6e6b3d8829f903412673c9adccdb0e3c.ppt

- Количество слайдов: 74

Ethics Update for the In-House Counsel: Whistleblowers, Compliance, Privilege, Work Product, and New Decisions of Note Presented by: Gary Parsons & David Smyth Brooks, Pierce, Mc. Lendon, Humphrey & Leonard, LLP

It’s Alive! 2

Insider Trading Bounty Program • 20 years of little use • Insider Trading and Securities Fraud Enforcement Act of 1988 • Authorized bounties of up to 10% of civil penalties in insider trading cases • Complete SEC discretion Whistleblower - 1 3

Information-sharing Problems in U. S. Government • 9/11 • Nigerian Hijacker – 2009 • SEC – Putnam Investments – 2003 – Bernie Madoff – 2008 Whistleblower – 1 -2 4

Dodd-Frank Section 922 • Required the SEC to establish a program to pay financial rewards to people who provide information about possible securities violations to the SEC. • The statute mandates payment of 10 -30% of the monetary sanctions from an enforcement action generated by a whistleblower tip. Whistleblower - 3 5

Privilege – The General Rule Federal • A client has a privilege to refuse to disclose and • to prevent any other person from disclosing • confidential communications • made for the purpose of facilitating the rendition of professional legal services to the client Privilege - 1 6

Privilege – The General Rule Federal • between himself or his representative and his lawyer or his lawyer's representative, or • between his lawyer and the lawyer's representative, or • by him or his lawyer to a lawyer representing another in a matter of common interest, or • between representatives of the client or between the client and a representative of the client, or • between lawyers representing the client. Privilege - 1 7

Privilege – The General Rule State • Attorney-client relationship existed at the time the communication was made • Communication was made in confidence • Communication relates to a matter about which the attorney is being professionally consulted • Communication was made in the course of giving or seeking legal advice for a proper purpose although litigation need not be contemplated and • Client has not waived the privilege. Privilege - 2 8

Privilege – Who Owns • Belongs to the client • Lawyer must assert until: – Authorized to disclose by client – Ordered to disclose by Court – Other ethical rule exception applies Privilege – 2 -3 9

Privilege – Privileged Communications • Any expression through which a client undertakes to convey information to the attorney – or vice versa • Must be for purpose of facilitating rendition of legal services • Does not extend to threats against the lawyer or other persons Privilege - 3 10

Privilege – “Non-Privileged Communications” • Pre-existing facts forming basis of communications. – “What did you tell your lawyer about the amount you claimed as a business expense? ” • PRIVILEGED – “Did you spend the amount you claimed for a business expense? ” • NOT Privilege - 3 11

Privilege – “Non-Privileged Communications” • Facts obtained by the attorney from third parties and communicated to the client are not privileged. – Ask “What do you know about? ” – Not “What did your lawyer tell you about? ” • Can’t stop questioning by saying “All she knows came from me as her lawyer. ” Privilege - 3 12

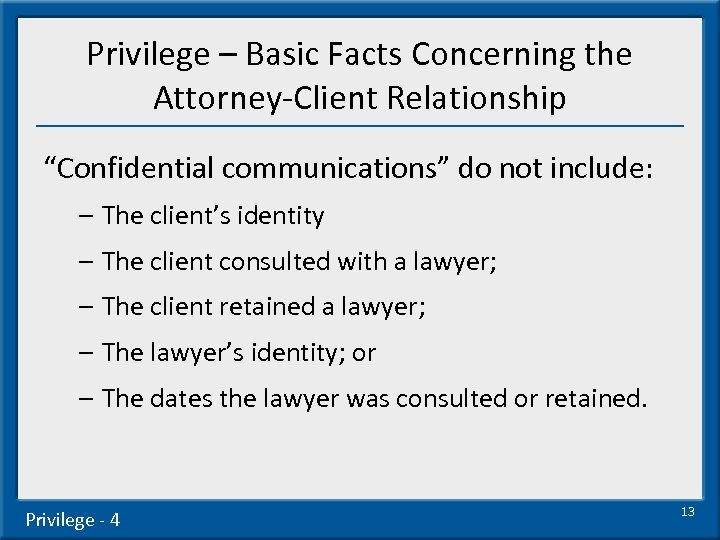

Privilege – Basic Facts Concerning the Attorney-Client Relationship “Confidential communications” do not include: – The client’s identity – The client consulted with a lawyer; – The client retained a lawyer; – The lawyer’s identity; or – The dates the lawyer was consulted or retained. Privilege - 4 13

