367406581a9a16a70919b1f4519a2fc3.ppt

- Количество слайдов: 41

EUROPEAN CENTRAL BANK and EUROSYSTEM Lecture 12 Monetary policy

European Central Bank • Since 1 January 1999 the European Central Bank (ECB) has been responsible for conducting monetary policy for the euro area European System of Central Banks • The ESCB comprises the ECB and the national central banks (NCBs) of all EU Member States whether they have adopted the euro or not. Eurosystem • The Eurosystem comprises the ECB and the NCBs of those countries that have adopted the euro. The Eurosystem and the ESCB will co-exist as long as there are EU Member States outside the euro area. Euro area • The euro area consists of the EU countries that have adopted the euro.

Euro area NCBs’ contributions to the ECB’s capital The net profits and losses of the ECB are allocated among the euro area NCBs in accordance with Article 33 of the Statute of the European System of Central Banks and of the European Central Bank

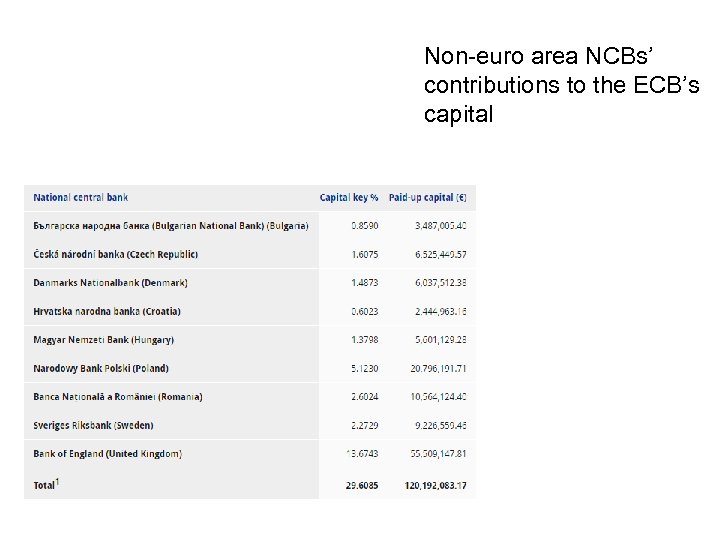

Non-euro area NCBs’ contributions to the ECB’s capital

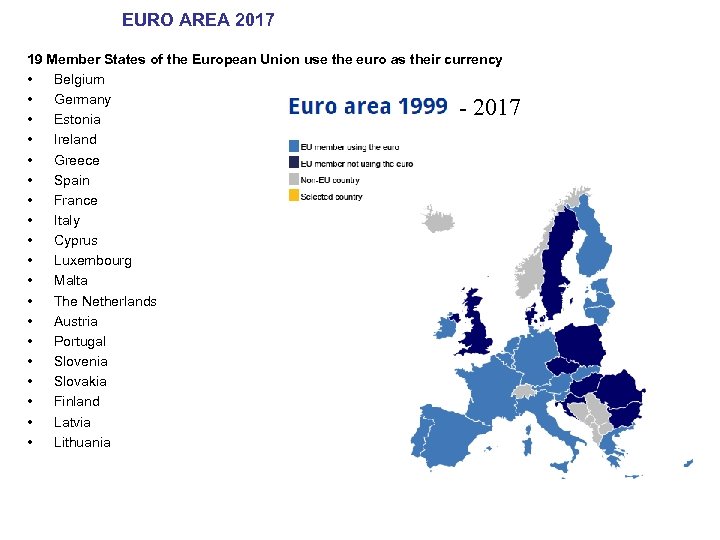

EURO AREA 2017 19 Member States of the European Union use the euro as their currency • Belgium • Germany • Estonia • Ireland • Greece • Spain • France • Italy • Cyprus • Luxembourg • Malta • The Netherlands • Austria • Portugal • Slovenia • Slovakia • Finland • Latvia • Lithuania - 2017

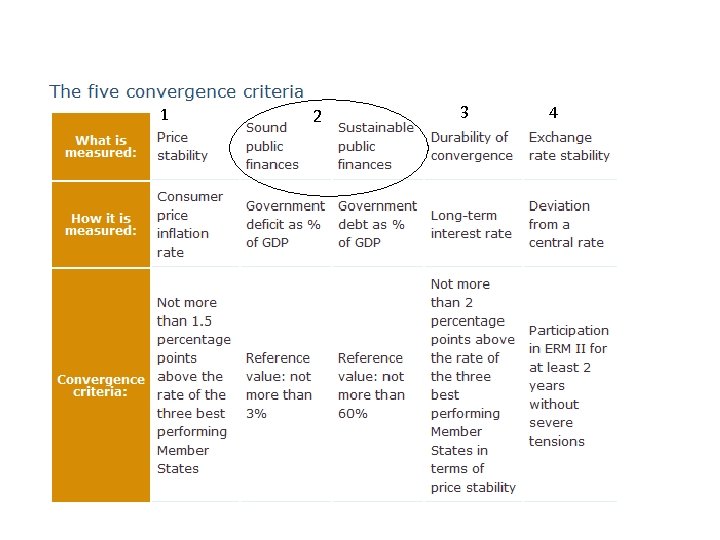

1 2 3 4

!["The primary objective of the European System of Central Banks […] shall be to "The primary objective of the European System of Central Banks […] shall be to](https://present5.com/presentation/367406581a9a16a70919b1f4519a2fc3/image-8.jpg)

"The primary objective of the European System of Central Banks […] shall be to maintain price stability". It continues as follows: "Without prejudice to the objective of price stability, the ESCB shall support the general economic policies in the Union with a view to contributing to the achievement of the objectives of the Union as laid down in Article 3 of the Treaty on European Union. “The Eurosystem is the monetary authority of the euro area. ” The ECB is the central bank for Europe's single currency, the euro. The ECB’s main task is to maintain the euro's purchasing power and thus price stability in the euro area.

