0b6bfb7b92bc33292cfc8e898fa2db31.ppt

- Количество слайдов: 37

EU Policy for Electronic Public Procurement Julia Ferger, European Commission, DG Internal Market & Services III GLOBAL CONFERENCE ON ELECTRONIC GOVERNMENT PROCUREMENT IDB, Washington, 9 -11 November 2009 1

Public procurement rules make a difference • The public sector: by far the biggest buyer in the economy – Estimated total EU public procurement (2007): 1. 900 bn EUR (16% of EU GDP) – Estimated total above thresholds (TED): 377 bn EUR (3% of EU GDP) • Recent trends – Public procurement is characterised by greater transparency – Greater transparency means more competition – Potential for tangible macro-economic effects 2

EU legal framework: Who procures? EU public procurement directives 2004/18/EC ‘classic’ (supplies, services, works) 2004/17/EC ‘utilities’ (water, energy, transp, postal services) Everybody is concerned… • Classic sector – State – Regional and local authorities – Bodies governed by public law • Special sectors (water, energy, transport, postal services) – + public undertakings – + private undertakings (special and exclusive rights) In 2008 39. 000 purchasers published a notice on TED 3

EU legal framework: How to procure? • Above thresholds • Below the thresholds Directives Treaty • BUT the Directives do not harmonise, they coordinate • Even above thresholds national and local legislation and practice are important (especially in organising the practical details of the procurement process ) 4

EU legal framework: principles • Use of electronic communication methods by contracting authorities & suppliers possible for all steps of procurement process • Contracting authority free to choose method. . . • . . . but fundamental principles (Treaty, case law) & EU Directives’ rules apply – Non-discrimination – Transparency – Fair competition • Avoid barriers: interoperability • Flexible and technology-neutral framework = Dematerialise what is done on paper = Employ new purchasing techniques using electronic means 5

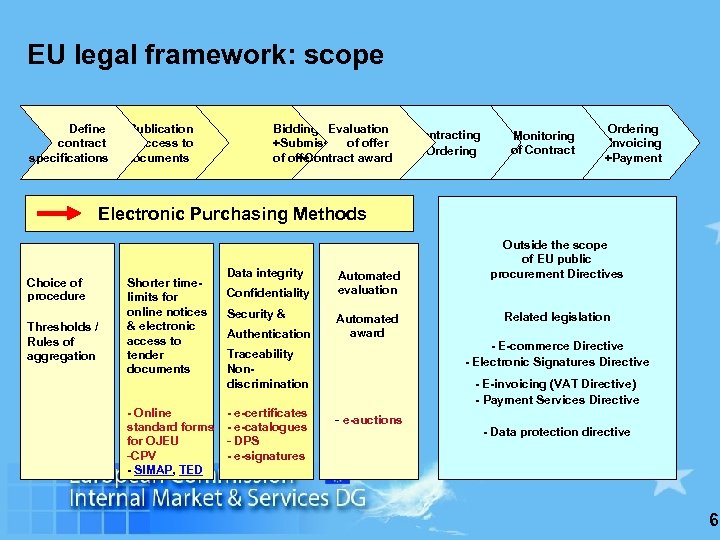

EU legal framework: scope Define contract specifications Publication +Access to documents Bidding Evaluation +Submissionof offers +Contract award Contracting +Ordering Monitoring of Contract Ordering +Invoicing +Payment Electronic Purchasing Methods Choice of procedure Thresholds / Rules of aggregation Shorter timelimits for online notices & electronic access to tender documents - Online standard forms for OJEU -CPV - SIMAP, TED Data integrity Confidentiality Security & Authentication Automated evaluation Automated award Traceability Nondiscrimination - e-certificates - e-catalogues - DPS - e-signatures Outside the scope of EU public procurement Directives Related legislation - E-commerce Directive - Electronic Signatures Directive - E-invoicing (VAT Directive) - Payment Services Directive - e-auctions - Data protection directive 6

