ff111be2e77d2a63e9140ec26a794301.ppt

- Количество слайдов: 14

European Climate Exchange The Carbon Market & Exchanges: Products, Participants and Strategies Sofia, 29 September 2009

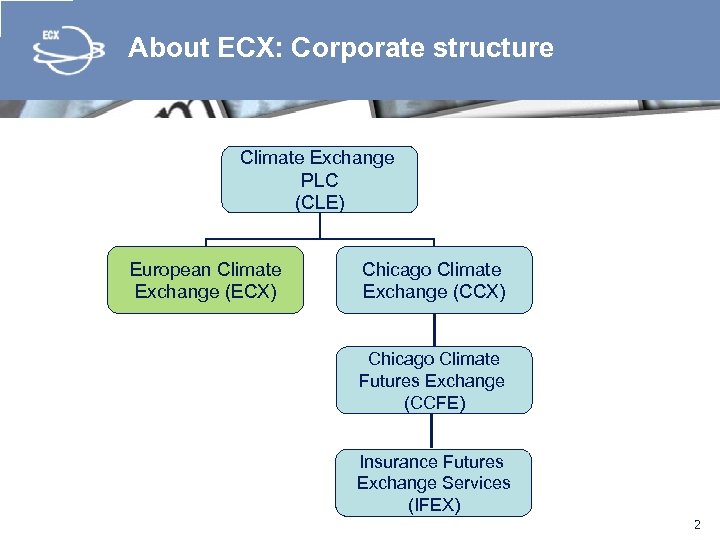

About ECX: Corporate structure Climate Exchange PLC (CLE) European Climate Exchange (ECX) Chicago Climate Exchange (CCX) Chicago Climate Futures Exchange (CCFE) Insurance Futures Exchange Services (IFEX) 2

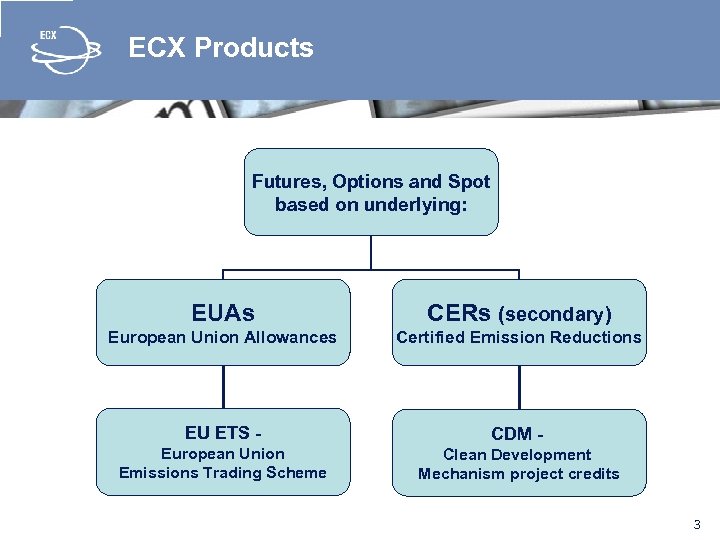

ECX Products Futures, Options and Spot based on underlying: EUAs CERs (secondary) European Union Allowances Certified Emission Reductions EU ETS - CDM - European Union Emissions Trading Scheme Clean Development Mechanism project credits 3

Why do you need an Exchange? Liquid: central marketplace Accessible: equal access for all market participants Transparent: all prices and volumes published Regulated: clear set of rules Cleared: credit risk management Anonymous: counterparty is always ICE Clear 4

