ef655168435b1509864d865f3a02fe21.ppt

- Количество слайдов: 66

Equity Valuation (II) adpted by November 13, 2012 Budi Frensidy PERTEMUAN 11 ANALISIS KEUANGAN 1

Active Stock Strategies Some stocks are mispriced Assumes the investor possesses some advantage relative to other market participants ◦ Most investors favor this approach despite evidence about efficient markets Identification of individual stocks as offering superior return-risk tradeoff ◦ Selection part of a diversified portfolio 2

Active Stock Strategies Majority of investment advice geared to selection of stocks Security returns analyst’s job is to forecast stock ◦ Estimates provided by analysts expected change in earnings per share, expected return on equity, and industry outlook ◦ Recommendations: Buy, Hold, or Sell 3

Sector Rotation Similar to stock selection, involves shifting sector weights in the portfolio ◦ Benefit from sectors expected to perform relatively well and de-emphasize sectors expected to perform poorly Expect bullish stock market: ◦ Choose cyclical and interest-sensitive industries Expect bearish stock market: ◦ Choose defensive industries 4

Market Timing Market timers attempt to earn excess returns by varying the percentage of portfolio assets in equity securities ◦ Increase portfolio beta when the market is expected to rise Success depends on the amount of brokerage commissions and taxes paid ◦ Can investors regularly time the market to provide positive risk-adjusted returns? 5

Equity Valuation § Discounted Cash Flow (Present Value) Model § Relative Methods (Price Multiple) § Hybrid Method 6

The Present Value Approach The estimated value of any security is the present value of its cash flows ◦ estimate an appropriate required rate of return three different methods to get the rate (CAPM model, dividend discount model, and bond yield plus equity risk premium) ◦ estimate the timing and amount of the future cash flows ◦ take present values, and determine the intrinsic value or estimated value of the asset 7

Dividend Discount Model Using dividends as the cash flow, we can say that the intrinsic value of a stock, or its estimated value, is the present value of all future dividends to be paid on the stock To implement the DDM, we model the estimated growth rate of dividends There are three growth rate cases 8

(Intrinsic) Value The DDM produces the intrinsic value (IV) for a stock Investors compare IV to current market price (CMP) If IV > CMP, the asset is undervalued buy If IV < CMP, the asset is overvalued avoid, sell if held, possibly sell short 9

Three Cases for the DDM The zero-growth rate model the dollar dividend is expected to remain constant The constant growth rate model the expected growth rate in dividends is expected to be approximately constant over time The multiple growth rate case at least two different growth rates 10

The Zero-Growth Rate Model Intrinsic value = dividend/required return (k) A zero-growth rate stock is a perpetuity and is easily valued once the required rate of return is determined Example: Preferred stock paying a constant dividend of Rp 200/year if k =10% ◦ Value = Rp 200/10% = Rp 2. 000 11

The Constant Growth Model If the expected growth rate in dividends is a constant, P 0 = D 1 / [k - g] Applicable to firms in the maturity life cycle stage 12

Required Rate of Return Minimum expected rate of return needed to induce investment ◦ Given risk, a security must offer some minimum expected return to persuade purchase ◦ Required return = Rf + Risk premium ◦ Using CAPM, risk premium = Beta * (E(Rm) – Rf) ◦ Another method to get the required return is using dividend discount model (DDM) that k = D 1/P 0 + g k = dividend yield + capital gain ◦ Investors expect risk free rate (Rf) plus risk premium to compensate for the additional risk assumed 13

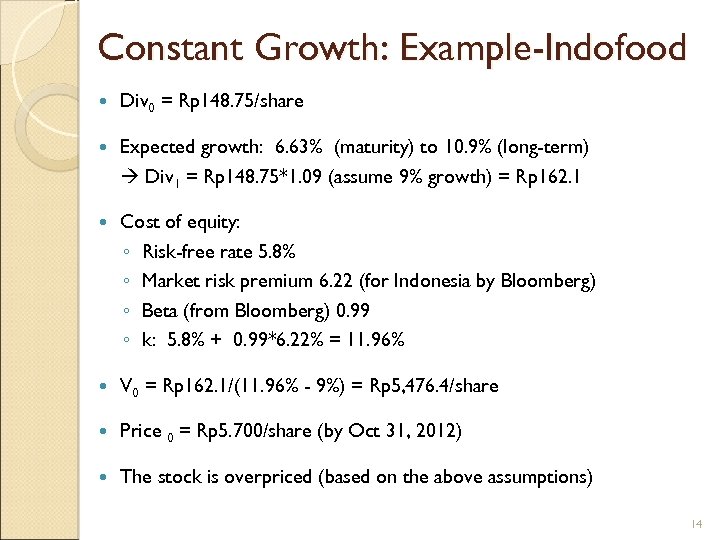

Constant Growth: Example-Indofood Div 0 = Rp 148. 75/share Expected growth: 6. 63% (maturity) to 10. 9% (long-term) Div 1 = Rp 148. 75*1. 09 (assume 9% growth) = Rp 162. 1 Cost of equity: ◦ Risk-free rate 5. 8% ◦ Market risk premium 6. 22 (for Indonesia by Bloomberg) ◦ Beta (from Bloomberg) 0. 99 ◦ k: 5. 8% + 0. 99*6. 22% = 11. 96% V 0 = Rp 162. 1/(11. 96% - 9%) = Rp 5, 476. 4/share Price 0 = Rp 5. 700/share (by Oct 31, 2012) The stock is overpriced (based on the above assumptions) 14

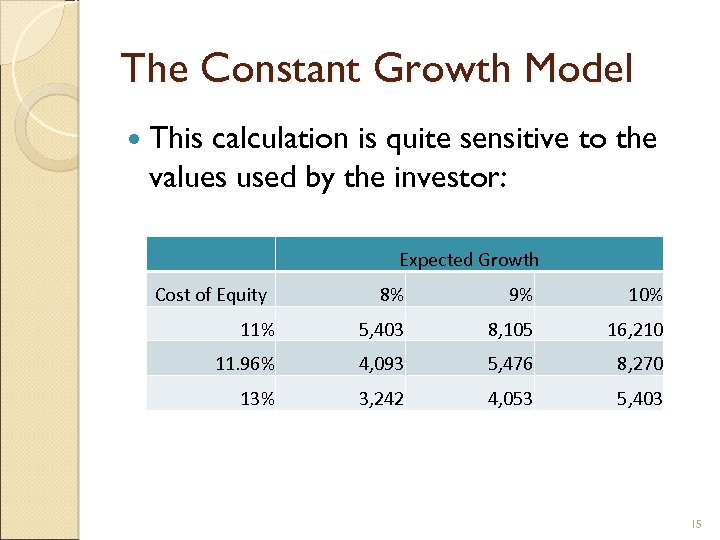

The Constant Growth Model This calculation is quite sensitive to the values used by the investor: Expected Growth Cost of Equity 8% 9% 10% 11% 5, 403 8, 105 16, 210 11. 96% 4, 093 5, 476 8, 270 13% 3, 242 4, 053 5, 403 15

The Multiple Growth Rate Case Involves two or more growth rates over different periods Two stages growth: ◦ First present value covers the period of super-normal (or sub-normal) growth ◦ Second present value covers the period of stable growth Expected price uses constant-growth model as of the end of super- (sub-) normal period Value at n must be discounted to time period zero Applicable for firms in start-up or expansion life cycle 16

