e0e9ba44e05130a39a5f01c9767f1657.ppt

- Количество слайдов: 83

Equity Portfolio Management 02/02/09

Equity Portfolio Management 02/02/09

Passive versus Active Management • Passive equity portfolio management • Long-term buy-and-hold strategy • Usually tracks an index over time • Designed to match market performance • Manager is judged on how well they track the target index • Active equity portfolio management • Attempts to outperform a passive benchmark portfolio on a risk-adjusted basis 2

Passive versus Active Management • Passive equity portfolio management • Long-term buy-and-hold strategy • Usually tracks an index over time • Designed to match market performance • Manager is judged on how well they track the target index • Active equity portfolio management • Attempts to outperform a passive benchmark portfolio on a risk-adjusted basis 2

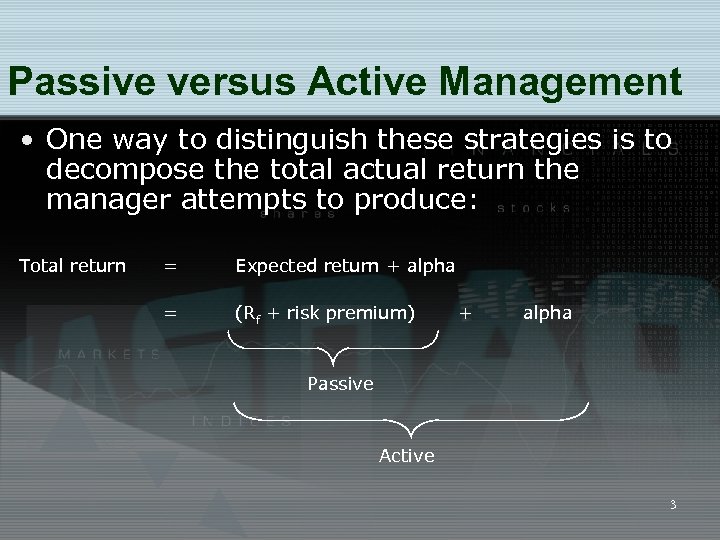

Passive versus Active Management • One way to distinguish these strategies is to decompose the total actual return the manager attempts to produce: Total return = Expected return + alpha = (Rf + risk premium) + alpha Passive Active 3

Passive versus Active Management • One way to distinguish these strategies is to decompose the total actual return the manager attempts to produce: Total return = Expected return + alpha = (Rf + risk premium) + alpha Passive Active 3

An Overview of Passive Equity Portfolio Management Strategies • Replicate the performance of an index • May slightly underperform the target index due to fees and commissions • Costs of active management (1 to 2 percent) are hard to overcome in risk-adjusted performance 4

An Overview of Passive Equity Portfolio Management Strategies • Replicate the performance of an index • May slightly underperform the target index due to fees and commissions • Costs of active management (1 to 2 percent) are hard to overcome in risk-adjusted performance 4

Index Portfolio Construction Techniques • Full replication • Sampling • Completeness Funds 5

Index Portfolio Construction Techniques • Full replication • Sampling • Completeness Funds 5

Full Replication • All securities in the index are purchased in proportion to weights in the index • This helps ensure close tracking • Increases transaction costs, particularly with dividend reinvestment 6

Full Replication • All securities in the index are purchased in proportion to weights in the index • This helps ensure close tracking • Increases transaction costs, particularly with dividend reinvestment 6

Sampling • Buys a representative sample of stocks in the benchmark index according to their weights in the index • Fewer stocks means lower commissions • Reinvestment of dividends is less difficult • Will not track the index as closely, so there will be some tracking error • Tracking error is the extent to which return fluctuation in the portfolio is not correlated with benchmark return fluctuation. 7

Sampling • Buys a representative sample of stocks in the benchmark index according to their weights in the index • Fewer stocks means lower commissions • Reinvestment of dividends is less difficult • Will not track the index as closely, so there will be some tracking error • Tracking error is the extent to which return fluctuation in the portfolio is not correlated with benchmark return fluctuation. 7

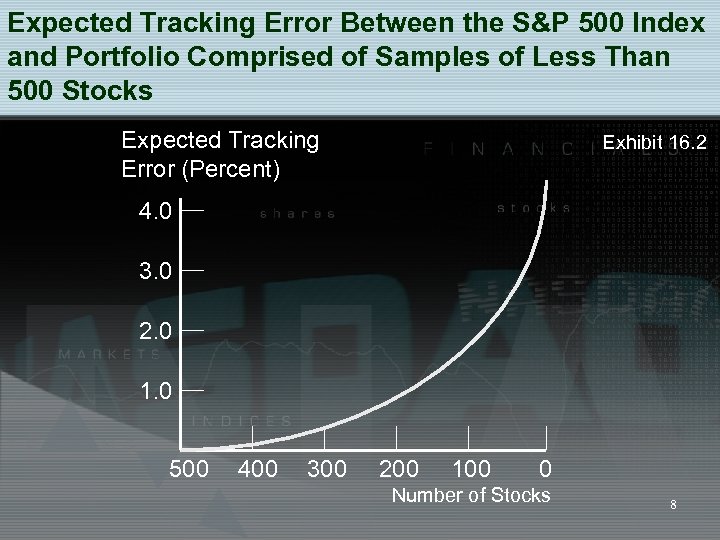

Expected Tracking Error Between the S&P 500 Index and Portfolio Comprised of Samples of Less Than 500 Stocks Expected Tracking Error (Percent) Exhibit 16. 2 4. 0 3. 0 2. 0 1. 0 500 400 300 200 100 0 Number of Stocks 8

Expected Tracking Error Between the S&P 500 Index and Portfolio Comprised of Samples of Less Than 500 Stocks Expected Tracking Error (Percent) Exhibit 16. 2 4. 0 3. 0 2. 0 1. 0 500 400 300 200 100 0 Number of Stocks 8

