d664080047bab020eb2713a37e2d77a4.ppt

- Количество слайдов: 38

EU Twinning Project: “Implementing PPP policy” Value-for-money in practice 6 June 2008

EU Twinning Project: “Implementing PPP policy” Value-for-money in practice 6 June 2008

Content On Value-for-Money in practice: 1. Real-life examples 2. Its sources 3. Its drivers 4. Its management Morning session 5. The affordability-dilemma Afternoon session 6. The do’s and don’ts

Content On Value-for-Money in practice: 1. Real-life examples 2. Its sources 3. Its drivers 4. Its management Morning session 5. The affordability-dilemma Afternoon session 6. The do’s and don’ts

Real-life examples

Real-life examples

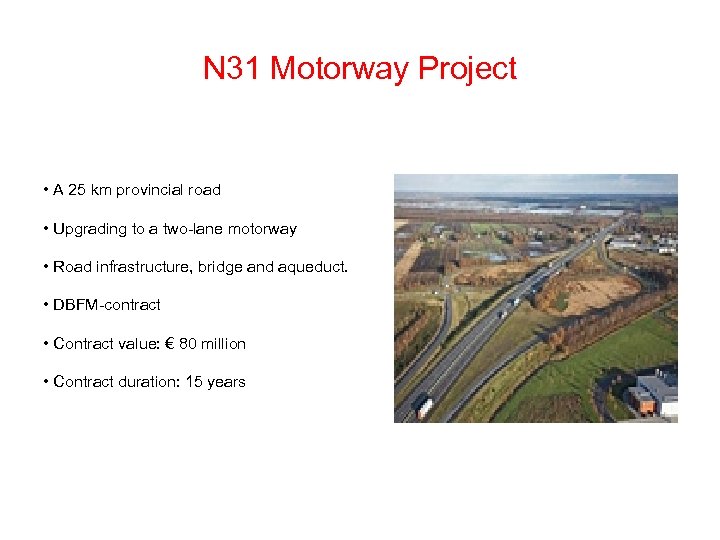

N 31 Motorway Project • A 25 km provincial road • Upgrading to a two-lane motorway • Road infrastructure, bridge and aqueduct. • DBFM-contract • Contract value: € 80 million • Contract duration: 15 years

N 31 Motorway Project • A 25 km provincial road • Upgrading to a two-lane motorway • Road infrastructure, bridge and aqueduct. • DBFM-contract • Contract value: € 80 million • Contract duration: 15 years

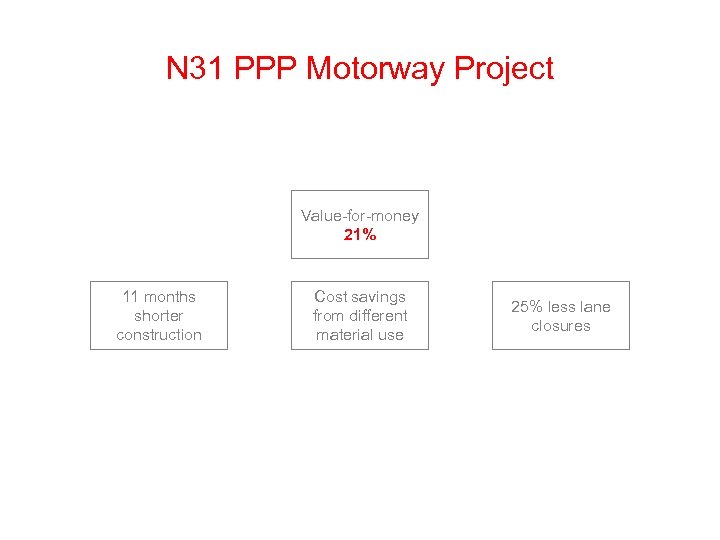

N 31 PPP Motorway Project Value-for-money 21% 11 months shorter construction Cost savings from different material use 25% less lane closures

N 31 PPP Motorway Project Value-for-money 21% 11 months shorter construction Cost savings from different material use 25% less lane closures

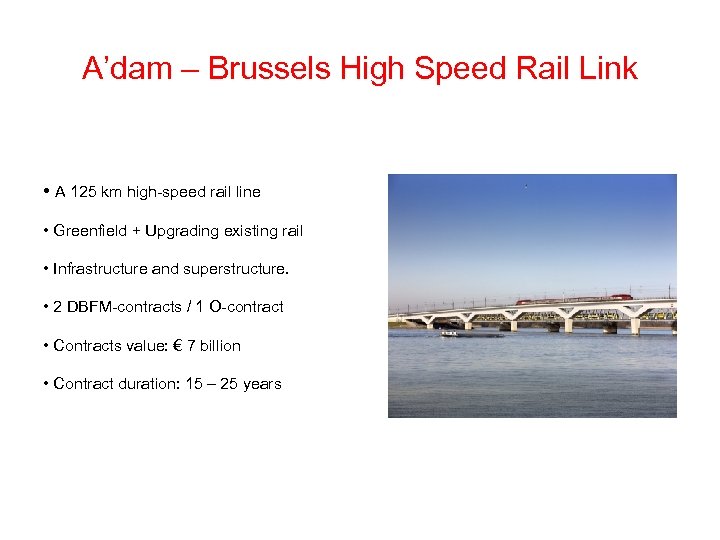

A’dam – Brussels High Speed Rail Link • A 125 km high-speed rail line • Greenfield + Upgrading existing rail • Infrastructure and superstructure. • 2 DBFM-contracts / 1 O-contract • Contracts value: € 7 billion • Contract duration: 15 – 25 years