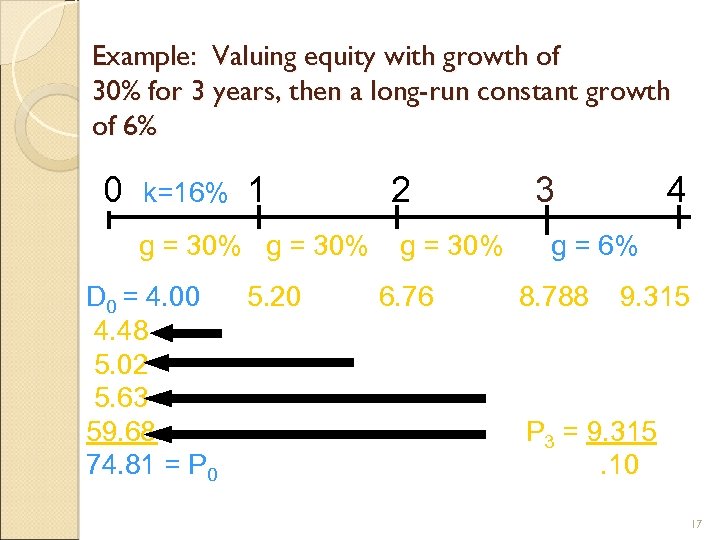

Example: Valuing equity with growth of 30% for 3 years, then a long-run constant growth of 6% 0 k=16% 1 g = 30% D 0 = 4. 00 4. 48 5. 02 5. 63 59. 68 74. 81 = P 0 5. 20 2 g = 30% 6. 76 3 4 g = 6% 8. 788 9. 315 P 3 = 9. 315. 10 17

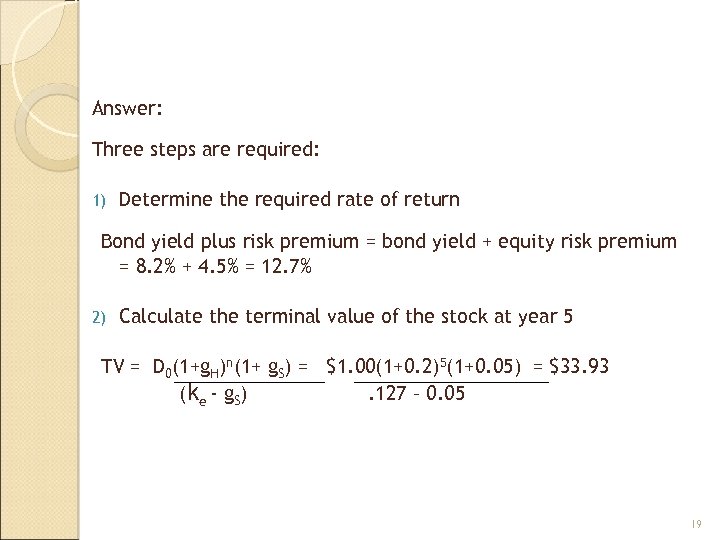

Another Example of Multiple Growth Assume you are analyzing ABC Corporation which has just announced that it will produce new products for the next five years. As a result, the company’s growth is expected to spike upward and then, at the end of the five year period, fall back to a constant long term rate. ABC currently pays a $1. 00 dividend per share You also estimate that ABC will able to grow at a 20% rate for the next five years and after that will fall to 5% in year 6 and remain constant at that level thereafter. Given CAPM’s weaknesses, you are uncomfortable using it to estimate the cost of equity of ABC. Instead, you use the bond yield plus risk premium approach and find that ABC long term debt is trading at an 8. 2% yield to maturity. You believe that a 4. 5% risk premium for equity is appropriate. What is the value per share for ABC common stock? 18

Answer: Three steps are required: 1) Determine the required rate of return Bond yield plus risk premium = bond yield + equity risk premium = 8. 2% + 4. 5% = 12. 7% 2) Calculate the terminal value of the stock at year 5 TV = D 0(1+g. H)n(1+ g. S) = $1. 00(1+0. 2)5(1+0. 05) = $33. 93 ( ke - g S ). 127 – 0. 05 19

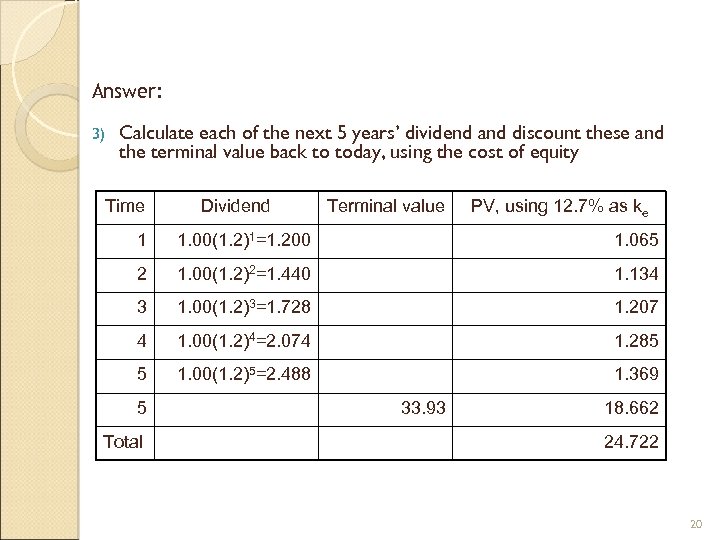

Answer: 3) Calculate each of the next 5 years’ dividend and discount these and the terminal value back to today, using the cost of equity Time Dividend Terminal value PV, using 12. 7% as ke 1 1. 00(1. 2)1=1. 200 1. 065 2 1. 00(1. 2)2=1. 440 1. 134 3 1. 00(1. 2)3=1. 728 1. 207 4 1. 00(1. 2)4=2. 074 1. 285 5 1. 00(1. 2)5=2. 488 1. 369 5 Total 33. 93 18. 662 24. 722 20

P/E Ratio or Earnings Multiplier Approach Alternative approach often used by security analysts P/E ratio or PER is the strength with which investors value earnings as expressed in stock price ◦ Divide the current market price of the stock by the latest 12 -month earnings ◦ Price paid for each $1 of earnings 21

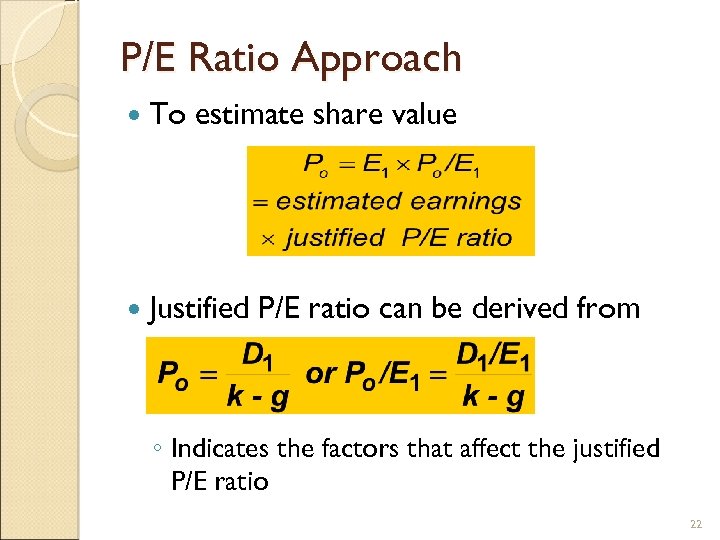

P/E Ratio Approach To estimate share value Justified P/E ratio can be derived from ◦ Indicates the factors that affect the justified P/E ratio 22