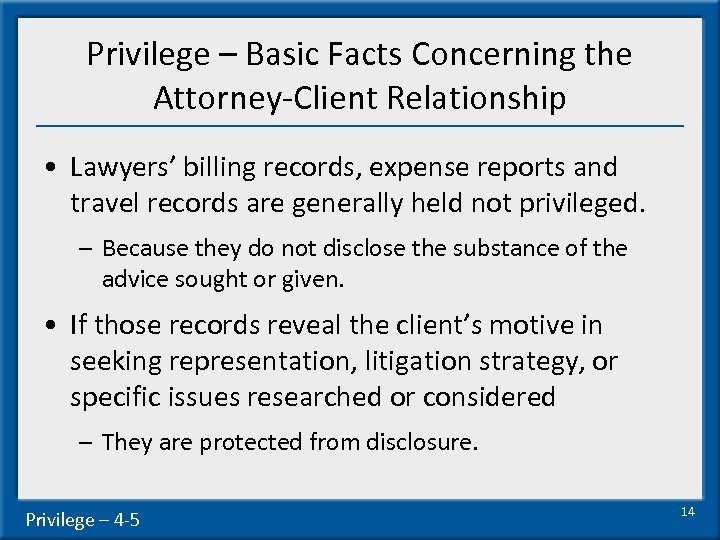

Privilege – Basic Facts Concerning the Attorney-Client Relationship • Lawyers’ billing records, expense reports and travel records are generally held not privileged. – Because they do not disclose the substance of the advice sought or given. • If those records reveal the client’s motive in seeking representation, litigation strategy, or specific issues researched or considered – They are protected from disclosure. Privilege – 4 -5 14

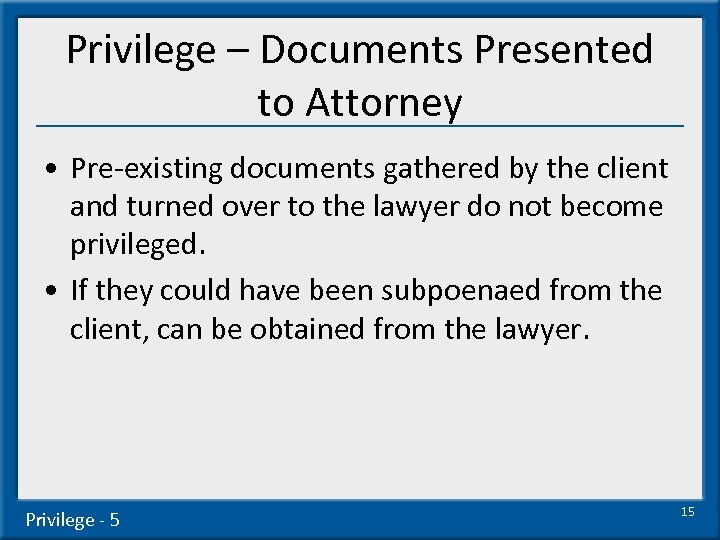

Privilege – Documents Presented to Attorney • Pre-existing documents gathered by the client and turned over to the lawyer do not become privileged. • If they could have been subpoenaed from the client, can be obtained from the lawyer. Privilege - 5 15