A’dam – Brussels High Speed Rail Link • A 125 km high-speed rail line • Greenfield + Upgrading existing rail • Infrastructure and superstructure. • 2 DBFM-contracts / 1 O-contract • Contracts value: € 7 billion • Contract duration: 15 – 25 years

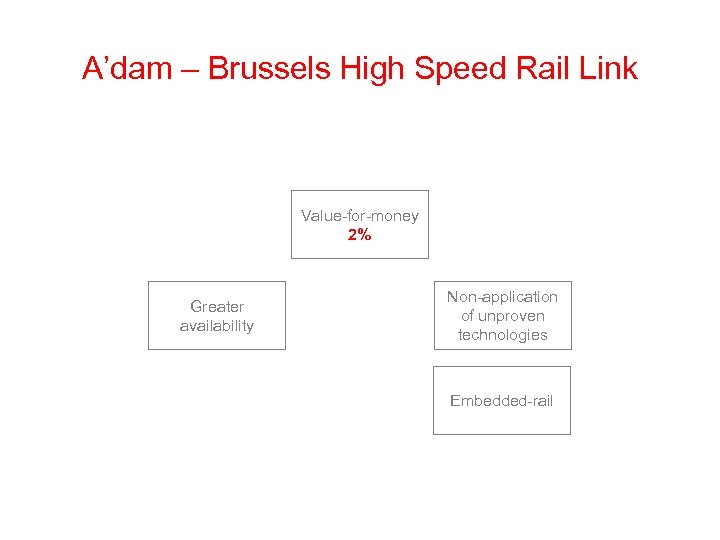

A’dam – Brussels High Speed Rail Link Value-for-money 2% Greater availability Non-application of unproven technologies Embedded-rail

A’dam – Brussels High Speed Rail Link Value-for-money 2% Greater availability Non-application of unproven technologies Embedded-rail

Renovation Finance Ministry • Accommodation of Finance Ministry • Renovation • 1 DBFMO-contract • Contracts value: € 175 million • Contract duration: 25 years

Renovation Finance Ministry • Accommodation of Finance Ministry • Renovation • 1 DBFMO-contract • Contracts value: € 175 million • Contract duration: 25 years

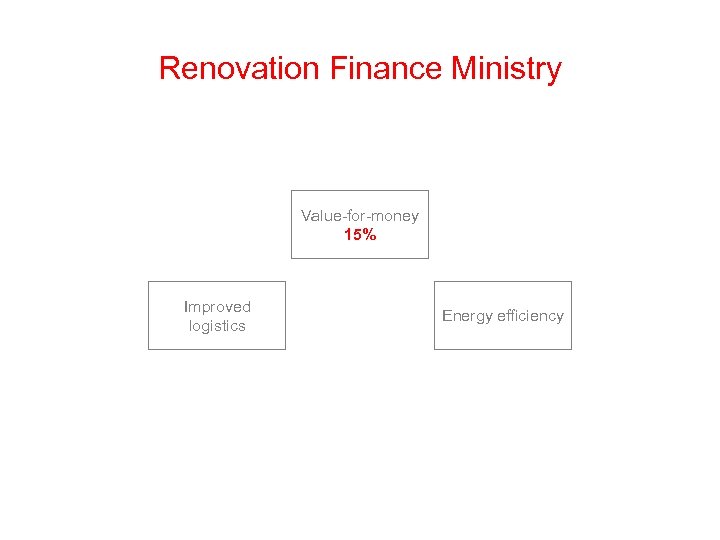

Renovation Finance Ministry Value-for-money 15% Improved logistics Energy efficiency

Renovation Finance Ministry Value-for-money 15% Improved logistics Energy efficiency

Montaigne School Building • School building • Greenfield • DBFM-contract • Contracts value: € 27 million • Contract duration: 30 years

Montaigne School Building • School building • Greenfield • DBFM-contract • Contracts value: € 27 million • Contract duration: 30 years

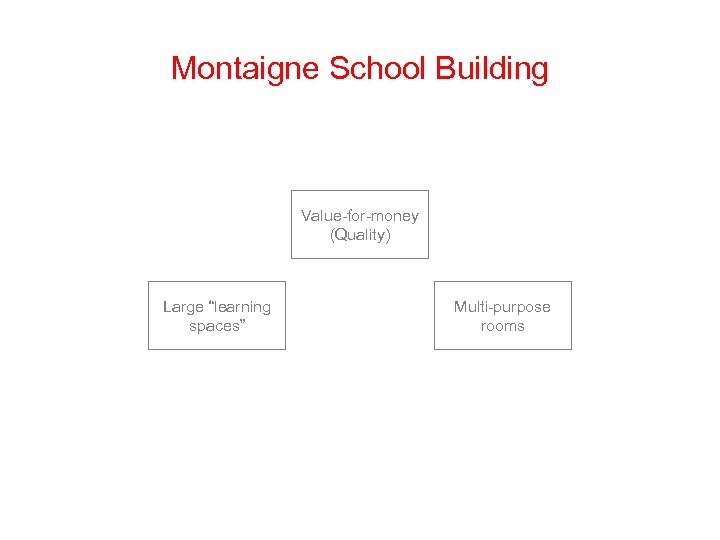

Montaigne School Building Value-for-money (Quality) Large “learning spaces” Multi-purpose rooms

Montaigne School Building Value-for-money (Quality) Large “learning spaces” Multi-purpose rooms

Delfuent Water Sanitation Plant • Water sanitation plant • Greenfield & modernization • DBFMO-contract • Contracts value: € 450 million • Contract duration: 30 years

Delfuent Water Sanitation Plant • Water sanitation plant • Greenfield & modernization • DBFMO-contract • Contracts value: € 450 million • Contract duration: 30 years

