bcb5e0bec247e74b018e5ddd01d3c360.ppt

- Количество слайдов: 18

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com European-Asian law congress ninth session International tax and legal regulation of cross-border taxation in BRICS countries Procedural aspects of taxation of permanent establishments in BRICS countries Eugene A. Zakharov Yekaterinburg, June 18 -19, 2015

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com European-Asian law congress ninth session International tax and legal regulation of cross-border taxation in BRICS countries Procedural aspects of taxation of permanent establishments in BRICS countries Eugene A. Zakharov Yekaterinburg, June 18 -19, 2015

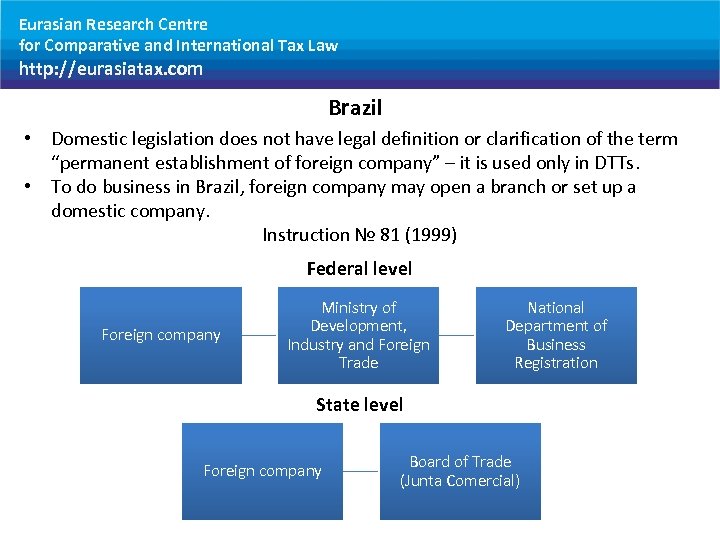

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Brazil • Domestic legislation does not have legal definition or clarification of the term “permanent establishment of foreign company” – it is used only in DTTs. • To do business in Brazil, foreign company may open a branch or set up a domestic company. Instruction № 81 (1999) Federal level Foreign company Ministry of Development, Industry and Foreign Trade National Department of Business Registration State level Foreign company Board of Trade (Junta Comercial)

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Brazil • Domestic legislation does not have legal definition or clarification of the term “permanent establishment of foreign company” – it is used only in DTTs. • To do business in Brazil, foreign company may open a branch or set up a domestic company. Instruction № 81 (1999) Federal level Foreign company Ministry of Development, Industry and Foreign Trade National Department of Business Registration State level Foreign company Board of Trade (Junta Comercial)

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Brazil (continue) Concept of “permanent establishment” is based on OECD Model Convention “Source taxation” or “residence”? Source taxation – easy way Permanent establishment: 1. Activities within Brazil de-facto 2. Activities through dependent agent Service permanent establishment: Article 5 (Permanent establishment) – only in Brazil-China DTT Articles 7 (Business income), 12 (Royalties), 21 (Other income) (not available now)

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Brazil (continue) Concept of “permanent establishment” is based on OECD Model Convention “Source taxation” or “residence”? Source taxation – easy way Permanent establishment: 1. Activities within Brazil de-facto 2. Activities through dependent agent Service permanent establishment: Article 5 (Permanent establishment) – only in Brazil-China DTT Articles 7 (Business income), 12 (Royalties), 21 (Other income) (not available now)

