179a68a201fed795c6feca6f3162b6f2.ppt

- Количество слайдов: 9

European Euro Project 4 Danielle Gardner Donna Zviely Garrett Mc. Culloch

European Euro Project 4 Danielle Gardner Donna Zviely Garrett Mc. Culloch

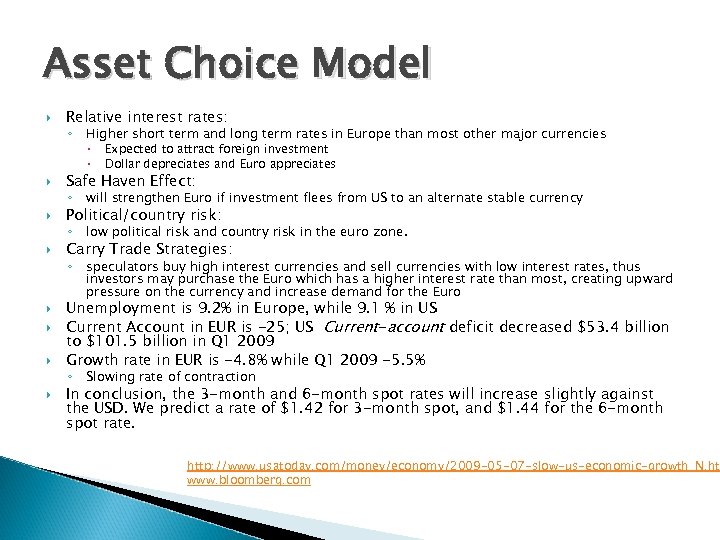

Asset Choice Model Relative interest rates: ◦ Higher short term and long term rates in Europe than most other major currencies Expected to attract foreign investment Dollar depreciates and Euro appreciates Safe Haven Effect: Political/country risk: Carry Trade Strategies: ◦ will strengthen Euro if investment flees from US to an alternate stable currency ◦ low political risk and country risk in the euro zone. ◦ speculators buy high interest currencies and sell currencies with low interest rates, thus investors may purchase the Euro which has a higher interest rate than most, creating upward pressure on the currency and increase demand for the Euro Unemployment is 9. 2% in Europe, while 9. 1 % in US Current Account in EUR is -25; US Current-account deficit decreased $53. 4 billion to $101. 5 billion in Q 1 2009 Growth rate in EUR is -4. 8% while Q 1 2009 -5. 5% ◦ Slowing rate of contraction In conclusion, the 3 -month and 6 -month spot rates will increase slightly against the USD. We predict a rate of $1. 42 for 3 -month spot, and $1. 44 for the 6 -month spot rate. http: //www. usatoday. com/money/economy/2009 -05 -07 -slow-us-economic-growth_N. htm www. bloomberg. com

Asset Choice Model Relative interest rates: ◦ Higher short term and long term rates in Europe than most other major currencies Expected to attract foreign investment Dollar depreciates and Euro appreciates Safe Haven Effect: Political/country risk: Carry Trade Strategies: ◦ will strengthen Euro if investment flees from US to an alternate stable currency ◦ low political risk and country risk in the euro zone. ◦ speculators buy high interest currencies and sell currencies with low interest rates, thus investors may purchase the Euro which has a higher interest rate than most, creating upward pressure on the currency and increase demand for the Euro Unemployment is 9. 2% in Europe, while 9. 1 % in US Current Account in EUR is -25; US Current-account deficit decreased $53. 4 billion to $101. 5 billion in Q 1 2009 Growth rate in EUR is -4. 8% while Q 1 2009 -5. 5% ◦ Slowing rate of contraction In conclusion, the 3 -month and 6 -month spot rates will increase slightly against the USD. We predict a rate of $1. 42 for 3 -month spot, and $1. 44 for the 6 -month spot rate. http: //www. usatoday. com/money/economy/2009 -05 -07 -slow-us-economic-growth_N. htm www. bloomberg. com

