6291261e6567df88825b7470fb09aada.ppt

- Количество слайдов: 39

Erik Zingmark Global Head CM CM Trends and ”the cure” Tallin, 8 feb, 2007 1

Agenda l SEB Cash Management l Trends in Cash Management l Cash Management Value Chain™ l Sum up One Market One Bank One Attitude 2

Cash Management 3

Cisco? 4

Cash Management! Logistics of information Moving and concentrating liquidity, securely, accurately and cost efficiently 5

Cash Management SEB, Merchant Banking l Own operations in 16 countries l Early mover and thought leader since mid 70 -ties l Long term commitment for CM from top management l Award winning solutions 6

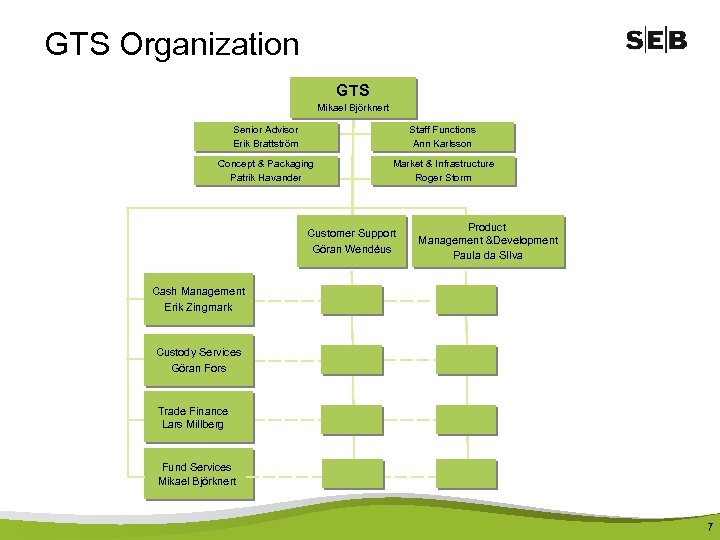

GTS Organization GTS Mikael Björknert Senior Advisor Erik Brattström Staff Functions Ann Karlsson Concept & Packaging Patrik Havander Market & Infrastructure Roger Storm Customer Support Göran Wendéus Product Management &Development Paula da SIlva Cash Management Erik Zingmark Custody Services Fund Services Göran Fors Trade Finance Lars Millberg Fund Services Mikael Björknert 7

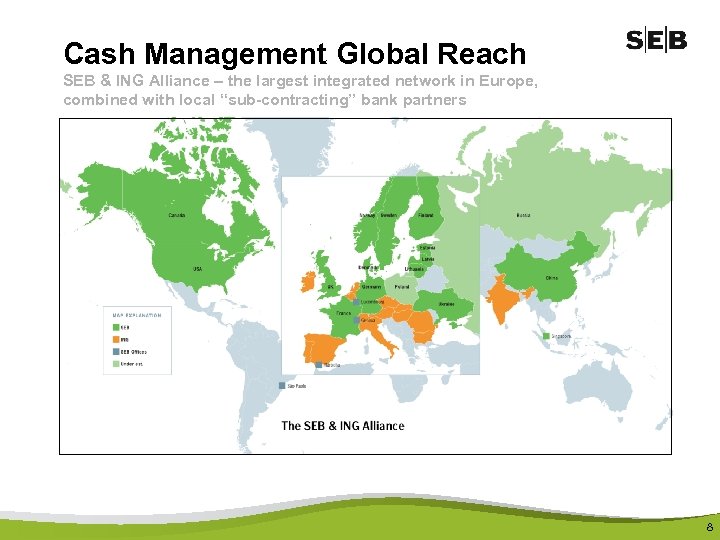

Cash Management Global Reach SEB & ING Alliance – the largest integrated network in Europe, combined with local “sub-contracting” bank partners 8