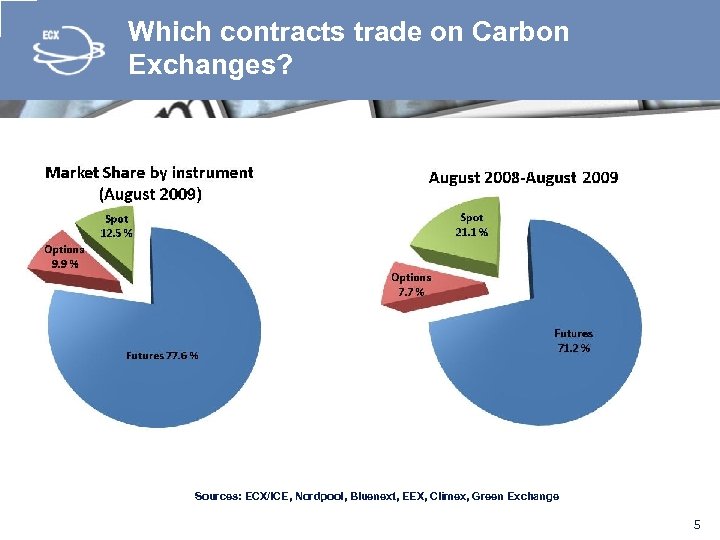

Which contracts trade on Carbon Exchanges? Sources: ECX/ICE, Nordpool, Bluenext, EEX, Climex, Green Exchange 5

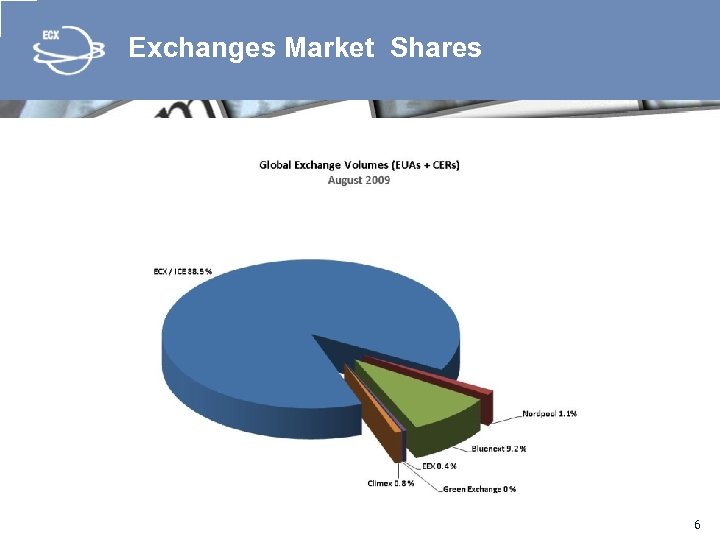

Exchanges Market Shares 6

Spot vs. Futures Contracts • Spot = agree on price, pay and deliver EUAs today • Futures = agree on price, but pay and delivery EUAs in the future eg. Dec 09 • Trading futures with the objective of reducing price risk is known as hedging. Hedging with futures typically involves taking a futures position that is equal & opposite to the physical (spot) position • Benefits of hedging: - Lock in a profit - Reduce your price risk - Cleared market = no counterparty risk • Liquidity of the contracts used for hedging also important 7

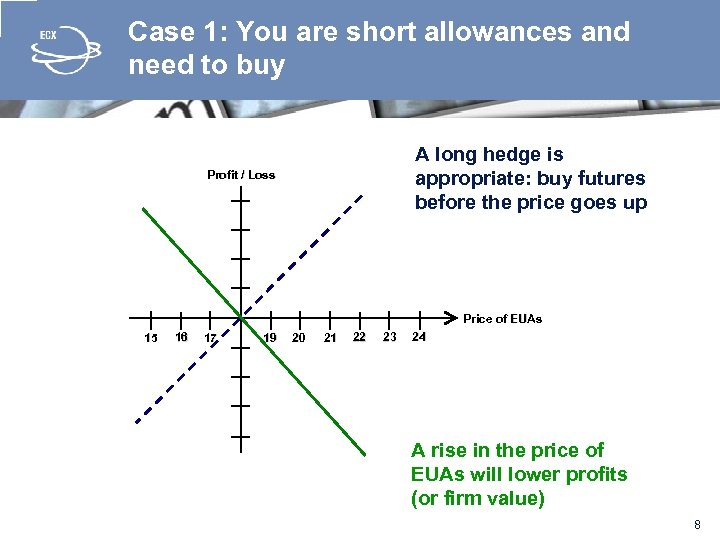

Case 1: You are short allowances and need to buy A long hedge is appropriate: buy futures before the price goes up Profit / Loss Price of EUAs 15 16 17 19 20 21 22 23 24 A rise in the price of EUAs will lower profits (or firm value) 8