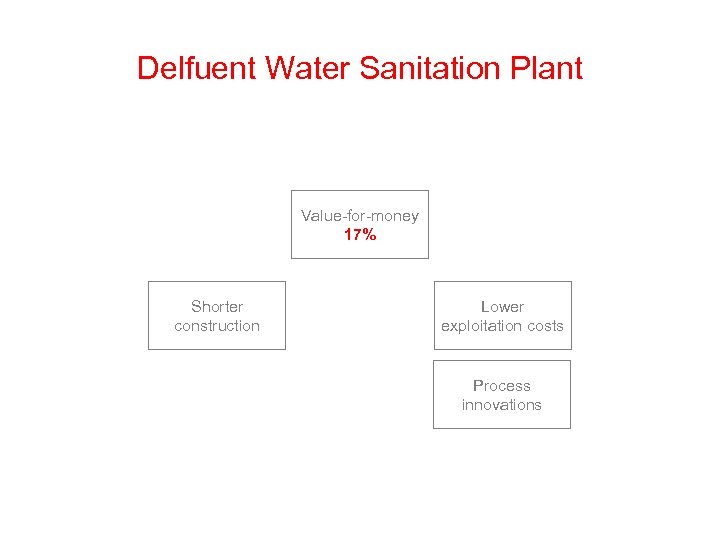

Delfuent Water Sanitation Plant Value-for-money 17% Shorter construction Lower exploitation costs Process innovations

Delfuent Water Sanitation Plant Value-for-money 17% Shorter construction Lower exploitation costs Process innovations

Real estate development • Port and accommodation Value-for-money • Greenfield, expansion & renovation • Multiple DBFM-contracts Flexibility Phasedimplementation Alternative usage

Real estate development • Port and accommodation Value-for-money • Greenfield, expansion & renovation • Multiple DBFM-contracts Flexibility Phasedimplementation Alternative usage

The sources of value-creation

The sources of value-creation

The main principles Quality

The main principles Quality

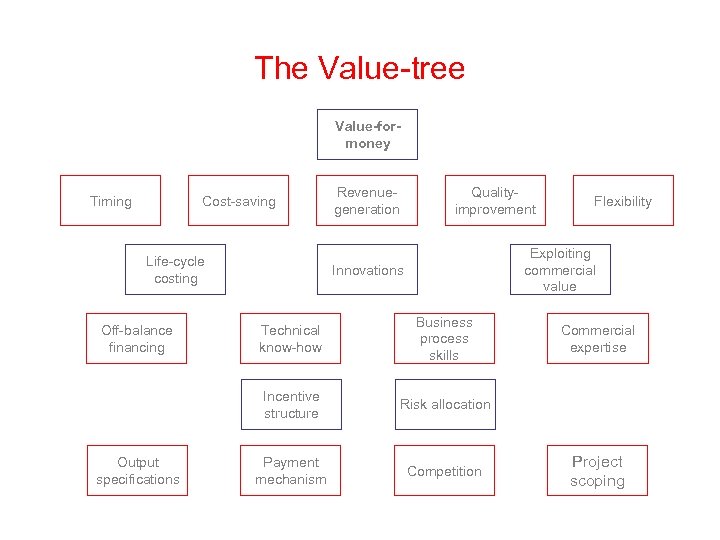

The Value-tree Value-formoney Timing Cost-saving Life-cycle costing Revenuegeneration Qualityimprovement Exploiting commercial value Innovations Output specifications Technical know-how Business process skills Incentive structure Off-balance financing Flexibility Risk allocation Payment mechanism Competition Commercial expertise Project scoping

The Value-tree Value-formoney Timing Cost-saving Life-cycle costing Revenuegeneration Qualityimprovement Exploiting commercial value Innovations Output specifications Technical know-how Business process skills Incentive structure Off-balance financing Flexibility Risk allocation Payment mechanism Competition Commercial expertise Project scoping

Key Value-drivers: N 31 Motorway Project

Key Value-drivers: N 31 Motorway Project

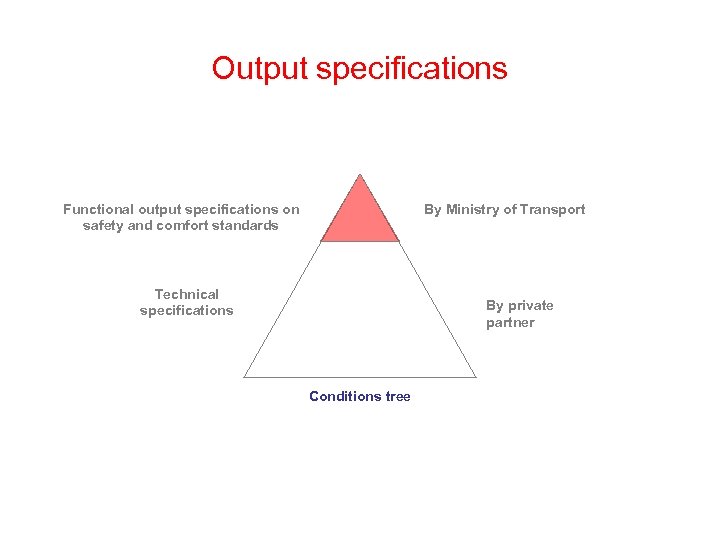

Output specifications Functional output specifications on safety and comfort standards By Ministry of Transport Technical specifications By private partner Conditions tree

Output specifications Functional output specifications on safety and comfort standards By Ministry of Transport Technical specifications By private partner Conditions tree