Trends 9

Trends - SEPA 10

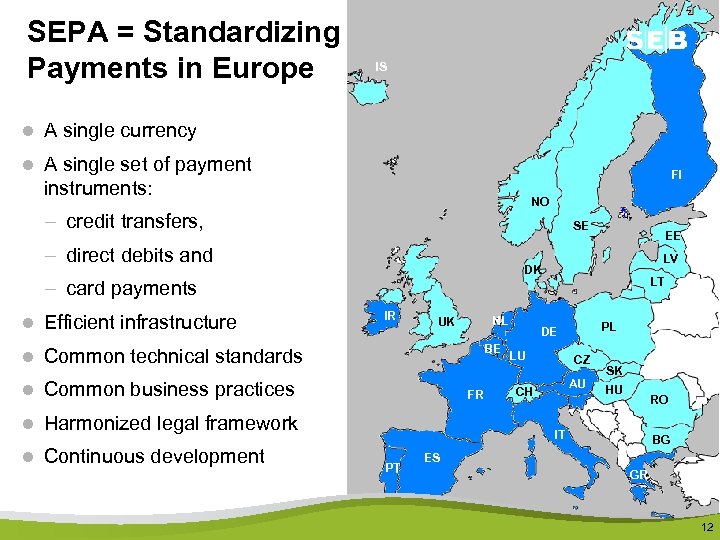

SEPA = Single Euro Payments Area l A politically driven and encouraged process – particularly for consumers l An enabler and catalyst for EU market integration and increased competition l Payments in Euro to be as easy, safe and efficient as the best of national systems – with no differentiation between cross-border and national payments l A single market for payments for the EU – pay and receive in Euro to a single account – a single set of payment instruments – a single format 11

SEPA = Standardizing Payments in Europe IS l A single currency l A single set of payment FI instruments: NO – credit transfers, SE – direct debits and EE LV DK LT – card payments l Efficient infrastructure IR NL UK BE l Common technical standards l Common business practices FR l Harmonized legal framework l Continuous development PL DE LU CZ AU CH SK HU RO IT PT BG ES GR 12

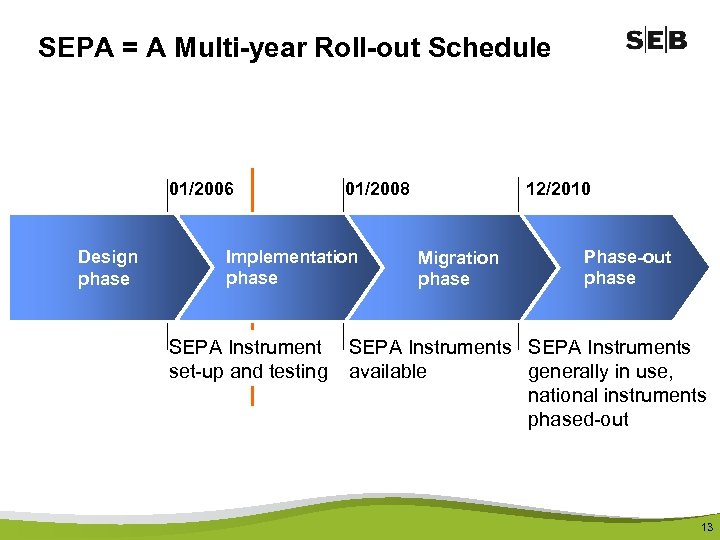

SEPA = A Multi-year Roll-out Schedule 01/2006 Design phase Implementation phase SEPA Instrument set-up and testing 12/2010 01/2008 Migration phase Phase-out phase SEPA Instruments generally in use, available national instruments phased-out 13

