df5a24224400f204ad09f2dc9cfffe4c.ppt

- Количество слайдов: 16

European Microfinance Week Luxembourg, 1 Dec 2010 Overview of the EC approach to microfinance support Alessandra Lustrati EC Microfinance Focal Point Europe. Aid

EC Support to Microfinance Development objectives Europe. Aid Linking microfinance to broader development objectives: Social development Financial inclusion of poor/low-income unbanked households (e. g. access to savings, payment services, microinsurance, financial literacy, …) Economic development Access to finance for micro/small-scale enterprises and smallholders (e. g. financial product development - appropriate loans, leases, etc. - based on enterprise/farm needs, cycles, seasonality…)

EC Support to Microfinance Development objectives (points for reflection) Europe. Aid • Social and economic development, poor household and micro -enterprise strategies are often interlinked • Some types of microfinance may help in ‘coping’ with poverty, others in ‘reducing’ income poverty or other forms of deprivation • Microfinance for enterprise development usually needs to be complemented by non-financial BDS • EC work in microfinance partly connects/overlaps with its action on broader ‘access to finance’ (for MSMEs) • Sufficient rural outreach remains a challenge

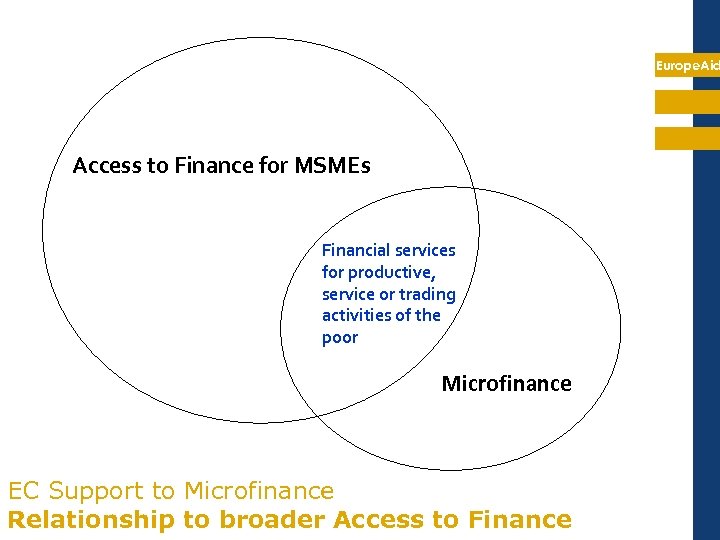

Europe. Aid Access to Finance for MSMEs Financial services for productive, service or trading activities of the poor Microfinance EC Support to Microfinance Relationship to broader Access to Finance

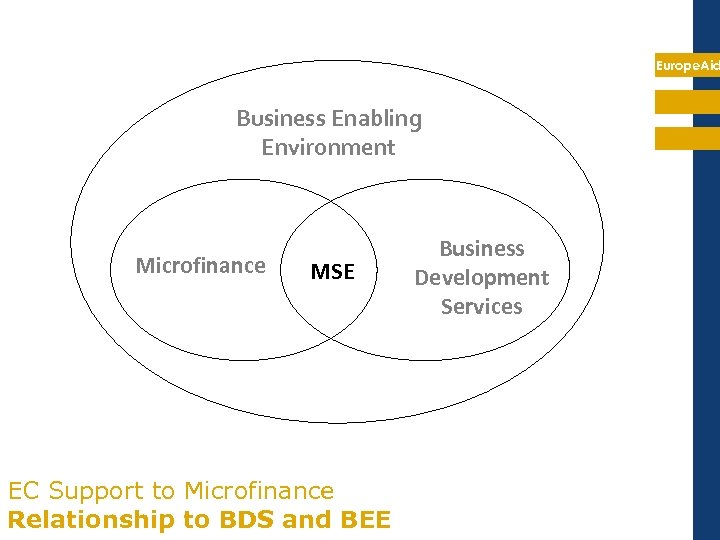

Europe. Aid Business Enabling Environment Microfinance MSE EC Support to Microfinance Relationship to BDS and BEE Business Development Services

