a2cc16ebc4323373f7c835528b4593c7.ppt

- Количество слайдов: 48

Ericsson (Aastra) Competitive Displacement 10 th February 2009 © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 1

Today’s Discussion Now is the time for Avaya and our partners to win in the marketplace Opportunity to attack unknown strategy from competitor and take market share Beat Aastra (Ericsson base) • Aggressive program that provides § Promotional Offers § Sales Enablement § Marketing Support § Technical Resources This program is all about enabling you, our Driving Force, in the market © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 2

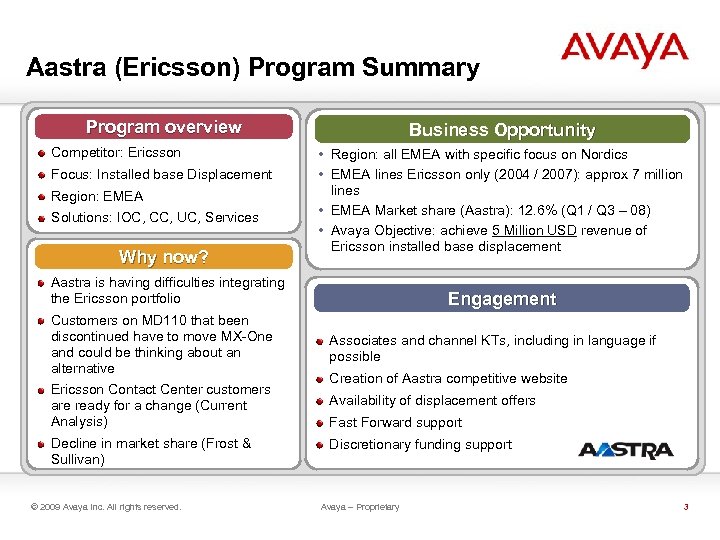

Aastra (Ericsson) Program Summary Program overview Competitor: Ericsson Focus: Installed base Displacement Region: EMEA Solutions: IOC, CC, UC, Services Why now? Business Opportunity • Region: all EMEA with specific focus on Nordics • EMEA lines Ericsson only (2004 / 2007): approx 7 million lines • EMEA Market share (Aastra): 12. 6% (Q 1 / Q 3 – 08) • Avaya Objective: achieve 5 Million USD revenue of Ericsson installed base displacement Aastra is having difficulties integrating the Ericsson portfolio Engagement Customers on MD 110 that been discontinued have to move MX-One and could be thinking about an alternative Associates and channel KTs, including in language if possible Ericsson Contact Center customers are ready for a change (Current Analysis) Availability of displacement offers Decline in market share (Frost & Sullivan) © 2009 Avaya Inc. All rights reserved. Creation of Aastra competitive website Fast Forward support Discretionary funding support Avaya – Proprietary 3

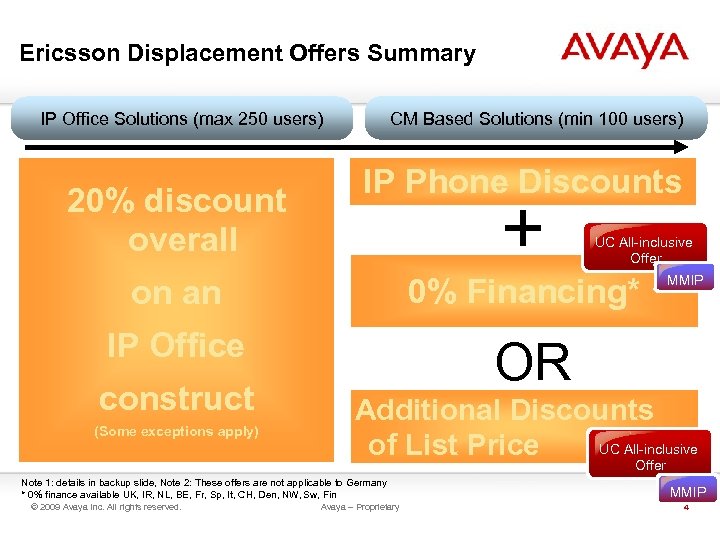

Ericsson Displacement Offers Summary CM Based Solutions (min 100 users) IP Office Solutions (max 250 users) 20% discount overall IP Phone Discounts + UC All-inclusive Offer on an 0% Financing* IP Office MMIP OR construct (Some exceptions apply) Additional Discounts UC All-inclusive of List Price Offer Note 1: details in backup slide, Note 2: These offers are not applicable to Germany * 0% finance available UK, IR, NL, BE, Fr, Sp, It, CH, Den, NW, Sw, Fin © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary MMIP 4

Program Customers Key Messages For a similar investment you can deploy a new Avaya Unified Communications solution versus upgrading your old Ericsson system Benefits include • Financing offer • Avaya’s award winning UC applications at no additional cost with CME or Enterprise Edition • Mobility solutions for largest number of mobile handsets • Built in remote and home working capabilities • Out of the box integration to Microsoft and IBM instant messaging environments © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 5

Program Channel Key Messages Avaya will offer aggressive pricing for Ericsson displacement opportunities and provide sales enablement tools and training to position your sales team for success whilst also enabling you to: • Up sell additional UC components such as advanced collaboration with Avaya Meeting Exchange and video • Retain the customer for longer with optional 3 year upgrade protection plan (SS+U) • Add more professional services time with UC © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 6

Aastra Overview © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 7

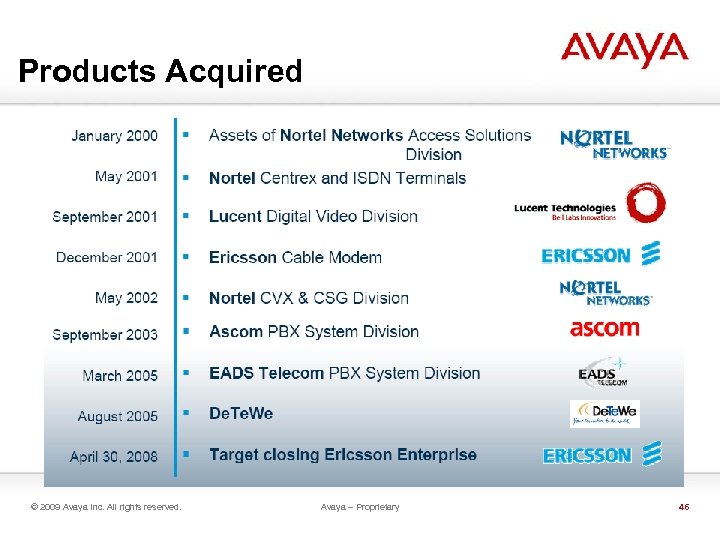

Aastra : Growth by Product Acquisition December 2001 April 2008 September 2003 March 2005 September 2001 January 2000 May 202 May 2002 © 2009 Avaya Inc. All rights reserved. August 2005 Avaya – Proprietary 8

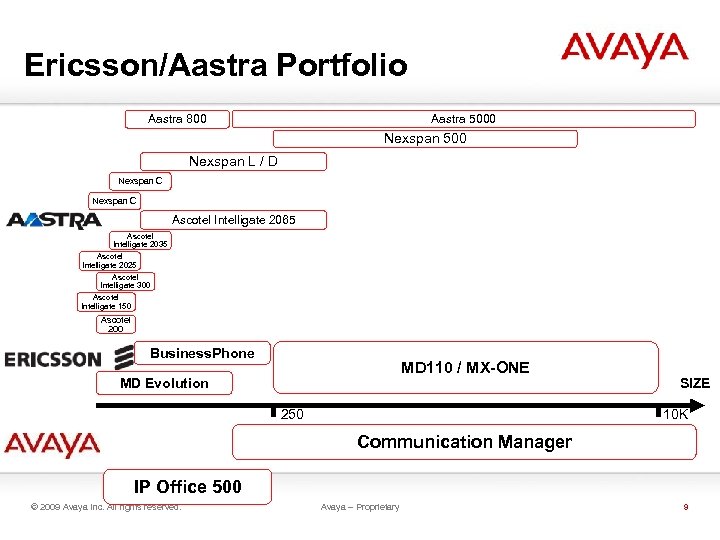

Ericsson/Aastra Portfolio Aastra 5000 Aastra 800 Nexspan 500 Nexspan L / D Nexspan C Ascotel Intelligate 2065 Ascotel Intelligate 2035 Ascotel Intelligate 2025 Ascotel Intelligate 300 Ascotel Intelligate 150 Ascotel 200 Business. Phone MD 110 / MX-ONE MD Evolution 250 SIZE 10 K Communication Manager IP Office 500 © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 9

