Chapter 12, Evaluating Consumer Credit.pptx

- Количество слайдов: 57

EVALUATING CONSUMER LOANS Source book: Management of Banking, 6 th Edition, Chapter 12

Why consumer loans are attractive? Historically, in the past, consumer loans were not prestigious. But this has changed as profitability of commercial loans has declined. Reason 1 Currently, the competition in commercial loans has lowered spreads on these loans where potential profits are small relative to credit risk. Ex 1: What’s the credit spread and credit risk? -Assume a bank which attracts the capital at 7%, and has annual OE of $10’ 000; -And lends this money to businesses at an average rate of 12%. -Suppose this bank has a credit portfolio of $1’ 000 -What is the interest cost of forming this portfolio? -What is the interest income for the bank derived from this portfolio? -What is the net profit for the bank? - the interest cost of forming this portfolio is $70’ 000 - the interest income from this portfolio is $120’ 000 - and, the net profit for the bank is II – IE – OE = $120’ 000 - $70’ 000 - $10’ 000 = $40’ 000. - Now, suppose that some commercial customers fail on their credits and the bank writes off a total of $25’ 000 as bad debts. - What will be the new net profit for the bank? If any. -The new net profit for the bank is II – IE – OE – bad debts = = $120’ 000 - $70’ 000 - $10’ 000 – 25’ 000 = $15’ 000. - And the net return on this loan portfolio is = $15’ 000/$1’ 000× 100 = 1. 5%

Ex 1 (continued): What’s the credit spread and credit risk? -Now, assume the same bank; -Suppose this bank thinks to invest its $1’ 000 in consumer loans which currently pay higher yields of 18% and have a bad debt ratio (a ratio of bad debts relative to the size of the credit portfolio) of 5. 5%? -What is the interest cost of forming this portfolio? -What is the interest income for the bank derived from this portfolio? -What should be the estimated amount of bad debts for this portfolio? -What is the net profit for the bank? - the interest cost of forming this portfolio is $70’ 000 - the interest income from this portfolio is $180’ 000 - expected amount of bad debts is 55’ 000 (0. 055×$1’ 000) - and, the net profit for the bank is II – IE – OE – bad debts = $180’ 000 - $70’ 000 - $10’ 000 - $55’ 000 = $45’ 000. NOTE: even adjusted for credit risk, the net profit from the consumer credit is greater than that of commercial credit. What can we learn from this example? Net Profit for the bank from credits = Interest Inc. – Interest Exp. – Noninterest Exp. – Bad Debts = = II – IE – OE – BAD DEBTS What can we see in reality? Credit spread Credit risk The issue is that with constant historical credit risk ratio for commercial loans, the competition in commercial lending sphere has lowered the average interest rate that banks charge to commercial customers. And this trend makes the commercial lenders less profitable. That’s why banks enter the consumer-loan market.

Why consumer loans are attractive? Reason 2 - Commercial borrowers are more sensitive to interest rates changes. - Consumer borrowers are not so much sensitive. Why? Ex 2: Interest rate sensitivity and size of a loan -Suppose you have owed -At a rate of 12% $100 and $1’ 000 The rates have dropped to 11% but -How much would you save in interest charges if you take a credit at another bank at 1% and repay the loan at bank 1? ? $1 per year ? $10’ 000 per year Now, is it clear why business customers are more sensitive? -Because the amounts they owe to the bank are large and thus interest savings from refinancing are substantial. -Whereas for individuals who owe little amounts – the shoe-leather costs are substantially higher than the benefit.

Performance Ratios by Asset Concentration Group 4. 5 Percent 4 3. 5 3 2. 5 2 1. 5 1 1. 23 0. 5 0. 760000003 0 International Agricultural Banks Return on Assets (YTD) December 31, 2004 4. 01 1. 3 1. 180000001 Credit Card Lenders Commercial Lenders Mortgage Lenders 1. 66 1. 1 Consumer Lenders Net Interest Margin (YTD) Other Specialized <$1 bln 1. 35 All Other <$1 All Other >$1 bln December 31, 2004 10 Percent 9 8 7 6 5 4 3 2 2. 5 1 0 9. 05 4. 07 International Agricultural Banks 3. 86 Credit Card Lenders Commercial Lenders 4. 71 3. 2 3. 05 Mortgage Lenders Consumer Lenders Other Specialized <$1 bln 3. 86 3. 27 All Other <$1 All Other >$1 bln

Types of Consumer Loans (Difficulties in Evaluation) • When evaluating the measurable aspects of consumer loans an analyst addresses the same issues that will be discussed later with commercial loans: Ø character of the borrower Ø use of loan proceeds Ø amount owed Ø primary and secondary source of repayment • However, consumer loans differ so much in design that no comprehensive analytical format applies to all loans. Ex 3: Differences in features of loans Credit Cards______________ -Bank doesn’t know what the loan proceeds will be used for, and - how much the customer will borrow at any point in time An Automobile Loan___________ - Fixed installment payments - Maximum borrowing amount - Regular repayment schedule • There is no formal analysis of individual borrower characteristics unless the lender uses a credit-scoring model. • Many banks use the technique of increasing volume and price of the credit where they cannot evaluate the individual credit risks

Types of Consumer Loans (Types) Consumer loans may be classified into three types Installment Loans Noninstallment Loans Credit Cards or Revolving Credit Lines