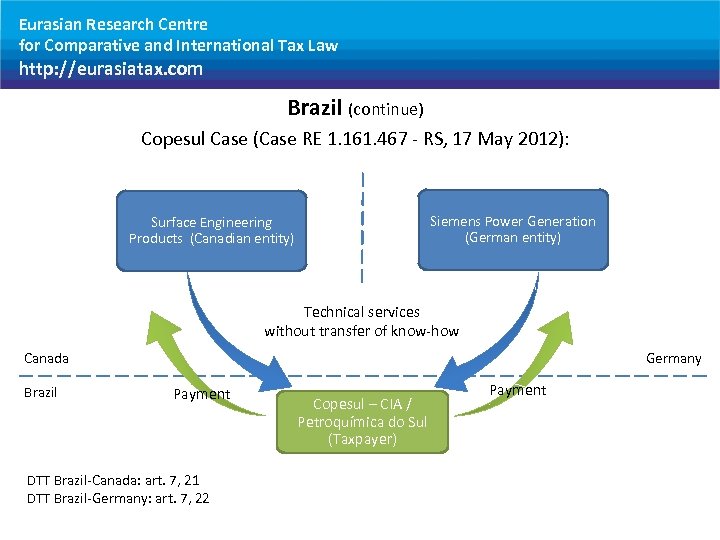

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Brazil (continue) Copesul Case (Case RE 1. 161. 467 - RS, 17 May 2012): Surface Engineering Products (Canadian entity) Siemens Power Generation (German entity) Technical services without transfer of know-how Canada Brazil Germany Payment DTT Brazil-Canada: art. 7, 21 DTT Brazil-Germany: art. 7, 22 Copesul – CIA / Petroquímica do Sul (Taxpayer) Payment

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Brazil (continue) Copesul Case (Case RE 1. 161. 467 - RS, 17 May 2012): Surface Engineering Products (Canadian entity) Siemens Power Generation (German entity) Technical services without transfer of know-how Canada Brazil Germany Payment DTT Brazil-Canada: art. 7, 21 DTT Brazil-Germany: art. 7, 22 Copesul – CIA / Petroquímica do Sul (Taxpayer) Payment

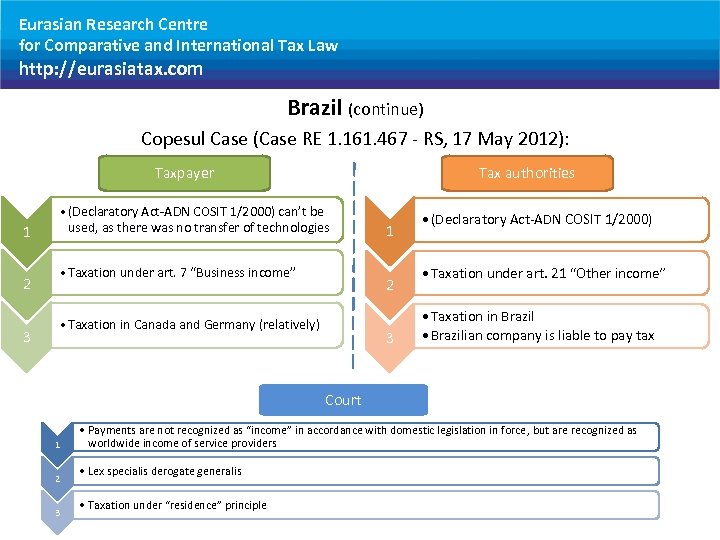

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Brazil (continue) Copesul Case (Case RE 1. 161. 467 - RS, 17 May 2012): Taxpayer 1 2 3 Tax authorities • (Declaratory Act-ADN COSIT 1/2000) can’t be used, as there was no transfer of technologies • Taxation under art. 7 “Business income” 1 2 • Taxation in Canada and Germany (relatively) 3 • (Declaratory Act-ADN COSIT 1/2000) • Taxation under art. 21 “Other income” • Taxation in Brazil • Brazilian company is liable to pay tax Court 1 2 3 • Payments are not recognized as “income” in accordance with domestic legislation in force, but are recognized as worldwide income of service providers • Lex specialis derogate generalis • Taxation under “residence” principle

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Brazil (continue) Copesul Case (Case RE 1. 161. 467 - RS, 17 May 2012): Taxpayer 1 2 3 Tax authorities • (Declaratory Act-ADN COSIT 1/2000) can’t be used, as there was no transfer of technologies • Taxation under art. 7 “Business income” 1 2 • Taxation in Canada and Germany (relatively) 3 • (Declaratory Act-ADN COSIT 1/2000) • Taxation under art. 21 “Other income” • Taxation in Brazil • Brazilian company is liable to pay tax Court 1 2 3 • Payments are not recognized as “income” in accordance with domestic legislation in force, but are recognized as worldwide income of service providers • Lex specialis derogate generalis • Taxation under “residence” principle

