b8c89be9bd04862124125e50d7f585ac.ppt

- Количество слайдов: 46

Erik. Ranheim@intertanko. com Manager Research and Projects Main issues facing the tanker industry China Logistics 19 October 2005

Erik. Ranheim@intertanko. com Manager Research and Projects Main issues facing the tanker industry China Logistics 19 October 2005

INTERTANKO The International Association of Independent Tanker Owners For Safe Transport, Cleaner Seas and Free Competition Spokesman/representative Service/advice Meeting place

INTERTANKO The International Association of Independent Tanker Owners For Safe Transport, Cleaner Seas and Free Competition Spokesman/representative Service/advice Meeting place

Representation Ø IMO, International Chamber of Shipping Ø UNCTAD, Oil Companies International Marine Forum Ø IACS, International Assoc. of Classification Societies Ø OECD/IEA of P&I Clubs Ø Brussels. Ø Washington Ø ……. .

Representation Ø IMO, International Chamber of Shipping Ø UNCTAD, Oil Companies International Marine Forum Ø IACS, International Assoc. of Classification Societies Ø OECD/IEA of P&I Clubs Ø Brussels. Ø Washington Ø ……. .

INTERTANKO Membership 255 Members 2, 380 tankers 192 million dwt 40 countries 70% of independent fleet 280 Associate Members

INTERTANKO Membership 255 Members 2, 380 tankers 192 million dwt 40 countries 70% of independent fleet 280 Associate Members

Main issues facing the global tanker industry Safety performance Current maritime regulatory environment Players in the tanker industry Challenges ahead

Main issues facing the global tanker industry Safety performance Current maritime regulatory environment Players in the tanker industry Challenges ahead

Environmental concerns Zero tolerance

Environmental concerns Zero tolerance

Tanker incidents down

Tanker incidents down

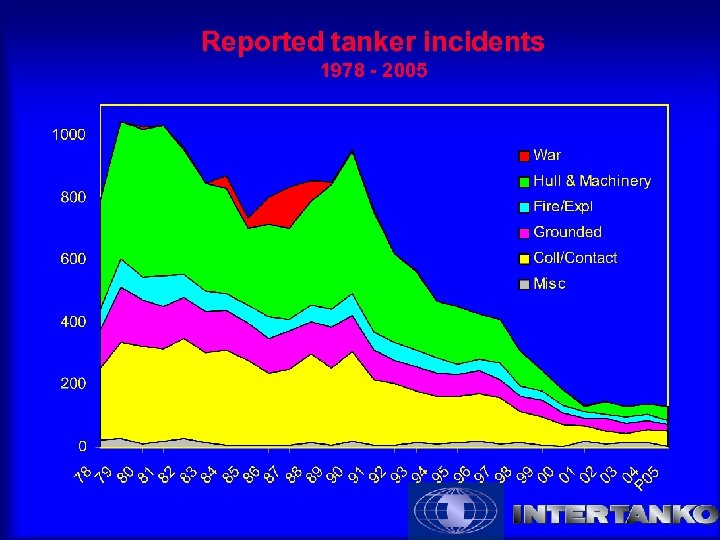

Reported tanker incidents 1978 - 2005

Reported tanker incidents 1978 - 2005

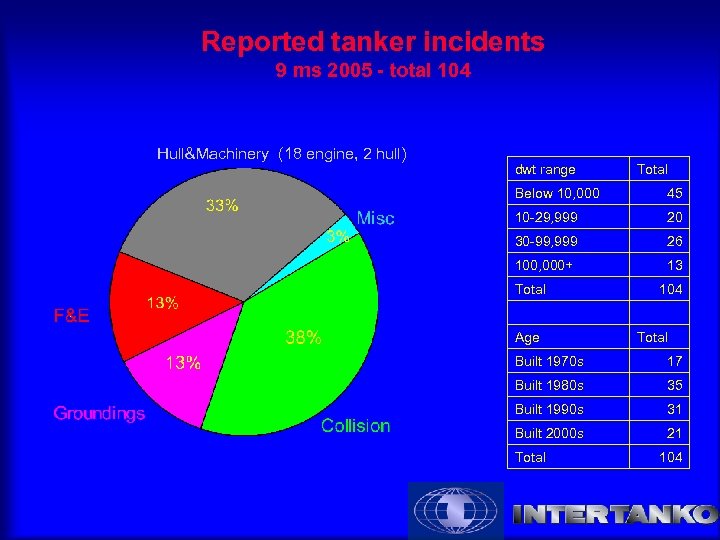

Reported tanker incidents 9 ms 2005 - total 104 Hull&Machinery (18 engine, 2 hull) dwt range Total Below 10, 000 45 10 -29, 999 20 30 -99, 999 26 100, 000+ 13 Total 104 Age Total Built 1970 s 17 Built 1980 s 35 Built 1990 s 31 Built 2000 s 21 Total 104

Reported tanker incidents 9 ms 2005 - total 104 Hull&Machinery (18 engine, 2 hull) dwt range Total Below 10, 000 45 10 -29, 999 20 30 -99, 999 26 100, 000+ 13 Total 104 Age Total Built 1970 s 17 Built 1980 s 35 Built 1990 s 31 Built 2000 s 21 Total 104

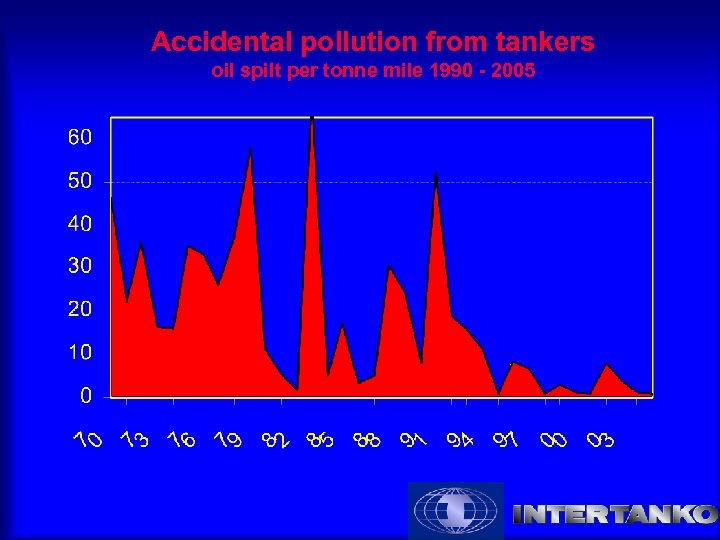

Tanker pollution down

Tanker pollution down

Accidental pollution from tankers oil spilt per tonne mile 1990 - 2005

Accidental pollution from tankers oil spilt per tonne mile 1990 - 2005

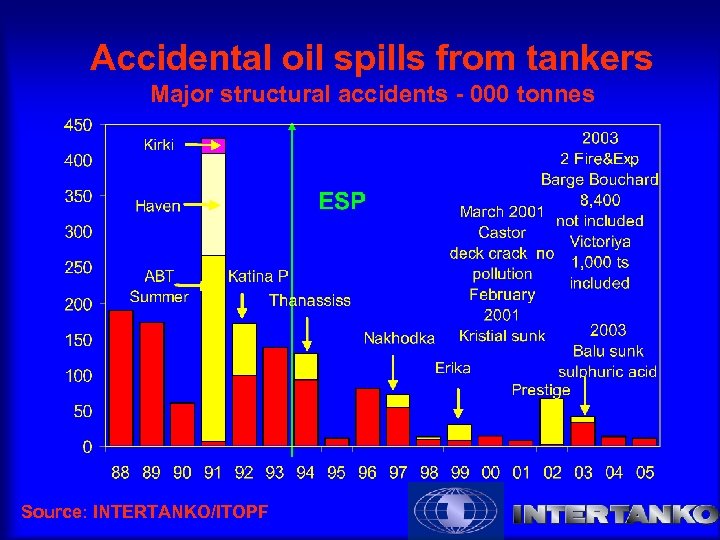

Accidental oil spills from tankers Major structural accidents - 000 tonnes Source: INTERTANKO/ITOPF

