e7df0a8ecb24c725d642ed5e4936f34e.ppt

- Количество слайдов: 56

EURES IE/NI Cross Border Partnership Breakfast Briefing on Tax Implications for Cross Border Employers & Workers

Tax Implications for Cross Border Employers & Workers Thurs 21 st May 2015, Dundalk CROSS-BORDER EMPLOYMENT LAW Brian Morgan Mc. Manus Solicitors Clones

Morgan Mc. Manus Solicitors • Practising in Republic of Ireland Northern Ireland • Web : www. morganmcmanus. com • Comparative Analysis of Employment Law North & South • 2013 Booklet with Pinsent Mason Solicitors • ezine Newsletter – register on website

TOPICS • • Jurisdiction and Posted Workers Directive Discipline and Dismissal Redundancy Minimum Notice

JURISDICTION AND POSTED WORKERS DIRECTIVE

JURISDICTION • Employees are protected by the employment legislation of the country where he / she mainly works • Art 6. 1 of Rome Convention: choice of law made by parties to an employment agreement shall not have result of depriving an employee of the protection afforded by the mandatory rules of law applicable in the country where the employee habitually carries out his / her work.

JURISDICTION (cont’d) • Directive 96/71/EC • Known as the “Posted Workers Directive” • Stipulates that workers who are posted by their employer from one EU Country to another for limited periods should have at least the same basic terms and conditions of employment as workers habitually employed in the EU country to which they are posted

JURISDICTION (cont’d) • “Forum Shopping” • An employee might take an action in a particular country because it applies the law most favorable to his / her case

DISCIPLINE and DISMISSAL

DISCIPLINE AND DISMISSAL • General Principles • An employer must be consistent in applying Procedures; • Employees must know what is expected of them and what will happen if they fall below expectation; • An employer must ascertain the full facts before taking Disciplinary Action;

DISCIPLINE AND DISMISSAL • General Principles (cont`d) • Employees must be allowed to question the facts and to present their Defence; • Employees are entitled to representation; • Employees are entitled to be treated as individuals.

DISCIPLINE AND DISMISSAL (cont’d) • PROCEDURES IRELAND • Labour Relations Commission Code on “Grievance and Disciplinary Procedures” issued May 2000. • Code : non-statutory, but Tribunal will be guided by the Code.

DISCIPLINE AND DISMISSAL (cont’d) • • PROCEDURES NORTHERN IRELAND Employment Act (Northern Ireland) 2011 Procedures are Statutory The Labour Relations Agency Code of Practise on Disciplinary & Grievance Procedures issued 3 rd April 2011

DISCIPLINE AND DISMISSAL (cont’d) • NORTHERN IRELAND • A Dismissal is deemed unfair where one of the statutory disciplinary procedures applied, the procedure was not completed and the noncompletion of the procedure was wholly or mainly attributable to a failure by the employer to comply with the requirement.

DISCIPLINE AND DISMISSAL (cont’d) • • NORTHERN IRELAND “ 3 STEPS” procedure Subject to “requisite service” provision Send a letter Hold a Meeting Hold an Appeal “requisite service”? – normally one year

DISCIPLINE AND DISMISSAL (cont’d) • NORTHERN IRELAND • SANCTIONS FOR FAILURE TO APPLY PROCEDURES – 3 POSSIBILITIES • Automatic Unfair Dismissal – min basic award of 4 weeks pay • If wholly or mainly fault of employer – increase of Award by at least 10% + discretion of Tribunal to increase further to up to 50%

DISCIPLINE AND DISMISSAL (cont’d) • NORTHERN IRELAND (Sanctions cont’d) • If wholly or mainly the fault of the employee – Tribunal should reduce the Award by at least 10% with a discretion to reduce by up to 50%.

DISCIPLINE AND DISMISSAL (cont’d) • IRELAND • More a question of compliance with Labour Relations Commission Code • And Custom and Practice • All the circumstances taken into account

DISCIPLINE AND DISMISSAL (cont’d) • Cross–Border Employer • In what circumstances are you required to use NI statutory procedures? • What about the “Posted Worker? ” • If unclear, ensure to take legal advice before implementing procedures

REDUNDANCY

REDUNDANCY • Redundancy is Dismissal • The same procedures as apply in Disciplinary matters apply also to Redundancy Consultation and Dismissal • Be careful to apply the appropriate procedure relevant to the jurisdiction of the employee`s Employment Contract