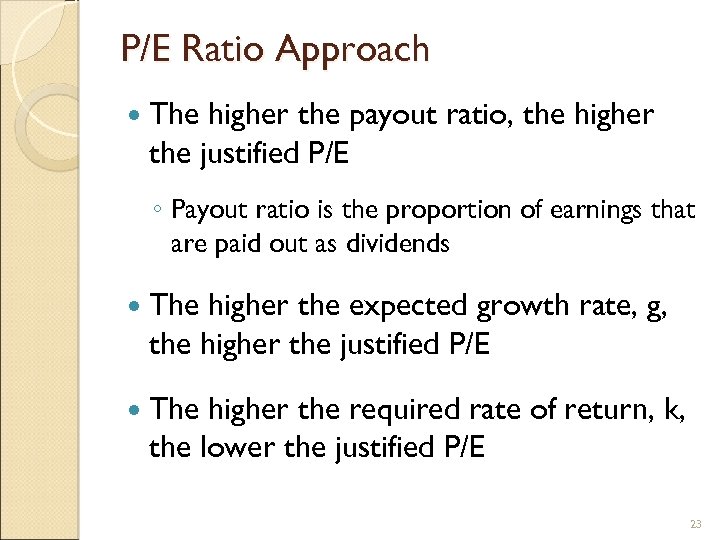

P/E Ratio Approach The higher the payout ratio, the higher the justified P/E ◦ Payout ratio is the proportion of earnings that are paid out as dividends The higher the expected growth rate, g, the higher the justified P/E The higher the required rate of return, k, the lower the justified P/E 23

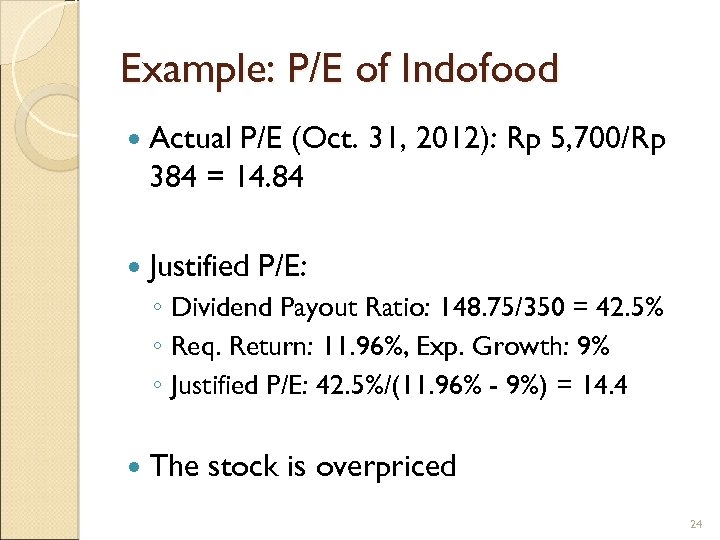

Example: P/E of Indofood Actual P/E (Oct. 31, 2012): Rp 5, 700/Rp 384 = 14. 84 Justified P/E: ◦ Dividend Payout Ratio: 148. 75/350 = 42. 5% ◦ Req. Return: 11. 96%, Exp. Growth: 9% ◦ Justified P/E: 42. 5%/(11. 96% - 9%) = 14. 4 The stock is overpriced 24

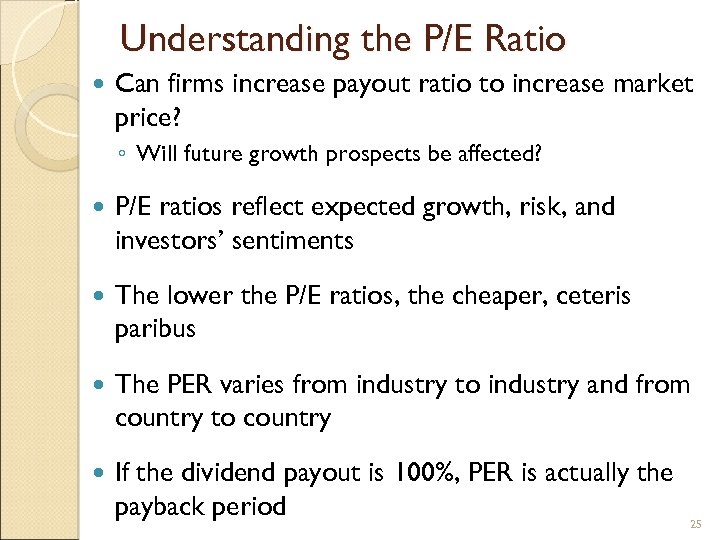

Understanding the P/E Ratio Can firms increase payout ratio to increase market price? ◦ Will future growth prospects be affected? P/E ratios reflect expected growth, risk, and investors’ sentiments The lower the P/E ratios, the cheaper, ceteris paribus The PER varies from industry to industry and from country to country If the dividend payout is 100%, PER is actually the payback period 25

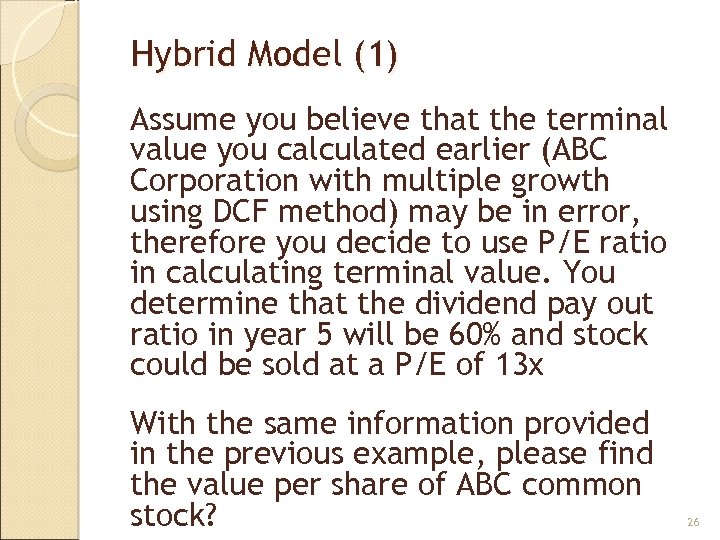

Hybrid Model (1) Assume you believe that the terminal value you calculated earlier (ABC Corporation with multiple growth using DCF method) may be in error, therefore you decide to use P/E ratio in calculating terminal value. You determine that the dividend pay out ratio in year 5 will be 60% and stock could be sold at a P/E of 13 x With the same information provided in the previous example, please find the value per share of ABC common stock? 26

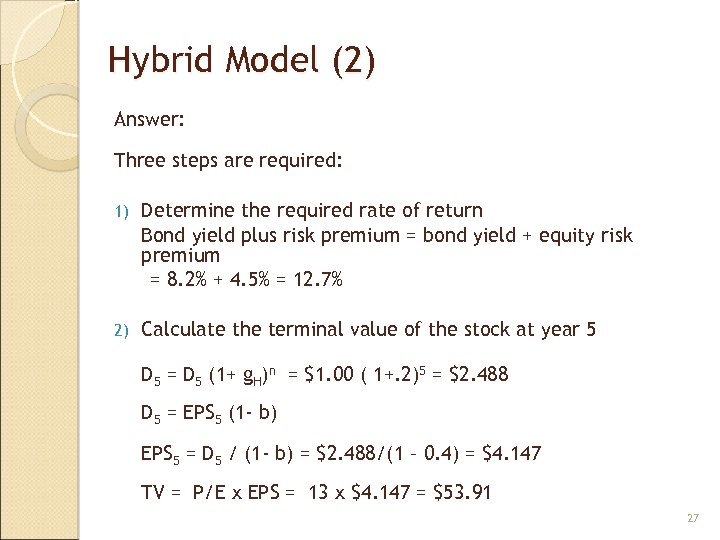

Hybrid Model (2) Answer: Three steps are required: 1) Determine the required rate of return Bond yield plus risk premium = bond yield + equity risk premium = 8. 2% + 4. 5% = 12. 7% 2) Calculate the terminal value of the stock at year 5 D 5 = D 5 (1+ g. H)n = $1. 00 ( 1+. 2)5 = $2. 488 D 5 = EPS 5 (1 - b) EPS 5 = D 5 / (1 - b) = $2. 488/(1 – 0. 4) = $4. 147 TV = P/E x EPS = 13 x $4. 147 = $53. 91 27