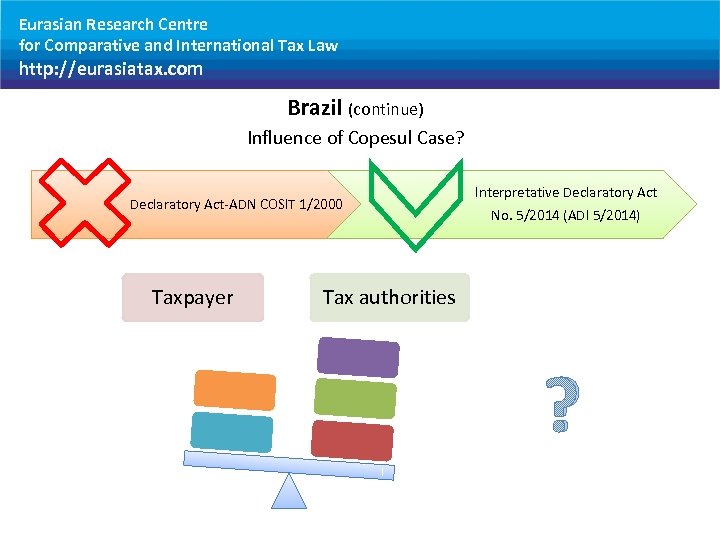

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Brazil (continue) Influence of Copesul Case? Declaratory Act-ADN COSIT 1/2000 Taxpayer Interpretative Declaratory Act No. 5/2014 (ADI 5/2014) Tax authorities ?

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Brazil (continue) Influence of Copesul Case? Declaratory Act-ADN COSIT 1/2000 Taxpayer Interpretative Declaratory Act No. 5/2014 (ADI 5/2014) Tax authorities ?

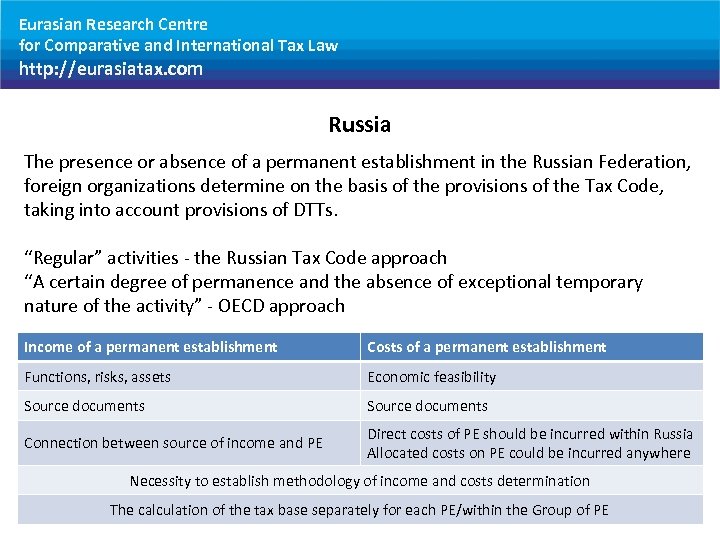

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Russia The presence or absence of a permanent establishment in the Russian Federation, foreign organizations determine on the basis of the provisions of the Tax Code, taking into account provisions of DTTs. “Regular” activities - the Russian Tax Code approach “A certain degree of permanence and the absence of exceptional temporary nature of the activity” - OECD approach Income of a permanent establishment Costs of a permanent establishment Functions, risks, assets Economic feasibility Source documents Connection between source of income and PE Direct costs of PE should be incurred within Russia Allocated costs on PE could be incurred anywhere Necessity to establish methodology of income and costs determination The calculation of the tax base separately for each PE/within the Group of PE

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Russia The presence or absence of a permanent establishment in the Russian Federation, foreign organizations determine on the basis of the provisions of the Tax Code, taking into account provisions of DTTs. “Regular” activities - the Russian Tax Code approach “A certain degree of permanence and the absence of exceptional temporary nature of the activity” - OECD approach Income of a permanent establishment Costs of a permanent establishment Functions, risks, assets Economic feasibility Source documents Connection between source of income and PE Direct costs of PE should be incurred within Russia Allocated costs on PE could be incurred anywhere Necessity to establish methodology of income and costs determination The calculation of the tax base separately for each PE/within the Group of PE