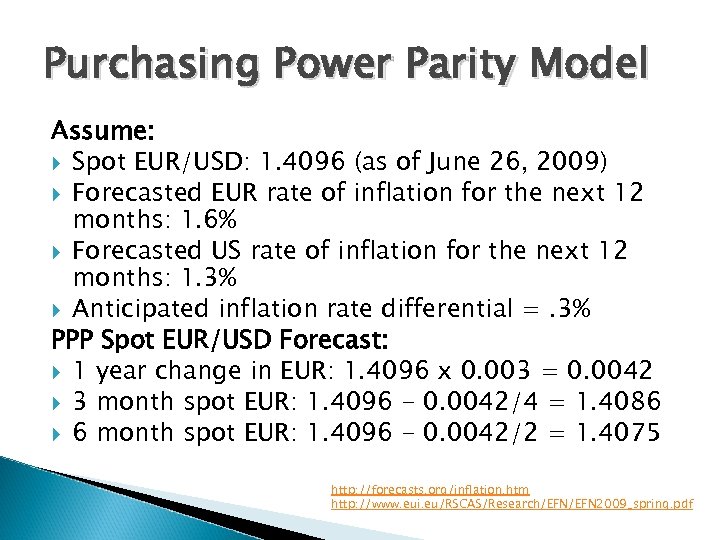

Purchasing Power Parity Model Assume: Spot EUR/USD: 1. 4096 (as of June 26, 2009) Forecasted EUR rate of inflation for the next 12 months: 1. 6% Forecasted US rate of inflation for the next 12 months: 1. 3% Anticipated inflation rate differential =. 3% PPP Spot EUR/USD Forecast: 1 year change in EUR: 1. 4096 x 0. 003 = 0. 0042 3 month spot EUR: 1. 4096 - 0. 0042/4 = 1. 4086 6 month spot EUR: 1. 4096 - 0. 0042/2 = 1. 4075 http: //forecasts. org/inflation. htm http: //www. eui. eu/RSCAS/Research/EFN 2009_spring. pdf

Purchasing Power Parity Model Assume: Spot EUR/USD: 1. 4096 (as of June 26, 2009) Forecasted EUR rate of inflation for the next 12 months: 1. 6% Forecasted US rate of inflation for the next 12 months: 1. 3% Anticipated inflation rate differential =. 3% PPP Spot EUR/USD Forecast: 1 year change in EUR: 1. 4096 x 0. 003 = 0. 0042 3 month spot EUR: 1. 4096 - 0. 0042/4 = 1. 4086 6 month spot EUR: 1. 4096 - 0. 0042/2 = 1. 4075 http: //forecasts. org/inflation. htm http: //www. eui. eu/RSCAS/Research/EFN 2009_spring. pdf

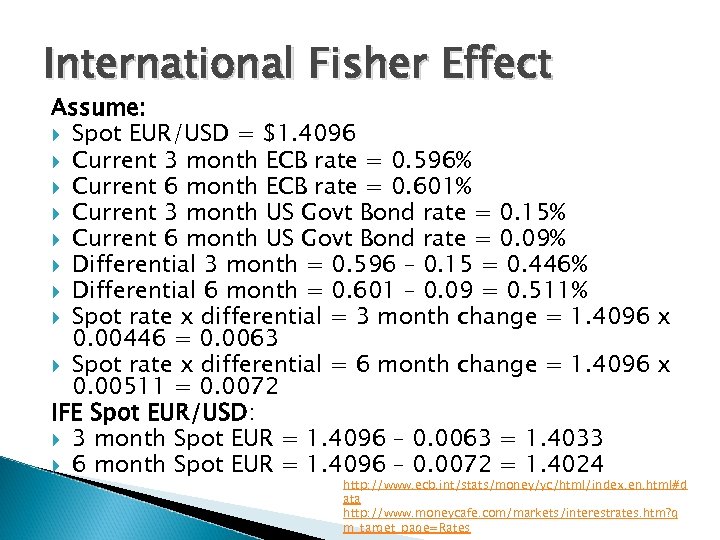

International Fisher Effect Assume: Spot EUR/USD = $1. 4096 Current 3 month ECB rate = 0. 596% Current 6 month ECB rate = 0. 601% Current 3 month US Govt Bond rate = 0. 15% Current 6 month US Govt Bond rate = 0. 09% Differential 3 month = 0. 596 – 0. 15 = 0. 446% Differential 6 month = 0. 601 – 0. 09 = 0. 511% Spot rate x differential = 3 month change = 1. 4096 x 0. 00446 = 0. 0063 Spot rate x differential = 6 month change = 1. 4096 x 0. 00511 = 0. 0072 IFE Spot EUR/USD: 3 month Spot EUR = 1. 4096 – 0. 0063 = 1. 4033 6 month Spot EUR = 1. 4096 – 0. 0072 = 1. 4024 http: //www. ecb. int/stats/money/yc/html/index. en. html#d ata http: //www. moneycafe. com/markets/interestrates. htm? q m_target_page=Rates