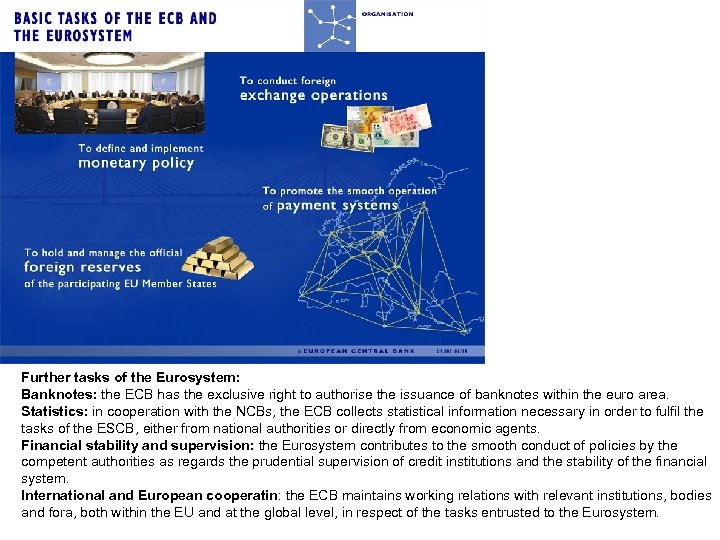

Further tasks of the Eurosystem: Banknotes: the ECB has the exclusive right to authorise the issuance of banknotes within the euro area. Statistics: in cooperation with the NCBs, the ECB collects statistical information necessary in order to fulfil the tasks of the ESCB, either from national authorities or directly from economic agents. Financial stability and supervision: the Eurosystem contributes to the smooth conduct of policies by the competent authorities as regards the prudential supervision of credit institutions and the stability of the financial system. International and European cooperatin: the ECB maintains working relations with relevant institutions, bodies and fora, both within the EU and at the global level, in respect of the tasks entrusted to the Eurosystem.

The Governing Council is the main decision-making body of the ECB. It consists of • the six members of the Executive Board, • plus the governors of the national central banks of the 19 euro area countries.

The Executive Board consists of the President, the Vice-President and four other members

THE GENERAL COUNCIL comprises • the President of the ECB; • the Vice-President of the ECB; • the governors of the national central banks (NCBs) of the 28 EU Member States. In other words, the General Council includes representatives of the 19 euro area countries and the 9 non-euro area countries

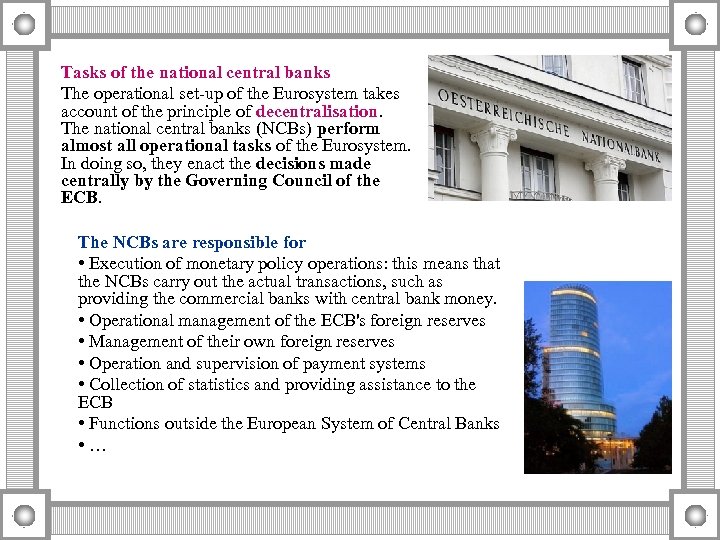

Tasks of the national central banks The operational set-up of the Eurosystem takes account of the principle of decentralisation. The national central banks (NCBs) perform almost all operational tasks of the Eurosystem. In doing so, they enact the decisions made centrally by the Governing Council of the ECB. The NCBs are responsible for • Execution of monetary policy operations: this means that the NCBs carry out the actual transactions, such as providing the commercial banks with central bank money. • Operational management of the ECB's foreign reserves • Management of their own foreign reserves • Operation and supervision of payment systems • Collection of statistics and providing assistance to the ECB • Functions outside the European System of Central Banks • …