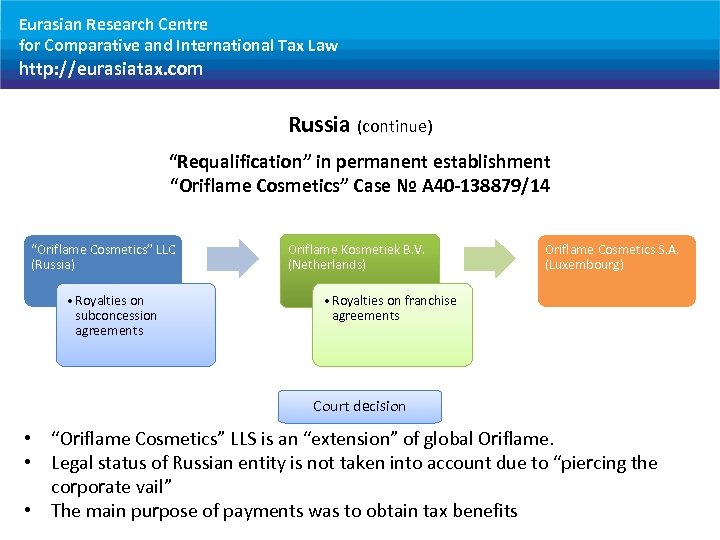

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Russia (continue) “Requalification” in permanent establishment “Oriflame Cosmetics” Case № А 40 -138879/14 “Oriflame Cosmetics” LLC (Russia) • Royalties on subconcession agreements Oriflame Kosmetiek B. V. (Netherlands) Oriflame Cosmetics S. A. (Luxembourg) • Royalties on franchise agreements Court decision • “Oriflame Cosmetics” LLS is an “extension” of global Oriflame. • Legal status of Russian entity is not taken into account due to “piercing the corporate vail” • The main purpose of payments was to obtain tax benefits

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Russia (continue) “Requalification” in permanent establishment “Oriflame Cosmetics” Case № А 40 -138879/14 “Oriflame Cosmetics” LLC (Russia) • Royalties on subconcession agreements Oriflame Kosmetiek B. V. (Netherlands) Oriflame Cosmetics S. A. (Luxembourg) • Royalties on franchise agreements Court decision • “Oriflame Cosmetics” LLS is an “extension” of global Oriflame. • Legal status of Russian entity is not taken into account due to “piercing the corporate vail” • The main purpose of payments was to obtain tax benefits

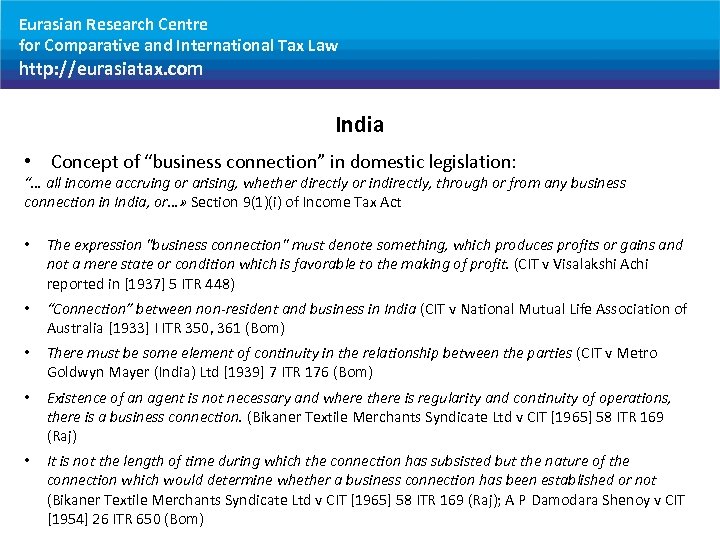

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com India • Concept of “business connection” in domestic legislation: “… all income accruing or arising, whether directly or indirectly, through or from any business connection in India, or…» Section 9(1)(i) of Income Tax Act • The expression "business connection" must denote something, which produces profits or gains and not a mere state or condition which is favorable to the making of profit. (CIT v Visalakshi Achi reported in [1937] 5 ITR 448) • “Connection” between non-resident and business in India (CIT v National Mutual Life Association of Australia [1933] I ITR 350, 361 (Bom) • There must be some element of continuity in the relationship between the parties (CIT v Metro Goldwyn Mayer (India) Ltd [1939] 7 ITR 176 (Bom) • Existence of an agent is not necessary and where there is regularity and continuity of operations, there is a business connection. (Bikaner Textile Merchants Syndicate Ltd v CIT [1965] 58 ITR 169 (Raj) • It is not the length of time during which the connection has subsisted but the nature of the connection which would determine whether a business connection has been established or not (Bikaner Textile Merchants Syndicate Ltd v CIT [1965] 58 ITR 169 (Raj); A P Damodara Shenoy v CIT [1954] 26 ITR 650 (Bom)