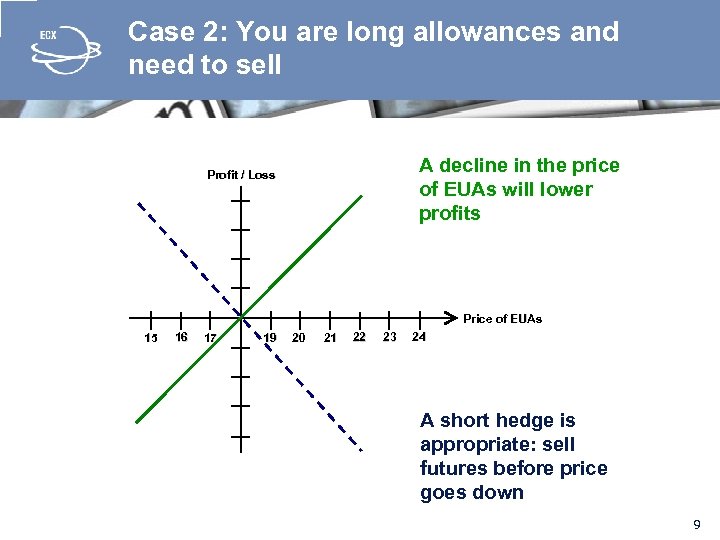

Case 2: You are long allowances and need to sell A decline in the price of EUAs will lower profits Profit / Loss Price of EUAs 15 16 17 19 20 21 22 23 24 A short hedge is appropriate: sell futures before price goes down 9

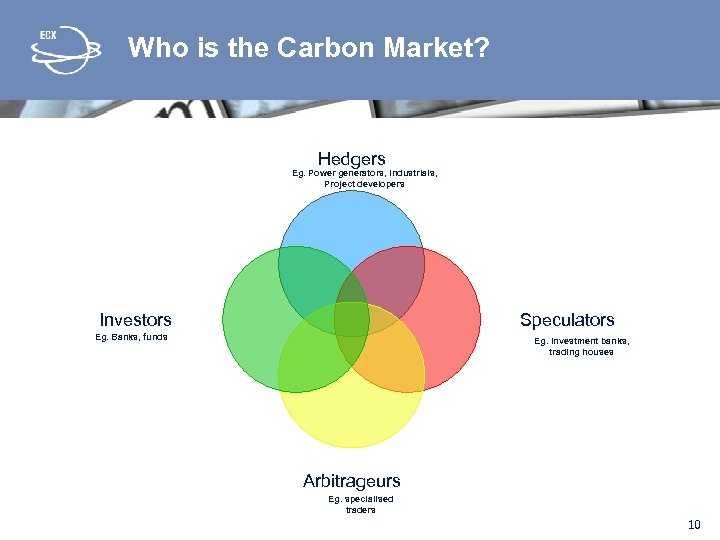

Who is the Carbon Market? Hedgers Eg. Power generators, Industrials, Project developers Investors Speculators Eg. Banks, funds Eg. Investment banks, trading houses Arbitrageurs Eg. specialised traders 10

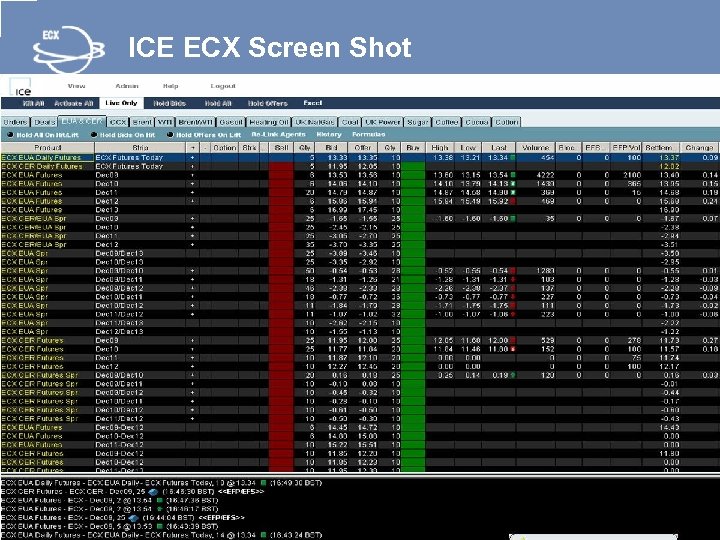

ICE ECX Screen Shot BACK TO CONTENTS 11

![Access to the ECX market Step-by-step process: [1] Select ICE ECX Member (Clearing or Access to the ECX market Step-by-step process: [1] Select ICE ECX Member (Clearing or](https://present5.com/presentation/ff111be2e77d2a63e9140ec26a794301/image-12.jpg)