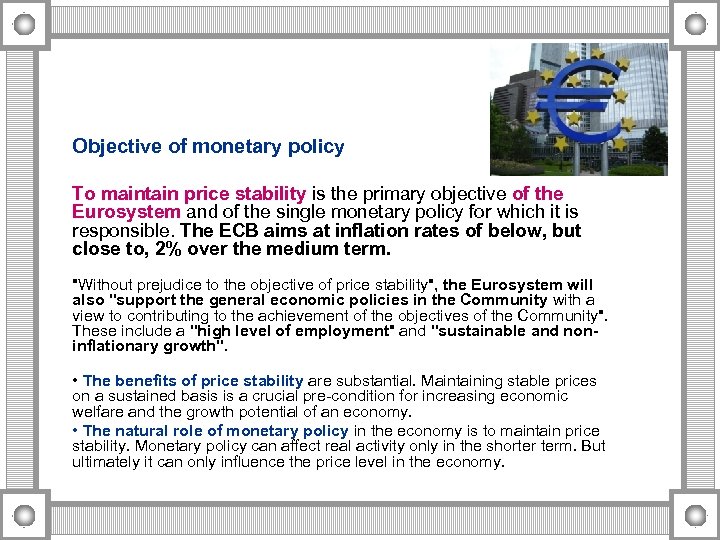

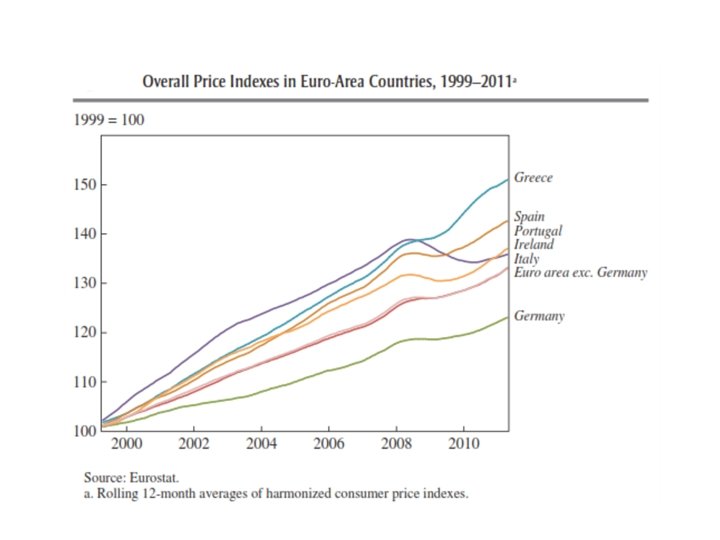

Objective of monetary policy To maintain price stability is the primary objective of the Eurosystem and of the single monetary policy for which it is responsible. The ECB aims at inflation rates of below, but close to, 2% over the medium term. "Without prejudice to the objective of price stability", the Eurosystem will also "support the general economic policies in the Community with a view to contributing to the achievement of the objectives of the Community". These include a "high level of employment" and "sustainable and noninflationary growth". • The benefits of price stability are substantial. Maintaining stable prices on a sustained basis is a crucial pre-condition for increasing economic welfare and the growth potential of an economy. • The natural role of monetary policy in the economy is to maintain price stability. Monetary policy can affect real activity only in the shorter term. But ultimately it can only influence the price level in the economy.

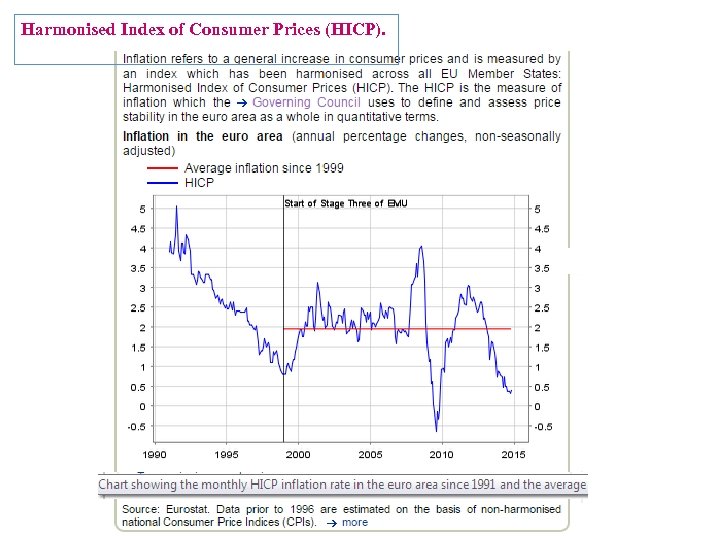

Harmonised Index of Consumer Prices (HICP).

https: //www. ecb. euro pa. eu/stats/prices/hic p/html/inflation. en. ht ml

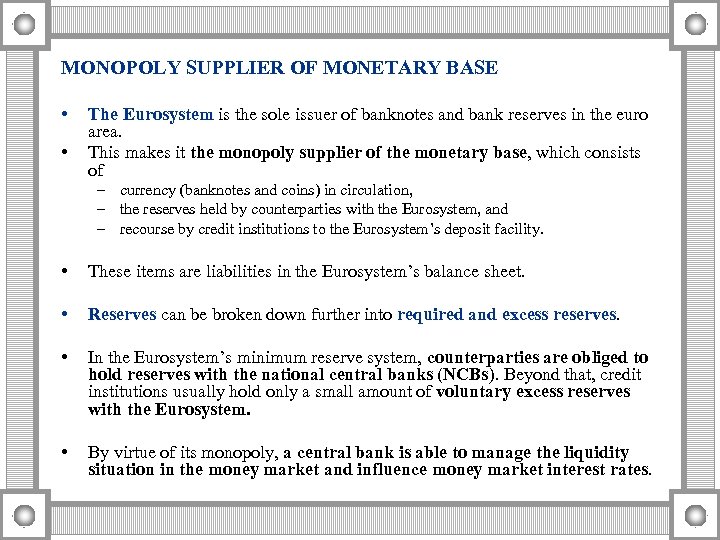

MONOPOLY SUPPLIER OF MONETARY BASE • • The Eurosystem is the sole issuer of banknotes and bank reserves in the euro area. This makes it the monopoly supplier of the monetary base, which consists of – currency (banknotes and coins) in circulation, – the reserves held by counterparties with the Eurosystem, and – recourse by credit institutions to the Eurosystem’s deposit facility. • These items are liabilities in the Eurosystem’s balance sheet. • Reserves can be broken down further into required and excess reserves. • In the Eurosystem’s minimum reserve system, counterparties are obliged to hold reserves with the national central banks (NCBs). Beyond that, credit institutions usually hold only a small amount of voluntary excess reserves with the Eurosystem. • By virtue of its monopoly, a central bank is able to manage the liquidity situation in the money market and influence money market interest rates.

