60695fed46e2dd79dece6ba6a5e0ff34.ppt

- Количество слайдов: 19

EU Industry and Monetary Policy Closing the investment gap EESC, 12 November 2015 Guido Nelissen Economic Adviser industri. All European Trade Union 1

EU Industry and Monetary Policy Closing the investment gap EESC, 12 November 2015 Guido Nelissen Economic Adviser industri. All European Trade Union 1

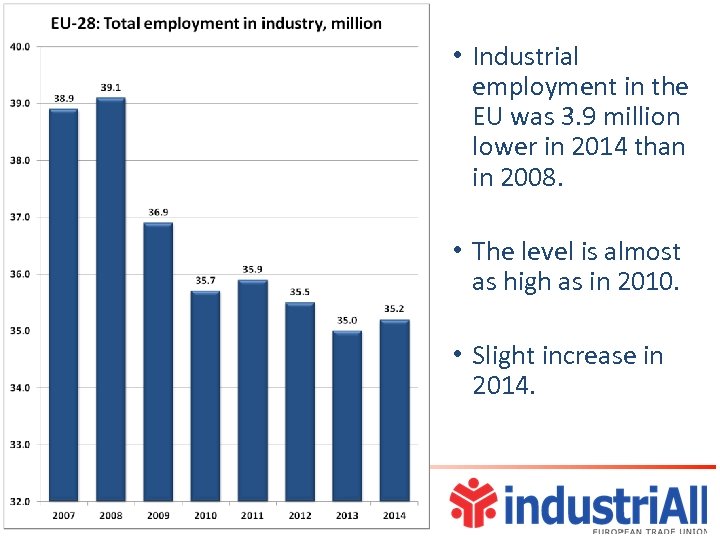

• Industrial employment in the EU was 3. 9 million lower in 2014 than in 2008. • The level is almost as high as in 2010. • Slight increase in 2014.

• Industrial employment in the EU was 3. 9 million lower in 2014 than in 2008. • The level is almost as high as in 2010. • Slight increase in 2014.