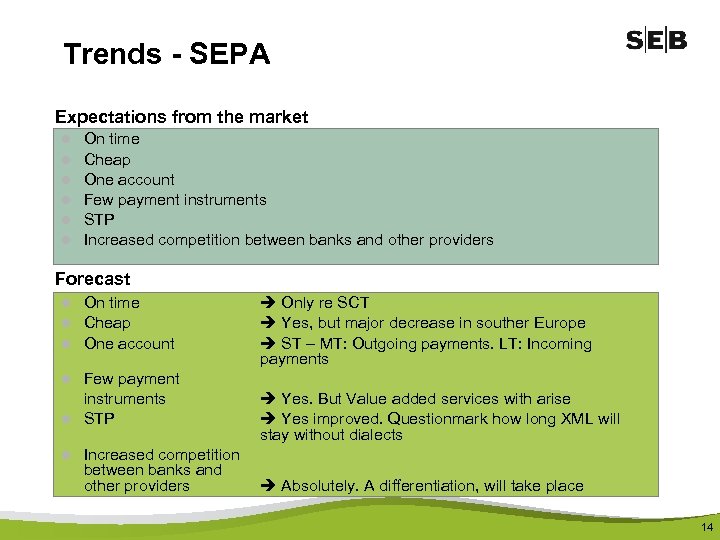

Trends - SEPA Expectations from the market l l l On time Cheap One account Few payment instruments STP Increased competition between banks and other providers Forecast l On time l Cheap l One account Only re SCT Yes, but major decrease in souther Europe ST – MT: Outgoing payments. LT: Incoming payments l Few payment instruments l STP Yes. But Value added services with arise Yes improved. Questionmark how long XML will stay without dialects l Increased competition between banks and other providers Absolutely. A differentiation, will take place 14

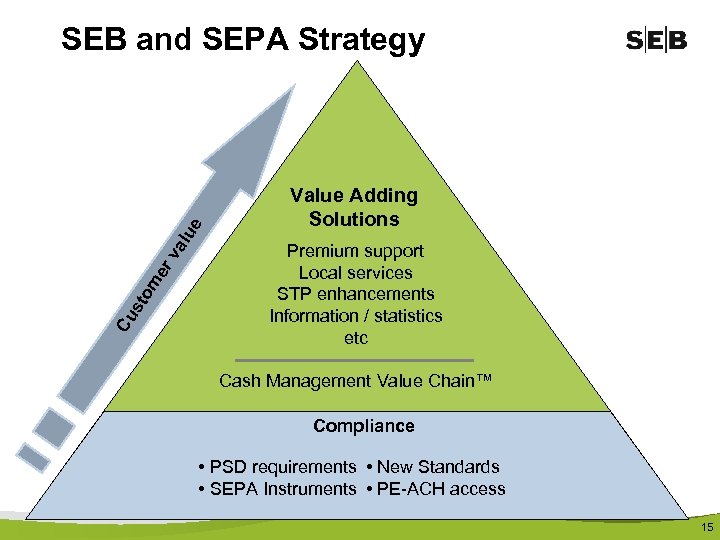

Cu st om er va lu e SEB and SEPA Strategy Value Adding Solutions Premium support Local services STP enhancements Information / statistics etc Cash Management Value Chain™ Compliance • PSD requirements • New Standards • SEPA Instruments • PE-ACH access 15

Trends – e. Invoicing 16

Trends – e. Invoicing (B 2 B) l e. Invoicing brings great benefits to all involved in the process l l l – Higher STP – Lower cost Government bodies and municipalities are driving the demand Slow up-take by market, especially among larger corporates Some hesitation about the business model / logics – Receiver driver (Customers) – Sender driven (Suppliers) Formats, content, rules and government not yet fully agreed upon – Thereby difficult to deliver cross border solutions A first few steps to make e. Invoicing happen are: – to establish a legal framework (e. g. what is an invoice) – to set up an infrastructure 17

Trends – e. Invoicing (B 2 B) Status l Receiver driver model seems to be the most l l effective model – Higher economic benefits (processes) for receiver – Challenge: Supplier activation. SEB cooperates with IBX SEB represent Sweden in the Nordic forum Nordics getting closer – can deliver area during 2007 Possible to offer that also to e. g. Estonian corporates within a year SEB is of course also working very hard in establishing an Estonian e. Invoicing solution 18

