f97ffa6cf11047739d4f46123c4a6870.ppt

- Количество слайдов: 10

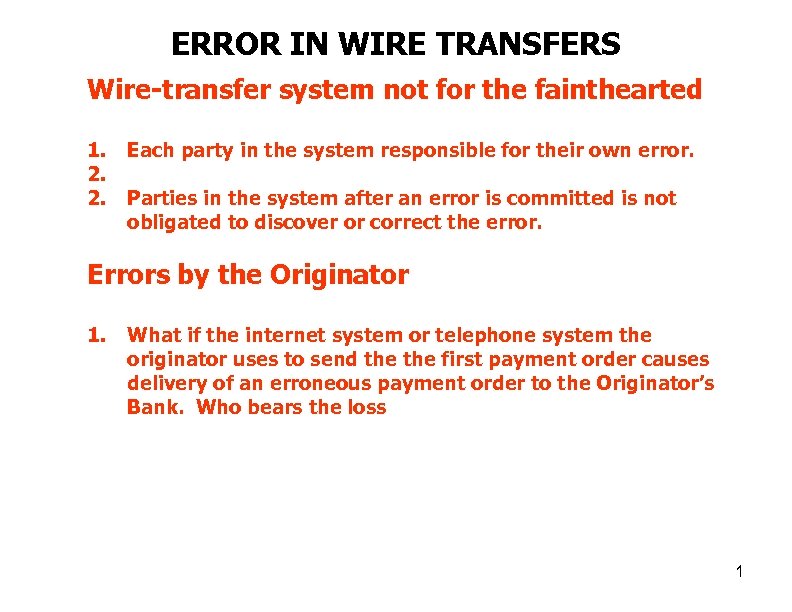

ERROR IN WIRE TRANSFERS Wire-transfer system not for the fainthearted 1. 2. 2. Each party in the system responsible for their own error. Parties in the system after an error is committed is not obligated to discover or correct the error. Errors by the Originator 1. What if the internet system or telephone system the originator uses to send the first payment order causes delivery of an erroneous payment order to the Originator’s Bank. Who bears the loss 1

ERROR IN WIRE TRANSFERS Wire-transfer system not for the fainthearted 1. 2. 2. Each party in the system responsible for their own error. Parties in the system after an error is committed is not obligated to discover or correct the error. Errors by the Originator 1. What if the internet system or telephone system the originator uses to send the first payment order causes delivery of an erroneous payment order to the Originator’s Bank. Who bears the loss 1

ERROR IN WIRE TRANSFERS Originator Internet service Duplicated payment order Delivery to Beneficiary Contrary to Intent of Originator. Beneficiary 4 A-103(a)(2) Tw Tr o P Or ans ay ig m me in itt n at ed t O or ’s to rde Te Ba rs or rm nk th der s o 4 A e sy tra f Pa -2 st nsm ym 06 em i e (a co tted nt ) nt to ro ls Beneficiary’s Bank 4 A- 103(a)(3) Originator’s Bank 4 A-104(d) 2

ERROR IN WIRE TRANSFERS Originator Internet service Duplicated payment order Delivery to Beneficiary Contrary to Intent of Originator. Beneficiary 4 A-103(a)(2) Tw Tr o P Or ans ay ig m me in itt n at ed t O or ’s to rde Te Ba rs or rm nk th der s o 4 A e sy tra f Pa -2 st nsm ym 06 em i e (a co tted nt ) nt to ro ls Beneficiary’s Bank 4 A- 103(a)(3) Originator’s Bank 4 A-104(d) 2

ERROR IN WIRE TRANSFERS Originator correctly Identifies name of beneficiary But has incorrect account number Beneficiary 4 A-103(a)(2) Pa Wr yme (Sa ong nt m lly ben ade Ma ef t y) icia o ry May Originator Recover from Beneficiary’s Bank? Pa # y. S 12 u 34 sa 5 n. S (S al and ly M ber ay g ) Beneficiary’s Bank 4 A-207(b) Reg J, 210. 27(b) Originator’s 3