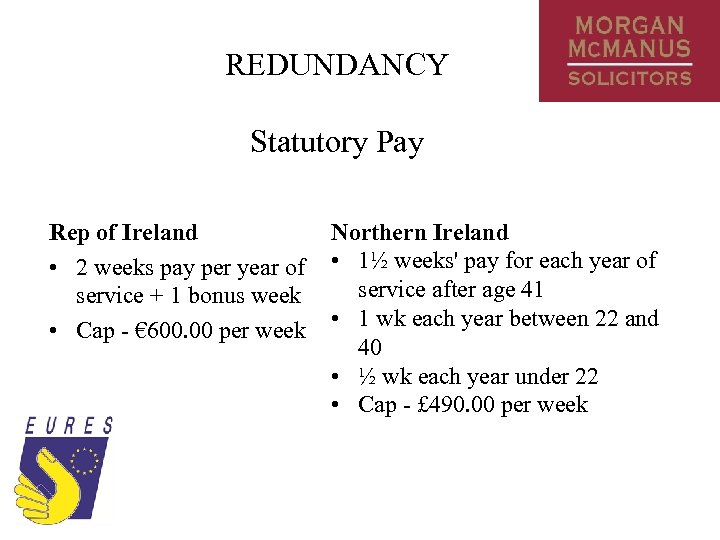

REDUNDANCY Statutory Pay Northern Ireland Rep of Ireland • 2 weeks pay per year of • 1½ weeks' pay for each year of service after age 41 service + 1 bonus week • Cap - € 600. 00 per week • 1 wk each year between 22 and 40 • ½ wk each year under 22 • Cap - £ 490. 00 per week

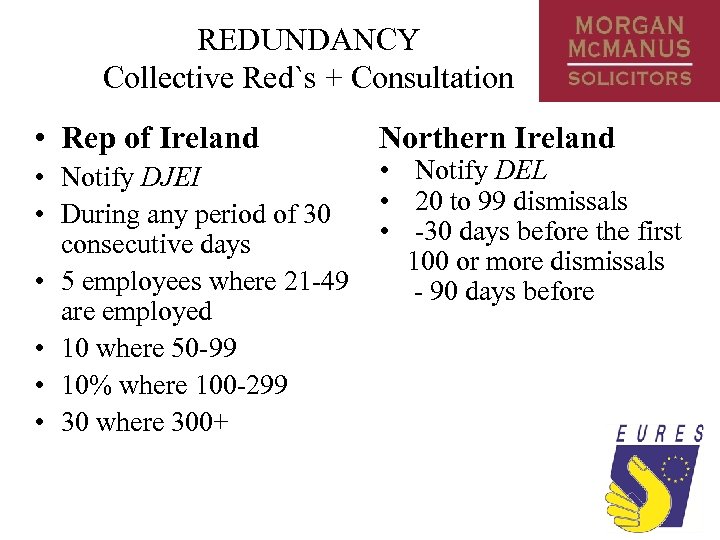

REDUNDANCY Collective Red`s + Consultation • Rep of Ireland • Notify DJEI • During any period of 30 consecutive days • 5 employees where 21 -49 are employed • 10 where 50 -99 • 10% where 100 -299 • 30 where 300+ Northern Ireland • Notify DEL • 20 to 99 dismissals • -30 days before the first 100 or more dismissals - 90 days before

MINIMUM NOTICE

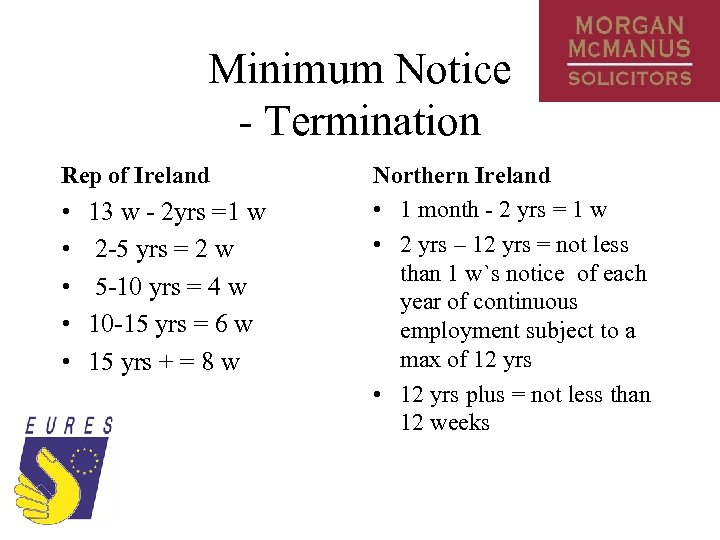

Minimum Notice - Termination Rep of Ireland • • • 13 w - 2 yrs =1 w 2 -5 yrs = 2 w 5 -10 yrs = 4 w 10 -15 yrs = 6 w 15 yrs + = 8 w Northern Ireland • 1 month - 2 yrs = 1 w • 2 yrs – 12 yrs = not less than 1 w`s notice of each year of continuous employment subject to a max of 12 yrs • 12 yrs plus = not less than 12 weeks

Employment Law and other Cross Border Resources • • Morgan Mc. Manus website – Ezine BLOGS and Articles

QUESTIONS ?