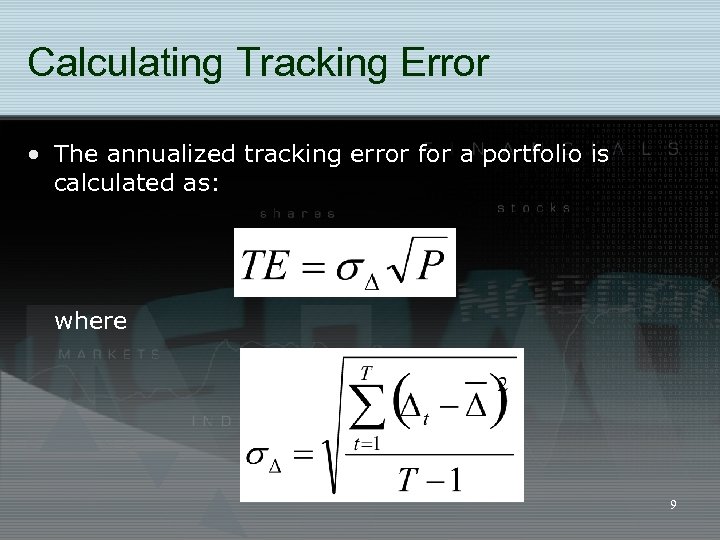

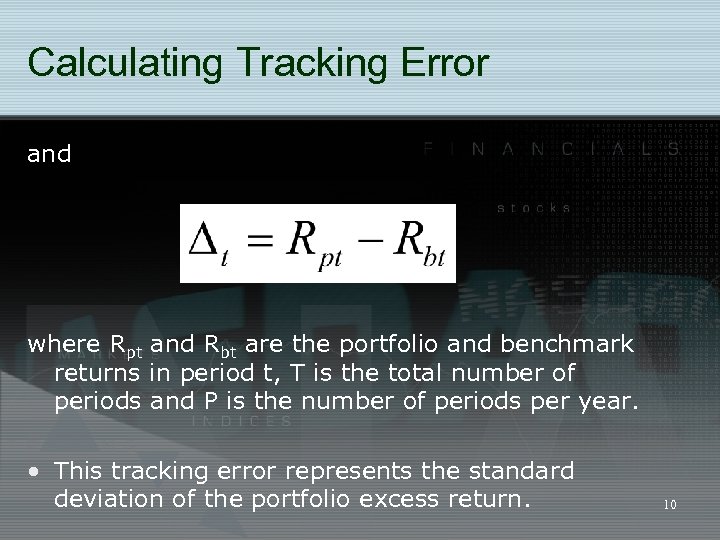

Calculating Tracking Error • The annualized tracking error for a portfolio is calculated as: where 9

Calculating Tracking Error • The annualized tracking error for a portfolio is calculated as: where 9

Calculating Tracking Error and where Rpt and Rbt are the portfolio and benchmark returns in period t, T is the total number of periods and P is the number of periods per year. • This tracking error represents the standard deviation of the portfolio excess return. 10

Calculating Tracking Error and where Rpt and Rbt are the portfolio and benchmark returns in period t, T is the total number of periods and P is the number of periods per year. • This tracking error represents the standard deviation of the portfolio excess return. 10

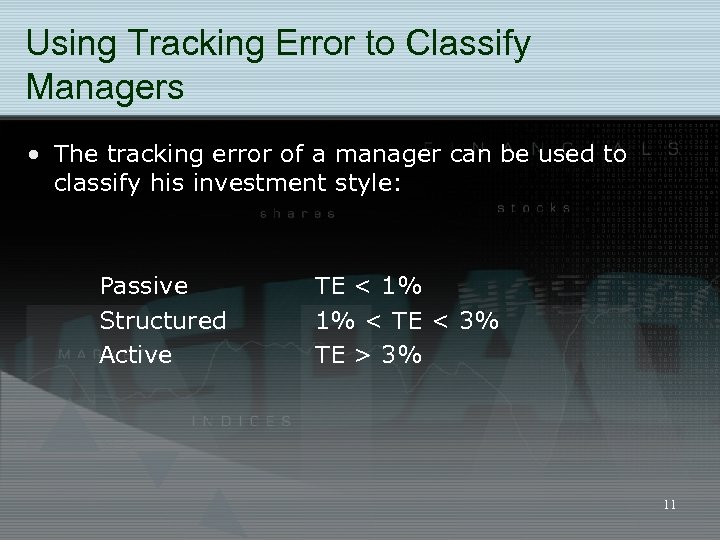

Using Tracking Error to Classify Managers • The tracking error of a manager can be used to classify his investment style: Passive Structured Active TE < 1% 1% < TE < 3% TE > 3% 11

Using Tracking Error to Classify Managers • The tracking error of a manager can be used to classify his investment style: Passive Structured Active TE < 1% 1% < TE < 3% TE > 3% 11

Completeness Funds • Completeness funds complement active portfolios. • Funds are allocated to sectors and styles that are not represented in the active portfolios 12

Completeness Funds • Completeness funds complement active portfolios. • Funds are allocated to sectors and styles that are not represented in the active portfolios 12

Justification for indexing • Markets are efficient OR • There are superior managers but it is difficult to identify them before the fact OR • The potential for higher returns from active management does not compensate for the higher risk and higher transaction costs 13

Justification for indexing • Markets are efficient OR • There are superior managers but it is difficult to identify them before the fact OR • The potential for higher returns from active management does not compensate for the higher risk and higher transaction costs 13

Efficient Capital Markets • In an efficient capital market, security prices adjust rapidly to the arrival of new information. • Whether markets are efficient has been extensively researched and remains controversial. 14

Efficient Capital Markets • In an efficient capital market, security prices adjust rapidly to the arrival of new information. • Whether markets are efficient has been extensively researched and remains controversial. 14

Why Should Capital Markets Be Efficient? • The premises of an efficient market • A large number of competing profit-maximizing participants analyze and value securities, each independently of the others • New information regarding securities comes to the market in a random fashion • Profit-maximizing investors adjust security prices rapidly to reflect the effect of new information • Conclusion: In an efficient market, the expected returns implicit in the current price 15 of a security should reflect its risk

Why Should Capital Markets Be Efficient? • The premises of an efficient market • A large number of competing profit-maximizing participants analyze and value securities, each independently of the others • New information regarding securities comes to the market in a random fashion • Profit-maximizing investors adjust security prices rapidly to reflect the effect of new information • Conclusion: In an efficient market, the expected returns implicit in the current price 15 of a security should reflect its risk

Efficient Market Hypotheses (EMH) • Weak-Form EMH - prices reflect all security-market information • Semistrong-form EMH - prices reflect all public information • Strong-form EMH - prices reflect all public and private information 16

Efficient Market Hypotheses (EMH) • Weak-Form EMH - prices reflect all security-market information • Semistrong-form EMH - prices reflect all public information • Strong-form EMH - prices reflect all public and private information 16

Weak-Form EMH • Current prices reflect all securitymarket information, including the historical sequence of prices, rates of return, trading volume data, and other market-generated information. • Implication (i. e. , if hypothesis holds): Past rates of return and other market data should have no relationship with future rates of return. 17

Weak-Form EMH • Current prices reflect all securitymarket information, including the historical sequence of prices, rates of return, trading volume data, and other market-generated information. • Implication (i. e. , if hypothesis holds): Past rates of return and other market data should have no relationship with future rates of return. 17

Weak-Form EMH • Tests: Runs tests, filter rule tests • Results: Results generally support the weak-form EMH, but results are not unanimous 18

Weak-Form EMH • Tests: Runs tests, filter rule tests • Results: Results generally support the weak-form EMH, but results are not unanimous 18

Semistrong-Form EMH • Current security prices reflect all public information, such as firm and market related announcements, P/E ratios, P/BV ratios, etc. • Implication: Decisions made on new information after it is public should not lead to above-average risk-adjusted profits from those transactions. 19

Semistrong-Form EMH • Current security prices reflect all public information, such as firm and market related announcements, P/E ratios, P/BV ratios, etc. • Implication: Decisions made on new information after it is public should not lead to above-average risk-adjusted profits from those transactions. 19

