d562d65ad47f8b0db7606cf68c1c4fc9.ppt

- Количество слайдов: 18

EV Energy Partners, L. P. The Public/Private Two-Step Ener. Vest Management Partners/EVEP John B. Walker, Chairman & CEO January 18, 2007

Risks and Forward-Looking Statements Some of the information in this presentation is considered to be a forward-looking statement within the meaning of federal securities laws. All statements other than statements of historical fact, that address future events or the future financial performance of EV Energy Partners, L. P. , including the drilling of wells, reserve estimates, future oil and gas prices, future production of oil and gas, future cash flows, the company's financial position, business strategy, plans and objectives of management are forward looking statements. We wish to caution you that these statements are only expressions of EV Energy Partners, L. P. 's expectations at the time such statements were initially made and that actual events or results may differ materially from those expectations. We refer you to the documents that EV Energy Partners, L. P. files from time to time with the Securities and Exchange Commission. These documents contain and identify important factors that could cause the actual results to differ materially from those contained in EV Energy Partners, L. P. 's projections or forward-looking statements. EV Energy Partners, L. P. undertakes no obligation to update any forward-looking statements, whether as a result of new or future events. -2 -

Company Overview n Consistently Generate Superior Returns Across Cycles ▼ 9 Fully Invested Funds with a Projected 32% IRR After Management Fees, Carried Interests and Hedge Payments n Experienced Management Team n Acquired $900 Million of Oil and Gas Reserves in 2005, $251 Million in 2006; Divested $300 Million in 2005 n $1 Billion Fund XI with First Close 12 -8 -06, Final Closing 1 Q 07 n 370 Employees -3 -

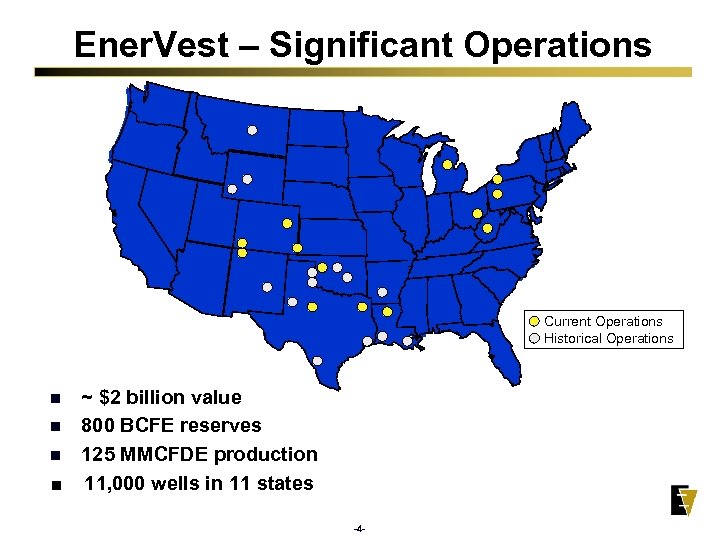

Ener. Vest – Significant Operations Current Operations Historical Operations ~ $2 billion value n 800 BCFE reserves n 125 MMCFDE production ■ 11, 000 wells in 11 states n -4 -

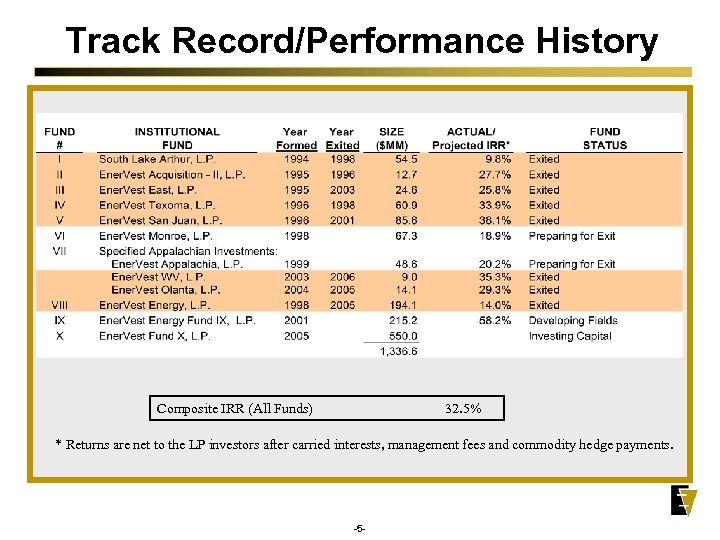

Track Record/Performance History Composite IRR (All Funds) 32. 5% * Returns are net to the LP investors after carried interests, management fees and commodity hedge payments. -5 -

