cfd34b22b46e05ca8d2c63a4f9d8f34e.ppt

- Количество слайдов: 20

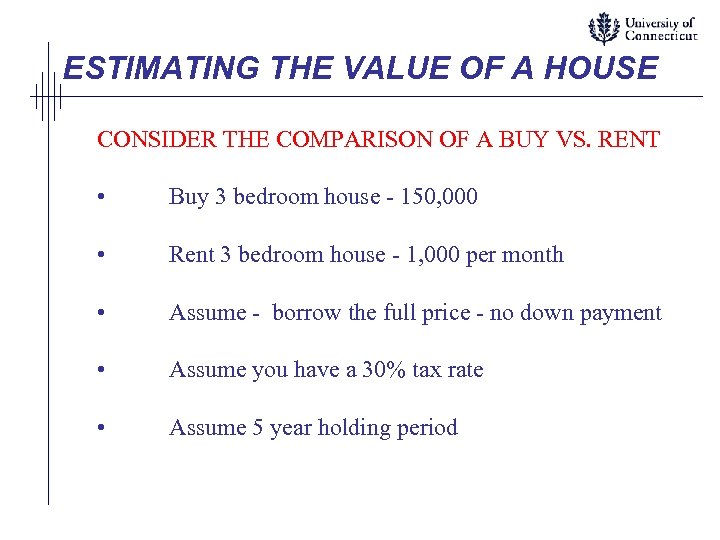

ESTIMATING THE VALUE OF A HOUSE CONSIDER THE COMPARISON OF A BUY VS. RENT • Buy 3 bedroom house - 150, 000 • Rent 3 bedroom house - 1, 000 per month • Assume - borrow the full price - no down payment • Assume you have a 30% tax rate • Assume 5 year holding period

ESTIMATING THE VALUE OF A HOUSE CONSIDER THE COMPARISON OF A BUY VS. RENT • Buy 3 bedroom house - 150, 000 • Rent 3 bedroom house - 1, 000 per month • Assume - borrow the full price - no down payment • Assume you have a 30% tax rate • Assume 5 year holding period

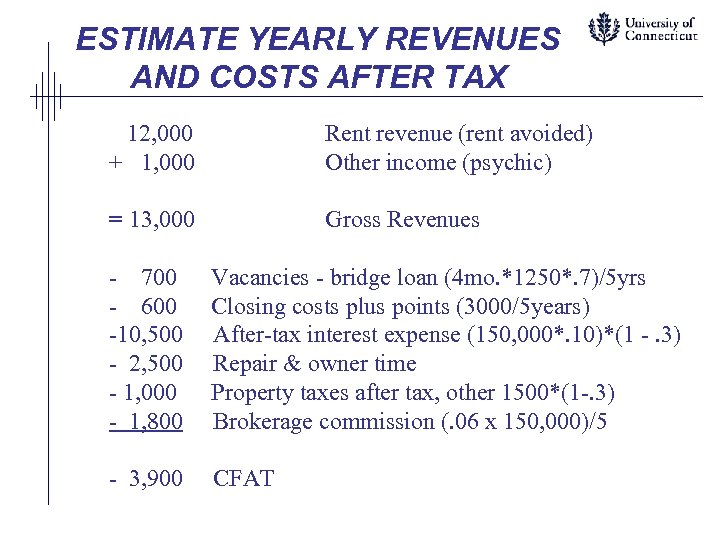

ESTIMATE YEARLY REVENUES AND COSTS AFTER TAX 12, 000 + 1, 000 Rent revenue (rent avoided) Other income (psychic) = 13, 000 Gross Revenues - 700 - 600 -10, 500 - 2, 500 - 1, 000 - 1, 800 Vacancies - bridge loan (4 mo. *1250*. 7)/5 yrs Closing costs plus points (3000/5 years) After-tax interest expense (150, 000*. 10)*(1 -. 3) Repair & owner time Property taxes after tax, other 1500*(1 -. 3) Brokerage commission (. 06 x 150, 000)/5 - 3, 900 CFAT

ESTIMATE YEARLY REVENUES AND COSTS AFTER TAX 12, 000 + 1, 000 Rent revenue (rent avoided) Other income (psychic) = 13, 000 Gross Revenues - 700 - 600 -10, 500 - 2, 500 - 1, 000 - 1, 800 Vacancies - bridge loan (4 mo. *1250*. 7)/5 yrs Closing costs plus points (3000/5 years) After-tax interest expense (150, 000*. 10)*(1 -. 3) Repair & owner time Property taxes after tax, other 1500*(1 -. 3) Brokerage commission (. 06 x 150, 000)/5 - 3, 900 CFAT

