ab4aaa58c40864e74dca5d55bd10a563.ppt

- Количество слайдов: 28

ERISA Retirement Plan Fiduciary Responsibility Practicing Fiduciary Prudence Workshop 2006 Benefits New York Conference New York, NY March 13, 2006 11: 00 AM – 11: 50 AM

About Your Presenters n Greg Limoges is Vice President, Compensation, Benefits & HRIS at Monster Worldwide, Maynard, MA. His responsibilities include strategy, design, and implementation of global compensation and benefits programs, executive compensation, and long-term incentives. Prior to joining Monster Worldwide, Greg held similar positions at The Math. Works Corporation in Natick, MA and Waters Corporation, Milford, MA, was a Principal at Clark Consulting (formerly Executive Alliance), and held senior human resources positions at State Street Corporation, Main Street America, Fidelity, and Lockheed. Greg holds a B. S. in Psychology, Plymouth State University, and an M. B. A. from Rivier College. He is a Certified Compensation Professional, Certified Benefits Professional and a member of Worldat. Work. n Wayne G. Bogosian is founder and President of The PFE Group, Southborough, MA, a leading retirement plan vendor search, investment advisory and financial education consulting firm. Wayne is a frequent public speaker, having conducted more than 1, 000 workshops and seminars on topics ranging from retirement planning and investments to corporate downsizing and mergers and acquisitions. He is co-author of The Complete Idiot’s Guide to 401(k) Plans and has been quoted in a variety of publications including Business Week, CNNMoney, Employee Benefit News, Reader’s Digest, USA Today, Wall Street Journal, Washington Post, and appeared on WCVB, MSNBC, and AOL. Wayne has a B. S. from Northeastern University, an M. B. A. from Suffolk University, is an Accredited Investment Fiduciary (AIF), and holds various securities licenses. ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 1

Workshop Objectives n What Are Your Fiduciary Duties? n Is Trouble On The Way? (i. e. , What Should Fiduciaries Be Doing? ) n What About Investment Selection & Monitoring? n What Actions Should You Take? ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 2

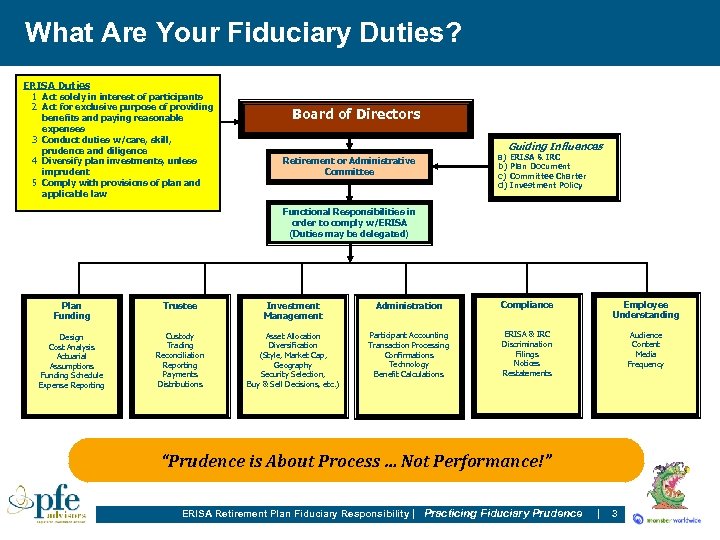

What Are Your Fiduciary Duties? ERISA Duties 1 Act solely in interest of participants 2 Act for exclusive purpose of providing benefits and paying reasonable expenses 3 Conduct duties w/care, skill, prudence and diligence 4 Diversify plan investments, unless imprudent 5 Comply with provisions of plan and applicable law Board of Directors Guiding Influences Retirement or Administrative Committee a) ERISA & IRC b) Plan Document c) Committee Charter d) Investment Policy Functional Responsibilities in order to comply w/ERISA (Duties may be delegated) Plan Funding Trustee Investment Management Administration Compliance Employee Understanding Design Cost Analysis Actuarial Assumptions Funding Schedule Expense Reporting Custody Trading Reconciliation Reporting Payments Distributions Asset Allocation Diversification (Style, Market Cap, Geography Security Selection, Buy & Sell Decisions, etc. ) Participant Accounting Transaction Processing Confirmations Technology Benefit Calculations ERISA & IRC Discrimination Filings Notices Restatements Audience Content Media Frequency “Prudence is About Process … Not Performance!” ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 3