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com India • Concept of “business connection” in domestic legislation: “… all income accruing or arising, whether directly or indirectly, through or from any business connection in India, or…» Section 9(1)(i) of Income Tax Act • The expression "business connection" must denote something, which produces profits or gains and not a mere state or condition which is favorable to the making of profit. (CIT v Visalakshi Achi reported in [1937] 5 ITR 448) • “Connection” between non-resident and business in India (CIT v National Mutual Life Association of Australia [1933] I ITR 350, 361 (Bom) • There must be some element of continuity in the relationship between the parties (CIT v Metro Goldwyn Mayer (India) Ltd [1939] 7 ITR 176 (Bom) • Existence of an agent is not necessary and where there is regularity and continuity of operations, there is a business connection. (Bikaner Textile Merchants Syndicate Ltd v CIT [1965] 58 ITR 169 (Raj) • It is not the length of time during which the connection has subsisted but the nature of the connection which would determine whether a business connection has been established or not (Bikaner Textile Merchants Syndicate Ltd v CIT [1965] 58 ITR 169 (Raj); A P Damodara Shenoy v CIT [1954] 26 ITR 650 (Bom)

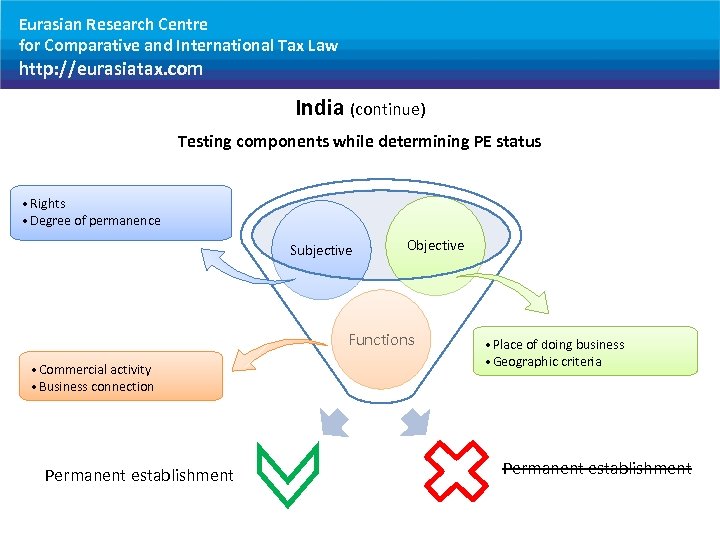

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com India (continue) Testing components while determining PE status • Rights • Degree of permanence Subjective Objective Functions • Commercial activity • Business connection Permanent establishment • Place of doing business • Geographic criteria Permanent establishment

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com India (continue) Testing components while determining PE status • Rights • Degree of permanence Subjective Objective Functions • Commercial activity • Business connection Permanent establishment • Place of doing business • Geographic criteria Permanent establishment

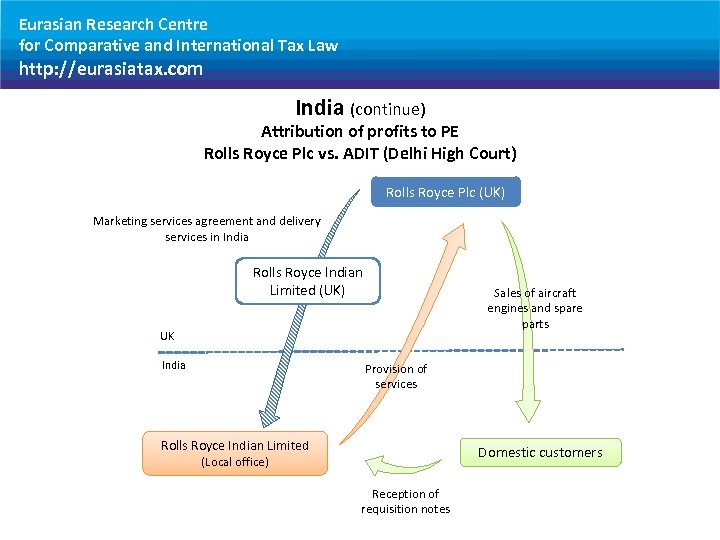

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com India (continue) Attribution of profits to PE Rolls Royce Plc vs. ADIT (Delhi High Court) Rolls Royce Plc (UK) Marketing services agreement and delivery services in India Rolls Royce Indian Limited (UK) UK India Sales of aircraft engines and spare parts Provision of services Rolls Royce Indian Limited Domestic customers (Local office) Reception of requisition notes