EC Support to Microfinance Key policy aspects Europe. Aid Main focus on institutional capacity building • • • institutional capacity is a bottleneck comparative advantage of EC (grant-giving donor) main focus at MFI level (but increasing attention for financial infrastructure and policy, in line with broader work on access to finance) Funding of MFI capital needs only in exceptional cases • better left to specialised financial institutions • design appropriate specific « exit » strategy if credit is revolving 6

EC Support to Microfinance Focus on capacity building at different levels Europe. Aid • Strengthen financial institutions (capacity building to diversify products, expand outreach, reach sustainability) • Build strong support infrastructure for MFIs (training, information infrastructure, payments systems, advocacy) • Promote a favourable legal and institutional environment for microfinance (balancing financial access, stability and client protection)

EC Support to Microfinance Guidelines (background) Europe. Aid Published in 2008 Based on EC experience and lessons learnt Aligned to donor consensus on microfinance (‘Pink Book’) Complementary to EC guidelines in PSD/access to finance Mainstreamed through trainings, ‘quality support’, events

EC Support to Microfinance Guidelines (outline) Europe. Aid • Key definitions, policy focus (capacity building) • Examples of areas/levels of intervention • Requirements for grant recipients (experience, expertise) • Performance indicators (explanation of financial, reference to social) • Criteria or onlending through specialised financial institutions and NGOs (special circumstances) • End-of-project strategies for revolving funds

EC Support to Microfinance Guidelines - example Europe. Aid Requirements for grant recipients o o experience with microfinance operations >3 years at least 3 similar actions technical expertise in-house qualified staff dedicated to microfinance 10

EC Support to Microfinance Guidelines - example Europe. Aid Measuring results o o Definition of performance baseline, targets and key indicators Standard performance indicators should cover at least the five core areas: (1) breadth of outreach (2) depth of outreach (3) portfolio quality (4) efficiency (5) sustainability 11

EC Support to Microfinance Guidelines - example Europe. Aid Providing on-lending capital • Involving specialised financial institutions or, exceptionally, specialised NGOs (following a call for proposals) • Limited to the following cases: there are no providers (remote areas, post-conflict) and the "start-up” MFI can fill the gap an existing MFI extends operations into rural areas • Funding must be complemented by capacity building • End-of-project (“exit”) strategy to ensure sustainable access to finance 12

EC Support to Microfinance Overview of portfolio Europe. Aid • Current portfolio approx 200 MEUR (at 31 Dec 2009) (Allocation stable over previous five years) • Almost 200 projects • Over more than 80 countries (in ACP, Neighbourhood, LA, Asia) • Funding levels: about 90% at micro level, under 10% at meso, macro and wholesale • Types of activities: wide range, in both rural and urban areas, mostly focused on the objective of supporting microentrepreneurs and smallholders.

EC Support to Microfinance Overview of portfolio Europe. Aid • Funding sources: NSA budget line (centralised and local Cf. Ps), country and multicountry programmes (under EDF, DCI, etc. ), Food Security budget line / EP pilot projects, Food Facility, Investing in People. • Partners and beneficiaries: mainly MFIs and NGOs/NSAs, but also meso-level organisations (financial infrastructure, networks, training providers, rating agencies), and government, central banks, supervisory authorities. • Collaboration with EIB for Investment Facility (equity+TA for MFIs) • (‘flagship’ initiative: EU-ACP Microfinance Programme)

EC Support to Microfinance Additional information For more information on the EC and microfinance: “Guidelines on EC support to microfinance” EC Microfinance project database (maintained by EC Microfinance Focal Point) Specific country-level information from EU Delegations EC Microfinance on Capacity 4 Dev: http: //capacity 4 dev. ec. europa. eu/topic/microfinance For comparison with other funders: CGAP Funder Survey (EC contributes data yearly) Europe. Aid

Europe. Aid Thank you!

df5a24224400f204ad09f2dc9cfffe4c.ppt