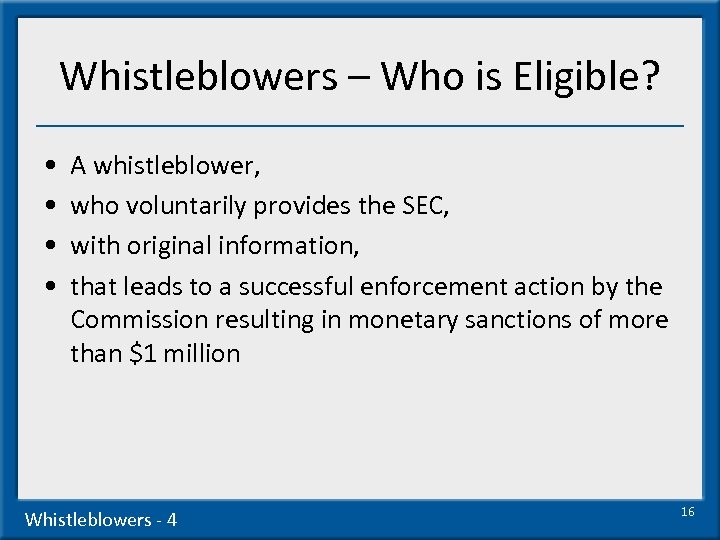

Whistleblowers – Who is Eligible? • • A whistleblower, who voluntarily provides the SEC, with original information, that leads to a successful enforcement action by the Commission resulting in monetary sanctions of more than $1 million Whistleblowers - 4 16

Whistleblowers – Who is Excluded? • Corporate principals who receive reports of violations • Compliance personnel • Investigators • Attorneys • Auditors Whistleblowers – 6 -8 17

Whistleblowers – Other Exclusions • Information that was obtained in a way that violated federal or state criminal law • Foreign government officials • Those downstream Whistleblowers - 8 18

Exceptions to Exclusions • Reasonable basis to believe substantial financial injury to the company or investors • Reasonable basis to believe conduct that will impede an investigation of the misconduct; or • If at least 120 days have elapsed since the whistleblower provided the information through the company’s internal reporting system. These don’t apply to attorneys. Whistleblowers – 8 -9 19

Whistleblowers – Factors Affecting Awards • Increasing Factors – significance of the information – degree of assistance provided – programmatic interest of the SEC – participation in internal compliance programs – 120 -day lookback provision Whistleblowers – 9 -10 20

Whistleblowers – Factors Affecting Awards • Decreasing Factors – whistleblower culpability – delay in reporting violation – interference with internal compliance programs – potential adverse incentives (CFTC only) Whistleblowers – 10 -11 21

Whistleblowers – Treatment of Culpable Individuals • No amnesty for whistleblowers. Also, those who are convicted of a criminal violation related to the action cannot receive an award • In calculating the $1 million threshold, the SEC will exclude any monetary sanctions the whistleblower has been ordered to pay • But not categorically excluded from eligibility Whistleblowers - 11 22

Whistleblowers – Whistleblower Confidentiality • The rules allow anonymous reporting if a whistleblower is represented by an attorney • The SEC has said it will not disclose information that could reasonably be expected to reveal whistleblower identities Whistleblowers - 11 23

Whistleblowers – New Cause of Action for Retaliation • No employer may discharge, demote, suspend, threaten, harass a whistleblower for: – providing information to the SEC – assisting in any investigation or judicial or administrative action – making disclosures protected under SOX or any rule subject to the SEC’s jurisdiction Whistleblowers – 11 -12 24

Whistleblowers – Reasonable Belief • Protections apply even if a whistleblower is not ultimately entitled to an award • Must have a “reasonable belief” that the information demonstrates a possible violation – See Beacom v. Oracle America, Inc. (8 th Cir. June 6, 2016) Whistleblowers - 12 25

Privilege – Communications by Corporate Employees (Upjohn) • Upjohn Co. v. United States, 449 U. S. 383 (1981): – Rejected the “control group” test – Was based on federal common law, so not binding beyond federal courts – Had considerable influence in state courts around the country Privilege – 5 -6 26

Privilege – Communications by Corporate Employees (Upjohn) • Control group test had limited the privilege to “senior management, guiding and integrating the several operations” • Upjohn Court said failed to recognize that privilege exists – not only to protect the giving of advice – but giving of information to the lawyer to enable him or her to give sound and informed advice Privilege - 6 27

Privilege – Communications by Corporate Employees (Upjohn) • Upjohn Court refused to craft a specific bright line test • But is clear that information will be privileged if: – communicated for the express purpose of securing legal advice for the corporation – relates to the specific corporate duties of the communicating employee – is treated as confidential within the corporation itself Privilege – 6 -7 28

