de882589da31d5350f855f35c6cac157.ppt

- Количество слайдов: 19

European Commission / Taxation and Customs Union 1968 -2008 Panel 1: Integrated Border Management & the role of Government/Private Sector partnership The EU Customs IT: 40 years of integration and a bold future! Theunissen P-H, Head of Unit Customs & Taxation trans European Systems Customs & Taxation Automated Services Directorate General Taxation and Customs Union European Commission paul-herve. theunissen@ec. europa. eu Seoul, 23 April 2008 WCO IT COnference 1 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 Panel 1: Integrated Border Management & the role of Government/Private Sector partnership The EU Customs IT: 40 years of integration and a bold future! Theunissen P-H, Head of Unit Customs & Taxation trans European Systems Customs & Taxation Automated Services Directorate General Taxation and Customs Union European Commission paul-herve. theunissen@ec. europa. eu Seoul, 23 April 2008 WCO IT COnference 1 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 EU Customs today • Challenges for EU Customs Administrations: – Fight against fraud and counterfeit goods; – Security and safety – Facilitate trade: • • • 27 Member States and the European Commission; 12. 440 km of external land frontier, 3. 000+ offices; 2. 000 registered traders; 183. 000 custom declarations, 80+% electronic; 220 Million electronic messages between Member States and EU Seoul, 23 April 2008 WCO IT COnference 2 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 EU Customs today • Challenges for EU Customs Administrations: – Fight against fraud and counterfeit goods; – Security and safety – Facilitate trade: • • • 27 Member States and the European Commission; 12. 440 km of external land frontier, 3. 000+ offices; 2. 000 registered traders; 183. 000 custom declarations, 80+% electronic; 220 Million electronic messages between Member States and EU Seoul, 23 April 2008 WCO IT COnference 2 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 The emergence of trans European systems • Principle of trans European Systems: – Trade connects to national Automated Customs Systems; – Collaborative and interoperable national Automated Customs Systems; – EU as “IT service broker”; • Applicable for the future of EU Customs operation, and its IT segment Seoul, 23 April 2008 WCO IT COnference 3 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 The emergence of trans European systems • Principle of trans European Systems: – Trade connects to national Automated Customs Systems; – Collaborative and interoperable national Automated Customs Systems; – EU as “IT service broker”; • Applicable for the future of EU Customs operation, and its IT segment Seoul, 23 April 2008 WCO IT COnference 3 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 A new legal environment for EU Customs • Security Amendments to the Customs Code; • Modernised EU Customs Code: streamlining the EU customs processes; • New stakeholders to interoperate with: – many other national Agencies and; – 3 rd countries; • Budget of 320+ Mio € over 2008 -2013; Seoul, 23 April 2008 WCO IT COnference 4 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 A new legal environment for EU Customs • Security Amendments to the Customs Code; • Modernised EU Customs Code: streamlining the EU customs processes; • New stakeholders to interoperate with: – many other national Agencies and; – 3 rd countries; • Budget of 320+ Mio € over 2008 -2013; Seoul, 23 April 2008 WCO IT COnference 4 Ver 2

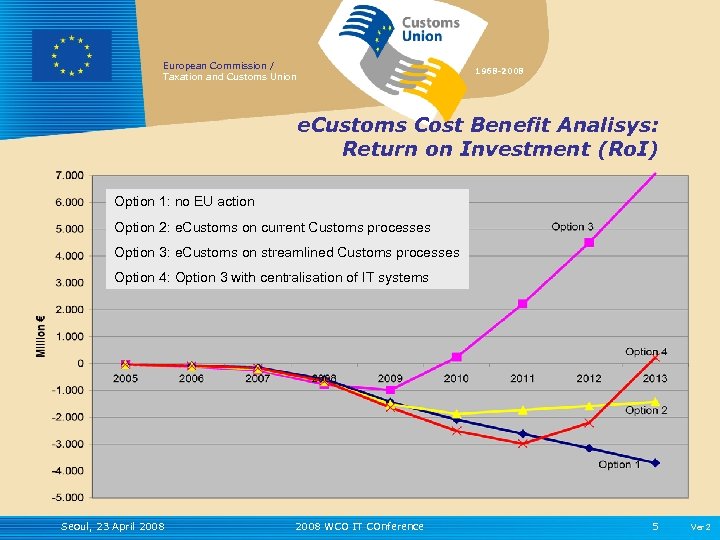

European Commission / Taxation and Customs Union 1968 -2008 e. Customs Cost Benefit Analisys: Return on Investment (Ro. I) Option 1: no EU action Option 2: e. Customs on current Customs processes Option 3: e. Customs on streamlined Customs processes Option 4: Option 3 with centralisation of IT systems Seoul, 23 April 2008 WCO IT COnference 5 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 e. Customs Cost Benefit Analisys: Return on Investment (Ro. I) Option 1: no EU action Option 2: e. Customs on current Customs processes Option 3: e. Customs on streamlined Customs processes Option 4: Option 3 with centralisation of IT systems Seoul, 23 April 2008 WCO IT COnference 5 Ver 2

