9e50c594c3e7c3bd1880b20331338017.ppt

- Количество слайдов: 17

European Pensions - Netherlands Summit Light at the end of the tunnel Tim Burggraaf Netherlands tim. burggraaf@mercer. com www. mercer. com

European Pensions - Netherlands Summit Light at the end of the tunnel Tim Burggraaf Netherlands tim. burggraaf@mercer. com www. mercer. com

Today’s agenda § 08. 30 – 09. 30 Registration and Coffee § 09. 30 - 10. 00 Chairman’s opening: Tim Burggraaf, Principal, Mercer § 10. 00 – 10. 30 Advocacy: the CFA Netherlands’ view in the financial crisis Rik Albrecht, Communications, Technology & Vice President, CFA Netherlands § 10. 30 – 11. 00 The recent market turbulence: what went wrong in the analysis of the interest rate sensitivity of the average Dutch pension fund? Geert-Jan Troost, Senior Consultant, Watson Wyatt § 11. 00 – 11. 30 Morning coffee § 11. 30 – 12. 00 The Importance of Emerging Markets to Global Growth Chris Taylor, Investment Director, Head of Research and Fund Manager, Neptune Asset Management § 12. 00 – 12. 30 Investing in Gold: The Strategic Case Rozanna Wozniak, Investment Research Manager, World Gold Council § 12. 30 – 13. 00 Fiduciary Management Philip Jan Looijen, Director Fiduciary Management, Mn Services § 13. 00 – 14. 00 Lunch § 14. 00 – 14. 30 SRI: Government Green Bonds Christopher Flensborg, Coordinator, Capital Markets, SEB § 14. 30 – 15. 00 Global Reits: Is it time to Invest? Simon Hedger, Managing Director - Portfolio Management Property Securities Principal Global Investors § 15. 00 – 15. 30 The positioning of Netherlands in the emerging European cross border pension market Jacqueline Lommen, Senior Principal, Hewitt § 15. 30 – 16. 00 Building pensions for the future - What the Dutch can learn from other countries Johan van Egmond, Regional Director for the Benelux, France and Spain, AEGON Global Pensions § 16. 00 Drinks reception Mercer 1

Today’s agenda § 08. 30 – 09. 30 Registration and Coffee § 09. 30 - 10. 00 Chairman’s opening: Tim Burggraaf, Principal, Mercer § 10. 00 – 10. 30 Advocacy: the CFA Netherlands’ view in the financial crisis Rik Albrecht, Communications, Technology & Vice President, CFA Netherlands § 10. 30 – 11. 00 The recent market turbulence: what went wrong in the analysis of the interest rate sensitivity of the average Dutch pension fund? Geert-Jan Troost, Senior Consultant, Watson Wyatt § 11. 00 – 11. 30 Morning coffee § 11. 30 – 12. 00 The Importance of Emerging Markets to Global Growth Chris Taylor, Investment Director, Head of Research and Fund Manager, Neptune Asset Management § 12. 00 – 12. 30 Investing in Gold: The Strategic Case Rozanna Wozniak, Investment Research Manager, World Gold Council § 12. 30 – 13. 00 Fiduciary Management Philip Jan Looijen, Director Fiduciary Management, Mn Services § 13. 00 – 14. 00 Lunch § 14. 00 – 14. 30 SRI: Government Green Bonds Christopher Flensborg, Coordinator, Capital Markets, SEB § 14. 30 – 15. 00 Global Reits: Is it time to Invest? Simon Hedger, Managing Director - Portfolio Management Property Securities Principal Global Investors § 15. 00 – 15. 30 The positioning of Netherlands in the emerging European cross border pension market Jacqueline Lommen, Senior Principal, Hewitt § 15. 30 – 16. 00 Building pensions for the future - What the Dutch can learn from other countries Johan van Egmond, Regional Director for the Benelux, France and Spain, AEGON Global Pensions § 16. 00 Drinks reception Mercer 1

Once upon a time (not so lang ago), there was… § Standalone country with a queen (guilder) § People solidary (VUT, final pay) § Widespread social provisions (ZW, WAO, AWW) § Almost 1, 000 pension funds § € 850 billion pension assets § Pension is invisible (is taken care of, right? ) § AEX at 700 points § Banks can be trusted without question § Every year in winter time, the Dutch go skating Mercer 2