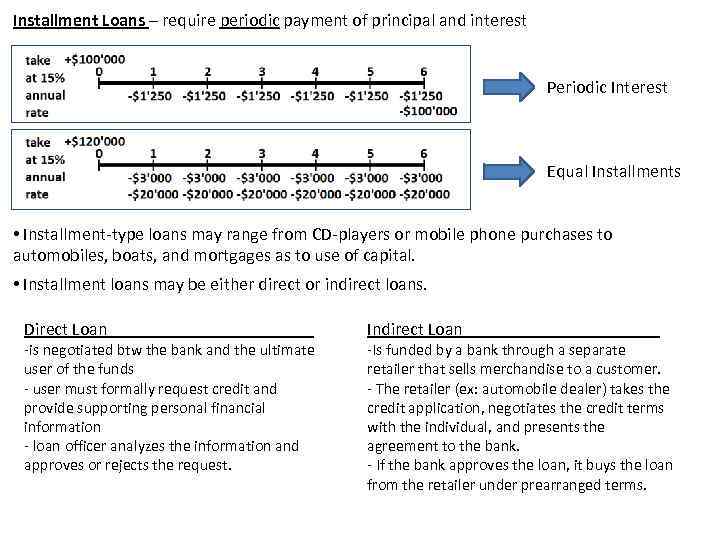

Installment Loans – require periodic payment of principal and interest Periodic Interest Equal Installments • Installment-type loans may range from CD-players or mobile phone purchases to automobiles, boats, and mortgages as to use of capital. • Installment loans may be either direct or indirect loans. Direct Loan____________ -is negotiated btw the bank and the ultimate user of the funds - user must formally request credit and provide supporting personal financial information - loan officer analyzes the information and approves or rejects the request. Indirect Loan___________ -Is funded by a bank through a separate retailer that sells merchandise to a customer. - The retailer (ex: automobile dealer) takes the credit application, negotiates the credit terms with the individual, and presents the agreement to the bank. - If the bank approves the loan, it buys the loan from the retailer under prearranged terms.

Installment Loans (part 2) Revenues and costs from installment credit Size Generally, the average size of the loan is small, averaging around $6’ 000 historically (for U. S. ) Origination Cost It costs from $100 to $250 to originate each installment loan. Types of origination costs Origination costs include: salaries, occupancy, computer, and marketing expenses associated with soliciting, approving, and processing loan applications, i. e. – all costs needed to underwrite a loan. Postorigination costs Other costs are also associated with collecting payments and charging-off loans. Profitability Generally, installment loans have yielded net spreads in excess of 5%. net spread = loan income – loan acquisition costs – collection costs – net charge-offs

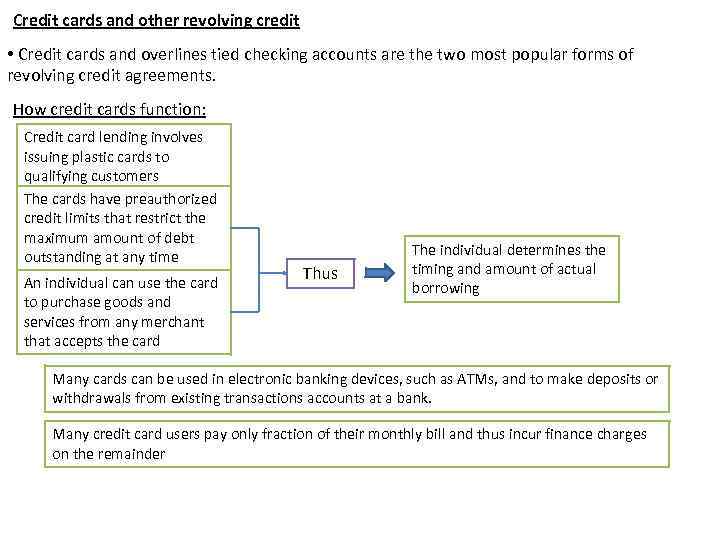

Credit cards and other revolving credit • Credit cards and overlines tied checking accounts are the two most popular forms of revolving credit agreements. How credit cards function: Credit card lending involves issuing plastic cards to qualifying customers The cards have preauthorized credit limits that restrict the maximum amount of debt outstanding at any time An individual can use the card to purchase goods and services from any merchant that accepts the card Thus The individual determines the timing and amount of actual borrowing Many cards can be used in electronic banking devices, such as ATMs, and to make deposits or withdrawals from existing transactions accounts at a bank. Many credit card users pay only fraction of their monthly bill and thus incur finance charges on the remainder

Credit cards and other revolving credit (Part 2) • Banks offer a variety of credit cards. • Although some banks issue credit cards with their own logo and support the card with their own marketing effort, most operate as franchises of Master. Card and Visa. • To become a part of either group’s system, a bank must pay a one-time membership fee plus an annual charge determined by the number of its customers actively using the cards. • Master. Card and Visa, in turn, handle the national marketing effort. • The primary advantage of membership is that an individual bank’s card is accepted nationally and internationally at most retail stores without each bank negotiating a separate agreement with every retailer. Some facts: A 2004 Nilson Report estimated that Visa had 443 mln debit and credit cards outstanding, Master. Card had 318 mln, Discover had 53 mln, and American Express had 38 mln.

Credit cards and other revolving credit (Part 3) • Credit cards are attractive for banks because they typically provide higher risk-adjusted returns than other types of loans. • Card issuers earn income from three sources: - charging cardholders fees (average $18 per account) - charging interest on outstanding loan balances (9%) - discounting the charges that merchants accept on purchases (2 to 5%) • Even though interest rates may fall, credit card rates are notoriously sticky Thus, the spread between the rate charged and a bank’s cost of funds widens during periods of low market interest rates. Some practical matters: - With competition and the pressure from different procurement groups banks have lowered the loan rates and annual fees. - Still, to generate more revenue, card issuers have been raising late-payment fees to around $30 per month when they don’t receive the monthly payment by the due date. - Many issuers view credit cards as a vehicle to generate a nationwide customer base; hoping to cross-sell mortgages, insurance products and securities. - One negative with credit cards is that losses are among the highest of all loan types. - These losses have two main sources: Defaults by customers Fraud