Players On The Same Team WHO IS A PLAN FIDUCIARY? Social Security 30% to 35% Pension 30% to 35% ERISA COUNSEL Personal Bonds Savings 30%40. 1% to 40% INVESTMENT ADVISOR RETIREMENT CONSULTANT PLAN SPONSOR ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 4

Fiduciary Responsibility is About Process n Who are the Plan’s fiduciaries? n Do fiduciaries know their duties (settlor vs. fiduciary; investment vs. administration)? n Do fiduciaries intend to comply with ERISA § 404(c)? n What selection criteria was used (documented) to select service providers? n How are fiduciaries monitoring directed-trustees, administrators, investment managers, consultants, etc. ? Using what benchmarks? n How are fiduciaries monitoring “parties-in-interest”? n How have fiduciaries communicated important Plan actions to participants? n Are the Plan’s fiduciaries properly bonded and insured? ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 5

How Objective is Your Advisor? “Under the Investment Advisers Act of 1940 (Advisers Act), an investment adviser providing consulting services has a fiduciary duty to provide disinterested advice and disclose any material conflicts of interest to their clients. In this context, SEC staff examined the practices of advisers that provide pension consulting services to plan sponsors and trustees. These consulting services included assisting in determining the plan's investment objectives and restrictions, allocating plan assets, selecting money managers, choosing mutual fund options, tracking investment performance, and selecting other service providers. Many of the consultants also offered, directly or through an affiliate or subsidiary, products and services to money managers. Additionally, many of the consultants also offered, directly or through an affiliate or subsidiary, brokerage and money management services, often marketed to plans as a package of “bundled” services. The SEC examination staff concluded in its report that the business alliances among pension consultants and money managers can give rise to serious potential conflicts of interest under the Advisers Act that need to be monitored and disclosed to plan fiduciaries. ” - Excerpt from “Selecting and Monitoring Pension Consultants: Tips for Plan Fiduciaries” Written by the Securities and Exchange Commission, May 2005 ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 6

Likely Places for Fiduciary “Exposure” n Plan Administration (Who, What, When, Where, Why, & How) – Misapplying Plan Rules • Eligibility • Compensation – Timely remittance (contributions & loan repayments) – Correcting discrimination test failures n Monitoring Service Providers – Ability of internal staff to monitor (training & education) – Administrative manual documenting processes & procedures – SAS 70 annual review n Plan Oversight – Meetings and Confirmation of Intent/Actions (Minutes) – Confirmation of “reasonable fees and expenses” ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 7

Fiduciary “To Do’s” n Fiduciary Committee – Structure and Function n Plan Oversight – Retained and Delegated ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 8

Fiduciary Committee – Structure and Function n Committee Structure – Review Plan Document for Guidance – Draft “Committee Charter” n Charter Should Define Committee Function – – – Purpose Structure Scope of Duties Resources & Authority Action Duties/Prohibitions General Guidelines Maintenance of Plan Investment Policy Selection and Oversight of Service Providers Compliance Indemnification Action: Does Your Plan have a “Committee Charter”? ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 9

Fiduciary Committee – Plan Oversight Options n Option 1: Retain and Delegate n Option 2: Engage Independent Fiduciary – Generally follow best practices approach – Advantages • Expertise • No conflicts of interest • Full-time professional – Disadvantages • Cost: Expensive • Relinquish direct authority and control • Obligation to select and monitor fiduciaries ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 10

Fiduciary Committee – Plan Oversight n Committee Responsibilities – Which will be delegated? Which retained? n Delegated Responsibilities – Trust (directed-trustee) – Plan Administration (day-to-day recordkeeping) – Communications n Retained Responsibilities (Non-Delegated) – – – Functioning as a Prudent Fiduciary Compliance Investment Policy (Construction & Monitoring) Fund Manager Performance Fee Analysis (Total and Vendor-specific) Vendor Oversight ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 11

