efabb7decc6599663a68106cb03ea035.ppt

- Количество слайдов: 35

EU-MPCs : Overview of Trade Issues

EU-MPCs : Overview of Trade Issues

Contents Preliminary remarks The aim of this overview: questions arising from figures An Asymmetric Neighbourhood EU-MPCs integration dynamics Agreements Financial assistance Trade FDI § The trade liberalisation process § Conclusions § §

Contents Preliminary remarks The aim of this overview: questions arising from figures An Asymmetric Neighbourhood EU-MPCs integration dynamics Agreements Financial assistance Trade FDI § The trade liberalisation process § Conclusions § §

Preliminary Remarks: 1. The three pillars within the Euro-Mediterranean Partnership (also known as the „Barcelona Process“): a) Political and security partnership, b) Economic and financial partnership, c) Social, human and cultural partnership. 2. The main aim of the EMP is to promote economic growth. The main instrument for this is the creation of a Free Trade Area (FTA) by 2010. 3. The components of the EMP: a) The Euro-Mediterranean Association Agreements (EMAAs) aimed at liberalisation and cooperation in different areas; b) The financial support provided through MEDA and the European Investment Bank 4. How far the FTA will be reached depends on: a) Relative importancy of liberalization to other factors, b) Amount of liberalization achieved by the agreements.

Preliminary Remarks: 1. The three pillars within the Euro-Mediterranean Partnership (also known as the „Barcelona Process“): a) Political and security partnership, b) Economic and financial partnership, c) Social, human and cultural partnership. 2. The main aim of the EMP is to promote economic growth. The main instrument for this is the creation of a Free Trade Area (FTA) by 2010. 3. The components of the EMP: a) The Euro-Mediterranean Association Agreements (EMAAs) aimed at liberalisation and cooperation in different areas; b) The financial support provided through MEDA and the European Investment Bank 4. How far the FTA will be reached depends on: a) Relative importancy of liberalization to other factors, b) Amount of liberalization achieved by the agreements.

The aim of this overview: questions arising from figures. Ten year after the beginning of the Barcelona process it is time to take stock. This is in part the aim of this seminar. Our overview has a narrower aim: to remind you some figures that can help to answer the following questions. Ø Can we identify progress in the process of economic integration between Europe and Mediterranean partner countries? Ø Can we detect some sign of positive impact resulting from the Barcelona process on the MPCs development? Ø Above all, can we say that the role of Europe as economic partner of MPCs has been strengthened by the Barcelona process in comparison with the rest of the world? Ø How attractive does Europe appear as a partner for MPCs in comparison to the rest of the world?

The aim of this overview: questions arising from figures. Ten year after the beginning of the Barcelona process it is time to take stock. This is in part the aim of this seminar. Our overview has a narrower aim: to remind you some figures that can help to answer the following questions. Ø Can we identify progress in the process of economic integration between Europe and Mediterranean partner countries? Ø Can we detect some sign of positive impact resulting from the Barcelona process on the MPCs development? Ø Above all, can we say that the role of Europe as economic partner of MPCs has been strengthened by the Barcelona process in comparison with the rest of the world? Ø How attractive does Europe appear as a partner for MPCs in comparison to the rest of the world?

The aim of this overview: questions arising from figures. The answers to the above questions are crucial in our view if the general objective of the Barcelona process, and of the announced (future) European Neighbourhood Policy, is to build a security belt around Europe through economic cooperation and integration.

The aim of this overview: questions arising from figures. The answers to the above questions are crucial in our view if the general objective of the Barcelona process, and of the announced (future) European Neighbourhood Policy, is to build a security belt around Europe through economic cooperation and integration.

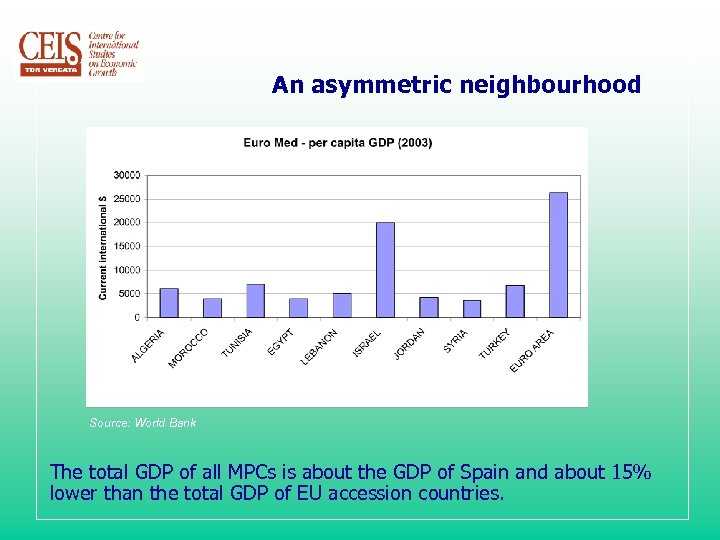

An asymmetric neighbourhood Source: World Bank The total GDP of all MPCs is about the GDP of Spain and about 15% lower than the total GDP of EU accession countries.

An asymmetric neighbourhood Source: World Bank The total GDP of all MPCs is about the GDP of Spain and about 15% lower than the total GDP of EU accession countries.