Accidental oil spills from tankers Major structural accidents - 000 tonnes Source: INTERTANKO/ITOPF

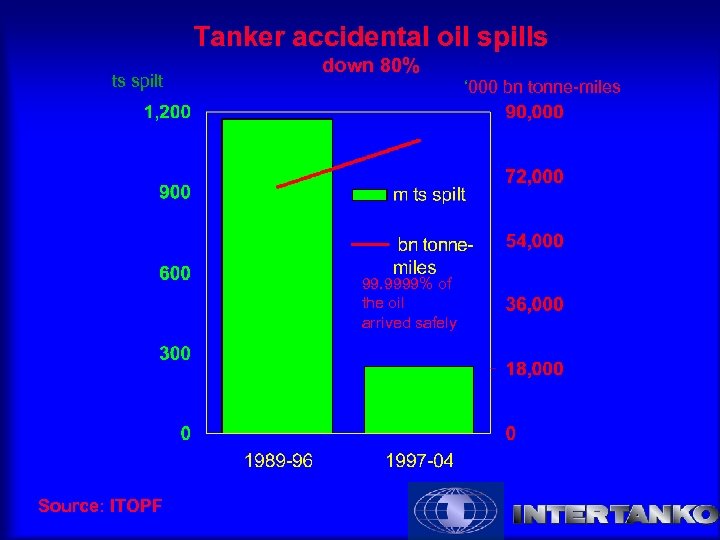

Tanker accidental oil spills ts spilt down 80% ‘ 000 bn tonne-miles 99. 9999% of the oil arrived safely Source: ITOPF

Tanker accidental oil spills ts spilt down 80% ‘ 000 bn tonne-miles 99. 9999% of the oil arrived safely Source: ITOPF

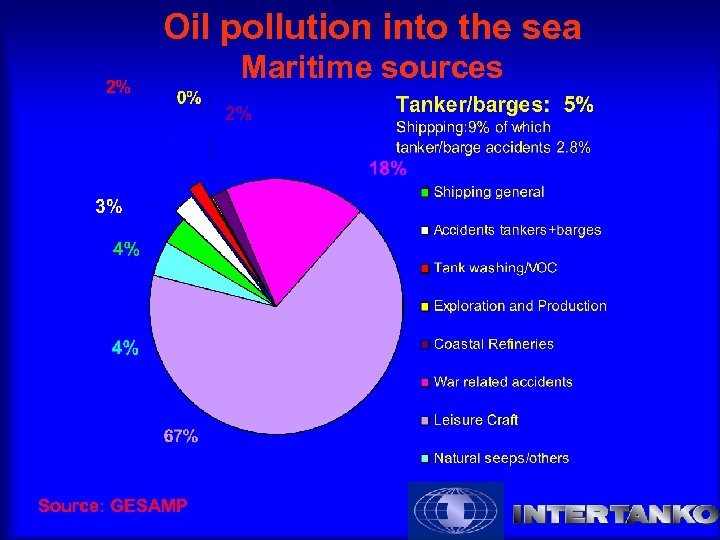

Oil pollution into the sea Maritime sources Source: GESAMP

Oil pollution into the sea Maritime sources Source: GESAMP

Total losses down

Total losses down

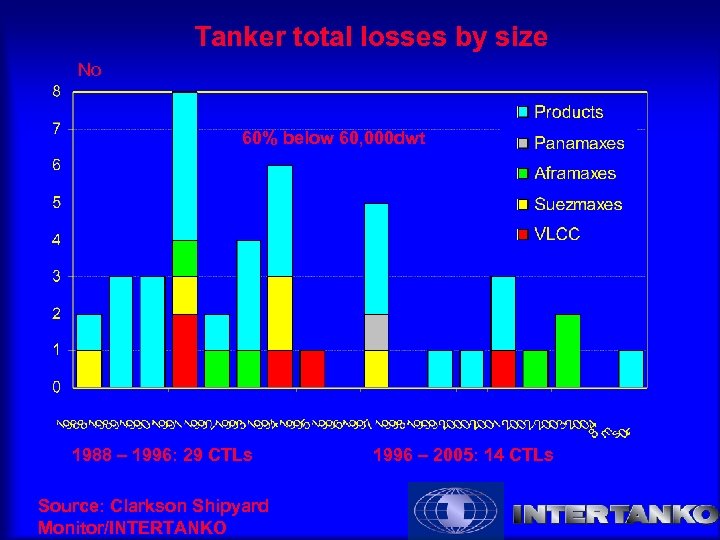

Tanker total losses by size No 60% below 60, 000 dwt 1988 – 1996: 29 CTLs Source: Clarkson Shipyard Monitor/INTERTANKO 1996 – 2005: 14 CTLs

Tanker total losses by size No 60% below 60, 000 dwt 1988 – 1996: 29 CTLs Source: Clarkson Shipyard Monitor/INTERTANKO 1996 – 2005: 14 CTLs