International Fisher Effect Assume: Spot EUR/USD = $1. 4096 Current 3 month ECB rate = 0. 596% Current 6 month ECB rate = 0. 601% Current 3 month US Govt Bond rate = 0. 15% Current 6 month US Govt Bond rate = 0. 09% Differential 3 month = 0. 596 – 0. 15 = 0. 446% Differential 6 month = 0. 601 – 0. 09 = 0. 511% Spot rate x differential = 3 month change = 1. 4096 x 0. 00446 = 0. 0063 Spot rate x differential = 6 month change = 1. 4096 x 0. 00511 = 0. 0072 IFE Spot EUR/USD: 3 month Spot EUR = 1. 4096 – 0. 0063 = 1. 4033 6 month Spot EUR = 1. 4096 – 0. 0072 = 1. 4024 http: //www. ecb. int/stats/money/yc/html/index. en. html#d ata http: //www. moneycafe. com/markets/interestrates. htm? q m_target_page=Rates

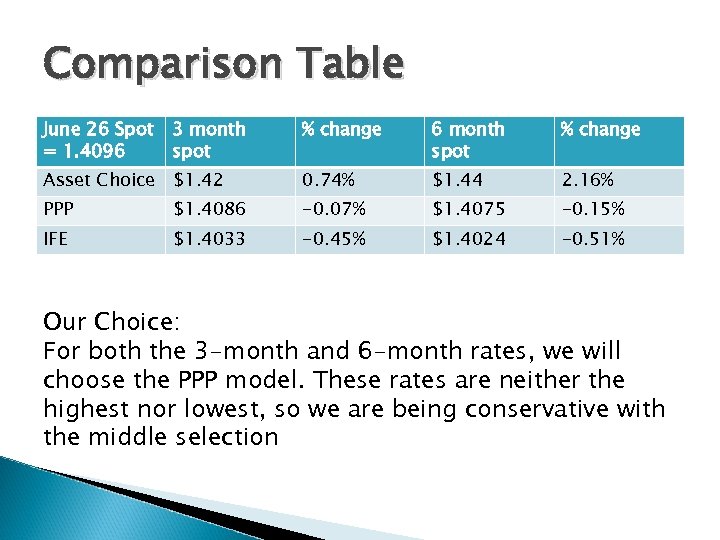

Comparison Table June 26 Spot = 1. 4096 3 month spot % change 6 month spot % change Asset Choice $1. 42 0. 74% $1. 44 2. 16% PPP $1. 4086 -0. 07% $1. 4075 -0. 15% IFE $1. 4033 -0. 45% $1. 4024 -0. 51% Our Choice: For both the 3 -month and 6 -month rates, we will choose the PPP model. These rates are neither the highest nor lowest, so we are being conservative with the middle selection

Comparison Table June 26 Spot = 1. 4096 3 month spot % change 6 month spot % change Asset Choice $1. 42 0. 74% $1. 44 2. 16% PPP $1. 4086 -0. 07% $1. 4075 -0. 15% IFE $1. 4033 -0. 45% $1. 4024 -0. 51% Our Choice: For both the 3 -month and 6 -month rates, we will choose the PPP model. These rates are neither the highest nor lowest, so we are being conservative with the middle selection

Advice to MNC: open short MNC open short: 3 -month spot rate with the PPP model is $1. 4086. 6 -month = 1. 4075. This MNC is paying debt off in euro or making a euro denominated purchase, so they should not hedge with a futures contract because dollarequivalent-costs will become lower in the future. The euro is depreciating against the dollar from $1. 4096 to $1. 4086 so a hedge would be detrimental to the financial value of the American based MNC. The same holds for the 6 -month spot rate, because the euro will further depreciate against the dollar according to the PPP model that we have chosen.