Potential State Action Issue • United States v. Stein (2 d Cir. 2008) – Thompson memo: Prosecutors should consider whether employees are being protected by having legal fees advanced. – Prosecutors told KPMG • they’d have to “take that into account. ” • KPMG should tell employees they should be “totally open” with the USAO “even if that [meant admitting] criminal wrongdoing. ” Whistleblowers – 19 -21 29

Potential State Action Issue • Gilman v. Marsh Mc. Lennan (2 d Cir. 2016) – “A company. . . typically has supremely reasonable, independent interests for conducting an internal investigation and for cooperating with a governmental investigation. ” – “A rule that deems all such companies to be government actors would be incompatible with corporate governance and modern regulation. ” Whistleblowers – 19 -21 30

Potential State Action Issue • Yates Memo: If a company wants to win any credit for cooperation, it must turn over all information it can find about employees suspected of misconduct. • Does this turn a company into an arm of the DOJ, and let prosecutors evade constitutional protections against self-incrimination? Whistleblowers – 19 -21 31

Privilege – Communications by Corporate Employees (In-House Counsel) • In-house counsel treated as same as outside counsel for privilege analysis • Communications related to business matters, management decisions, or business advice – Neither soliciting or predominantly delivering legal advice • Not protected Privilege – 7 -8 32

Privilege – Communications by Corporate Employees (In-House Counsel) • One indicator courts look to is the lawyer’s position in the organization – Lawyer working in the legal department – presumed to be giving legal advice – Lawyer working in business or management side, presumed not • Presumption is rebuttable – Party asserting privilege has burden of proof Privilege - 8 33

Privilege – Communications by Corporate Employees (Compliance Officers) • Subject of much debate • Some argue that because compliance officers are not providing legal advice, privilege cannot apply • But – communications that combine business and legal advice can be privileged – So long as one of the primary purposes was obtaining legal advice Privilege – 8 -9 34

Privilege – Communications by Corporate Employees (Internal Compliance Investigations) • Good recent decision from D. C. Cir. Held that if one of the significant purposes of the investigation was to obtain or provide legal advice, privilege applies – Regardless of whether investigation was conducted pursuant to program required by statute or regulation – “Helping a corporation comply with a statute – although required by law – does not transform legal advice into business advice. ” Privilege – 9 35

Privilege – Communications by Corporate Employees (Compliance Officers) • As risk increases, reach a point at which no longer “routine” • When “special” situation arises: – Involve General Counsel’s office or outside lawyer – Take the usual Upjohn measures • Lawyers conduct the interviews • Treat the information as confidential within the company • Limit disclosures to employees who “need to know” to do their jobs Privilege - 10 36

Privilege – Communications by Corporate Employees (Former Employees) • Most courts allow ex parte contact with former corporate employees who have no existing relationship with the corporation • But NC Prof Conduct Rule 4. 2, cmt. [2] prohibits lawyer from speaking with any former employee who “participated substantially in the legal representation of the organization in the matter” Privilege - 10 37

Privilege – Communications by Corporate Employees (Former Employees) • Even if former employee not involved in the representation – Cannot seek or obtain privileged communications with the former employer’s lawyer • If lawyer receives document from former employee that may be privileged – Must immediately return it to the former employee Privilege - 10 38

Privilege - Waiver • Over-disclosure within the organization can waive: – If disclosed to other than those who • “need to know the content to perform their job effectively or • to make informed decisions concerning or affected by the subject matter of the communication” Privilege – 11 -12 39

Privilege – Inadvertent Waiver • Ethical issues: – When receive writing from opposing lawyer mistakenly sent – Must notify the opposing lawyer, so he or she can take measures to protect the client – May, in your professional judgment, return unread – Not required to do so Privilege - 13 40

Privilege – Inadvertent Waiver • Ethical issues: – This includes inadvertently provided metadata – But NC says cannot search metadata – If unintentionally view confidential metadata, must • Notify sender • May not use the information without consent of the other party Privilege – 13 -14 41

Privilege – Litigating Privilege Issues • Burden of Proof – On the party asserting the privilege – Not on the party seeking the communications • Party claiming privilege must produce evidence establishing all the elements of the privilege – Document-by-document – Conversation-by-conversation Privilege - 16 42