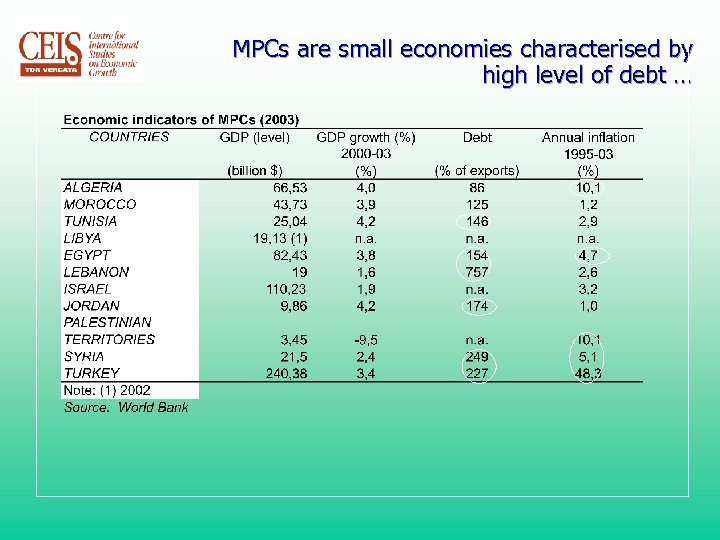

MPCs are small economies characterised by high level of debt …

MPCs are small economies characterised by high level of debt …

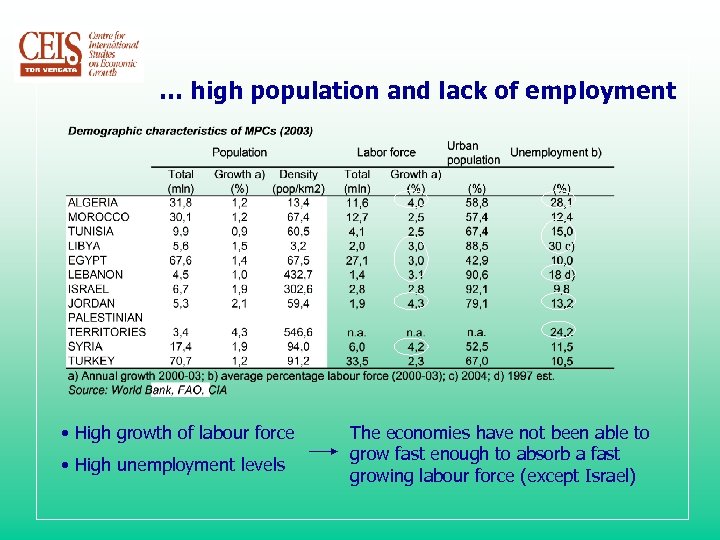

… high population and lack of employment • High growth of labour force • High unemployment levels The economies have not been able to grow fast enough to absorb a fast growing labour force (except Israel)

… high population and lack of employment • High growth of labour force • High unemployment levels The economies have not been able to grow fast enough to absorb a fast growing labour force (except Israel)

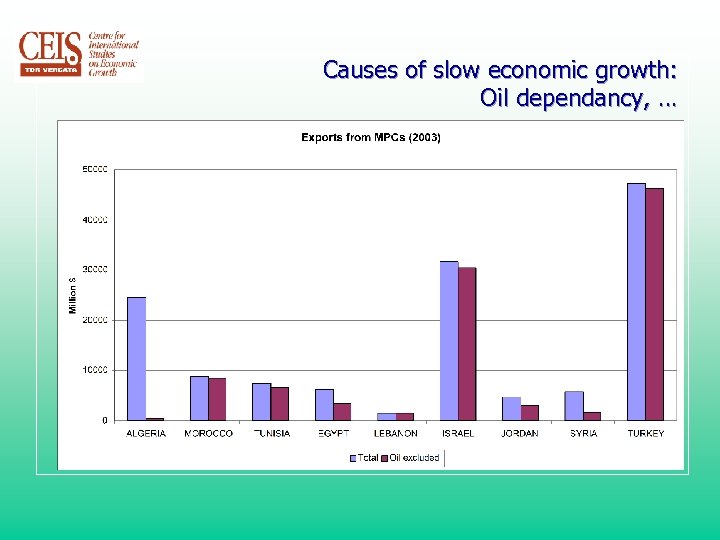

Causes of slow economic growth: Oil dependancy, …

Causes of slow economic growth: Oil dependancy, …

…High protection… Note: Freedom index: Free (Score 1 -1, 99), Mostly Free (Score 2 -2, 99), Mostly Unfree (Score 3 -3, 99), Repressed (Score 4 -5) Source: World Bank, Heritage Foundation With exeption of Israel, all MPCs have protectionist trade policies

…High protection… Note: Freedom index: Free (Score 1 -1, 99), Mostly Free (Score 2 -2, 99), Mostly Unfree (Score 3 -3, 99), Repressed (Score 4 -5) Source: World Bank, Heritage Foundation With exeption of Israel, all MPCs have protectionist trade policies

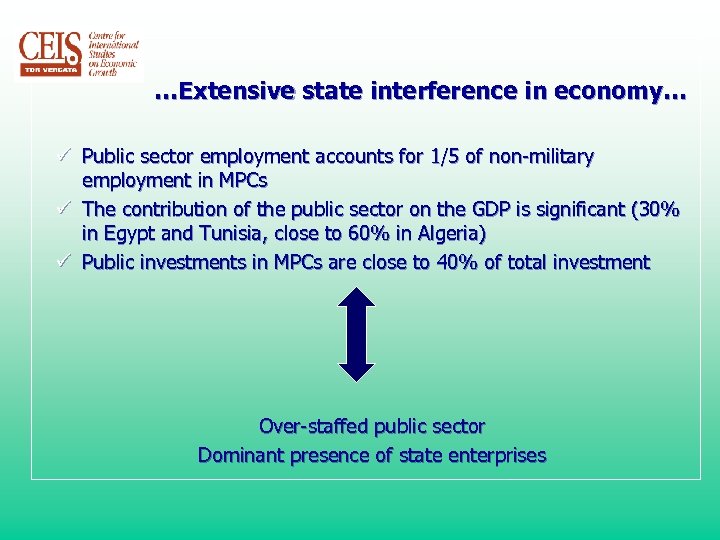

…Extensive state interference in economy… ü Public sector employment accounts for 1/5 of non-military employment in MPCs ü The contribution of the public sector on the GDP is significant (30% in Egypt and Tunisia, close to 60% in Algeria) ü Public investments in MPCs are close to 40% of total investment Over-staffed public sector Dominant presence of state enterprises