3

3

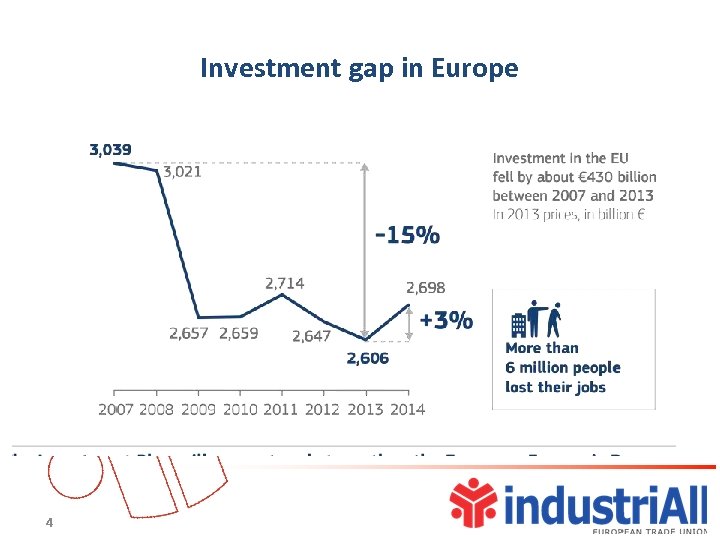

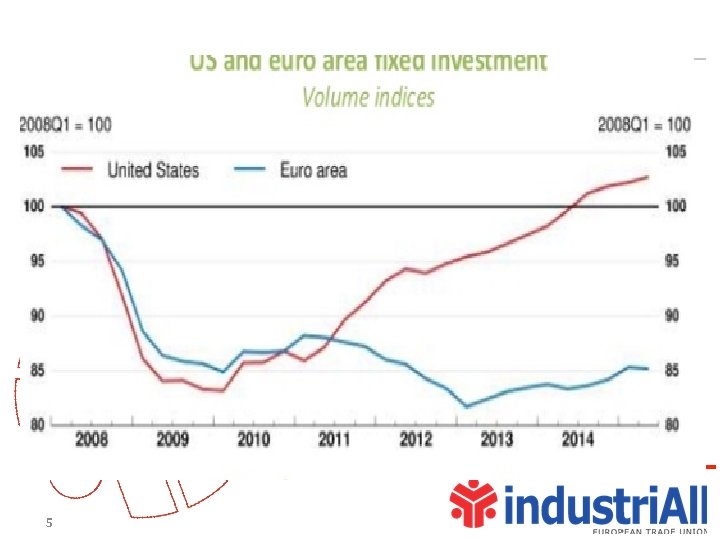

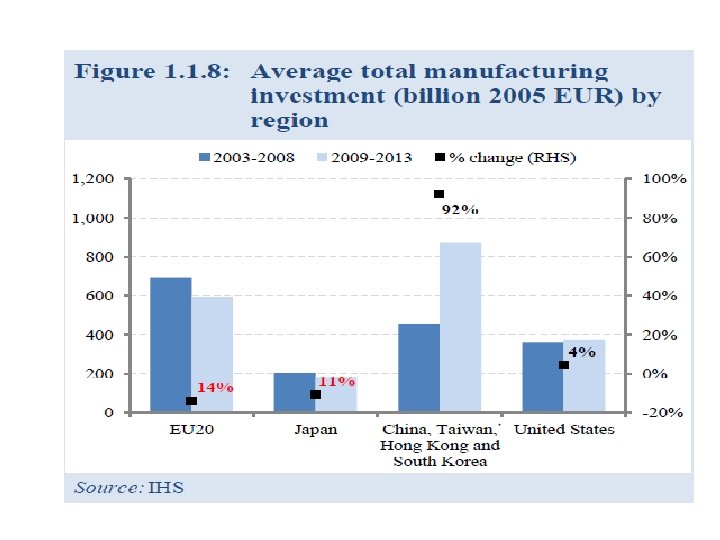

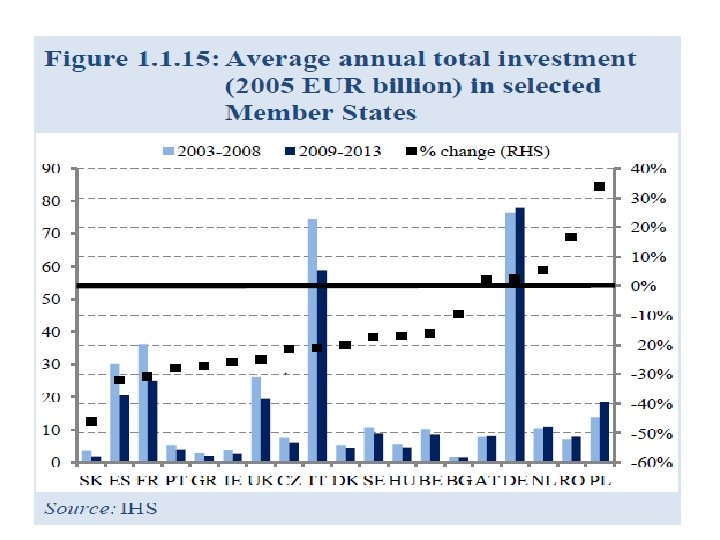

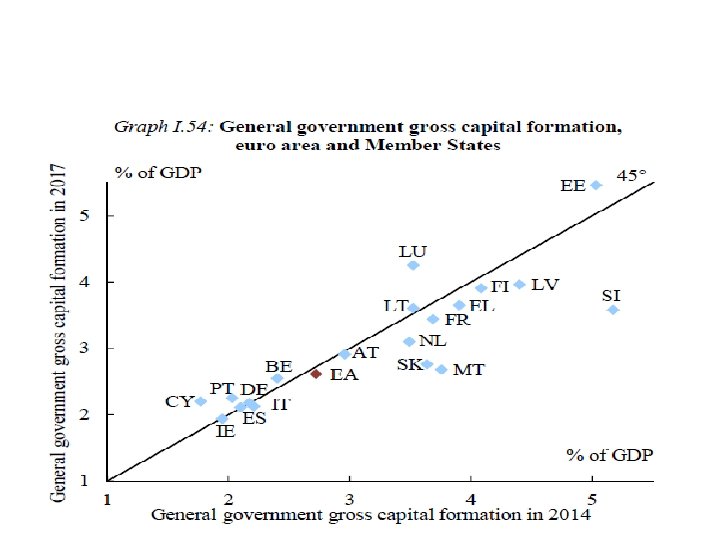

Investment gap in Europe 4

Investment gap in Europe 4

5

5

6

6

7

7

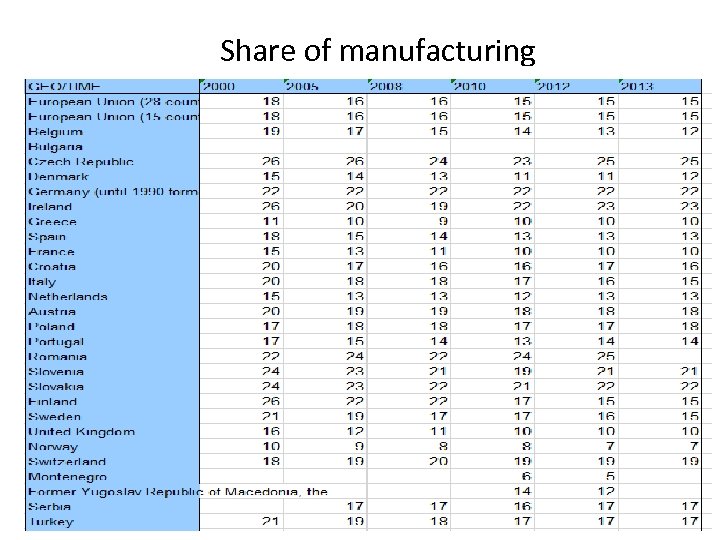

Share of manufacturing 8

Share of manufacturing 8

9

9

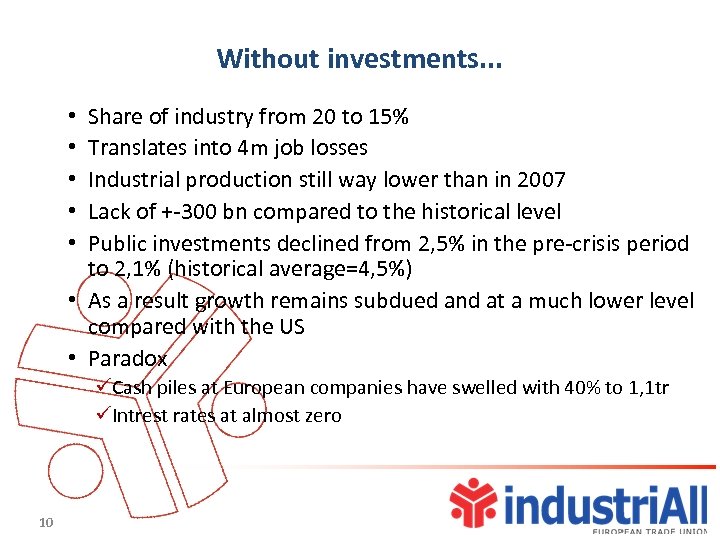

Without investments. . . Share of industry from 20 to 15% Translates into 4 m job losses Industrial production still way lower than in 2007 Lack of +-300 bn compared to the historical level Public investments declined from 2, 5% in the pre-crisis period to 2, 1% (historical average=4, 5%) • As a result growth remains subdued and at a much lower level compared with the US • Paradox • • • üCash piles at European companies have swelled with 40% to 1, 1 tr üIntrest rates at almost zero 10