Once upon a time (not so lang ago), there was… § Standalone country with a queen (guilder) § People solidary (VUT, final pay) § Widespread social provisions (ZW, WAO, AWW) § Almost 1, 000 pension funds § € 850 billion pension assets § Pension is invisible (is taken care of, right? ) § AEX at 700 points § Banks can be trusted without question § Every year in winter time, the Dutch go skating Mercer 2

Once upon a time (not so lang ago), there was… § Part of Europe (euro) § Solidarity is an issue (generations) § Personal social responsibility § 650 pension funds left § € 600 billion pension assets § Pension clearly visible (media) § AEX has seen 200 points § Banks suffered brand damage § Dutch swim rather than skate § Tennis arm turned into Wii arm Mercer 3

Once upon a time (not so lang ago), there was… § Part of Europe (euro) § Solidarity is an issue (generations) § Personal social responsibility § 650 pension funds left § € 600 billion pension assets § Pension clearly visible (media) § AEX has seen 200 points § Banks suffered brand damage § Dutch swim rather than skate § Tennis arm turned into Wii arm Mercer 3

Welcome in this new reality … “the age of uncertainty” § Everything is insecure § Volatility stock markets § Life expectancy keeps increasing § Solidarity decreases § Solvency rate causes tension § Solvency frameworks are tested (again) § Where are we in the economic climate? § How do we manage DC risks? § Is the Dutch model still tenable? Mercer 4

Welcome in this new reality … “the age of uncertainty” § Everything is insecure § Volatility stock markets § Life expectancy keeps increasing § Solidarity decreases § Solvency rate causes tension § Solvency frameworks are tested (again) § Where are we in the economic climate? § How do we manage DC risks? § Is the Dutch model still tenable? Mercer 4

. . the world has changed … Mercer 5

. . the world has changed … Mercer 5

… the world has changed … “The world of retirement has changed and we live in a defined-contribution world now. ” Karen Salinaro, IBM's VP of Benefits and Compensation Mercer 6

… the world has changed … “The world of retirement has changed and we live in a defined-contribution world now. ” Karen Salinaro, IBM's VP of Benefits and Compensation Mercer 6