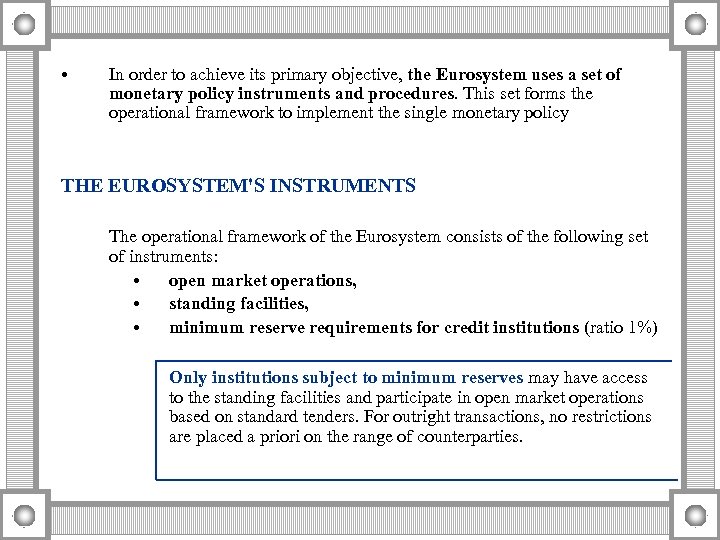

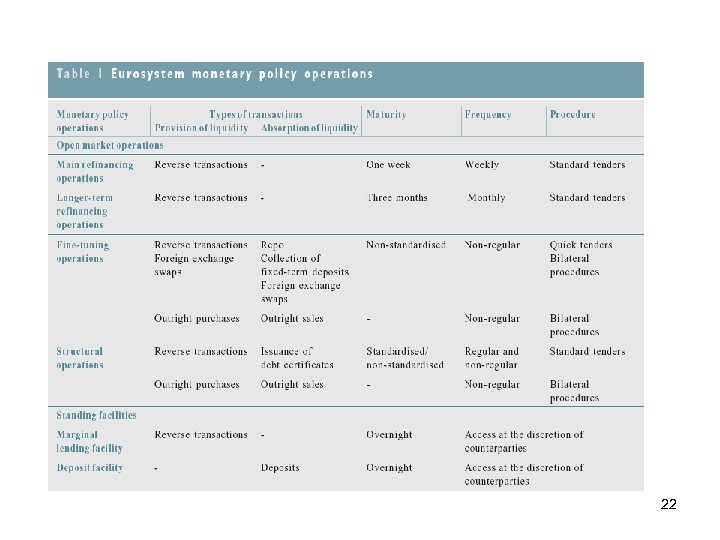

• In order to achieve its primary objective, the Eurosystem uses a set of monetary policy instruments and procedures. This set forms the operational framework to implement the single monetary policy THE EUROSYSTEM'S INSTRUMENTS The operational framework of the Eurosystem consists of the following set of instruments: • open market operations, • standing facilities, • minimum reserve requirements for credit institutions (ratio 1%) Only institutions subject to minimum reserves may have access to the standing facilities and participate in open market operations based on standard tenders. For outright transactions, no restrictions are placed a priori on the range of counterparties.

In addition, since 2009 the ECB has implemented several non-standard monetary policy measures, i. e. asset purchase programmes, to complement the regular operations of the Eurosystem.

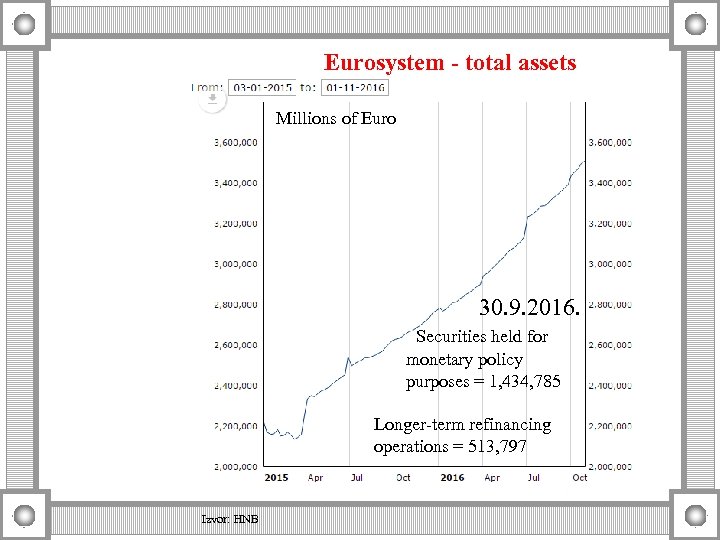

Eurosystem - total assets Millions of Euro 30. 9. 2016. Securities held for monetary policy purposes = 1, 434, 785 Longer-term refinancing operations = 513, 797 Izvor: HNB

22

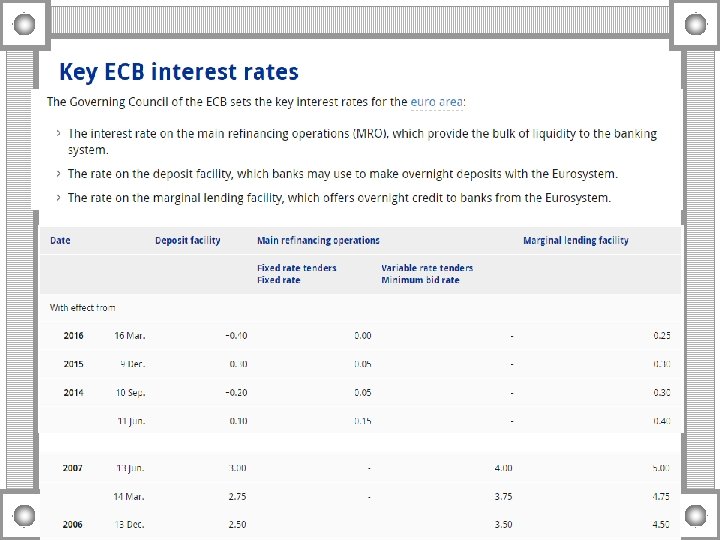

OPEN MARKET OPERATIONS • • Open market operations play an important role in managing interest rates and a liquidity situation in the market as well as signalling the character of monetary policy Open market operations can differ in terms of aim, regularity and procedure. • TYPES OF OPEN MARKET OPERATIONS 1. Main refinancing operations are regular liquidity-providing reverse transactions with a frequency and maturity of one week - - reverse REPOs (repurchase agreements) conducted in the form of collateralised loans). 2. Longer-term refinancing operations are liquidity-providing reverse transactions that are regularly conducted with a monthly frequency and a maturity of three months (but sometimes longer). 3. Fine-tuning operations can be executed on an ad hoc basis to manage the liquidity situation in the market and to steer interest rates. 4. Structural operations will be executed whenever the ECB wishes to adjust the structural position of the Eurosystem vis-à-vis the financial sector (on a regular or non-regular basis). The interest rate on the main refinancing operations (MRO)