Semistrong-Form EMH • Tests: • Can aggregate market information allow us to estimate future returns? • Can firm-specific and market announcements (events) be used to predict future returns? • Are there characteristics of certain securities that will allow you to generate above-average risk-adjusted returns? 20

Semistrong-Form EMH • Tests: • Can aggregate market information allow us to estimate future returns? • Can firm-specific and market announcements (events) be used to predict future returns? • Are there characteristics of certain securities that will allow you to generate above-average risk-adjusted returns? 20

Semistrong-Form EMH • Results: • short-horizon returns have limited results • long-horizon returns analysis has been quite successful based on • aggregate dividend yield (D/P) • default spread • term structure spread • Quarterly earnings reports may yield abnormal returns due to unanticipated earnings change 21

Semistrong-Form EMH • Results: • short-horizon returns have limited results • long-horizon returns analysis has been quite successful based on • aggregate dividend yield (D/P) • default spread • term structure spread • Quarterly earnings reports may yield abnormal returns due to unanticipated earnings change 21

Semistrong-Form EMH • Results: • The January Anomaly • Stocks with negative returns during the prior year had higher returns right after the first of the year • Tax selling toward the end of the year has been mentioned as the reason for this phenomenon • Such a seasonal pattern is inconsistent with the EMH 22

Semistrong-Form EMH • Results: • The January Anomaly • Stocks with negative returns during the prior year had higher returns right after the first of the year • Tax selling toward the end of the year has been mentioned as the reason for this phenomenon • Such a seasonal pattern is inconsistent with the EMH 22

Semistrong-Form EMH • Results: • Event studies • Stock split studies show that splits do not result in abnormal gains after the split announcement, but before. • Initial public offerings seems to be underpriced by almost 18%, but that varies over time, and the price is adjusted within one day after the offering. 23

Semistrong-Form EMH • Results: • Event studies • Stock split studies show that splits do not result in abnormal gains after the split announcement, but before. • Initial public offerings seems to be underpriced by almost 18%, but that varies over time, and the price is adjusted within one day after the offering. 23

Semistrong-Form EMH • Results: • Price-earnings ratios and returns • Low P/E stocks experienced superior riskadjusted results relative to the market, whereas high P/E stocks had significantly inferior risk-adjusted results • Publicly available P/E ratios possess valuable information regarding future returns • This is inconsistent with semistrong efficiency 24

Semistrong-Form EMH • Results: • Price-earnings ratios and returns • Low P/E stocks experienced superior riskadjusted results relative to the market, whereas high P/E stocks had significantly inferior risk-adjusted results • Publicly available P/E ratios possess valuable information regarding future returns • This is inconsistent with semistrong efficiency 24

Summary on the Semistrong-Form EMH • Studies on predicting rates of return indicates markets are not semistrong efficient. • Dividend yields, risk premiums, calendar patterns, and earnings surprises • This also includes cross-sectional predictors such as p/e ratio. 25

Summary on the Semistrong-Form EMH • Studies on predicting rates of return indicates markets are not semistrong efficient. • Dividend yields, risk premiums, calendar patterns, and earnings surprises • This also includes cross-sectional predictors such as p/e ratio. 25

Strong-Form EMH • Stock prices fully reflect all information from public and private sources • Implication: No group of investors should be able to consistently derive above-average risk-adjusted rates of return. 26

Strong-Form EMH • Stock prices fully reflect all information from public and private sources • Implication: No group of investors should be able to consistently derive above-average risk-adjusted rates of return. 26

Strong Form EMH • Tests: How do investors considered to be insiders perform? • Corporate insiders include major corporate officers, directors, and owners of 10% or more of any equity class of securities. • Security analysts • Professional money managers • Trained professionals, working full time at investment management 27

Strong Form EMH • Tests: How do investors considered to be insiders perform? • Corporate insiders include major corporate officers, directors, and owners of 10% or more of any equity class of securities. • Security analysts • Professional money managers • Trained professionals, working full time at investment management 27

Strong-form EMH • Results: • Corporate insiders generally experience above-average profits especially on purchase transactions • Studies show that public investors who trade with the insiders based on announced transactions cannot generate excess risk-adjusted returns (after commissions). 28

Strong-form EMH • Results: • Corporate insiders generally experience above-average profits especially on purchase transactions • Studies show that public investors who trade with the insiders based on announced transactions cannot generate excess risk-adjusted returns (after commissions). 28

Strong-form EMH • Results: • There is evidence in favor of existence of superior analysts who apparently possess private information: • Sell recommendations • Changes in consensus recommendations • Earnings revisions prior to earnings announcements (especially upward) 29

Strong-form EMH • Results: • There is evidence in favor of existence of superior analysts who apparently possess private information: • Sell recommendations • Changes in consensus recommendations • Earnings revisions prior to earnings announcements (especially upward) 29

Strong-form EMH • Results: • Most tests examine mutual funds • Risk-adjusted, after expenses, returns of mutual funds generally show that funds, on average, did not match aggregate market performance 30

Strong-form EMH • Results: • Most tests examine mutual funds • Risk-adjusted, after expenses, returns of mutual funds generally show that funds, on average, did not match aggregate market performance 30

Implications of EMH on Technical Analysis • Technical analysts develop systems to detect movement to a new equilibrium (breakout) and trade based on that. • Contradicts rapid price adjustments indicated by the EMH. 31

Implications of EMH on Technical Analysis • Technical analysts develop systems to detect movement to a new equilibrium (breakout) and trade based on that. • Contradicts rapid price adjustments indicated by the EMH. 31

Implications of EMH on Technical Analysis • Technicians believe that investors do not analyze information and act immediately - it takes time. • Therefore, stock prices move to a new equilibrium after the release of new information in a gradual manner, causing trends in stock price movements that persist for periods of time. 32

Implications of EMH on Technical Analysis • Technicians believe that investors do not analyze information and act immediately - it takes time. • Therefore, stock prices move to a new equilibrium after the release of new information in a gradual manner, causing trends in stock price movements that persist for periods of time. 32

Implications of EMH on Technical Analysis • If the capital market is weak-form efficient, a trading system that depends on past trading data can have no value. • However… • Many managers use technical indicators as a means of narrowing down stock selection and determining buy and sell opportunities. 33

Implications of EMH on Technical Analysis • If the capital market is weak-form efficient, a trading system that depends on past trading data can have no value. • However… • Many managers use technical indicators as a means of narrowing down stock selection and determining buy and sell opportunities. 33

Implications of EMH on Fundamental Analysis • Fundamental analysts believe that there is a basic intrinsic value for the aggregate stock market, various industries, or individual securities and these values depend on underlying economic factors. • Investors should determine the intrinsic value of an investment at a point in time and compare it to the market price. 34

Implications of EMH on Fundamental Analysis • Fundamental analysts believe that there is a basic intrinsic value for the aggregate stock market, various industries, or individual securities and these values depend on underlying economic factors. • Investors should determine the intrinsic value of an investment at a point in time and compare it to the market price. 34

