8bf15c035e6445499ed90bb1b5ad5678.ppt

- Количество слайдов: 9

ETF Sales & Trading Exchange Traded Funds Structure and Market Making September 2014 Toronto | 416. 869. 6654 Montreal | 514. 394. 8561

ETF Sales & Trading Exchange Traded Funds Structure and Market Making September 2014 Toronto | 416. 869. 6654 Montreal | 514. 394. 8561

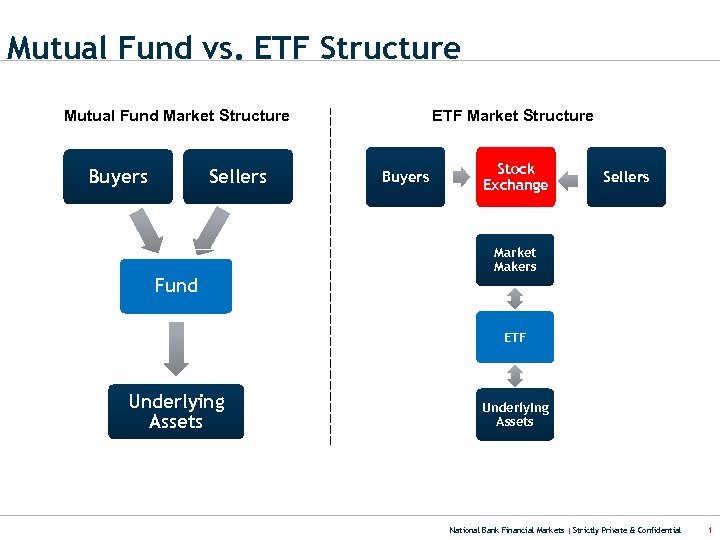

Mutual Fund vs. ETF Structure Mutual Fund Market Structure Sellers Buyers ETF Market Structure Buyers Stock Exchange Sellers Market Makers Fund ETF Underlying Assets National Bank Financial Markets | Strictly Private & Confidential 1

Mutual Fund vs. ETF Structure Mutual Fund Market Structure Sellers Buyers ETF Market Structure Buyers Stock Exchange Sellers Market Makers Fund ETF Underlying Assets National Bank Financial Markets | Strictly Private & Confidential 1

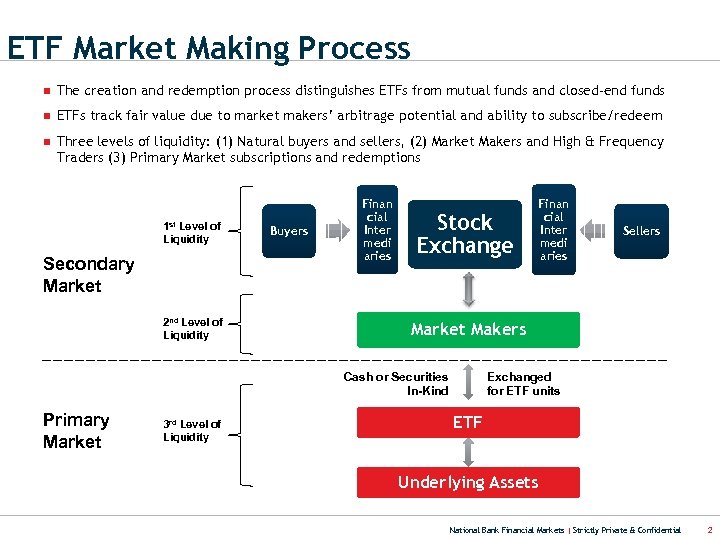

ETF Market Making Process n The creation and redemption process distinguishes ETFs from mutual funds and closed-end funds n ETFs track fair value due to market makers’ arbitrage potential and ability to subscribe/redeem n Three levels of liquidity: (1) Natural buyers and sellers, (2) Market Makers and High & Frequency Traders (3) Primary Market subscriptions and redemptions 1 st Level of Liquidity Secondary Market 2 nd Level of Liquidity Buyers Finan cial Inter medi aries Stock Exchange 3 rd Level of Liquidity Sellers Market Makers Cash or Securities In-Kind Primary Market Finan cial Inter medi aries Exchanged for ETF units ETF Underlying Assets National Bank Financial Markets | Strictly Private & Confidential 2

ETF Market Making Process n The creation and redemption process distinguishes ETFs from mutual funds and closed-end funds n ETFs track fair value due to market makers’ arbitrage potential and ability to subscribe/redeem n Three levels of liquidity: (1) Natural buyers and sellers, (2) Market Makers and High & Frequency Traders (3) Primary Market subscriptions and redemptions 1 st Level of Liquidity Secondary Market 2 nd Level of Liquidity Buyers Finan cial Inter medi aries Stock Exchange 3 rd Level of Liquidity Sellers Market Makers Cash or Securities In-Kind Primary Market Finan cial Inter medi aries Exchanged for ETF units ETF Underlying Assets National Bank Financial Markets | Strictly Private & Confidential 2