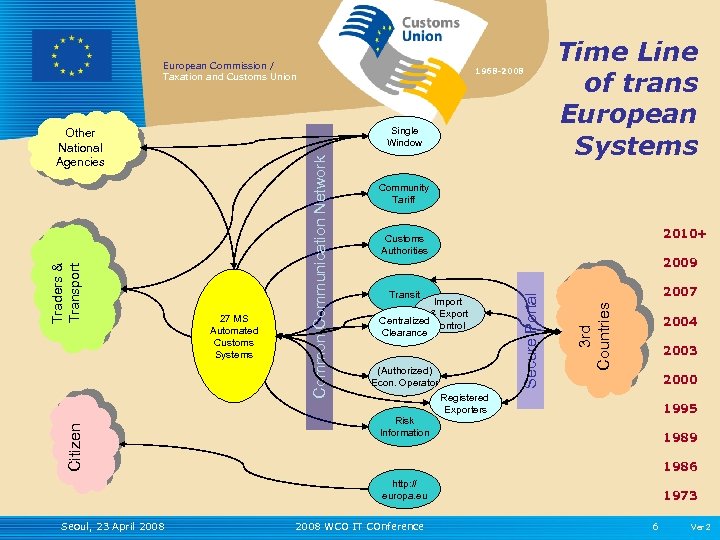

European Commission / Taxation and Customs Union Citizen Time Line of trans European Systems Community Tariff 2010+ Customs Authorities 2009 Import & Export Centralized Control Clearance (Authorized) Econ. Operator 2007 3 rd Countries Transit Secure Portal 27 MS 15 MS 25 MS 12 MS 9 Automated Customs Systems Common Communication Network Single Window Other National Agencies Traders & Transport 1968 -2008 2004 2003 2000 Registered Exporters 1995 Risk Information 1989 1986 http: // europa. eu Seoul, 23 April 2008 WCO IT COnference 1973 6 Ver 2