Access to the ECX market Step-by-step process: [1] Select ICE ECX Member (Clearing or Non-clearing) [2] Agree Terms of Business and specify what you want to trade (Spot/ Futures, EUAs/ CERs) [3] Deposit margin/security with Member [4] Trading can done electronically on the screen or by telephone with aggregator/broker 12

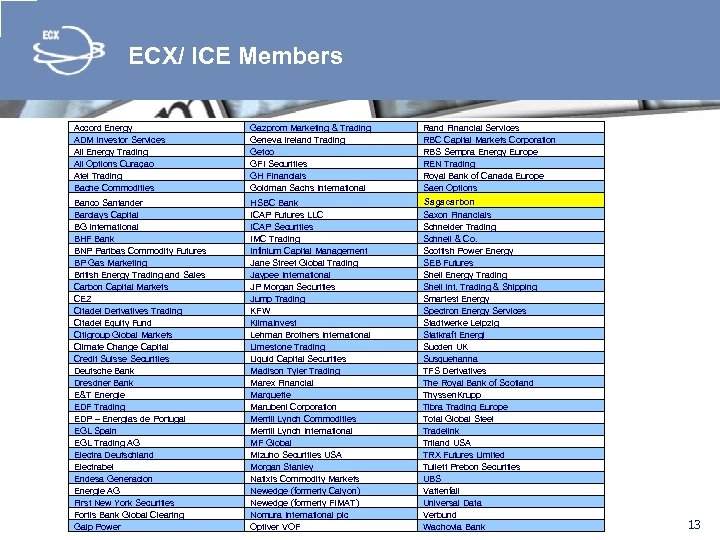

ECX/ ICE Members Accord Energy ADM Investor Services All Energy Trading All Options Curaçao Atel Trading Bache Commodities Gazprom Marketing & Trading Geneva Ireland Trading Getco GFI Securities GH Financials Goldman Sachs International Banco Santander Barclays Capital BG International BHF Bank BNP Paribas Commodity Futures BP Gas Marketing British Energy Trading and Sales Carbon Capital Markets CEZ Citadel Derivatives Trading Citadel Equity Fund Citigroup Global Markets Climate Change Capital Credit Suisse Securities Deutsche Bank Dresdner Bank E&T Energie EDF Trading EDP – Energias de Portugal EGL Spain EGL Trading AG Electra Deutschland Electrabel Endesa Generacion Energie AG First New York Securities Fortis Bank Global Clearing Galp Power HSBC Bank ICAP Futures LLC ICAP Securities IMC Trading Infinium Capital Management Jane Street Global Trading Jaypee International JP Morgan Securities Jump Trading KFW Klima. Invest Lehman Brothers International Limestone Trading Liquid Capital Securities Madison Tyler Trading Marex Financial Marquette Marubeni Corporation Merrill Lynch Commodities Merrill Lynch International MF Global Mizuho Securities USA Morgan Stanley Natixis Commodity Markets Newedge (formerly Calyon) Newedge (formerly FIMAT) Nomura International plc Optiver VOF Rand Financial Services RBC Capital Markets Corporation RBS Sempra Energy Europe REN Trading Royal Bank of Canada Europe Saen Options Sagacarbon Saxon Financials Schneider Trading Schnell & Co. Scottish Power Energy SEB Futures Shell Energy Trading Shell Int. Trading & Shipping Smartest Energy Spectron Energy Services Stadtwerke Leipzig Statkraft Energi Sucden UK Susquehanna TFS Derivatives The Royal Bank of Scotland Thyssen. Krupp Tibra Trading Europe Total Global Steel Tradelink Triland USA TRX Futures Limited Tullett Prebon Securities UBS Vattenfall Universal Data Verbund Wachovia Bank 13

Thank You for Listening! Sara Ståhl Director of Market Development European Climate Exchange Tel: +44 (0)20 7382 7804 Email: sara. stahl@ecx. eu Web: www. ecx. eu 14

ff111be2e77d2a63e9140ec26a794301.ppt