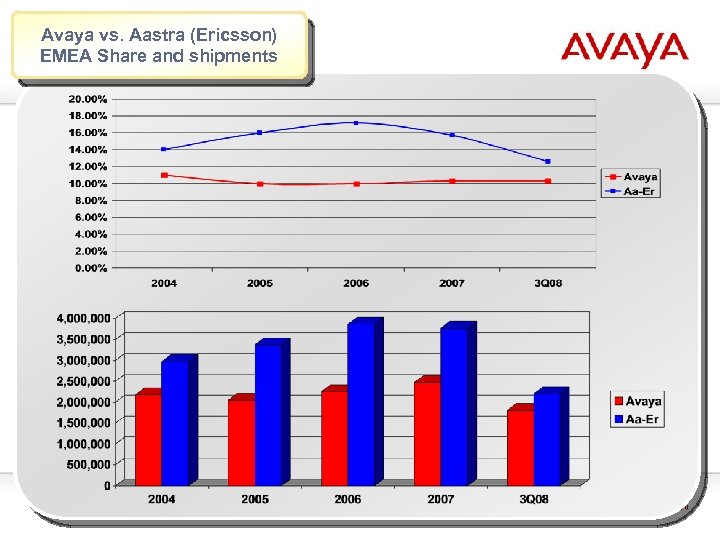

Avaya vs. Aastra (Ericsson) EMEA Share and shipments © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 10

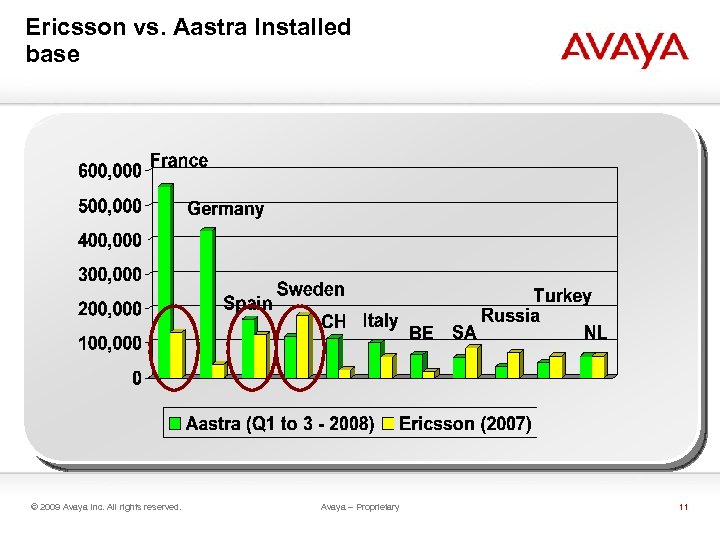

Ericsson vs. Aastra Installed base © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 11

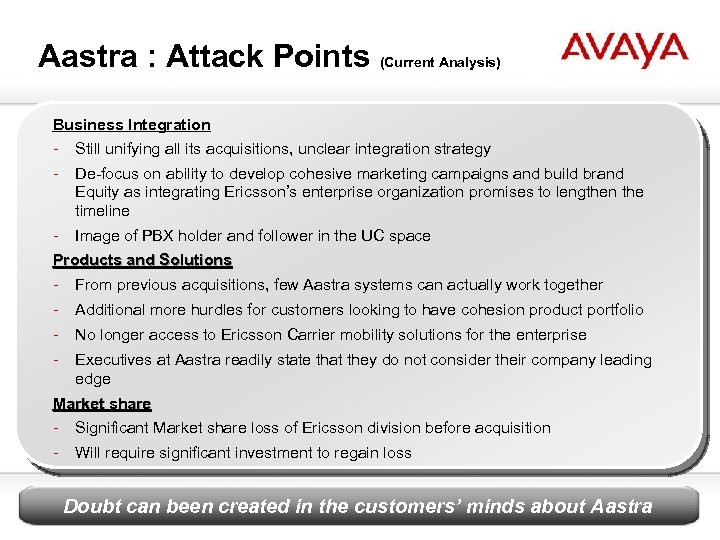

Aastra : Attack Points (Current Analysis) Business Integration - Still unifying all its acquisitions, unclear integration strategy - De-focus on ability to develop cohesive marketing campaigns and build brand Equity as integrating Ericsson’s enterprise organization promises to lengthen the timeline - Image of PBX holder and follower in the UC space Products and Solutions - From previous acquisitions, few Aastra systems can actually work together - Additional more hurdles for customers looking to have cohesion product portfolio - No longer access to Ericsson Carrier mobility solutions for the enterprise - Executives at Aastra readily state that they do not consider their company leading edge Market share - Significant Market share loss of Ericsson division before acquisition - Will require significant investment to regain loss Avaya Proprietary Doubt can been created in the– customers’ minds about Aastra © 2009 Avaya Inc. All rights reserved. 12

Why Avaya? © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 13

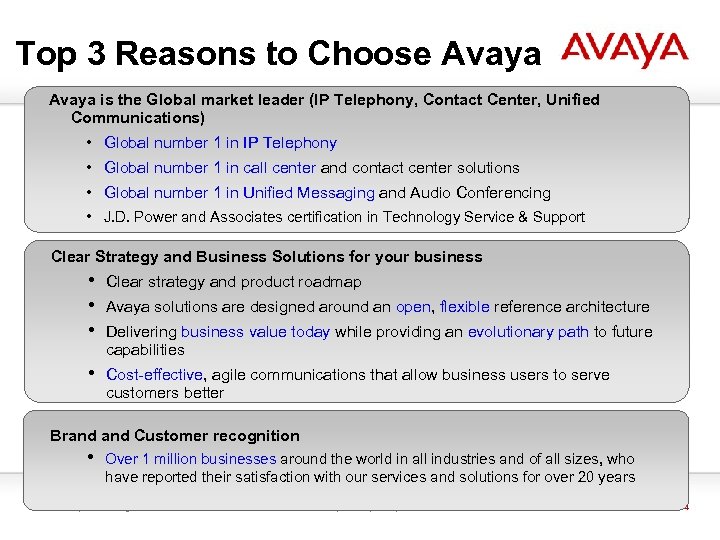

Top 3 Reasons to Choose Avaya is the Global market leader (IP Telephony, Contact Center, Unified Communications) • Global number 1 in IP Telephony • Global number 1 in call center and contact center solutions • Global number 1 in Unified Messaging and Audio Conferencing • J. D. Power and Associates certification in Technology Service & Support Clear Strategy and Business Solutions for your business • • • Clear strategy and product roadmap • Cost-effective, agile communications that allow business users to serve customers better Avaya solutions are designed around an open, flexible reference architecture Delivering business value today while providing an evolutionary path to future capabilities Brand Customer recognition • Over 1 million businesses around the world in all industries and of all sizes, who have reported their satisfaction with our services and solutions for over 20 years © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 14