What are the advantages of e-proc? • Efficient & inclusive procedures: – Reduce transaction costs for authorities and tenderers (expected reduction of 50 -80% of transaction costs); – Accelerate procedures; – Increase participation rates in tenders – including by SMEs (IT MEPA: 70% of contracts awarded are to micro or small firms). • Market aggregation: centralisation of procurement on e-platforms increases market transparency. • Technology test-bed: e-procurement can stimulate the development of ICT solutions for business processes of wide market relevance. 7

Challenges to deployment • Legal and policy: create legal environment that supports on-line procedures, removes policy barriers to use. • Technical: Availability of applications that ensure data integrity, confidentiality, security & authentication, traceability; • Market infrastructure: some standardisation systems, applications, classifications and protocols; • Behaviour: inertia by contracting authorities and operators. • Investment and up-front costs; who pays? in start-up phase, cost of operating paper and electronic circuits. 8

What is EU objective? 1. Ensure that the EU legal and policy environment supports the speedy roll-out of e-procurement by Member States; 2. Remove technical, practical and administrative obstacles to crossborder participation in e-procurement. The introduction of eprocurement must not close procurement markets - neither in EU nor internationally. 9

EU level activity: Action Plan for e-procurement (2004 -08) • • Enabling legislation: change EU procurement rules to permit electronic procedures (2004), allow new e-procedures; explain and support compliant and timely transposition Common basic tools: provide standard forms for online procurement notices, Common Procurement Vocabulary Monitor and remove other legal/policy barriers (e. g. encourage esignatures, change VAT rules to facilitate e-invoicing) Promote inter-operability: ensure national systems can receive submissions from operators using generally available technology / applications; investigate / promote new tools (e-catalogues, e-attestations) Encourage standardisation (e. g. CEN ICT standardisation) Invest in inter-connectivity: support research on ICT to accelerate use of new tools and to inter-connect participants in procurement markets (PEPPOL) Evaluation and review of EU policy - 2010 10

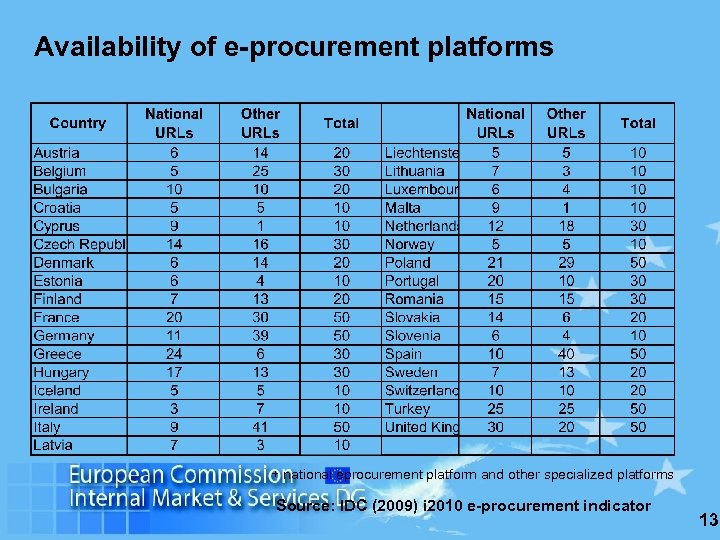

How is market evolving? • Proliferation of platforms; over 800 national e-procurement and other specialised platforms identified in EU; • Volumes of put-through unknown: some platforms have high volumes (e-proc Scotland = 30% of Scottish govt purchasing of goods & services); • E-proc platforms seem best suited to purchasing of repeated small volumes of standard supplies (through framework agreements, qualification systems). 11

Assessment of progress so far • E-procurement takes root – but use varies across MS. n° of MS with functioning e-procurement up from 6 (2004) to 17 (2009). • Some procurement phases are heavily automated, others less so: notification and access to documents fully automated. Post-award less so – solutions coming on stream. • Most frequent e-tools are framework agreements and e-auctions (both price only/MEAT). e-auctions seen as useful but not well understood. • factors limiting x-border e-procurement: main obstacle = esignatures/identification; then lack of interoperability & language. • Price effects are perceptible but tentative: minority observing changes noted decrease of >5%. Price effect most noticeable for e-auctions (>15%). • Positive assessment by all stakeholder groups: investments in eprocurement already paid off or expected to in near future. 12