To keep informed Register to receive our Monthly Ezine (Visit Home Page of website)

Morgan Mc. Manus Solicitors Advising the Private Client and the Business Community Web – www. morganmcmanus. com

EURES IE/NI Cross Border Partnership Breakfast Briefing on Tax Implications for Cross Border Employers & Workers

Taxation Implications for Cross Border Employers and Contractors Rose Tierney

1. Tax Implications for Employers employing Cross Border Workers or having staff working on either side of the border. 2. Redundancy, Pensions and Social Insurance in a cross border context.

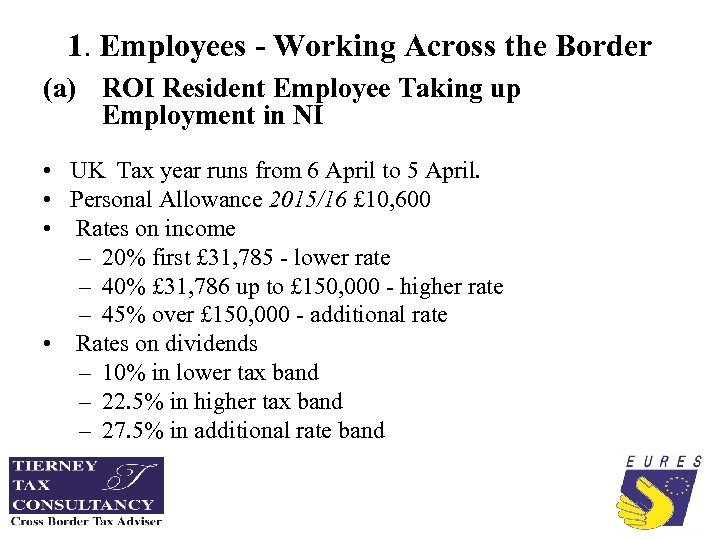

1. Employees - Working Across the Border (a) ROI Resident Employee Taking up Employment in NI • UK Tax year runs from 6 April to 5 April. • Personal Allowance 2015/16 £ 10, 600 • Rates on income – 20% first £ 31, 785 - lower rate – 40% £ 31, 786 up to £ 150, 000 - higher rate – 45% over £ 150, 000 - additional rate • Rates on dividends – 10% in lower tax band – 22. 5% in higher tax band – 27. 5% in additional rate band

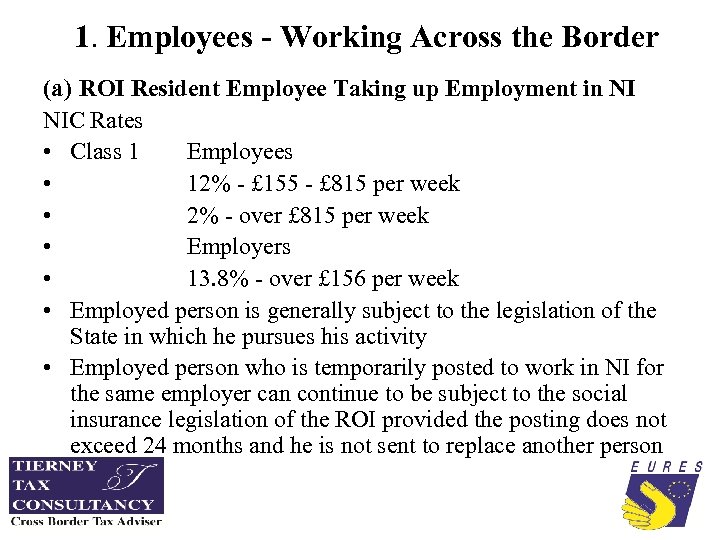

1. Employees - Working Across the Border (a) ROI Resident Employee Taking up Employment in NI NIC Rates • Class 1 Employees • 12% - £ 155 - £ 815 per week • 2% - over £ 815 per week • Employers • 13. 8% - over £ 156 per week • Employed person is generally subject to the legislation of the State in which he pursues his activity • Employed person who is temporarily posted to work in NI for the same employer can continue to be subject to the social insurance legislation of the ROI provided the posting does not exceed 24 months and he is not sent to replace another person

1. Employees - Working Across the Border (a) ROI Resident Employee Taking up Employment in NI • Requirement to File a Tax Return – “Foreign” Income must be returned. The taxes deducted in the UK are available as a double tax credit against the ROI tax and USC on the same income. • Cross Border Workers Relief (Transborder Relief) – ROI residents who commute to work in the UK. – Employment must be held for 13 weeks continuously – Tax must be paid in UK on employment income. – For every week the individual works abroad, he/she must be present in the ROI for at least one day in that week. – The relief can be claimed instead of the double taxation credit whichever is more favourable for the employee. – Separate assessment of spouses may be preferable.