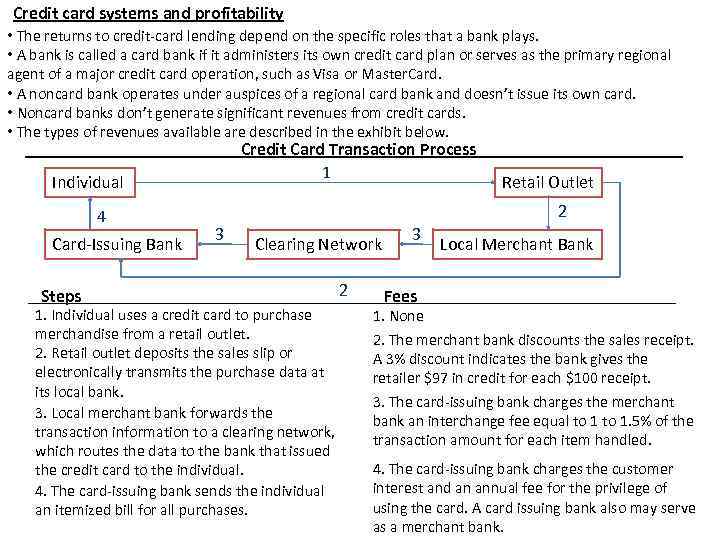

Credit card systems and profitability • The returns to credit-card lending depend on the specific roles that a bank plays. • A bank is called a card bank if it administers its own credit card plan or serves as the primary regional agent of a major credit card operation, such as Visa or Master. Card. • A noncard bank operates under auspices of a regional card bank and doesn’t issue its own card. • Noncard banks don’t generate significant revenues from credit cards. • The types of revenues available are described in the exhibit below. ____________Credit Card Transaction Process____________ 1 Individual Retail Outlet 4 Card-Issuing Bank Steps 2 3 Clearing Network 1. Individual uses a credit card to purchase merchandise from a retail outlet. 2. Retail outlet deposits the sales slip or electronically transmits the purchase data at its local bank. 3. Local merchant bank forwards the transaction information to a clearing network, which routes the data to the bank that issued the credit card to the individual. 4. The card-issuing bank sends the individual an itemized bill for all purchases. 2 3 Local Merchant Bank Fees 1. None 2. The merchant bank discounts the sales receipt. A 3% discount indicates the bank gives the retailer $97 in credit for each $100 receipt. 3. The card-issuing bank charges the merchant bank an interchange fee equal to 1. 5% of the transaction amount for each item handled. 4. The card-issuing bank charges the customer interest and an annual fee for the privilege of using the card. A card issuing bank also may serve as a merchant bank.

Debit cards, Smart cards, and Prepaid cards: Debit Cards -A debit card (also known as a bank card or check card) is a plastic card that provides the cardholder electronic access to his or her bank account/s at a financial institution. -Some cards have a stored value with which a payment is made, while most relay a message to the cardholder's bank to withdraw funds from a designated account in favor of the payee's designated bank account. -The card can be used as an alternative payment method to cash when making purchases. In some cases, the cards are designed exclusively for use on the Internet, and so there is no physical card. -In many countries the use of debit cards has become so widespread that their volume of use has overtaken or entirely replaced the check and, in some instances, cash transactions. -Like credit cards, debit cards are used widely for telephone and Internet purchases. -However, unlike credit cards, the funds paid using a debit card are transferred immediately from the bearer's bank account, instead of having the bearer pay back the money at a later date. -Debit cards usually also allow for instant withdrawal of cash, acting as the ATM card for withdrawing cash and as a check guarantee card. Merchants may also offer cashback facilities to customers, where a customer can withdraw cash along with their purchase.

Debit cards, Smart cards, and Prepaid cards: Smart Cards -A smart card is an extension of debit and credit cards. - It contains a computer memory chip that stores and manipulates information. - Such a chip can store more than 500 X the data of a magnetic-stripe credit or debit card. - When inserted in a terminal, the cardholder can pay for goods and services, dial the telephone, make airline arrangements, authorize currency exchanges, etc. - It is programmable, so users can store information when effecting transactions. - Smartcards are very popular in Europe and Japan. In U. S. they are not popular (2% of worldwide usage). This reflects the U. S. consumers’ satisfaction with existing technology and banks’ unwillingness to invest in the computer terminals necessary to process transactions. - Several reasons why smart card usage will likely take off in U. S. in the near future: • Firms can offer a much wider range of services, which will increase OI, • Smart cards are an alternative to digital money, or e-cash, used to buy items via the Internet, with security advantages for the user. • Suppliers of smart cards are standardizing the formats so that all cards work on the same systems.

Debit cards, Smart cards, and Prepaid cards: More about Smart Cards What are Smart Cards Smart card is a pocket-sized card with integrated circuits in it which can process information. It is also called as chip card or integrated circuit card(ICC). This card is made of plastic generally PVC but some times ABS (Acrylonitrile butadiene styrene which is a common thermoplastic). Smart cards typically hold 2, 000 to 8, 000 electronic bytes of data—roughly several pages of information. Benefits of Smart Cards : Smart cards are used for single sign-on to computers, laptops, data with encryption etc. It provides with a means of effective business transactions in a flexible, secure and standard way. Smart cards are widely used to protect digital television streams. The Malaysian government uses smart card technology in identity cards carried by all Malaysian citizens and resident non-citizens.

Debit cards, Smart cards, and Prepaid cards: More about Smart Cards Smart Card Technology : Smart cards are secure, compact and intelligent data carriers. Though they lack screens and keyboards, smart cards should be regarded as specialized computers capable of processing, storing and safeguarding thousands of bytes of data. Smart cards operate with special read/write devices, some of which may be attached to computers and point-of-sale (POS) terminals using standard cables and interfaces.

Debit cards, Smart cards, and Prepaid cards: More about Smart Cards Why use Smart Cards : Migrating to smart cards will impact toll agency operations in at least four ways: 1. It will separate payment from management functions. 2. Toll agencies will benefit from technological innovations and cost savings arising from marketplace competition among smart card and POS terminal vendors. 3. It will push the vendor community toward standardized ETC based on smart cards. 4. It will reduce or eliminate theft and fraud. The most common smart card applications are: Credit cards Electronic cash Computer security systems Wireless communication Loyalty systems (like frequent flyer points) Banking Satellite TV Government identification Smart cards can be used with a smart-card reader attachment to a personal computer to authenticate a user. Web browsers also can use smart card technology to supplement Secure Sockets Layer (SSL) for improved security of Internet transactions.

Debit cards, Smart cards, and Prepaid cards: More about Smart Cards Problems with Smart Cards : The plastic card in which the chip is fixed is fairly flexible and the larger chip has higher probability of breaking. Smart cards are often carried in wallets or pockets which is a fairly harsh environment for a chip. In addition to technical hurdles is the lack of standards for smart card functionality and security. To address this problem, the ERIDANE Project was launched by The Berlin Group to develop a proposal for “a new functional and security framework for smart-card based Point of Interaction (POI) equipment”, equipment that would be used, for instance, in retail environments.