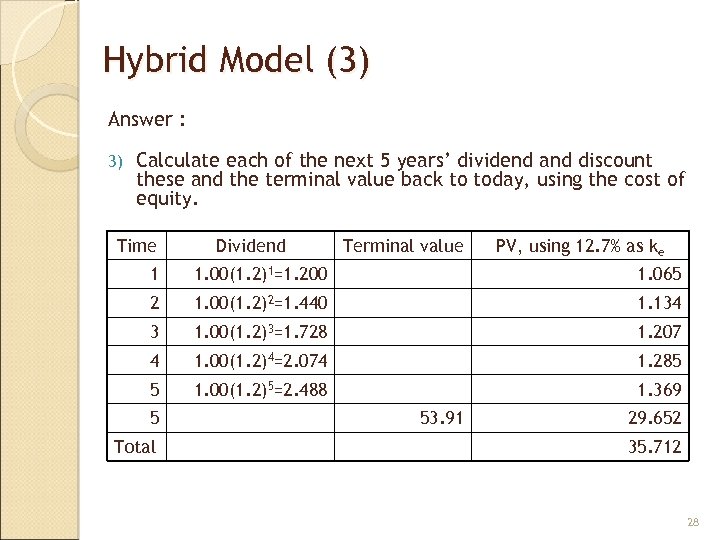

Hybrid Model (3) Answer : 3) Calculate each of the next 5 years’ dividend and discount these and the terminal value back to today, using the cost of equity. Time Dividend Terminal value PV, using 12. 7% as ke 1 1. 00(1. 2)1=1. 200 1. 065 2 1. 00(1. 2)2=1. 440 1. 134 3 1. 00(1. 2)3=1. 728 1. 207 4 1. 00(1. 2)4=2. 074 1. 285 5 1. 00(1. 2)5=2. 488 1. 369 5 Total 53. 91 29. 652 35. 712 28

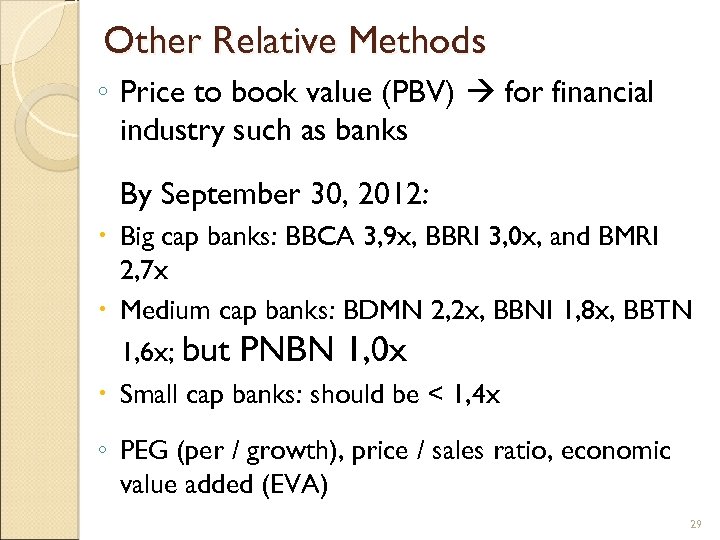

Other Relative Methods ◦ Price to book value (PBV) for financial industry such as banks By September 30, 2012: Big cap banks: BBCA 3, 9 x, BBRI 3, 0 x, and BMRI 2, 7 x Medium cap banks: BDMN 2, 2 x, BBNI 1, 8 x, BBTN 1, 6 x; but PNBN 1, 0 x Small cap banks: should be < 1, 4 x ◦ PEG (per / growth), price / sales ratio, economic value added (EVA) 29

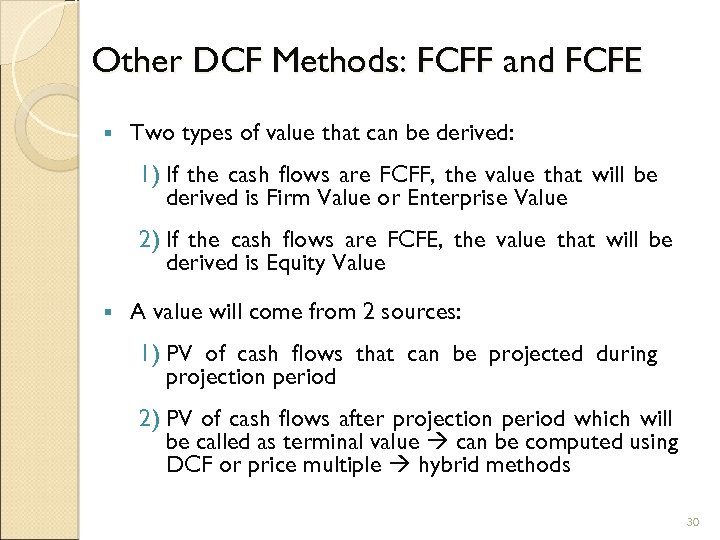

Other DCF Methods: FCFF and FCFE § Two types of value that can be derived: 1) If the cash flows are FCFF, the value that will be derived is Firm Value or Enterprise Value 2) If the cash flows are FCFE, the value that will be derived is Equity Value § A value will come from 2 sources: 1) PV of cash flows that can be projected during projection period 2) PV of cash flows after projection period which will be called as terminal value can be computed using DCF or price multiple hybrid methods 30

FCFF – Definition FCFF: ØCash flows that will be available to company’s capital suppliers ØCash flows that are available after paying all operational expense (including tax) and after making investment in form of working capital and capital expenditure to sustain company’s business activities 31

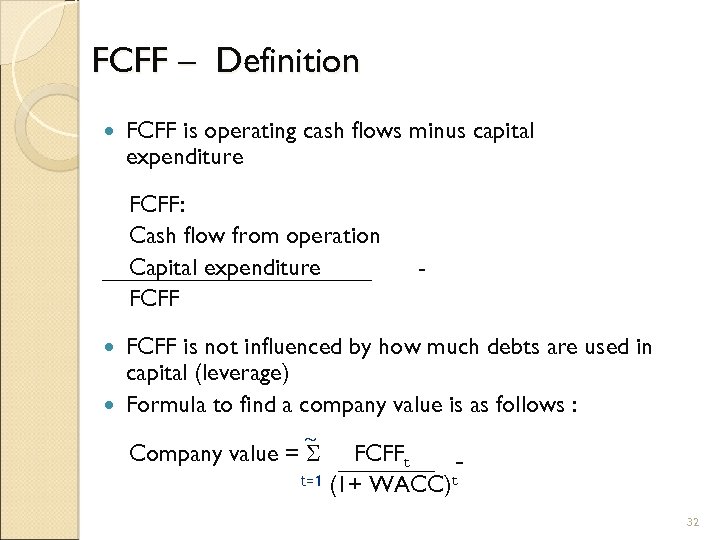

FCFF – Definition FCFF is operating cash flows minus capital expenditure FCFF: Cash flow from operation Capital expenditure FCFF - FCFF is not influenced by how much debts are used in capital (leverage) Formula to find a company value is as follows : Company value = FCFFt t=1 (1+ WACC) t 32