About Monster Worldwide • Founded 1967 • Online Recruitment • Public Company • 5, 000 Employees • 26 Countries • 77% 401(k) Participation • Company Stock Match • Formal Plan Oversight ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 12

Our Fiduciary “To Do List” n Fiduciary Oversight – Getting Back to Basics – Committee Structure – Committee Charter – Investment Policy n Fiduciary Awareness and Understanding – Expectation Investment Only! – Reality Funding, Investment, Administration, Compliance, Communications n Initial and Ongoing Commitment n Objective and Unbiased Advice ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 13

“Work-in-Progress” n 401(k) Plan Vendor Search n What were our fees? Were they competitive? n How is the plan being “merchandised” to employees? n What role has/should company stock play in the plan? n Should we continue to use Plan Recordkeeper for investment reviews? n What actions were needed? ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 14

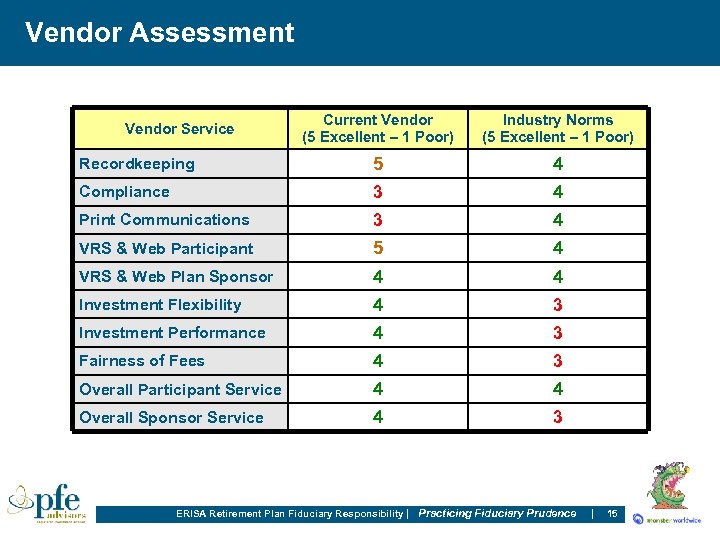

Vendor Assessment Current Vendor (5 Excellent – 1 Poor) Industry Norms (5 Excellent – 1 Poor) Recordkeeping 5 4 Compliance 3 4 Print Communications 3 4 VRS & Web Participant 5 4 VRS & Web Plan Sponsor 4 4 Investment Flexibility 4 3 Investment Performance 4 3 Fairness of Fees 4 3 Overall Participant Service 4 4 Overall Sponsor Service 4 3 Vendor Service ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 15

Plan Fees n Fee Benchmarking – Competitive investment expense – High-side administration expense n Investment Performance – Top-quartile rankings for most plan funds – Employees were happy ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 16

Taking Stock of Company Stock n Know What You Are Getting Into – Oversight IS Required – Due diligence for Stock is no different than other Plan funds – Trouble travels with access (restricting diversification) n Fiduciary “Catch-22” – SEC vs. ERISA – Fiduciary duty to disclose material information that could prove harmful to participants Vs. SEC restrictions upon public disclosure by insiders – Who is an insider? n Actions – Discuss and document the issues – Develop and document proper procedures ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 17

Excerpt From A Fiduciary Meeting Agenda n Adoption of Feb. 10, 2005 (4 th Quarter 2004) Meeting Minutes n Current Events (Affecting Qualified Retirement Savings Plans) – – – n Mutual Fund Investigations Update Implementation of Contingent Redemption Fees Roth 401(k) Feature – Strategic/Tactical Discussion New Fund Introductions Company Stock Administration: Allocating Administration Expense Share Class Adjustments: Passing Savings to Participants Review of Q 1 2005 401(k) Plan Results – Financial Markets Overview – Plan and Investment Performance • Participant Behaviors (participation/deferrals/loans, etc. ) • Trust Financials • Investment Performance • Observations and Recommendations ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 18

Fiduciary Reporting Should Include … n Trust Reconciliation n Trust Allocation (Cash, Bonds, Stocks) n Participation & Average Deferral Rate Trends n Automatic Enrollment Results – Defaults and Investment Use n Loan Use (#s and average balances) n Self-Directed Brokerage Use n Advice Use ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 19