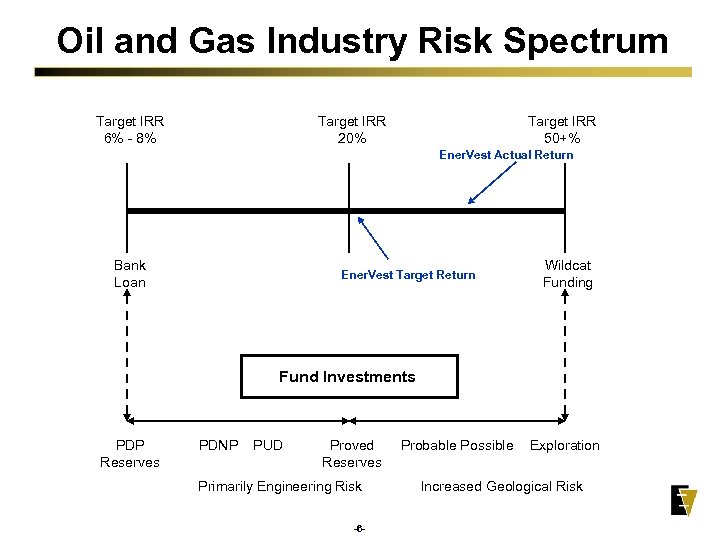

Oil and Gas Industry Risk Spectrum Target IRR 6% - 8% Target IRR 20% Target IRR 50+% Ener. Vest Actual Return Bank Loan Ener. Vest Target Return Wildcat Funding Fund Investments PDP Reserves PDNP PUD Proved Reserves Probable Possible Exploration Primarily Engineering Risk Increased Geological Risk -6 -

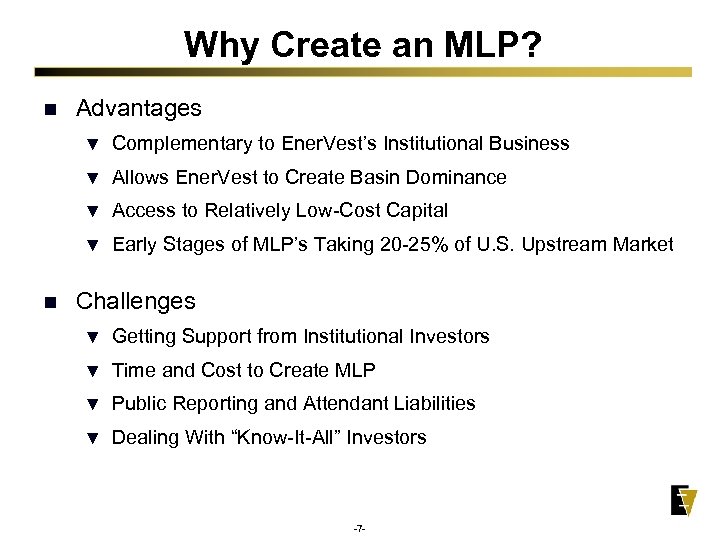

Why Create an MLP? n Advantages ▼ ▼ Allows Ener. Vest to Create Basin Dominance ▼ Access to Relatively Low-Cost Capital ▼ n Complementary to Ener. Vest’s Institutional Business Early Stages of MLP’s Taking 20 -25% of U. S. Upstream Market Challenges ▼ Getting Support from Institutional Investors ▼ Time and Cost to Create MLP ▼ Public Reporting and Attendant Liabilities ▼ Dealing With “Know-It-All” Investors -7 -