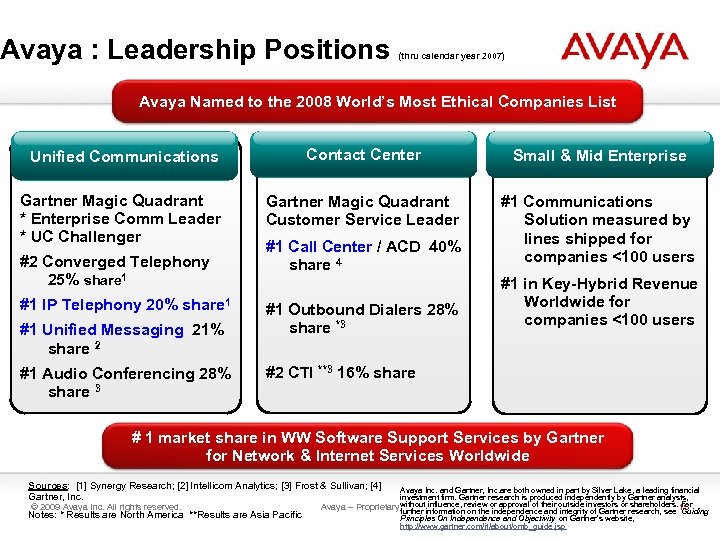

Avaya : Leadership Positions (thru calendar year 2007) Avaya Named to the 2008 World’s Most Ethical Companies List Unified Communications Contact Center Small & Mid Enterprise Gartner Magic Quadrant * Enterprise Comm Leader * UC Challenger Gartner Magic Quadrant Customer Service Leader #1 Communications Solution measured by lines shipped for companies <100 users #2 Converged Telephony 25% share 1 #1 IP Telephony 20% share 1 #1 Unified Messaging 21% share 2 #1 Audio Conferencing 28% share 3 #1 Call Center / ACD 40% share 4 #1 Outbound Dialers 28% share *3 #1 in Key-Hybrid Revenue Worldwide for companies <100 users #2 CTI **3 16% share # 1 market share in WW Software Support Services by Gartner for Network & Internet Services Worldwide Sources: [1] Synergy Research; [2] Intellicom Analytics; [3] Frost & Sullivan; [4] Gartner, Inc. © 2009 Avaya Inc. All rights reserved. Notes: * Results are North America **Results are Asia Pacific Avaya Inc. and Gartner, Inc. are both owned in part by Silver Lake, a leading financial investment firm. Gartner research is produced independently by Gartner analysts, influence, shareholders. For Avaya – Proprietary withoutinformationreview or approval of their outside investors or research, see 15 further on the independence and integrity of Gartner Guiding Principles On Independence and Objectivity on Gartner’s website, http: //www. gartner. com/it/about/omb_guide. jsp

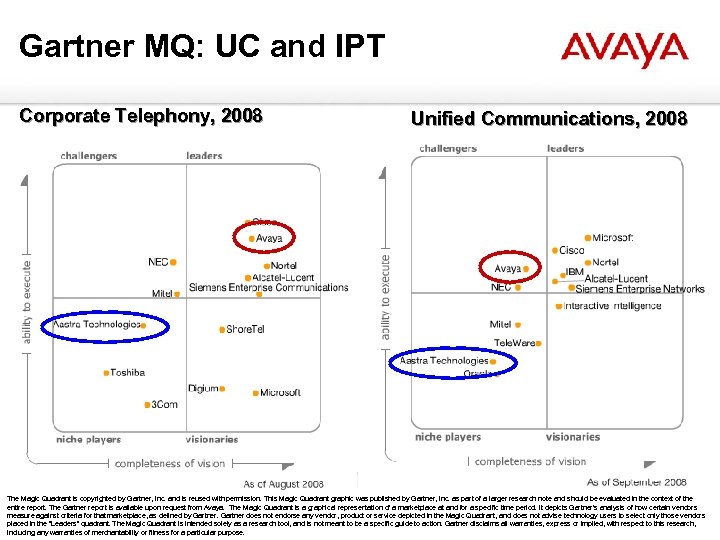

Gartner MQ: UC and IPT Corporate Telephony, 2008 Unified Communications, 2008 The Magic Quadrant is copyrighted by Gartner, Inc. and is reused with permission. This Magic Quadrant graphic was published by Gartner, Inc. as part of a larger research note and should be evaluated in the context of the entire report. The Avaya report All rights reserved. from Avaya. The Magic Quadrant is a graphical representation of a marketplace at and for a specific time period. It depicts Gartner's analysis of how certain vendors Avaya – Proprietary 16 © 2009 Gartner Inc. is available upon request measure against criteria for that marketplace, as defined by Gartner does not endorse any vendor, product or service depicted in the Magic Quadrant, and does not advise technology users to select only those vendors placed in the "Leaders" quadrant. The Magic Quadrant is intended solely as a research tool, and is not meant to be a specific guide to action. Gartner disclaims all warranties, express or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

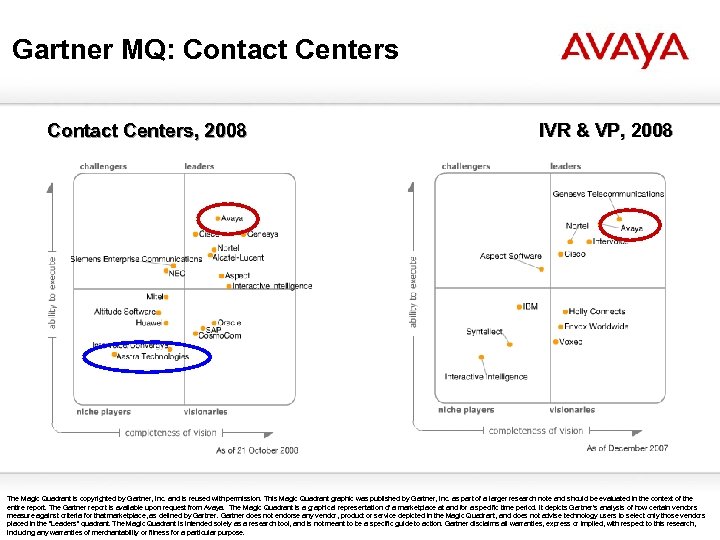

Gartner MQ: Contact Centers, 2008 IVR & VP, 2008 The Magic Quadrant is copyrighted by Gartner, Inc. and is reused with permission. This Magic Quadrant graphic was published by Gartner, Inc. as part of a larger research note and should be evaluated in the context of the entire report. The Avaya report All rights reserved. from Avaya. The Magic Quadrant is a graphical representation of a marketplace at and for a specific time period. It depicts Gartner's analysis of how certain vendors Avaya – Proprietary 17 © 2009 Gartner Inc. is available upon request measure against criteria for that marketplace, as defined by Gartner does not endorse any vendor, product or service depicted in the Magic Quadrant, and does not advise technology users to select only those vendors placed in the "Leaders" quadrant. The Magic Quadrant is intended solely as a research tool, and is not meant to be a specific guide to action. Gartner disclaims all warranties, express or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

J. D. Power and Associates Certification in Technology Service & Support Recognized for providing "An Outstanding Customer Service Experience" • Top 20% for customer satisfaction results within technology industry Exceeded the benchmark for satisfaction, verified through survey results and rigorous audit Certification Includes • • Core Service and Support Assisted Support Non-Assisted Support (Web) Field Support © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary J. D. Power and Associates 2009 Certified Technology Service & Support Program. SM, developed in conjunction with SSPA. For more information, visit www. jdpower. com or www. thesspa. com 18

Avaya Strategy Focus on the Business User keeping it simple and making it matter © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 19

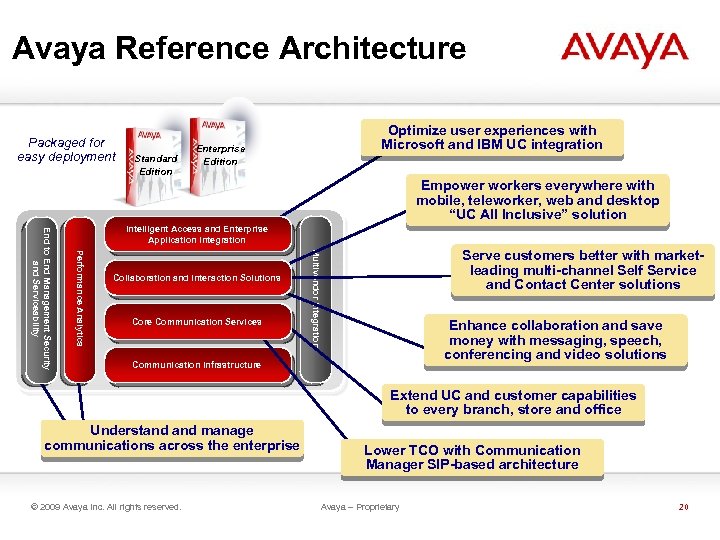

Avaya Reference Architecture Packaged for easy deployment Standard Edition Optimize user experiences with Microsoft and IBM UC integration Enterprise Edition Empower workers everywhere with mobile, teleworker, web and desktop “UC All Inclusive” solution Collaboration and Interaction Solutions Core Communication Services Serve customers better with marketleading multi-channel Self Service and Contact Center solutions Multivendor Integration Performance Analytics End to End Management Security and Serviceability Intelligent Access and Enterprise Application Integration Enhance collaboration and save money with messaging, speech, conferencing and video solutions Communication Infrastructure Extend UC and customer capabilities to every branch, store and office Understand manage communications across the enterprise © 2009 Avaya Inc. All rights reserved. Lower TCO with Communication Manager SIP-based architecture Avaya – Proprietary 20