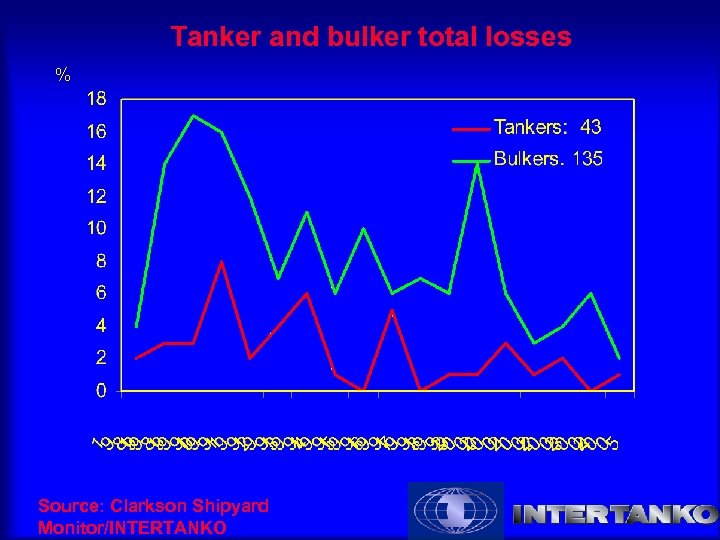

Tanker and bulker total losses % Source: Clarkson Shipyard Monitor/INTERTANKO

Tanker and bulker total losses % Source: Clarkson Shipyard Monitor/INTERTANKO

Explosions

Explosions

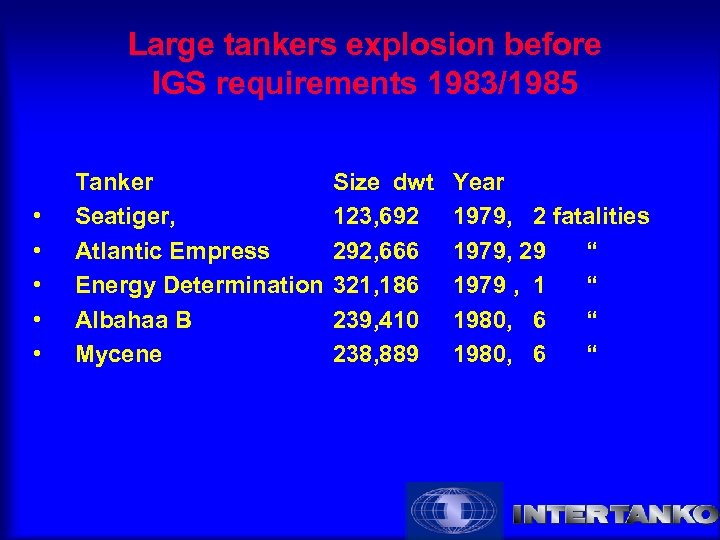

Large tankers explosion before IGS requirements 1983/1985 • • • Tanker Seatiger, Atlantic Empress Energy Determination Albahaa B Mycene Size dwt 123, 692 292, 666 321, 186 239, 410 238, 889 Year 1979, 2 fatalities 1979, 29 “ 1979 , 1 “ 1980, 6 “

Large tankers explosion before IGS requirements 1983/1985 • • • Tanker Seatiger, Atlantic Empress Energy Determination Albahaa B Mycene Size dwt 123, 692 292, 666 321, 186 239, 410 238, 889 Year 1979, 2 fatalities 1979, 29 “ 1979 , 1 “ 1980, 6 “

Recent tankers explosion • • Tanker Bow Mariner Vicuna NCC Mekka Panam Serana Sun Venus Sunnny Jewel Isola Azura Size GT 22, 587 23, 197 6, 499 4, 356 4, 386 9, 383 Year 2004, 21 fatalities 2004, 2 “ 2004, 3 “ 2005, 2 “

Recent tankers explosion • • Tanker Bow Mariner Vicuna NCC Mekka Panam Serana Sun Venus Sunnny Jewel Isola Azura Size GT 22, 587 23, 197 6, 499 4, 356 4, 386 9, 383 Year 2004, 21 fatalities 2004, 2 “ 2004, 3 “ 2005, 2 “

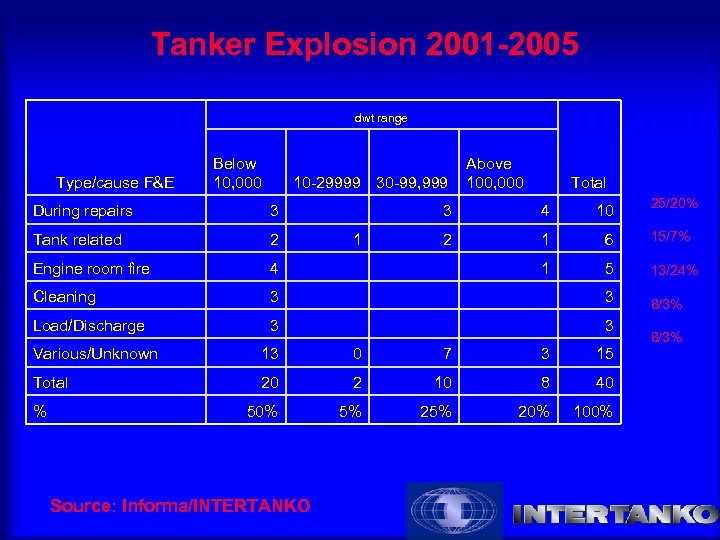

Tanker Explosion 2001 -2005 dwt range Type/cause F&E Below 10, 000 10 -29999 30 -99, 999 During repairs 3 Tank related 2 Engine room fire 4 Cleaning 3 Load/Discharge 3 Above 100, 000 Total 10 2 1 4 1 6 15/7% 1 5 13/24% 3 8/3% 3 Various/Unknown 13 0 7 3 15 Total 20 2 10 8 40 50% 5% 20% 100% % Source: Informa/INTERTANKO 25/20% 3 8/3%

Tanker Explosion 2001 -2005 dwt range Type/cause F&E Below 10, 000 10 -29999 30 -99, 999 During repairs 3 Tank related 2 Engine room fire 4 Cleaning 3 Load/Discharge 3 Above 100, 000 Total 10 2 1 4 1 6 15/7% 1 5 13/24% 3 8/3% 3 Various/Unknown 13 0 7 3 15 Total 20 2 10 8 40 50% 5% 20% 100% % Source: Informa/INTERTANKO 25/20% 3 8/3%

Average down

Average down

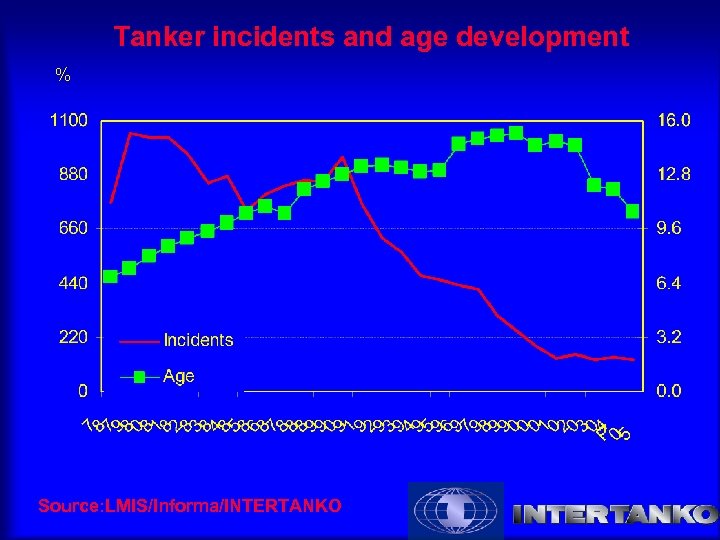

Tanker incidents and age development % Source: LMIS/Informa/INTERTANKO

Tanker incidents and age development % Source: LMIS/Informa/INTERTANKO

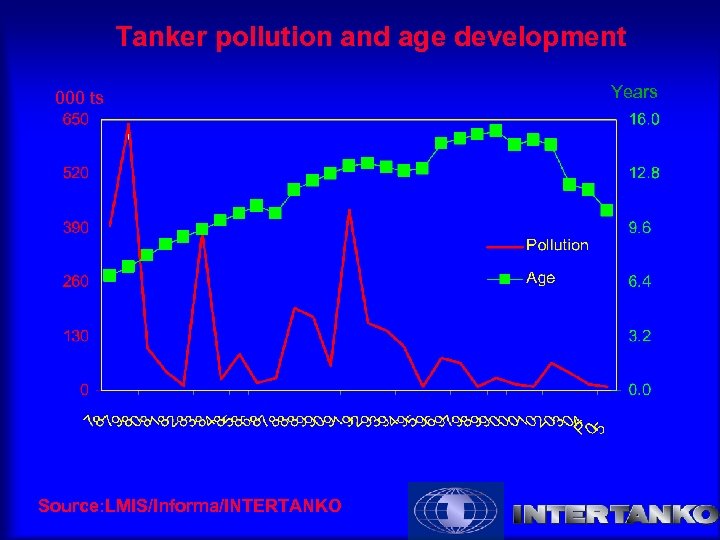

Tanker pollution and age development 000 ts Source: LMIS/Informa/INTERTANKO Years