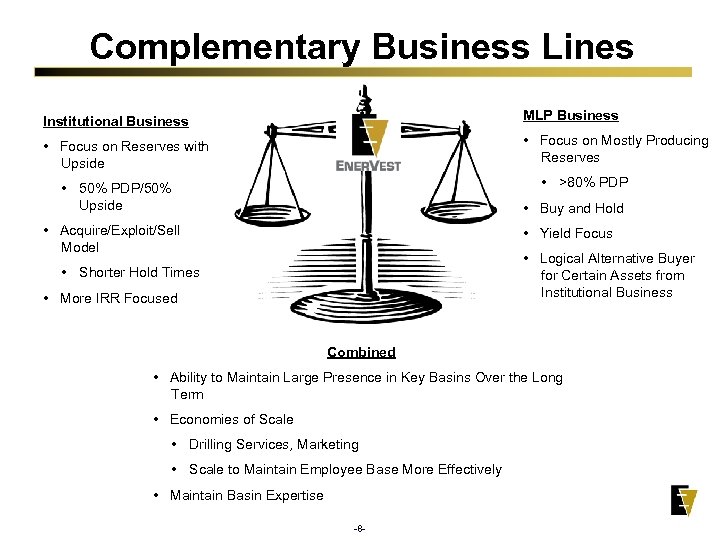

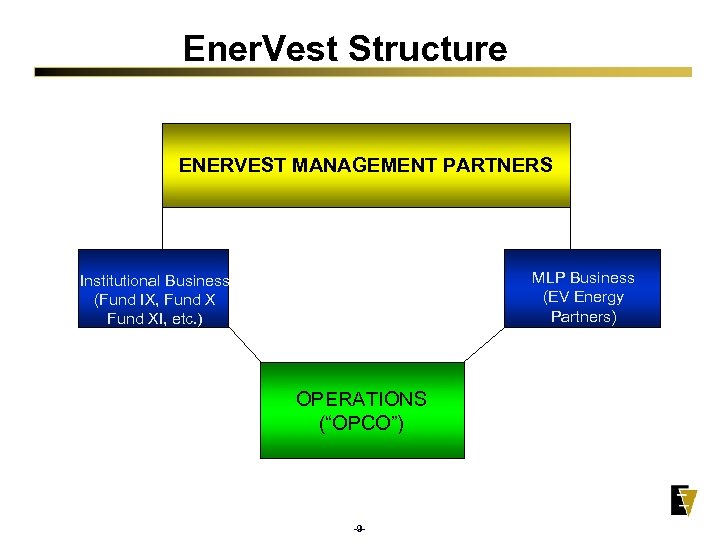

Complementary Business Lines Institutional Business MLP Business • Focus on Reserves with Upside • Focus on Mostly Producing Reserves • >80% PDP • 50% PDP/50% Upside • Buy and Hold • Acquire/Exploit/Sell Model • Yield Focus • Logical Alternative Buyer for Certain Assets from Institutional Business • Shorter Hold Times • More IRR Focused Combined • Ability to Maintain Large Presence in Key Basins Over the Long Term • Economies of Scale • Drilling Services, Marketing • Scale to Maintain Employee Base More Effectively • Maintain Basin Expertise -8 -

Ener. Vest Structure ENERVEST MANAGEMENT PARTNERS MLP Business (EV Energy Partners) Institutional Business (Fund IX, Fund XI, etc. ) OPERATIONS (“OPCO”) -9 -