…Extensive state interference in economy… ü Public sector employment accounts for 1/5 of non-military employment in MPCs ü The contribution of the public sector on the GDP is significant (30% in Egypt and Tunisia, close to 60% in Algeria) ü Public investments in MPCs are close to 40% of total investment Over-staffed public sector Dominant presence of state enterprises

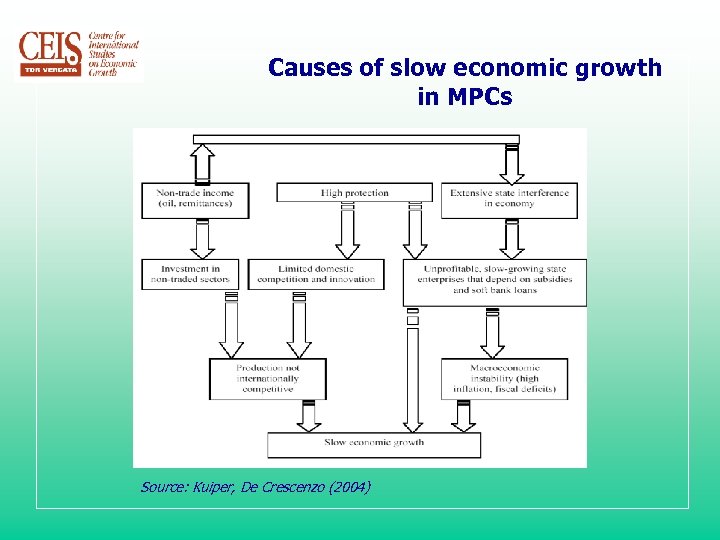

Causes of slow economic growth in MPCs Source: Kuiper, De Crescenzo (2004)

Causes of slow economic growth in MPCs Source: Kuiper, De Crescenzo (2004)

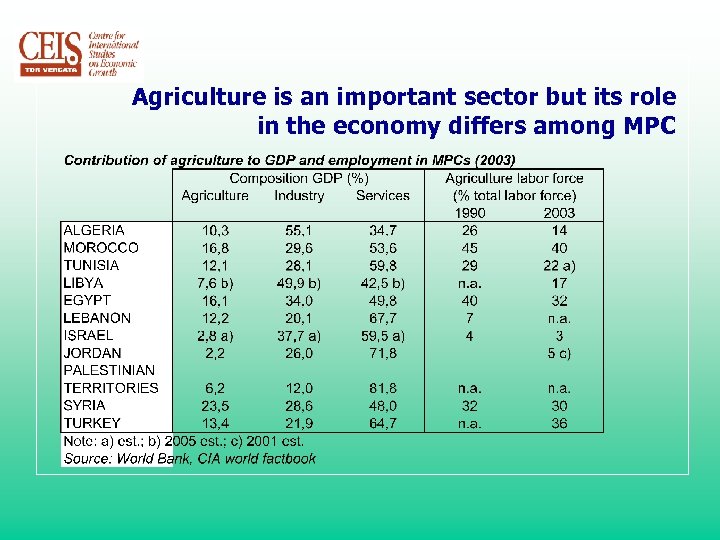

Agriculture is an important sector but its role in the economy differs among MPC

Agriculture is an important sector but its role in the economy differs among MPC

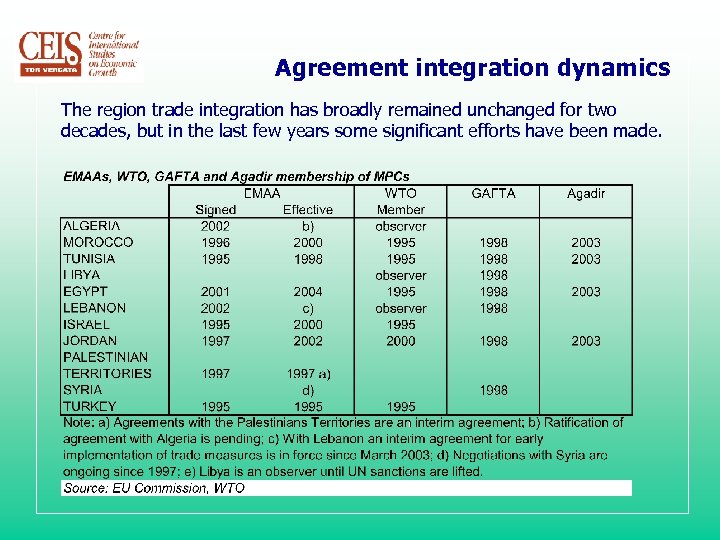

Agreement integration dynamics The region trade integration has broadly remained unchanged for two decades, but in the last few years some significant efforts have been made.

Agreement integration dynamics The region trade integration has broadly remained unchanged for two decades, but in the last few years some significant efforts have been made.