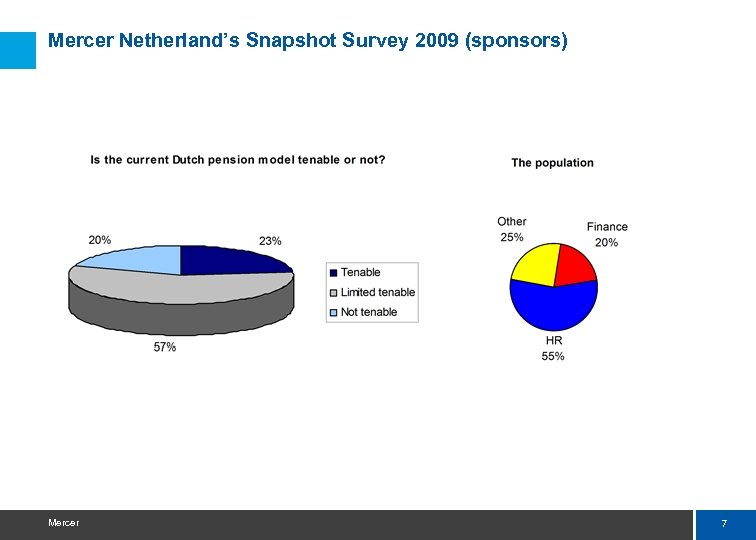

Mercer Netherland’s Snapshot Survey 2009 (sponsors) Mercer 7

Mercer Netherland’s Snapshot Survey 2009 (sponsors) Mercer 7

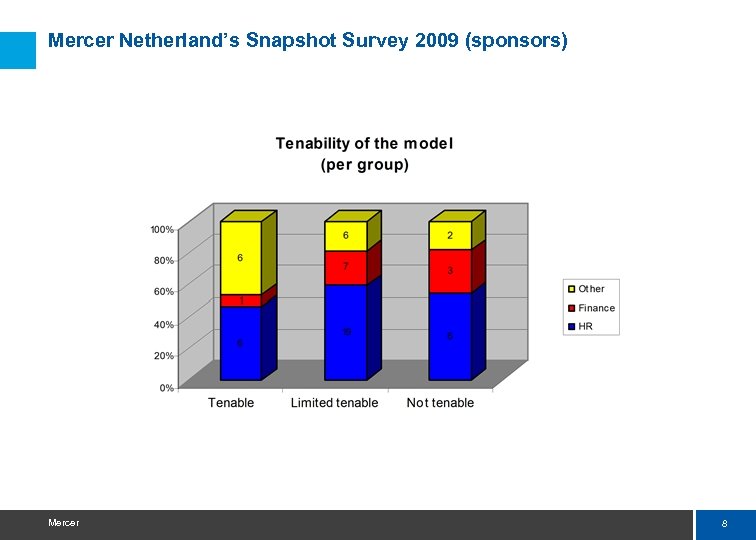

Mercer Netherland’s Snapshot Survey 2009 (sponsors) Mercer 8

Mercer Netherland’s Snapshot Survey 2009 (sponsors) Mercer 8

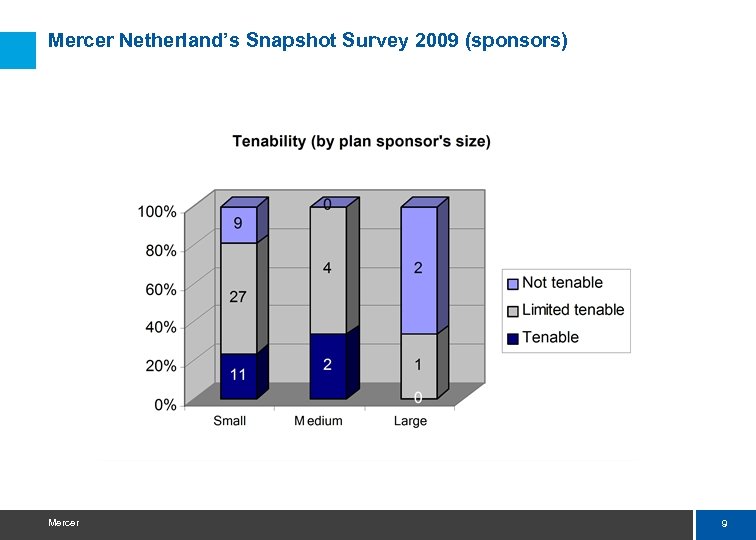

Mercer Netherland’s Snapshot Survey 2009 (sponsors) Mercer 9

Mercer Netherland’s Snapshot Survey 2009 (sponsors) Mercer 9

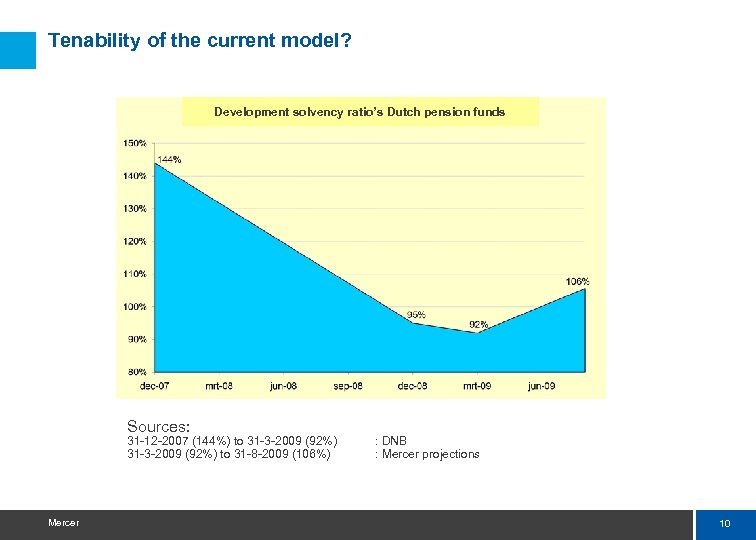

Tenability of the current model? Development solvency ratio’s Dutch pension funds Sources: 31 -12 -2007 (144%) to 31 -3 -2009 (92%) to 31 -8 -2009 (106%) Mercer : DNB : Mercer projections 10

Tenability of the current model? Development solvency ratio’s Dutch pension funds Sources: 31 -12 -2007 (144%) to 31 -3 -2009 (92%) to 31 -8 -2009 (106%) Mercer : DNB : Mercer projections 10