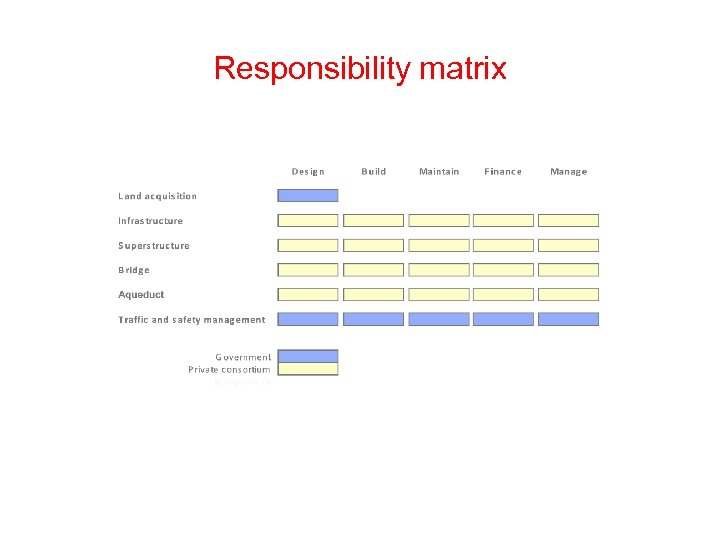

Responsibility matrix

Responsibility matrix

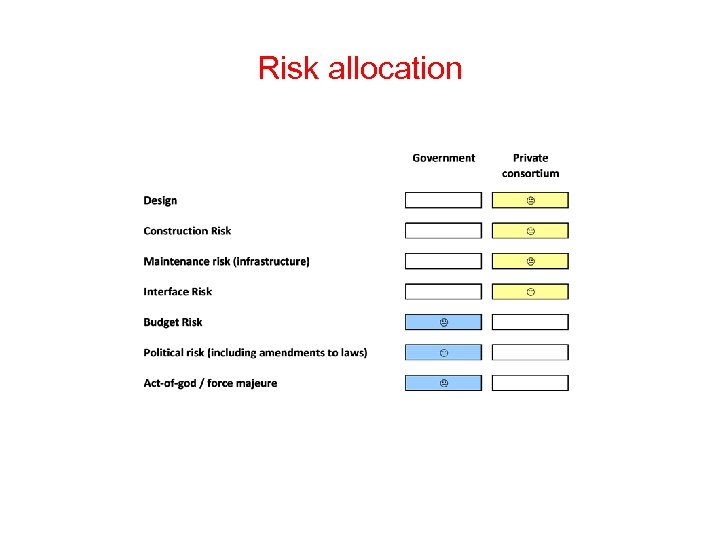

Risk allocation

Risk allocation

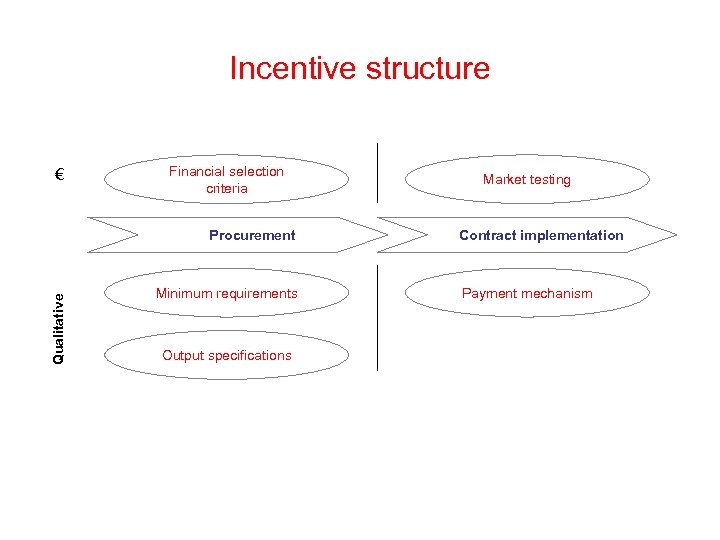

Incentive structure € Financial selection criteria Qualitative Procurement Minimum requirements Output specifications Market testing Contract implementation Payment mechanism

Incentive structure € Financial selection criteria Qualitative Procurement Minimum requirements Output specifications Market testing Contract implementation Payment mechanism

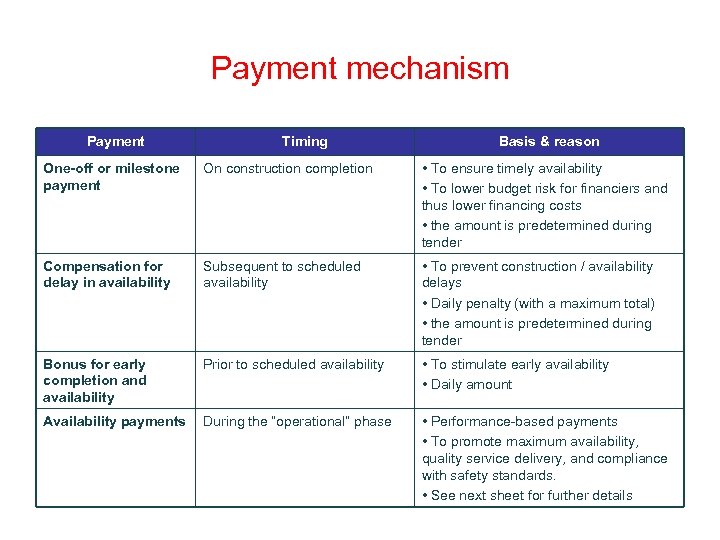

Payment mechanism Payment Timing Basis & reason One-off or milestone payment On construction completion • To ensure timely availability • To lower budget risk for financiers and thus lower financing costs • the amount is predetermined during tender Compensation for delay in availability Subsequent to scheduled availability • To prevent construction / availability delays • Daily penalty (with a maximum total) • the amount is predetermined during tender Bonus for early completion and availability Prior to scheduled availability • To stimulate early availability • Daily amount Availability payments During the “operational” phase • Performance-based payments • To promote maximum availability, quality service delivery, and compliance with safety standards. • See next sheet for further details