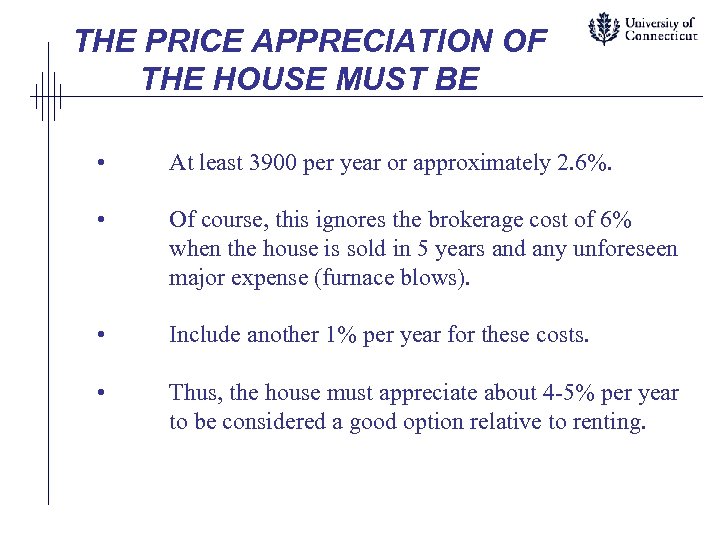

THE PRICE APPRECIATION OF THE HOUSE MUST BE • At least 3900 per year or approximately 2. 6%. • Of course, this ignores the brokerage cost of 6% when the house is sold in 5 years and any unforeseen major expense (furnace blows). • Include another 1% per year for these costs. • Thus, the house must appreciate about 4 -5% per year to be considered a good option relative to renting.

THE PRICE APPRECIATION OF THE HOUSE MUST BE • At least 3900 per year or approximately 2. 6%. • Of course, this ignores the brokerage cost of 6% when the house is sold in 5 years and any unforeseen major expense (furnace blows). • Include another 1% per year for these costs. • Thus, the house must appreciate about 4 -5% per year to be considered a good option relative to renting.

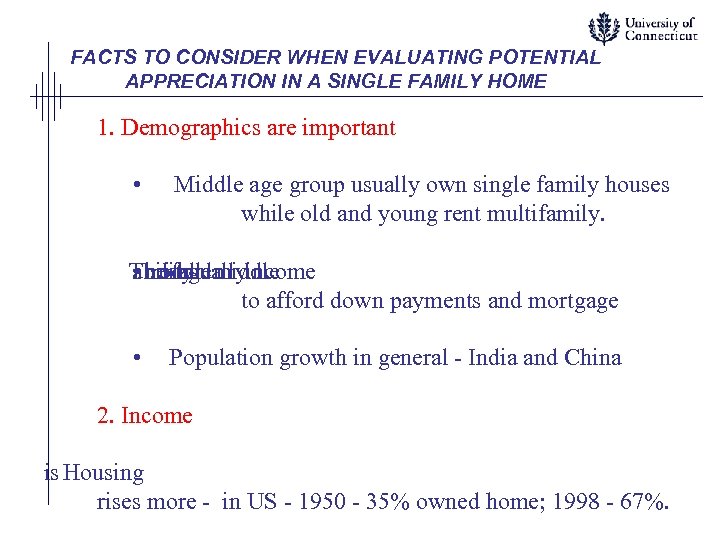

FACTS TO CONSIDER WHEN EVALUATING POTENTIAL APPRECIATION IN A SINGLE FAMILY HOME 1. Demographics are important • Middle age group usually own single family houses while old and young rent multifamily. The and middle ability • middle income ofusually age to afford down payments and mortgage • Population growth in general - India and China 2. Income is Housing rises more - in US - 1950 - 35% owned home; 1998 - 67%.

FACTS TO CONSIDER WHEN EVALUATING POTENTIAL APPRECIATION IN A SINGLE FAMILY HOME 1. Demographics are important • Middle age group usually own single family houses while old and young rent multifamily. The and middle ability • middle income ofusually age to afford down payments and mortgage • Population growth in general - India and China 2. Income is Housing rises more - in US - 1950 - 35% owned home; 1998 - 67%.

3. Interest Rates • Affect mortgage payments -especially for ARM's • Affect the cost of builders in financing construction. 4. Inflation • Housing is a real asset - hedge against inflation 1966 - 1982 inflation increased 165% 1966 - 1982 Housing prices increased 240%

3. Interest Rates • Affect mortgage payments -especially for ARM's • Affect the cost of builders in financing construction. 4. Inflation • Housing is a real asset - hedge against inflation 1966 - 1982 inflation increased 165% 1966 - 1982 Housing prices increased 240%

5. Tax Rates • Higher tax rates mean lower after tax costs for houses - government subsidy - not true in most foreign countries • Some believe the favorable treatment of mortgage interest will be phased out =>capital loses • Capital gains can be deferred if proceeds reinvested in new house - over 55 => $500, 000 tax free gain.