Privilege – Multi-Jurisdictional Practice (Foreign Nations) • Foreign privilege laws vary – Often hold that communications between in-house lawyers and the lawyer’s employer are not privileged – Privilege only available to communications with “external” lawyers – “Follows from in-house lawyer’s economic dependence and close ties with his employer that he did not enjoy the level of professional independence comparable to that of an external lawyer” Privilege - 21 43

Privilege – Joint Defense or Common Interest Privilege • Supreme Court Standard 503(b)(3) extends attorneyclient privilege to communications by the client or the client’s lawyer to “to a lawyer representing another in a matter of common interest” – Requires a meeting of the minds – Does not require a writing or that litigation has commenced – Can be oral – Can be entered into before any civil or criminal litigation begins – Once privilege exists, cannot be unilaterally waived Privilege – 22 -23 44

Work Product Immunity • What it is not – Applies only to “documents and tangible things” – Not to what lawyer has said to parties other than client – Not to discoverable facts contained in documents Privilege - 23 45

Work Product Immunity • “Documents and tangible things” – Examples—letters, interview notes, interview transcripts, surveillance tapes, studies, “post-it” notes attached to files by the lawyer • Division of authority on whether lawyer’s selection of documents to show a witness during deposition preparation are protected – Some cases – yes – Some cases – no • Check your jurisdiction before preparing the witness, or make sure you show them nothing that you don’t want the other side to see Privilege – 23 -24 46

Work Product Immunity • Fact vs. Opinion Work Product – Fact WP – does not contain lawyer’s or other party representative’s mental impressions, conclusions, opinions, or legal theories concerning the litigation – Opinion WP – does contain lawyer’s or other party representative’s mental impressions, conclusions, opinions, or legal theories concerning the litigation Privilege - 24 47

Work Product Immunity • Opinion Work Product – Some courts hold is absolutely protected – Most federal courts have permitted discovery on showing of “extraordinary circumstances” – Even those say “opinion work product enjoys a nearly absolute immunity, and can be discovered only in very rare and extraordinary circumstances. ” Privilege - 27 48

Whistleblowers – SEC Enforcement • Adopting Release claimed enforcement authority for violations by employers who retaliate against whistleblowers • Department of Labor historically has not done so under SOX. • In re Paradigm Capital Mgmt. (June 2014) Whistleblowers – 13 49

Whistleblowers – Who is Excluded? • Whistleblowers overseas, under SOX and Dodd-Frank. Carnero v. Boston Scientific Corp. (1 st Cir. 2006) (SOX); Liu v. Siemens AG (2 d Cir. 2014) (D-F). • Those reporting internally (maybe). Asadi v. G. E. Energy (USA), LLC (5 th Cir. 2013) (excludes internal reporters); Berman v. Neo@Ogilvy LLC (2 d Cir. 2015) (includes internal reporters). Problems for you! (if you’re in-house) Whistleblowers - 12 50

Whistleblowers – Rule 21 F-17 • “No person shall take any action to impede an individual from communicating directly with the Commission staff about a possible securities law violation, including. . . threatening to enforce a confidentiality agreement. . ” Whistleblowers - 13 51