Advice to MNC: open short MNC open short: 3 -month spot rate with the PPP model is $1. 4086. 6 -month = 1. 4075. This MNC is paying debt off in euro or making a euro denominated purchase, so they should not hedge with a futures contract because dollarequivalent-costs will become lower in the future. The euro is depreciating against the dollar from $1. 4096 to $1. 4086 so a hedge would be detrimental to the financial value of the American based MNC. The same holds for the 6 -month spot rate, because the euro will further depreciate against the dollar according to the PPP model that we have chosen.

MNC- open long MNC open long: 3 -month spot rate with the PPP model is $1. 4086. 6 -month = 1. 4075. This MNC is receiving euro, most likely from conducting business in the euro zone, so we will advise them to lock in a forward rate now, to assure a higher USD-equivalent-value than would be attained without the contract. Since the euro will depreciate against the USD, the firm receiving euro will gain higher cash flows by locking in a forward contract with the current exchange rate of $1. 4096. The euro is not expected to depreciate enough to use an options contract and pay the premium.

MNC- open long MNC open long: 3 -month spot rate with the PPP model is $1. 4086. 6 -month = 1. 4075. This MNC is receiving euro, most likely from conducting business in the euro zone, so we will advise them to lock in a forward rate now, to assure a higher USD-equivalent-value than would be attained without the contract. Since the euro will depreciate against the USD, the firm receiving euro will gain higher cash flows by locking in a forward contract with the current exchange rate of $1. 4096. The euro is not expected to depreciate enough to use an options contract and pay the premium.

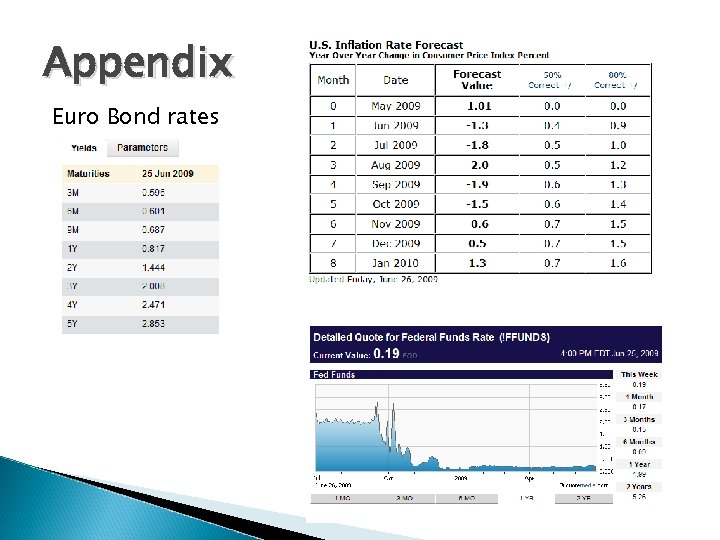

Appendix Euro Bond rates

Appendix Euro Bond rates

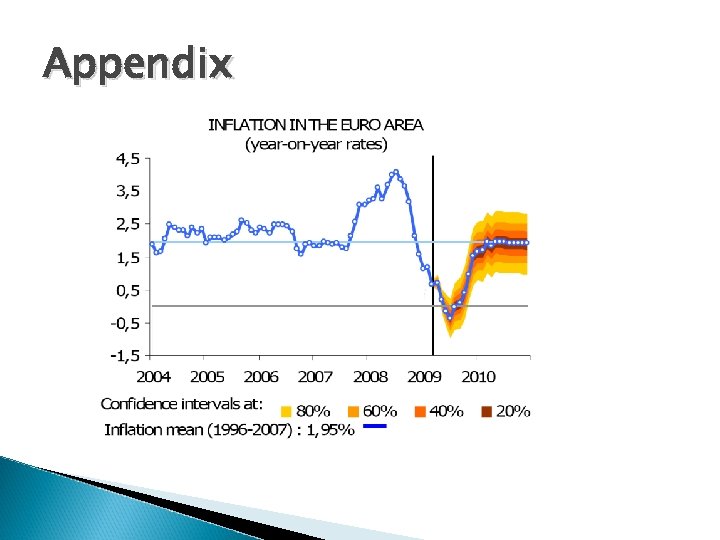

Appendix

Appendix