Barclaycard Contactless Smartcard

Barclaycard Contactless Smartcard

Barclaycard Contactless Smartcard

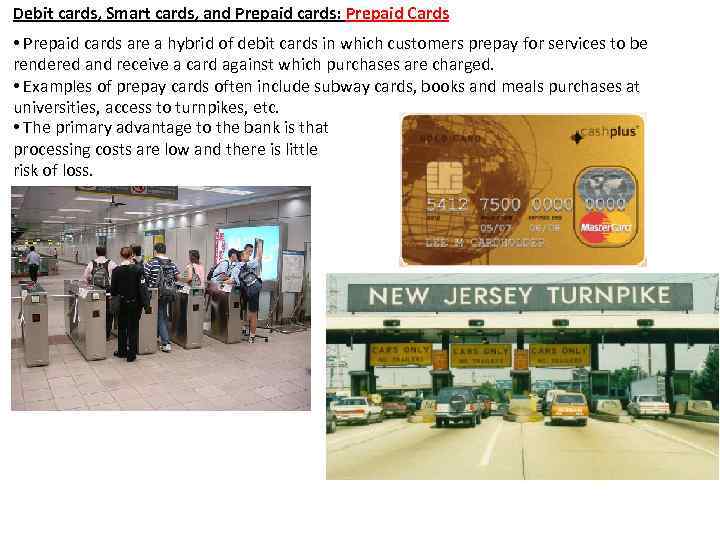

Debit cards, Smart cards, and Prepaid cards: Prepaid Cards • Prepaid cards are a hybrid of debit cards in which customers prepay for services to be rendered and receive a card against which purchases are charged. • Examples of prepay cards often include subway cards, books and meals purchases at universities, access to turnpikes, etc. • The primary advantage to the bank is that processing costs are low and there is little risk of loss.

Noninstallment Loans • Is a loan that requires a single principal and interest payment. Ex: Bridge loans - These loans often arise when an individual borrows funds for the down payment on a new house. - The loan is repaid when a borrower sells an existing home. Another example of noninstallment loan: Discount loan is a loan on which the interest and financing charges are deducted from the face amount when the loan is undertaken. The borrower only receives the principal after the financing charges and interest are taken out but must repay the full amount of the loan. For example: If you take a loan for the amount of 50, 000. If the interest and financing charges were 10, 000, you would receive 40, 000 from the lender, but still have to pay back the whole 50, 000. This is primarily used for short term loans.

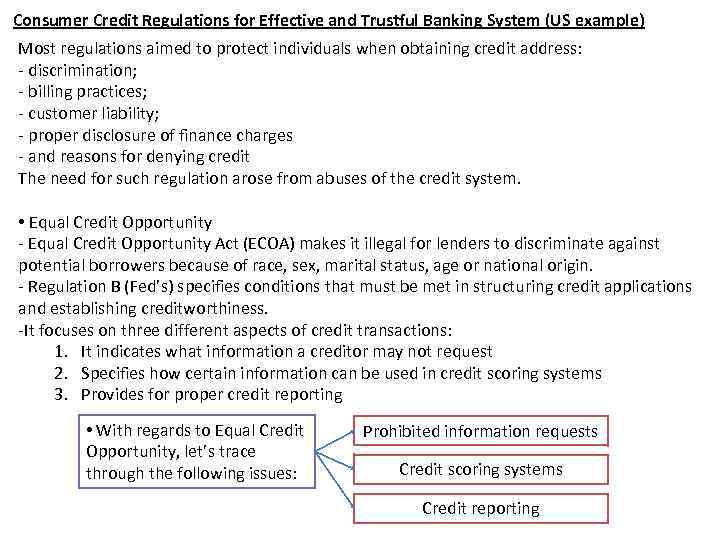

Consumer Credit Regulations for Effective and Trustful Banking System (US example) Most regulations aimed to protect individuals when obtaining credit address: - discrimination; - billing practices; - customer liability; - proper disclosure of finance charges - and reasons for denying credit The need for such regulation arose from abuses of the credit system. • Equal Credit Opportunity - Equal Credit Opportunity Act (ECOA) makes it illegal for lenders to discriminate against potential borrowers because of race, sex, marital status, age or national origin. - Regulation B (Fed’s) specifies conditions that must be met in structuring credit applications and establishing creditworthiness. -It focuses on three different aspects of credit transactions: 1. It indicates what information a creditor may not request 2. Specifies how certain information can be used in credit scoring systems 3. Provides for proper credit reporting • With regards to Equal Credit Opportunity, let’s trace through the following issues: Prohibited information requests Credit scoring systems Credit reporting

Consumer Credit Regulations for Effective and Trustfull Banking System (US example) Prohibited Information Requests 1. Lenders may not request information about the applicant’s marital status unless credit is being requested jointly, the spouses assets will be used to repay the loan, or the applicant lives in the community property state. 2. Lenders may not request information about whether alimony, child support, and public assistance payments are included in an applicant’s reported income. Applicants can voluntarily provide this information if they believe it will improve perceived creditworthiness. 3. Lenders may not request information about a woman’s childbearing capability and plans, or birth control practices. 4. Lenders may not request information about whether an applicant has a telephone. Credit Scoring Systems 1. Credit scoring systems are acceptable if they do not require prohibited information and are statistically justified. The statistical soundness should be systematically reviewed and updated. 2. Credit scoring systems can use information about age, sex, and marital status as long as these factors contribute positively to the applicants creditworthiness. Credit Reporting 1. Lenders must report credit extended jointly to married couples in both spouses’ names. This enables both individuals to build a credit history. 2. Whenever lenders reject a loan, they must notify applicants of the credit denial within 30 days and indicate why the request was turned down. An applicant may request a written notification, and the lender must comply. In practice, the ECOA includes many complex provisions that are difficult to comprehend. To make compliance easier, the Federal Reserve provides model loan application forms that conform to Regulation B.