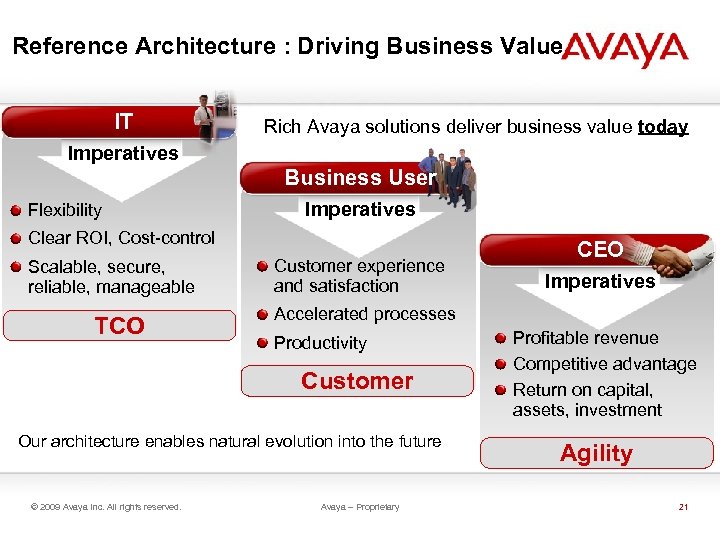

Reference Architecture : Driving Business Value IT Rich Avaya solutions deliver business value today Imperatives Business User Flexibility Imperatives Clear ROI, Cost-control Scalable, secure, reliable, manageable TCO Customer experience and satisfaction Imperatives Accelerated processes Productivity Customer Our architecture enables natural evolution into the future © 2009 Avaya Inc. All rights reserved. CEO Avaya – Proprietary Profitable revenue Competitive advantage Return on capital, assets, investment Agility 21

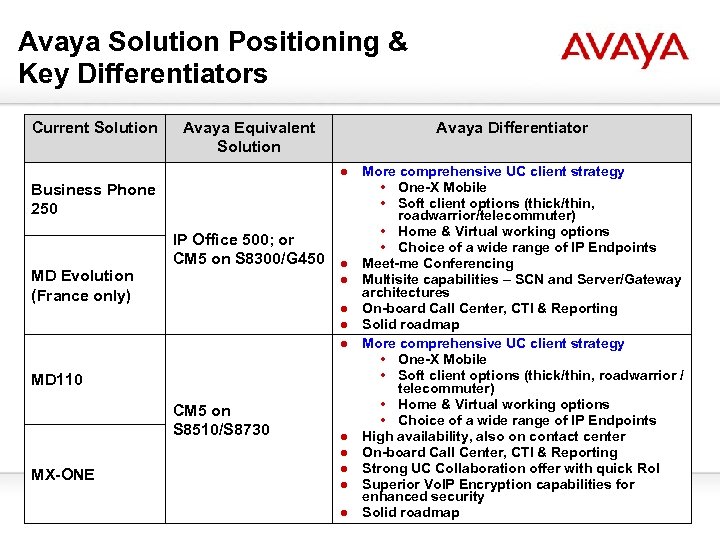

Avaya Solution Positioning & Key Differentiators Current Solution Avaya Equivalent Solution Avaya Differentiator ● More comprehensive UC client strategy • One-X Mobile Business Phone • Soft client options (thick/thin, 250 roadwarrior/telecommuter) • Home & Virtual working options IP Office 500; or • Choice of a wide range of IP Endpoints CM 5 on S 8300/G 450 ● Meet-me Conferencing MD Evolution ● Multisite capabilities – SCN and Server/Gateway architectures (France only) ● On-board Call Center, CTI & Reporting ● Solid roadmap ● More comprehensive UC client strategy • One-X Mobile • Soft client options (thick/thin, roadwarrior / MD 110 telecommuter) • Home & Virtual working options CM 5 on • Choice of a wide range of IP Endpoints S 8510/S 8730 ● High availability, also on contact center ● On-board Call Center, CTI & Reporting ● Strong UC Collaboration offer with quick Ro. I MX-ONE ● Superior Vo. IP Encryption capabilities for enhanced security Avaya – Proprietary 22 © 2009 Avaya Inc. All rights reserved. ● Solid roadmap

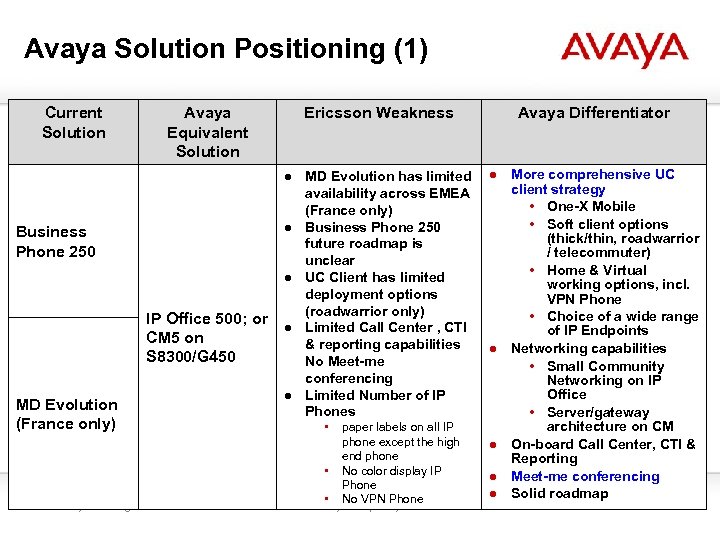

Avaya Solution Positioning (1) Current Solution Avaya Equivalent Solution Business Phone 250 IP Office 500; or CM 5 on S 8300/G 450 MD Evolution (France only) Ericsson Weakness Avaya Differentiator ● MD Evolution has limited availability across EMEA (France only) ● Business Phone 250 future roadmap is unclear ● UC Client has limited deployment options (roadwarrior only) ● Limited Call Center , CTI & reporting capabilities No Meet-me conferencing ● Limited Number of IP Phones ● More comprehensive UC client strategy • One-X Mobile • Soft client options (thick/thin, roadwarrior / telecommuter) • Home & Virtual working options, incl. VPN Phone • Choice of a wide range of IP Endpoints ● Networking capabilities • Small Community Networking on IP Office • Server/gateway architecture on CM ● On-board Call Center, CTI & Reporting ● Meet-me conferencing ● Solid roadmap • • © 2009 Avaya Inc. All rights reserved. • paper labels on all IP phone except the high end phone No color display IP Phone No VPN Phone Avaya – Proprietary 23

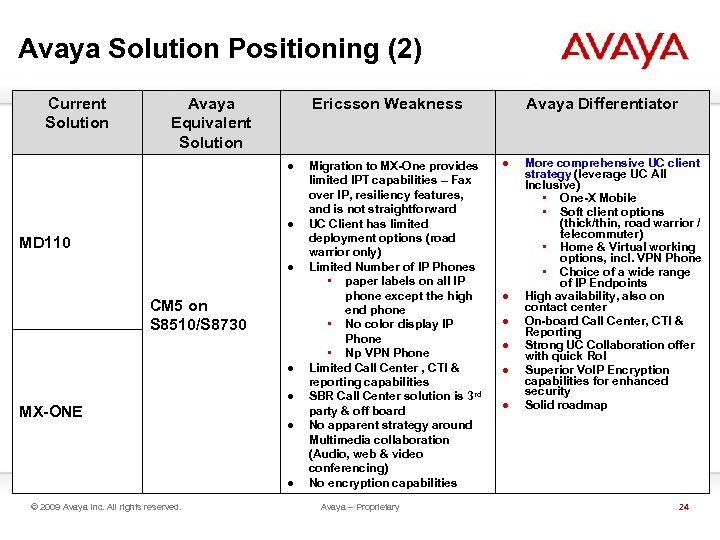

Avaya Solution Positioning (2) Current Solution Avaya Equivalent Solution Ericsson Weakness ● ● MD 110 ● CM 5 on S 8510/S 8730 ● MX-ONE ● ● ● © 2009 Avaya Inc. All rights reserved. Migration to MX-One provides limited IPT capabilities – Fax over IP, resiliency features, and is not straightforward UC Client has limited deployment options (road warrior only) Limited Number of IP Phones • paper labels on all IP phone except the high end phone • No color display IP Phone • Np VPN Phone Limited Call Center , CTI & reporting capabilities SBR Call Center solution is 3 rd party & off board No apparent strategy around Multimedia collaboration (Audio, web & video conferencing) No encryption capabilities Avaya – Proprietary Avaya Differentiator ● ● ● More comprehensive UC client strategy (leverage UC All Inclusive) • One-X Mobile • Soft client options (thick/thin, road warrior / telecommuter) • Home & Virtual working options, incl. VPN Phone • Choice of a wide range of IP Endpoints High availability, also on contact center On-board Call Center, CTI & Reporting Strong UC Collaboration offer with quick Ro. I Superior Vo. IP Encryption capabilities for enhanced security Solid roadmap 24