1. Employees - Working Across the Border (a) ROI Resident Employee Taking up Employment in NI • Double Tax Treaty Relief for Certain Government Workers • The ROI UK tax treaty Article 18 deals gives relief for certain government salaries and pensions • The relief is that the income is only taxed in the state of employment and not in their home state. • Eg ROI resident would not be taxed in the ROI on the employment income from government service in the UK. • What is government service? • Not all State funded employments are included. • In order to qualify for relief the employee must be rendering services to the government or a local authority and must be discharging services of a governmental nature. • No relief – nurses, teachers, IDA etc • Relief – Council workers

1. Employees - Working Across the Border (b) NI Resident Employee Taking up Employment in ROI • Tax year -1 January to 31 December. • A tax credit system applies. Income is taxed at rates and bands then credits deducted. • Joint assessment and married credit only applies to non residents where the entire income of the spouse is taxable in ROI. • However aggregation can be used (TB 67) where the couple would be better off. This will however reduce the credit available against UK tax on the same income.

1. Employees - Working Across the Border • (b) NI Resident Employee Taking up Employment in ROI • Tax Rates on income – 20% first € 33, 800 (Single) up to € 67, 600 (Married) - lower rate – Balance at 40% - marginal rate • Personal Tax Credit 2015 € 1, 650 (Single) € 3, 300 (Married) • Employee Tax Credit 2015 € 1, 650

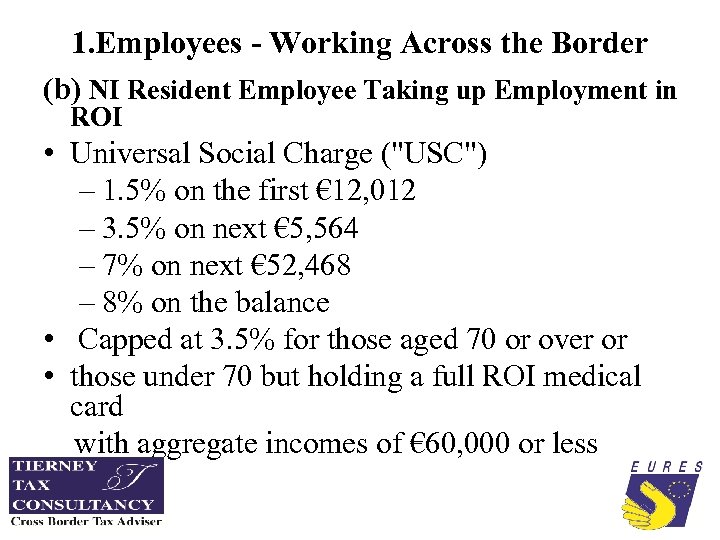

1. Employees - Working Across the Border (b) NI Resident Employee Taking up Employment in ROI • Universal Social Charge ("USC") – 1. 5% on the first € 12, 012 – 3. 5% on next € 5, 564 – 7% on next € 52, 468 – 8% on the balance • Capped at 3. 5% for those aged 70 or over or • those under 70 but holding a full ROI medical card with aggregate incomes of € 60, 000 or less

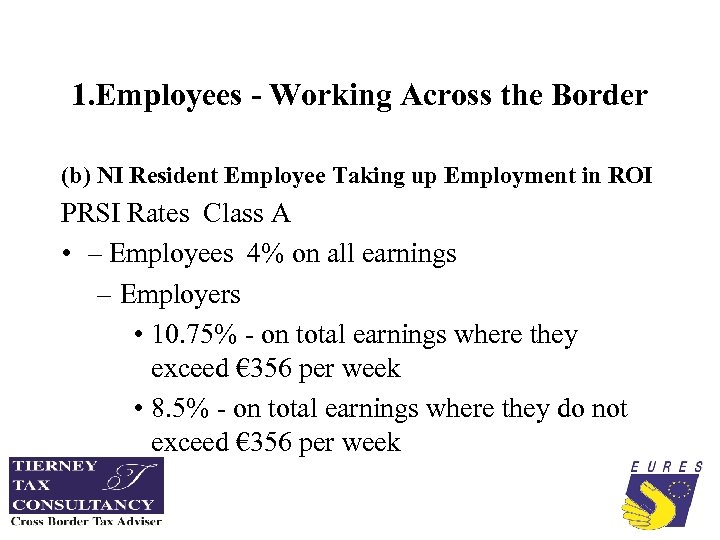

1. Employees - Working Across the Border (b) NI Resident Employee Taking up Employment in ROI PRSI Rates Class A • – Employees 4% on all earnings – Employers • 10. 75% - on total earnings where they exceed € 356 per week • 8. 5% - on total earnings where they do not exceed € 356 per week