How to Find FCFF To find FCFF, starting from net income: FCFF = net income + non cash charges – working capital + interest expenses (1 – tax rate) – capital expenditure. To find FCFF, starting form operating cash flow FCFF = operating cash flows + interest expenses (1 – tax rate) – capital expenditure Operating cash flows = net income + non cash charges – working capital 33

FCFE – Definition FCFE : ØCash flows that are available to common stock holders ØCash flows that are available after paying all operational expenses, interest + debt principle, and making expenditure for working capital and fixed assets to sustain the company’s business activities Cash flow from operation Capital expenditure Debt / interest payment New debt + FCFE - 34

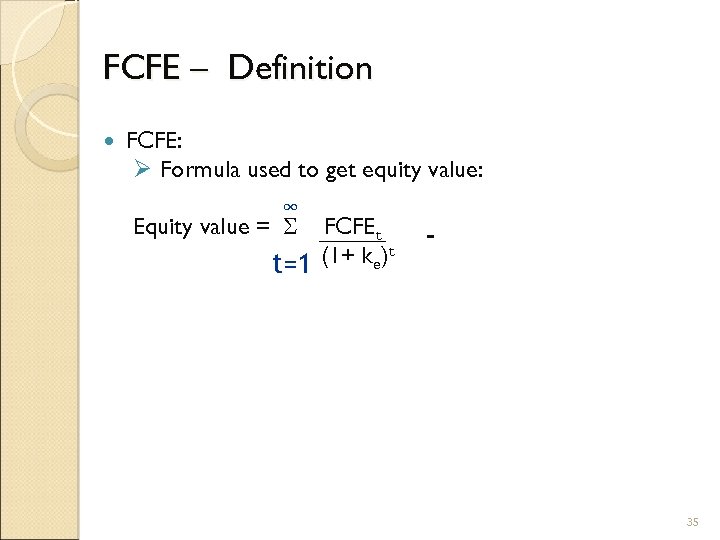

FCFE – Definition FCFE: Ø Formula used to get equity value: ∞ Equity value = FCFEt (1+ ke)t t=1 35

FCFE – To Find FCFE To find FCFE, starting from net income FCFE = net income + non cash charges – working capital – capital expenditure + net additional debt To find FCFE, starting from cash flow from operational FCFE = cash flow from operational – capital expenditure + net additional debt 36

Price/Earning Ratio in Detail 37

PE Ratio: Understanding the Fundamentals To understand the fundamentals, start with a basic equity discounted cash flow model With the dividend discount model, P 0 = DPS 1 / (r-g) Dividing both sides by the current earnings per share, P 0/EPS 0 = PE = dividend payout ratio/(rg) 38

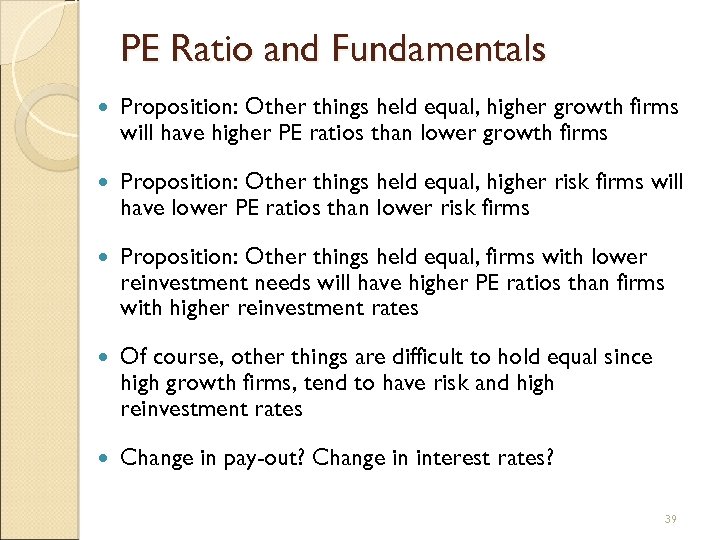

PE Ratio and Fundamentals Proposition: Other things held equal, higher growth firms will have higher PE ratios than lower growth firms Proposition: Other things held equal, higher risk firms will have lower PE ratios than lower risk firms Proposition: Other things held equal, firms with lower reinvestment needs will have higher PE ratios than firms with higher reinvestment rates Of course, other things are difficult to hold equal since high growth firms, tend to have risk and high reinvestment rates Change in pay-out? Change in interest rates? 39

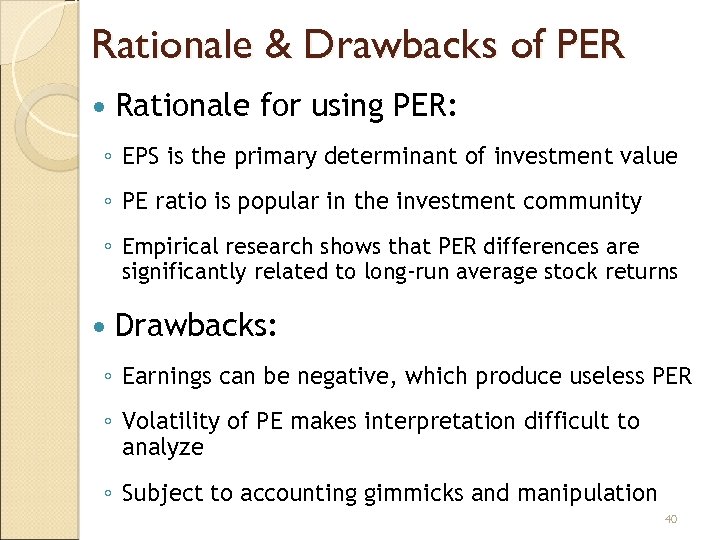

Rationale & Drawbacks of PER Rationale for using PER: ◦ EPS is the primary determinant of investment value ◦ PE ratio is popular in the investment community ◦ Empirical research shows that PER differences are significantly related to long-run average stock returns Drawbacks: ◦ Earnings can be negative, which produce useless PER ◦ Volatility of PE makes interpretation difficult to analyze ◦ Subject to accounting gimmicks and manipulation 40