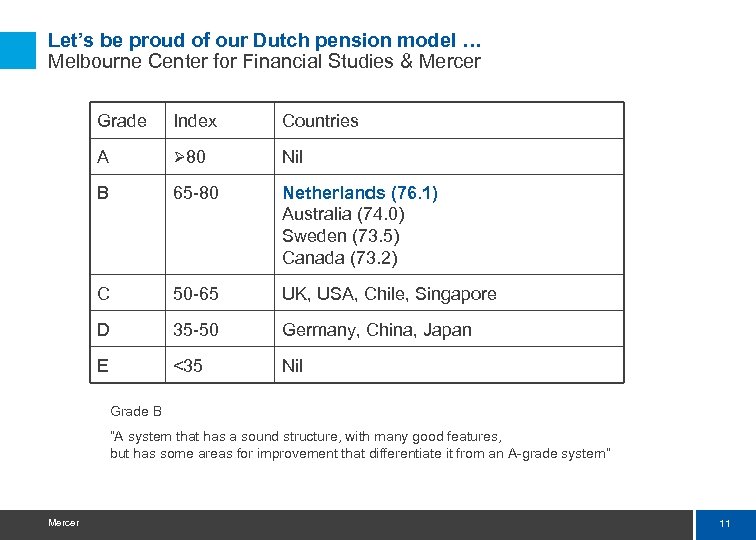

Let’s be proud of our Dutch pension model … Melbourne Center for Financial Studies & Mercer Grade Index Countries A Ø 80 Nil B 65 -80 Netherlands (76. 1) Australia (74. 0) Sweden (73. 5) Canada (73. 2) C 50 -65 UK, USA, Chile, Singapore D 35 -50 Germany, China, Japan E <35 Nil Grade B “A system that has a sound structure, with many good features, but has some areas for improvement that differentiate it from an A-grade system” Mercer 11

Let’s be proud of our Dutch pension model … Melbourne Center for Financial Studies & Mercer Grade Index Countries A Ø 80 Nil B 65 -80 Netherlands (76. 1) Australia (74. 0) Sweden (73. 5) Canada (73. 2) C 50 -65 UK, USA, Chile, Singapore D 35 -50 Germany, China, Japan E <35 Nil Grade B “A system that has a sound structure, with many good features, but has some areas for improvement that differentiate it from an A-grade system” Mercer 11

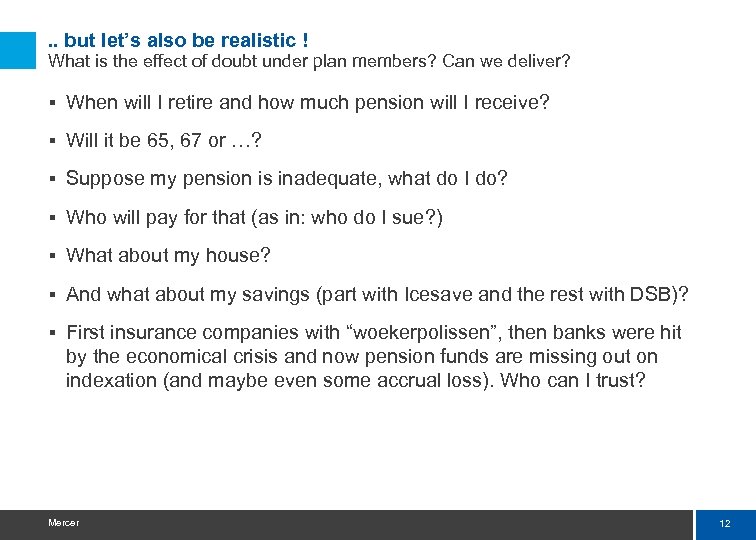

. . but let’s also be realistic ! What is the effect of doubt under plan members? Can we deliver? § When will I retire and how much pension will I receive? § Will it be 65, 67 or …? § Suppose my pension is inadequate, what do I do? § Who will pay for that (as in: who do I sue? ) § What about my house? § And what about my savings (part with Icesave and the rest with DSB)? § First insurance companies with “woekerpolissen”, then banks were hit by the economical crisis and now pension funds are missing out on indexation (and maybe even some accrual loss). Who can I trust? Mercer 12

. . but let’s also be realistic ! What is the effect of doubt under plan members? Can we deliver? § When will I retire and how much pension will I receive? § Will it be 65, 67 or …? § Suppose my pension is inadequate, what do I do? § Who will pay for that (as in: who do I sue? ) § What about my house? § And what about my savings (part with Icesave and the rest with DSB)? § First insurance companies with “woekerpolissen”, then banks were hit by the economical crisis and now pension funds are missing out on indexation (and maybe even some accrual loss). Who can I trust? Mercer 12