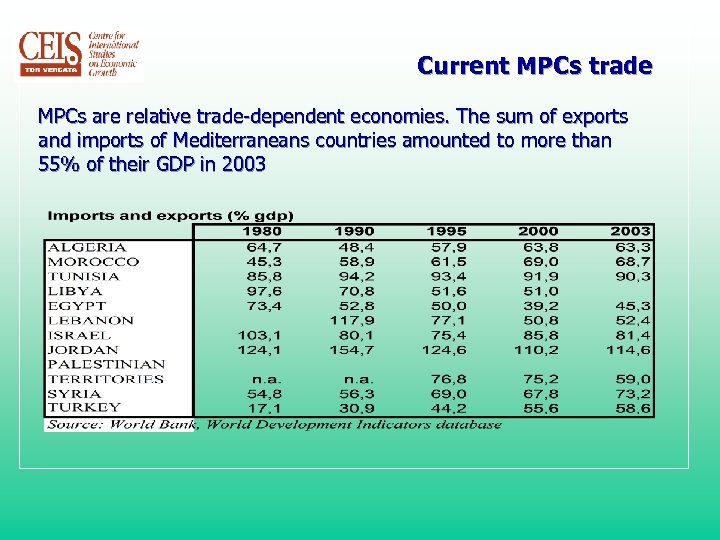

Current MPCs trade MPCs are relative trade-dependent economies. The sum of exports and imports of Mediterraneans countries amounted to more than 55% of their GDP in 2003

Current MPCs trade MPCs are relative trade-dependent economies. The sum of exports and imports of Mediterraneans countries amounted to more than 55% of their GDP in 2003

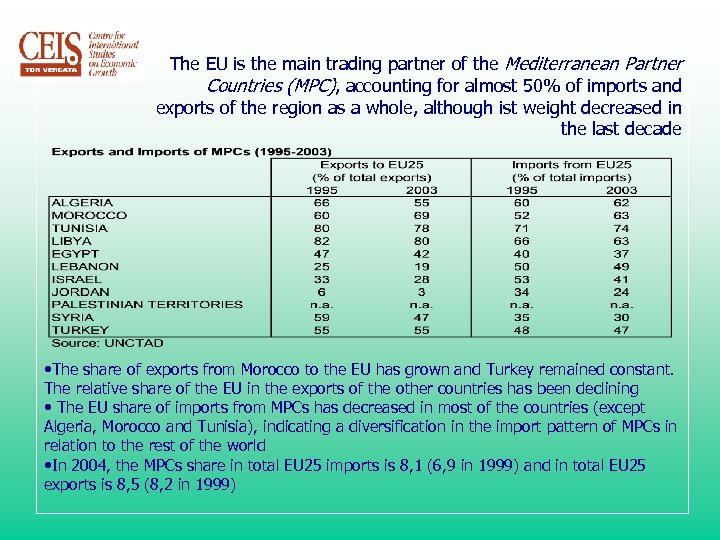

The EU is the main trading partner of the Mediterranean Partner Countries (MPC), accounting for almost 50% of imports and exports of the region as a whole, although ist weight decreased in the last decade • The share of exports from Morocco to the EU has grown and Turkey remained constant. The relative share of the EU in the exports of the other countries has been declining • The EU share of imports from MPCs has decreased in most of the countries (except Algeria, Morocco and Tunisia), indicating a diversification in the import pattern of MPCs in relation to the rest of the world • In 2004, the MPCs share in total EU 25 imports is 8, 1 (6, 9 in 1999) and in total EU 25 exports is 8, 5 (8, 2 in 1999)

The EU is the main trading partner of the Mediterranean Partner Countries (MPC), accounting for almost 50% of imports and exports of the region as a whole, although ist weight decreased in the last decade • The share of exports from Morocco to the EU has grown and Turkey remained constant. The relative share of the EU in the exports of the other countries has been declining • The EU share of imports from MPCs has decreased in most of the countries (except Algeria, Morocco and Tunisia), indicating a diversification in the import pattern of MPCs in relation to the rest of the world • In 2004, the MPCs share in total EU 25 imports is 8, 1 (6, 9 in 1999) and in total EU 25 exports is 8, 5 (8, 2 in 1999)

Inter Arab Trade does not seem to be affected by the EMP: only in Morocco the IAT/TET ratio has decreased between 1995 and 2003

Inter Arab Trade does not seem to be affected by the EMP: only in Morocco the IAT/TET ratio has decreased between 1995 and 2003

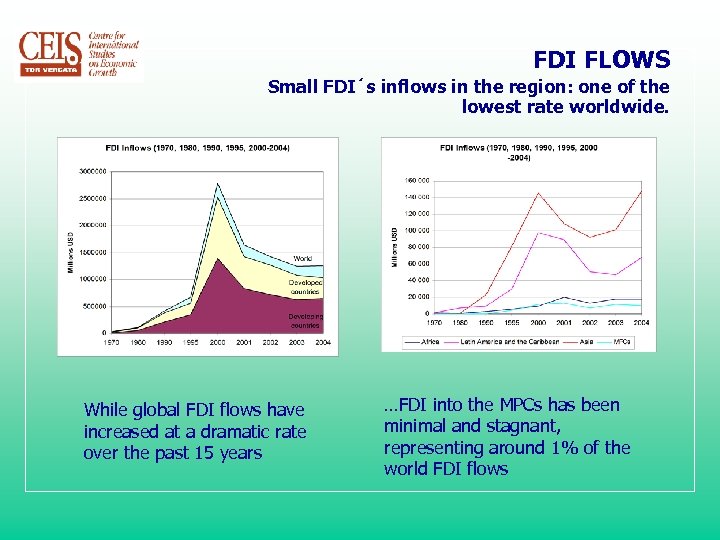

FDI FLOWS Small FDI´s inflows in the region: one of the lowest rate worldwide. While global FDI flows have increased at a dramatic rate over the past 15 years …FDI into the MPCs has been minimal and stagnant, representing around 1% of the world FDI flows