Payment mechanism Payment Timing Basis & reason One-off or milestone payment On construction completion • To ensure timely availability • To lower budget risk for financiers and thus lower financing costs • the amount is predetermined during tender Compensation for delay in availability Subsequent to scheduled availability • To prevent construction / availability delays • Daily penalty (with a maximum total) • the amount is predetermined during tender Bonus for early completion and availability Prior to scheduled availability • To stimulate early availability • Daily amount Availability payments During the “operational” phase • Performance-based payments • To promote maximum availability, quality service delivery, and compliance with safety standards. • See next sheet for further details

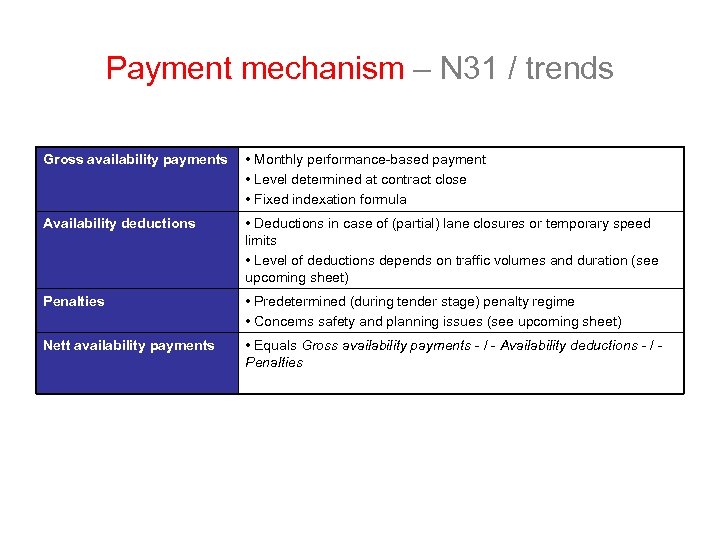

Payment mechanism – N 31 / trends Gross availability payments • Monthly performance-based payment • Level determined at contract close • Fixed indexation formula Availability deductions • Deductions in case of (partial) lane closures or temporary speed limits • Level of deductions depends on traffic volumes and duration (see upcoming sheet) Penalties • Predetermined (during tender stage) penalty regime • Concerns safety and planning issues (see upcoming sheet) Nett availability payments • Equals Gross availability payments - / - Availability deductions - / Penalties

Payment mechanism – N 31 / trends Gross availability payments • Monthly performance-based payment • Level determined at contract close • Fixed indexation formula Availability deductions • Deductions in case of (partial) lane closures or temporary speed limits • Level of deductions depends on traffic volumes and duration (see upcoming sheet) Penalties • Predetermined (during tender stage) penalty regime • Concerns safety and planning issues (see upcoming sheet) Nett availability payments • Equals Gross availability payments - / - Availability deductions - / Penalties

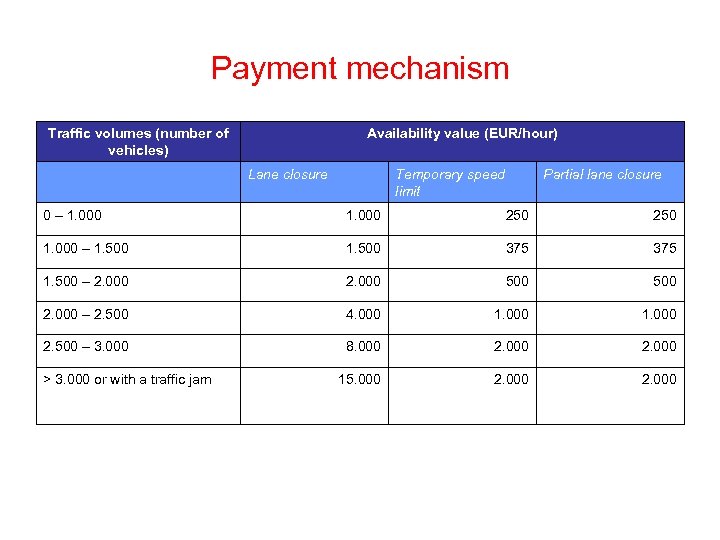

Payment mechanism Traffic volumes (number of vehicles) Availability value (EUR/hour) Lane closure Temporary speed limit Partial lane closure 0 – 1. 000 250 1. 000 – 1. 500 375 1. 500 – 2. 000 500 2. 000 – 2. 500 4. 000 1. 000 2. 500 – 3. 000 8. 000 2. 000 15. 000 2. 000 > 3. 000 or with a traffic jam

Payment mechanism Traffic volumes (number of vehicles) Availability value (EUR/hour) Lane closure Temporary speed limit Partial lane closure 0 – 1. 000 250 1. 000 – 1. 500 375 1. 500 – 2. 000 500 2. 000 – 2. 500 4. 000 1. 000 2. 500 – 3. 000 8. 000 2. 000 15. 000 2. 000 > 3. 000 or with a traffic jam