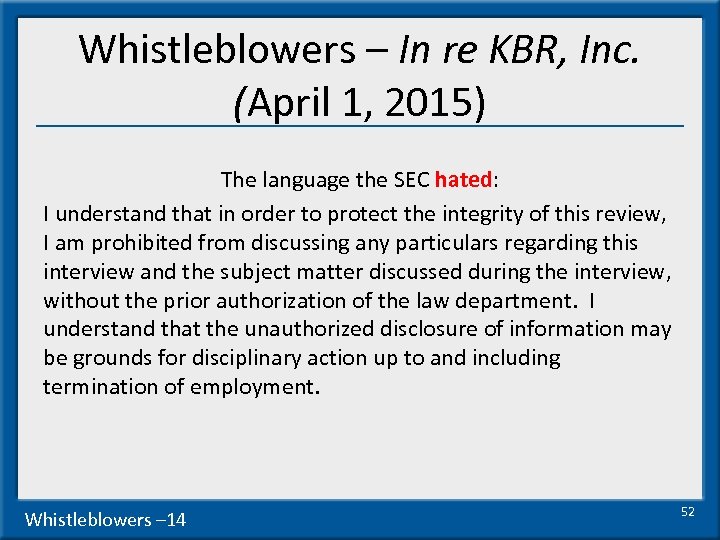

Whistleblowers – In re KBR, Inc. (April 1, 2015) The language the SEC hated: I understand that in order to protect the integrity of this review, I am prohibited from discussing any particulars regarding this interview and the subject matter discussed during the interview, without the prior authorization of the law department. I understand that the unauthorized disclosure of information may be grounds for disciplinary action up to and including termination of employment. Whistleblowers – 14 52

Whistleblowers – In re KBR, Inc. (April 1, 2015) • written before Dodd-Frank’s passage. • never prevented a KBR employee from communicating with the SEC. • doesn’t refer to the SEC as a prohibited destination for the confidential information. Whistleblowers - 14 53

Whistleblowers – In re KBR, Inc. (April 1, 2015) • Nothing in this confidentiality statement prohibits me from reporting possible violations of federal law or regulation to any governmental agency or entity, including but not limited to the Department of Justice, the Securities and Exchange Commission, the Congress, and any inspector general, or making other disclosures that are protected under the whistleblower provisions of federal law or regulation. I do not need the prior authorization of the law department to make any such reports or disclosures and I am not required to notify the company that I have made such reports or disclosures. Whistleblowers - 14 54

Client Confidentiality –Ethical Rules • General Rule – N. C. Rules Prof’l Conduct R. 1. 6(a) – A lawyer shall not reveal information acquired during the professional relationship with a client unless • the client gives informed consent • the disclosure is impliedly authorized in order to carry out the representation or • the disclosure is permitted by paragraph (b) Privilege - 28 55

Client Confidentiality –Ethical Rules • General Rule – Rule 1. 6(a) – Is broader than the attorney-client privilege or work product immunity – Those apply only to judicial or other proceedings where lawyer may be compelled to produce evidence • Rule 1. 6 applies – in all situations – to all information acquired during the representation, whatever its source Privilege - 28 56

Client Confidentiality –Ethical Rules • Exceptions – Prevent Commission of a Crime by the Client – May disclose to the extent lawyer believes necessary to prevent client from committing – future crime or fraud – N. C. Rule does not require that crime or fraud be “reasonably certain to result in substantial injury to the financial interests or property of another” Privilege – 28 -29 57

Client Confidentiality –Ethical Rules • Exceptions – Prevent Reasonably Certain Death or Substantial Bodily Harm – Harm must be “reasonably certain to occur” – Will be suffered “imminently” or – “There is a present and substantial threat that a person will suffer such harm at a later date if the lawyer fails to take action to eliminate threat” Privilege - 29 58

Client Confidentiality –Ethical Rules • Exceptions – Prevent Reasonably Certain Death or Substantial Bodily Harm – Example – client’s accidental discharge of toxic waste into a municipal water supply. Disclosure permitted if: • “present and substantial risk” that person consuming the water • will contract a “life-threatening or debilitating disease” and • disclosure by the lawyer is “necessary to eliminate threat or reduce the number of victims” Privilege - 30 59

Client Confidentiality –Ethical Rules • Exceptions – Past Criminal or Fraudulent Acts in Which the Lawyer’s Services Were Used – Lawyer did not learn about the client’s crime or fraud until after it has been committed – Can no longer prevent the act – But the loss suffered can be prevented, rectified or mitigated – Can disclose to extent necessary to enable affected persons to prevent or mitigate reasonably certain losses or attempt to recoup their losses Privilege - 30 60

Client Confidentiality –Ethical Rules • Exceptions— Disclosure Under Rule 1. 6(b) Exceptions is Discretionary—Not Mandatory – Rule 1. 6(b) permits but does not require disclosure of information acquired during a client’s representation – A lawyer’s decision not to disclose, as permitted by 1. 6(b) does not violate this Rule – Other Rules may require disclosure, e. g. , disclosure to avoid lawyer assisting client with crime or fraud, mandatory reporting of ethical violations by lawyer, responding to lawful demands from bar disciplinary authority Privilege - 32 61