FDI FLOWS Small FDI´s inflows in the region: one of the lowest rate worldwide. While global FDI flows have increased at a dramatic rate over the past 15 years …FDI into the MPCs has been minimal and stagnant, representing around 1% of the world FDI flows

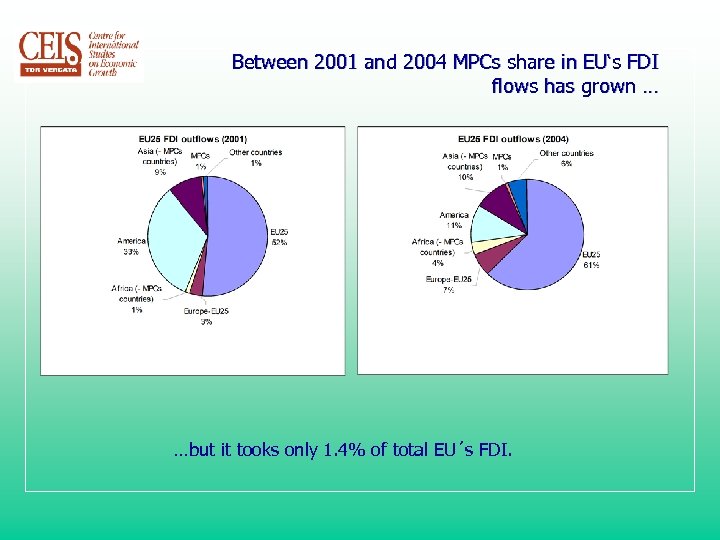

Between 2001 and 2004 MPCs share in EU‘s FDI flows has grown … …but it tooks only 1. 4% of total EU´s FDI.

Between 2001 and 2004 MPCs share in EU‘s FDI flows has grown … …but it tooks only 1. 4% of total EU´s FDI.

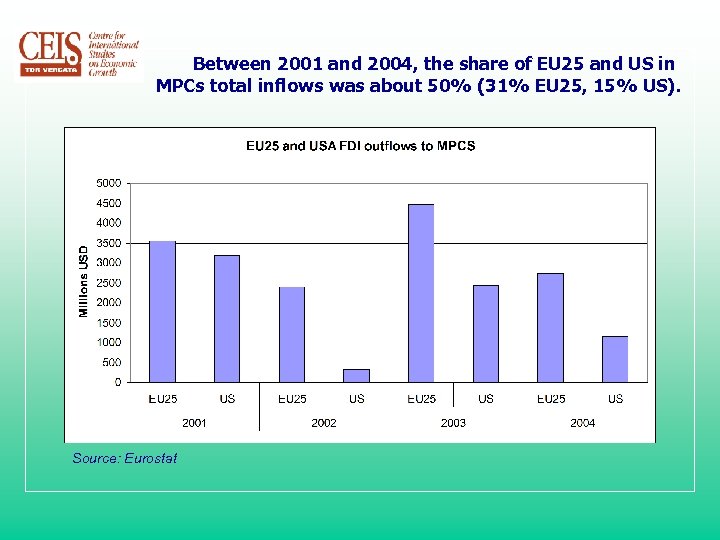

Between 2001 and 2004, the share of EU 25 and US in MPCs total inflows was about 50% (31% EU 25, 15% US). Source: Eurostat

Between 2001 and 2004, the share of EU 25 and US in MPCs total inflows was about 50% (31% EU 25, 15% US). Source: Eurostat

Why Such a Small FDI Share? • The region has long been plagued by violent conflict and instability • Several Mediterranean states have compounded this problem with poor economic governance • Governments have monopolies in most strategic sectors – especially energy • Private sectors are generally small and largely dominated by family business groups • Poor social and physical infrastructures (eg. education and transport) diminish the attractiveness of the region. Electricity per capita, telecom and internet penetration rates are relatively poor • Underdeveloped financial sectors (eg. central and private banking infrastructures) impede the mobilization and channelling of funds. • Strong local partners (eg. experienced local contracting firms) have been lacking, and there is a shortage of skilled labour • Several of the region’s administrations have lacked accountability and consistency (a feature of autocratic systems of governance). • There are still significant trade barriers in UE and MPCs

Why Such a Small FDI Share? • The region has long been plagued by violent conflict and instability • Several Mediterranean states have compounded this problem with poor economic governance • Governments have monopolies in most strategic sectors – especially energy • Private sectors are generally small and largely dominated by family business groups • Poor social and physical infrastructures (eg. education and transport) diminish the attractiveness of the region. Electricity per capita, telecom and internet penetration rates are relatively poor • Underdeveloped financial sectors (eg. central and private banking infrastructures) impede the mobilization and channelling of funds. • Strong local partners (eg. experienced local contracting firms) have been lacking, and there is a shortage of skilled labour • Several of the region’s administrations have lacked accountability and consistency (a feature of autocratic systems of governance). • There are still significant trade barriers in UE and MPCs

Measures to improve FDI conditions specified under Barcelona Process • Withdrawal of the state so as to: üimprove resource allocation and competitiveness; üincrease budgetary resources; üencourage national and foreign private investment • In-depth reform of indirect taxation, so as to reduce fiscal pressure on foreign trade • Opening up of financial intermediation activities to competition and scaling down public sector involvement in this field • Support for privatisation in the Mediterranean region

Measures to improve FDI conditions specified under Barcelona Process • Withdrawal of the state so as to: üimprove resource allocation and competitiveness; üincrease budgetary resources; üencourage national and foreign private investment • In-depth reform of indirect taxation, so as to reduce fiscal pressure on foreign trade • Opening up of financial intermediation activities to competition and scaling down public sector involvement in this field • Support for privatisation in the Mediterranean region