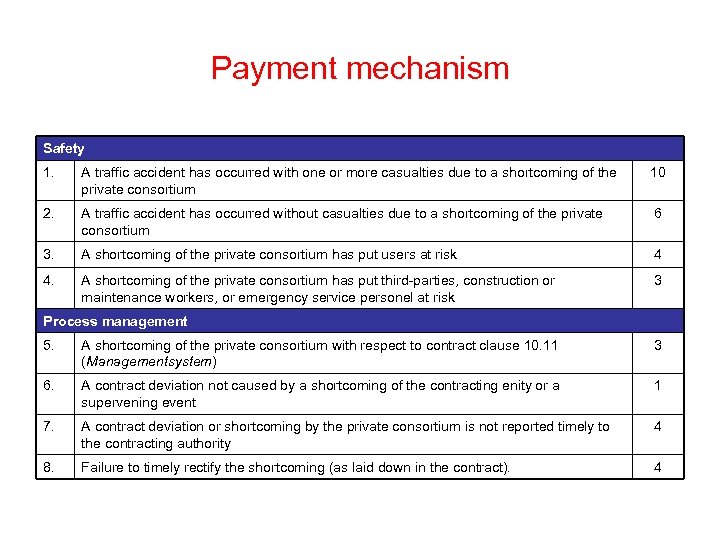

Payment mechanism Safety 1. A traffic accident has occurred with one or more casualties due to a shortcoming of the private consortium 10 2. A traffic accident has occurred without casualties due to a shortcoming of the private consortium 6 3. A shortcoming of the private consortium has put users at risk 4 4. A shortcoming of the private consortium has put third-parties, construction or maintenance workers, or emergency service personel at risk 3 Process management 5. A shortcoming of the private consortium with respect to contract clause 10. 11 (Managementsystem) 3 6. A contract deviation not caused by a shortcoming of the contracting enity or a supervening event 1 7. A contract deviation or shortcoming by the private consortium is not reported timely to the contracting authority 4 8. Failure to timely rectify the shortcoming (as laid down in the contract). 4

Payment mechanism Safety 1. A traffic accident has occurred with one or more casualties due to a shortcoming of the private consortium 10 2. A traffic accident has occurred without casualties due to a shortcoming of the private consortium 6 3. A shortcoming of the private consortium has put users at risk 4 4. A shortcoming of the private consortium has put third-parties, construction or maintenance workers, or emergency service personel at risk 3 Process management 5. A shortcoming of the private consortium with respect to contract clause 10. 11 (Managementsystem) 3 6. A contract deviation not caused by a shortcoming of the contracting enity or a supervening event 1 7. A contract deviation or shortcoming by the private consortium is not reported timely to the contracting authority 4 8. Failure to timely rectify the shortcoming (as laid down in the contract). 4

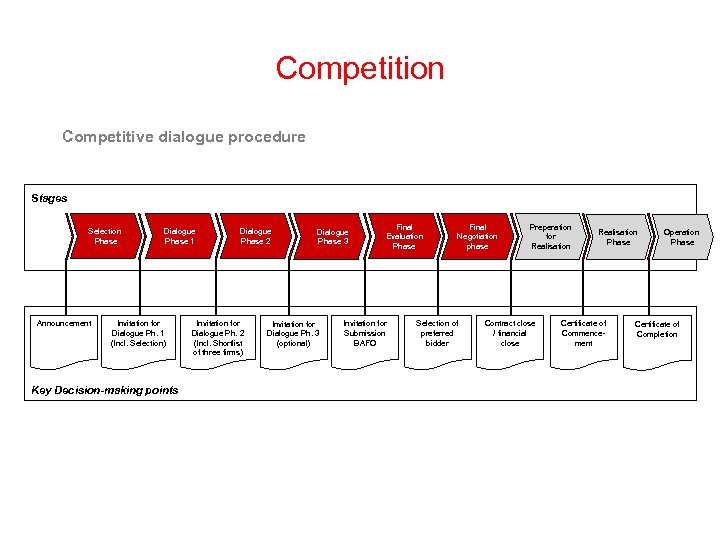

Competition Competitive dialogue procedure Stages Selection Phase Announcement Dialogue Phase 1 Invitation for Dialogue Ph. 1 (Incl. Selection) Key Decision-making points Dialogue Phase 2 Invitation for Dialogue Ph. 2 (Incl. Shortlist of three firms) Dialogue Phase 3 Invitation for Dialogue Ph. 3 (optional) Final Evaluation Phase Invitation for Submission BAFO Final Negotiation phase Selection of preferred bidder Preperation for Realisation Contract close / financial close Realisation Phase Certificate of Aanvangs. Commencecertificaat ment Operation Phase Certificate of Oplevering Completion

Competition Competitive dialogue procedure Stages Selection Phase Announcement Dialogue Phase 1 Invitation for Dialogue Ph. 1 (Incl. Selection) Key Decision-making points Dialogue Phase 2 Invitation for Dialogue Ph. 2 (Incl. Shortlist of three firms) Dialogue Phase 3 Invitation for Dialogue Ph. 3 (optional) Final Evaluation Phase Invitation for Submission BAFO Final Negotiation phase Selection of preferred bidder Preperation for Realisation Contract close / financial close Realisation Phase Certificate of Aanvangs. Commencecertificaat ment Operation Phase Certificate of Oplevering Completion

Value-for-money management

Value-for-money management

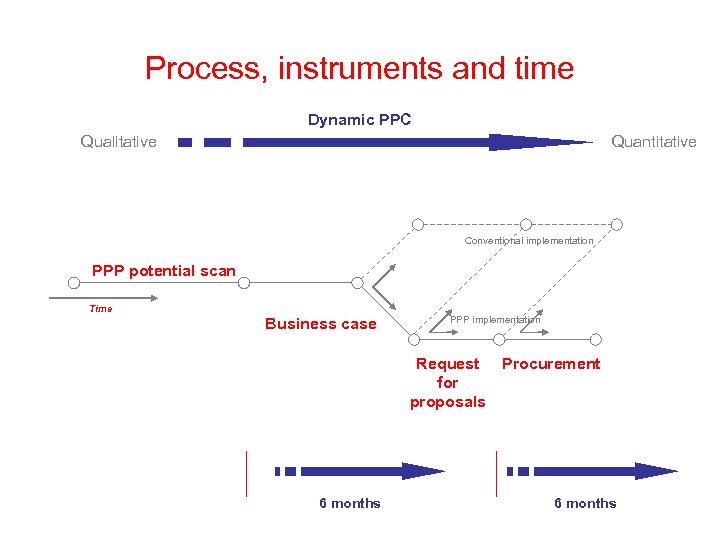

Process, instruments and time Dynamic PPC Qualitative Quantitative Conventional implementation PPP potential scan Time Business case PPP implementation Request Procurement for proposals 6 months