Offer Details © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 25

EMEA Program Elements - Summary Key Ericsson Migration Offers: Ø IP Office Offer Ø Communication Ø Messaging Manager Offers Migration Program (MMIP) Other Supporting Programs: Ø Sales Enablement Tools and Knowledge Transfers Ø Co-Marketing © 2009 Avaya Inc. All rights reserved. Support Avaya – Proprietary 26

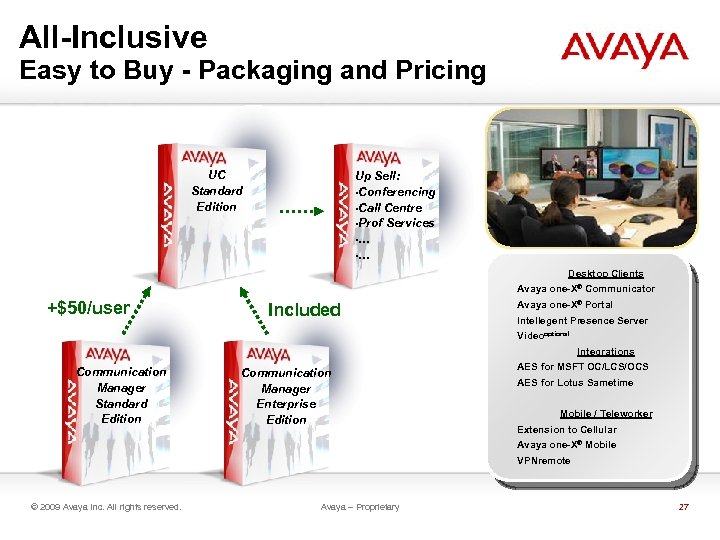

All-Inclusive Easy to Buy - Packaging and Pricing UC Standard Edition Up Sell: • Conferencing • Call Centre • Prof Services • … Desktop Clients Avaya one-X® Communicator +$50/user Included Avaya one-X® Portal Intellegent Presence Server Videooptional Integrations Communication Manager Standard Edition Communication Manager Enterprise Edition AES for MSFT OC/LCS/OCS AES for Lotus Sametime Mobile / Teleworker Extension to Cellular Avaya one-X® Mobile VPNremote © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 27

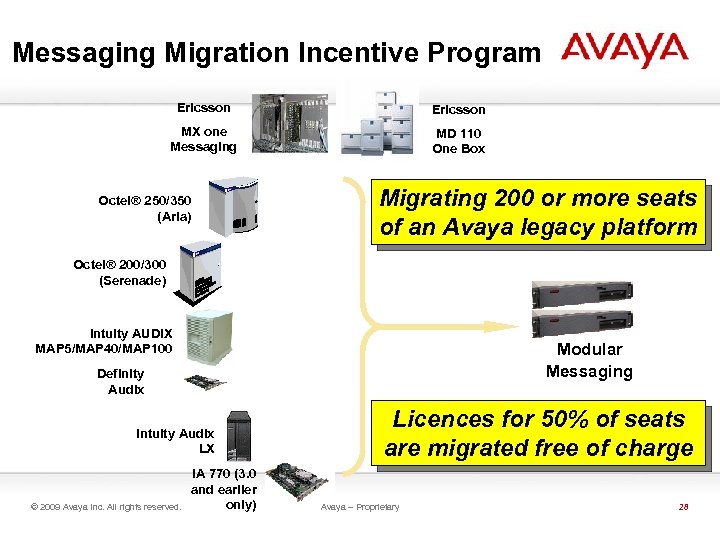

Messaging Migration Incentive Program Ericsson MX one Messaging MD 110 One Box Octel® 250/350 (Aria) Migrating 200 or more seats of an Avaya legacy platform Octel® 200/300 (Serenade) Intuity AUDIX MAP 5/MAP 40/MAP 100 Modular Messaging Definity Audix Intuity Audix LX © 2009 Avaya Inc. All rights reserved. IA 770 (3. 0 and earlier only) Licences for 50% of seats are migrated free of charge Avaya – Proprietary 28

IP Office Promotion Detail Target segment: Existing Ericsson base up to 250 users Channels: All channels Offer: 20% additional discount for an IP Office construct • Excluded are the 5402, 5602 & 1603 IP phones, and IP DECT Timing: 9 th February 2009 until 30 th September 2009 How: Through SBR - Certificate of Destruction is requested © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 29

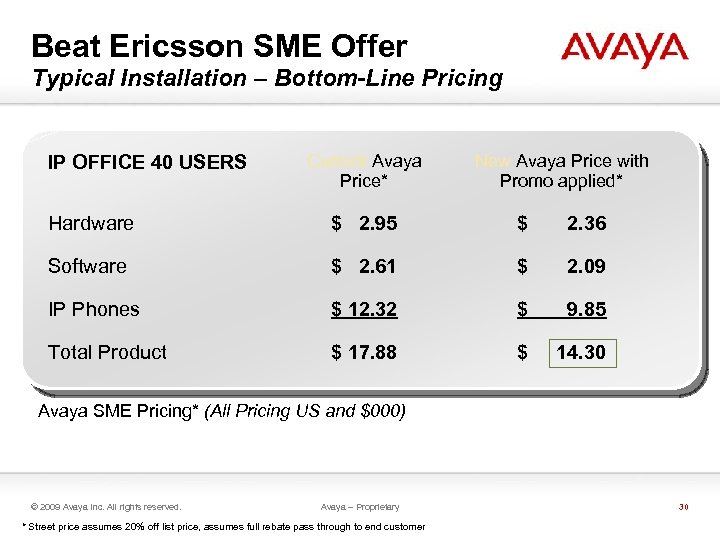

Beat Ericsson SME Offer Typical Installation – Bottom-Line Pricing IP OFFICE 40 USERS Current Avaya Price* New Avaya Price with Promo applied* Hardware $ 2. 95 $ 2. 36 Software $ 2. 61 $ 2. 09 IP Phones $ 12. 32 $ 9. 85 Total Product $ 17. 88 $ 14. 30 Avaya SME Pricing* (All Pricing US and $000) © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary * Street price assumes 20% off list price, assumes full rebate pass through to end customer 30

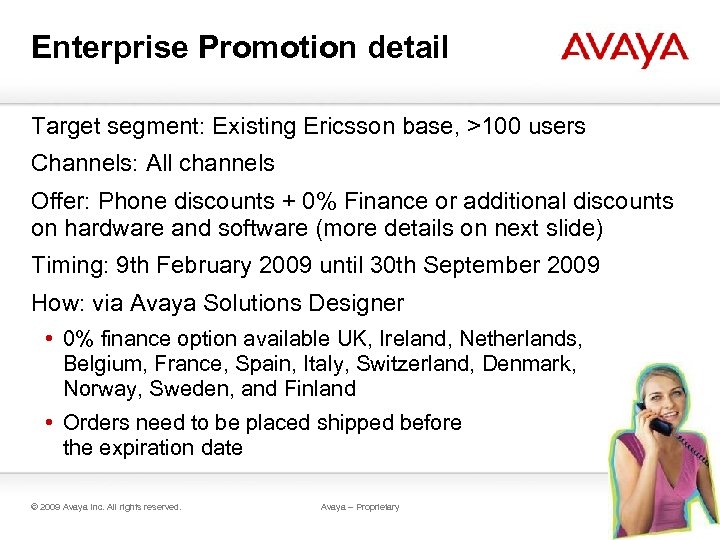

Enterprise Promotion detail Target segment: Existing Ericsson base, >100 users Channels: All channels Offer: Phone discounts + 0% Finance or additional discounts on hardware and software (more details on next slide) Timing: 9 th February 2009 until 30 th September 2009 How: via Avaya Solutions Designer • 0% finance option available UK, Ireland, Netherlands, Belgium, France, Spain, Italy, Switzerland, Denmark, Norway, Sweden, and Finland • Orders need to be placed shipped before the expiration date © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 31