Tanker pollution and age development 000 ts Source: LMIS/Informa/INTERTANKO Years

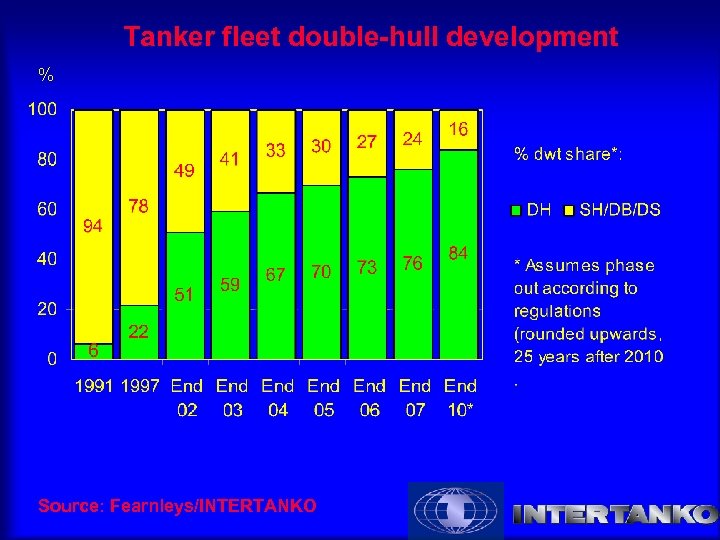

Tanker fleet double-hull development % Source: Fearnleys/INTERTANKO

Tanker fleet double-hull development % Source: Fearnleys/INTERTANKO

In shipping high standards reflect the quality of the owner not the regulatory regime Erik Murdoch Director of Risk Management, The Standard P&I Club

In shipping high standards reflect the quality of the owner not the regulatory regime Erik Murdoch Director of Risk Management, The Standard P&I Club

Regulatory Environment

Regulatory Environment

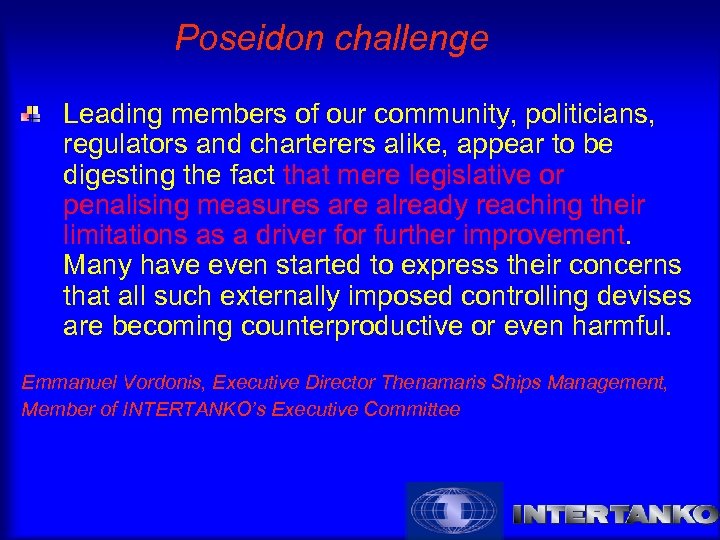

Poseidon challenge Leading members of our community, politicians, regulators and charterers alike, appear to be digesting the fact that mere legislative or penalising measures are already reaching their limitations as a driver for further improvement. Many have even started to express their concerns that all such externally imposed controlling devises are becoming counterproductive or even harmful. Emmanuel Vordonis, Executive Director Thenamaris Ships Management, Member of INTERTANKO’s Executive Committee

Poseidon challenge Leading members of our community, politicians, regulators and charterers alike, appear to be digesting the fact that mere legislative or penalising measures are already reaching their limitations as a driver for further improvement. Many have even started to express their concerns that all such externally imposed controlling devises are becoming counterproductive or even harmful. Emmanuel Vordonis, Executive Director Thenamaris Ships Management, Member of INTERTANKO’s Executive Committee

Regulation vs self regulation

Regulation vs self regulation

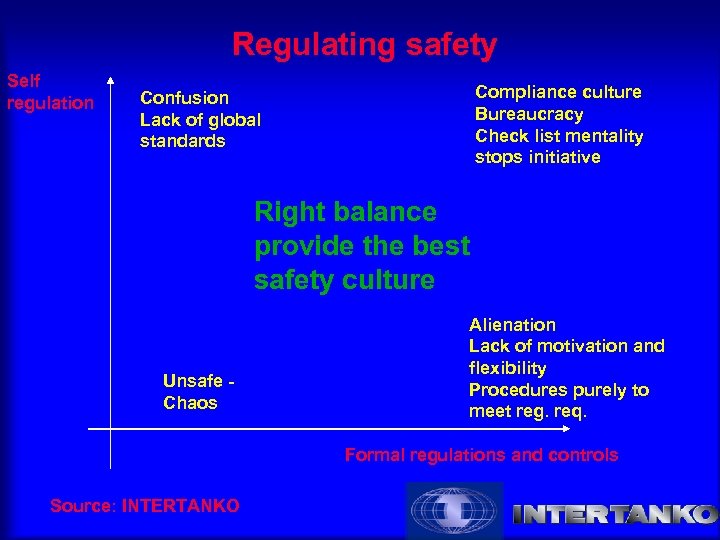

Regulating safety Self regulation Compliance culture Bureaucracy Check list mentality stops initiative Confusion Lack of global standards Right balance provide the best safety culture Unsafe Chaos Alienation Lack of motivation and flexibility Procedures purely to meet reg. req. Formal regulations and controls Source: INTERTANKO

Regulating safety Self regulation Compliance culture Bureaucracy Check list mentality stops initiative Confusion Lack of global standards Right balance provide the best safety culture Unsafe Chaos Alienation Lack of motivation and flexibility Procedures purely to meet reg. req. Formal regulations and controls Source: INTERTANKO

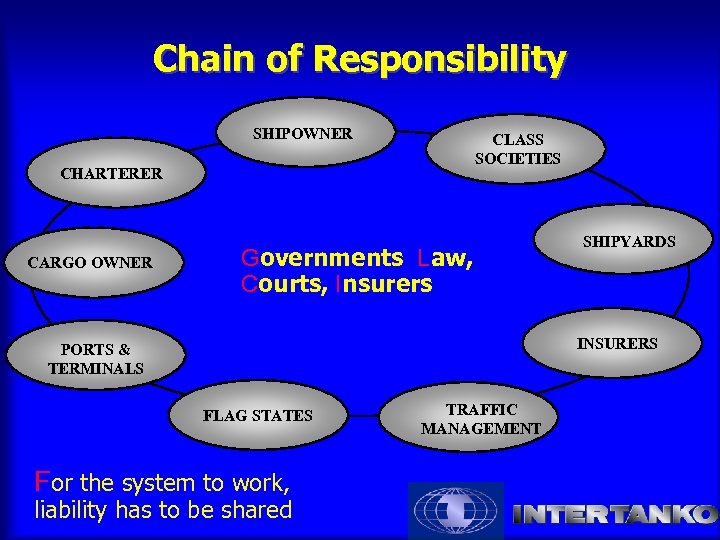

Chain of Responsibility SHIPOWNER CLASS SOCIETIES CHARTERER CARGO OWNER Governments Law, Courts, Insurers SHIPYARDS INSURERS PORTS & TERMINALS FLAG STATES For the system to work, liability has to be shared TRAFFIC MANAGEMENT