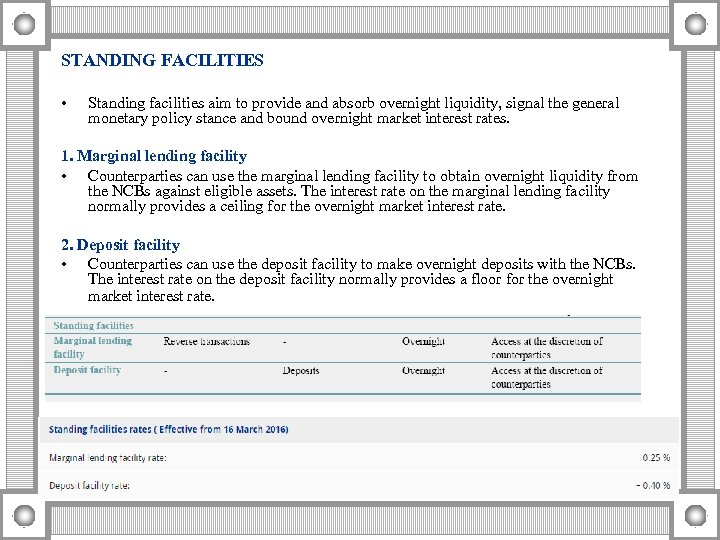

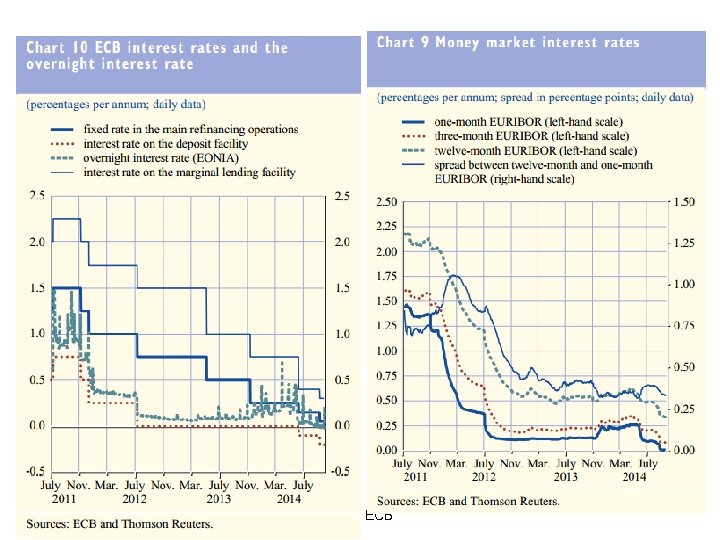

STANDING FACILITIES • Standing facilities aim to provide and absorb overnight liquidity, signal the general monetary policy stance and bound overnight market interest rates. 1. Marginal lending facility • Counterparties can use the marginal lending facility to obtain overnight liquidity from the NCBs against eligible assets. The interest rate on the marginal lending facility normally provides a ceiling for the overnight market interest rate. 2. Deposit facility • Counterparties can use the deposit facility to make overnight deposits with the NCBs. The interest rate on the deposit facility normally provides a floor for the overnight market interest rate.

Izvor: ECB

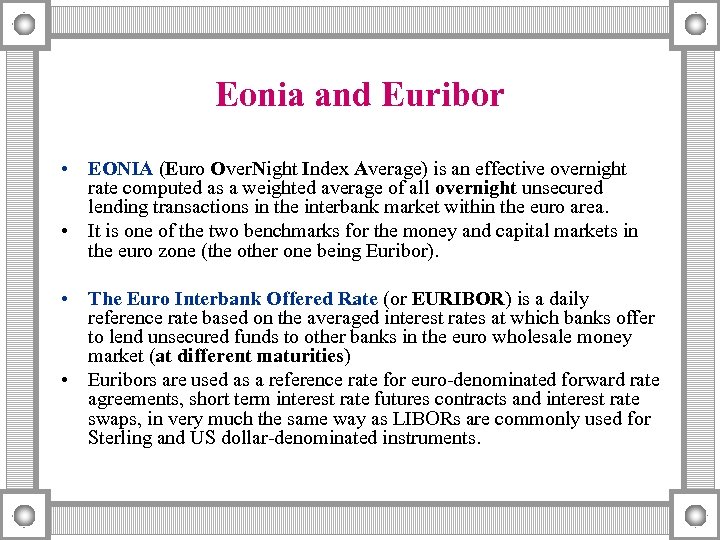

Eonia and Euribor • EONIA (Euro Over. Night Index Average) is an effective overnight rate computed as a weighted average of all overnight unsecured lending transactions in the interbank market within the euro area. • It is one of the two benchmarks for the money and capital markets in the euro zone (the other one being Euribor). • The Euro Interbank Offered Rate (or EURIBOR) is a daily reference rate based on the averaged interest rates at which banks offer to lend unsecured funds to other banks in the euro wholesale money market (at different maturities) • Euribors are used as a reference rate for euro-denominated forward rate agreements, short term interest rate futures contracts and interest rate swaps, in very much the same way as LIBORs are commonly used for Sterling and US dollar-denominated instruments.

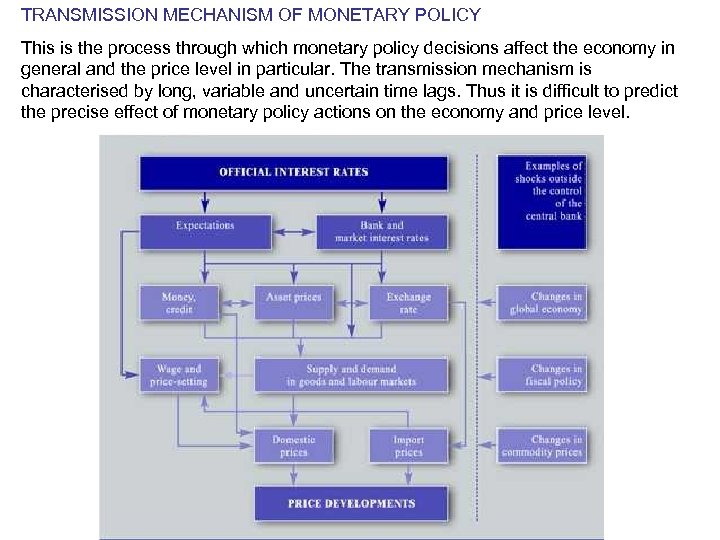

TRANSMISSION MECHANISM OF MONETARY POLICY This is the process through which monetary policy decisions affect the economy in general and the price level in particular. The transmission mechanism is characterised by long, variable and uncertain time lags. Thus it is difficult to predict the precise effect of monetary policy actions on the economy and price level.