European Commission / Taxation and Customs Union Citizen Time Line of trans European Systems Community Tariff 2010+ Customs Authorities 2009 Import & Export Centralized Control Clearance (Authorized) Econ. Operator 2007 3 rd Countries Transit Secure Portal 27 MS 15 MS 25 MS 12 MS 9 Automated Customs Systems Common Communication Network Single Window Other National Agencies Traders & Transport 1968 -2008 2004 2003 2000 Registered Exporters 1995 Risk Information 1989 1986 http: // europa. eu Seoul, 23 April 2008 WCO IT COnference 1973 6 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 The Integration Dimensions of EU Customs Automated EU Customs Processes: EU Customs Administrations: from 6 An increasing number of to 27, and more to come, With their national ACS (from 1970) stakeholders to integrate over an increasing number of Other Customs processes National Agencies: Traders & Transport 100+ (2010) Consultation on over time! Tariff (1989), Transit (2000), Security (2005 -09), AEO (2008), Single Window, Central Clearance (2010+) Customs Process, legal bases, IT 3 rd Countries: EFTA (2000), CN (2008), RU (2008), US (200 x), others Seoul, 23 April 2008 WCO IT COnference 7 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 The Integration Dimensions of EU Customs Automated EU Customs Processes: EU Customs Administrations: from 6 An increasing number of to 27, and more to come, With their national ACS (from 1970) stakeholders to integrate over an increasing number of Other Customs processes National Agencies: Traders & Transport 100+ (2010) Consultation on over time! Tariff (1989), Transit (2000), Security (2005 -09), AEO (2008), Single Window, Central Clearance (2010+) Customs Process, legal bases, IT 3 rd Countries: EFTA (2000), CN (2008), RU (2008), US (200 x), others Seoul, 23 April 2008 WCO IT COnference 7 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 Key success factors for trans European Systems (T€S) • • • Programming (strategic and tactical), Cost Benefit Analysis; Governance, with clear responsibilities; Business process model drives Legal and IT; Trader Consultation; Legal certainty; Availability of resources (time in years, budget in million €, sourcing strategy); Trans European Systems project life cycle (Systems of Systems); A common IT infrastructure; Use international best practices, frameworks, standards; Strong project management for transparency & predictability. Seoul, 23 April 2008 WCO IT COnference 8 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 Key success factors for trans European Systems (T€S) • • • Programming (strategic and tactical), Cost Benefit Analysis; Governance, with clear responsibilities; Business process model drives Legal and IT; Trader Consultation; Legal certainty; Availability of resources (time in years, budget in million €, sourcing strategy); Trans European Systems project life cycle (Systems of Systems); A common IT infrastructure; Use international best practices, frameworks, standards; Strong project management for transparency & predictability. Seoul, 23 April 2008 WCO IT COnference 8 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 Area of Responsibility Automated Services Responsible External Domain Traders National Domain Member States Common Domain European Union Seoul, 23 April 2008 WCO IT COnference 9 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 Area of Responsibility Automated Services Responsible External Domain Traders National Domain Member States Common Domain European Union Seoul, 23 April 2008 WCO IT COnference 9 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 Traders perspective • Traders connect to National Automated Customs Systems; • 6 to 15 months lead time for trader to connect to new system, traders ask for 24 months… • Trade information and consultation at national & EU level; • EU Trade Contact Group: platform for consultation on customs policy, business process, legal bases & IT systems. Seoul, 23 April 2008 WCO IT COnference 10 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 Traders perspective • Traders connect to National Automated Customs Systems; • 6 to 15 months lead time for trader to connect to new system, traders ask for 24 months… • Trade information and consultation at national & EU level; • EU Trade Contact Group: platform for consultation on customs policy, business process, legal bases & IT systems. Seoul, 23 April 2008 WCO IT COnference 10 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 Member States role in trans European systems • Approve EU policy, business process models, legal bases, IT specifications; • Deploy and operate their Automated Customs Systems; • Manage the trader consultation and their connectivity to Automated Customs Systems; • Cooperate with other Member States and with EU; Seoul, 23 April 2008 WCO IT COnference 11 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 Member States role in trans European systems • Approve EU policy, business process models, legal bases, IT specifications; • Deploy and operate their Automated Customs Systems; • Manage the trader consultation and their connectivity to Automated Customs Systems; • Cooperate with other Member States and with EU; Seoul, 23 April 2008 WCO IT COnference 11 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 The EU role in trans European systems • Propose Customs policies, EU Business process model, legal bases, IT specifications, Terms of Collaboration; • Operate central/EU parts of Systems testing, statistics…); (network, monitoring, • Co-ordinate & test the national developments; • IT Service Management (ITIL) of the trans European systems: Service Desk, configuration, change, release, availability, continuity, security… • Governance management, programming, project & quality management, trade consultation at EU level. Seoul, 23 April 2008 WCO IT COnference 12 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 The EU role in trans European systems • Propose Customs policies, EU Business process model, legal bases, IT specifications, Terms of Collaboration; • Operate central/EU parts of Systems testing, statistics…); (network, monitoring, • Co-ordinate & test the national developments; • IT Service Management (ITIL) of the trans European systems: Service Desk, configuration, change, release, availability, continuity, security… • Governance management, programming, project & quality management, trade consultation at EU level. Seoul, 23 April 2008 WCO IT COnference 12 Ver 2