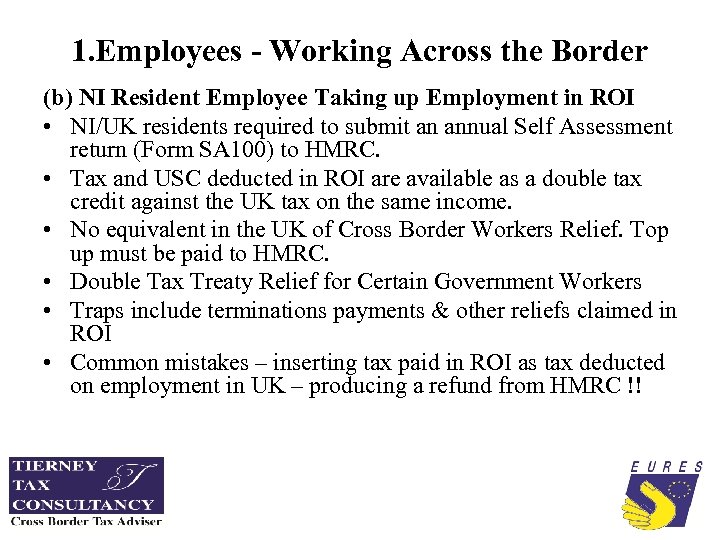

1. Employees - Working Across the Border (b) NI Resident Employee Taking up Employment in ROI • NI/UK residents required to submit an annual Self Assessment return (Form SA 100) to HMRC. • Tax and USC deducted in ROI are available as a double tax credit against the UK tax on the same income. • No equivalent in the UK of Cross Border Workers Relief. Top up must be paid to HMRC. • Double Tax Treaty Relief for Certain Government Workers • Traps include terminations payments & other reliefs claimed in ROI • Common mistakes – inserting tax paid in ROI as tax deducted on employment in UK – producing a refund from HMRC !!

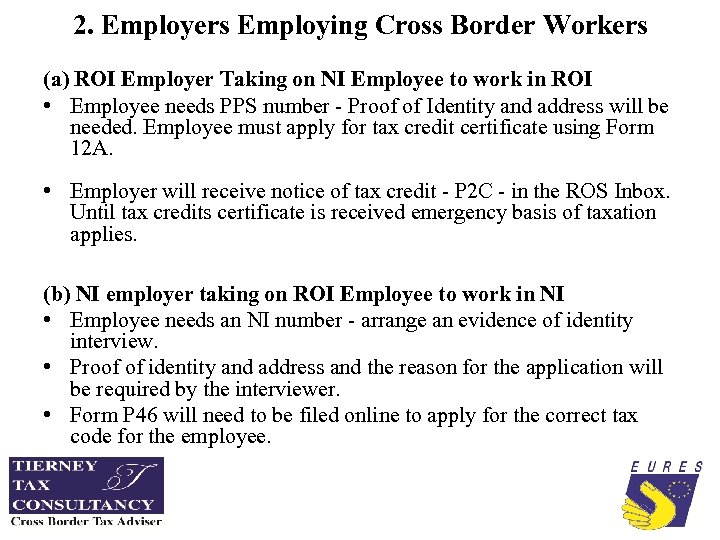

2. Employers Employing Cross Border Workers (a) ROI Employer Taking on NI Employee to work in ROI • Employee needs PPS number - Proof of Identity and address will be needed. Employee must apply for tax credit certificate using Form 12 A. • Employer will receive notice of tax credit - P 2 C - in the ROS Inbox. Until tax credits certificate is received emergency basis of taxation applies. (b) NI employer taking on ROI Employee to work in NI • Employee needs an NI number - arrange an evidence of identity interview. • Proof of identity and address and the reason for the application will be required by the interviewer. • Form P 46 will need to be filed online to apply for the correct tax code for the employee.

