7480d11893fefacfd437a75796088a8c.ppt

- Количество слайдов: 21

ERG Construction Program 2008 Review

ERG Construction Program 2008 Review

Industry Update Economic Outlook - Recent global economic developments are expected affect to our domestic market through two main channels. • The fall in the stock market will significantly reduce household wealth which dampens household spending and consumer confidence. • The unwinding of the boom in commodity prices which boosted incomes and demand over the past 5 years will result in the scaling back of mining related investment. A number of resource companies have already reviewed their capital expenditure for 2009, the smaller mining firms are likely to cut back their investment. Reduced spending in the resources sector would flow into slower activity in the other sectors of the economy.

Industry Update Economic Outlook - Recent global economic developments are expected affect to our domestic market through two main channels. • The fall in the stock market will significantly reduce household wealth which dampens household spending and consumer confidence. • The unwinding of the boom in commodity prices which boosted incomes and demand over the past 5 years will result in the scaling back of mining related investment. A number of resource companies have already reviewed their capital expenditure for 2009, the smaller mining firms are likely to cut back their investment. Reduced spending in the resources sector would flow into slower activity in the other sectors of the economy.

Industry Update The Economic Crash - Access to Finance • Equipment purchasers will find it harder to obtain finance of new equipment • Smaller contractors will feel it more therefore we expect sales of lower to mid range equipment to drop • Mining will be solid as major mining houses still have access to finance • Most other industries we report on are experiencing the similar drops in Quarter 4 2008

Industry Update The Economic Crash - Access to Finance • Equipment purchasers will find it harder to obtain finance of new equipment • Smaller contractors will feel it more therefore we expect sales of lower to mid range equipment to drop • Mining will be solid as major mining houses still have access to finance • Most other industries we report on are experiencing the similar drops in Quarter 4 2008

Industry Update • Construction equipment sales had undergone massive growth since 2001 • 2009 sales expected to be lower largely due to the economic environment

Industry Update • Construction equipment sales had undergone massive growth since 2001 • 2009 sales expected to be lower largely due to the economic environment