Chain of Responsibility SHIPOWNER CLASS SOCIETIES CHARTERER CARGO OWNER Governments Law, Courts, Insurers SHIPYARDS INSURERS PORTS & TERMINALS FLAG STATES For the system to work, liability has to be shared TRAFFIC MANAGEMENT

Challenges

Challenges

Challenges to the industry Supremacy of IMO & International Maritime Law versus regional and local legislation Liability - moves to open up CLC/Fund Convention Annex VI implementation Criminalising accidental pollution - Penal sanctions adopted by EU Common Structural Rules & Goal Based Standards Ship Recycling Ballast water management Security - (ISPS costs to be reflected in Worldscale) Phase out

Challenges to the industry Supremacy of IMO & International Maritime Law versus regional and local legislation Liability - moves to open up CLC/Fund Convention Annex VI implementation Criminalising accidental pollution - Penal sanctions adopted by EU Common Structural Rules & Goal Based Standards Ship Recycling Ballast water management Security - (ISPS costs to be reflected in Worldscale) Phase out

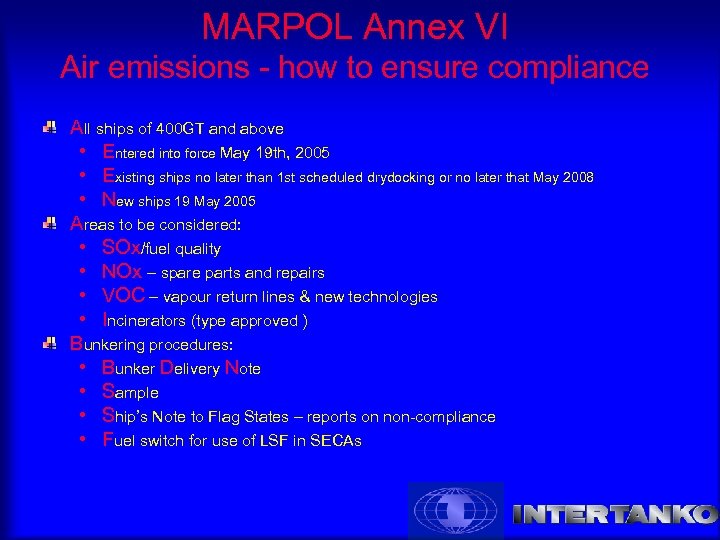

MARPOL Annex VI Air emissions - how to ensure compliance All ships of 400 GT and above • Entered into force May 19 th, 2005 • Existing ships no later than 1 st scheduled drydocking or no later that May 2008 • New ships 19 May 2005 Areas to be considered: • SOx/fuel quality • NOx – spare parts and repairs • VOC – vapour return lines & new technologies • Incinerators (type approved ) Bunkering procedures: • Bunker Delivery Note • Sample • Ship’s Note to Flag States – reports on non-compliance • Fuel switch for use of LSF in SECAs

MARPOL Annex VI Air emissions - how to ensure compliance All ships of 400 GT and above • Entered into force May 19 th, 2005 • Existing ships no later than 1 st scheduled drydocking or no later that May 2008 • New ships 19 May 2005 Areas to be considered: • SOx/fuel quality • NOx – spare parts and repairs • VOC – vapour return lines & new technologies • Incinerators (type approved ) Bunkering procedures: • Bunker Delivery Note • Sample • Ship’s Note to Flag States – reports on non-compliance • Fuel switch for use of LSF in SECAs

Ratification Ratified by 22 Governments that have a combined tonnage over 50% of World tonnage: • Azerbaijan, Bahamas, Bangladesh, Barbados, Bulgaria, Cyprus, Denmark, Finland, Germany, Greece, Japan, Liberia, Marshall Islands, Norway, Panama, St. Kitts and Nevis, Samoa, Singapore, Spain, Sweden, United Kingdom, Vanuatu. Not ratified by for example: • China, S Korea, France, Netherlands, Middle East Countries, US Bunkering in a “non party” port followed by a call in a “party” port Potential source of trouble out of ship’s control

Ratification Ratified by 22 Governments that have a combined tonnage over 50% of World tonnage: • Azerbaijan, Bahamas, Bangladesh, Barbados, Bulgaria, Cyprus, Denmark, Finland, Germany, Greece, Japan, Liberia, Marshall Islands, Norway, Panama, St. Kitts and Nevis, Samoa, Singapore, Spain, Sweden, United Kingdom, Vanuatu. Not ratified by for example: • China, S Korea, France, Netherlands, Middle East Countries, US Bunkering in a “non party” port followed by a call in a “party” port Potential source of trouble out of ship’s control

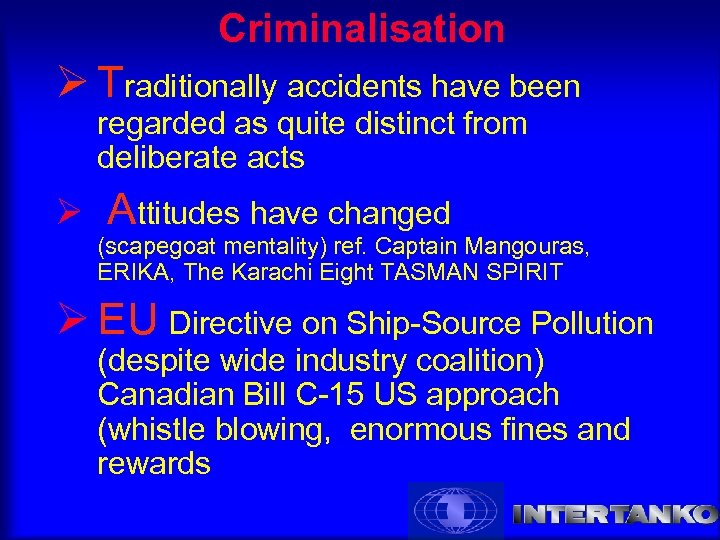

Criminalisation Ø Traditionally accidents have been regarded as quite distinct from deliberate acts Ø Attitudes have changed (scapegoat mentality) ref. Captain Mangouras, ERIKA, The Karachi Eight TASMAN SPIRIT Ø EU Directive on Ship-Source Pollution (despite wide industry coalition) Canadian Bill C-15 US approach (whistle blowing, enormous fines and rewards

Criminalisation Ø Traditionally accidents have been regarded as quite distinct from deliberate acts Ø Attitudes have changed (scapegoat mentality) ref. Captain Mangouras, ERIKA, The Karachi Eight TASMAN SPIRIT Ø EU Directive on Ship-Source Pollution (despite wide industry coalition) Canadian Bill C-15 US approach (whistle blowing, enormous fines and rewards