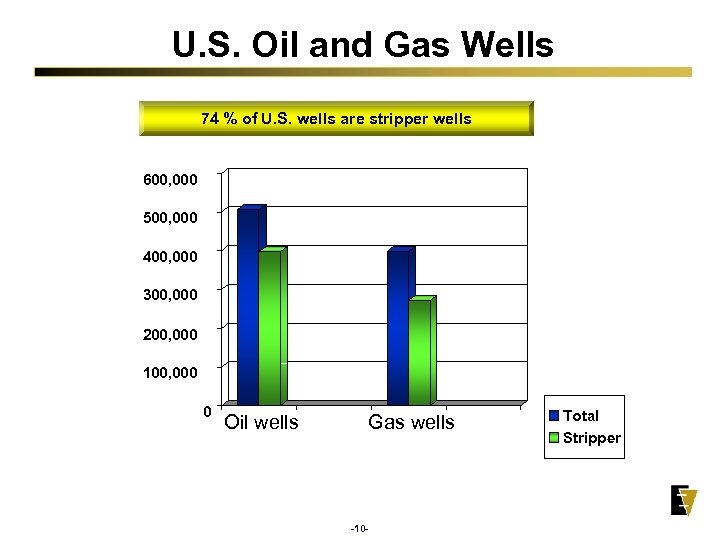

U. S. Oil and Gas Wells 74 % of U. S. wells are stripper wells 600, 000 500, 000 400, 000 300, 000 200, 000 100, 000 0 Oil wells Gas wells -10 - Total Stripper

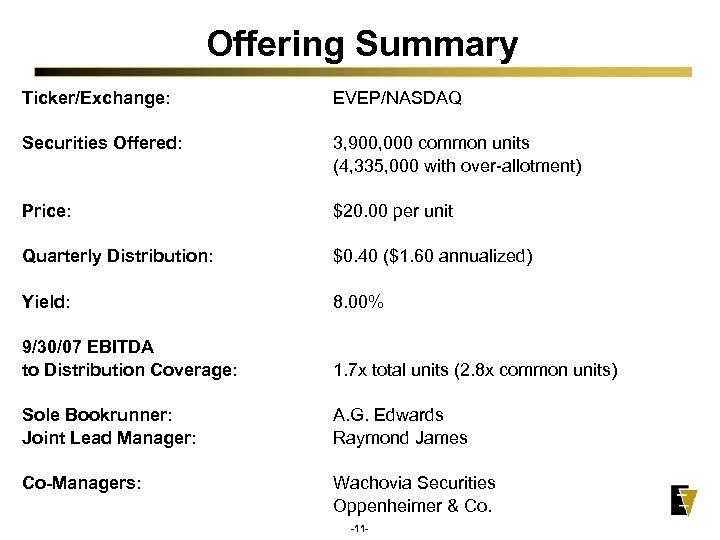

Offering Summary Ticker/Exchange: EVEP/NASDAQ Securities Offered: 3, 900, 000 common units (4, 335, 000 with over-allotment) Price: $20. 00 per unit Quarterly Distribution: $0. 40 ($1. 60 annualized) Yield: 8. 00% 9/30/07 EBITDA to Distribution Coverage: 1. 7 x total units (2. 8 x common units) Sole Bookrunner: Joint Lead Manager: A. G. Edwards Raymond James Co-Managers: Wachovia Securities Oppenheimer & Co. -11 -