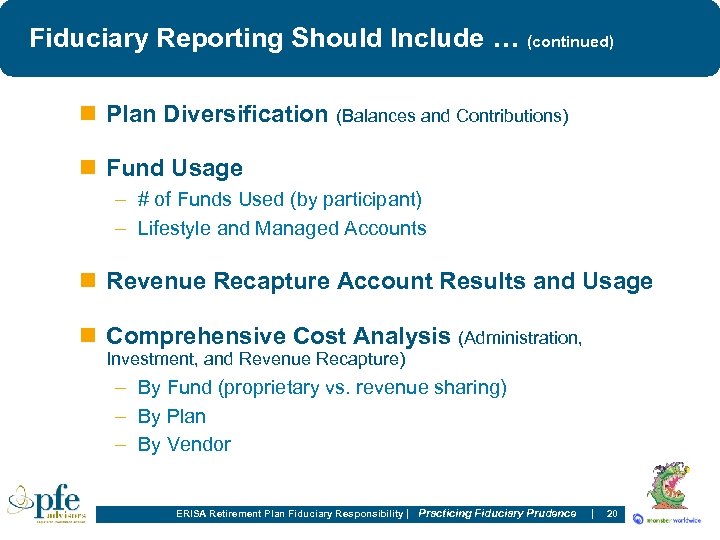

Fiduciary Reporting Should Include … (continued) n Plan Diversification (Balances and Contributions) n Fund Usage – # of Funds Used (by participant) – Lifestyle and Managed Accounts n Revenue Recapture Account Results and Usage n Comprehensive Cost Analysis (Administration, Investment, and Revenue Recapture) – By Fund (proprietary vs. revenue sharing) – By Plan – By Vendor ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 20

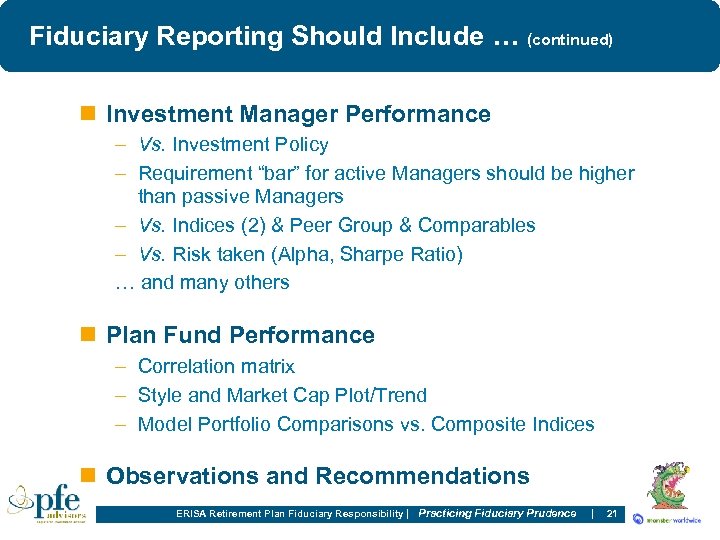

Fiduciary Reporting Should Include … (continued) n Investment Manager Performance – Vs. Investment Policy – Requirement “bar” for active Managers should be higher than passive Managers – Vs. Indices (2) & Peer Group & Comparables – Vs. Risk taken (Alpha, Sharpe Ratio) … and many others n Plan Fund Performance – Correlation matrix – Style and Market Cap Plot/Trend – Model Portfolio Comparisons vs. Composite Indices n Observations and Recommendations ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 21