Implications of EMH on Fundamental Analysis • If you can do a superior job of estimating intrinsic value you can make superior market timing decisions and generate aboveaverage returns. • This involves aggregate market analysis, industry analysis, company analysis, and portfolio management. • Intrinsic value analysis should start with aggregate market analysis. 35

Implications of EMH on Fundamental Analysis • If you can do a superior job of estimating intrinsic value you can make superior market timing decisions and generate aboveaverage returns. • This involves aggregate market analysis, industry analysis, company analysis, and portfolio management. • Intrinsic value analysis should start with aggregate market analysis. 35

Efficient Markets and Portfolio Management • Portfolio Managers with Superior Analysts • Concentrate efforts in mid-cap stocks that do not receive the attention given by institutional portfolio managers to the top-tier stocks. • The market for these neglected stocks may be less efficient than the market for large wellknown stocks. • Pay attention to firm size, BV/MV, etc. 36

Efficient Markets and Portfolio Management • Portfolio Managers with Superior Analysts • Concentrate efforts in mid-cap stocks that do not receive the attention given by institutional portfolio managers to the top-tier stocks. • The market for these neglected stocks may be less efficient than the market for large wellknown stocks. • Pay attention to firm size, BV/MV, etc. 36

Efficient Markets and Portfolio Management • Portfolio Managers without Superior Analysts • Determine and quantify your client's risk preferences • Construct the appropriate portfolio • Diversify completely on a global basis to eliminate all unsystematic risk • Maintain the desired risk level by rebalancing the portfolio whenever necessary • Minimize total transaction costs 37

Efficient Markets and Portfolio Management • Portfolio Managers without Superior Analysts • Determine and quantify your client's risk preferences • Construct the appropriate portfolio • Diversify completely on a global basis to eliminate all unsystematic risk • Maintain the desired risk level by rebalancing the portfolio whenever necessary • Minimize total transaction costs 37

An Overview of Active Equity Portfolio Management Strategies • Goal is to earn a portfolio return that exceeds the return of a passive benchmark portfolio, net of transaction costs, on a risk-adjusted basis. • Practical difficulties of active manager • Transactions costs must be offset • Risk can exceed passive benchmark 38

An Overview of Active Equity Portfolio Management Strategies • Goal is to earn a portfolio return that exceeds the return of a passive benchmark portfolio, net of transaction costs, on a risk-adjusted basis. • Practical difficulties of active manager • Transactions costs must be offset • Risk can exceed passive benchmark 38

Beyond Long-only Portfolios • Up to now we have considered long-only portfolios, i. e. , we have not introduced the possibility of shorting asset classes and securities. • This is a reasonable starting point since many managers operate under this short-selling constraint. • However, those that are not constrained can consider: • Long-short portfolios (market-neutral strategy) • “Combination” portfolios (for example, 130/30 strategy) 39

Beyond Long-only Portfolios • Up to now we have considered long-only portfolios, i. e. , we have not introduced the possibility of shorting asset classes and securities. • This is a reasonable starting point since many managers operate under this short-selling constraint. • However, those that are not constrained can consider: • Long-short portfolios (market-neutral strategy) • “Combination” portfolios (for example, 130/30 strategy) 39

Spectrum of Strategies • Indexed equity • passive strategy • Enhanced indexed equity • Active strategy that allows for over/under weight of securities • These strategies typically have minimum and maximum weight restrictions 40

Spectrum of Strategies • Indexed equity • passive strategy • Enhanced indexed equity • Active strategy that allows for over/under weight of securities • These strategies typically have minimum and maximum weight restrictions 40

Spectrum of Strategies • Active equity • Active strategy that allows for over/under weight of securities • These strategies do not have minimum and maximum weight restrictions • No short-selling is allowed 41

Spectrum of Strategies • Active equity • Active strategy that allows for over/under weight of securities • These strategies do not have minimum and maximum weight restrictions • No short-selling is allowed 41

Spectrum of Strategies • Enhanced active equity • Active strategy that allows for overweighting and short-selling of securities. • These strategies continue to maintain (and often increase) exposure to the market. 42

Spectrum of Strategies • Enhanced active equity • Active strategy that allows for overweighting and short-selling of securities. • These strategies continue to maintain (and often increase) exposure to the market. 42

Spectrum of Strategies • Market-neutral long-short equity • Active strategy that allows for overweighting and short-selling of securities. • These strategies do not have a net exposure to market risk. 43

Spectrum of Strategies • Market-neutral long-short equity • Active strategy that allows for overweighting and short-selling of securities. • These strategies do not have a net exposure to market risk. 43

Short-selling restrictions • In an attempt to stabilize the financial markets, the SEC implemented a temporary short-selling ban on 900 financial stocks in September. • The ban was lifted in early October. • Short-selling has declined since then: • Reduced hedge fund activity? • Uncertainty of further restrictions? • Increased use of short ETFs? 44

Short-selling restrictions • In an attempt to stabilize the financial markets, the SEC implemented a temporary short-selling ban on 900 financial stocks in September. • The ban was lifted in early October. • Short-selling has declined since then: • Reduced hedge fund activity? • Uncertainty of further restrictions? • Increased use of short ETFs? 44

Market neutral long-short equity • A long-short portfolio is constructed to go long the markets (or securities) that are most attractive and to short the markets (or securities) that are least attractive. • Security or market selection can be based on valuations, factors (ex. , book -to-market), general economic conditions 45

Market neutral long-short equity • A long-short portfolio is constructed to go long the markets (or securities) that are most attractive and to short the markets (or securities) that are least attractive. • Security or market selection can be based on valuations, factors (ex. , book -to-market), general economic conditions 45

Market neutral long-short equity • Benefits of relaxing the short selling constraint: • An active manager can take full advantage of their research regarding securities that will underperform and with short-selling the potential return is considerably greater than with underweighting (in a long-only portfolio). • The manager can reduce the portfolio’s exposure to the market. • The efficient frontier can be moved outward resulting in more efficient portfolios. 46

Market neutral long-short equity • Benefits of relaxing the short selling constraint: • An active manager can take full advantage of their research regarding securities that will underperform and with short-selling the potential return is considerably greater than with underweighting (in a long-only portfolio). • The manager can reduce the portfolio’s exposure to the market. • The efficient frontier can be moved outward resulting in more efficient portfolios. 46

Market neutral long-short equity • The benchmark against which longshort portfolio returns are measured against is usually the risk-free rate (or some other short-term cash return). • However, overall market movements do effect long-short portfolios. 47

Market neutral long-short equity • The benchmark against which longshort portfolio returns are measured against is usually the risk-free rate (or some other short-term cash return). • However, overall market movements do effect long-short portfolios. 47

Market neutral long-short equity • The original hedge funds developed long-short portfolios to “hedge” against the market. • They were very successful around the stock market crash (of 1987) because investors were not exposed to the market factor. 48

Market neutral long-short equity • The original hedge funds developed long-short portfolios to “hedge” against the market. • They were very successful around the stock market crash (of 1987) because investors were not exposed to the market factor. 48

130/30 Equity Strategies (Enhanced active equity) • A 130/30 equity strategy is a cross between a long-only strategy and a long-short strategy. • The term ‘ 130/30’ refers to 130% in long positions and 30% in short positions. 49