Client Confidentiality – SEC Communications and A/C Privilege • The rules authorize SEC staff to communicate directly with WBs who are directors, officers, members, agents, or employees of a company who have counsel, without first seeking the consent of the company’s counsel. • This rule designed to address rule 4. 2 • The SEC assures us that “nothing about this rule authorizes the staff to depart from the commission’s existing procedures and practices when dealing with potential attorney-client privileged information. ” Whistleblowers – 15 62

Client Confidentiality –Ethical Rules • The Organization as Client – Rule 1. 13 – May not disclose to client’s constituents information regarding the representation – Except those explicitly or impliedly authorized by the client – To carry out the representation – Or as authorized by Rule 1. 6 Privilege - 32 63

Client Confidentiality –Ethical Rules • The Organization as Client – Rule 1. 13 – Over-disclosure to client’s constituents can result in privilege waiver – And constitute ethical violation, leading to professional discipline Privilege – 32 -33 64

Client Confidentiality –Ethical Rules • The Organization as Client – Rule 1. 13 – When lawyer knows or reasonably should know that the client’s interests are adverse to the constituent with whom the lawyer is dealing – Must explain that • The organization is the client • Conflict of interest exists between the client and the constituent • Lawyer cannot represent the constituent • Constituent may want independent counsel • Conversations with the constituent may not be privileged Privilege - 33 65

Client Confidentiality –Ethical Rules • The Organization as Client – Rule 1. 13 – Duty to “Go Up the Ladder” – Lawyer is bound by constituents’ decisions – even if they appear unreasonable or counterproductive – Even if they involve serious peril to the organization – These are outside the lawyer’s province Privilege – 33 -34 66

Client Confidentiality –Ethical Rules • The Organization as Client – Rule 1. 13 – Duty to “Go Up the Ladder” – But when the lawyer knows that constituent is acting or intends to act in a way that • Violates constituent’s duty to the organization or • Is a violation of law that might be imputed to the client – Must refer the matter to higher authority in the organization – If warranted by the circumstances, to the highest authority that can act on the organization’s behalf • Usually the board of directors or other governing body Privilege – 34 67

Compliance – Practical Considerations • Culture of compliance – Creating an atmosphere that encourages compliance and prompt reporting of potential misconduct will alleviate many of these issues. – Much of what is required of investment advisers and broker-dealers is good practice for others. • i. e. , In re Retirement Systems of Alabama (2008) Whistleblowers – 16 68

Compliance – Compliance Programs • Agencies explicitly consider the strength of your compliance programs. – SEC’s Seaboard Report (2001) – Sentencing Guidelines Section 8 – DOJ compliance counsel Hui Chen Whistleblowers - 16 69

Compliance – Codes of Conduct • Review periodically • Regular training • Annual certifications – United States v. Garth Peterson (E. D. N. Y. 2012) – SEC v. Garth Peterson (E. D. N. Y. 2012) Whistleblowers – 16 -17 70

Compliance – Know Your Business and Teach Accordingly • • • Quarter-end issues - “Making numbers” FCPA and third-party sales agents Channel stuffing Round trips Related-party transactions Build inter-departmental relationships now so people will be receptive when you need them. Whistleblowers - 17 71

Compliance – Internal Investigations • • Develop a system to respond quickly Create a plan in advance Keep whistleblowers informed if you can Avoid revealing allegations in interviews if possible • Upjohn warnings still important Whistleblowers – 18 -19 72

Compliance – Implications for Enforcement Practice • Self-reporting • Protect privileges to the extent you can • Assess public disclosure issues. Whistleblowers – 19 -20 73

Any Questions? Brooks, Pierce, Mc. Lendon, Humphrey & Leonard 150 Fayetteville Street, Suite 1700 Raleigh, NC 27601 Gary Parsons (919) 573 -6241 gparsons@brookspierce. com David Smyth (919) 573 -6218 dsmyth@brookspierce. com 74

6e6b3d8829f903412673c9adccdb0e3c.ppt