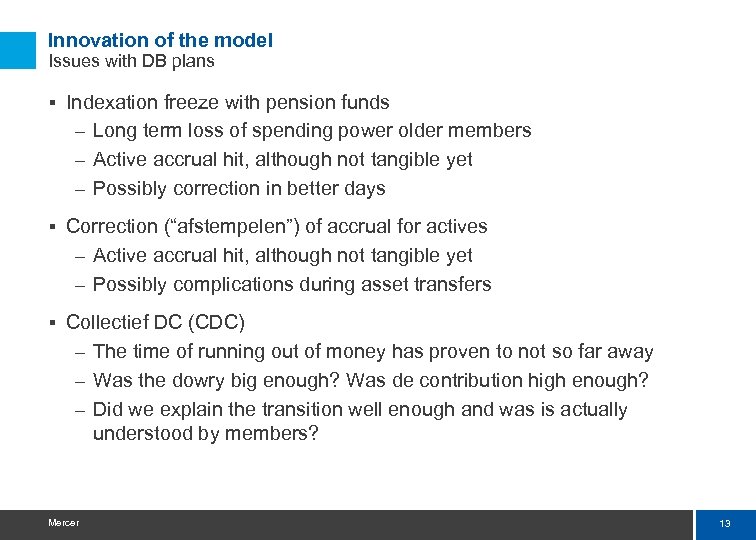

Innovation of the model Issues with DB plans § Indexation freeze with pension funds – Long term loss of spending power older members – Active accrual hit, although not tangible yet – Possibly correction in better days § Correction (“afstempelen”) of accrual for actives – Active accrual hit, although not tangible yet – Possibly complications during asset transfers § Collectief DC (CDC) – The time of running out of money has proven to not so far away – Was the dowry big enough? Was de contribution high enough? – Did we explain the transition well enough and was is actually understood by members? Mercer 13

Innovation of the model Issues with DB plans § Indexation freeze with pension funds – Long term loss of spending power older members – Active accrual hit, although not tangible yet – Possibly correction in better days § Correction (“afstempelen”) of accrual for actives – Active accrual hit, although not tangible yet – Possibly complications during asset transfers § Collectief DC (CDC) – The time of running out of money has proven to not so far away – Was the dowry big enough? Was de contribution high enough? – Did we explain the transition well enough and was is actually understood by members? Mercer 13

Innovation of the model Issues with DC plans § The Dutch DC tax ladders will not provide adequate benefits, because of construction flaws (both fundamentally as well as assumption wise) § Individual DC plans assume commitment from young members with their plan § The usury policies (“woekerpolissen”) have placed DC plans in bad lighting with little of no nuance, causing “brand damage” § Both pension funds and plan sponsors do not invest enough in the execution of their duty of care § Regulator (AFM) concludes that insurers do not properly execute their duty of care (August 2009) § The Dutch DC Market needs further evolution (p. e. Master Trusts) Mercer 14

Innovation of the model Issues with DC plans § The Dutch DC tax ladders will not provide adequate benefits, because of construction flaws (both fundamentally as well as assumption wise) § Individual DC plans assume commitment from young members with their plan § The usury policies (“woekerpolissen”) have placed DC plans in bad lighting with little of no nuance, causing “brand damage” § Both pension funds and plan sponsors do not invest enough in the execution of their duty of care § Regulator (AFM) concludes that insurers do not properly execute their duty of care (August 2009) § The Dutch DC Market needs further evolution (p. e. Master Trusts) Mercer 14

Is our pension model retiring? Time for innovation – back to the drawing board § What is a modern level of pensions? – our “ 70%” or derivatives might be from another era – Is that level still valid? § Which model fits to our current society, keeping in mind – Level of solidarity – Personal responsibility or paternalism? – Position of pension assets relative to other assets, i. o. w. what should be the role of the second pillar? – What does the client think? – Does the client want the best product? Mercer 15

Is our pension model retiring? Time for innovation – back to the drawing board § What is a modern level of pensions? – our “ 70%” or derivatives might be from another era – Is that level still valid? § Which model fits to our current society, keeping in mind – Level of solidarity – Personal responsibility or paternalism? – Position of pension assets relative to other assets, i. o. w. what should be the role of the second pillar? – What does the client think? – Does the client want the best product? Mercer 15

European Pensions Netherlands Summit Light at the end of the tunnel Tim Burggraaf Netherlands tim. burggraaf@mercer. com www. mercer. com

European Pensions Netherlands Summit Light at the end of the tunnel Tim Burggraaf Netherlands tim. burggraaf@mercer. com www. mercer. com