Trends – MA CUGs 19

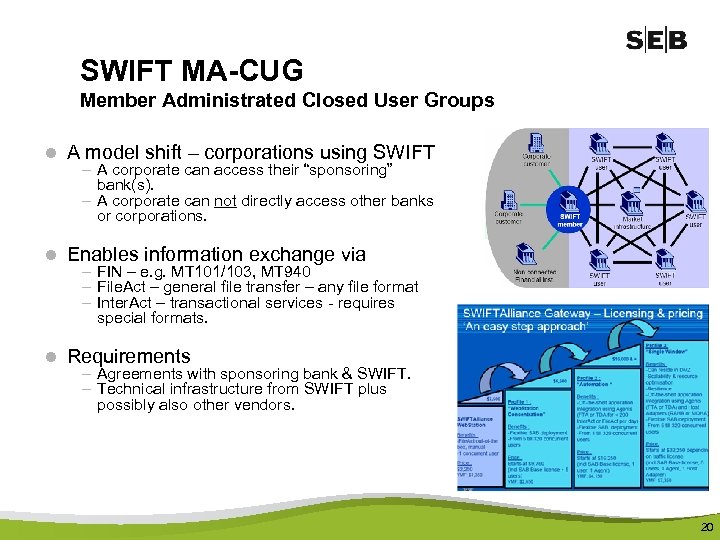

SWIFT MA-CUG Member Administrated Closed User Groups l A model shift – corporations using SWIFT – A corporate can access their “sponsoring” bank(s). – A corporate can not directly access other banks or corporations. l Enables information exchange via – FIN – e. g. MT 101/103, MT 940 – File. Act – general file transfer – any file format – Inter. Act – transactional services - requires special formats. l Requirements – Agreements with sponsoring bank & SWIFT. – Technical infrastructure from SWIFT plus possibly also other vendors. 20

MA-CUG Update l SCORE – Standardised Corporate Environment. – – Standardized and simplification of agreements Pilot expected to start beginning of 2007 Many corporates and banks in same group To use SCORE, corporates must be listed on a regulated stock exchange of a country which is member of the Financial Action Task Force l Market demand – Still low to no demand from Nordic corporates. – Worldwide about 150 corporates after 5 years. l Conclusions – The corporate business case is still in many cases not obvious. Similar communication functions are often available at lower price. 21

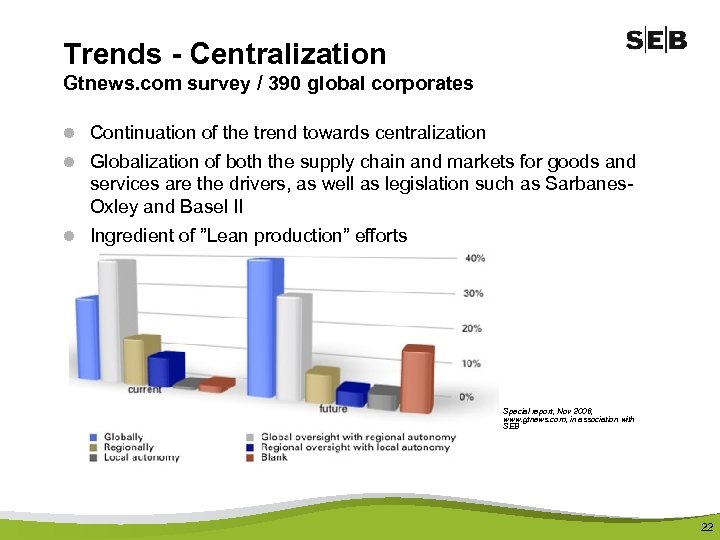

Trends - Centralization Gtnews. com survey / 390 global corporates l Continuation of the trend towards centralization l Globalization of both the supply chain and markets for goods and services are the drivers, as well as legislation such as Sarbanes. Oxley and Basel II l Ingredient of ”Lean production” efforts Special report, Nov 2006, www. gtnews. com, in association with SEB 22

Trends – Treasurer’s role Gtnews. com survey / 390 global corporates l Low value activities such as payment processing and in-house bank administration are moved to SSCs, outside Treasury l Treasury becomes an internal consultant on cash-flow management and therefore advise business management on increasing shareholder value by improving working capital, financial supply chain and risk management Special report, Nov 2006, www. gtnews. com, in association with SEB 23