European Commission http: //ec. europa. eu/finance/generalpolicy/banking-union/index_en. htm European Central Bank

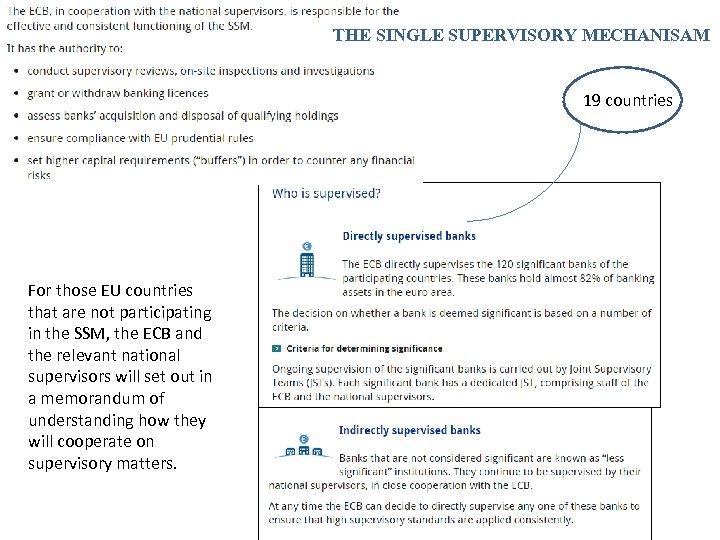

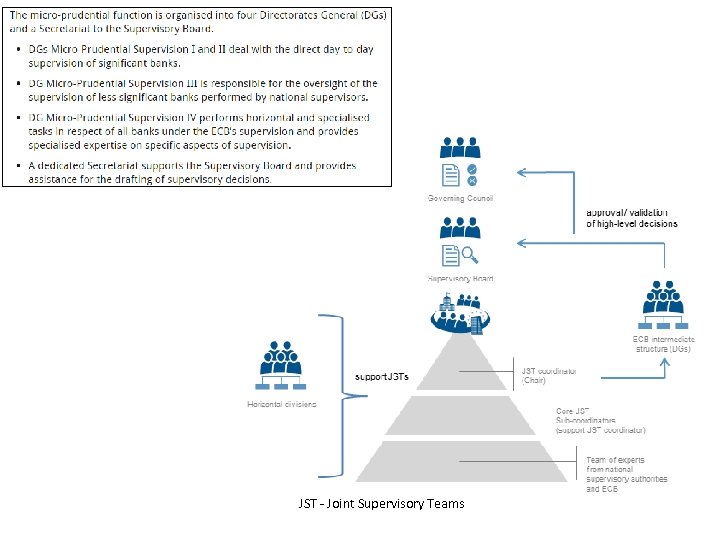

THE SINGLE SUPERVISORY MECHANISAM 19 countries For those EU countries that are not participating in the SSM, the ECB and the relevant national supervisors will set out in a memorandum of understanding how they will cooperate on supervisory matters.