ERROR IN WIRE TRANSFERS Originator correctly Identifies name of beneficiary But has incorrect account number Beneficiary 4 A-103(a)(2) Pa Wr yme (Sa ong nt m lly ben ade Ma ef t y) icia o ry May Originator Recover from Beneficiary’s Bank? Pa # y. S 12 u 34 sa 5 n. S (S al and ly M ber ay g ) Beneficiary’s Bank 4 A-207(b) Reg J, 210. 27(b) Originator’s 3

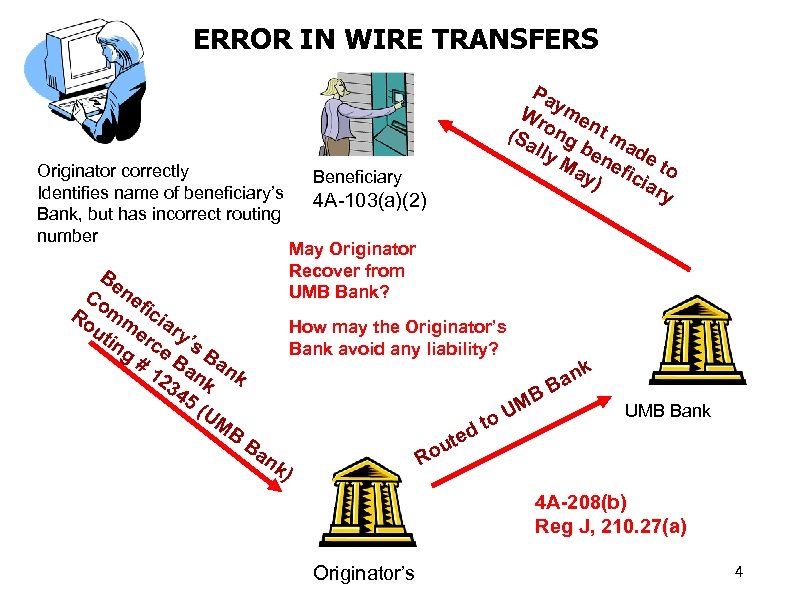

ERROR IN WIRE TRANSFERS Originator correctly Identifies name of beneficiary’s Bank, but has incorrect routing number Be Co ne Ro mm ficia ut er ry in ce ’s g # Ba Ban 12 n 34 k k 5 (U M B Pa Wr yme (Sa ong nt m lly ben ade Ma ef t y) icia o ry Beneficiary 4 A-103(a)(2) May Originator Recover from UMB Bank? How may the Originator’s Bank avoid any liability? o dt k MB U n Ba UMB Bank te Ba u Ro nk ) 4 A-208(b) Reg J, 210. 27(a) Originator’s 4

ERROR IN WIRE TRANSFERS Originator correctly Identifies name of beneficiary’s Bank, but has incorrect routing number Be Co ne Ro mm ficia ut er ry in ce ’s g # Ba Ban 12 n 34 k k 5 (U M B Pa Wr yme (Sa ong nt m lly ben ade Ma ef t y) icia o ry Beneficiary 4 A-103(a)(2) May Originator Recover from UMB Bank? How may the Originator’s Bank avoid any liability? o dt k MB U n Ba UMB Bank te Ba u Ro nk ) 4 A-208(b) Reg J, 210. 27(a) Originator’s 4