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com India (continue) Attribution of profits to PE Rolls Royce Plc vs. ADIT (Delhi High Court) Rolls Royce Plc (UK) Marketing services agreement and delivery services in India Rolls Royce Indian Limited (UK) UK India Sales of aircraft engines and spare parts Provision of services Rolls Royce Indian Limited Domestic customers (Local office) Reception of requisition notes

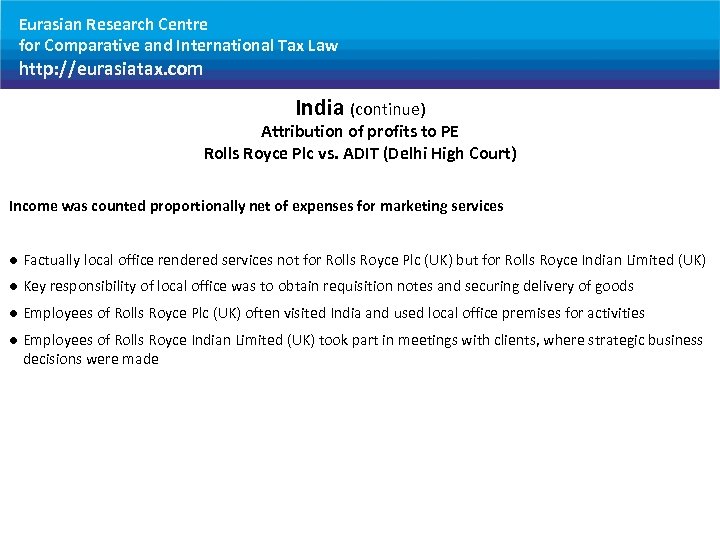

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com India (continue) Attribution of profits to PE Rolls Royce Plc vs. ADIT (Delhi High Court) Income was counted proportionally net of expenses for marketing services l Factually local office rendered services not for Rolls Royce Plc (UK) but for Rolls Royce Indian Limited (UK) l Key responsibility of local office was to obtain requisition notes and securing delivery of goods l Employees of Rolls Royce Plc (UK) often visited India and used local office premises for activities l Employees of Rolls Royce Indian Limited (UK) took part in meetings with clients, where strategic business decisions were made

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com India (continue) Attribution of profits to PE Rolls Royce Plc vs. ADIT (Delhi High Court) Income was counted proportionally net of expenses for marketing services l Factually local office rendered services not for Rolls Royce Plc (UK) but for Rolls Royce Indian Limited (UK) l Key responsibility of local office was to obtain requisition notes and securing delivery of goods l Employees of Rolls Royce Plc (UK) often visited India and used local office premises for activities l Employees of Rolls Royce Indian Limited (UK) took part in meetings with clients, where strategic business decisions were made