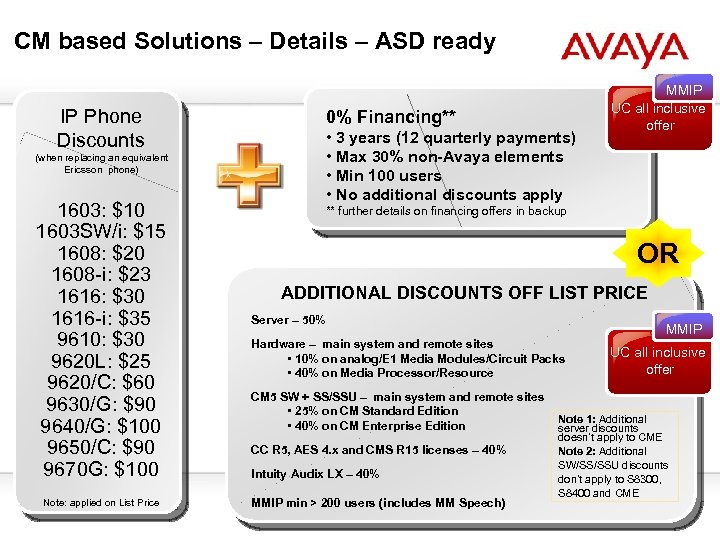

CM based Solutions – Details – ASD ready IP Phone Discounts (when replacing an equivalent Ericsson phone) 1603: $10 1603 SW/i: $15 1608: $20 1608 -i: $23 1616: $30 1616 -i: $35 9610: $30 9620 L: $25 9620/C: $60 9630/G: $90 9640/G: $100 9650/C: $90 9670 G: $100 Note: applied All rights reserved. © 2009 Avaya Inc. on List Price 0% Financing** • 3 years (12 quarterly payments) • Max 30% non-Avaya elements • Min 100 users • No additional discounts apply MMIP UC all inclusive offer ** further details on financing offers in backup OR ADDITIONAL DISCOUNTS OFF LIST PRICE Server – 50% MMIP Hardware – main system and remote sites • 10% on analog/E 1 Media Modules/Circuit Packs • 40% on Media Processor/Resource CM 5 SW + SS/SSU – main system and remote sites • 25% on CM Standard Edition • 40% on CM Enterprise Edition CC R 5, AES 4. x and CMS R 15 licenses – 40% Intuity Audix LX – 40% MMIP min > Avayausers (includes MM Speech) 200 – Proprietary UC all inclusive offer Note 1: Additional server discounts doesn’t apply to CME Note 2: Additional SW/SS/SSU discounts don’t apply to S 8300, S 8400 and CME 32

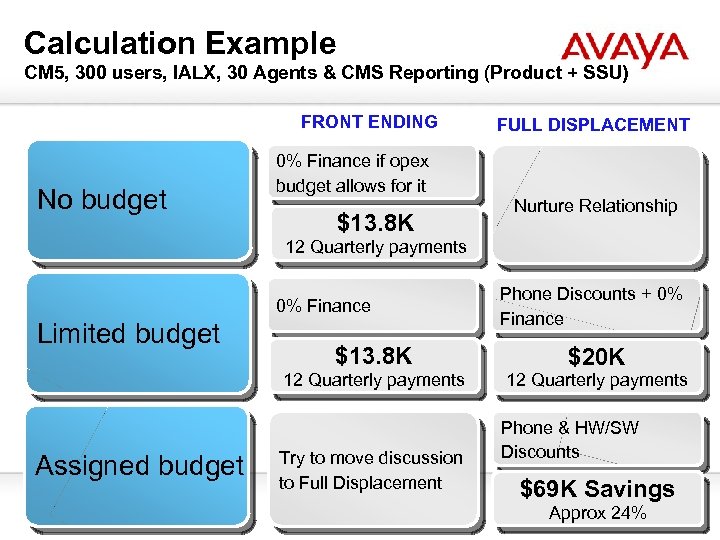

Calculation Example CM 5, 300 users, IALX, 30 Agents & CMS Reporting (Product + SSU) FRONT ENDING No budget 0% Finance if opex budget allows for it $13. 8 K FULL DISPLACEMENT Nurture Relationship 12 Quarterly payments 0% Finance Limited budget $13. 8 K 12 Quarterly payments Assigned budget © 2009 Avaya Inc. All rights reserved. Try to move discussion to Full Displacement Avaya – Proprietary Phone Discounts + 0% Finance $20 K 12 Quarterly payments Phone & HW/SW Discounts $69 K Savings Approx 24% 33

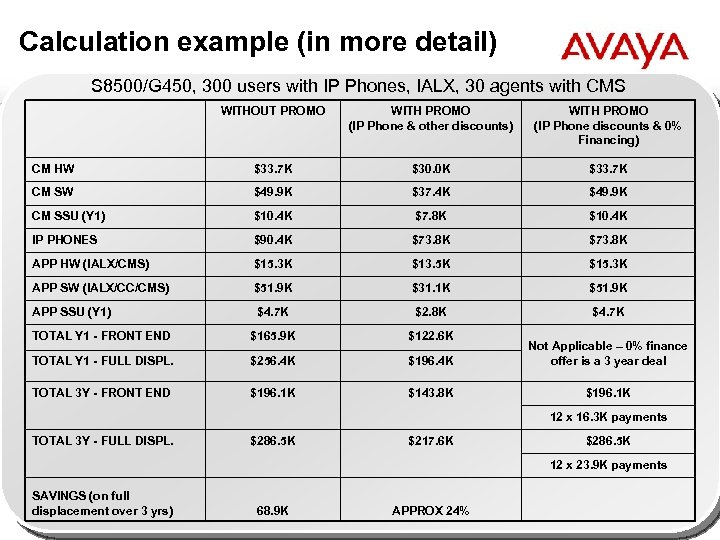

Calculation example (in more detail) S 8500/G 450, 300 users with IP Phones, IALX, 30 agents with CMS WITHOUT PROMO WITH PROMO (IP Phone & other discounts) WITH PROMO (IP Phone discounts & 0% Financing) CM HW $33. 7 K $30. 0 K $33. 7 K CM SW $49. 9 K $37. 4 K $49. 9 K CM SSU (Y 1) $10. 4 K $7. 8 K $10. 4 K IP PHONES $90. 4 K $73. 8 K APP HW (IALX/CMS) $15. 3 K $13. 5 K $15. 3 K APP SW (IALX/CC/CMS) $51. 9 K $31. 1 K $51. 9 K APP SSU (Y 1) $4. 7 K $2. 8 K $4. 7 K TOTAL Y 1 - FRONT END $165. 9 K $122. 6 K TOTAL Y 1 - FULL DISPL. $256. 4 K $196. 4 K Not Applicable – 0% finance offer is a 3 year deal TOTAL 3 Y - FRONT END $196. 1 K $143. 8 K $196. 1 K 12 x 16. 3 K payments TOTAL 3 Y - FULL DISPL. $286. 5 K $217. 6 K $286. 5 K 12 x 23. 9 K payments SAVINGS (on full displacement over 3 yrs) © 2009 Avaya Inc. All rights reserved. 68. 9 K Avaya – Proprietary APPROX 24% 34