Financial support through MEDA and EIB • A cornerstone of the EMP is a financial support for the whole region through MEDA. • MEDA is comparable to the PHARE (Eastern Europe) and TACIS (Central Asia) programmes. • MEDA replaced previous bilateral aid protocols. The Funds: MEDA I (1995 -1999) 3, 435 million € MEDA II (2000 -2006) 5, 350 million € • MEDA pursues the creation of an EMFTZ by 2010 by supporting mainly structure adjustment programmes and economic transition programmes • The biggest difference of the new European Mediterranean Association Agreements (EMAAs) with former agreements from the 1970 s is the reciprocity • In addition, the European Investment Bank has launched in 2002 the Facility for Euro-Mediterranean Investment and Partnership (FEMIP) for promoting private sector development. Total loans in 2004: 2, 2 billion €. • The main competitor of the EU, the US, has already FTAs with Israel (1985) and Jordan (2002) and in 2003 launched a plan to create the Middle East Free Trade Area (MEFTA) by 2013.

Financial support through MEDA and EIB • A cornerstone of the EMP is a financial support for the whole region through MEDA. • MEDA is comparable to the PHARE (Eastern Europe) and TACIS (Central Asia) programmes. • MEDA replaced previous bilateral aid protocols. The Funds: MEDA I (1995 -1999) 3, 435 million € MEDA II (2000 -2006) 5, 350 million € • MEDA pursues the creation of an EMFTZ by 2010 by supporting mainly structure adjustment programmes and economic transition programmes • The biggest difference of the new European Mediterranean Association Agreements (EMAAs) with former agreements from the 1970 s is the reciprocity • In addition, the European Investment Bank has launched in 2002 the Facility for Euro-Mediterranean Investment and Partnership (FEMIP) for promoting private sector development. Total loans in 2004: 2, 2 billion €. • The main competitor of the EU, the US, has already FTAs with Israel (1985) and Jordan (2002) and in 2003 launched a plan to create the Middle East Free Trade Area (MEFTA) by 2013.

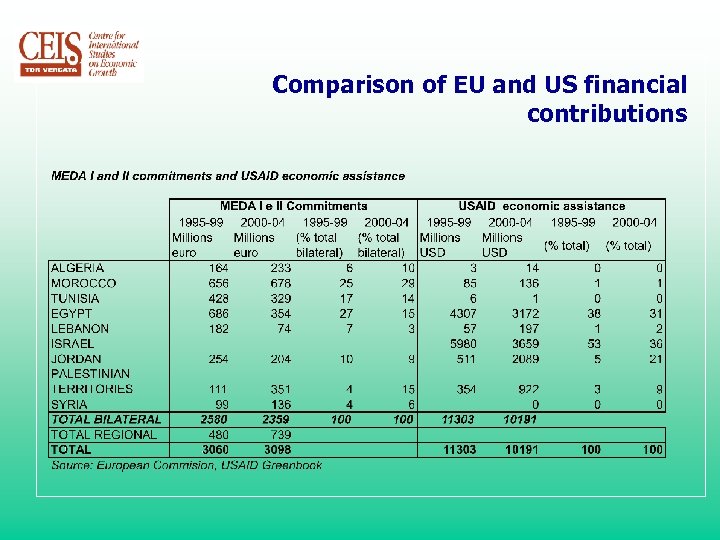

Comparison of EU and US financial contributions

Comparison of EU and US financial contributions

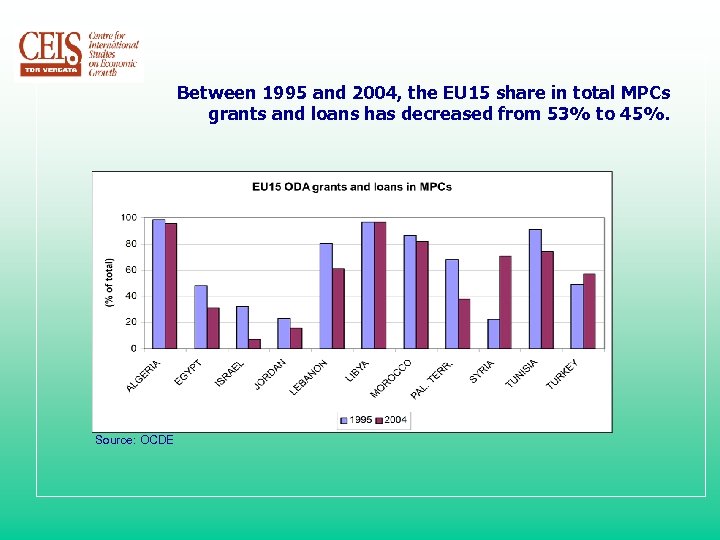

Between 1995 and 2004, the EU 15 share in total MPCs grants and loans has decreased from 53% to 45%. Source: OCDE

Between 1995 and 2004, the EU 15 share in total MPCs grants and loans has decreased from 53% to 45%. Source: OCDE

The Liberalisation Process a) The Liberalisation of Agricultural trade • Key sector in most of the MPCs, for which the EU is the principal overseas market. • EU Agricultural trade policies are a complex system of seasonal preferences for sensitive products (e. g. tomatoes and oranges) • EU quantity and quality restrictions: üTariff rate quotas (TRQs) on a large number of fresh fruit and vegetables and some dried or processed ones, as well as flowers, Tunisian olive oil and all qualities of wine; üReference quantities (RQs) imposed on many fresh fruit and vegetables, some dried or processed ones, nuts, and fresh and preserved tropical fruit; ü Sanitary and phyto-sanitary standards • MPC preferences are even more limited, both in terms of share of preferential over total trade flows and in term of tariff reductions for strategic products, like cereals and milk, that lead to high domestic prices.

