Eurozone debt crisis.pptx

- Количество слайдов: 8

Eurozone debt crisis 1

Contents 1. 2. 3. 4. 5. 6. 7. Introduction. The essence of the problem. Countries overview. Perspectives. Consequences if the EU will fall apart. Consequences if the EU will survive. Sources 2

Introduction I have chosen this topic because I wanted to prove myself, that I can make essay in English. The Eurozone is one of the biggest currency systems in the world. Nevertheless, scince 2010 the EU experiences several shocks and ongoing problems. Complex of this problems is called The Eurozone debt crisis undermined belief in European community, and showed that the model of the European Union is not that stable. The problem is important because: • The European Union influences on world economy in high extent (25% of world GDP). • It includes the most stable and developed countries. • It is the biggest political and economic unity of large number of neighboring countries in history. • This unity ensures free trade environment and barrier free labor market. All this applicable for all the union members. • There is tight cooperation within the EU both technological and scientific spheres. I’ve used internet sources because it contains the most updated information. The purpose of this essay is to tell people about the crisis in short, brief, explanatory form and break people’s misconceptions on this topic. 3

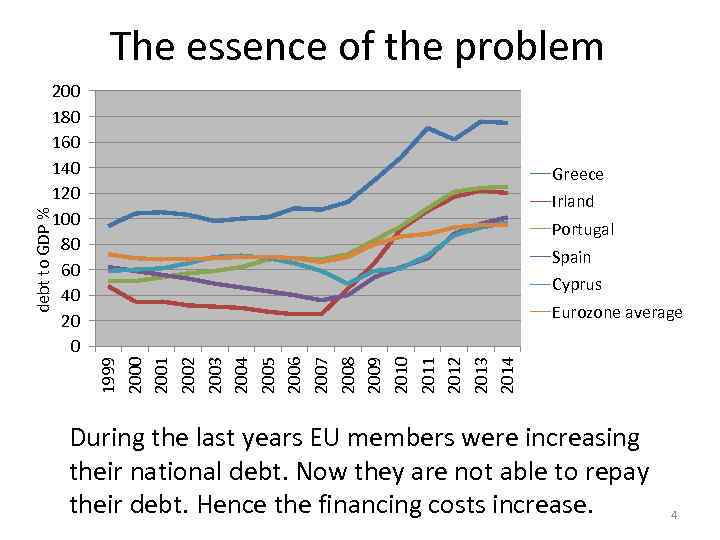

The essence of the problem 200 180 160 140 120 100 80 60 40 20 0 Greece debt to GDP % Irland Portugal Spain Cyprus 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Eurozone average During the last years EU members were increasing their national debt. Now they are not able to repay their debt. Hence the financing costs increase. 4

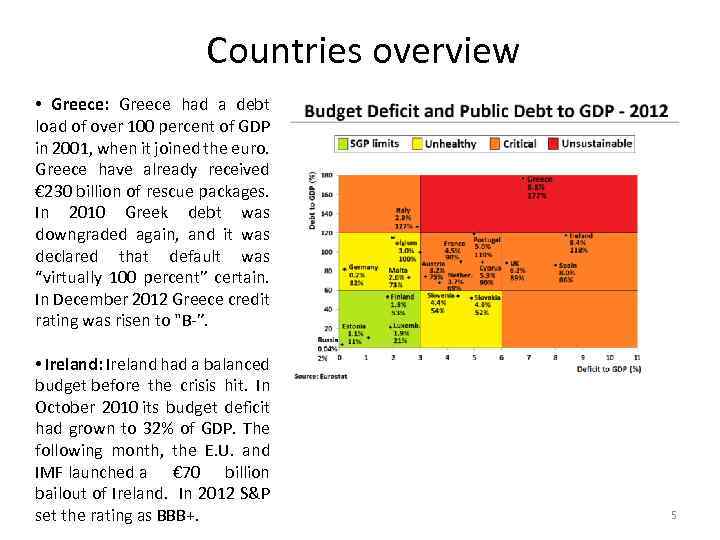

Countries overview • Greece: Greece had a debt load of over 100 percent of GDP in 2001, when it joined the euro. Greece have already received € 230 billion of rescue packages. In 2010 Greek debt was downgraded again, and it was declared that default was “virtually 100 percent” certain. In December 2012 Greece credit rating was risen to "B-”. • Ireland: Ireland had a balanced budget before the crisis hit. In October 2010 its budget deficit had grown to 32% of GDP. The following month, the E. U. and IMF launched a € 70 billion bailout of Ireland. In 2012 S&P set the rating as BBB+. 5