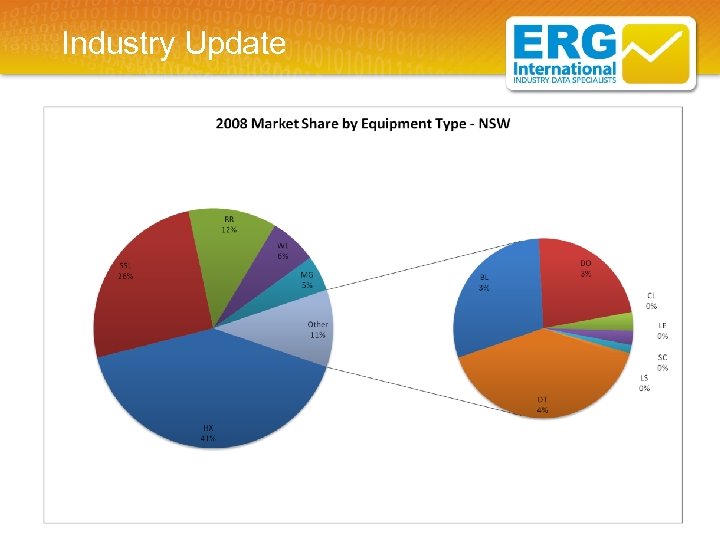

Industry Update

Industry Update

Industry Update

Industry Update

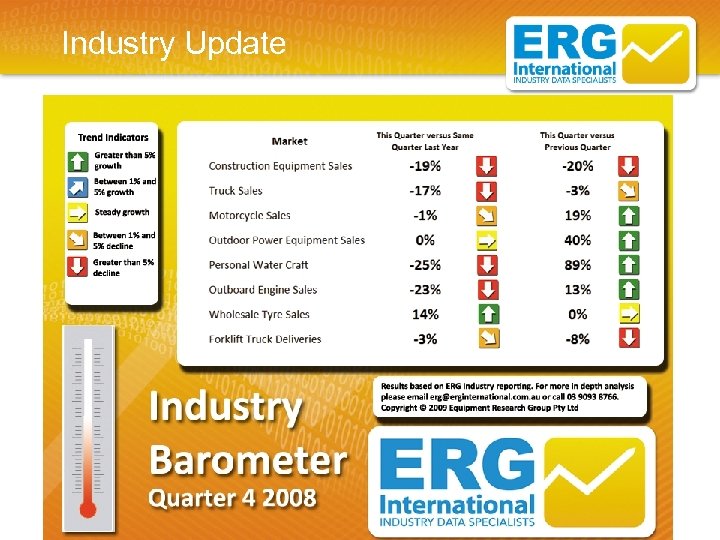

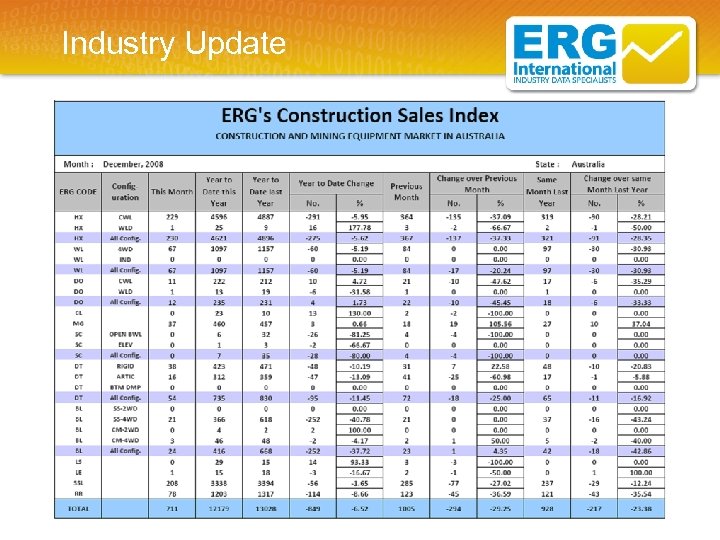

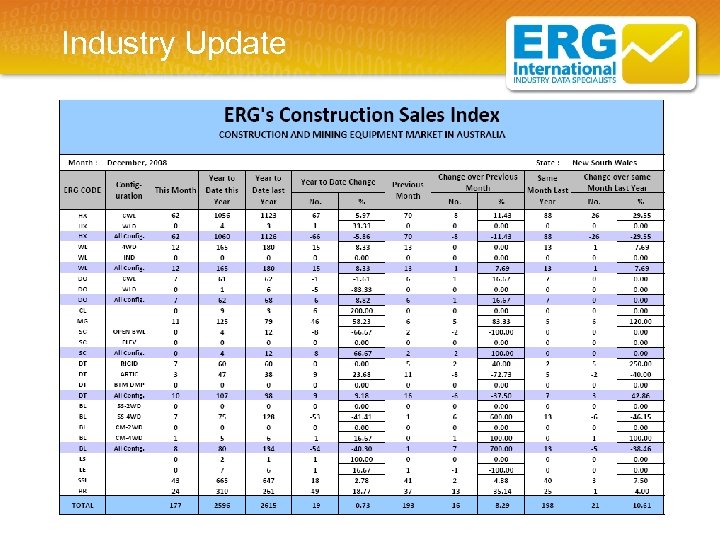

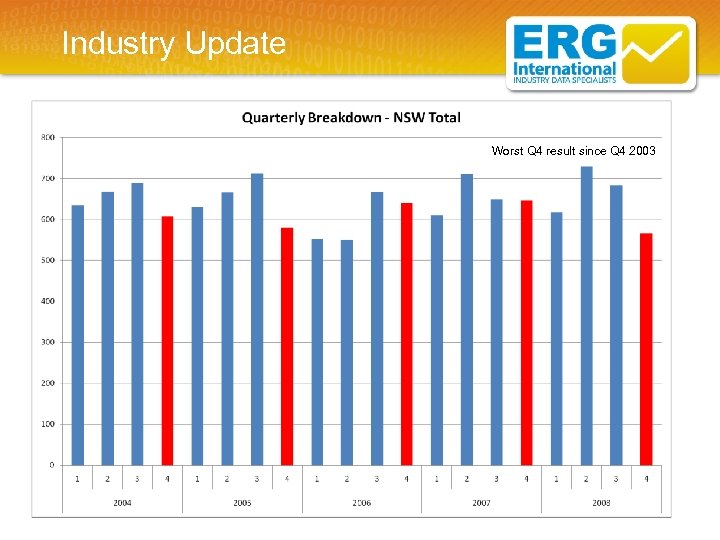

Industry Update The Numbers • Latest December numbers indicate a total market drop of 23% compared to the same month last year • Quarter 4 is 19% down versus the same quarter last year and 20% down on the previous Quarter • YTD the total market is down 6. 5%

Industry Update The Numbers • Latest December numbers indicate a total market drop of 23% compared to the same month last year • Quarter 4 is 19% down versus the same quarter last year and 20% down on the previous Quarter • YTD the total market is down 6. 5%

