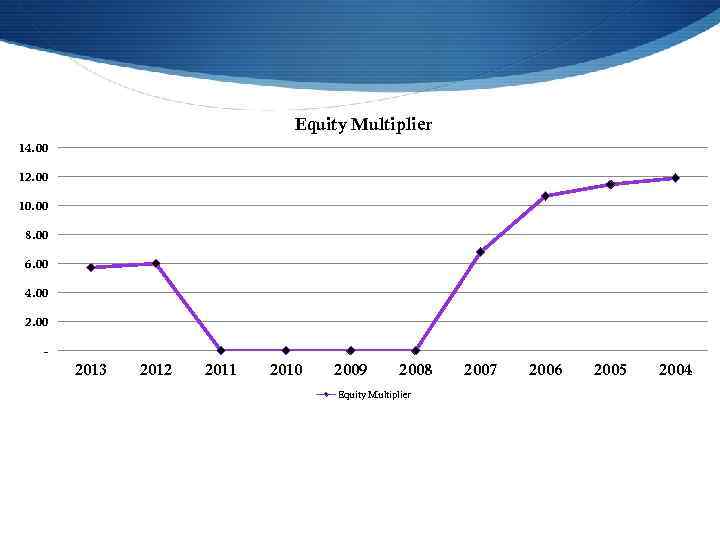

Equity Multiplier 14. 00 12. 00 10. 00 8. 00 6. 00 4. 00 2. 00 - 2013 2012 2011 2010 2009 2008 Equity Multiplier 2007 2006 2005 2004

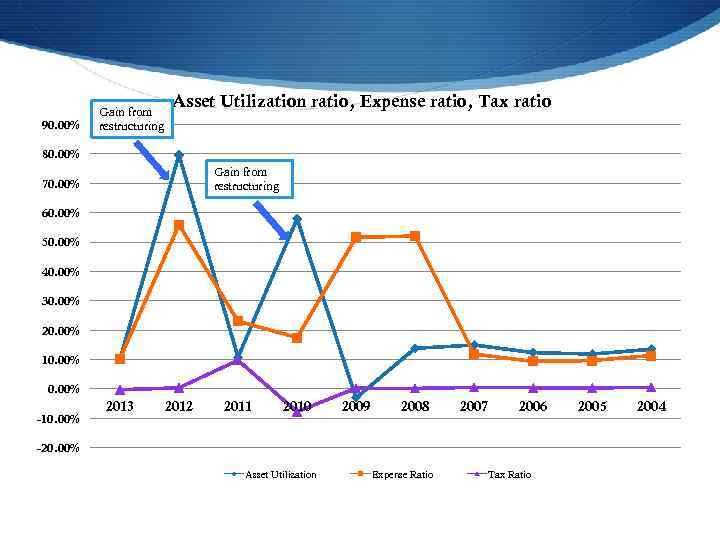

90. 00% Gain from restructuring Asset Utilization ratio, Expense ratio, Tax ratio 80. 00% Gain from restructuring 70. 00% 60. 00% 50. 00% 40. 00% 30. 00% 20. 00% 10. 00% -10. 00% 2013 2012 2011 2010 2009 2008 2007 2006 -20. 00% Asset Utilization Expense Ratio Tax Ratio 2005 2004

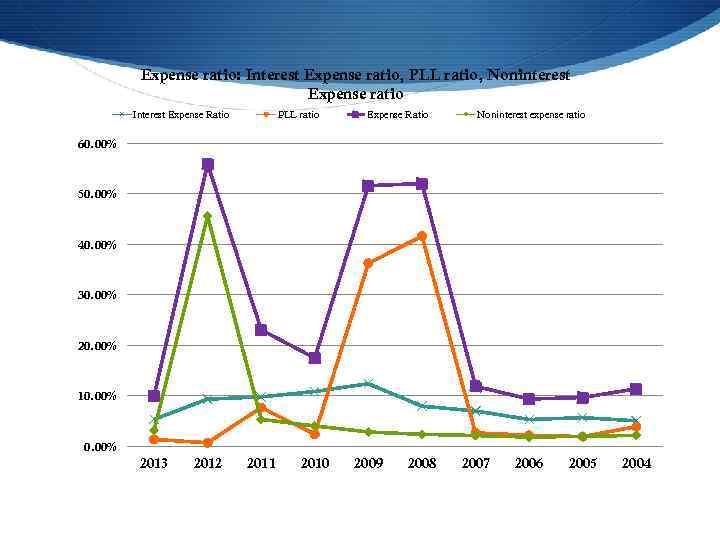

Expense ratio: Interest Expense ratio, PLL ratio, Noninterest Expense ratio Interest Expense Ratio PLL ratio Expense Ratio Noninterest expense ratio 60. 00% 50. 00% 40. 00% 30. 00% 20. 00% 10. 00% 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004