Without investments. . . Share of industry from 20 to 15% Translates into 4 m job losses Industrial production still way lower than in 2007 Lack of +-300 bn compared to the historical level Public investments declined from 2, 5% in the pre-crisis period to 2, 1% (historical average=4, 5%) • As a result growth remains subdued and at a much lower level compared with the US • Paradox • • • üCash piles at European companies have swelled with 40% to 1, 1 tr üIntrest rates at almost zero 10

. . . no industrial “renaissance” • Without investments üNo increase in productivity and thus economic growth üNo technological progress üNo proper replacement for our capital stock and decrease of our potential output üSecular stagnation with permanent high unemployment, permanent risk of sliding in recession again, permanent risk for deflation üNo solution for our big societal challenges • EU 2020 strategy • Roadmap 2050: 1, 5% additional investments required üNo increase share of industry again to 20% 11

. . . no industrial “renaissance” • Without investments üNo increase in productivity and thus economic growth üNo technological progress üNo proper replacement for our capital stock and decrease of our potential output üSecular stagnation with permanent high unemployment, permanent risk of sliding in recession again, permanent risk for deflation üNo solution for our big societal challenges • EU 2020 strategy • Roadmap 2050: 1, 5% additional investments required üNo increase share of industry again to 20% 11

How come? • Supply side factors ü uncertainty about the global economic outlook ü a still fragile financial sector ü Overcapacities ü Banks that have become risk averse • but mainly the result of a massive shortfall of demand: investments follow demand! ü Lethal combination of • A fiscal contraction of 5% • Processes of internal devaluation: creation of a low-wage sector, reduction of purchasing power, deregulation of labour markets • Deleveraging in the private sector and in the financial sector ü Only positive development was the increase in exports but exporting our way out of the crisis will become more and more difficult 12

How come? • Supply side factors ü uncertainty about the global economic outlook ü a still fragile financial sector ü Overcapacities ü Banks that have become risk averse • but mainly the result of a massive shortfall of demand: investments follow demand! ü Lethal combination of • A fiscal contraction of 5% • Processes of internal devaluation: creation of a low-wage sector, reduction of purchasing power, deregulation of labour markets • Deleveraging in the private sector and in the financial sector ü Only positive development was the increase in exports but exporting our way out of the crisis will become more and more difficult 12

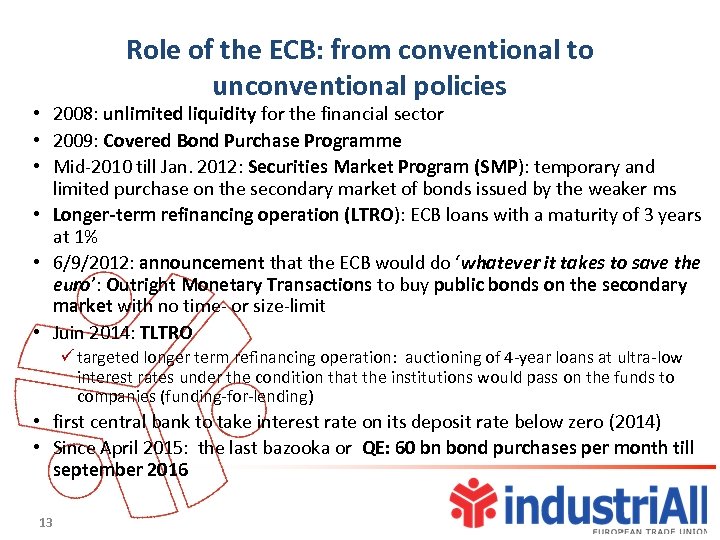

Role of the ECB: from conventional to unconventional policies • 2008: unlimited liquidity for the financial sector • 2009: Covered Bond Purchase Programme • Mid-2010 till Jan. 2012: Securities Market Program (SMP): temporary and limited purchase on the secondary market of bonds issued by the weaker ms • Longer-term refinancing operation (LTRO): ECB loans with a maturity of 3 years at 1% • 6/9/2012: announcement that the ECB would do ‘whatever it takes to save the euro’: Outright Monetary Transactions to buy public bonds on the secondary market with no time- or size-limit • Juin 2014: TLTRO ü targeted longer term refinancing operation: auctioning of 4 -year loans at ultra-low interest rates under the condition that the institutions would pass on the funds to companies (funding-for-lending) • first central bank to take interest rate on its deposit rate below zero (2014) • Since April 2015: the last bazooka or QE: 60 bn bond purchases per month till september 2016 13