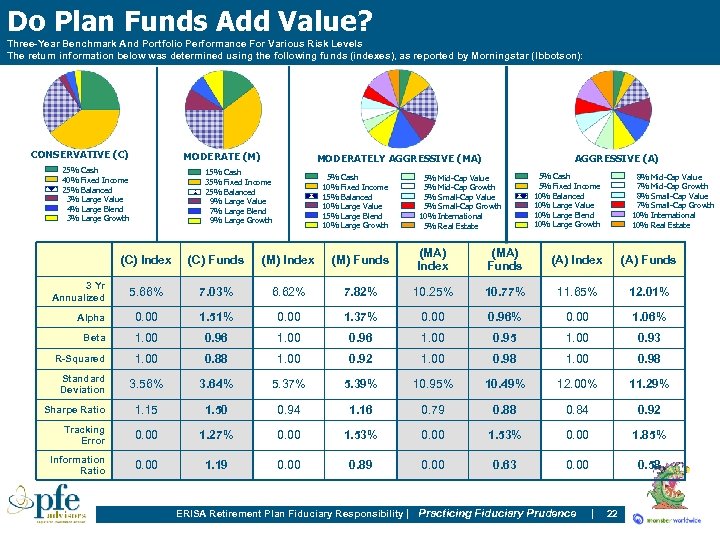

Do Plan Funds Add Value? Three-Year Benchmark And Portfolio Performance For Various Risk Levels The return information below was determined using the following funds (indexes), as reported by Morningstar (Ibbotson): CONSERVATIVE (C) MODERATE (M) 25% Cash 40% Fixed Income 25% Balanced 3% Large Value 4% Large Blend 3% Large Growth MODERATELY AGGRESSIVE (MA) 15% Cash 35% Fixed Income 25% Balanced 9% Large Value 7% Large Blend 9% Large Growth 5% Cash 10% Fixed Income 15% Balanced 10% Large Value 15% Large Blend 10% Large Growth AGGRESSIVE (A) 5% Mid-Cap Value 5% Mid-Cap Growth 5% Small-Cap Value 5% Small-Cap Growth 10% International 5% Real Estate 5% Cash 5% Fixed Income 10% Balanced 10% Large Value 10% Large Blend 10% Large Growth 8% Mid-Cap Value 7% Mid-Cap Growth 8% Small-Cap Value 7% Small-Cap Growth 10% International 10% Real Estate (C) Index (C) Funds (M) Index (M) Funds (MA) Index (MA) Funds (A) Index (A) Funds 5. 66% 7. 03% 6. 62% 7. 82% 10. 25% 10. 77% 11. 65% 12. 01% Alpha 0. 00 1. 51% 0. 00 1. 37% 0. 00 0. 96% 0. 00 1. 06% Beta 1. 00 0. 96 1. 00 0. 95 1. 00 0. 93 R-Squared 1. 00 0. 88 1. 00 0. 92 1. 00 0. 98 Standard Deviation 3. 56% 3. 64% 5. 37% 5. 39% 10. 95% 10. 49% 12. 00% 11. 29% Sharpe Ratio 1. 15 1. 50 0. 94 1. 16 0. 79 0. 88 0. 84 0. 92 Tracking Error 0. 00 1. 27% 0. 00 1. 53% 0. 00 1. 85% Information Ratio 0. 00 1. 19 0. 00 0. 89 0. 00 0. 63 0. 00 0. 58 3 Yr Annualized ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 22