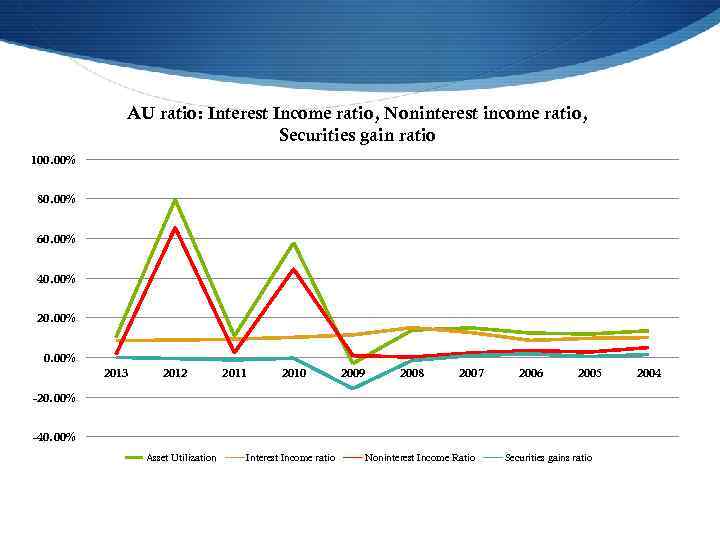

AU ratio: Interest Income ratio, Noninterest income ratio, Securities gain ratio 100. 00% 80. 00% 60. 00% 40. 00% 2013 2012 2011 2010 2009 2008 2007 2006 2005 -20. 00% -40. 00% Asset Utilization Interest Income ratio Noninterest Income Ratio Securities gains ratio 2004

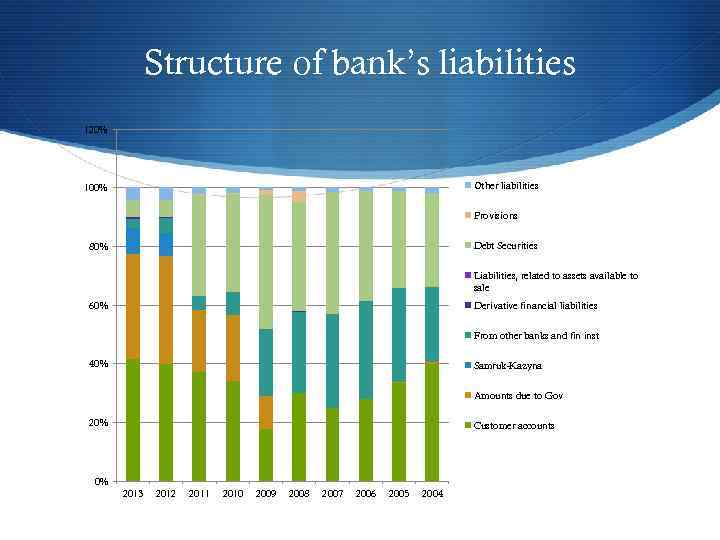

Structure of bank’s liabilities 120% Other liabilities 100% Provisions Debt Securities 80% Liabilities, related to assets available to sale 60% Derivative financial liabilities From other banks and fin inst 40% Samruk-Kazyna Amounts due to Gov 20% Customer accounts 0% 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004