5. Tax Rates • Higher tax rates mean lower after tax costs for houses - government subsidy - not true in most foreign countries • Some believe the favorable treatment of mortgage interest will be phased out =>capital loses • Capital gains can be deferred if proceeds reinvested in new house - over 55 => $500, 000 tax free gain.

6. Local economy & U. S. economy • Boom implies rising income • New businesses moving into area • Cheap relative to an expensive area near by 7. Location way but Close • ansportation to streets and industrial waste • Good services - trash pick-up, schools, etc.

6. Local economy & U. S. economy • Boom implies rising income • New businesses moving into area • Cheap relative to an expensive area near by 7. Location way but Close • ansportation to streets and industrial waste • Good services - trash pick-up, schools, etc.

TIPS ON HOUSE BUYING Houses are complex assets with many features • much psychological attachments • much leverage • people don't want to take losses on their homes

TIPS ON HOUSE BUYING Houses are complex assets with many features • much psychological attachments • much leverage • people don't want to take losses on their homes

BUYER TIPS Get as much information as possible • Friends • Neighbors of house you are interested in • Multiple Listing book - brokers have - inside cover lists average monthly prices, volume sold, inventory, and other helpful statistics. Also, lists specifics on houses for sale, pictures, and how long on the market. • Comparable houses sold for last three years brokers have this.

BUYER TIPS Get as much information as possible • Friends • Neighbors of house you are interested in • Multiple Listing book - brokers have - inside cover lists average monthly prices, volume sold, inventory, and other helpful statistics. Also, lists specifics on houses for sale, pictures, and how long on the market. • Comparable houses sold for last three years brokers have this.

Remember - brokers are salespeople - they will present the best of this information to you in order to sell you they often don't fully understand the statistics GET ALL THE INFORMATION Some of the statistics reported in MLS and reported to you by the broker are biased. For example: Average time on the market is biased down since only the time on the market with the current broker is included. Some sellers go through more than one broker - especially in bad markets

Remember - brokers are salespeople - they will present the best of this information to you in order to sell you they often don't fully understand the statistics GET ALL THE INFORMATION Some of the statistics reported in MLS and reported to you by the broker are biased. For example: Average time on the market is biased down since only the time on the market with the current broker is included. Some sellers go through more than one broker - especially in bad markets

Selling price / list price biased up because the list price is often cut more than once - only the final list price is used. Control the information you give about yourself to broker -enough to get them to work for you i. e. , that you are a serious buyer, but not enough that it will work against you in price negotiations (e. g. , must buy immediately or must have specific house) Get as much information about seller as possible from deed records, broker, etc.

Selling price / list price biased up because the list price is often cut more than once - only the final list price is used. Control the information you give about yourself to broker -enough to get them to work for you i. e. , that you are a serious buyer, but not enough that it will work against you in price negotiations (e. g. , must buy immediately or must have specific house) Get as much information about seller as possible from deed records, broker, etc.

Bidding low is OK as long as you don't mind if you don't get the house - should at least bid low enough to get a 'no' and a counter offer. Some sellers have psychological fixations on round number prices - e. g. if you are thinking of offering $205, 000, you may as well offer $200, 000. Brokers are usually a few steps behind the market - therefore - in a rising market - bid higher and consider paying full price (brokers have many opportunities and so don't bid as aggressively for listings - they are more interested in fast turnover which implies lower pricing)

Bidding low is OK as long as you don't mind if you don't get the house - should at least bid low enough to get a 'no' and a counter offer. Some sellers have psychological fixations on round number prices - e. g. if you are thinking of offering $205, 000, you may as well offer $200, 000. Brokers are usually a few steps behind the market - therefore - in a rising market - bid higher and consider paying full price (brokers have many opportunities and so don't bid as aggressively for listings - they are more interested in fast turnover which implies lower pricing)

- in a declining market bid below the price of recently sold comparable homes - brokers offer to sell homes at high prices in order to compete for fewer listings. Check out as many potential problems with the house before submitting a bid and all potential problems before signing a purchase and sale. - pay attention to details - condition of the house - brokers bid with one another for listing and so winner usually claims they can sell house for more than its worth - overlooks defects.

- in a declining market bid below the price of recently sold comparable homes - brokers offer to sell homes at high prices in order to compete for fewer listings. Check out as many potential problems with the house before submitting a bid and all potential problems before signing a purchase and sale. - pay attention to details - condition of the house - brokers bid with one another for listing and so winner usually claims they can sell house for more than its worth - overlooks defects.