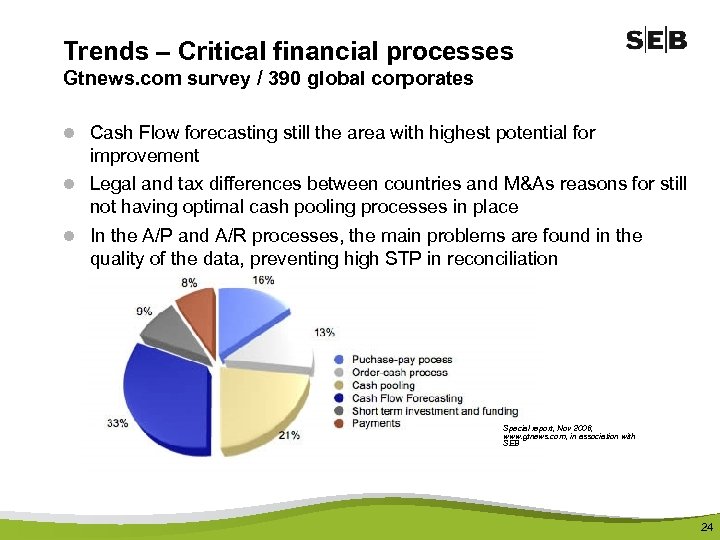

Trends – Critical financial processes Gtnews. com survey / 390 global corporates l Cash Flow forecasting still the area with highest potential for improvement l Legal and tax differences between countries and M&As reasons for still not having optimal cash pooling processes in place l In the A/P and A/R processes, the main problems are found in the quality of the data, preventing high STP in reconciliation Special report, Nov 2006, www. gtnews. com, in association with SEB 24