Role of the ECB: from conventional to unconventional policies • 2008: unlimited liquidity for the financial sector • 2009: Covered Bond Purchase Programme • Mid-2010 till Jan. 2012: Securities Market Program (SMP): temporary and limited purchase on the secondary market of bonds issued by the weaker ms • Longer-term refinancing operation (LTRO): ECB loans with a maturity of 3 years at 1% • 6/9/2012: announcement that the ECB would do ‘whatever it takes to save the euro’: Outright Monetary Transactions to buy public bonds on the secondary market with no time- or size-limit • Juin 2014: TLTRO ü targeted longer term refinancing operation: auctioning of 4 -year loans at ultra-low interest rates under the condition that the institutions would pass on the funds to companies (funding-for-lending) • first central bank to take interest rate on its deposit rate below zero (2014) • Since April 2015: the last bazooka or QE: 60 bn bond purchases per month till september 2016 13

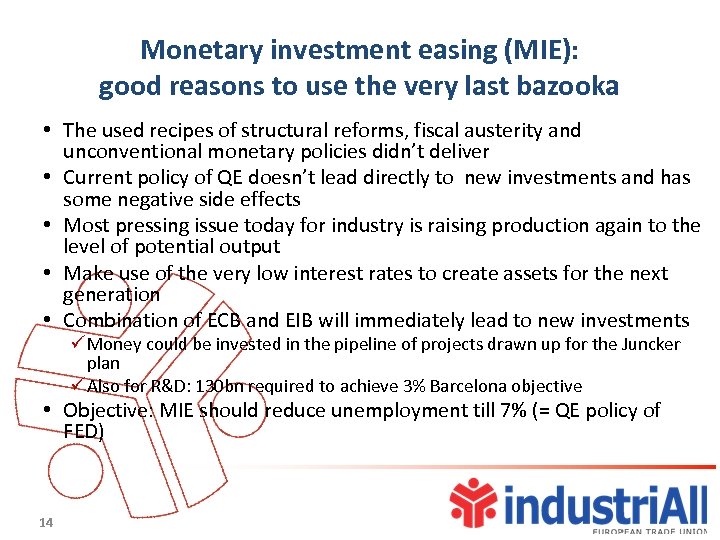

Monetary investment easing (MIE): good reasons to use the very last bazooka • The used recipes of structural reforms, fiscal austerity and unconventional monetary policies didn’t deliver • Current policy of QE doesn’t lead directly to new investments and has some negative side effects • Most pressing issue today for industry is raising production again to the level of potential output • Make use of the very low interest rates to create assets for the next generation • Combination of ECB and EIB will immediately lead to new investments ü Money could be invested in the pipeline of projects drawn up for the Juncker plan ü Also for R&D: 130 bn required to achieve 3% Barcelona objective • Objective: MIE should reduce unemployment till 7% (= QE policy of FED) 14

Monetary investment easing (MIE): good reasons to use the very last bazooka • The used recipes of structural reforms, fiscal austerity and unconventional monetary policies didn’t deliver • Current policy of QE doesn’t lead directly to new investments and has some negative side effects • Most pressing issue today for industry is raising production again to the level of potential output • Make use of the very low interest rates to create assets for the next generation • Combination of ECB and EIB will immediately lead to new investments ü Money could be invested in the pipeline of projects drawn up for the Juncker plan ü Also for R&D: 130 bn required to achieve 3% Barcelona objective • Objective: MIE should reduce unemployment till 7% (= QE policy of FED) 14