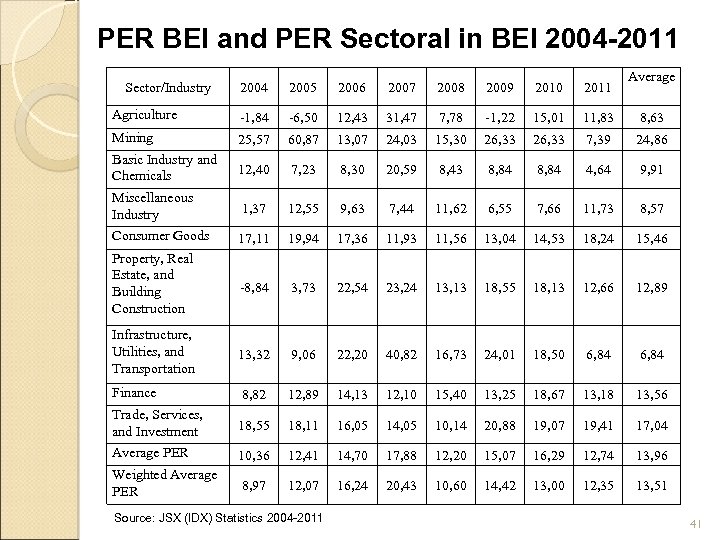

PER BEI and PER Sectoral in BEI 2004 -2011 Sector/Industry Average 2004 2005 2006 2007 2008 2009 2010 2011 Agriculture -1, 84 -6, 50 12, 43 31, 47 7, 78 -1, 22 15, 01 11, 83 8, 63 Mining 25, 57 60, 87 13, 07 24, 03 15, 30 26, 33 7, 39 24, 86 Basic Industry and Chemicals 12, 40 7, 23 8, 30 20, 59 8, 43 8, 84 4, 64 9, 91 Miscellaneous Industry 1, 37 12, 55 9, 63 7, 44 11, 62 6, 55 7, 66 11, 73 8, 57 Consumer Goods 17, 11 19, 94 17, 36 11, 93 11, 56 13, 04 14, 53 18, 24 15, 46 Property, Real Estate, and Building Construction -8, 84 3, 73 22, 54 23, 24 13, 13 18, 55 18, 13 12, 66 12, 89 Infrastructure, Utilities, and Transportation 13, 32 9, 06 22, 20 40, 82 16, 73 24, 01 18, 50 6, 84 Finance 8, 82 12, 89 14, 13 12, 10 15, 40 13, 25 18, 67 13, 18 13, 56 Trade, Services, and Investment 18, 55 18, 11 16, 05 14, 05 10, 14 20, 88 19, 07 19, 41 17, 04 Average PER 10, 36 12, 41 14, 70 17, 88 12, 20 15, 07 16, 29 12, 74 13, 96 Weighted Average PER 8, 97 12, 07 16, 24 20, 43 10, 60 14, 42 13, 00 12, 35 13, 51 Source: JSX (IDX) Statistics 2004 -2011 41

Comparison across Countries (1) A BEJ official was making argument that Indonesian stocks were cheap relative to Malaysian stocks, because they had lower PER. Would you agree? q. Yes q. No What are some of the factors that may cause one market’s PERs to be lower than another market’s PER? 42

Comparison across Countries (2) An analyst was making argument that Indonesia stocks were cheap because the average PER of the stocks are 14, below 15. Would you agree? q. Yes q. No Why or why not? 43

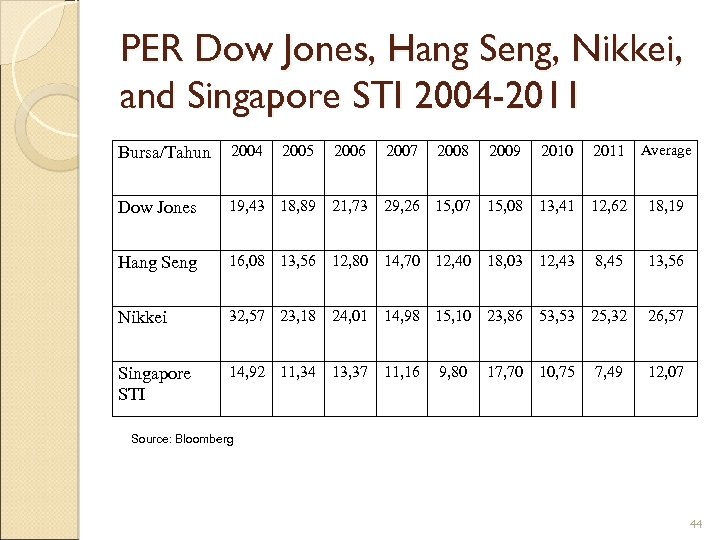

PER Dow Jones, Hang Seng, Nikkei, and Singapore STI 2004 -2011 2005 2006 2007 2008 2004 Dow Jones 19, 43 18, 89 21, 73 29, 26 15, 07 15, 08 13, 41 12, 62 18, 19 Hang Seng 16, 08 13, 56 12, 80 14, 70 12, 40 18, 03 12, 43 8, 45 13, 56 Nikkei 32, 57 23, 18 24, 01 14, 98 15, 10 23, 86 53, 53 25, 32 26, 57 Singapore STI 14, 92 11, 34 13, 37 11, 16 12, 07 9, 80 2009 2010 17, 70 10, 75 2011 Average Bursa/Tahun 7, 49 Source: Bloomberg 44

Is Low (High) PER Cheap (Expensive)? A market strategist argues that stocks are overpriced because the PER today is too high relative to the average PER across time. Do you agree? q. Yes q. No If you do not agree, what factors might explain the higher PER today? 45

Comparing PERs across Firms You are reading an equity research report on telco sector, and the analyst claims that Telkom is undervalued because it has low PE ratios. Would you agree? q. Yes q. No Why or why not? 46

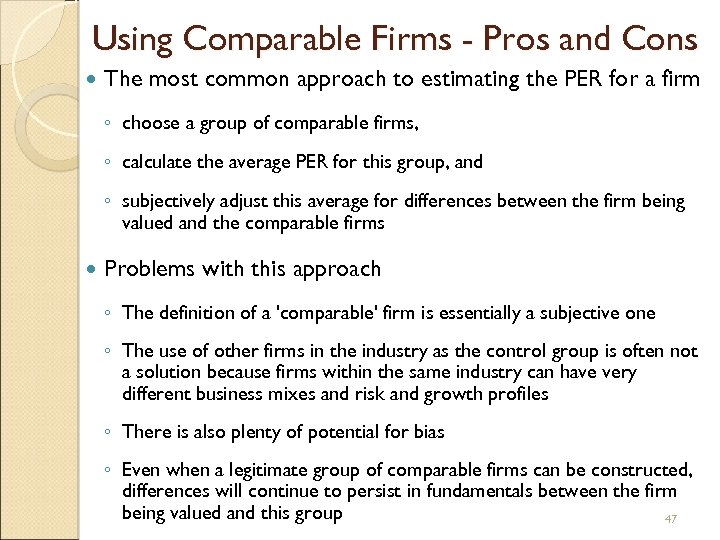

Using Comparable Firms - Pros and Cons The most common approach to estimating the PER for a firm ◦ choose a group of comparable firms, ◦ calculate the average PER for this group, and ◦ subjectively adjust this average for differences between the firm being valued and the comparable firms Problems with this approach ◦ The definition of a 'comparable' firm is essentially a subjective one ◦ The use of other firms in the industry as the control group is often not a solution because firms within the same industry can have very different business mixes and risk and growth profiles ◦ There is also plenty of potential for bias ◦ Even when a legitimate group of comparable firms can be constructed, differences will continue to persist in fundamentals between the firm being valued and this group 47

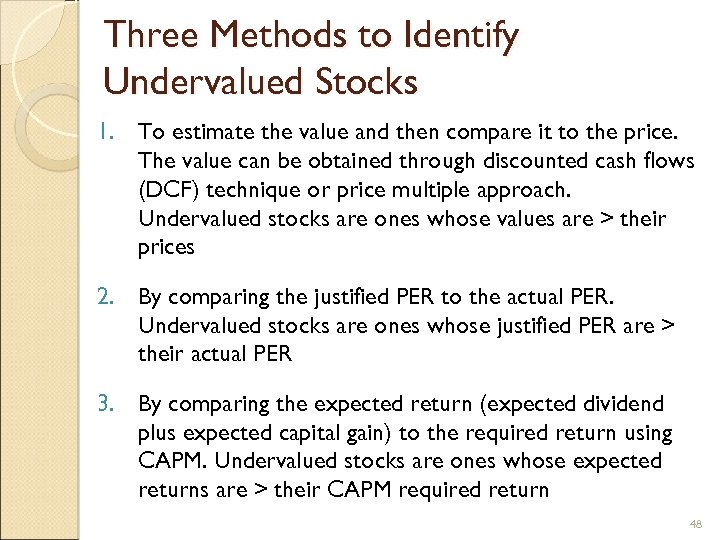

Three Methods to Identify Undervalued Stocks 1. To estimate the value and then compare it to the price. The value can be obtained through discounted cash flows (DCF) technique or price multiple approach. Undervalued stocks are ones whose values are > their prices 2. By comparing the justified PER to the actual PER. Undervalued stocks are ones whose justified PER are > their actual PER 3. By comparing the expected return (expected dividend plus expected capital gain) to the required return using CAPM. Undervalued stocks are ones whose expected returns are > their CAPM required return 48