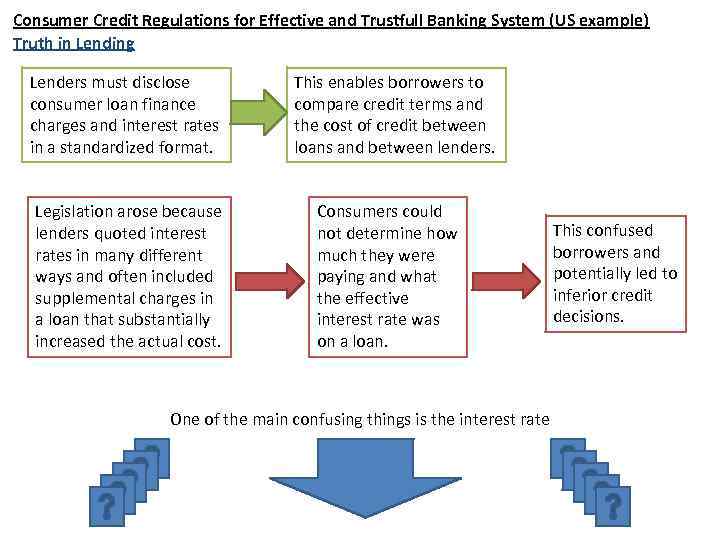

Consumer Credit Regulations for Effective and Trustfull Banking System (US example) Truth in Lending Lenders must disclose consumer loan finance charges and interest rates in a standardized format. Legislation arose because lenders quoted interest rates in many different ways and often included supplemental charges in a loan that substantially increased the actual cost. This enables borrowers to compare credit terms and the cost of credit between loans and between lenders. Consumers could not determine how much they were paying and what the effective interest rate was on a loan. One of the main confusing things is the interest rate This confused borrowers and potentially led to inferior credit decisions.

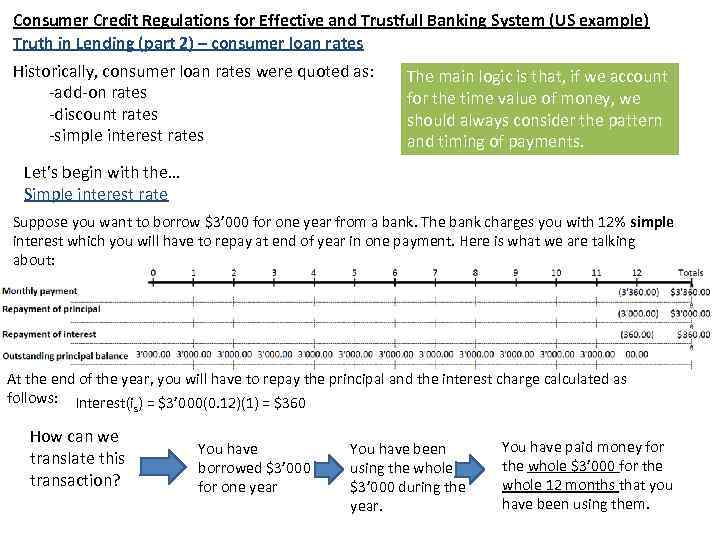

Consumer Credit Regulations for Effective and Trustfull Banking System (US example) Truth in Lending (part 2) – consumer loan rates Historically, consumer loan rates were quoted as: -add-on rates -discount rates -simple interest rates The main logic is that, if we account for the time value of money, we should always consider the pattern and timing of payments. Let’s begin with the… Simple interest rate Suppose you want to borrow $3’ 000 for one year from a bank. The bank charges you with 12% simple interest which you will have to repay at end of year in one payment. Here is what we are talking about: At the end of the year, you will have to repay the principal and the interest charge calculated as follows: Interest(i ) = $3’ 000(0. 12)(1) = $360 s How can we translate this transaction? You have borrowed $3’ 000 for one year You have been using the whole $3’ 000 during the year. You have paid money for the whole $3’ 000 for the whole 12 months that you have been using them.

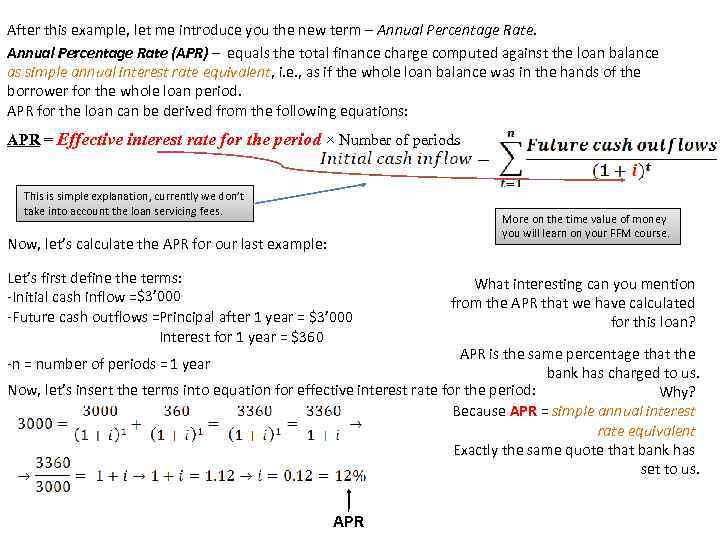

After this example, let me introduce you the new term – Annual Percentage Rate (APR) – equals the total finance charge computed against the loan balance as simple annual interest rate equivalent, i. e. , as if the whole loan balance was in the hands of the borrower for the whole loan period. APR for the loan can be derived from the following equations: APR = Effective interest rate for the period × Number of periods This is simple explanation, currently we don’t take into account the loan servicing fees. More on the time value of money you will learn on your FFM course. Now, let’s calculate the APR for our last example: Let’s first define the terms: -Initial cash inflow =$3’ 000 -Future cash outflows =Principal after 1 year = $3’ 000 Interest for 1 year = $360 What interesting can you mention from the APR that we have calculated for this loan? APR is the same percentage that the bank has charged to us. Now, let’s insert the terms into equation for effective interest rate for the period: Why? Because APR = simple annual interest rate equivalent Exactly the same quote that bank has set to us. -n = number of periods = 1 year APR