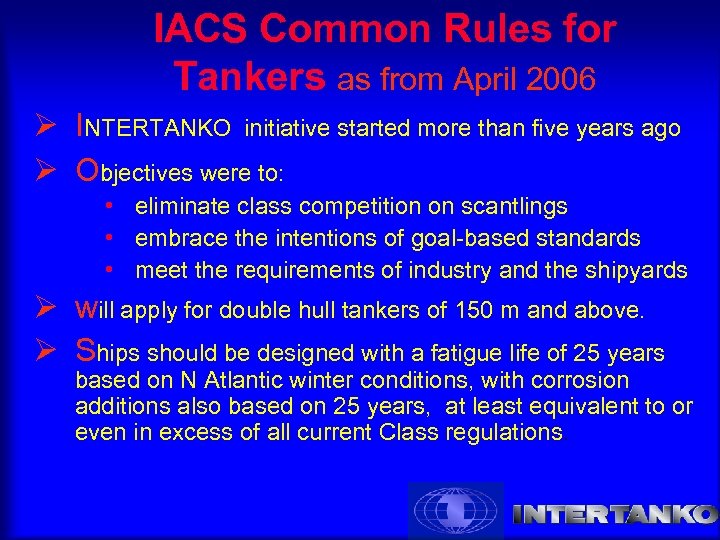

IACS Common Rules for Tankers as from April 2006 Ø INTERTANKO initiative started more than five years ago Ø Objectives were to: • eliminate class competition on scantlings • embrace the intentions of goal-based standards • meet the requirements of industry and the shipyards Ø will apply for double hull tankers of 150 m and above. Ø Ships should be designed with a fatigue life of 25 years based on N Atlantic winter conditions, with corrosion additions also based on 25 years, at least equivalent to or even in excess of all current Class regulations.

IACS Common Rules for Tankers as from April 2006 Ø INTERTANKO initiative started more than five years ago Ø Objectives were to: • eliminate class competition on scantlings • embrace the intentions of goal-based standards • meet the requirements of industry and the shipyards Ø will apply for double hull tankers of 150 m and above. Ø Ships should be designed with a fatigue life of 25 years based on N Atlantic winter conditions, with corrosion additions also based on 25 years, at least equivalent to or even in excess of all current Class regulations.

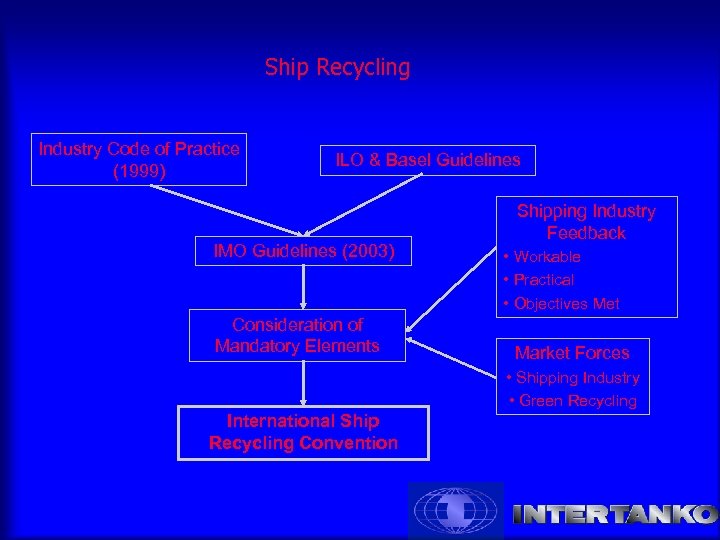

Ship Recycling Industry Code of Practice (1999) ILO & Basel Guidelines IMO Guidelines (2003) Consideration of Mandatory Elements Shipping Industry Feedback • Workable • Practical • Objectives Met Market Forces • Shipping Industry • Green Recycling International Ship Recycling Convention

Ship Recycling Industry Code of Practice (1999) ILO & Basel Guidelines IMO Guidelines (2003) Consideration of Mandatory Elements Shipping Industry Feedback • Workable • Practical • Objectives Met Market Forces • Shipping Industry • Green Recycling International Ship Recycling Convention

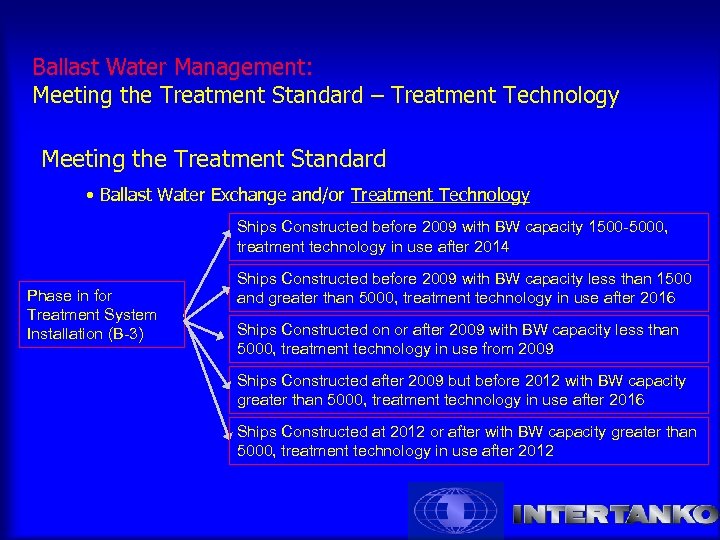

Ballast Water Management: Meeting the Treatment Standard – Treatment Technology Meeting the Treatment Standard • Ballast Water Exchange and/or Treatment Technology Ships Constructed before 2009 with BW capacity 1500 -5000, treatment technology in use after 2014 Phase in for Treatment System Installation (B-3) Ships Constructed before 2009 with BW capacity less than 1500 and greater than 5000, treatment technology in use after 2016 Ships Constructed on or after 2009 with BW capacity less than 5000, treatment technology in use from 2009 Ships Constructed after 2009 but before 2012 with BW capacity greater than 5000, treatment technology in use after 2016 Ships Constructed at 2012 or after with BW capacity greater than 5000, treatment technology in use after 2012

Ballast Water Management: Meeting the Treatment Standard – Treatment Technology Meeting the Treatment Standard • Ballast Water Exchange and/or Treatment Technology Ships Constructed before 2009 with BW capacity 1500 -5000, treatment technology in use after 2014 Phase in for Treatment System Installation (B-3) Ships Constructed before 2009 with BW capacity less than 1500 and greater than 5000, treatment technology in use after 2016 Ships Constructed on or after 2009 with BW capacity less than 5000, treatment technology in use from 2009 Ships Constructed after 2009 but before 2012 with BW capacity greater than 5000, treatment technology in use after 2016 Ships Constructed at 2012 or after with BW capacity greater than 5000, treatment technology in use after 2012