3. The Tax Implications of Having Staff Working on Either Side of the Border • (a) NI Employer taking on employees to carry out duties in ROI • Requirement to register as an ROI employer if employees duties exceed 183 days in calendar year to 31 December. • Register online on ROS or on paper Forms Prem Reg or TR 1/TR 2. • The 60 day and 183 day Rules • Not required to register if employee spends less than 60 days on duties in ROI in a calendar year • Where days spent >60 <183 not required to register provided conditions satisfied

3. The Tax Implications of Having Staff Working on Either Side of the Border (b) ROI Employer taking on employees to carry out duties in NI (or rest of UK) • 183 day rule - requirement to register as a UK employer if the employee performs duties of employment in NI /UK exceeding 183 days in a tax year (ended 5 April). • If from the outset it is known that the employee will exceed 183 days on duties then employer registration must commence from the outset. • Register as an employer online at www. hmrc. gov. uk. • UK operating PAYE Real Time Information (RTI) system. Employers are required to provide online reports which will include details of the employees, the payments made to them and the deductions. This information has to be provided on or before each payday. Penalties can apply.

Other Issues • UK Workplace Pension • Automatic enrolment’ • A new law means that every employer must automatically enrol workers into a workplace pension scheme if they: – are aged between 22 and State Pension age – earn more than £ 10, 000 a year – work in the UK

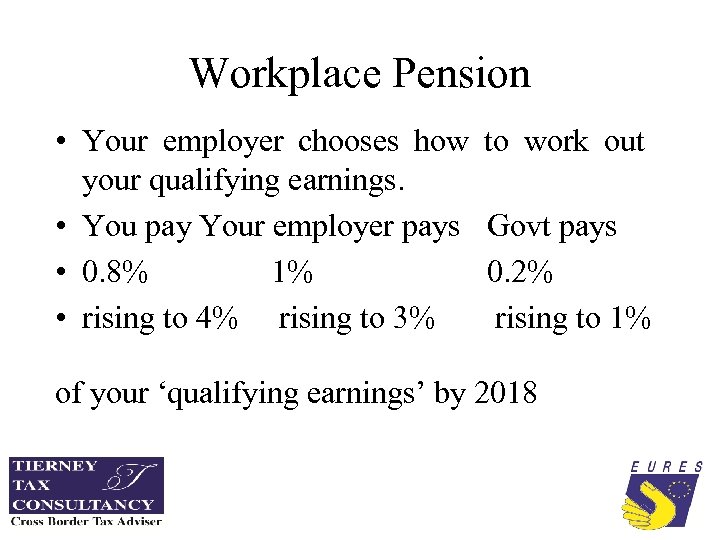

Workplace Pension • The law says a minimum percentage of your ‘qualifying earnings’ must be paid into your workplace pension scheme. • ‘Qualifying earnings’ are either: • the amount you earn before tax between £ 5, 824 and £ 42, 385 a year • your entire salary or wages before tax

Workplace Pension • Your employer chooses how to work out your qualifying earnings. • You pay Your employer pays Govt pays • 0. 8% 1% 0. 2% • rising to 4% rising to 3% rising to 1% of your ‘qualifying earnings’ by 2018

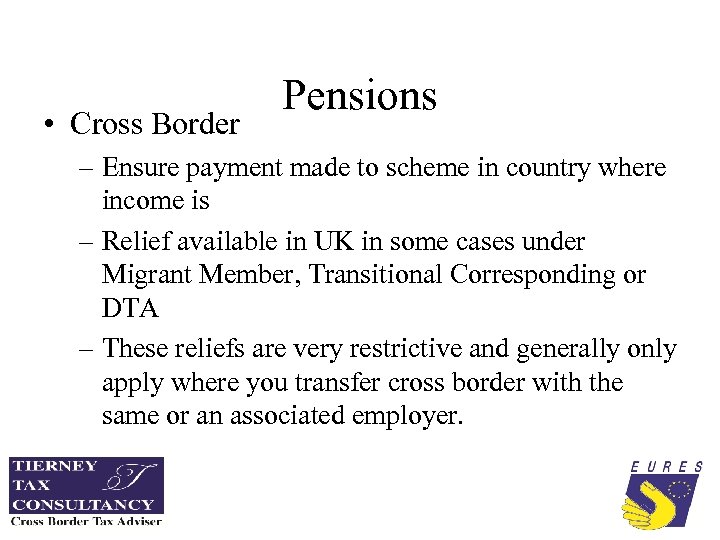

• Cross Border Pensions – Ensure payment made to scheme in country where income is – Relief available in UK in some cases under Migrant Member, Transitional Corresponding or DTA – These reliefs are very restrictive and generally only apply where you transfer cross border with the same or an associated employer.