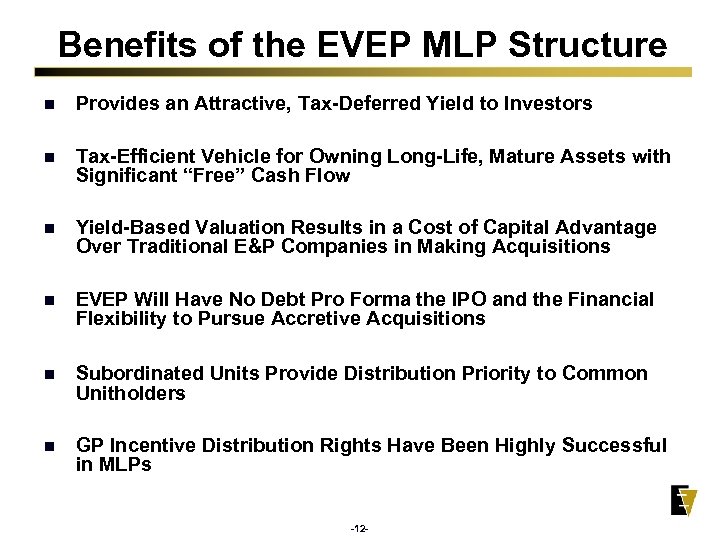

Benefits of the EVEP MLP Structure n Provides an Attractive, Tax-Deferred Yield to Investors n Tax-Efficient Vehicle for Owning Long-Life, Mature Assets with Significant “Free” Cash Flow n Yield-Based Valuation Results in a Cost of Capital Advantage Over Traditional E&P Companies in Making Acquisitions n EVEP Will Have No Debt Pro Forma the IPO and the Financial Flexibility to Pursue Accretive Acquisitions n Subordinated Units Provide Distribution Priority to Common Unitholders n GP Incentive Distribution Rights Have Been Highly Successful in MLPs -12 -

Business Strategy Provide Stability and Growth in Cash Distributions Per Unit Over Time n Increase Reserves and Production Over Long Term Through Accretive Acquisitions n Maintain Low Debt Levels to Reduce Risk and Facilitate Acquisitions n Reduce Exposure to Commodity Price Risk Through Hedging n Keep Inventory of Proved Undeveloped Drilling Locations Sufficient to Maintain Production n Retain Operational Control n Focus on Controlling Costs -13 -

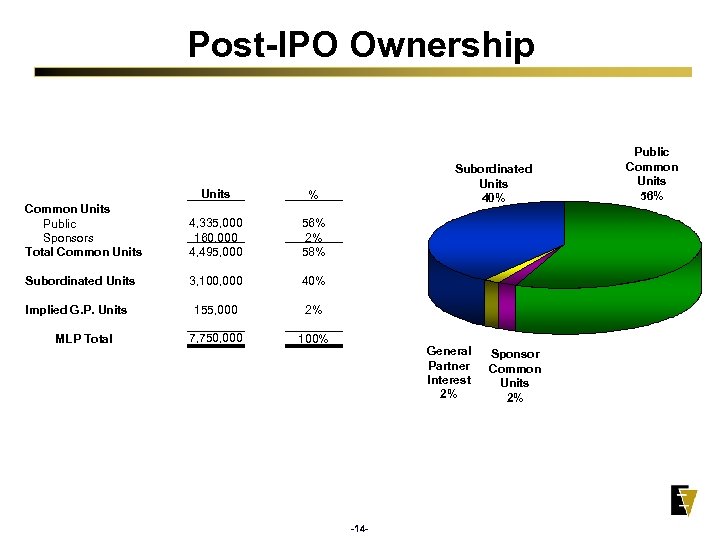

Post-IPO Ownership Common Units Public Sponsors Total Common Units 4, 335, 000 160, 000 4, 495, 000 56% 2% 58% Subordinated Units 3, 100, 000 40% 155, 000 2% 7, 750, 000 Subordinated Units 40% 100% Implied G. P. Units MLP Total % General Partner Interest 2% -14 - Sponsor Common Units 2% Public Common Units 56%

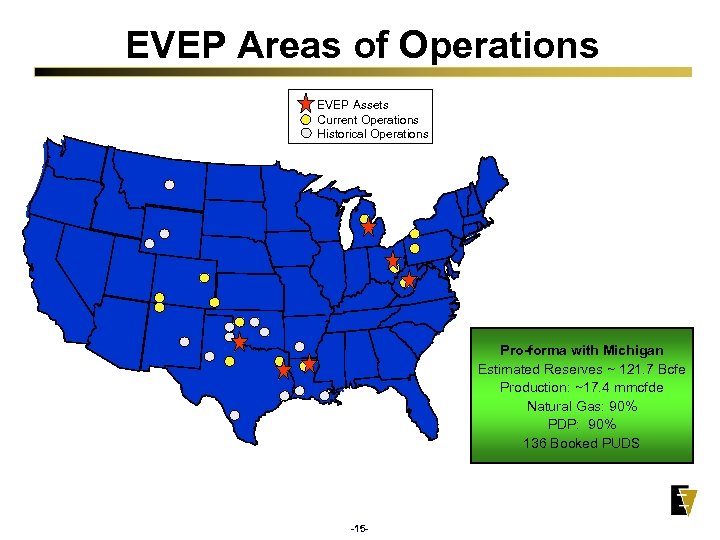

EVEP Areas of Operations EVEP Assets Current Operations Historical Operations Pro-forma with Michigan Estimated Reserves ~ 121. 7 Bcfe Production: ~17. 4 mmcfde Natural Gas: 90% PDP: 90% 136 Booked PUDS -15 -