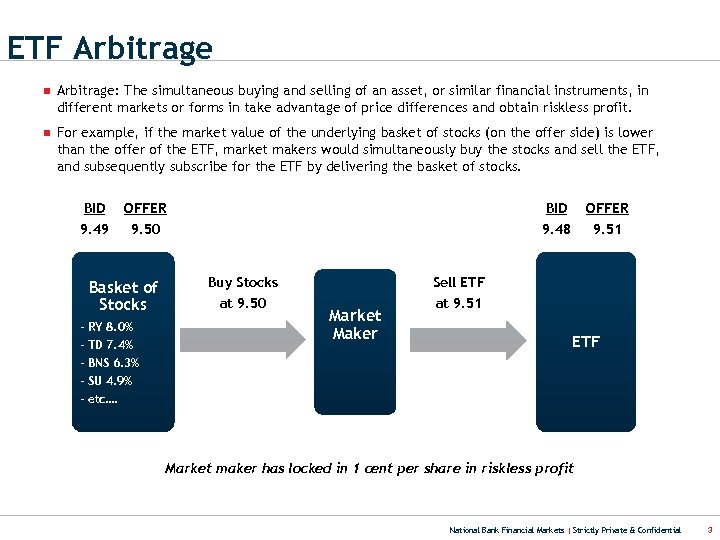

ETF Arbitrage n Arbitrage: The simultaneous buying and selling of an asset, or similar financial instruments, in different markets or forms in take advantage of price differences and obtain riskless profit. n For example, if the market value of the underlying basket of stocks (on the offer side) is lower than the offer of the ETF, market makers would simultaneously buy the stocks and sell the ETF, and subsequently subscribe for the ETF by delivering the basket of stocks. BID 9. 49 BID OFFER 9. 50 Basket of Stocks - RY 8. 0% - TD 7. 4% - BNS 6. 3% - SU 4. 9% OFFER 9. 51 9. 48 Buy Stocks at 9. 50 Sell ETF Market Maker at 9. 51 ETF - etc…. Market maker has locked in 1 cent per share in riskless profit National Bank Financial Markets | Strictly Private & Confidential 3

ETF Arbitrage n Arbitrage: The simultaneous buying and selling of an asset, or similar financial instruments, in different markets or forms in take advantage of price differences and obtain riskless profit. n For example, if the market value of the underlying basket of stocks (on the offer side) is lower than the offer of the ETF, market makers would simultaneously buy the stocks and sell the ETF, and subsequently subscribe for the ETF by delivering the basket of stocks. BID 9. 49 BID OFFER 9. 50 Basket of Stocks - RY 8. 0% - TD 7. 4% - BNS 6. 3% - SU 4. 9% OFFER 9. 51 9. 48 Buy Stocks at 9. 50 Sell ETF Market Maker at 9. 51 ETF - etc…. Market maker has locked in 1 cent per share in riskless profit National Bank Financial Markets | Strictly Private & Confidential 3

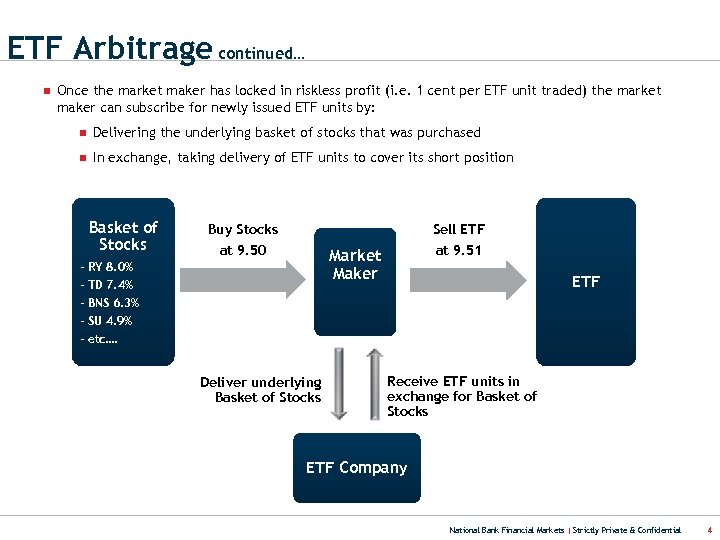

ETF Arbitrage continued… n Once the market maker has locked in riskless profit (i. e. 1 cent per ETF unit traded) the market maker can subscribe for newly issued ETF units by: n Delivering the underlying basket of stocks that was purchased n In exchange, taking delivery of ETF units to cover its short position Basket of Stocks Buy Stocks Sell ETF at 9. 50 at 9. 51 Market Maker - RY 8. 0% - TD 7. 4% - BNS 6. 3% - SU 4. 9% ETF - etc…. Deliver underlying Basket of Stocks Receive ETF units in exchange for Basket of Stocks ETF Company National Bank Financial Markets | Strictly Private & Confidential 4