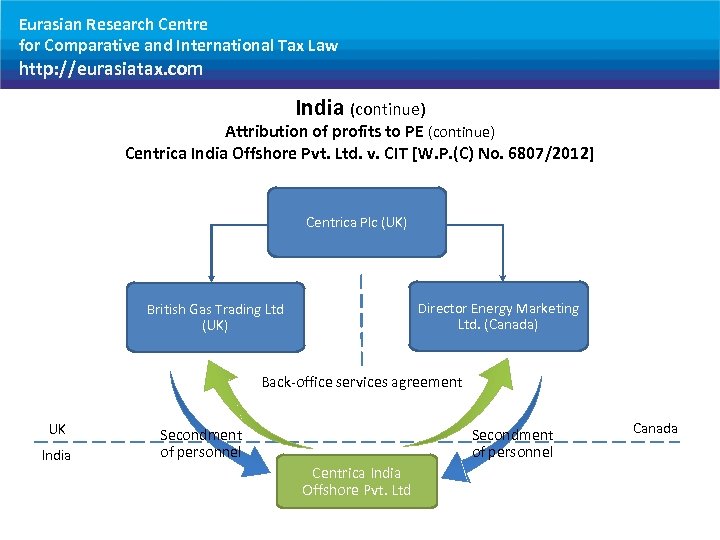

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com India (continue) Attribution of profits to PE (continue) Centrica India Offshore Pvt. Ltd. v. CIT [W. P. (C) No. 6807/2012] Centrica Plc (UK) Director Energy Marketing Ltd. (Canada) British Gas Trading Ltd (UK) Back-office services agreement UK India Secondment of personnel Centrica India Offshore Pvt. Ltd Canada

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com India (continue) Attribution of profits to PE (continue) Centrica India Offshore Pvt. Ltd. v. CIT [W. P. (C) No. 6807/2012] Centrica Plc (UK) Director Energy Marketing Ltd. (Canada) British Gas Trading Ltd (UK) Back-office services agreement UK India Secondment of personnel Centrica India Offshore Pvt. Ltd Canada

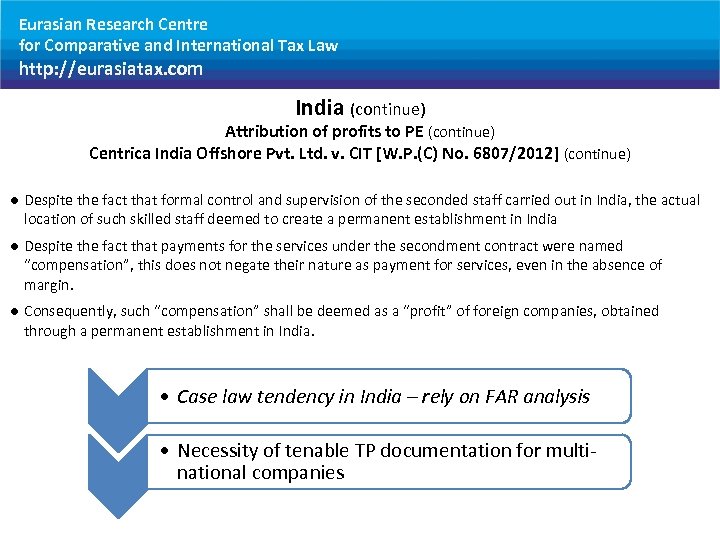

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com India (continue) Attribution of profits to PE (continue) Centrica India Offshore Pvt. Ltd. v. CIT [W. P. (C) No. 6807/2012] (continue) l Despite the fact that formal control and supervision of the seconded staff carried out in India, the actual location of such skilled staff deemed to create a permanent establishment in India l Despite the fact that payments for the services under the secondment contract were named “compensation”, this does not negate their nature as payment for services, even in the absence of margin. l Consequently, such “compensation” shall be deemed as a “profit” of foreign companies, obtained through a permanent establishment in India. ● ● • Case law tendency in India – rely on FAR analysis • Necessity of tenable TP documentation for multinational companies

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com India (continue) Attribution of profits to PE (continue) Centrica India Offshore Pvt. Ltd. v. CIT [W. P. (C) No. 6807/2012] (continue) l Despite the fact that formal control and supervision of the seconded staff carried out in India, the actual location of such skilled staff deemed to create a permanent establishment in India l Despite the fact that payments for the services under the secondment contract were named “compensation”, this does not negate their nature as payment for services, even in the absence of margin. l Consequently, such “compensation” shall be deemed as a “profit” of foreign companies, obtained through a permanent establishment in India. ● ● • Case law tendency in India – rely on FAR analysis • Necessity of tenable TP documentation for multinational companies