Availability of e-procurement platforms + national eprocurement platform and other specialized platforms Source: IDC (2009) i 2010 e-procurement indicator 13

Usage of e-procurement platforms Up-Take of e-Procurement is still low: • In 2004, 6 MS had implemented a system • In 2009, 17 MS had implemented a system Factors limiting use, especially across borders • Difficult use of e-signatures • Lack of interoperable systems and tools • Linguistic issues • Need to operate double circuits (paper and electronic) • Lack of trust • Resistance to change 14

The PEPPOL project - ‘Pan-European Public Procurement On-line’ Objective: Enabling EU-wide public e. Procurement A Large Scale Pilot focused on Interoperability – Key actors: Member States/national authorised representatives – Outcome: an open, common interoperable solution – EU contributes up to 50% of costs for achieving interoperability From 1. 11. 2009 – based on enlargement proposal – – 19 beneficiaries from 13 countries Total budget 30, 8 M€ 8 work packages, <1. 600 person months Project start up: 1 May 2008, duration 42 months 15

PEPPOL vision Any business in the EU can communicate electronically with any public purchaser for all procurement processes 16

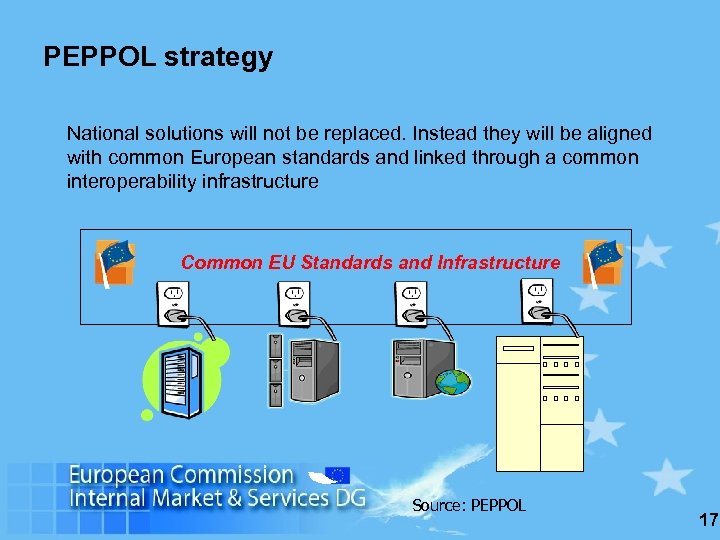

PEPPOL strategy National solutions will not be replaced. Instead they will be aligned with common European standards and linked through a common interoperability infrastructure Common EU Standards and Infrastructure Source: PEPPOL 17

PEPPOL expected results ü A secure, reliable and scalable European electronic transport infrastructure ü Demonstrator software supporting public procurement processes ü Guidance and building blocks for connecting national e-procurement solutions to the PEPPOL infrastructure ü A methodology to encompass all Member States ü Long term sustainability 18

Thank you European Commission Internal Market and Services DG C 4 - Economic aspects of public procurement, e-procurement Julia FERGER Tel. : (32 2) 2998389 Fax: (32 2) 2950127 E-mail: Julia. FERGER@ec. europa. eu 19

FOR MORE INFORMATION § SIMAP http: //simap. europa. eu - TED http: //ted. europa. eu (standard forms, CPV, publication of notices, links) § Commission – e-procurement pages http: //ec. europa. eu/comm/internal_market/publicprocurement/eprocurement_en. htm (Action Plan, explanatory documents, studies) http: //ec. europa. eu/idabc/eprocurement (tools, technical background documents, demonstrators) § PEPPOL project www. peppol. eu (large-scale cross-border pilot project) § e. Procurement Forum at e. Practice (user forum) http: //www. epractice. eu/community/eprocurement 20