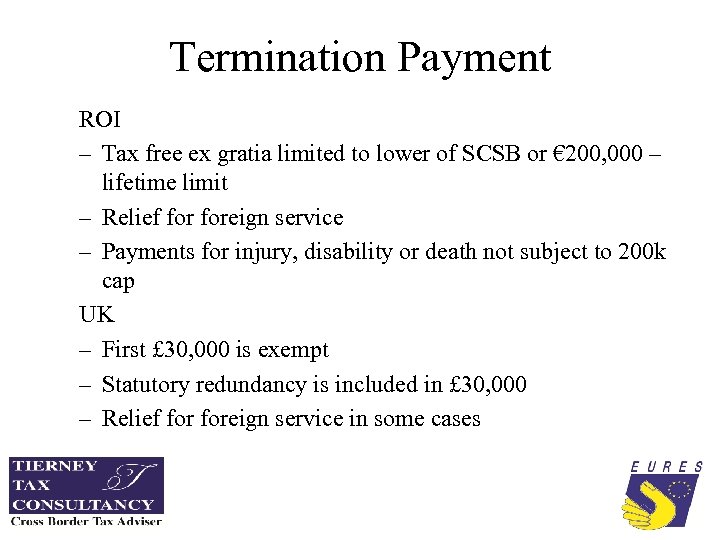

Termination Payment ROI – Tax free ex gratia limited to lower of SCSB or € 200, 000 – lifetime limit – Relief foreign service – Payments for injury, disability or death not subject to 200 k cap UK – First £ 30, 000 is exempt – Statutory redundancy is included in £ 30, 000 – Relief foreign service in some cases

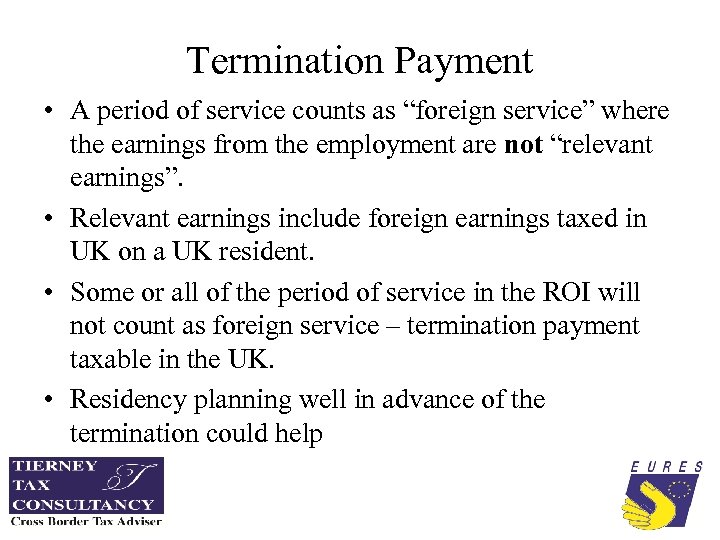

Termination Payment • A period of service counts as “foreign service” where the earnings from the employment are not “relevant earnings”. • Relevant earnings include foreign earnings taxed in UK on a UK resident. • Some or all of the period of service in the ROI will not count as foreign service – termination payment taxable in the UK. • Residency planning well in advance of the termination could help

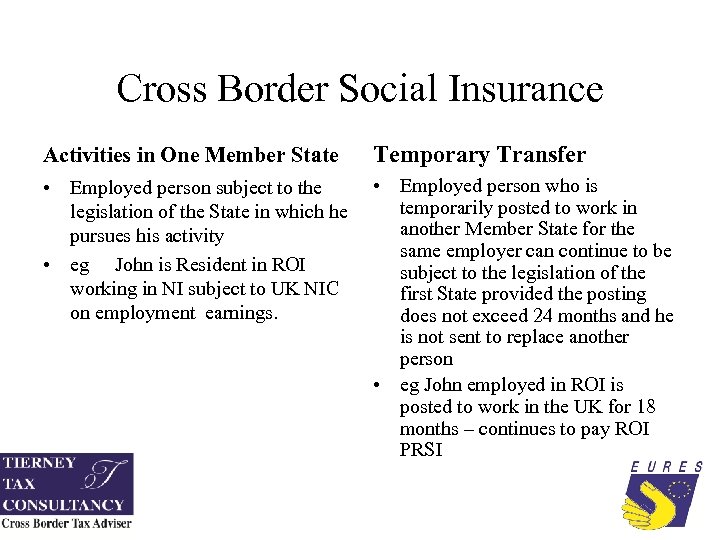

Cross Border Social Insurance Activities in One Member State Temporary Transfer • Employed person who is • Employed person subject to the temporarily posted to work in legislation of the State in which he another Member State for the pursues his activity same employer can continue to be • eg John is Resident in ROI subject to the legislation of the working in NI subject to UK NIC first State provided the posting on employment earnings. does not exceed 24 months and he is not sent to replace another person • eg John employed in ROI is posted to work in the UK for 18 months – continues to pay ROI PRSI