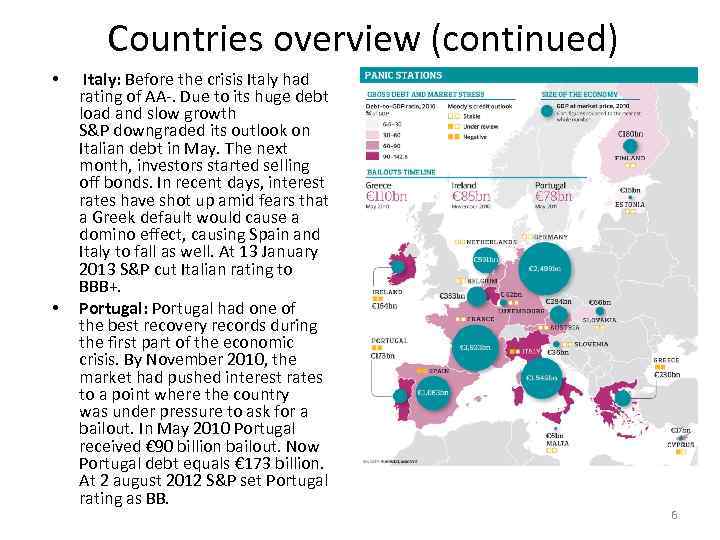

Countries overview (continued) • • Italy: Before the crisis Italy had rating of AA-. Due to its huge debt load and slow growth S&P downgraded its outlook on Italian debt in May. The next month, investors started selling off bonds. In recent days, interest rates have shot up amid fears that a Greek default would cause a domino effect, causing Spain and Italy to fall as well. At 13 January 2013 S&P cut Italian rating to BBB+. Portugal: Portugal had one of the best recovery records during the first part of the economic crisis. By November 2010, the market had pushed interest rates to a point where the country was under pressure to ask for a bailout. In May 2010 Portugal received € 90 billion bailout. Now Portugal debt equals € 173 billion. At 2 august 2012 S&P set Portugal rating as BB. 6

Perspectives • The Euro could survive Greece's Exit. The severe measures and structural reforms are pushing the Greek economy into deep recession. Leaving the eurozone will likely be considered. Currency devaluation could help its economy become more competitive in the long run. • Eurozone economies face weak outlook, possibly recession. Economic data indicate that eurozone growth is very weak right now. However, recession could happen if eurozone leaders continue their excessive focus on fiscal consolidation and fighting inflation. • Decisive actions could alleviate the crisis Although there are serious institutional and political constraints that limit what European policymakers can do. it is likely that the eurozone will continue to muddle through until events worsen enough to compel policymakers to make the difficult but necessary decisions. • Eurozone disintegration If strong economies will decide to separate, it is highly probable that the whole system will fall apart and the Euro currency will be killed. It will cause high level of inflation and structural problems in weak economies. Also, in some countries it can cause default and painful restructural process. 7

Sources • • • www. standardandpoors. com/ratings/articles/en/us/? article. Type=HTML&asset. ID=1245327296243 http: //www. washingtonpost. com/blogs/wonkblog/post/everything-you-need-to-know-about-theeuropean-debt-crisis-in-one-post/2011/08/05/g. IQAg 69 Qw. I_blog. html http: //individual. troweprice. com/public/Retail/Planning-&-Research/T. -Rowe-Price-Insights/Market. Analysis/T. -Rowe-Price-Perspectives-Eurozone-Debt-Crisis 8

Eurozone debt crisis.pptx