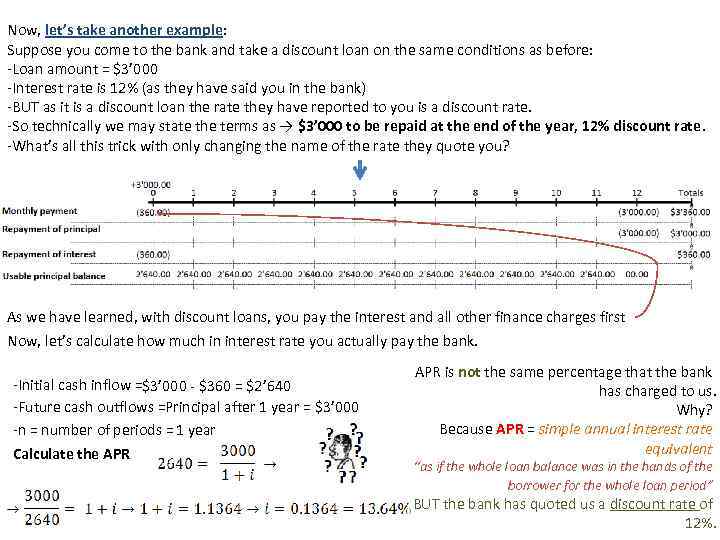

Now, let’s take another example: Suppose you come to the bank and take a discount loan on the same conditions as before: -Loan amount = $3’ 000 -Interest rate is 12% (as they have said you in the bank) -BUT as it is a discount loan the rate they have reported to you is a discount rate. -So technically we may state the terms as → $3’ 000 to be repaid at the end of the year, 12% discount rate. -What’s all this trick with only changing the name of the rate they quote you? As we have learned, with discount loans, you pay the interest and all other finance charges first Now, let’s calculate how much in interest rate you actually pay the bank. -Initial cash inflow =$3’ 000 - $360 = $2’ 640 -Future cash outflows =Principal after 1 year = $3’ 000 -n = number of periods = 1 year Calculate the APR is not the same percentage that the bank has charged to us. Why? Because APR = simple annual interest rate equivalent “as if the whole loan balance was in the hands of the borrower for the whole loan period” BUT the bank has quoted us a discount rate of 12%.

Discount Rate of 12% for this loan Simple annual interest rate (or APR) of 13. 64% is equivalent to The cornerstone of this problem is in the amount of owed cash that you possess during the period! $2’ 640 Simple issue that you don’t possess the whole loan amount of $3’ 000 from the beginning Makes the actual interest cost of borrowing greater than it would with simple annual interest rate Until now we were looking at examples with stable Usable Principal Balance during the period. What if this amount is not stable but gradually decreasing…

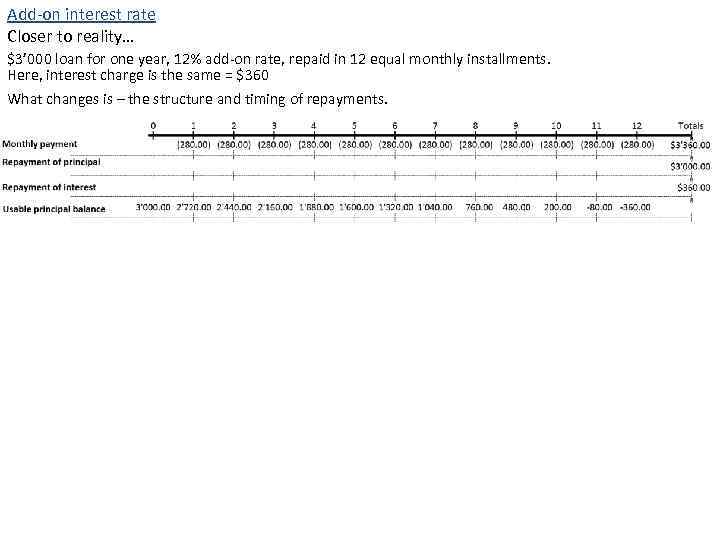

Add-on interest rate Closer to reality… $3’ 000 loan for one year, 12% add-on rate, repaid in 12 equal monthly installments. Here, interest charge is the same = $360 What changes is – the structure and timing of repayments.

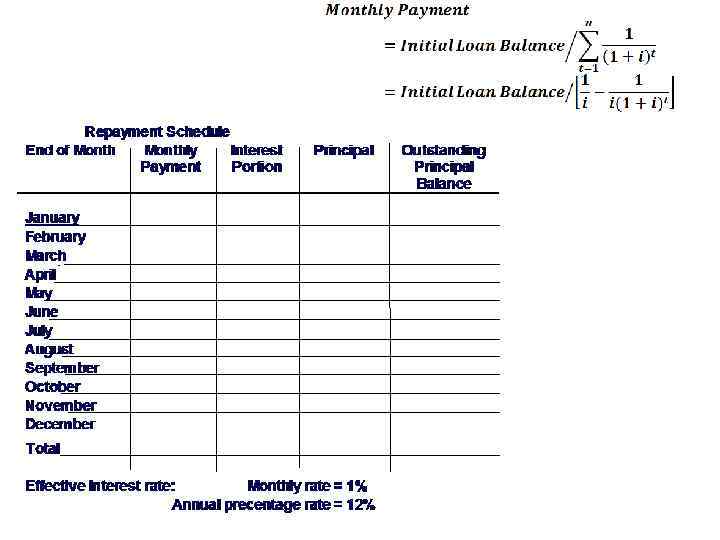

• Simple Interest – The quoted rate (APR) is adjusted to its monthly equivalent, which is applied against the unpaid principal balance on a loan – The loan is repaid in 12 monthly installments and the monthly interest rate equals 1 percent of the outstanding principal balance at each month

HW: The Add-on rate hoax Need to: write a reflection paper on the article

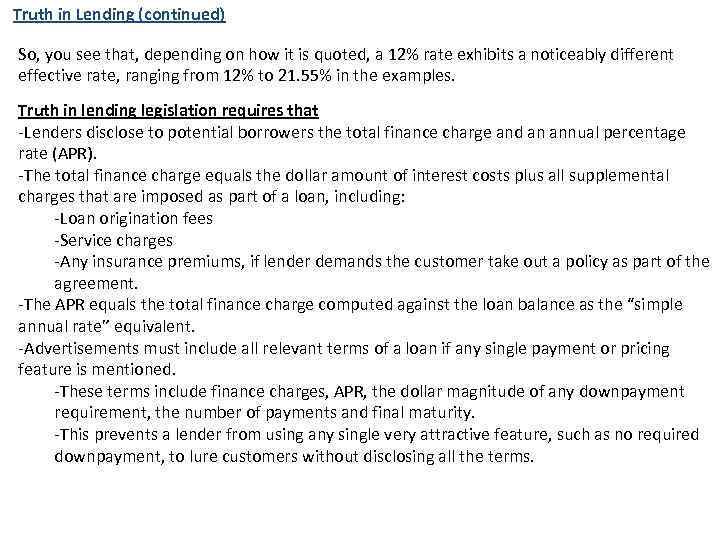

Truth in Lending (continued) So, you see that, depending on how it is quoted, a 12% rate exhibits a noticeably different effective rate, ranging from 12% to 21. 55% in the examples. Truth in lending legislation requires that -Lenders disclose to potential borrowers the total finance charge and an annual percentage rate (APR). -The total finance charge equals the dollar amount of interest costs plus all supplemental charges that are imposed as part of a loan, including: -Loan origination fees -Service charges -Any insurance premiums, if lender demands the customer take out a policy as part of the agreement. -The APR equals the total finance charge computed against the loan balance as the “simple annual rate” equivalent. -Advertisements must include all relevant terms of a loan if any single payment or pricing feature is mentioned. -These terms include finance charges, APR, the dollar magnitude of any downpayment requirement, the number of payments and final maturity. -This prevents a lender from using any single very attractive feature, such as no required downpayment, to lure customers without disclosing all the terms.