The Liberalisation Process a) The Liberalisation of Agricultural trade • Key sector in most of the MPCs, for which the EU is the principal overseas market. • EU Agricultural trade policies are a complex system of seasonal preferences for sensitive products (e. g. tomatoes and oranges) • EU quantity and quality restrictions: üTariff rate quotas (TRQs) on a large number of fresh fruit and vegetables and some dried or processed ones, as well as flowers, Tunisian olive oil and all qualities of wine; üReference quantities (RQs) imposed on many fresh fruit and vegetables, some dried or processed ones, nuts, and fresh and preserved tropical fruit; ü Sanitary and phyto-sanitary standards • MPC preferences are even more limited, both in terms of share of preferential over total trade flows and in term of tariff reductions for strategic products, like cereals and milk, that lead to high domestic prices.

The Liberalisation Process Even if a liberalisation of agricultural trade would have enormous impact on Euro-Med trade flows, no defined prospect for the liberalisation of agriculture was stressed under the Barcelona Process There have been no significant new concessions made by the EU for agriculture products in the EMAAs, nor are these expected to come about in the near future

The Liberalisation Process Even if a liberalisation of agricultural trade would have enormous impact on Euro-Med trade flows, no defined prospect for the liberalisation of agriculture was stressed under the Barcelona Process There have been no significant new concessions made by the EU for agriculture products in the EMAAs, nor are these expected to come about in the near future

The Liberalisation Process b) The liberalisation of Industrial products trade The EMAAs set out a trade liberalisation commitment by the MPCs, which complements the tariff-free treatment for industrial goods already granted to their exports to the EU since mid-1970 s Under the EMAAs the MPCs gradually remove all tariffs on imports of industrial products from EU over by 2010. The specific time schedules for dismantling are differentiated according to the sensitivity of the goods. Tunisia is ahead of other MPCs in reforming ist economy and implementing a range of major reforms, except for abolishing trade barriers. If the liberalisation of manufactured goods was implemented overnight, 1/3 of the industrial firms would go bankrupt. With a view to achieving a full FTA, the MPCs are also expected to implement free trade among themselves (South-South integration)

The Liberalisation Process b) The liberalisation of Industrial products trade The EMAAs set out a trade liberalisation commitment by the MPCs, which complements the tariff-free treatment for industrial goods already granted to their exports to the EU since mid-1970 s Under the EMAAs the MPCs gradually remove all tariffs on imports of industrial products from EU over by 2010. The specific time schedules for dismantling are differentiated according to the sensitivity of the goods. Tunisia is ahead of other MPCs in reforming ist economy and implementing a range of major reforms, except for abolishing trade barriers. If the liberalisation of manufactured goods was implemented overnight, 1/3 of the industrial firms would go bankrupt. With a view to achieving a full FTA, the MPCs are also expected to implement free trade among themselves (South-South integration)

The Liberalisation Process The liberalisation of textiles and clothes trade • The countries in the Southern and Eastern Mediterranean area employ over 3. 7 million people in the textile sector: 39% of total employment in Morocco, 41% in Tunisia, 34% in Turkey. • The share of T&C exports of their total exports to the EU is high (e. g. 54% for Tunisia, 53% for Morocco, 47% for Turkey) • The importance of this sector is double: -Because of the very important dependance of MPCs on the Eu market for their exports and employment; -Because of the close relationship between EU T&C industry and the T&C industry of those countries, via investment and subcontracting relationships • In 2004, the EU imports from MPC represent 28% of EU textile market (12, 8 billion €) and EU exports to MPC represent 14% of EU textile market (2, 3 billion €) • Due to WTO, the Agreement on textiles and clothing expired on 2005 • Between January and May 2004, the EU imports from China represent 11% of EU textile market. One year late, the EU imports from China represent 22% of EU textile market.

The Liberalisation Process The liberalisation of textiles and clothes trade • The countries in the Southern and Eastern Mediterranean area employ over 3. 7 million people in the textile sector: 39% of total employment in Morocco, 41% in Tunisia, 34% in Turkey. • The share of T&C exports of their total exports to the EU is high (e. g. 54% for Tunisia, 53% for Morocco, 47% for Turkey) • The importance of this sector is double: -Because of the very important dependance of MPCs on the Eu market for their exports and employment; -Because of the close relationship between EU T&C industry and the T&C industry of those countries, via investment and subcontracting relationships • In 2004, the EU imports from MPC represent 28% of EU textile market (12, 8 billion €) and EU exports to MPC represent 14% of EU textile market (2, 3 billion €) • Due to WTO, the Agreement on textiles and clothing expired on 2005 • Between January and May 2004, the EU imports from China represent 11% of EU textile market. One year late, the EU imports from China represent 22% of EU textile market.

The Liberalisation Process c) The liberalisation of trade in Services The liberalisation of trade in services • will spill over into the production and export of goods • will serve to improve the functioning e. g. , transport, energy, telecoms, finance in the MPCs • Regional solutions to promote liberalisation of trade in services: üReform of the transport sector at national level, definition and promotion of an efficient regional transport infrastructure network, with national transport systems linked to each other and with Trans-European Networks üDevelopment of appropriate energy policies üModernisation of the telecomunications sector and facilitation of interconnections as a prerequisite for the development of the Information Society.