CM Value Chain™ 25

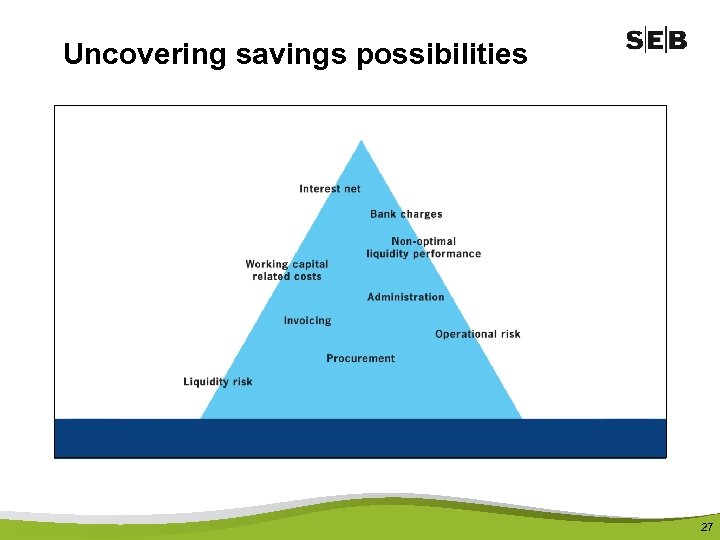

Which of your CM costs do you want to, or dare to, see? 26

Uncovering savings possibilities 27

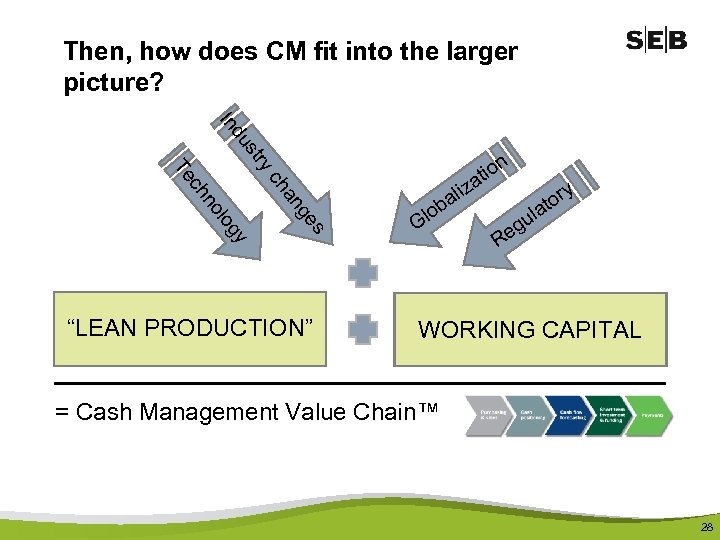

Then, how does CM fit into the larger picture? str du In Te yc n z ali lob es ng ha gy lo no ch “LEAN PRODUCTION” o ati G y tor la u eg R WORKING CAPITAL = Cash Management Value Chain™ 28

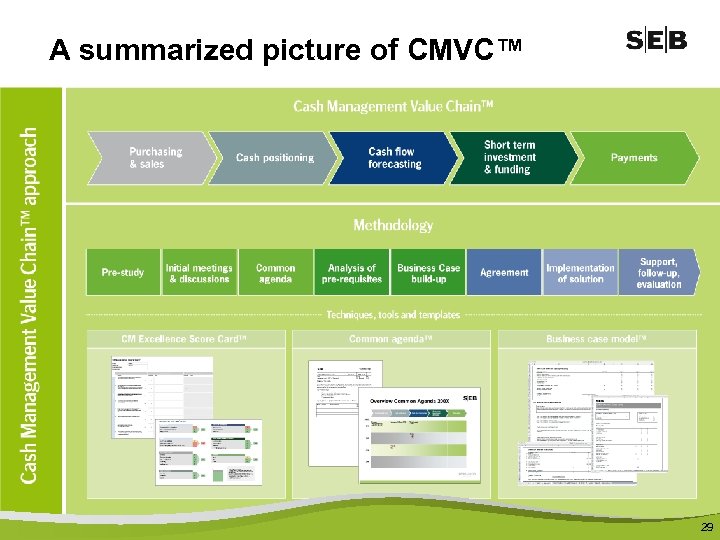

A summarized picture of CMVC™ 29

A process for excellence 30

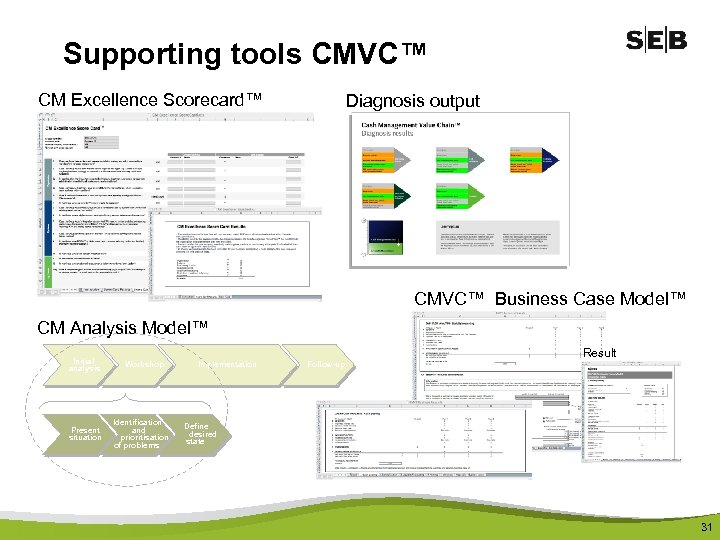

Supporting tools CMVC™ CM Excellence Scorecard™ Diagnosis output CMVC™ Business Case Model™ CM Analysis Model™ Initial analysis Present situation Result Workshop Identification and prioritisation of problems Implementation Follow-up Define desired state 31

Cash Management Value Chain™ Pro-active advise and expertise Lower total cost of Cash Management A guarantee for continuous development of your processes and organization Access to ”best practice” and tools for benchmarking your own level of CM excellence 32