JST - Joint Supervisory Teams

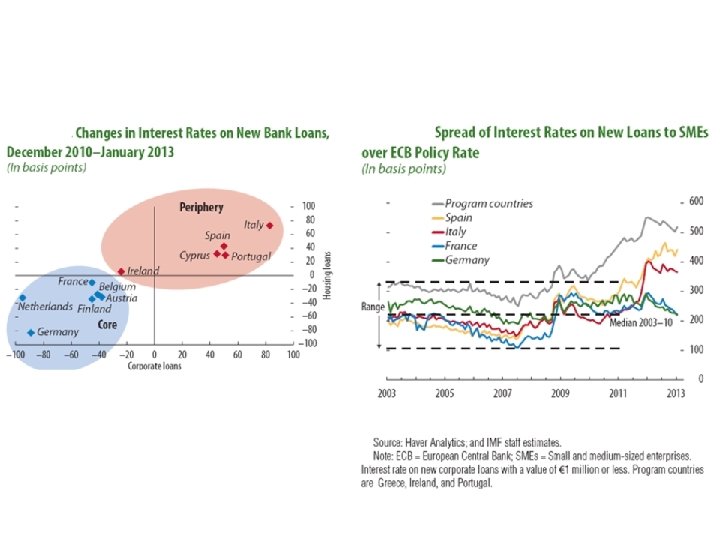

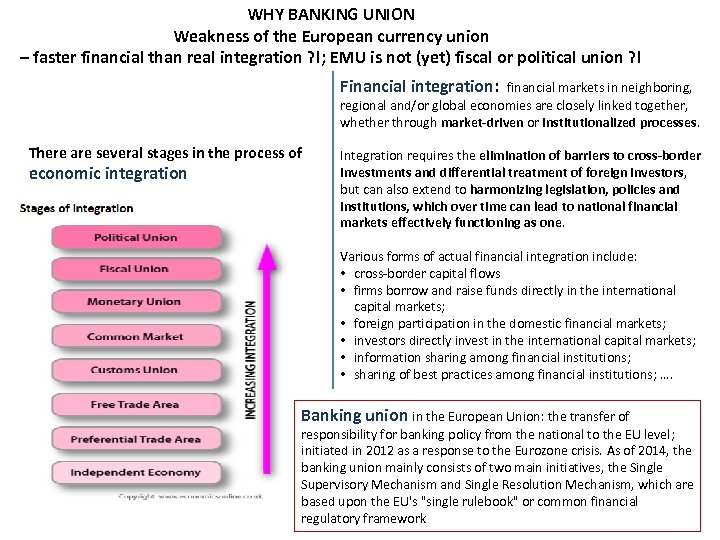

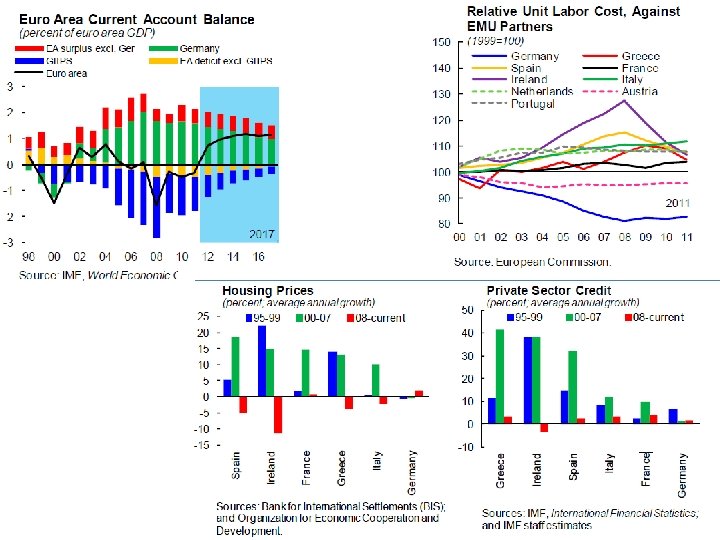

WHY BANKING UNION Weakness of the European currency union – faster financial than real integration ? !; EMU is not (yet) fiscal or political union ? ! Financial integration: financial markets in neighboring, regional and/or global economies are closely linked together, whether through market-driven or institutionalized processes. There are several stages in the process of economic integration Integration requires the elimination of barriers to cross-border investments and differential treatment of foreign investors, but can also extend to harmonizing legislation, policies and institutions, which over time can lead to national financial markets effectively functioning as one. Various forms of actual financial integration include: • cross-border capital flows • firms borrow and raise funds directly in the international capital markets; • foreign participation in the domestic financial markets; • investors directly invest in the international capital markets; • information sharing among financial institutions; • sharing of best practices among financial institutions; …. Banking union in the European Union: the transfer of responsibility for banking policy from the national to the EU level; initiated in 2012 as a response to the Eurozone crisis. As of 2014, the banking union mainly consists of two main initiatives, the Single Supervisory Mechanism and Single Resolution Mechanism, which are based upon the EU's "single rulebook" or common financial regulatory framework

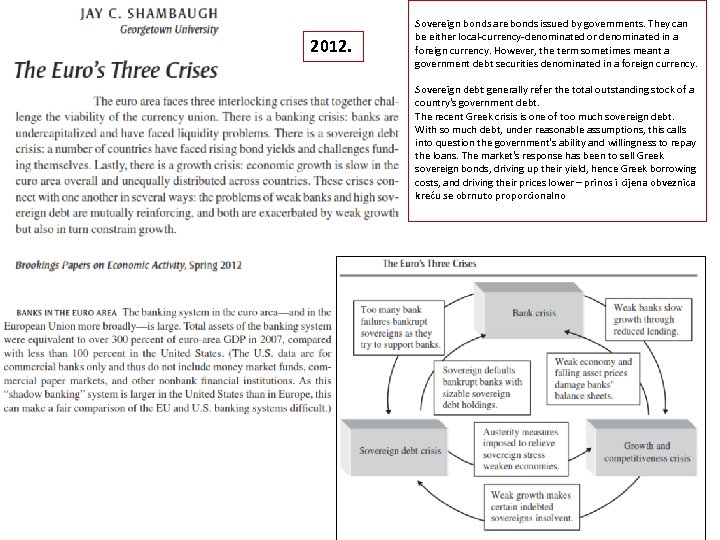

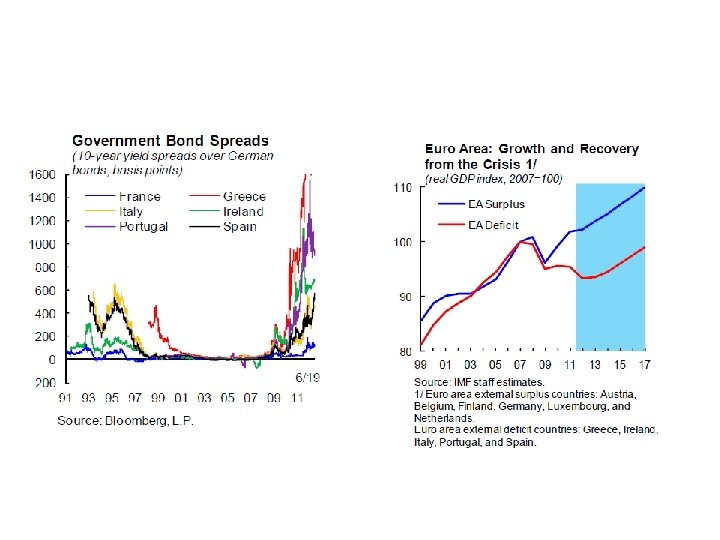

2012. Sovereign bonds are bonds issued by governments. They can be either local-currency-denominated or denominated in a foreign currency. However, the term sometimes meant a government debt securities denominated in a foreign currency. Sovereign debt generally refer the total outstanding stock of a country's government debt. The recent Greek crisis is one of too much sovereign debt. With so much debt, under reasonable assumptions, this calls into question the government's ability and willingness to repay the loans. The market's response has been to sell Greek sovereign bonds, driving up their yield, hence Greek borrowing costs, and driving their prices lower – prinos i cijena obveznica kreću se obrnuto proporcionalno 34