Process, instruments and time Dynamic PPC Qualitative Quantitative Conventional implementation PPP potential scan Time Business case PPP implementation Request Procurement for proposals 6 months

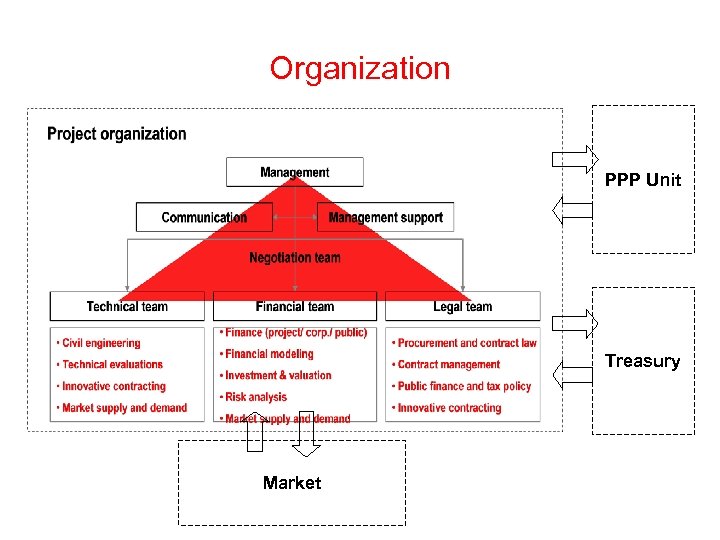

Organization PPP Unit Treasury Market

Organization PPP Unit Treasury Market

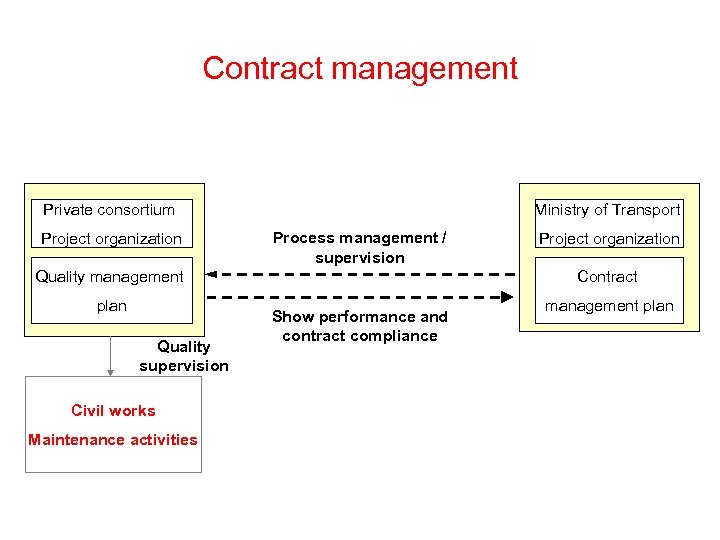

Contract management Private consortium Project organization Ministry of Transport Process management / supervision Quality management plan Quality supervision Civil works Maintenance activities Project organization Contract Show performance and contract compliance management plan

Contract management Private consortium Project organization Ministry of Transport Process management / supervision Quality management plan Quality supervision Civil works Maintenance activities Project organization Contract Show performance and contract compliance management plan

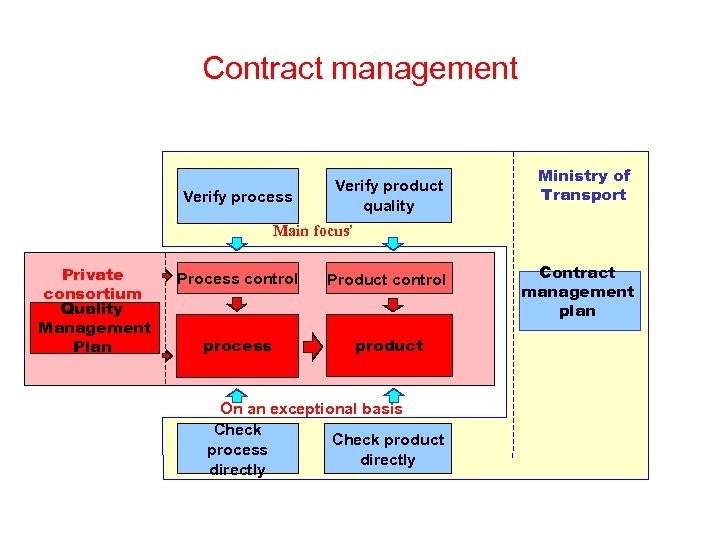

Contract management Verify process Verify product quality Ministry of Transport Main focus’ Private consortium Quality Management Plan Process control Product control process product On an exceptional basis Check product process directly Contract management plan

Contract management Verify process Verify product quality Ministry of Transport Main focus’ Private consortium Quality Management Plan Process control Product control process product On an exceptional basis Check product process directly Contract management plan