The Liberalisation Process c) The liberalisation of trade in Services The liberalisation of trade in services • will spill over into the production and export of goods • will serve to improve the functioning e. g. , transport, energy, telecoms, finance in the MPCs • Regional solutions to promote liberalisation of trade in services: üReform of the transport sector at national level, definition and promotion of an efficient regional transport infrastructure network, with national transport systems linked to each other and with Trans-European Networks üDevelopment of appropriate energy policies üModernisation of the telecomunications sector and facilitation of interconnections as a prerequisite for the development of the Information Society.

The Liberalisation Process § In the context of the EU’s relationship with its Mediterranean partners, rules of origin (ROOs) are increasingly seen as playing an important role. § In principle the Mediterranean partners should adopt what is known as the “pan-European system of cumulation of rules of origin” § Rules of origin can indeed serve to restrict suppliers’ ability to buy their inputs from the cheapest available source. In so doing rules of origin impact upon patterns of trade, production and consequently also welfare. Clearly to the extent that rules of origin do indeed have such an impact, this is likely to fall most heavily on small, possibly less diversified economies, who consequently find it more difficult to source their inputs domestically and competitively.

The Liberalisation Process § In the context of the EU’s relationship with its Mediterranean partners, rules of origin (ROOs) are increasingly seen as playing an important role. § In principle the Mediterranean partners should adopt what is known as the “pan-European system of cumulation of rules of origin” § Rules of origin can indeed serve to restrict suppliers’ ability to buy their inputs from the cheapest available source. In so doing rules of origin impact upon patterns of trade, production and consequently also welfare. Clearly to the extent that rules of origin do indeed have such an impact, this is likely to fall most heavily on small, possibly less diversified economies, who consequently find it more difficult to source their inputs domestically and competitively.

Conclusion 1 What do these figures tell us? The European Commission has reached a critical level in order to have a significant impact on national policies only in some Mediterranean Partner Countries. The total MEDA I and II commitments for the period 1995 -2004 have been less than one third of the USAID economic assistance for the same period (even if this assistance has been concentrated in three countries: Israel, Egypt and Jordan). The EU 15 (European Commission and member states) share in total MPCs grants and loans has decreased from 53 % to 45 %.

Conclusion 1 What do these figures tell us? The European Commission has reached a critical level in order to have a significant impact on national policies only in some Mediterranean Partner Countries. The total MEDA I and II commitments for the period 1995 -2004 have been less than one third of the USAID economic assistance for the same period (even if this assistance has been concentrated in three countries: Israel, Egypt and Jordan). The EU 15 (European Commission and member states) share in total MPCs grants and loans has decreased from 53 % to 45 %.

Conclusion 2 The MPCs are not following the global trend towards trade liberalisation and this implies that these countries are losing in terms of international competitiveness relative to other regions in the world. This creates a cumulative process: high protection rates increase the relative strength of import-substitution inefficient industries and in this way the strength of lobbies in favour of maintaining high protection rates increases as well. The mechanism is made possible in presence of inflows of foreign exchange coming from remittances, export of natural resources, financial official assistance (grants and loans) and FDI. A role in maintaining the mechanism was the preferential access to European markets that some MPCs countries enjoyed for some products (for example textiles and clothes). Currently, the liberalisation of textiles and clothes imports from Asia dramatically changes the context in which MPCs have to compete in European markets and the expected returns of investments made in these sectors.

Conclusion 2 The MPCs are not following the global trend towards trade liberalisation and this implies that these countries are losing in terms of international competitiveness relative to other regions in the world. This creates a cumulative process: high protection rates increase the relative strength of import-substitution inefficient industries and in this way the strength of lobbies in favour of maintaining high protection rates increases as well. The mechanism is made possible in presence of inflows of foreign exchange coming from remittances, export of natural resources, financial official assistance (grants and loans) and FDI. A role in maintaining the mechanism was the preferential access to European markets that some MPCs countries enjoyed for some products (for example textiles and clothes). Currently, the liberalisation of textiles and clothes imports from Asia dramatically changes the context in which MPCs have to compete in European markets and the expected returns of investments made in these sectors.

Conclusion 3 Some final considerations within the framework above described: Trade liberalisation needed for attracting more FDI and increase competitiveness of the MPCs production creates major problems for government tariff revenues and for the social impact of the structural adjustment process in both import-substitution industries and export-oriented industries. Which are the financial resources and the size of unilateral trade liberalization that EU is willing to offer to MPCs for alleviating their structural adjustment?

Conclusion 3 Some final considerations within the framework above described: Trade liberalisation needed for attracting more FDI and increase competitiveness of the MPCs production creates major problems for government tariff revenues and for the social impact of the structural adjustment process in both import-substitution industries and export-oriented industries. Which are the financial resources and the size of unilateral trade liberalization that EU is willing to offer to MPCs for alleviating their structural adjustment?

Conclusion 3 The increasing trade with the US suggests that their trade agreements and financial support are more effective than the European initiatives. In fact, when the prime objective is political as well as related to creating development, the quantity of assistance, both in terms of absolute value and in proportion to the offer by other donors, becomes an important factor in the effectiveness of the policy itself. This is the case particularly when other countries offer assistance, having objectives not always consistent with or in conflict with European ones. In conclusion what does the EU currently offer to MPCs in order to carry on the Barcelona process?

Conclusion 3 The increasing trade with the US suggests that their trade agreements and financial support are more effective than the European initiatives. In fact, when the prime objective is political as well as related to creating development, the quantity of assistance, both in terms of absolute value and in proportion to the offer by other donors, becomes an important factor in the effectiveness of the policy itself. This is the case particularly when other countries offer assistance, having objectives not always consistent with or in conflict with European ones. In conclusion what does the EU currently offer to MPCs in order to carry on the Barcelona process?