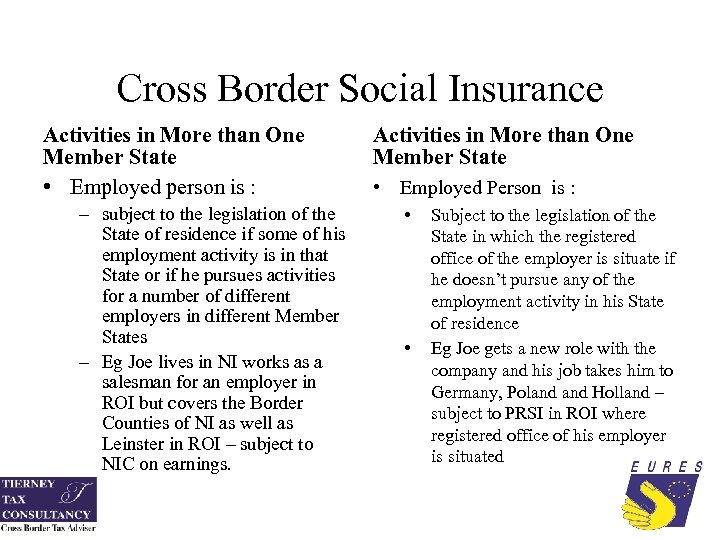

Cross Border Social Insurance Activities in More than One Member State • Employed person is : – subject to the legislation of the State of residence if some of his employment activity is in that State or if he pursues activities for a number of different employers in different Member States – Eg Joe lives in NI works as a salesman for an employer in ROI but covers the Border Counties of NI as well as Leinster in ROI – subject to NIC on earnings. Activities in More than One Member State • Employed Person is : • • Subject to the legislation of the State in which the registered office of the employer is situate if he doesn’t pursue any of the employment activity in his State of residence Eg Joe gets a new role with the company and his job takes him to Germany, Poland Holland – subject to PRSI in ROI where registered office of his employer is situated

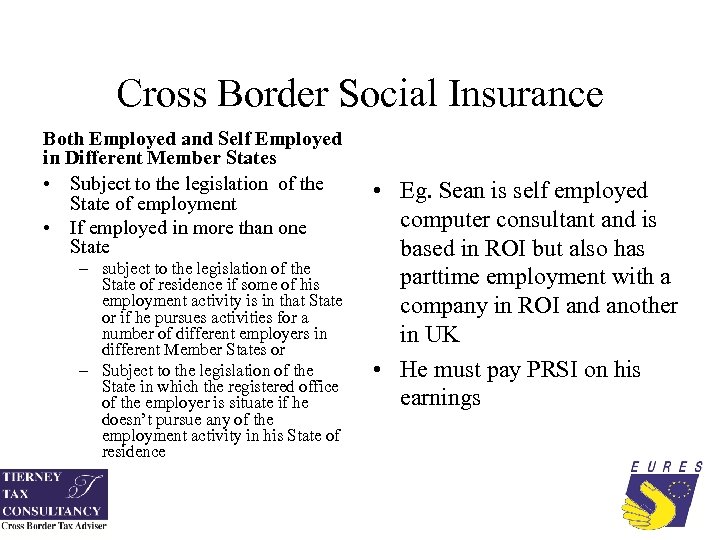

Cross Border Social Insurance Both Employed and Self Employed in Different Member States • Subject to the legislation of the State of employment • If employed in more than one State – subject to the legislation of the State of residence if some of his employment activity is in that State or if he pursues activities for a number of different employers in different Member States or – Subject to the legislation of the State in which the registered office of the employer is situate if he doesn’t pursue any of the employment activity in his State of residence • Eg. Sean is self employed computer consultant and is based in ROI but also has parttime employment with a company in ROI and another in UK • He must pay PRSI on his earnings

• EU and Bilateral agreements allow the Social Contributions made in EU and other bilateral countries to be taken into account when assessing eligibility to Social Welfare and State Pension.

Questions? • • Contact Details: Rose Tierney Tel: 047 57843 Email: rose@tierneytax. ie

EURES IE/NI Cross Border Partnership Eures Cross Border Partnership Floor 1, Millennium Building St. Alphonsus Road Dundalk County Louth Dundalk Chamber Unit 4, Partnership Court Park Street Dundalk County Louth www. eures-crossborder. org www. dundalk. ie

e7df0a8ecb24c725d642ed5e4936f34e.ppt