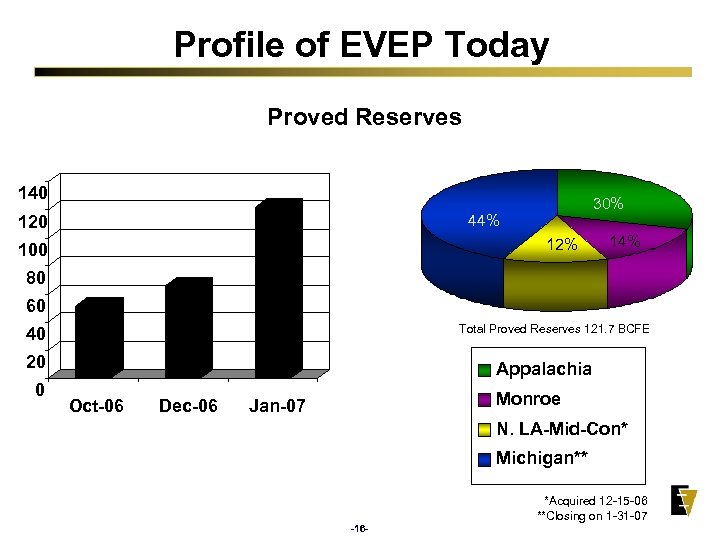

Profile of EVEP Today Proved Reserves 140 30% 44% 120 12% 100 14% 80 60 Total Proved Reserves 121. 7 BCFE 40 20 0 Appalachia Oct-06 Dec-06 Monroe Jan-07 N. LA-Mid-Con* Michigan** *Acquired 12 -15 -06 **Closing on 1 -31 -07 -16 -

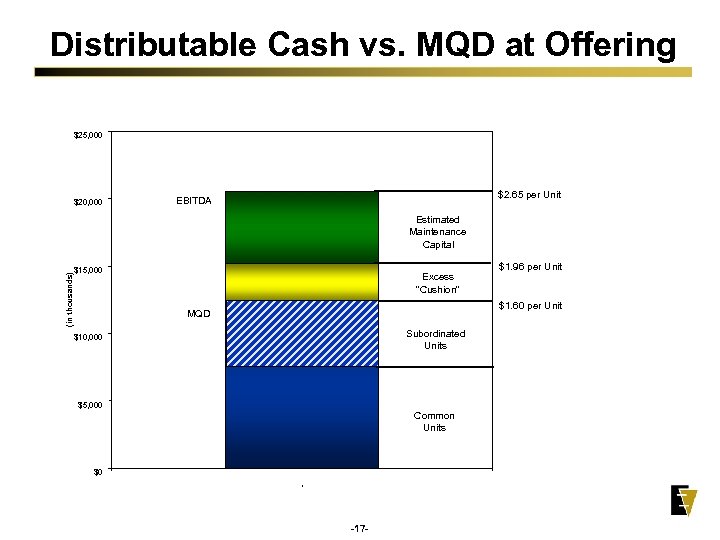

Distributable Cash vs. MQD at Offering $25, 000 $20, 000 $2. 65 per Unit EBITDA (in thousands) Estimated Maintenance Capital $15, 000 Excess "Cushion" $1. 96 per Unit $1. 60 per Unit MQD Subordinated Units $10, 000 $5, 000 Common Units $0 1 -17 -

EV Energy Partners, L. P. The Public/Private Two-Step Ener. Vest Management Partners/EVEP John B. Walker, Chairman & CEO January 18, 2007

d562d65ad47f8b0db7606cf68c1c4fc9.ppt