130/30 Equity Strategies (Enhanced active equity) • A 130/30 equity strategy is a cross between a long-only strategy and a long-short strategy. • The term ‘ 130/30’ refers to 130% in long positions and 30% in short positions. 49

130/30 Equity Strategies • Benefits: • This strategy allows managers to get the full benefit from their research, short stocks that they expect will underperform. • They can continue to maintain their market exposure (beta). 50

130/30 Equity Strategies • Benefits: • This strategy allows managers to get the full benefit from their research, short stocks that they expect will underperform. • They can continue to maintain their market exposure (beta). 50

Costs of establishing a strategy with a short component can include. . • Establishing an account with a prime broker – usually about 0. 5% of market value shorted • Margin limits and cost. • Dividend payment on short positions • Transaction costs for rebalancing (monthly rebalancing may result in 100 -200% annual turnover for market neutral portfolios). • Cost of borrowing: • The rebate received on cash placed as collateral offsets some of the costs. • The difference between the borrowing cost and rebate rate is around 40 basis points. 51

Costs of establishing a strategy with a short component can include. . • Establishing an account with a prime broker – usually about 0. 5% of market value shorted • Margin limits and cost. • Dividend payment on short positions • Transaction costs for rebalancing (monthly rebalancing may result in 100 -200% annual turnover for market neutral portfolios). • Cost of borrowing: • The rebate received on cash placed as collateral offsets some of the costs. • The difference between the borrowing cost and rebate rate is around 40 basis points. 51

Enhanced prime brokerage • Enhanced active strategies depend on a prime brokerage structure that allow investors to establish a stock loan account with a broker. • The investor is a counterparty to the loan transaction and not a customer of the prime broker as is the case with a regular margin account. 52

Enhanced prime brokerage • Enhanced active strategies depend on a prime brokerage structure that allow investors to establish a stock loan account with a broker. • The investor is a counterparty to the loan transaction and not a customer of the prime broker as is the case with a regular margin account. 52

Enhanced prime brokerage vs. margin accounts • In a prime brokerage structure • Investors can borrow directly the shares they want to sell short. The long shares serve as collateral • Therefore the proceeds from the short sale are available for purchasing securities long. 53

Enhanced prime brokerage vs. margin accounts • In a prime brokerage structure • Investors can borrow directly the shares they want to sell short. The long shares serve as collateral • Therefore the proceeds from the short sale are available for purchasing securities long. 53

Enhanced prime brokerage vs. margin accounts • In a prime brokerage structure • No cash buffer (for losses in short positions) is required since the long securities are collateral for the short positions. • For a margin account, the buffer may be up to 10% of the capital 54

Enhanced prime brokerage vs. margin accounts • In a prime brokerage structure • No cash buffer (for losses in short positions) is required since the long securities are collateral for the short positions. • For a margin account, the buffer may be up to 10% of the capital 54

Enhanced prime brokerage vs. margin accounts • In a prime brokerage structure • No cash buffer (for losses in short positions) is required since the long securities are collateral for the short positions. • For a margin account, the buffer may be up to 10% of the capital 55

Enhanced prime brokerage vs. margin accounts • In a prime brokerage structure • No cash buffer (for losses in short positions) is required since the long securities are collateral for the short positions. • For a margin account, the buffer may be up to 10% of the capital 55

Enhanced prime brokerage vs. margin accounts • In a prime brokerage structure • The investor is not subject to Regulation T since the investor is a counterparty in the stock loan amount rather than a customer of the prime broker. • Reg T specifies that an equity margin account be at least 50% collateralized. 56

Enhanced prime brokerage vs. margin accounts • In a prime brokerage structure • The investor is not subject to Regulation T since the investor is a counterparty in the stock loan amount rather than a customer of the prime broker. • Reg T specifies that an equity margin account be at least 50% collateralized. 56

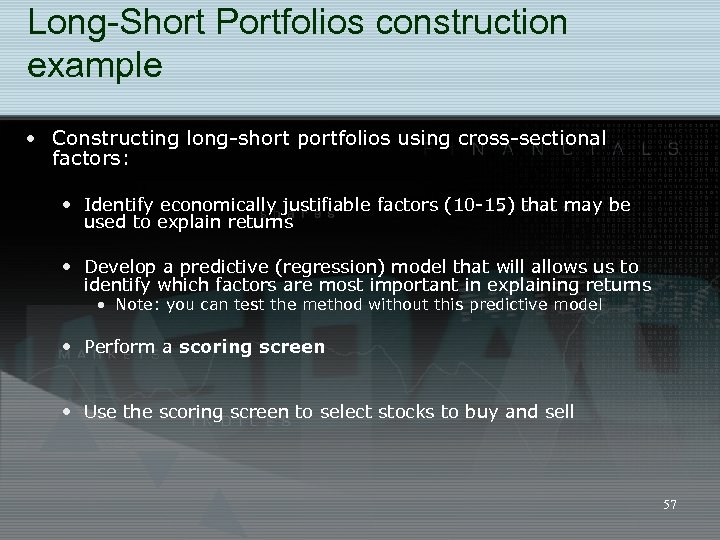

Long-Short Portfolios construction example • Constructing long-short portfolios using cross-sectional factors: • Identify economically justifiable factors (10 -15) that may be used to explain returns • Develop a predictive (regression) model that will allows us to identify which factors are most important in explaining returns • Note: you can test the method without this predictive model • Perform a scoring screen • Use the scoring screen to select stocks to buy and sell 57

Long-Short Portfolios construction example • Constructing long-short portfolios using cross-sectional factors: • Identify economically justifiable factors (10 -15) that may be used to explain returns • Develop a predictive (regression) model that will allows us to identify which factors are most important in explaining returns • Note: you can test the method without this predictive model • Perform a scoring screen • Use the scoring screen to select stocks to buy and sell 57

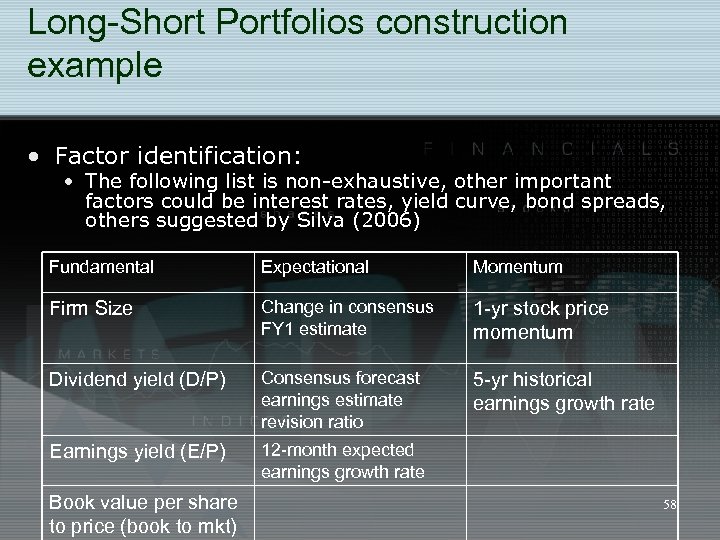

Long-Short Portfolios construction example • Factor identification: • The following list is non-exhaustive, other important factors could be interest rates, yield curve, bond spreads, others suggested by Silva (2006) Fundamental Expectational Momentum Firm Size Change in consensus FY 1 estimate 1 -yr stock price momentum Dividend yield (D/P) Consensus forecast earnings estimate revision ratio 5 -yr historical earnings growth rate Earnings yield (E/P) 12 -month expected earnings growth rate Book value per share to price (book to mkt) 58