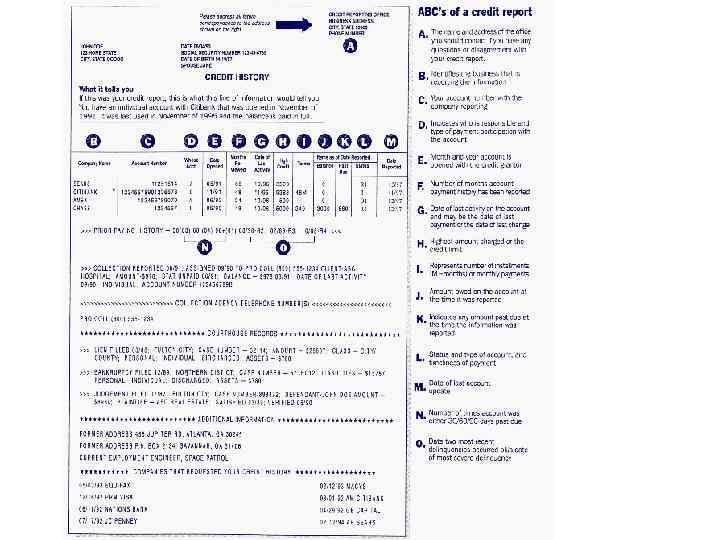

Fair Credit Reporting -The Fair Credit Reporting Act enables individuals to examine their credit reports provided by credit bureaus. -If any information is incorrect, the individual can have the bureau make changes and notify all lenders who obtained the inaccurate data. -If the accuracy of the information is disputed, an individual can permanently enter into the credit file his or her interpretation of the error. -The credit bureau, when requested must also notify an individual which lenders have received credit reports. -There are primarily three credit reporting agencies in U. S. : Equifax, Experion, and Trans Union. -There are some problems, however, with these agencies: -They make little effort to verify the information they receive from retailers, banks, and finance companies. -They don’t rush to correct their records when errors are found

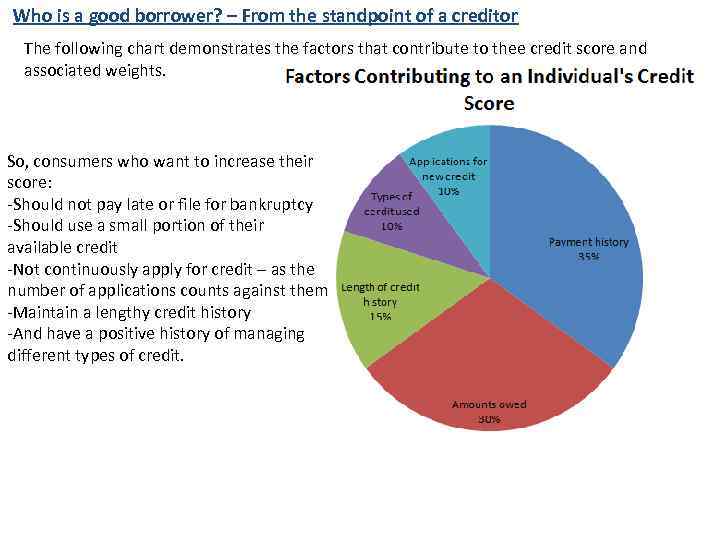

Who is a good borrower? – From the standpoint of a creditor The following chart demonstrates the factors that contribute to thee credit score and associated weights. So, consumers who want to increase their score: -Should not pay late or file for bankruptcy -Should use a small portion of their available credit -Not continuously apply for credit – as the number of applications counts against them -Maintain a lengthy credit history -And have a positive history of managing different types of credit.

HW: http: //www. myfico. com/products/ficoone/sample/ficoscore/sample_summary. aspx? What is needed: Study thoroughly all 9 steps in understanding the FICO score. This information will be asked from you on first quiz.

• Bankruptcy Reform – Individuals who cannot repay their debts on time can file for bankruptcy and receive court protection against creditors – Individuals can file for bankruptcy under: • Chapter 7 – Individuals liquidate qualified assets and distribute the proceeds to creditors • Chapter 13 – An individual works out a repayment plan with court supervision. – Unfortunately, individuals appear to be using bankruptcy as a financial planning tool – It appears the stigma of bankruptcy is largely gone

Credit Analysis • Objective of consumer credit analysis is to assess the risks associated with lending to individuals – When evaluating loans, bankers cite the Cs of credit: • Character – The most important element, but difficult to assess • Capital – Refers to the individual's wealth position • Capacity – The lender often imposes maximum allowable debt-service to income ratios • Conditions – The impact of economic events on the borrower's capacity to pay • Collateral – The importance of collateral is in providing a secondary source of repayment

Credit Analysis • Two additional Cs – Customer Relationship • A bank’s prior relationship with a customer reveals information about past credit and deposit experience that is useful in assessing willingness and ability to repay. – Competition • Has an impact by affecting the pricing of a loan. • All loans should generate positive risk-adjusted returns • Lenders periodically react to competitive pressures by undercutting competitors’ rates in order to attract new business • Competition should not affect the accept/reject decision

Credit Analysis • Policy Guidelines – Acceptable Loans • • • Automobile Boat Home Improvement Personal-Unsecured Single Payment Cosigned

Credit Analysis • Policy Guidelines – Unacceptable Loans • Loans for speculative purposes • Loans secured by a second lien – Other than home improvement or home equity loans • Any participation with a correspondent bank in a loan that the bank would not normally approve • Loans to a poor credit risk based on the strength of the cosigner • Single payment automobile or boat loans • Loans secured by existing home furnishings • Loans for skydiving equipment and hang gliders

Credit Analysis • Evaluation Procedures: – Judgmental and – Quantitative, Credit Scoring