Brokers help to arrange home showings for you, alert you to new homes on the market, and provide some information. However, you can do much of this by yourself by looking through the newspaper and calling for appointments. Doing it yourself has two advantages The seller's broker is more likely to cut their commission to lower the price if he/she doesn't have to split the commission with your broker You are more likely to see homes for sale by owner - brokers won't show them to you

Brokers help to arrange home showings for you, alert you to new homes on the market, and provide some information. However, you can do much of this by yourself by looking through the newspaper and calling for appointments. Doing it yourself has two advantages The seller's broker is more likely to cut their commission to lower the price if he/she doesn't have to split the commission with your broker You are more likely to see homes for sale by owner - brokers won't show them to you

You can identify a down market before prices drop a lot by looking at newspaper listing -look for more for-saleby-owner homes, calls for bids, price discounts, gimmicks to attract buyers.

You can identify a down market before prices drop a lot by looking at newspaper listing -look for more for-saleby-owner homes, calls for bids, price discounts, gimmicks to attract buyers.

MAKING OFFERS AND NEGOTIATING 1. Give only one or two days for seller to respond to an offer, otherwise they will use your offer to push other potential buyers to bid. 2. Keep responding quickly to their counteroffers to keep the pressure on them. 3. If you really want the property - settle on a price quickly this excludes other potential buyers 4. Make thorough inspections, send seller copy of defects and renegotiate the price down before signing the purchase and sale agreement.

MAKING OFFERS AND NEGOTIATING 1. Give only one or two days for seller to respond to an offer, otherwise they will use your offer to push other potential buyers to bid. 2. Keep responding quickly to their counteroffers to keep the pressure on them. 3. If you really want the property - settle on a price quickly this excludes other potential buyers 4. Make thorough inspections, send seller copy of defects and renegotiate the price down before signing the purchase and sale agreement.

SELLER TIPS 1. Don't choose a broker simply because they say they can sell your house for the most money. Offering to sell for a high price may be a way to get your listing and later they will work you down to a lower price in order to sell the house. 2. Do your homework by viewing similar houses that are for sale or have sold. - be realistic in your appraisal of how your house compares to others. - many sellers have a psychological attachment to their home - it is the best

SELLER TIPS 1. Don't choose a broker simply because they say they can sell your house for the most money. Offering to sell for a high price may be a way to get your listing and later they will work you down to a lower price in order to sell the house. 2. Do your homework by viewing similar houses that are for sale or have sold. - be realistic in your appraisal of how your house compares to others. - many sellers have a psychological attachment to their home - it is the best

- much of the RTC property had faulty appraisals because they used only basic qualities and missed other qualities that made property less attractive biased - like most investments, effort pays off on difficult to see factors 3. In a down market you may have to price below recent sales and the average of houses for sale now. This is because some houses presently on the market are over-priced. The better buys sell first so their features are probably better than the average home.

- much of the RTC property had faulty appraisals because they used only basic qualities and missed other qualities that made property less attractive biased - like most investments, effort pays off on difficult to see factors 3. In a down market you may have to price below recent sales and the average of houses for sale now. This is because some houses presently on the market are over-priced. The better buys sell first so their features are probably better than the average home.

- at the start of a down market - it pays to cut price before sellers are forced to realize the market condition - don't hang on because average prices appear to be holding up - they are holding up because fewer homes are sold and only the better quality homes at a specific price are sold. 4. In an up market - quality details are less important and you can sell based on basic features (4 bedroom, 2 bath, etc. ) 5. Often, the first or second offer is the best because it is from someone who knows your house is new to the market and wants to buy it before someone else.

- at the start of a down market - it pays to cut price before sellers are forced to realize the market condition - don't hang on because average prices appear to be holding up - they are holding up because fewer homes are sold and only the better quality homes at a specific price are sold. 4. In an up market - quality details are less important and you can sell based on basic features (4 bedroom, 2 bath, etc. ) 5. Often, the first or second offer is the best because it is from someone who knows your house is new to the market and wants to buy it before someone else.

6. If you must sell - cut price until sold - you must attract one of the few buyers by offering what looks like a good deal. You may feel better later if prices fall a lot. If they don't fall, at least you have the use of the money and avoid further hassles and can move on. - this is important if you move away and must buy another house. A quick sale avoids costs of carrying two houses (interest, heat, taxes, extra insurance on unoccupied home). Also, showing a home that is vacated shows the seller may be desperate. 7. Offer to pay points, do repairs, etc. in order to get home sold. This sells some buyers that don't have cash.

6. If you must sell - cut price until sold - you must attract one of the few buyers by offering what looks like a good deal. You may feel better later if prices fall a lot. If they don't fall, at least you have the use of the money and avoid further hassles and can move on. - this is important if you move away and must buy another house. A quick sale avoids costs of carrying two houses (interest, heat, taxes, extra insurance on unoccupied home). Also, showing a home that is vacated shows the seller may be desperate. 7. Offer to pay points, do repairs, etc. in order to get home sold. This sells some buyers that don't have cash.