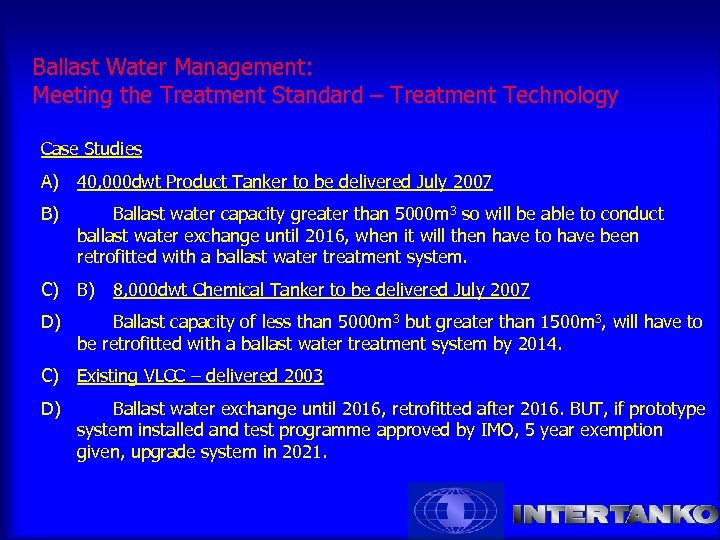

Ballast Water Management: Meeting the Treatment Standard – Treatment Technology Case Studies A) 40, 000 dwt Product Tanker to be delivered July 2007 B) Ballast water capacity greater than 5000 m 3 so will be able to conduct ballast water exchange until 2016, when it will then have to have been retrofitted with a ballast water treatment system. C) B) D) 8, 000 dwt Chemical Tanker to be delivered July 2007 Ballast capacity of less than 5000 m 3 but greater than 1500 m 3, will have to be retrofitted with a ballast water treatment system by 2014. C) Existing VLCC – delivered 2003 D) Ballast water exchange until 2016, retrofitted after 2016. BUT, if prototype system installed and test programme approved by IMO, 5 year exemption given, upgrade system in 2021.

Ballast Water Management: Meeting the Treatment Standard – Treatment Technology Case Studies A) 40, 000 dwt Product Tanker to be delivered July 2007 B) Ballast water capacity greater than 5000 m 3 so will be able to conduct ballast water exchange until 2016, when it will then have to have been retrofitted with a ballast water treatment system. C) B) D) 8, 000 dwt Chemical Tanker to be delivered July 2007 Ballast capacity of less than 5000 m 3 but greater than 1500 m 3, will have to be retrofitted with a ballast water treatment system by 2014. C) Existing VLCC – delivered 2003 D) Ballast water exchange until 2016, retrofitted after 2016. BUT, if prototype system installed and test programme approved by IMO, 5 year exemption given, upgrade system in 2021.

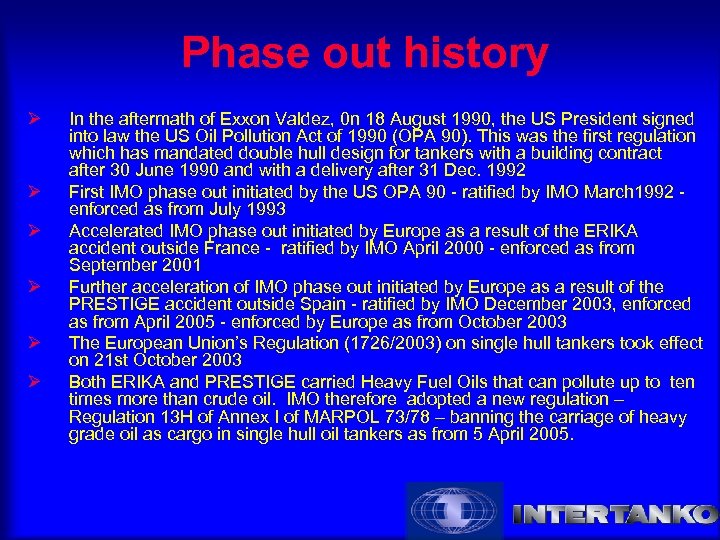

Phase out history Ø Ø Ø In the aftermath of Exxon Valdez, 0 n 18 August 1990, the US President signed into law the US Oil Pollution Act of 1990 (OPA 90). This was the first regulation which has mandated double hull design for tankers with a building contract after 30 June 1990 and with a delivery after 31 Dec. 1992 First IMO phase out initiated by the US OPA 90 - ratified by IMO March 1992 - enforced as from July 1993 Accelerated IMO phase out initiated by Europe as a result of the ERIKA accident outside France - ratified by IMO April 2000 - enforced as from September 2001 Further acceleration of IMO phase out initiated by Europe as a result of the PRESTIGE accident outside Spain - ratified by IMO December 2003, enforced as from April 2005 - enforced by Europe as from October 2003 The European Union’s Regulation (1726/2003) on single hull tankers took effect on 21 st October 2003 Both ERIKA and PRESTIGE carried Heavy Fuel Oils that can pollute up to ten times more than crude oil. IMO therefore adopted a new regulation – Regulation 13 H of Annex I of MARPOL 73/78 – banning the carriage of heavy grade oil as cargo in single hull oil tankers as from 5 April 2005.

Phase out history Ø Ø Ø In the aftermath of Exxon Valdez, 0 n 18 August 1990, the US President signed into law the US Oil Pollution Act of 1990 (OPA 90). This was the first regulation which has mandated double hull design for tankers with a building contract after 30 June 1990 and with a delivery after 31 Dec. 1992 First IMO phase out initiated by the US OPA 90 - ratified by IMO March 1992 - enforced as from July 1993 Accelerated IMO phase out initiated by Europe as a result of the ERIKA accident outside France - ratified by IMO April 2000 - enforced as from September 2001 Further acceleration of IMO phase out initiated by Europe as a result of the PRESTIGE accident outside Spain - ratified by IMO December 2003, enforced as from April 2005 - enforced by Europe as from October 2003 The European Union’s Regulation (1726/2003) on single hull tankers took effect on 21 st October 2003 Both ERIKA and PRESTIGE carried Heavy Fuel Oils that can pollute up to ten times more than crude oil. IMO therefore adopted a new regulation – Regulation 13 H of Annex I of MARPOL 73/78 – banning the carriage of heavy grade oil as cargo in single hull oil tankers as from 5 April 2005.

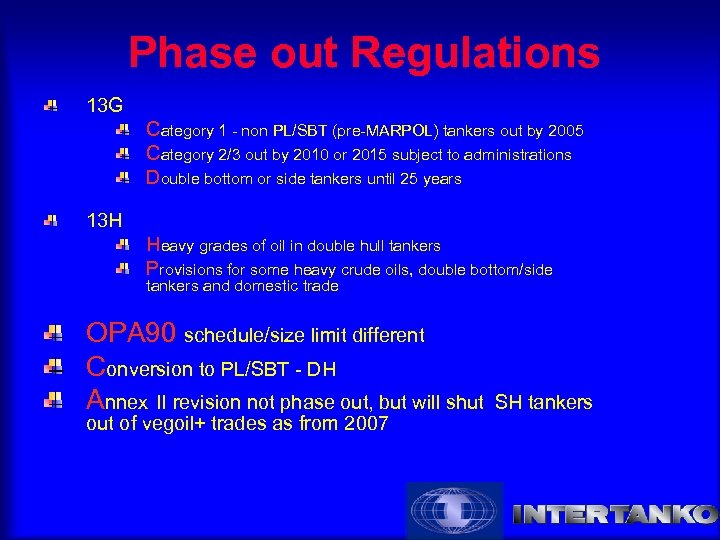

Phase out Regulations 13 G Category 1 - non PL/SBT (pre-MARPOL) tankers out by 2005 Category 2/3 out by 2010 or 2015 subject to administrations Double bottom or side tankers until 25 years 13 H Heavy grades of oil in double hull tankers Provisions for some heavy crude oils, double bottom/side tankers and domestic trade OPA 90 schedule/size limit different Conversion to PL/SBT - DH Annex II revision not phase out, but will shut SH tankers out of vegoil+ trades as from 2007