Background slides 21

Points for discussion (1) Do findings reflect situation in your country? (2) How satisfactory is the shift from paper to e-procurement? (3) What factors do you consider most important in explaining observed delays? (4) In your country, is there a trend towards fragmentation or consolidation? At regional/local level? (5) In light of the market situation, is the evolutionary approach still appropriate or is more prescriptive action needed? Of which kind? 22

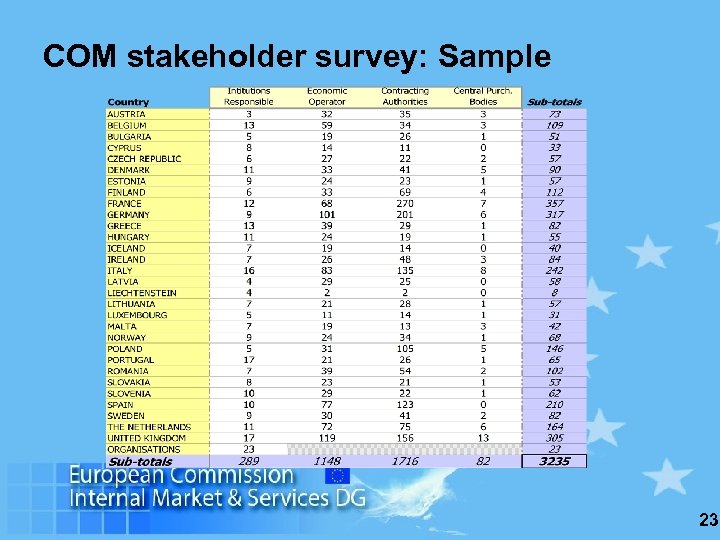

COM stakeholder survey: Sample 23

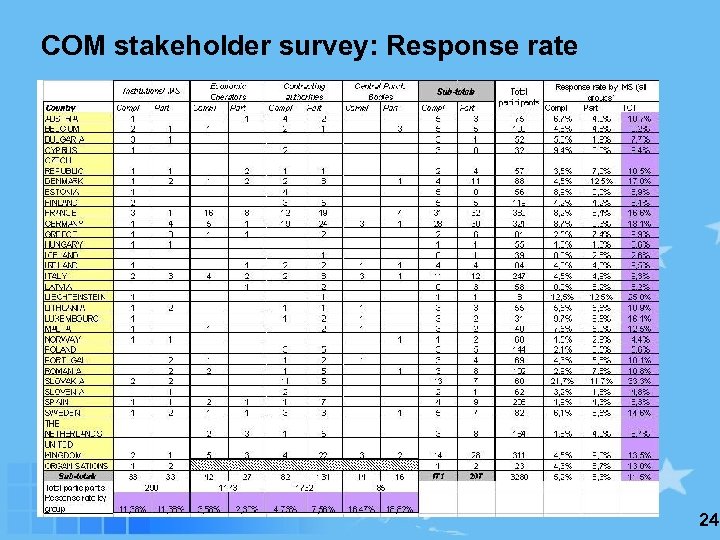

COM stakeholder survey: Response rate 24

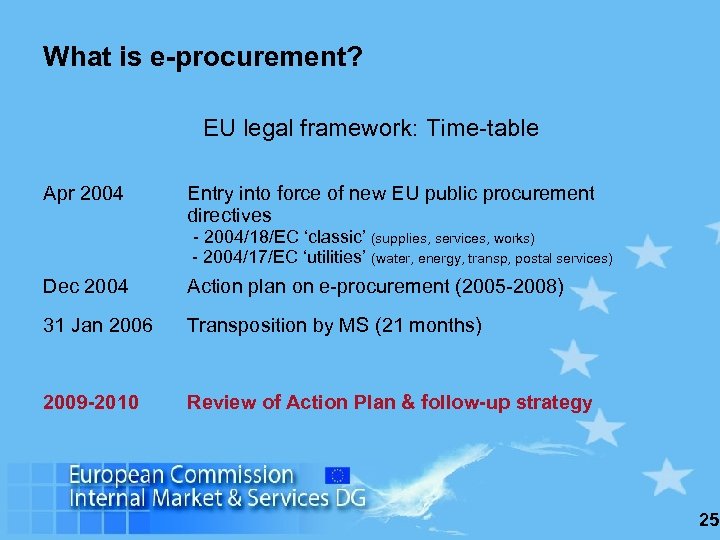

What is e-procurement? EU legal framework: Time-table Apr 2004 Entry into force of new EU public procurement directives - 