Long-Short Portfolios construction example • Factor identification: • The following list is non-exhaustive, other important factors could be interest rates, yield curve, bond spreads, others suggested by Silva (2006) Fundamental Expectational Momentum Firm Size Change in consensus FY 1 estimate 1 -yr stock price momentum Dividend yield (D/P) Consensus forecast earnings estimate revision ratio 5 -yr historical earnings growth rate Earnings yield (E/P) 12 -month expected earnings growth rate Book value per share to price (book to mkt) 58

Long-Short Portfolios construction example • Developing a predictive model • Select a basket of stocks (preferably 300 – 500 stocks) • Gather monthly information for each factor for each stock for 5 – 10 years • Gather monthly returns for each stock for the same period 59

Long-Short Portfolios construction example • Developing a predictive model • Select a basket of stocks (preferably 300 – 500 stocks) • Gather monthly information for each factor for each stock for 5 – 10 years • Gather monthly returns for each stock for the same period 59

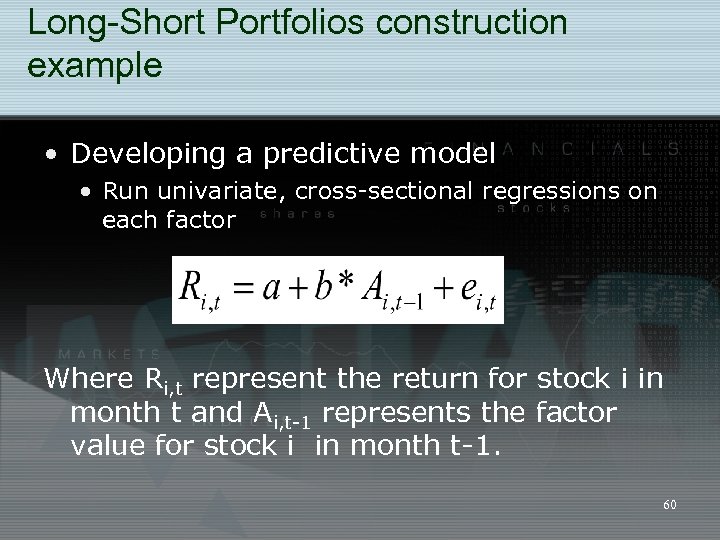

Long-Short Portfolios construction example • Developing a predictive model • Run univariate, cross-sectional regressions on each factor Where Ri, t represent the return for stock i in month t and Ai, t-1 represents the factor value for stock i in month t-1. 60

Long-Short Portfolios construction example • Developing a predictive model • Run univariate, cross-sectional regressions on each factor Where Ri, t represent the return for stock i in month t and Ai, t-1 represents the factor value for stock i in month t-1. 60

Long-Short Portfolios construction example • We need to see how well our model works “out-of-sample”: • Run the regression model for years 1997 -2006. • Identify three factors that provide the greatest explanatory power (R 2) • Use the scoring screen method to select stocks to buy/sell during each month in 2007 • If factors do not work out-of-sample, they are not useful. 61

Long-Short Portfolios construction example • We need to see how well our model works “out-of-sample”: • Run the regression model for years 1997 -2006. • Identify three factors that provide the greatest explanatory power (R 2) • Use the scoring screen method to select stocks to buy/sell during each month in 2007 • If factors do not work out-of-sample, they are not useful. 61

Long-Short Portfolios construction example • Here’s how it works…. • You select a set of 500 stocks (say S&P 500) • You determine that earnings yield, book to price and 1 year price momentum are most useful factors in explaining monthly returns. • for example, firms with high earnings yield in month t do exceptionally well in month t+1, firms with low earnings yield in month t do 62 poorly in month t +1.

Long-Short Portfolios construction example • Here’s how it works…. • You select a set of 500 stocks (say S&P 500) • You determine that earnings yield, book to price and 1 year price momentum are most useful factors in explaining monthly returns. • for example, firms with high earnings yield in month t do exceptionally well in month t+1, firms with low earnings yield in month t do 62 poorly in month t +1.

Long-Short Portfolios construction example • Here’s how it works…. • Sort all the stocks by earnings yield. • For each of the 500 stocks, you assign a score of 3 (0, -3) if its earnings yield is in the top 100 (middle 300, bottom 100) each month. • You do the same for the other two factors. • Each stock will have a total score between 9 and 9. • The weights assigned to each factor can be altered, or determined by other variables. 63

Long-Short Portfolios construction example • Here’s how it works…. • Sort all the stocks by earnings yield. • For each of the 500 stocks, you assign a score of 3 (0, -3) if its earnings yield is in the top 100 (middle 300, bottom 100) each month. • You do the same for the other two factors. • Each stock will have a total score between 9 and 9. • The weights assigned to each factor can be altered, or determined by other variables. 63

Long-Short Portfolios construction example • Here’s how it works…. • Sort by total score • You purchase the top 50 or 100 stocks and you sell the bottom 50 or 100 stocks. • Repeat this procedure each month. • This is an example of a long-short portfolio where stocks are selected using a scoring screen. 64

Long-Short Portfolios construction example • Here’s how it works…. • Sort by total score • You purchase the top 50 or 100 stocks and you sell the bottom 50 or 100 stocks. • Repeat this procedure each month. • This is an example of a long-short portfolio where stocks are selected using a scoring screen. 64