Phase out Regulations 13 G Category 1 - non PL/SBT (pre-MARPOL) tankers out by 2005 Category 2/3 out by 2010 or 2015 subject to administrations Double bottom or side tankers until 25 years 13 H Heavy grades of oil in double hull tankers Provisions for some heavy crude oils, double bottom/side tankers and domestic trade OPA 90 schedule/size limit different Conversion to PL/SBT - DH Annex II revision not phase out, but will shut SH tankers out of vegoil+ trades as from 2007

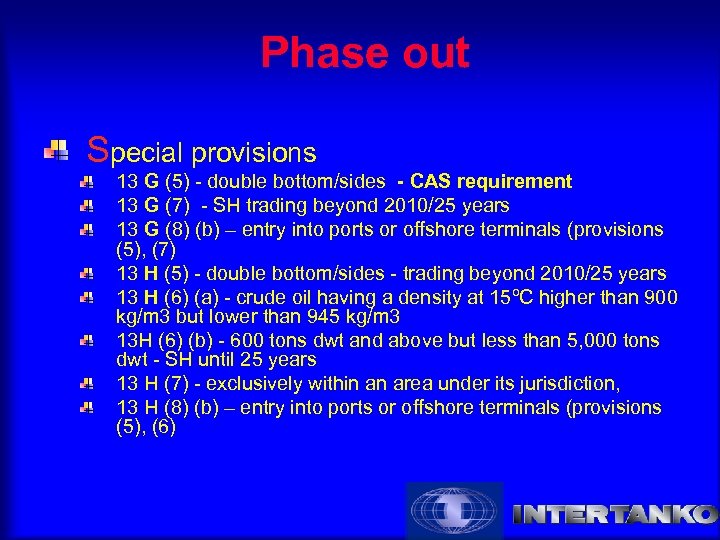

Phase out Special provisions 13 G (5) - double bottom/sides - CAS requirement 13 G (7) - SH trading beyond 2010/25 years 13 G (8) (b) – entry into ports or offshore terminals (provisions (5), (7) 13 H (5) - double bottom/sides - trading beyond 2010/25 years 13 H (6) (a) - crude oil having a density at 15ºC higher than 900 kg/m 3 but lower than 945 kg/m 3 13 H (6) (b) - 600 tons dwt and above but less than 5, 000 tons dwt - SH until 25 years 13 H (7) - exclusively within an area under its jurisdiction, 13 H (8) (b) – entry into ports or offshore terminals (provisions (5), (6)

Phase out Special provisions 13 G (5) - double bottom/sides - CAS requirement 13 G (7) - SH trading beyond 2010/25 years 13 G (8) (b) – entry into ports or offshore terminals (provisions (5), (7) 13 H (5) - double bottom/sides - trading beyond 2010/25 years 13 H (6) (a) - crude oil having a density at 15ºC higher than 900 kg/m 3 but lower than 945 kg/m 3 13 H (6) (b) - 600 tons dwt and above but less than 5, 000 tons dwt - SH until 25 years 13 H (7) - exclusively within an area under its jurisdiction, 13 H (8) (b) – entry into ports or offshore terminals (provisions (5), (6)

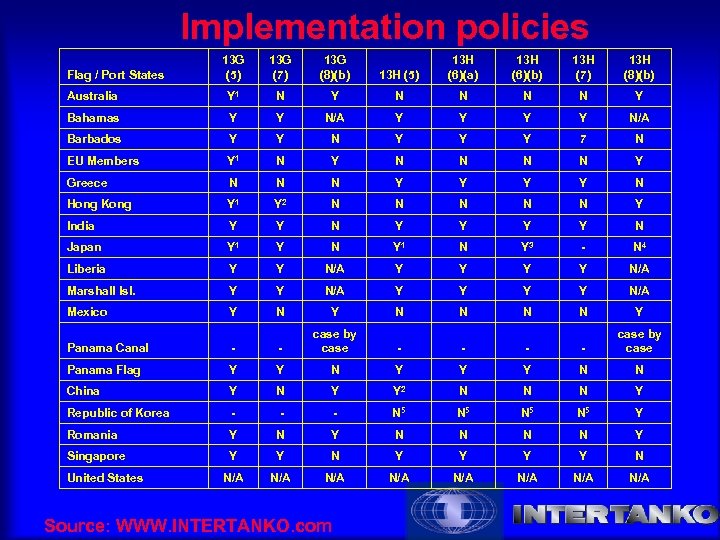

Implementation policies 13 G (5) 13 G (7) 13 G (8)(b) 13 H (5) 13 H (6)(a) 13 H (6)(b) 13 H (7) 13 H (8)(b) Australia Y 1 N Y N N Y Bahamas Y Y N/A Barbados Y Y N Y Y Y 7 N EU Members Y 1 N Y N N Y Greece N N N Y Y N Hong Kong Y 1 Y 2 N N N Y India Y Y N Japan Y 1 Y N Y 1 N Y 3 - N 4 Liberia Y Y N/A Marshall Isl. Y Y N/A Mexico Y N N N N Y - - case by case Flag / Port States Panama Canal - - case by case Panama Flag Y Y N Y Y Y N N China Y N Y Y 2 N N N Y Republic of Korea - - - N 5 N 5 Y Romania Y N N N N Y Singapore Y Y N N/A N/A United States Source: WWW. INTERTANKO. com

Implementation policies 13 G (5) 13 G (7) 13 G (8)(b) 13 H (5) 13 H (6)(a) 13 H (6)(b) 13 H (7) 13 H (8)(b) Australia Y 1 N Y N N Y Bahamas Y Y N/A Barbados Y Y N Y Y Y 7 N EU Members Y 1 N Y N N Y Greece N N N Y Y N Hong Kong Y 1 Y 2 N N N Y India Y Y N Japan Y 1 Y N Y 1 N Y 3 - N 4 Liberia Y Y N/A Marshall Isl. Y Y N/A Mexico Y N N N N Y - - case by case Flag / Port States Panama Canal - - case by case Panama Flag Y Y N Y Y Y N N China Y N Y Y 2 N N N Y Republic of Korea - - - N 5 N 5 Y Romania Y N N N N Y Singapore Y Y N N/A N/A United States Source: WWW. INTERTANKO. com

Conclusion Ø Strong industry performance, but no complacency Ø Zero tolerance to oil pollution Ø Formal Regulations must provide room for flexibility and new initiatives Ø Most pending regulations are common industry regulations Ø Industry challenge to ensure global standards and regulations Ø Cooperation with all the members in the maritime responsibility chain will provide the best results

Conclusion Ø Strong industry performance, but no complacency Ø Zero tolerance to oil pollution Ø Formal Regulations must provide room for flexibility and new initiatives Ø Most pending regulations are common industry regulations Ø Industry challenge to ensure global standards and regulations Ø Cooperation with all the members in the maritime responsibility chain will provide the best results

INTERTANKO’s aim Strong responsible, sustainable and respected industry able to influence its own destiny

INTERTANKO’s aim Strong responsible, sustainable and respected industry able to influence its own destiny