ETF Arbitrage continued… n Once the market maker has locked in riskless profit (i. e. 1 cent per ETF unit traded) the market maker can subscribe for newly issued ETF units by: n Delivering the underlying basket of stocks that was purchased n In exchange, taking delivery of ETF units to cover its short position Basket of Stocks Buy Stocks Sell ETF at 9. 50 at 9. 51 Market Maker - RY 8. 0% - TD 7. 4% - BNS 6. 3% - SU 4. 9% ETF - etc…. Deliver underlying Basket of Stocks Receive ETF units in exchange for Basket of Stocks ETF Company National Bank Financial Markets | Strictly Private & Confidential 4

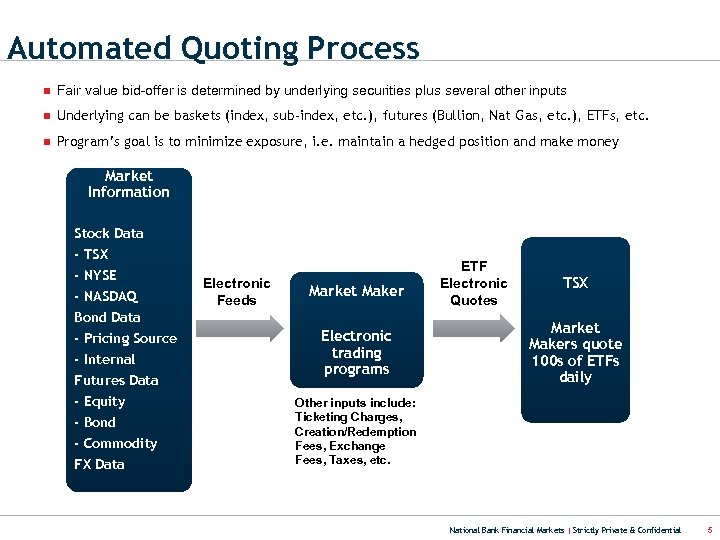

Automated Quoting Process n Fair value bid-offer is determined by underlying securities plus several other inputs n Underlying can be baskets (index, sub-index, etc. ), futures (Bullion, Nat Gas, etc. ), ETFs, etc. n Program’s goal is to minimize exposure, i. e. maintain a hedged position and make money Market Information Stock Data - TSX - NYSE - NASDAQ Bond Data - Pricing Source - Internal Futures Data - Equity - Bond - Commodity FX Data Electronic Feeds Market Maker Electronic trading programs ETF Electronic Quotes TSX Market Makers quote 100 s of ETFs daily Other inputs include: Ticketing Charges, Creation/Redemption Fees, Exchange Fees, Taxes, etc. National Bank Financial Markets | Strictly Private & Confidential 5

Automated Quoting Process n Fair value bid-offer is determined by underlying securities plus several other inputs n Underlying can be baskets (index, sub-index, etc. ), futures (Bullion, Nat Gas, etc. ), ETFs, etc. n Program’s goal is to minimize exposure, i. e. maintain a hedged position and make money Market Information Stock Data - TSX - NYSE - NASDAQ Bond Data - Pricing Source - Internal Futures Data - Equity - Bond - Commodity FX Data Electronic Feeds Market Maker Electronic trading programs ETF Electronic Quotes TSX Market Makers quote 100 s of ETFs daily Other inputs include: Ticketing Charges, Creation/Redemption Fees, Exchange Fees, Taxes, etc. National Bank Financial Markets | Strictly Private & Confidential 5

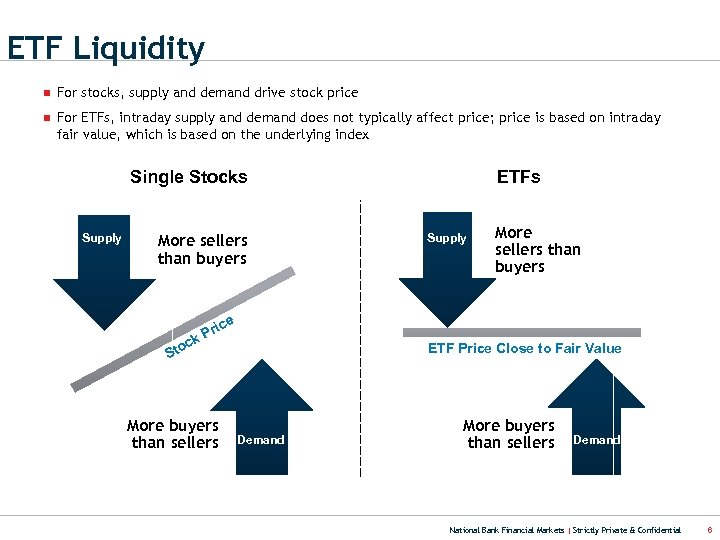

ETF Liquidity n For stocks, supply and demand drive stock price n For ETFs, intraday supply and demand does not typically affect price; price is based on intraday fair value, which is based on the underlying index Single Stocks Supply More sellers than buyers ETFs Supply More sellers than buyers ice c Sto r k. P More buyers than sellers ETF Price Close to Fair Value Demand More buyers than sellers Demand National Bank Financial Markets | Strictly Private & Confidential 6