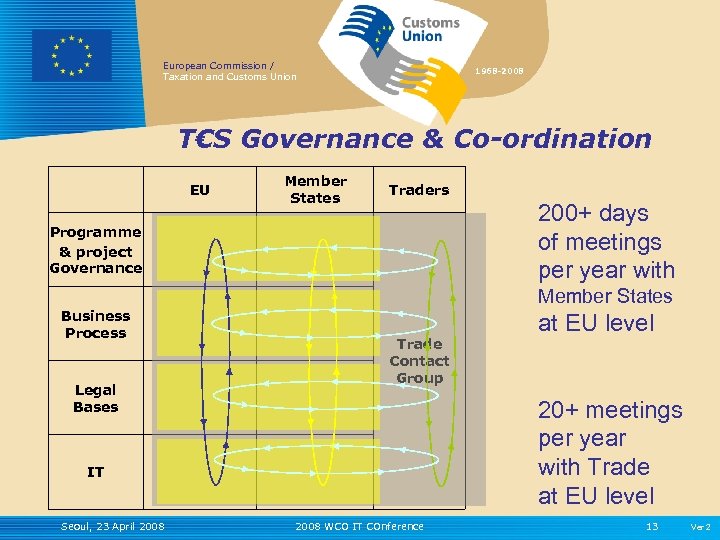

European Commission / Taxation and Customs Union 1968 -2008 T€S Governance & Co-ordination EU Member States Traders 200+ days of meetings per year with Programme & project Governance Business Process Legal Bases Member States Trade Contact Group 20+ meetings per year with Trade at EU level IT Seoul, 23 April 2008 at EU level 2008 WCO IT COnference 13 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 T€S Governance & Co-ordination EU Member States Traders 200+ days of meetings per year with Programme & project Governance Business Process Legal Bases Member States Trade Contact Group 20+ meetings per year with Trade at EU level IT Seoul, 23 April 2008 at EU level 2008 WCO IT COnference 13 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 CCN/CSI: the T€S backbone! Common Communication Network /Common System Interface A secure managed “end to end” network, with CCN gateways acting as access points, and CSI as “CCN driver” for each National Administration. ted States rus er EU Data Center EU T mb E U Me he CCN e gateway application platform th dt y b an Member State xxx CCN gateway CCN/CSI Member State yyy Seoul, 23 April 2008 application platform (host) CCN gateway 2008 WCO IT COnference 14 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 CCN/CSI: the T€S backbone! Common Communication Network /Common System Interface A secure managed “end to end” network, with CCN gateways acting as access points, and CSI as “CCN driver” for each National Administration. ted States rus er EU Data Center EU T mb E U Me he CCN e gateway application platform th dt y b an Member State xxx CCN gateway CCN/CSI Member State yyy Seoul, 23 April 2008 application platform (host) CCN gateway 2008 WCO IT COnference 14 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 The 3 rd countries perspective • Growing demand for international IT interoperability: – Exchange of pre arrival/pre departure information; – Mutual recognition of trader authorisation; – Better secure certificates of origin; • Projects with RU & CN, emerging with US and EU neighbouring countries; • Governance based on bilateral agreements; • Reference to international frameworks such as WCO data model and SAFE foster effectiveness & efficiency; • EU Secured Portal (SPEED) operational end 2008 to interconnect with 3 rd Countries IT systems; Seoul, 23 April 2008 WCO IT COnference 15 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 The 3 rd countries perspective • Growing demand for international IT interoperability: – Exchange of pre arrival/pre departure information; – Mutual recognition of trader authorisation; – Better secure certificates of origin; • Projects with RU & CN, emerging with US and EU neighbouring countries; • Governance based on bilateral agreements; • Reference to international frameworks such as WCO data model and SAFE foster effectiveness & efficiency; • EU Secured Portal (SPEED) operational end 2008 to interconnect with 3 rd Countries IT systems; Seoul, 23 April 2008 WCO IT COnference 15 Ver 2

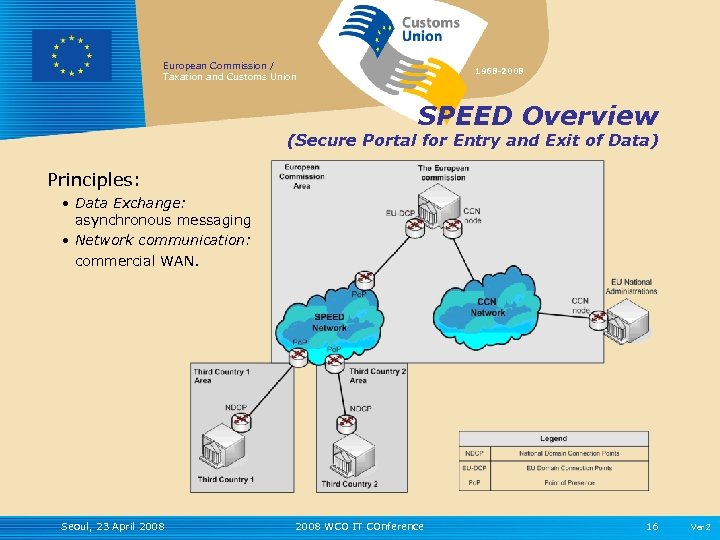

European Commission / Taxation and Customs Union 1968 -2008 SPEED Overview (Secure Portal for Entry and Exit of Data) Principles: • Data Exchange: asynchronous messaging • Network communication: commercial WAN. Seoul, 23 April 2008 WCO IT COnference 16 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 SPEED Overview (Secure Portal for Entry and Exit of Data) Principles: • Data Exchange: asynchronous messaging • Network communication: commercial WAN. Seoul, 23 April 2008 WCO IT COnference 16 Ver 2