2004/18/EC ‘classic’ (supplies, services, works) - 2004/17/EC ‘utilities’ (water, energy, transp, postal services) Dec 2004 Action plan on e-procurement (2005 -2008) 31 Jan 2006 Transposition by MS (21 months) 2009 -2010 Review of Action Plan & follow-up strategy 25

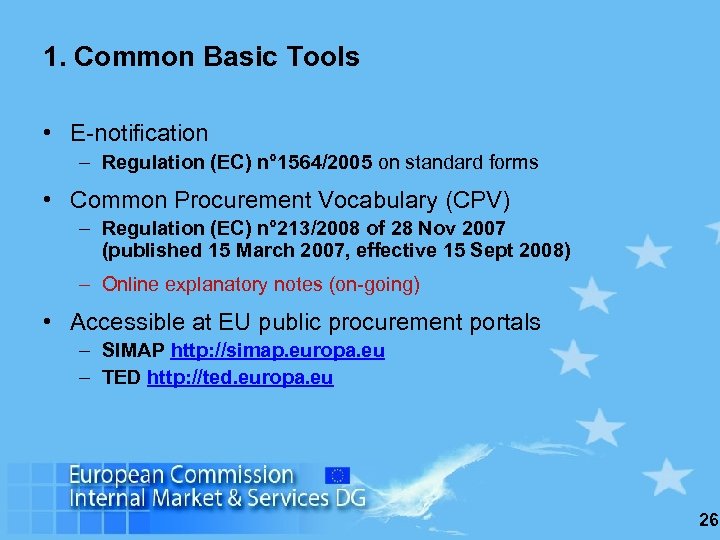

1. Common Basic Tools • E-notification – Regulation (EC) n° 1564/2005 on standard forms • Common Procurement Vocabulary (CPV) – Regulation (EC) n° 213/2008 of 28 Nov 2007 (published 15 March 2007, effective 15 Sept 2008) – Online explanatory notes (on-going) • Accessible at EU public procurement portals – SIMAP http: //simap. europa. eu – TED http: //ted. europa. eu 26

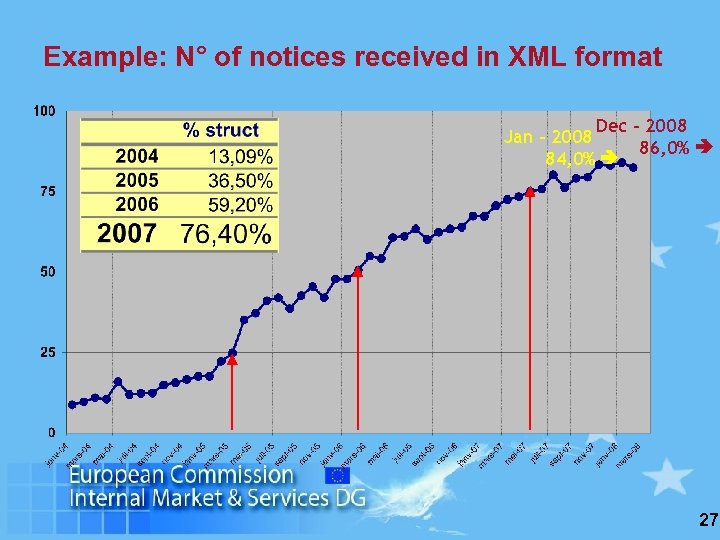

Example: N° of notices received in XML format Dec – 2008 Jan – 2008 86, 0% 84, 0% 27