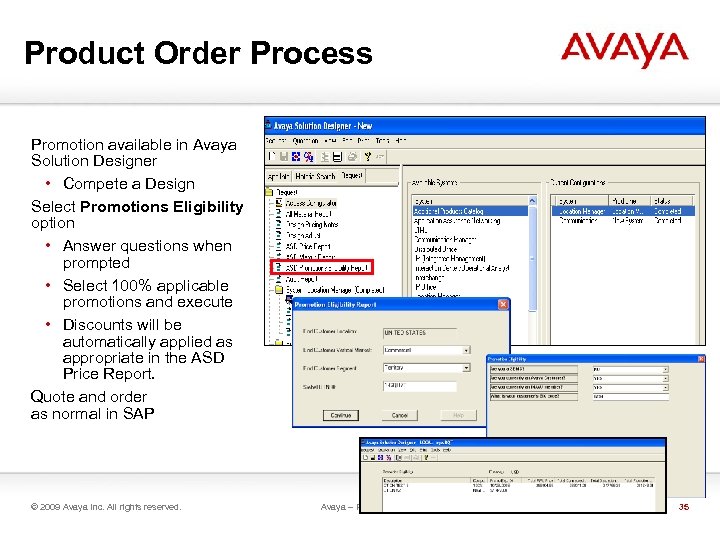

Product Order Process Promotion available in Avaya Solution Designer • Compete a Design Select Promotions Eligibility option • Answer questions when prompted • Select 100% applicable promotions and execute • Discounts will be automatically applied as appropriate in the ASD Price Report. Quote and order as normal in SAP © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 35

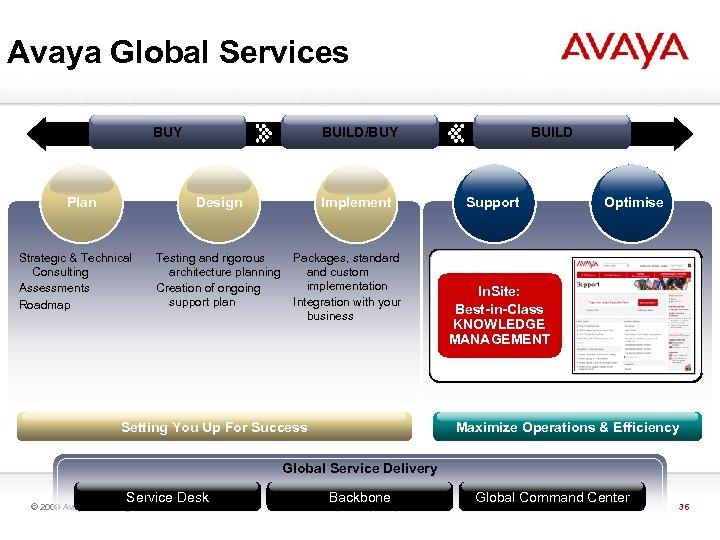

Avaya Global Services BUY BUILD/BUY Design Plan Strategic & Technical Consulting Assessments Roadmap Testing and rigorous architecture planning Creation of ongoing support plan BUILD Support Optimise Global coverage 24 x 7 Support for Software with Optional 24 x 7 In. Site: Upgrade Subscription PROACTIVE GLOBAL HEALTH Best-in-Class Hardware Maintenance CASE STATUS with EXPERT Systems KNOWLEDGE COMMAND CHECK Proactive Monitoring Enhanced Management options for IP Environments Custom Elements Available Implement Packages, standard and custom implementation Integration with your business NOTIFICATION MANAGEMENT CENTER Maximize Operations & Efficiency Setting You Up For Success Global Service Delivery Service Desk © 2009 Avaya Inc. All rights reserved. Backbone Avaya – Proprietary Global Command Center 36

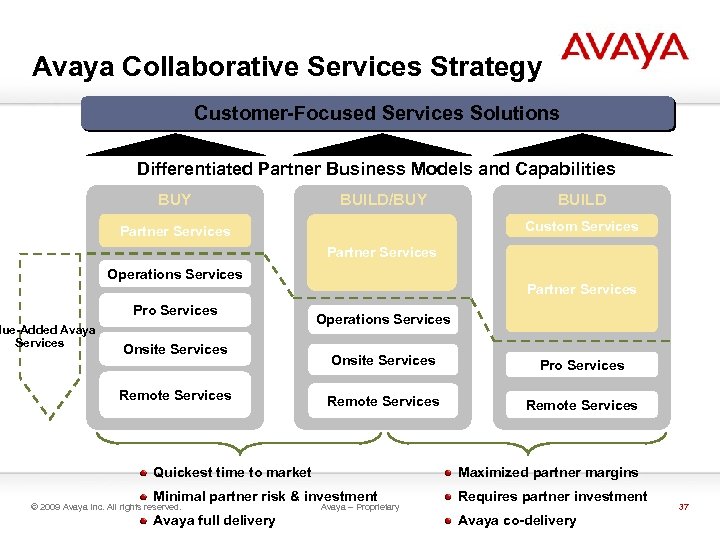

Avaya Collaborative Services Strategy Customer-Focused Services Solutions Differentiated Partner Business Models and Capabilities BUY BUILD/BUY BUILD Custom Services Partner Services Operations Services Pro Services lue-Added Avaya Services Onsite Services Remote Services Partner Services Operations Services Onsite Services Pro Services Remote Services Quickest time to market Maximized partner margins Minimal partner risk & investment Requires partner investment Avaya full delivery Avaya co-delivery © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 37

Marketing Support © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 38

Locating Promotions (Marketing) Enterprise Portal • Click Here Business. Partner Portal (SMB view) • Click Here © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 39

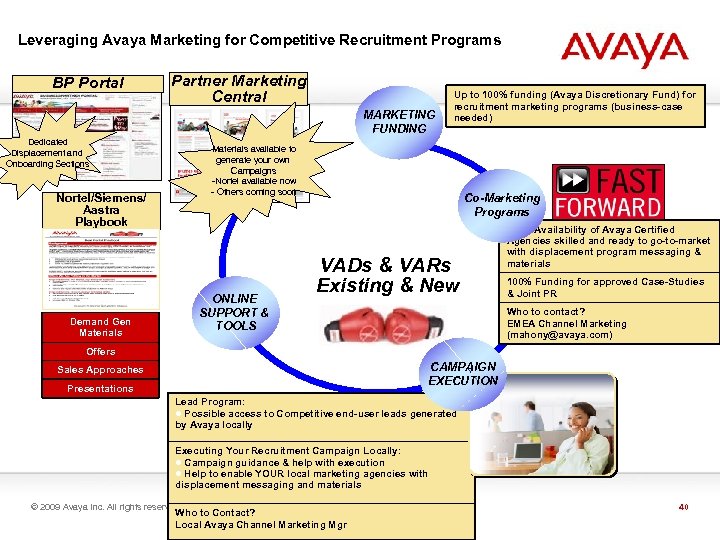

Leveraging Avaya Marketing for Competitive Recruitment Programs BP Portal Partner Marketing Central MARKETING FUNDING Dedicated Displacement and Onboarding Sections Up to 100% funding (Avaya Discretionary Fund) for recruitment marketing programs (business-case needed) Materials available to generate your own Campaigns -Nortel available now - Others coming soon Nortel/Siemens/ Aastra Playbook ONLINE SUPPORT & TOOLS Demand Gen Materials Co-Marketing Programs VADs & VARs Existing & New Availability of Avaya Certified Agencies skilled and ready to go-to-market with displacement program messaging & materials 100% Funding for approved Case-Studies & Joint PR Who to contact? EMEA Channel Marketing (mahony@avaya. com) Offers CAMPAIGN EXECUTION Sales Approaches Presentations Lead Program: ● Possible access to Competitive end-user leads generated by Avaya locally Executing Your Recruitment Campaign Locally: ● Campaign guidance & help with execution ● Help to enable YOUR local marketing agencies with displacement messaging and materials © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary Who to Contact? Local Avaya Channel Marketing Mgr 40