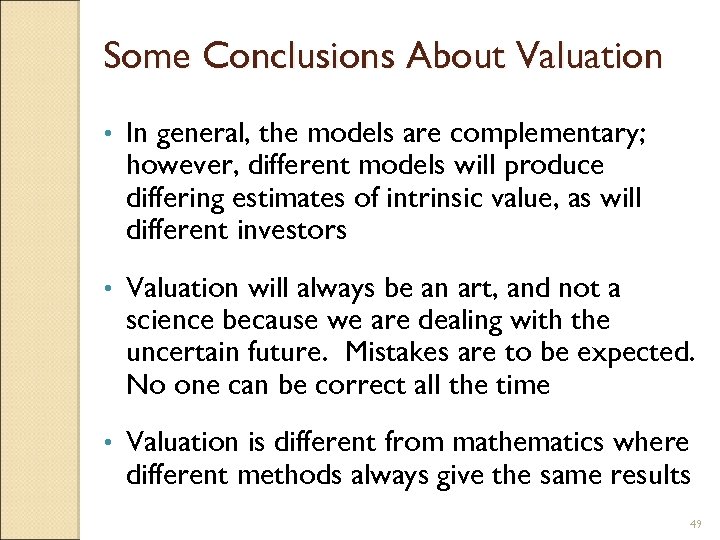

Some Conclusions About Valuation • In general, the models are complementary; however, different models will produce differing estimates of intrinsic value, as will different investors • Valuation will always be an art, and not a science because we are dealing with the uncertain future. Mistakes are to be expected. No one can be correct all the time • Valuation is different from mathematics where different methods always give the same results 49

Valuation of Speculative Stocks 50

Valuation of Speculative Stocks (1) • The emergence of speculative stocks has become unavoidable • Speculative stocks or high-growth/high-risk stocks include zero-income stocks and internet-related companies • Many stocks previously known as speculative stocks have performed very well. Amazon and Yahoo! once grew 800% and 600% to have a market cap of USD 11 billion and 23 billion respectively in 1998 51

Valuation of Speculative Stocks (2) • These two stocks were then included in many stock indexes with significant weights • Many fund managers can no longer ignore such stocks because they have exposure to not owning them • Using the same approach for high-growth/high risk stocks as for most companies can be misleading because they fluctuate so much. The less use of comparables is also the better 52

Valuation of Speculative Stocks (3) The use of the PV method to highgrowth/high-risk stocks has two problems • Wide range of critical variables • Irrelevant discount rate 53

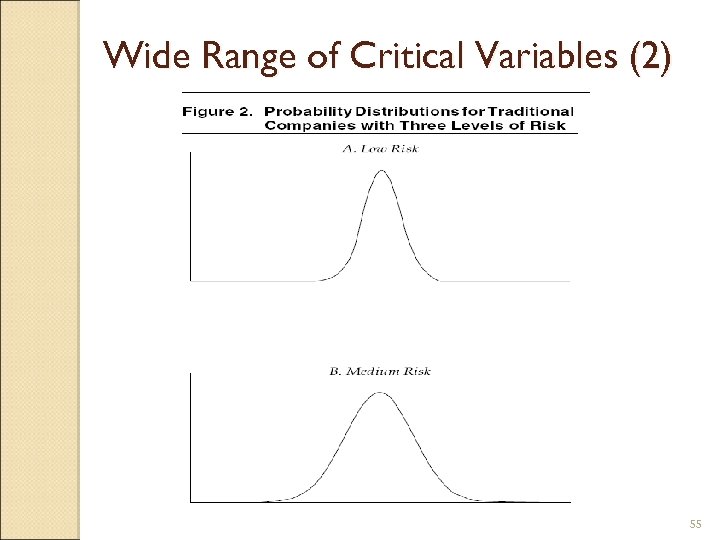

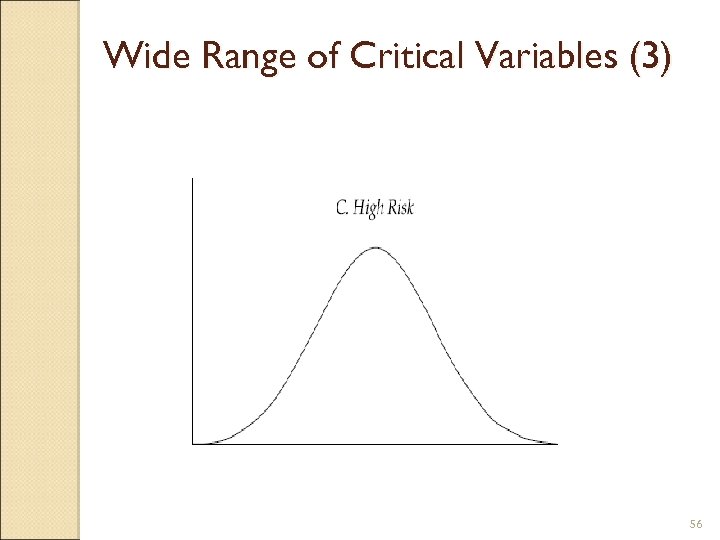

Wide Range of Critical Variables (1) For a traditional company, the probability of actual revenues being within plus or minus 3% of forecast is high (about 60 -70%). The lowest risk companies have the narrowest distribution and the medium-risk companies with a little wider distribution A traditional company with relatively high risk will simply have a much wider bell of probability and therefore greater uncertainty of an accurate forecast and it is still a normal distribution 54

Wide Range of Critical Variables (2) 55

Wide Range of Critical Variables (3) 56

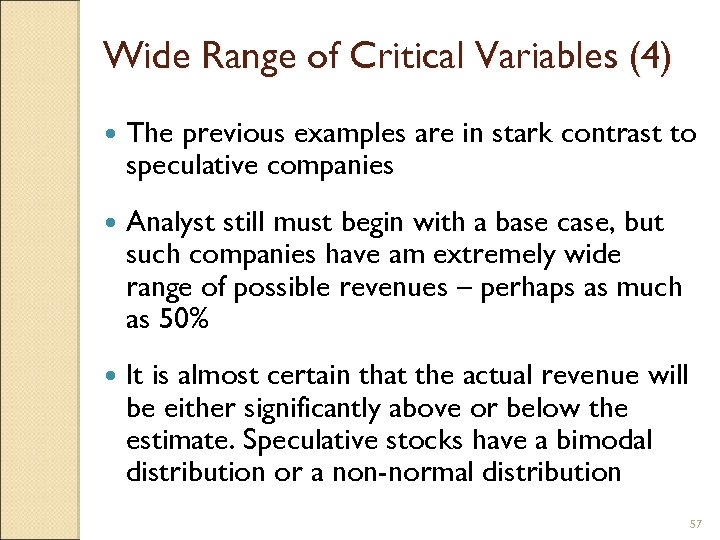

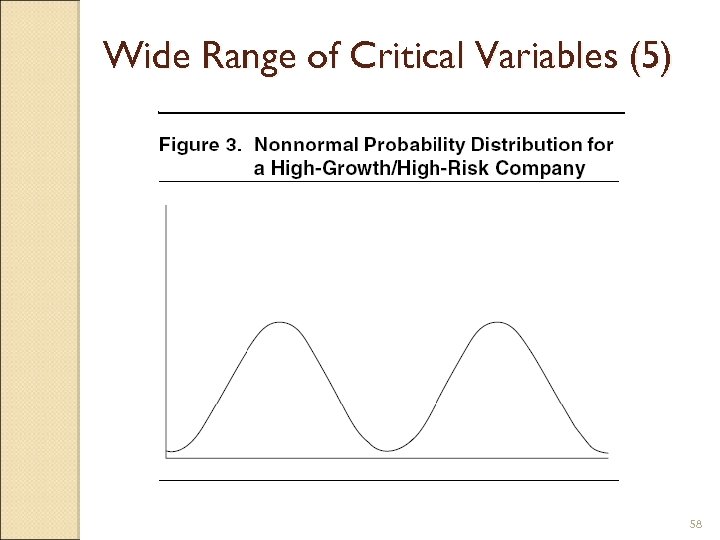

Wide Range of Critical Variables (4) The previous examples are in stark contrast to speculative companies Analyst still must begin with a base case, but such companies have am extremely wide range of possible revenues – perhaps as much as 50% It is almost certain that the actual revenue will be either significantly above or below the estimate. Speculative stocks have a bimodal distribution or a non-normal distribution 57