2. Interoperable tools & standards • Explanatory tools – Explanatory Document on EU Directives (2005) – Preliminary functional requirements & Learning demonstrators (2005) – IDABC XML model schemas (2005) • Interoperability studies – Compliance verification mechanism(s) (2007) – e-catalogues (2007) – e-certificates & attestations (2008) – e-signatures (2007) e-signatures Action Plan (2009 -2010) 28

3. Interoperability pilot projects • CIP large-scale cross-border e-procurement pilot ‘PEPPOL’ (20082010) – Provide common specifications & building blocks in 4 areas • e-signature • Virtual Company Dossier (e-certificates) • e-catalogues (pre- and post-award) • e-invoicing • CEN BII e-procurement and e. PPS standardisation workshops (2008 -2009) • e. Signatures Action Plan (28 Nov. 2008) • e. Procurement Forum at e. Practice http: //www. epractice. eu/community/eprocurement 29

MOVING AHEAD: Action Plan Progress Review Objectives • Evaluate the effective up-take of e-procurement – extent to which PP procedures have been digitised – How: legal, organisational, economic, technical aspects • How the AP contributed to it • 4 work packages 1) Overview of the state of play 2) Assess extent to which AP objectives have been reached 3) Identify issues, gaps + recommendations 4) Provide a methodology for future monitoring • Results available by mid-2009 30

MOVING AHEAD: Action Plan Progress Review Preliminary findings (mid-2009) • Transposition of PP directives - • E-Procurement portals and functionalities - • All MS implemented some form of portal; 25% more than one 22 MS developed e. Notification module 15 MS do not yet permit e-submission 17 e. Access, 9 e. Auctions, 5 e. Invoicing e. Notification - • All MS have completed transposition 86% of all notices transmitted electronically to OJEU (2008) From 2006 -2007 n° of visits to TED website increased by 36% New tools referenced in TED notices (2006 -2007) - Buyer Profile (200 notices), e. Auction (1500), DPS (50) 31

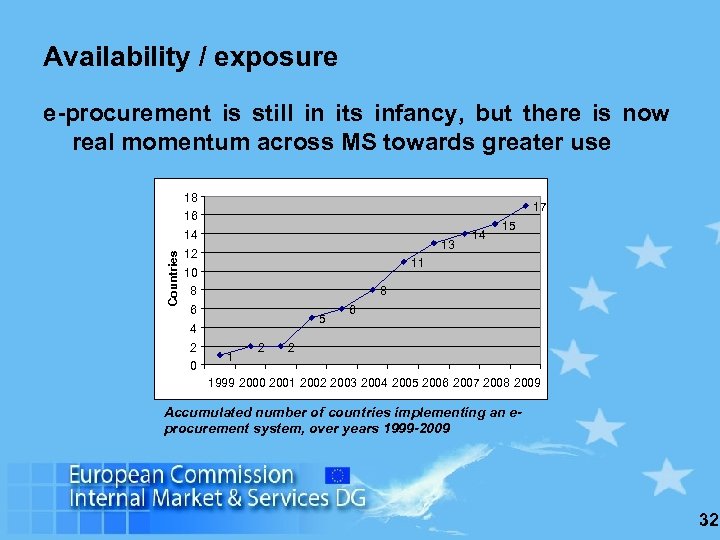

Availability / exposure e-procurement is still in its infancy, but there is now real momentum across MS towards greater use 18 17 16 Countries 14 13 12 8 8 6 5 4 0 15 11 10 2 14 1 2 6 2 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Accumulated number of countries implementing an eprocurement system, over years 1999 -2009 32

Specific phases and tools Certain phases are heavily automated, others less so • • • Processes: e-notification and e-access to documents first to be made electronic and most used Tools: framework agreements and e-auctions (both on price and MEAT) most used Post-award phases (e-ordering, e-invoicing and e-payment) not frequent today but forecast for future use 33