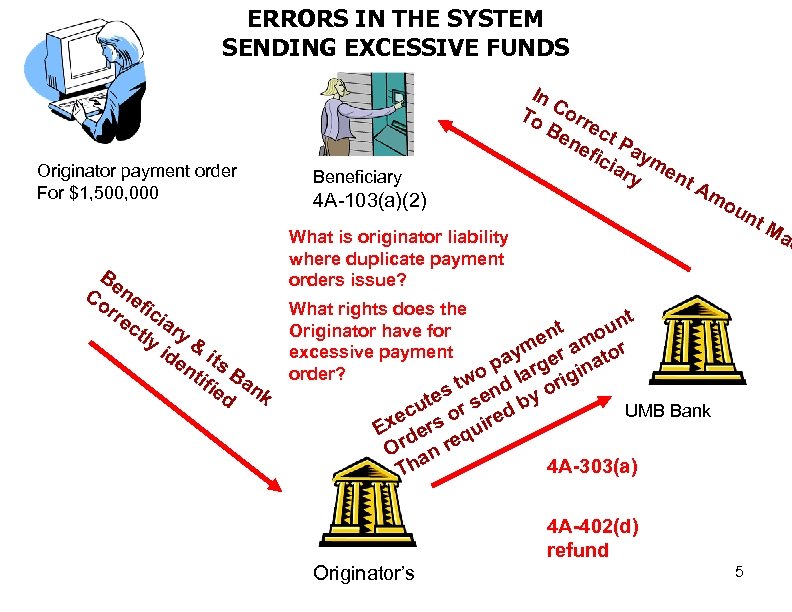

ERRORS IN THE SYSTEM SENDING EXCESSIVE FUNDS Originator payment order For $1, 500, 000 Be Co ne rre fici ct ary ly id & it en s tif Ba ie nk d Beneficiary 4 A-103(a)(2) In To Corr Be ect ne P fic aym iar y ent Am What is originator liability where duplicate payment orders issue? ou nt What rights does the t t un Originator have for n o me r am tor excessive payment y pa rge ina order? la ig wo t r d es sen by o t UMB Bank cu or red xe rs ui E de r req O an 4 A-303(a) Th 4 A-402(d) refund Originator’s 5 Ma d

ERRORS IN THE SYSTEM SENDING EXCESSIVE FUNDS Originator payment order For $1, 500, 000 Be Co ne rre fici ct ary ly id & it en s tif Ba ie nk d Beneficiary 4 A-103(a)(2) In To Corr Be ect ne P fic aym iar y ent Am What is originator liability where duplicate payment orders issue? ou nt What rights does the t t un Originator have for n o me r am tor excessive payment y pa rge ina order? la ig wo t r d es sen by o t UMB Bank cu or red xe rs ui E de r req O an 4 A-303(a) Th 4 A-402(d) refund Originator’s 5 Ma d

ERRORS IN THE SYSTEM SENDING INADEQUATE FUNDS Originator payment order For $1, 500, 000 Be Co ne rre fici ct ary ly id & it en s tif Ba ie nk d Pa $1 yme , 00 nt 0, 0 ma 00 de f or Beneficiary 4 A-103(a)(2) What is originator’s liability when inadequate payment orders issue? What is originator’s rights For default on the underlying Obligation? t en m ay 0, 000 p UMB Bank es 1, 00 ut r c xe r fo E rde O 4 A-402(c) 4 A-303(b) Originator’s 4 A-305(a) interest 4 A-305(b) expenses 6 4 A-305(c) consequential?

ERRORS IN THE SYSTEM SENDING INADEQUATE FUNDS Originator payment order For $1, 500, 000 Be Co ne rre fici ct ary ly id & it en s tif Ba ie nk d Pa $1 yme , 00 nt 0, 0 ma 00 de f or Beneficiary 4 A-103(a)(2) What is originator’s liability when inadequate payment orders issue? What is originator’s rights For default on the underlying Obligation? t en m ay 0, 000 p UMB Bank es 1, 00 ut r c xe r fo E rde O 4 A-402(c) 4 A-303(b) Originator’s 4 A-305(a) interest 4 A-305(b) expenses 6 4 A-305(c) consequential?