Wide Range of Critical Variables (5) 58

Discount Rate The second difficulty in valuing these companies is getting the right discount rate To increase the normal rate by 50% simply because the speculative stocks are so extremely risky is not the solution. Using this approach could cause you to lose large amounts of money as you could sell appreciating stocks too early and buy declining stocks too soon Simply increasing the discount rate cannot account for the extraordinary increase in uncertainty from the bimodal distribution 59

Adjustments Needed (1) Distinguish between the hypergrowth period and the subsequent period of traditional growth Use scenario analysis Supplement the DCF analysis or PV approach with other tools 60

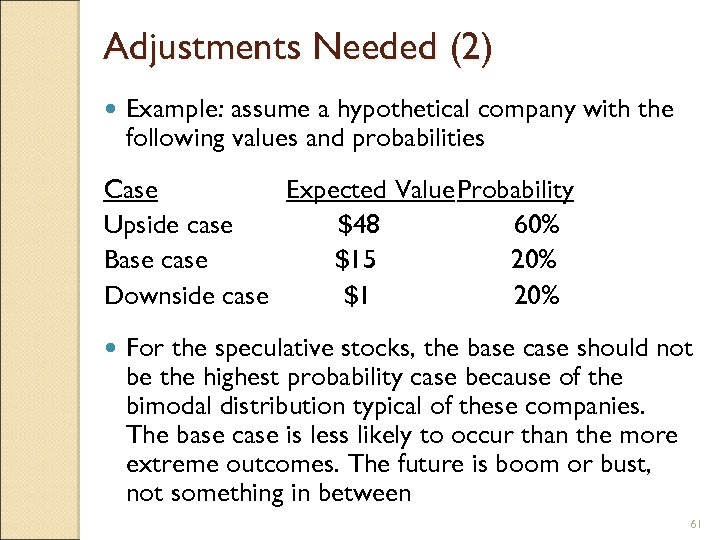

Adjustments Needed (2) Example: assume a hypothetical company with the following values and probabilities Case Expected Value. Probability Upside case $48 60% Base case $15 20% Downside case $1 20% For the speculative stocks, the base case should not be the highest probability case because of the bimodal distribution typical of these companies. The base case is less likely to occur than the more extreme outcomes. The future is boom or bust, not something in between 61

Adjustments Needed (3) The next step is not to calculate the expected value as this is not meaningful, but to focus on the probabilities and the expected values related to these stocks Using the scenario analysis avoids the problems with determining the discount rate and also gets away with taking the average of disparate possible outcomes This approach is very useful in interpreting breaking news or sharply moving stock prices. For example, news about some stocks suggest that the upside case will not happen or that the probability of upside to come has increased 62

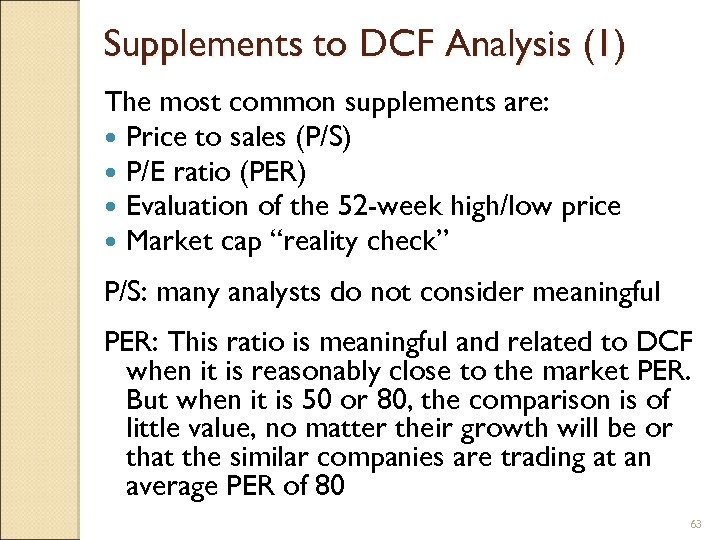

Supplements to DCF Analysis (1) The most common supplements are: Price to sales (P/S) P/E ratio (PER) Evaluation of the 52 -week high/low price Market cap “reality check” P/S: many analysts do not consider meaningful PER: This ratio is meaningful and related to DCF when it is reasonably close to the market PER. But when it is 50 or 80, the comparison is of little value, no matter their growth will be or that the similar companies are trading at an average PER of 80 63

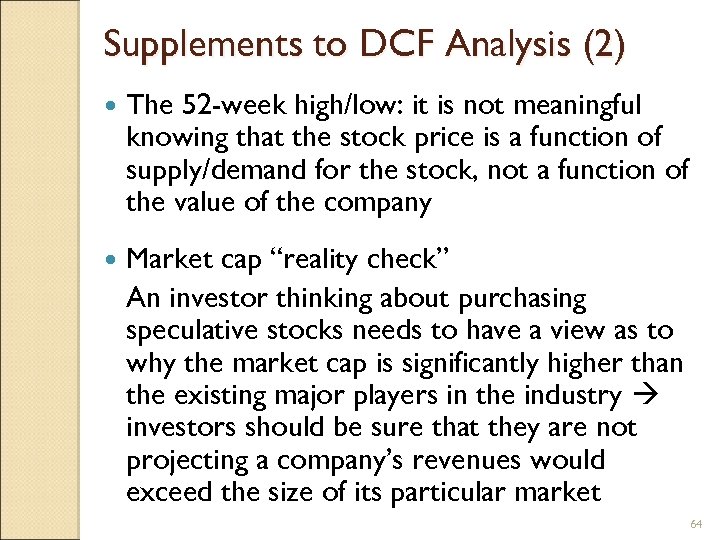

Supplements to DCF Analysis (2) The 52 -week high/low: it is not meaningful knowing that the stock price is a function of supply/demand for the stock, not a function of the value of the company Market cap “reality check” An investor thinking about purchasing speculative stocks needs to have a view as to why the market cap is significantly higher than the existing major players in the industry investors should be sure that they are not projecting a company’s revenues would exceed the size of its particular market 64

Summary The standard framework of valuation is meaningless when applied to speculative stocks However, investors do not have the luxury of ignoring such stocks A straight forward modification exists with focus on the existence of multiple scenarios The key is to understand the probabilities and magnitudes of each scenario and to avoid being tied to a single fair value of a stock 65

Kegiatan dan Forum SCL Discovery Learning: a. Dosen menjelaskan secara rinci bagian 1 I penilaian saham. b. Mahasiswa diminta untuk terjun ke dunia riil memahami secara rinci bagian 1 I penilaian saham. c. Dosen memberikan evaluasi, sebagai guide adalah bahan ajar dalam hybrid learning. 66

ef655168435b1509864d865f3a02fe21.ppt