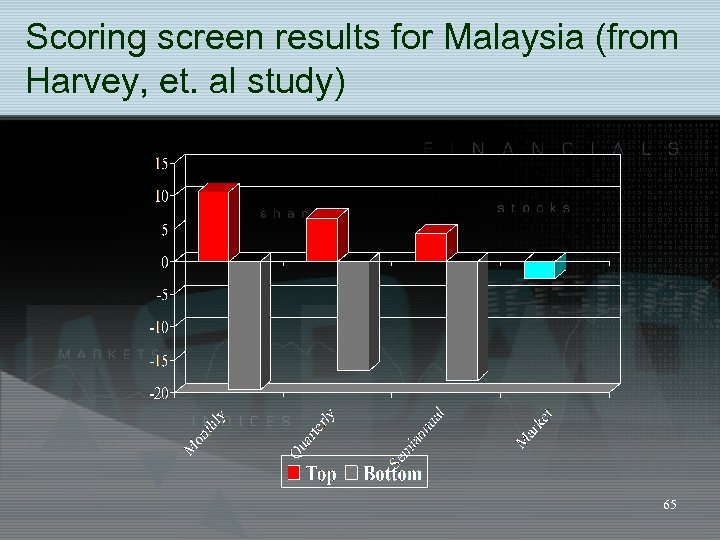

Scoring screen results for Malaysia (from Harvey, et. al study) 65

Scoring screen results for Malaysia (from Harvey, et. al study) 65

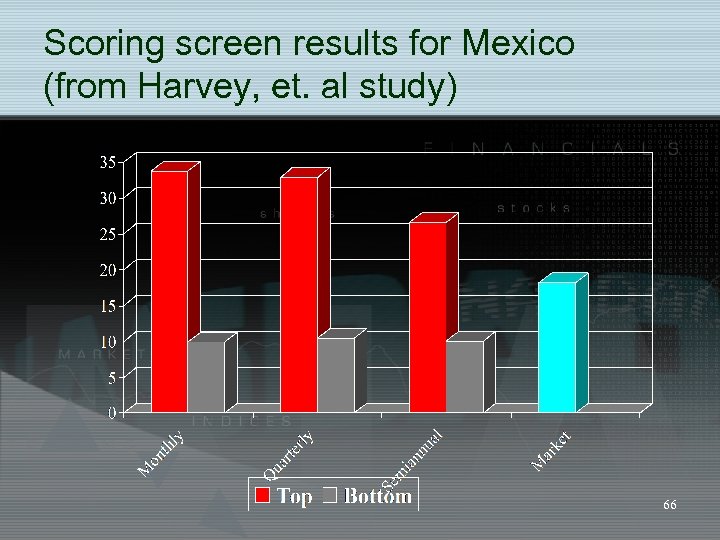

Scoring screen results for Mexico (from Harvey, et. al study) 66

Scoring screen results for Mexico (from Harvey, et. al study) 66

Technical analysis • What is technical analysis? • How can we combine this with fundamental analysis? • How do we read charts? • What are some of the commonly used technical tools and indicators? 67

Technical analysis • What is technical analysis? • How can we combine this with fundamental analysis? • How do we read charts? • What are some of the commonly used technical tools and indicators? 67

Introduction • Technical analysis is the attempt to forecast stock prices on the basis of market-derived data. • Technicians (or quantitative analysts or chartists) are looking for trends and patterns in price and volume data that indicate future price movements. 68

Introduction • Technical analysis is the attempt to forecast stock prices on the basis of market-derived data. • Technicians (or quantitative analysts or chartists) are looking for trends and patterns in price and volume data that indicate future price movements. 68

Fusion Analysis • Practitioners and academics are more accepting of approaches that combine fundamental and technical analyses. These techniques are sometimes referred to as fusion analysis. • Fundamental analysis determines what securities to buy, technical analysis determines when to buy. • Another approach is to use technical analysis to identify groups or sectors, and fundamental analysis to pick stocks. 69

Fusion Analysis • Practitioners and academics are more accepting of approaches that combine fundamental and technical analyses. These techniques are sometimes referred to as fusion analysis. • Fundamental analysis determines what securities to buy, technical analysis determines when to buy. • Another approach is to use technical analysis to identify groups or sectors, and fundamental analysis to pick stocks. 69

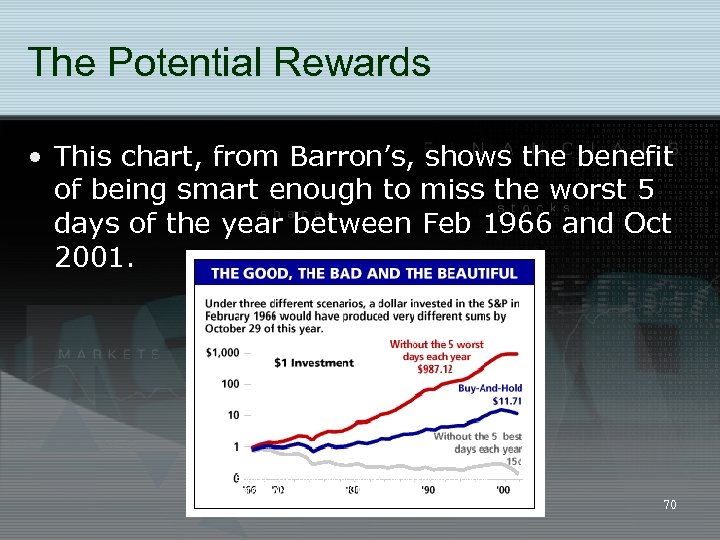

The Potential Rewards • This chart, from Barron’s, shows the benefit of being smart enough to miss the worst 5 days of the year between Feb 1966 and Oct 2001. Source: “The Truth About Timing, ” by Jacqueline Doherty, Barron’s (November 5, 2001) 70

The Potential Rewards • This chart, from Barron’s, shows the benefit of being smart enough to miss the worst 5 days of the year between Feb 1966 and Oct 2001. Source: “The Truth About Timing, ” by Jacqueline Doherty, Barron’s (November 5, 2001) 70

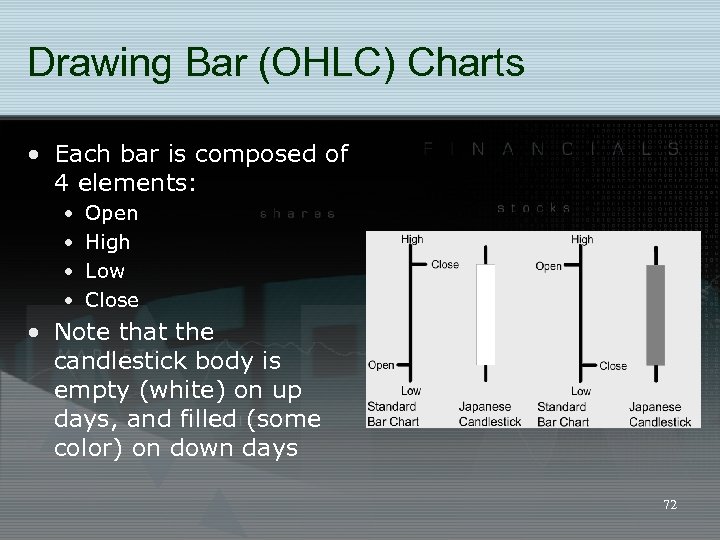

Charting • Chartists use bar charts or candlestick charts to look for patterns which may indicate future price movements. 71

Charting • Chartists use bar charts or candlestick charts to look for patterns which may indicate future price movements. 71

Drawing Bar (OHLC) Charts • Each bar is composed of 4 elements: • • Open High Low Close • Note that the candlestick body is empty (white) on up days, and filled (some color) on down days 72

Drawing Bar (OHLC) Charts • Each bar is composed of 4 elements: • • Open High Low Close • Note that the candlestick body is empty (white) on up days, and filled (some color) on down days 72

Trend lines • There are three basic kinds of trends: • An Up trend where prices are generally increasing. • A Down trend where prices are generally decreasing. • A Trading Range where prices are not moving substantially up or down. 73