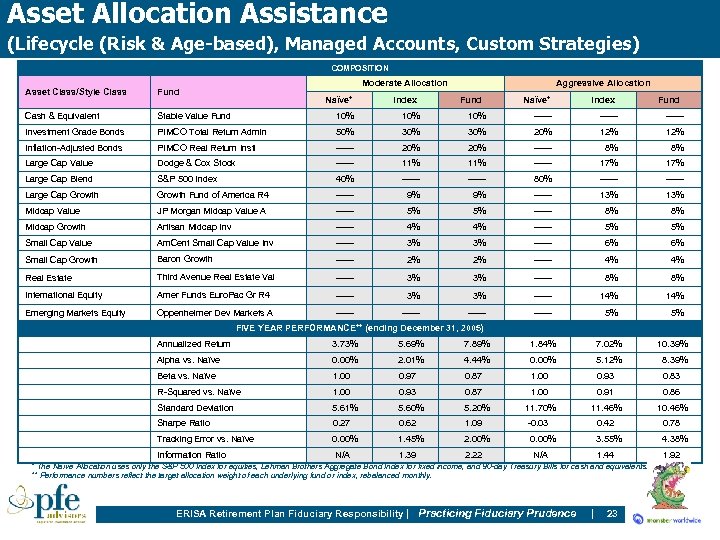

Asset Allocation Assistance (Lifecycle (Risk & Age-based), Managed Accounts, Custom Strategies) COMPOSITION Moderate Allocation Aggressive Allocation Asset Class/Style Class Fund Cash & Equivalent Stable Value Fund 10% 10% ------ Investment Grade Bonds PIMCO Total Return Admin 50% 30% 20% 12% Inflation-Adjusted Bonds PIMCO Real Return Instl ------ 20% ------ 8% 8% Large Cap Value Dodge & Cox Stock ------ 11% ------ 17% Large Cap Blend S&P 500 Index 40% ------ 80% ------ Large Cap Growth Fund of America R 4 ------ 9% 9% ------ 13% Midcap Value JP Morgan Midcap Value A ------ 5% 5% ------ 8% 8% Midcap Growth Artisan Midcap Inv ------ 4% 4% ------ 5% 5% Small Cap Value Am. Cent Small Cap Value Inv ------ 3% 3% ------ 6% 6% Small Cap Growth Baron Growth ------ 2% 2% ------ 4% 4% Real Estate Third Avenue Real Estate Val ------ 3% 3% ------ 8% 8% International Equity Amer Funds Euro. Pac Gr R 4 ------ 3% 3% ------ 14% Emerging Markets Equity Oppenheimer Dev Markets A ------ 5% 5% Naïve* Index Fund FIVE YEAR PERFORMANCE** (ending December 31, 2005) Annualized Return 3. 73% 5. 69% 7. 89% 1. 84% 7. 02% 10. 39% Alpha vs. Naïve 0. 00% 2. 01% 4. 44% 0. 00% 5. 12% 8. 39% Beta vs. Naïve 1. 00 0. 97 0. 87 1. 00 0. 93 0. 83 R-Squared vs. Naïve 1. 00 0. 93 0. 87 1. 00 0. 91 0. 86 Standard Deviation 5. 61% 5. 60% 5. 20% 11. 70% 11. 46% 10. 46% Sharpe Ratio 0. 27 0. 62 1. 09 -0. 03 0. 42 0. 78 Tracking Error vs. Naïve 0. 00% 1. 45% 2. 00% 0. 00% 3. 55% 4. 38% 1. 39 2. 22 1. 44 1. 92 Information Ratio N/A * The Naïve Allocation uses only the S&P 500 Index for equities, Lehman Brothers Aggregate Bond Index for fixed income, and 90 -day Treasury Bills for cash and equivalents. ** Performance numbers reflect the target allocation weight of each underlying fund or index, rebalanced monthly. ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 23

Trouble Spots for Fiduciaries … n Pension Plan vs. 401(k) Due Diligence? n Share Class selection and monitoring? n Vendor agreement proprietary-asset commitment? n Investment advice? (Investment Policy update) n Vendor gross revenue projections? n Cost vs. benefit (does a low cost plan require more plan sponsor support)? n Default fund selection? ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 24

Trouble Spots for Fiduciaries. . . (continued) n Comparing plan investments and plan costs to incorrect benchmarks? n “Watch List” – Is it being used? n Company stock? Are insiders on Committee? n Reporting fiduciary actions to Board of Directors? ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 25

Fiduciary “To Do’s” n Confirm Your Committee (Structure and Governance) n Review/Draft Your Investment Policy n Identify How Vendor Oversight Is Accomplished n Interview Your Investment Advisor for Conflicts of Interest If you don’t know what you are doing … ERISA requires you to find someone who does. ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 26

Thanks for coming! Wayne G. Bogosian Greg Limoges President, CEO Vice President, Compensation, Benefits, HRIS The PFE Group 144 Turnpike Road, Suite 360 Southborough, MA 01772 (508) 683 -1400, ext. 205 wayne_bogosian@pfegroup. com Monster Worldwide Five Clock Tower Place Maynard, MA 01754 (978) 461 -8701 greg. limoges@Monster. com ERISA Retirement Plan Fiduciary Responsibility | Practicing Fiduciary Prudence | 27

ab4aaa58c40864e74dca5d55bd10a563.ppt