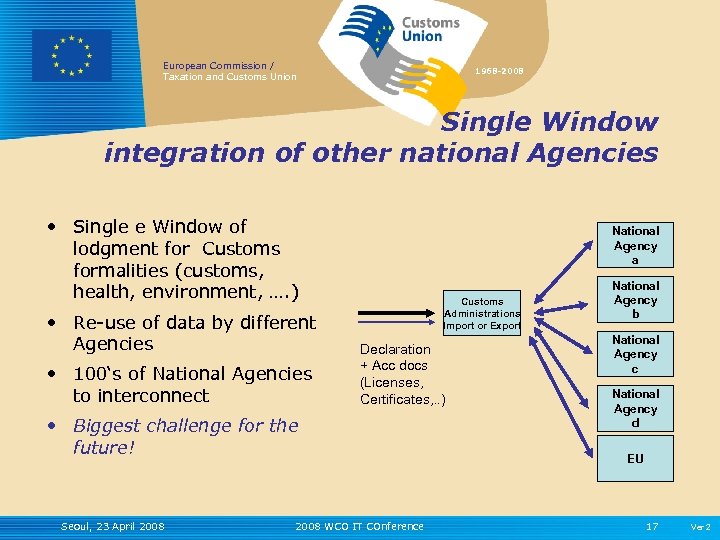

European Commission / Taxation and Customs Union 1968 -2008 Single Window integration of other national Agencies • Single e Window of lodgment for Customs formalities (customs, health, environment, …. ) • Re-use of data by different Agencies • 100‘s of National Agencies to interconnect National Agency a Customs Administrations Import or Export Declaration + Acc docs (Licenses, Certificates, . . ) • Biggest challenge for the future! Seoul, 23 April 2008 WCO IT COnference National Agency b National Agency c National Agency d EU 17 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 Single Window integration of other national Agencies • Single e Window of lodgment for Customs formalities (customs, health, environment, …. ) • Re-use of data by different Agencies • 100‘s of National Agencies to interconnect National Agency a Customs Administrations Import or Export Declaration + Acc docs (Licenses, Certificates, . . ) • Biggest challenge for the future! Seoul, 23 April 2008 WCO IT COnference National Agency b National Agency c National Agency d EU 17 Ver 2

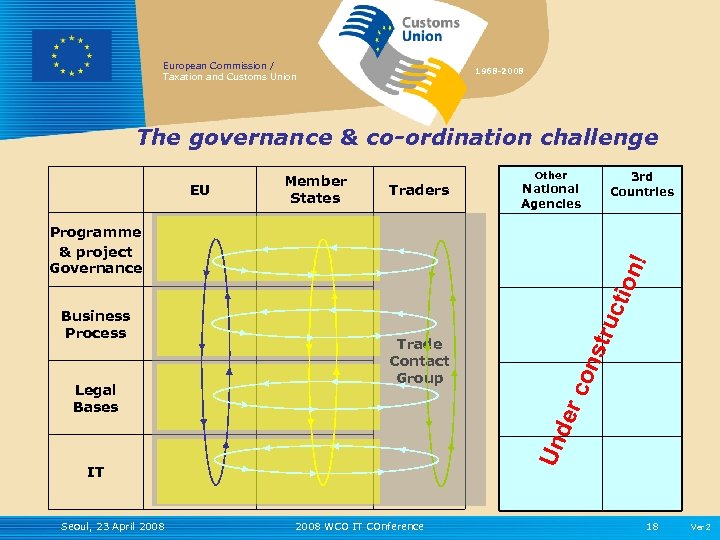

European Commission / Taxation and Customs Union 1968 -2008 The governance & co-ordination challenge EU Member States Traders 3 rd Countries Other National Agencies ion str uct IT Seoul, 23 April 2008 con der Legal Bases Trade Contact Group Un Business Process ! Programme & project Governance 2008 WCO IT COnference 18 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 The governance & co-ordination challenge EU Member States Traders 3 rd Countries Other National Agencies ion str uct IT Seoul, 23 April 2008 con der Legal Bases Trade Contact Group Un Business Process ! Programme & project Governance 2008 WCO IT COnference 18 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 Conclusions: key elements to progress border integration • Streamlined, integrated & common business processes; • Strong governance and co-ordination schemes; • Legal certainty; • Years…, resource and leadership; • Trader consultation; • Ubiquitous Service Oriented Architecture (e. g. Web Services) to distribute business process flow over national, regional, administrative borders; • Consolidate knowledge in international frameworks & standards. Seoul, 23 April 2008 WCO IT COnference 19 Ver 2

European Commission / Taxation and Customs Union 1968 -2008 Conclusions: key elements to progress border integration • Streamlined, integrated & common business processes; • Strong governance and co-ordination schemes; • Legal certainty; • Years…, resource and leadership; • Trader consultation; • Ubiquitous Service Oriented Architecture (e. g. Web Services) to distribute business process flow over national, regional, administrative borders; • Consolidate knowledge in international frameworks & standards. Seoul, 23 April 2008 WCO IT COnference 19 Ver 2