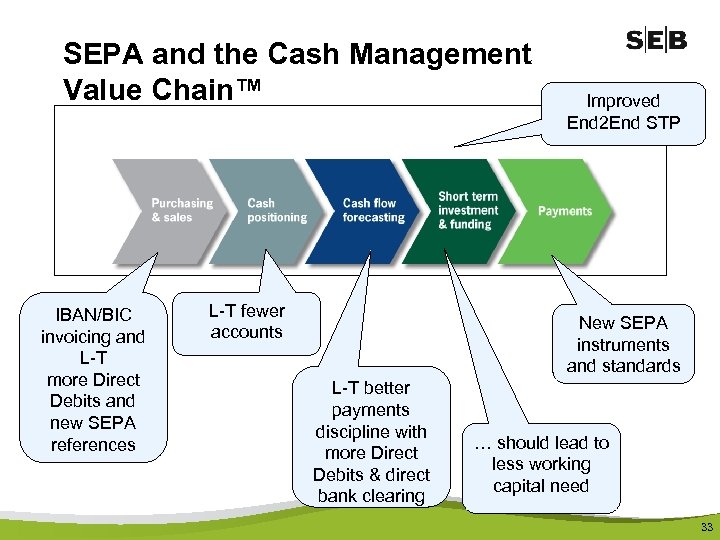

SEPA and the Cash Management Value Chain™ IBAN/BIC invoicing and L-T more Direct Debits and new SEPA references L-T fewer accounts Improved End 2 End STP New SEPA instruments and standards L-T better payments discipline with more Direct Debits & direct bank clearing … should lead to less working capital need 33

Sum up 34

Sum up l Regulations, political initiatives etc will continue to “rain over us” l SEPA is mandatory for banks and a great opportunity for l l corporates B 2 B e. Invoicing will happen soon. Currently calibration of formats and rule Liquidity forecasting / Working capital management here to stay Also, Swift will become more available for corporates (Swift. Net, MA-CUGs), but still not clear to what extent and value CMVC™ is a great ”tool” to – address these challenges – lower your total cost of CM and optimize your working capital – help you focus on your core business, by optimizing your financial processes 35

Award-winning Cash Management – thanks to our clients! l No. 1 Customer satisfaction l No. 1 globally. Voted Best Bank l No. 1 Commitment to Cash Management, l Best at Cash Management in the in Europe Euromoney’s Cash Management Poll, 2006 globally Euromoney’s Cash Management Poll, 2006 l No. 7 globally in market share as International Cash Management Bank Euromoney’s Cash Management Poll, 2006 for Electronic Cash Management Euromoney Technology Awards, 2005 Nordic/Baltic region Euromoney Awards for Excellence, 2004, 2005 & 2006 l Best Bank Cash Management – Nordic Region TMI Awards, 2004, 2005, 2006 l The most innovative cash management provider the Nordic Region Financial-i, 2006 36

The End 37

Extras 38

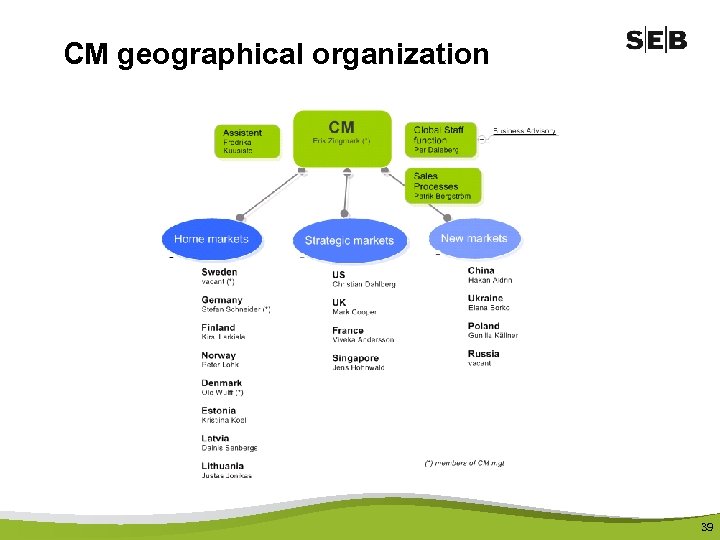

CM geographical organization 39

6291261e6567df88825b7470fb09aada.ppt