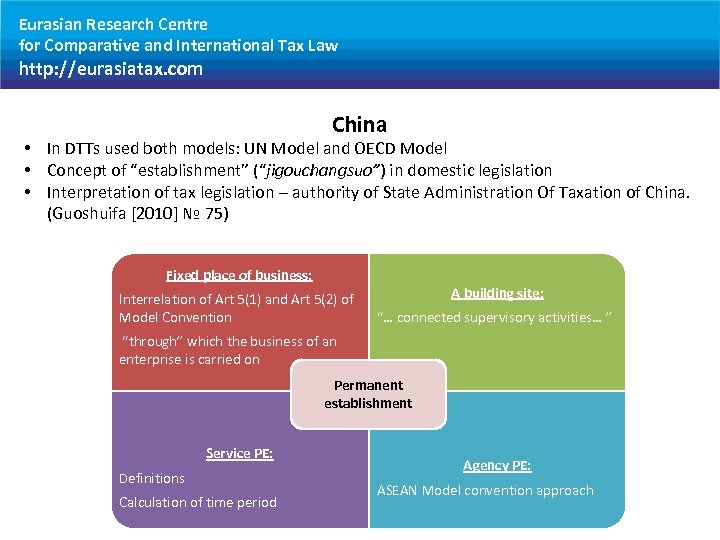

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com China • In DTTs used both models: UN Model and OECD Model • Concept of “establishment” (“jigouchangsuo”) in domestic legislation • Interpretation of tax legislation – authority of State Administration Of Taxation of China. (Guoshuifa [2010] № 75) Fixed place of business: Interrelation of Art 5(1) and Art 5(2) of Model Convention A building site: “… connected supervisory activities… ” “through” which the business of an enterprise is carried on Permanent establishment Service PE: Definitions Calculation of time period Agency PE: ASEAN Model convention approach

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com China • In DTTs used both models: UN Model and OECD Model • Concept of “establishment” (“jigouchangsuo”) in domestic legislation • Interpretation of tax legislation – authority of State Administration Of Taxation of China. (Guoshuifa [2010] № 75) Fixed place of business: Interrelation of Art 5(1) and Art 5(2) of Model Convention A building site: “… connected supervisory activities… ” “through” which the business of an enterprise is carried on Permanent establishment Service PE: Definitions Calculation of time period Agency PE: ASEAN Model convention approach

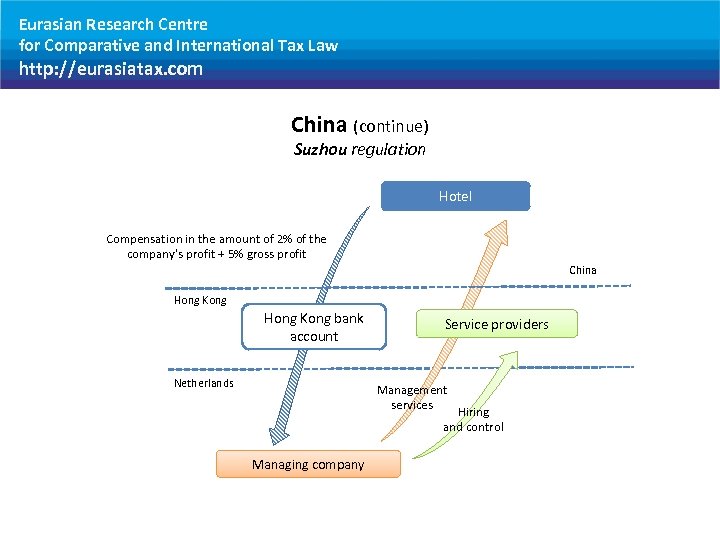

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com China (continue) Suzhou regulation Hotel Compensation in the amount of 2% of the company's profit + 5% gross profit China Hong Kong bank account Netherlands Service providers Management services Hiring and control Managing company

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com China (continue) Suzhou regulation Hotel Compensation in the amount of 2% of the company's profit + 5% gross profit China Hong Kong bank account Netherlands Service providers Management services Hiring and control Managing company

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com South Africa • • OECD Model is used “Source taxation” approach Residence on the “basis of origin” or “place of effective management” Taxation of revenues but not income in accordance with domestic Income Tax Act Service PE • If there are VAT operations - the obligation to register and pay the appropriate amount of tax • If the secondment of foreign personnel leads to a permanent establishment - the obligation to register as an employer • Requisition of contract conditions from RSA resident

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com South Africa • • OECD Model is used “Source taxation” approach Residence on the “basis of origin” or “place of effective management” Taxation of revenues but not income in accordance with domestic Income Tax Act Service PE • If there are VAT operations - the obligation to register and pay the appropriate amount of tax • If the secondment of foreign personnel leads to a permanent establishment - the obligation to register as an employer • Requisition of contract conditions from RSA resident

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Thank you for your attention!

Eurasian Research Centre for Comparative and International Tax Law http: //eurasiatax. com Thank you for your attention!