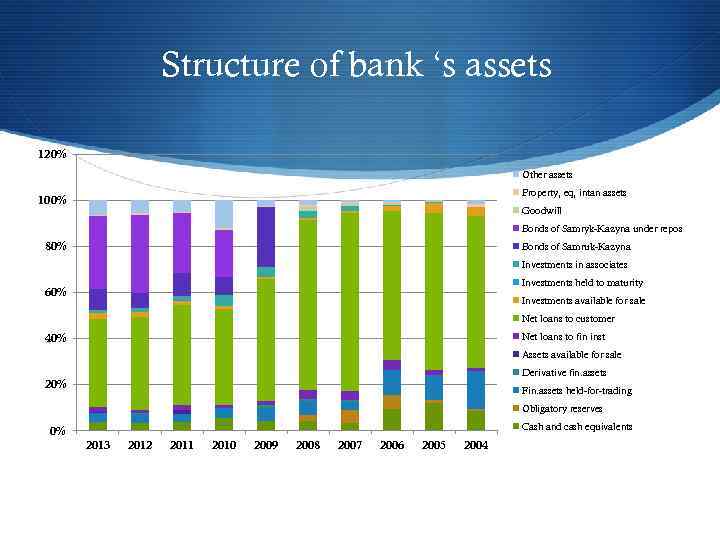

Structure of bank ‘s assets 120% Other assets Property, eq, intan assets 100% Goodwill Bonds of Samryk-Kazyna under repos 80% Bonds of Samruk-Kazyna Investments in associates Investments held to maturity 60% Investments available for sale Net loans to customer Net loans to fin inst 40% Assets available for sale Derivative fin. assets 20% Fin. assets held-for-trading Obligatory reserves Cash and cash equivalents 0% 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004

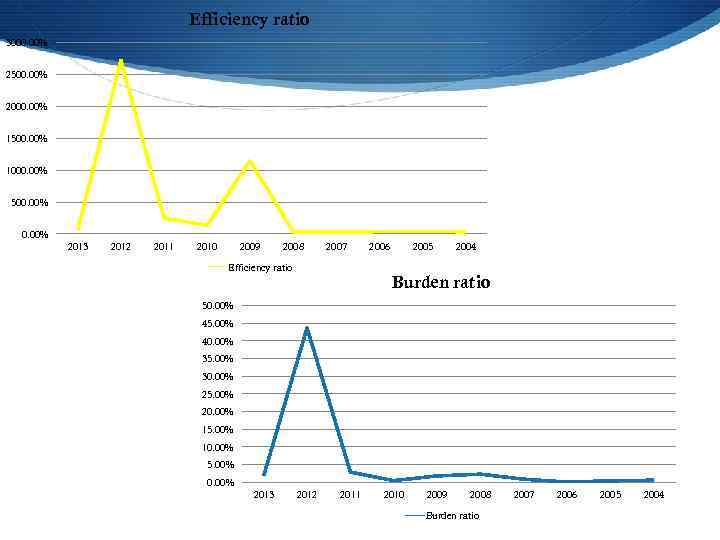

Efficiency ratio 3000. 00% 2500. 00% 2000. 00% 1500. 00% 1000. 00% 500. 00% 2013 2012 2011 2010 2009 2008 2007 Efficiency ratio 2006 2005 2004 Burden ratio 50. 00% 45. 00% 40. 00% 35. 00% 30. 00% 25. 00% 20. 00% 15. 00% 10. 00% 5. 00% 0. 00% 2013 2012 2011 2010 2009 2008 Burden ratio 2007 2006 2005 2004

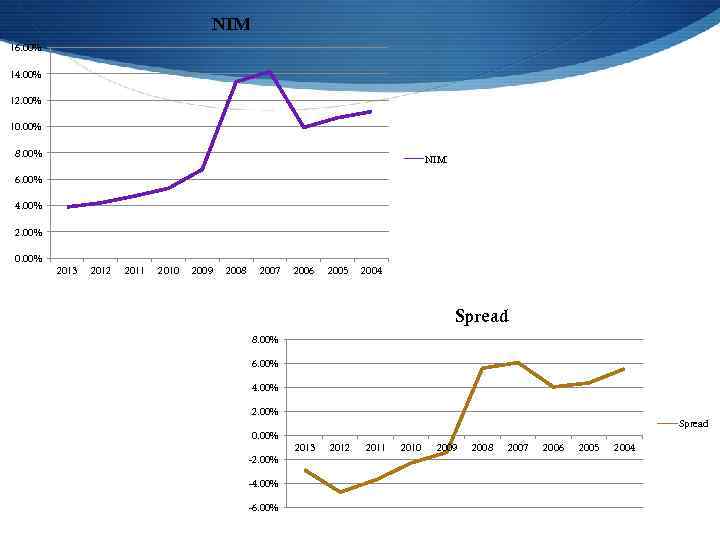

NIM 16. 00% 14. 00% 12. 00% 10. 00% 8. 00% NIM 6. 00% 4. 00% 2. 00% 0. 00% 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 Spread 8. 00% 6. 00% 4. 00% 2. 00% Spread 0. 00% 2013 -2. 00% -4. 00% -6. 00% 2012 2011 2010 2009 2008 2007 2006 2005 2004

BTA bank-Madina, final version.pptx