The affordability-dilemma

The affordability-dilemma

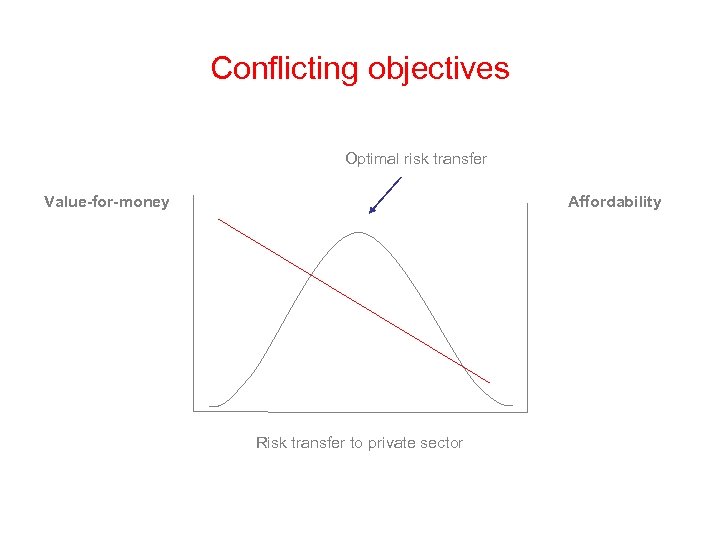

Conflicting objectives Optimal risk transfer Value-for-money Affordability Risk transfer to private sector

Conflicting objectives Optimal risk transfer Value-for-money Affordability Risk transfer to private sector

The do’s and don’ts

The do’s and don’ts

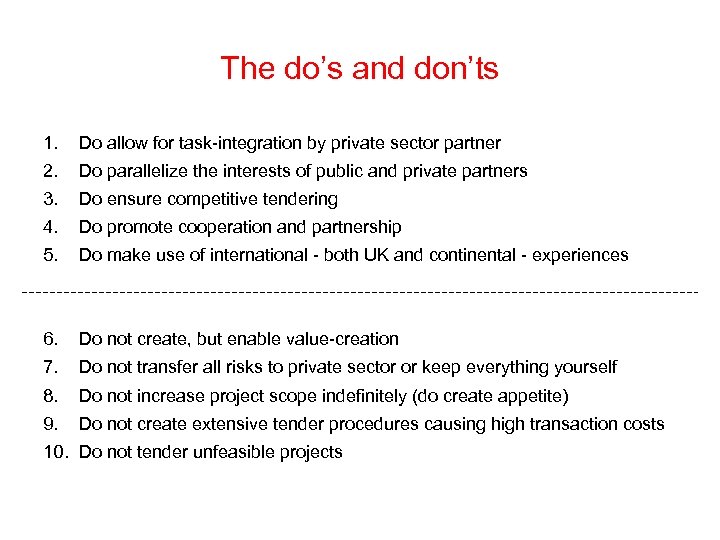

The do’s and don’ts 1. Do allow for task-integration by private sector partner 2. Do parallelize the interests of public and private partners 3. Do ensure competitive tendering 4. Do promote cooperation and partnership 5. Do make use of international - both UK and continental - experiences 6. Do not create, but enable value-creation 7. Do not transfer all risks to private sector or keep everything yourself 8. Do not increase project scope indefinitely (do create appetite) 9. Do not create extensive tender procedures causing high transaction costs 10. Do not tender unfeasible projects

The do’s and don’ts 1. Do allow for task-integration by private sector partner 2. Do parallelize the interests of public and private partners 3. Do ensure competitive tendering 4. Do promote cooperation and partnership 5. Do make use of international - both UK and continental - experiences 6. Do not create, but enable value-creation 7. Do not transfer all risks to private sector or keep everything yourself 8. Do not increase project scope indefinitely (do create appetite) 9. Do not create extensive tender procedures causing high transaction costs 10. Do not tender unfeasible projects

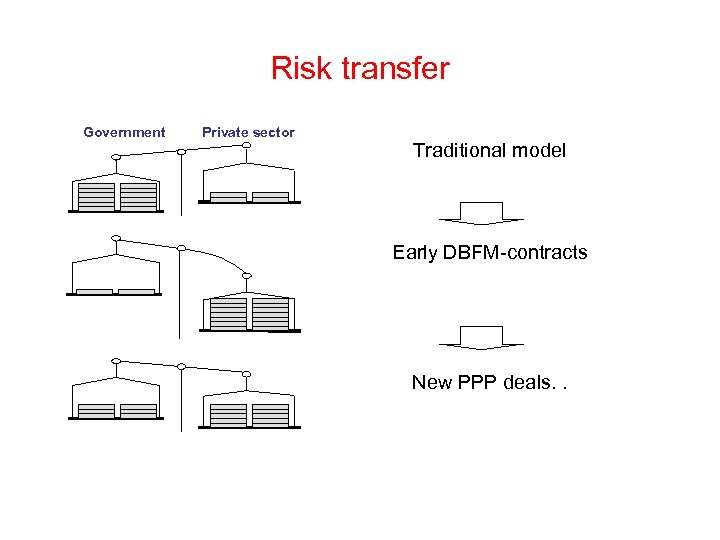

Risk transfer Government Private sector Traditional model Early DBFM-contracts New PPP deals. .

Risk transfer Government Private sector Traditional model Early DBFM-contracts New PPP deals. .

Contact information Rebelgroup Advisory BV Geert Engelsman Wijnhaven 3 -O, 3011 WG Rotterdam, The Netherlands Tel +31 10 2755995 Fax +31 10 2755999 www. rebelgroup. nl geertjan. engelsman@rebelgroup. nl

Contact information Rebelgroup Advisory BV Geert Engelsman Wijnhaven 3 -O, 3011 WG Rotterdam, The Netherlands Tel +31 10 2755995 Fax +31 10 2755999 www. rebelgroup. nl geertjan. engelsman@rebelgroup. nl