ETF Liquidity n For stocks, supply and demand drive stock price n For ETFs, intraday supply and demand does not typically affect price; price is based on intraday fair value, which is based on the underlying index Single Stocks Supply More sellers than buyers ETFs Supply More sellers than buyers ice c Sto r k. P More buyers than sellers ETF Price Close to Fair Value Demand More buyers than sellers Demand National Bank Financial Markets | Strictly Private & Confidential 6

Presenter Greg Jones, Managing Director 416. 869. 6654 | greg. jones@nbf. ca National Bank Financial Markets | Strictly Private & Confidential 7

Presenter Greg Jones, Managing Director 416. 869. 6654 | greg. jones@nbf. ca National Bank Financial Markets | Strictly Private & Confidential 7

Disclaimer To view company specific disclosures for any companies covered by National http: //www. nbcn. ca/disclosure_english. jhtml & http: //www. nbcn. ca/disclosure_french. jhtml Bank Financial, please go to This document was prepared by the people (‘authors”) named above, who take sole responsibility for its contents. The content may have been based, at least in part, on material provided by National Bank Financial Research Department and other research providers to National Bank Financial Private Wealth Management. The information contained in this document is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, and in providing it neither the authors of this document nor National Bank Financial (“NBF”) assume any liability. The information is current as of the date on this document and neither the authors nor NBF assumes any obligation to update the information or advise on further developments relating to the topics or securities discussed. This document is intended for distribution in those jurisdictions where the authors and NBF are registered. Any distribution or dissemination of this document in any other jurisdiction is prohibited. The opinions expressed in this document reflect a trading perspective. This document has not been prepared nor approved by the NBF Research Department. NBF may publish fundamental research on the issuers discussed in this document, which may express a different opinion. NBF clients should contact their NBF representative to request such research material. NBF may engage in the trading strategies described in this document for its own account and may, as market conditions change, amend or change its investment strategy including full and complete divestment. NBF may act as financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive remuneration for its services. As well NBF and/or its officers, directors, representatives, associates, may have a position in the securities mentioned herein and may make purchases and/or sales of these securities from time to time in the open market or otherwise. This report may not be reproduced in whole or in part, or further distributed or published or referred to in any manner whatsoever nor may the information, opinions or conclusions contained in it be referred to without in each case the prior express consent of NBF is an indirect wholly owned subsidiary of National Bank of Canada. National Bank Financial Markets | Strictly Private & Confidential 8

Disclaimer To view company specific disclosures for any companies covered by National http: //www. nbcn. ca/disclosure_english. jhtml & http: //www. nbcn. ca/disclosure_french. jhtml Bank Financial, please go to This document was prepared by the people (‘authors”) named above, who take sole responsibility for its contents. The content may have been based, at least in part, on material provided by National Bank Financial Research Department and other research providers to National Bank Financial Private Wealth Management. The information contained in this document is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, and in providing it neither the authors of this document nor National Bank Financial (“NBF”) assume any liability. The information is current as of the date on this document and neither the authors nor NBF assumes any obligation to update the information or advise on further developments relating to the topics or securities discussed. This document is intended for distribution in those jurisdictions where the authors and NBF are registered. Any distribution or dissemination of this document in any other jurisdiction is prohibited. The opinions expressed in this document reflect a trading perspective. This document has not been prepared nor approved by the NBF Research Department. NBF may publish fundamental research on the issuers discussed in this document, which may express a different opinion. NBF clients should contact their NBF representative to request such research material. NBF may engage in the trading strategies described in this document for its own account and may, as market conditions change, amend or change its investment strategy including full and complete divestment. NBF may act as financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive remuneration for its services. As well NBF and/or its officers, directors, representatives, associates, may have a position in the securities mentioned herein and may make purchases and/or sales of these securities from time to time in the open market or otherwise. This report may not be reproduced in whole or in part, or further distributed or published or referred to in any manner whatsoever nor may the information, opinions or conclusions contained in it be referred to without in each case the prior express consent of NBF is an indirect wholly owned subsidiary of National Bank of Canada. National Bank Financial Markets | Strictly Private & Confidential 8