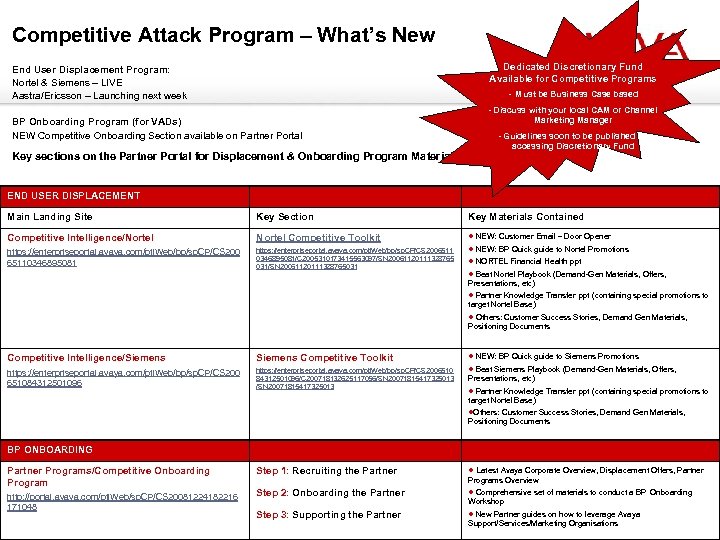

Competitive Attack Program – What’s New Dedicated Discretionary Fund Available for Competitive Programs End User Displacement Program: Nortel & Siemens – LIVE Aastra/Ericsson – Launching next week - Must be Business Case based - Discuss with your local CAM or Channel Marketing Manager BP Onboarding Program (for VADs) NEW Competitive Onboarding Section available on Partner Portal Key sections on the Partner Portal for Displacement & Onboarding Program Materials: - Guidelines soon to be published on accessing Discretionary Fund END USER DISPLACEMENT Main Landing Site Key Section Key Materials Contained Competitive Intelligence/Nortel Competitive Toolkit https: //enterpriseportal. avaya. com/ptl. Web/bp/sp. CP/CS 200 65110346895081 https: //enterpriseportal. avaya. com/ptl. Web/bp/sp. CP/CS 2006511 0346895081/C 2005310173415563097/SN 20061120111328765 031/SN 20061120111328765031 ● NEW: Customer Email – Door Opener ● NEW: BP Quick guide to Nortel Promotions ● NORTEL Financial Health ppt ● Beat Nortel Playbook (Demand-Gen Materials, Offers, Presentations, etc) ● Partner Knowledge Transfer ppt (containing special promotions to target Nortel Base) ● Others: Customer Success Stories, Demand Gen Materials, Positioning Documents Competitive Intelligence/Siemens Competitive Toolkit https: //enterpriseportal. avaya. com/ptl. Web/bp/sp. CP/CS 200 651084312501096 https: //enterpriseportal. avaya. com/ptl. Web/bp/sp. CP/CS 2006510 84312501096/C 200718132625117056/SN 20071815417325013 ● NEW: BP Quick guide to Siemens Promotions ● Beat Siemens Playbook (Demand-Gen Materials, Offers, Presentations, etc) ● Partner Knowledge Transfer ppt (containing special promotions to target Nortel Base) ●Others: Customer Success Stories, Demand Gen Materials, Positioning Documents BP ONBOARDING Partner Programs/Competitive Onboarding Program http: //portal. avaya. com/ptl. Web/sp. CP/CS 20081224182216 © 171048 2009 Avaya Inc. All rights reserved. Step 1: Recruiting the Partner ● Latest Avaya Corporate Overview, Displacement Offers, Partner Step 2: Onboarding the Partner ● Comprehensive set of materials to conduct a BP Onboarding Avaya – Proprietary Step 3: Supporting the Partner Programs Overview Workshop ● New Partner guides on how to leverage Avaya Support/Services/Marketing Organisations 41

Supporting Materials: the Playbook One guide for most relevant resources to help you win against Ericsson • Background • Offer description • Sales approaches • Customer wins • Avaya Contacts • Customer Presentations • Demand Generation Assets • Collaterals © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 42

Key Contacts Enterprise Offer Contact: Axel Baran, baran@avaya. com, +441483308894 Promotions Contact: Vincent Uppelschoten, vuppelschoten@avaya. com +44 1483 309 057 SME Offer Contact: Philippe du. Fou, dufou@avaya. com, +441707364688 SME Promotions Contact: Rob Andrew, rmandrew@avaya. com , +441707364150 Technical Contact: ATAC, atacemea@avaya. com, +31 70 414 8099 Avaya Financial Services: Paul Fazakerley, paul. fazakerley@cit. com Partner Marketing Central: Monica Scotto d’Antuono, mscotto@avaya. com , +39 0226293256 © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 43

Call to Action Engage with your CAM to kick-start your own displacement program Engage with your local EMEA channel marketing manager to discuss marketing funding options Download the zip file containing all playbook material Familiarize yourself with the materials and the beat Ericsson promotions • Leverage aforementioned All-in-One Unified Communications offer and SME Unified Communication Application bundles • Up sell Audio & Web Conferencing and our Desktop Video solutions • Lead with the Software Support as part of your offers for improved customer TCO Utilise Avaya Financing to tie in customer for the long-term Familiarise with the offers now loaded onto ASD Give feedback (baran@avaya. com) © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 44

© 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 45

Products Acquired © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 46

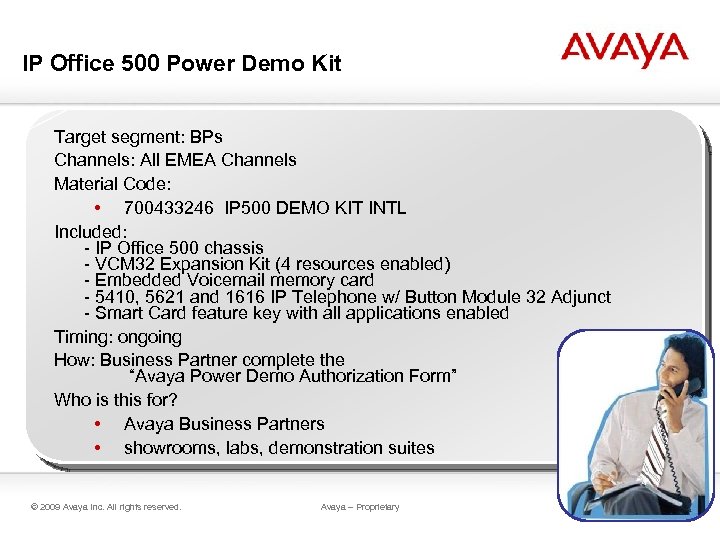

IP Office 500 Power Demo Kit Target segment: BPs Channels: All EMEA Channels Material Code: • 700433246 IP 500 DEMO KIT INTL Included: - IP Office 500 chassis - VCM 32 Expansion Kit (4 resources enabled) - Embedded Voicemail memory card - 5410, 5621 and 1616 IP Telephone w/ Button Module 32 Adjunct - Smart Card feature key with all applications enabled Timing: ongoing How: Business Partner complete the “Avaya Power Demo Authorization Form” Who is this for? • Avaya Business Partners • showrooms, labs, demonstration suites © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 47

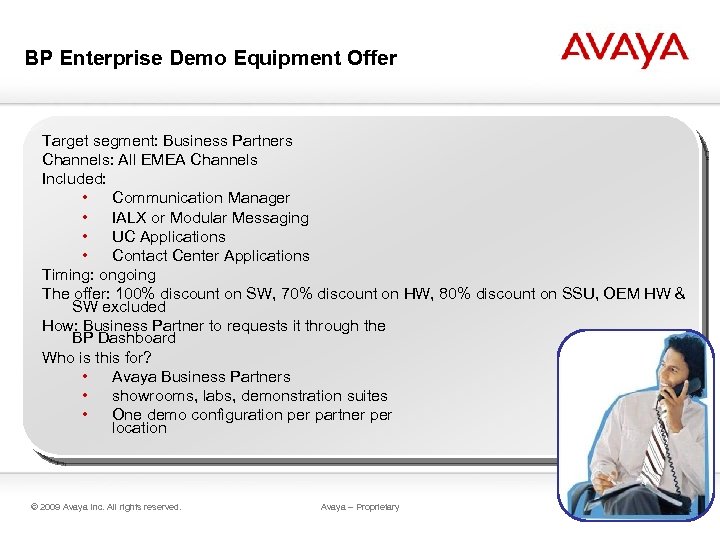

BP Enterprise Demo Equipment Offer Target segment: Business Partners Channels: All EMEA Channels Included: • Communication Manager • IALX or Modular Messaging • UC Applications • Contact Center Applications Timing: ongoing The offer: 100% discount on SW, 70% discount on HW, 80% discount on SSU, OEM HW & SW excluded How: Business Partner to requests it through the BP Dashboard Who is this for? • Avaya Business Partners • showrooms, labs, demonstration suites • One demo configuration per partner per location © 2009 Avaya Inc. All rights reserved. Avaya – Proprietary 48

a2cc16ebc4323373f7c835528b4593c7.ppt