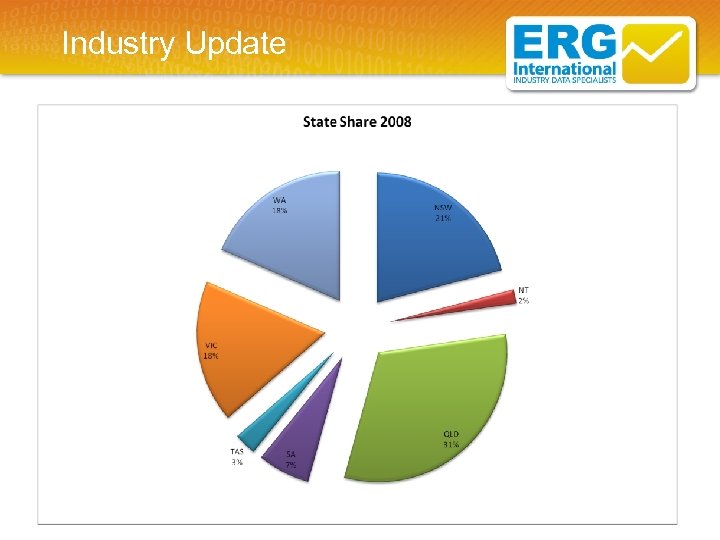

Industry Update

Industry Update

Industry Update

Industry Update

Industry Update

Industry Update

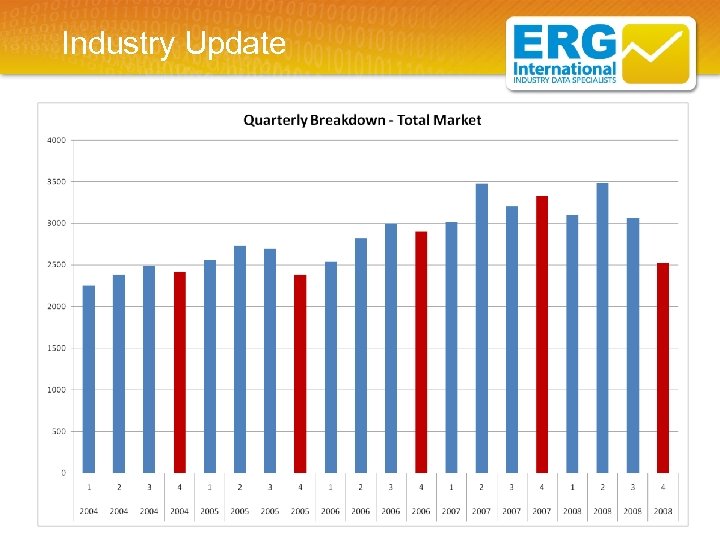

Industry Update Worst Q 4 result since Q 4 2003

Industry Update Worst Q 4 result since Q 4 2003

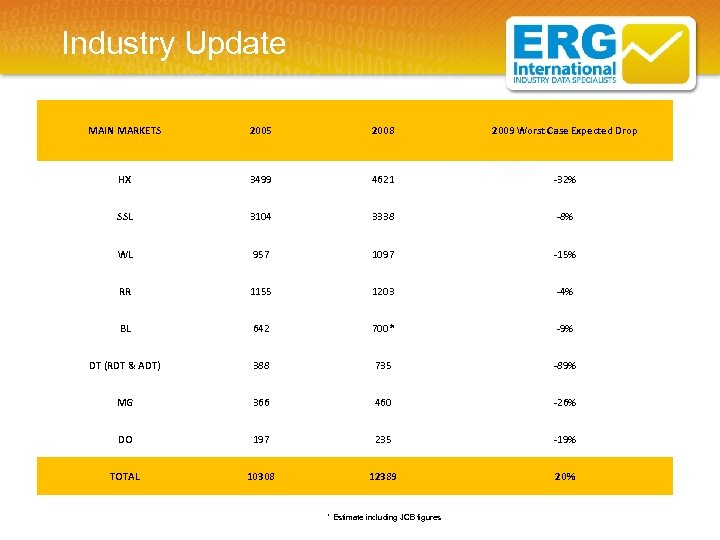

Industry Update Forecast – 2009 Expectations • We expect sales to decline then stabilise halfway through 2009 • Analysing the drop off from Quarter 4 numbers, we believe that 2009 sales will be equivalent to 2005 -2006 numbers. • Worst case scenario at 2005 numbers, we would expect the total market to drop by about 20%