Credit Analysis • Judgmental – The loan officer subjectively interprets the information in light of the bank’s lending guidelines and accepts or rejects the loan

Credit Analysis • Quantitative credit scoring / Credit scoring model – The loan officer grades the loan request according to a statistically sound model that assigns points to selected characteristics of the prospective borrower • In both cases, judgmental and quantitative, a lending officer collects information regarding the borrower’s character, capacity, and collateral

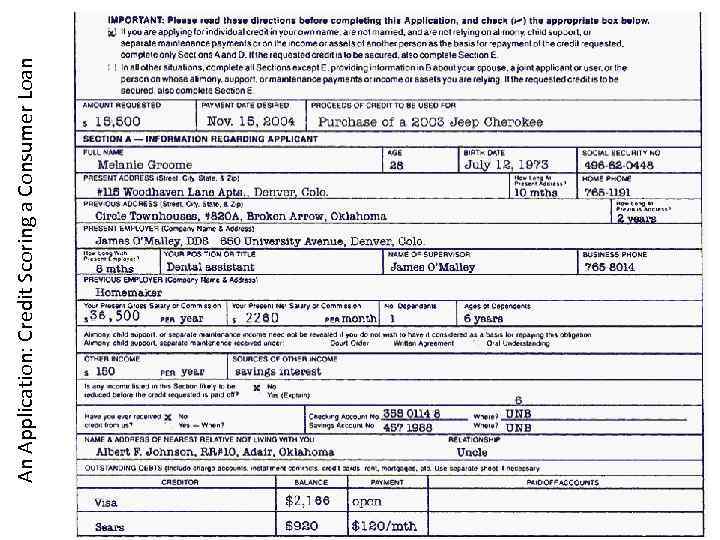

Credit Analysis An Application: Credit Scoring a Consumer Loan • You receive an application for a customer to purchase a 2003 Jeep Cherokee – Do you make the loan?

An Application: Credit Scoring a Consumer Loan

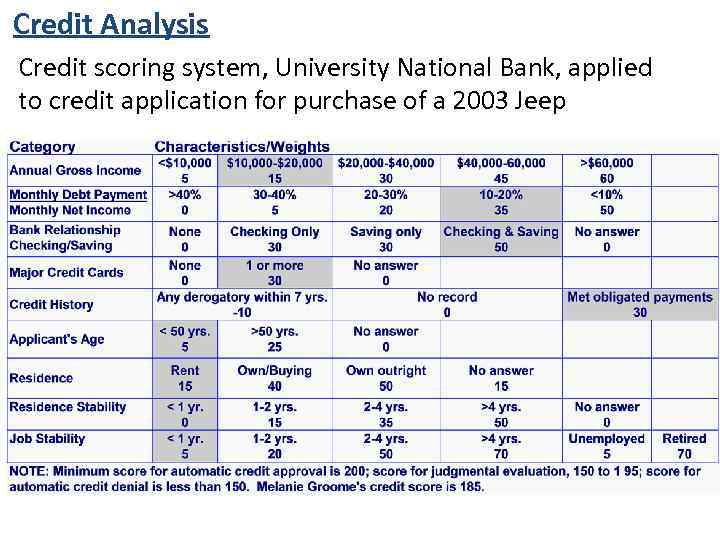

Credit Analysis Credit scoring system, University National Bank, applied to credit application for purchase of a 2003 Jeep

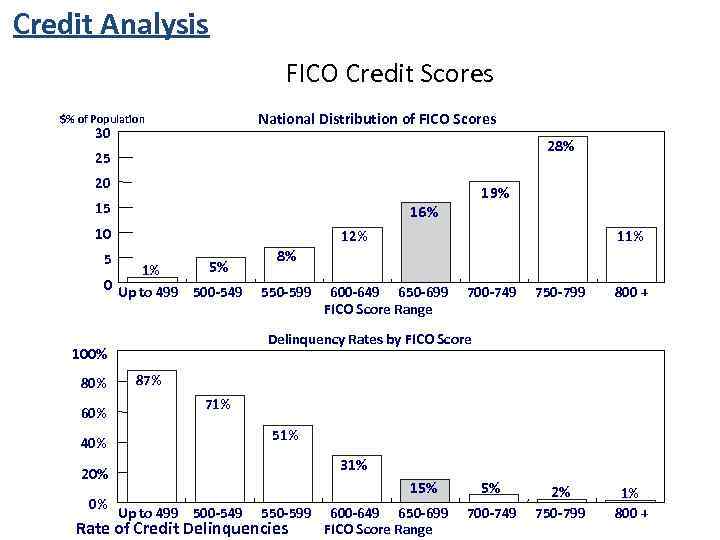

Credit Analysis FICO Credit Scores National Distribution of FICO Scores $% of Population 30 28% 25 20 19% 15 16% 10 12% 5 5% 1% 0 Up to 499 500 -549 60% 8% 550 -599 700 -749 750 -799 800 + 5% 2% 700 -749 750 -799 1% 800 + 87% 71% 51% 40% 31% 20% 0% 600 -649 650 -699 FICO Score Range Delinquency Rates by FICO Score 100% 80% 11% 15% Up to 499 500 -549 550 -599 Rate of Credit Delinquencies 600 -649 650 -699 FICO Score Range

An Application: Indirect Lending • A retailer sells merchandise and takes the credit application – Because many firms do not have the resources to carry their receivables, they sell the loans to banks or other financial institutions • These loans are collectively referred to as dealer paper – Banks aggressively compete for paper originated by well-established automobile, mobile home, and furniture dealers

An Application: Indirect Lending • Indirect lending is an attractive form of consumer lending when a bank deals with reputable retailers • Dealers negotiate finance charges directly with their customers – A bank, in turn, agrees to purchase the paper at predetermined rates that vary with the default risk assumed by the bank, the quality of the assets sold, and the maturity of the consumer loan – A dealer normally negotiates a higher rate with the car buyer than the determined rate charged by the bank – This differential varies with competitive conditions but potentially represents a significant source of dealer profit

An Application: Indirect Lending • Most indirect loan arrangements provide for dealer reserves that reduce the risk in indirect lending – The reserves are derived from the differential between the normal, or contract loan rate and the bank rate, and help protect the bank against customer defaults and refunds

Chapter 12, Evaluating Consumer Credit.pptx