Questions • Who will carry the risks, • Which guarantees to ensure a triple AAA rating • Quality of projects ü Technical preparation ü Financial due diligence ü Implementation • Combining fiscal and monetary policies contains risks • Democratic deficit? ü EIB/ECB as the investment policy makers in the EU? • ECB covers only eurozone • Cofinancing? • Why not a European Treasury to finance investments? 15

Questions • Who will carry the risks, • Which guarantees to ensure a triple AAA rating • Quality of projects ü Technical preparation ü Financial due diligence ü Implementation • Combining fiscal and monetary policies contains risks • Democratic deficit? ü EIB/ECB as the investment policy makers in the EU? • ECB covers only eurozone • Cofinancing? • Why not a European Treasury to finance investments? 15

What else to restart investments? • A more flexible interpretation of the SGP ü Strenghtening the flexibility clause of SGP ü Room for manoever in MS with <3% deficit • Promote internal demand ü Restore consumer confidence=restore workers’ confidence • Shrinking the low-wage sector • Minimum wages • Reduce precarious work ü Real wages in line with productity increases ü Juncker Plan: 1, 8 m new jobs (ILO) • Restore trust in the financial sector ü Completing the banking union ü Separation of investment banking and retail banking ü A Financial Transaction Tax will reduce speculative behaviour and provide additional revenues ü Transparency and regulate shadow banking 16

What else to restart investments? • A more flexible interpretation of the SGP ü Strenghtening the flexibility clause of SGP ü Room for manoever in MS with <3% deficit • Promote internal demand ü Restore consumer confidence=restore workers’ confidence • Shrinking the low-wage sector • Minimum wages • Reduce precarious work ü Real wages in line with productity increases ü Juncker Plan: 1, 8 m new jobs (ILO) • Restore trust in the financial sector ü Completing the banking union ü Separation of investment banking and retail banking ü A Financial Transaction Tax will reduce speculative behaviour and provide additional revenues ü Transparency and regulate shadow banking 16

• Restore monetary transmission: diversification in funding sources üDevelop markets for high quality structured products, covered bonds, corporate bonds üBetter integrated capital markets will promote cross-border investments üAn integrated European market for venture capital üCooperative finance, micro-finance üSupport to long term finance • ELTIF’s to mobilize funds of institutional investors • Project bonds • Green investment funds which couple finance with technical assistance and risk sharing 17

• Restore monetary transmission: diversification in funding sources üDevelop markets for high quality structured products, covered bonds, corporate bonds üBetter integrated capital markets will promote cross-border investments üAn integrated European market for venture capital üCooperative finance, micro-finance üSupport to long term finance • ELTIF’s to mobilize funds of institutional investors • Project bonds • Green investment funds which couple finance with technical assistance and risk sharing 17

• Shape the supply side by an industrial policy in support of the ‘third industrial revolution’ based on ü Renewable energy and energy-efficiency ü Digitalisation of economic activities ü New materials ü Renewable raw materials ü Circular economy ü Sustainable transport ü Breakthrough techologies: nano-electronics, biotech, optonics • With special attention for the market introduction of new products/services ü Joint European PPP’s: Shift 2 Rail, Biobased industries, Fuel Cells, Innovative Medicines, ECSEL, Green Cars ü Innovative public procurement ü Dynamic standardisation procedures Addressing the big societal challenges will trigger new investments in high -value added activities and with a high multiplier 18

• Shape the supply side by an industrial policy in support of the ‘third industrial revolution’ based on ü Renewable energy and energy-efficiency ü Digitalisation of economic activities ü New materials ü Renewable raw materials ü Circular economy ü Sustainable transport ü Breakthrough techologies: nano-electronics, biotech, optonics • With special attention for the market introduction of new products/services ü Joint European PPP’s: Shift 2 Rail, Biobased industries, Fuel Cells, Innovative Medicines, ECSEL, Green Cars ü Innovative public procurement ü Dynamic standardisation procedures Addressing the big societal challenges will trigger new investments in high -value added activities and with a high multiplier 18

Thank you for your attention! 19

Thank you for your attention! 19