Industry Update Forecast – 2009 Expectations • We expect sales to decline then stabilise halfway through 2009 • Analysing the drop off from Quarter 4 numbers, we believe that 2009 sales will be equivalent to 2005 -2006 numbers. • Worst case scenario at 2005 numbers, we would expect the total market to drop by about 20%

Industry Update MAIN MARKETS 2005 2008 2009 Worst Case Expected Drop HX 3499 4621 -32% SSL 3104 3338 -8% WL 957 1097 -15% RR 1155 1203 -4% BL 642 700* -9% DT (RDT & ADT) 388 735 -89% MG 366 460 -26% DO 197 235 -19% TOTAL 10308 12389 20% * Estimate including JCB figures

Industry Update MAIN MARKETS 2005 2008 2009 Worst Case Expected Drop HX 3499 4621 -32% SSL 3104 3338 -8% WL 957 1097 -15% RR 1155 1203 -4% BL 642 700* -9% DT (RDT & ADT) 388 735 -89% MG 366 460 -26% DO 197 235 -19% TOTAL 10308 12389 20% * Estimate including JCB figures

Industry Update Forecast • Federal, State and Local Governments appear ready to invest in projects small and large • Major markets for mineral exports are still quite strong • There are still large backlogs for mining equipment

Industry Update Forecast • Federal, State and Local Governments appear ready to invest in projects small and large • Major markets for mineral exports are still quite strong • There are still large backlogs for mining equipment

Industry Update Industry Sentiment A survey was recently sent to ERG’s industry connections who participate in our reporting program. The aim of the survey was to understand how the current economic environment is impacting their businesses. Following is an extract of some of the responses to the questions posed by the survey. The full results will be released in our Q 4 Market Executive report.

Industry Update Industry Sentiment A survey was recently sent to ERG’s industry connections who participate in our reporting program. The aim of the survey was to understand how the current economic environment is impacting their businesses. Following is an extract of some of the responses to the questions posed by the survey. The full results will be released in our Q 4 Market Executive report.

Industry Update How has the recent economic downturn affected your business? • Uncertainty has caused longer decision making processes further compacted by the ability to access finance. • Purchasers who are ready to buy are waiting for 09 models to ensure they get best value for their dollar • Business activity slowed with some markets sales down by 50% • Cancellation/Delay of orders has caused significant overstocking • Several cost cutting techniques implemented including staff retrenchment and layoffs

Industry Update How has the recent economic downturn affected your business? • Uncertainty has caused longer decision making processes further compacted by the ability to access finance. • Purchasers who are ready to buy are waiting for 09 models to ensure they get best value for their dollar • Business activity slowed with some markets sales down by 50% • Cancellation/Delay of orders has caused significant overstocking • Several cost cutting techniques implemented including staff retrenchment and layoffs

Industry Update What key factors do you see affecting your industry in the next quarter? • Lack of infrastructure projects/spending • Exchange rates for the AUS$ • Increased pricing pressure • Customer confidence

Industry Update What key factors do you see affecting your industry in the next quarter? • Lack of infrastructure projects/spending • Exchange rates for the AUS$ • Increased pricing pressure • Customer confidence

Industry Update The fluctuating Australian dollar combined with the global economic outlook has left many players within the industry considering their prices between 30% & 40%. Do you feel such a dramatic price increase will take place? • Strongly Agree (25%) • Agree (43. 8%) • Neutral (6. 2%) • Disagree (25%) • Disagree Strongly

Industry Update The fluctuating Australian dollar combined with the global economic outlook has left many players within the industry considering their prices between 30% & 40%. Do you feel such a dramatic price increase will take place? • Strongly Agree (25%) • Agree (43. 8%) • Neutral (6. 2%) • Disagree (25%) • Disagree Strongly

Industry Update With consumer confidence low, which of the following factors do you see as the biggest decision factor in the sales of new equipment to your client base? • Access to finance (62. 5%) • Client with-holding spend (31. 3%) • Lack of projects/tenders (62. 5%) • Decision to purchase cheaper imported machines (0%) • Other (reluctance to release projects, availability of local capacity)

Industry Update With consumer confidence low, which of the following factors do you see as the biggest decision factor in the sales of new equipment to your client base? • Access to finance (62. 5%) • Client with-holding spend (31. 3%) • Lack of projects/tenders (62. 5%) • Decision to purchase cheaper imported machines (0%) • Other (reluctance to release projects, availability of local capacity)

Industry Update

Industry Update

Industry Update

Industry Update