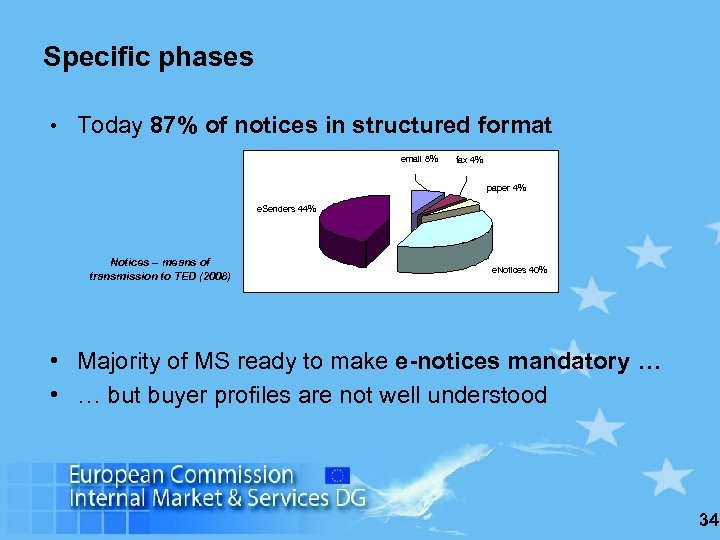

Specific phases • Today 87% of notices in structured format email 8% fax 4% paper 4% e. Senders 44% Notices – means of transmission to TED (2008) e. Notices 40% • Majority of MS ready to make e-notices mandatory … • … but buyer profiles are not well understood 34

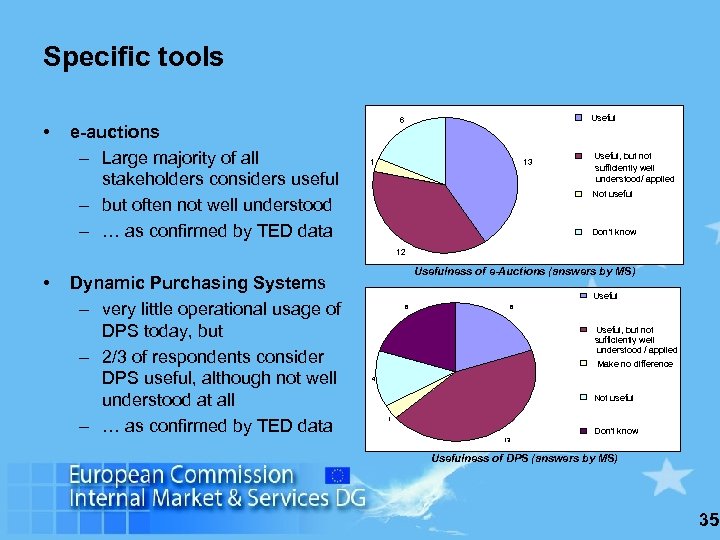

Specific tools • e-auctions – Large majority of all stakeholders considers useful – but often not well understood – … as confirmed by TED data Useful 6 1 13 Useful, but not sufficiently well understood/ applied Not useful Don't know 12 • Dynamic Purchasing Systems – very little operational usage of DPS today, but – 2/3 of respondents consider DPS useful, although not well understood at all – … as confirmed by TED data Usefulness of e-Auctions (answers by MS) Useful 6 6 Useful, but not sufficiently well understood / applied Make no difference 4 Not useful 1 Don't know 13 Usefulness of DPS (answers by MS) 35

Factors limiting cross-border use Opinions differ… • MS – difficult use of e-signatures – lack of interoperable systems and tools – linguistic issues • CAs, CPBs – need to operate double circuits (paper and electronic) • CPBs – lack of trust – resistance to change by CAs • Note: Lack of interest from suppliers not often noted 36

Cost and benefits • Effects on price perceptible but still inconclusive – majority of MS do not know the impact on prices – those available indicate a decrease of at least 5% • Price effect strongest for e-auctions on price only (15% <) • Overall positive experience – CAs, CPBs and operators say investments have already paid off or are expected to in near future – only a few CAs say expected benefits have not materialised 37

0b6bfb7b92bc33292cfc8e898fa2db31.ppt