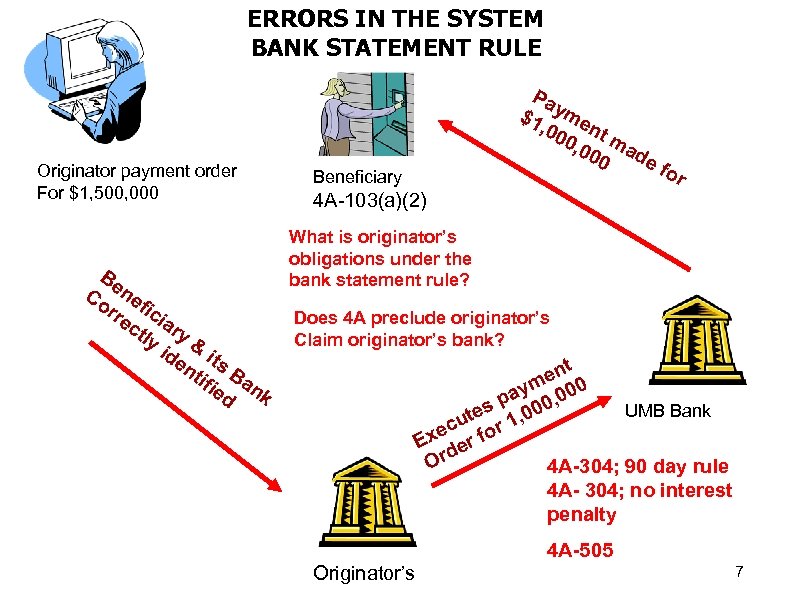

ERRORS IN THE SYSTEM BANK STATEMENT RULE Originator payment order For $1, 500, 000 Be Co ne rre fici ct ary ly id & it en s tif Ba ie nk d Pa $1 yme , 00 nt 0, 0 ma 00 de f or Beneficiary 4 A-103(a)(2) What is originator’s obligations under the bank statement rule? Does 4 A preclude originator’s Claim originator’s bank? t en m ay 0, 000 p UMB Bank es 1, 00 ut r c xe r fo E rde O 4 A-304; 90 day rule 4 A- 304; no interest penalty 4 A-505 Originator’s 7

ERRORS IN THE SYSTEM BANK STATEMENT RULE Originator payment order For $1, 500, 000 Be Co ne rre fici ct ary ly id & it en s tif Ba ie nk d Pa $1 yme , 00 nt 0, 0 ma 00 de f or Beneficiary 4 A-103(a)(2) What is originator’s obligations under the bank statement rule? Does 4 A preclude originator’s Claim originator’s bank? t en m ay 0, 000 p UMB Bank es 1, 00 ut r c xe r fo E rde O 4 A-304; 90 day rule 4 A- 304; no interest penalty 4 A-505 Originator’s 7

RECOVERING FROM RECIPIENT Du Originator correctly Identifies name of beneficiary’s Bank, but has incorrect routing number Be Co ne Ro mm ficia ut er ry in ce ’s g # Ba Ban 12 n 34 k k 5 (U M B pli ca te Beneficiary pa ym e nt 4 A-103(a)(2) If duplicate payment orders issued and paid by beneficiary’s bank, may bank recover from beneficiary? ent m pay te ica pl Ba ord ers rd o UMB Bank Du nk ) 4 A-211(c )(2) 4 A-303(a) Originator’s 8

RECOVERING FROM RECIPIENT Du Originator correctly Identifies name of beneficiary’s Bank, but has incorrect routing number Be Co ne Ro mm ficia ut er ry in ce ’s g # Ba Ban 12 n 34 k k 5 (U M B pli ca te Beneficiary pa ym e nt 4 A-103(a)(2) If duplicate payment orders issued and paid by beneficiary’s bank, may bank recover from beneficiary? ent m pay te ica pl Ba ord ers rd o UMB Bank Du nk ) 4 A-211(c )(2) 4 A-303(a) Originator’s 8

FRAUD, SYSTEM FAILURE & INT’L WIRE-TRANSFERS Wire-transfer system Attractive Target for Fraud 1. 2. 2. Large sums of money involved in the system. Largely an automated system. Banks Have Responded In Several Ways 1. 2. 3. 4. 5. Implementing security procedures to increase difficulty of carrying out thefts. Fedwire procedures for on-line transfers includes identification code and confidential password for access to the system. Off-line Fedwire transaction include a “four-party call-back” procedure. Many banks will use similar procedure with their customers (senders). Some bank use a less sophisticated “listen-back” security procedure in which an employee of the bank listens to a taped copy of the originator’s payment order. Some Banks use a “contractual overdraft limits” to prevent 9 fraud.