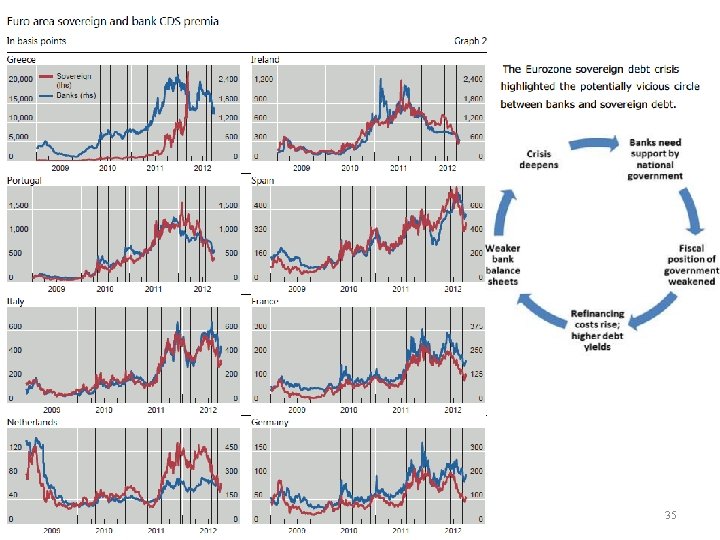

35

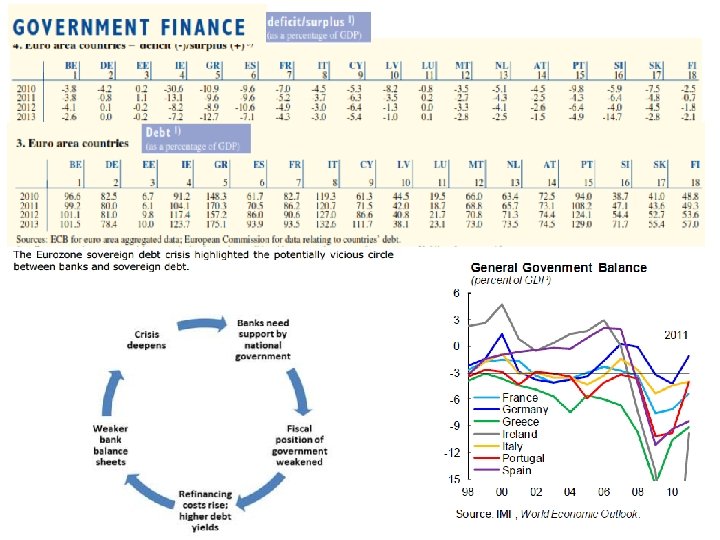

36

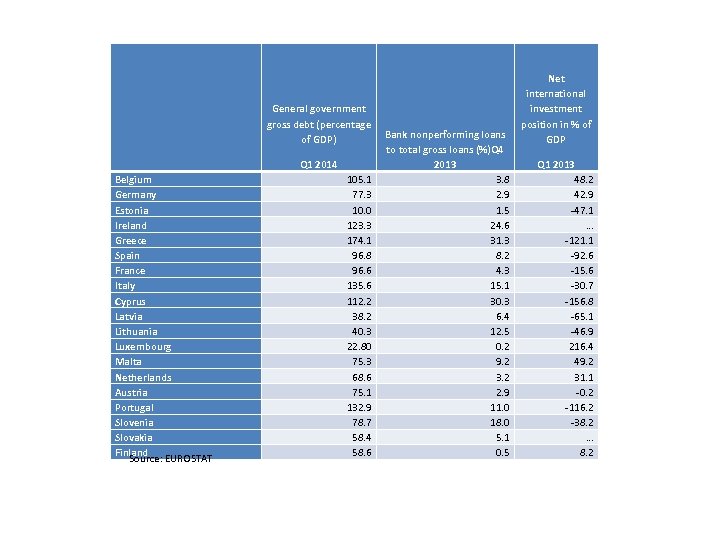

General government gross debt (percentage of GDP) Q 1 2014 Belgium Germany Estonia Ireland Greece Spain France Italy Cyprus Latvia Lithuania Luxembourg Malta Netherlands Austria Portugal Slovenia Slovakia Finland Source: EUROSTAT 105. 1 77. 3 10. 0 123. 3 174. 1 96. 8 96. 6 135. 6 112. 2 38. 2 40. 3 22. 80 75. 3 68. 6 75. 1 132. 9 78. 7 58. 4 58. 6 Bank nonperforming loans to total gross loans (%)Q 4 2013 3. 8 2. 9 1. 5 24. 6 31. 3 8. 2 4. 3 15. 1 30. 3 6. 4 12. 5 0. 2 9. 2 3. 2 2. 9 11. 0 18. 0 5. 1 0. 5 Net international investment position in % of GDP Q 1 2013 48. 2 42. 9 -47. 1 … -121. 1 -92. 6 -15. 6 -30. 7 -156. 8 -65. 1 -46. 9 216. 4 49. 2 31. 1 -0. 2 -116. 2 -38. 2 … 8. 2

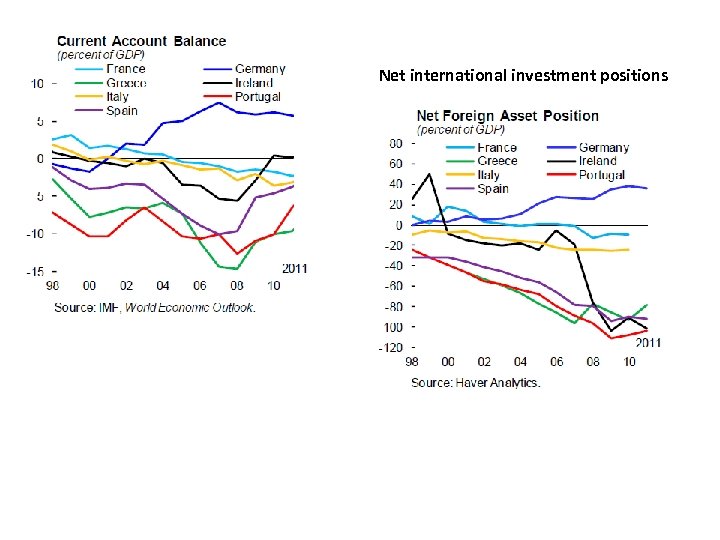

Net international investment positions

367406581a9a16a70919b1f4519a2fc3.ppt