FRAUD, SYSTEM FAILURE & INT’L WIRE-TRANSFERS Wire-transfer system Attractive Target for Fraud 1. 2. 2. Large sums of money involved in the system. Largely an automated system. Banks Have Responded In Several Ways 1. 2. 3. 4. 5. Implementing security procedures to increase difficulty of carrying out thefts. Fedwire procedures for on-line transfers includes identification code and confidential password for access to the system. Off-line Fedwire transaction include a “four-party call-back” procedure. Many banks will use similar procedure with their customers (senders). Some bank use a less sophisticated “listen-back” security procedure in which an employee of the bank listens to a taped copy of the originator’s payment order. Some Banks use a “contractual overdraft limits” to prevent 9 fraud.

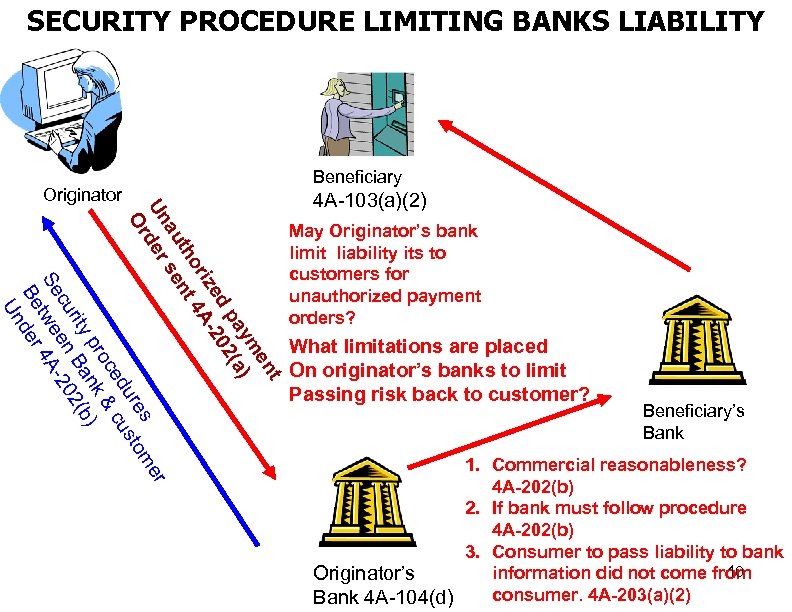

SECURITY PROCEDURE LIMITING BANKS LIABILITY r me es ur sto ed cu oc & pr nk ) rity Ba 2(b cu en 20 Se twe 4 ABe der Un t en ym ) pa 2(a 0 d ize -2 or 4 A th nt au se Un der Or Originator Beneficiary 4 A-103(a)(2) May Originator’s bank limit liability its to customers for unauthorized payment orders? What limitations are placed On originator’s banks to limit Passing risk back to customer? Beneficiary’s Bank 1. Commercial reasonableness? 4 A-202(b) 2. If bank must follow procedure 4 A-202(b) 3. Consumer to pass liability to bank 10 information did not come from Originator’s consumer. 4 A-203(a)(2) Bank 4 A-104(d)

SECURITY PROCEDURE LIMITING BANKS LIABILITY r me es ur sto ed cu oc & pr nk ) rity Ba 2(b cu en 20 Se twe 4 ABe der Un t en ym ) pa 2(a 0 d ize -2 or 4 A th nt au se Un der Or Originator Beneficiary 4 A-103(a)(2) May Originator’s bank limit liability its to customers for unauthorized payment orders? What limitations are placed On originator’s banks to limit Passing risk back to customer? Beneficiary’s Bank 1. Commercial reasonableness? 4 A-202(b) 2. If bank must follow procedure 4 A-202(b) 3. Consumer to pass liability to bank 10 information did not come from Originator’s consumer. 4 A-203(a)(2) Bank 4 A-104(d)