Trend lines • There are three basic kinds of trends: • An Up trend where prices are generally increasing. • A Down trend where prices are generally decreasing. • A Trading Range where prices are not moving substantially up or down. 73

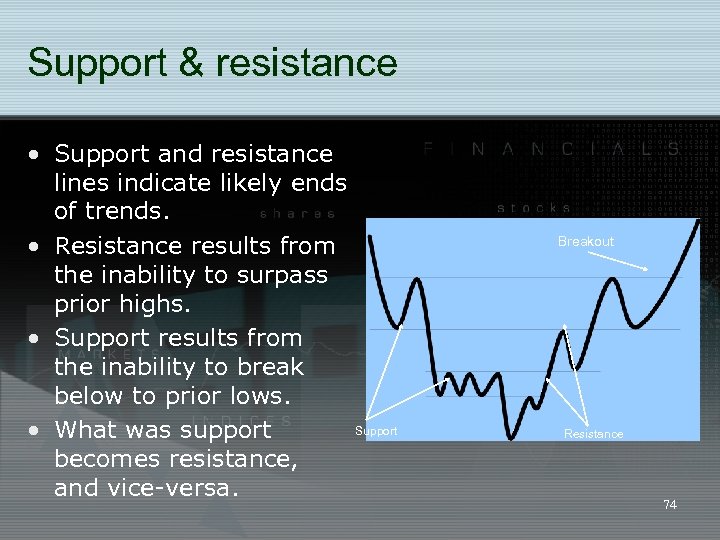

Support & resistance • Support and resistance lines indicate likely ends of trends. • Resistance results from the inability to surpass prior highs. • Support results from the inability to break below to prior lows. Support • What was support becomes resistance, and vice-versa. Breakout Resistance 74

Support & resistance • Support and resistance lines indicate likely ends of trends. • Resistance results from the inability to surpass prior highs. • Support results from the inability to break below to prior lows. Support • What was support becomes resistance, and vice-versa. Breakout Resistance 74

Moving averages • A simple moving average is the average price (usually the closing price) over the last N periods. • They are used to smooth out fluctuations of less than N periods. • An exponential moving average gives more weight to the most recent prices during the N periods. 75

Moving averages • A simple moving average is the average price (usually the closing price) over the last N periods. • They are used to smooth out fluctuations of less than N periods. • An exponential moving average gives more weight to the most recent prices during the N periods. 75

Price patterns • Technicians look for many patterns in the historical time series of prices. • These patterns are reputed to provide information regarding the size and timing of subsequent price moves. 76

Price patterns • Technicians look for many patterns in the historical time series of prices. • These patterns are reputed to provide information regarding the size and timing of subsequent price moves. 76

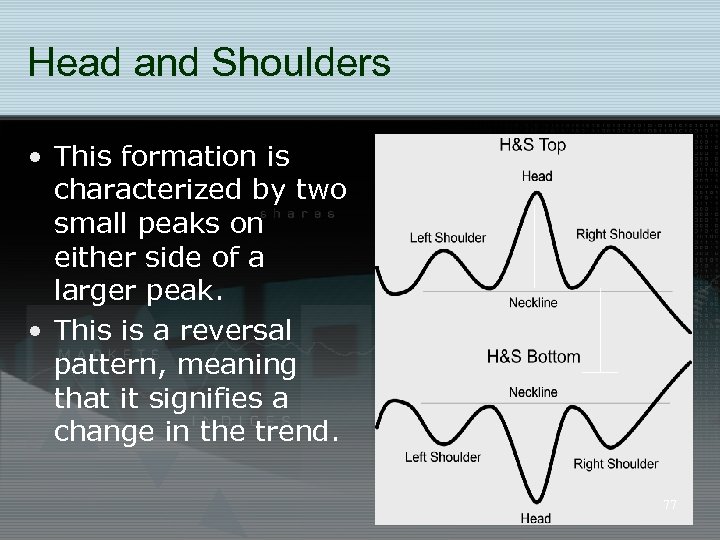

Head and Shoulders • This formation is characterized by two small peaks on either side of a larger peak. • This is a reversal pattern, meaning that it signifies a change in the trend. 77

Head and Shoulders • This formation is characterized by two small peaks on either side of a larger peak. • This is a reversal pattern, meaning that it signifies a change in the trend. 77

Technical Indicators • There are, literally, hundreds of technical indicators used to generate buy and sell signals. • We will look at three of the more commonly used indicators: • Moving Average Convergence/Divergence (MACD) • Relative Strength Index (RSI) • Accumulation/Distribution 78

Technical Indicators • There are, literally, hundreds of technical indicators used to generate buy and sell signals. • We will look at three of the more commonly used indicators: • Moving Average Convergence/Divergence (MACD) • Relative Strength Index (RSI) • Accumulation/Distribution 78

MACD • MACD was developed by Gerald Appel as a way to keep track of a moving average crossover system. • Appel defined MACD as the difference between a 12 -day and 26 -day exponential moving averages. A 9 -day moving average of this difference is used to generate signals. • When this signal line goes from negative to positive, a buy signal is generated. • When the signal line goes from positive to negative, a sell signal is generated. • MACD is best used in choppy (trendless) markets. 79

MACD • MACD was developed by Gerald Appel as a way to keep track of a moving average crossover system. • Appel defined MACD as the difference between a 12 -day and 26 -day exponential moving averages. A 9 -day moving average of this difference is used to generate signals. • When this signal line goes from negative to positive, a buy signal is generated. • When the signal line goes from positive to negative, a sell signal is generated. • MACD is best used in choppy (trendless) markets. 79

Relative Strength Index (RSI) • RSI was developed by Welles Wilder as an oscillator to gauge overbought/oversold levels. • RSI is a rescaled measure of the ratio of average price changes on up days to average price changes on down days. • The most important thing to understand about RSI is that a level above 70 indicates a stock is overbought, and a level below 30 indicates that it is oversold (it can range from 0 to 100). 80

Relative Strength Index (RSI) • RSI was developed by Welles Wilder as an oscillator to gauge overbought/oversold levels. • RSI is a rescaled measure of the ratio of average price changes on up days to average price changes on down days. • The most important thing to understand about RSI is that a level above 70 indicates a stock is overbought, and a level below 30 indicates that it is oversold (it can range from 0 to 100). 80

Accumulation/Distribution Line (volume indicator) • The Accumulation/Distribution Line was developed by Marc Chaikin to assess the cumulative flow of money into and out of a security. • The basic premise with this indicator is that volume precedes price. • Accumulation (distribution): when day’s closing price is higher (lower) than previous day’s close. • On accumulation (distribution) days the day’s volume is added (subtracted) from the previous days Acc/Dist line. 81

Accumulation/Distribution Line (volume indicator) • The Accumulation/Distribution Line was developed by Marc Chaikin to assess the cumulative flow of money into and out of a security. • The basic premise with this indicator is that volume precedes price. • Accumulation (distribution): when day’s closing price is higher (lower) than previous day’s close. • On accumulation (distribution) days the day’s volume is added (subtracted) from the previous days Acc/Dist line. 81

Accumulation/Distribution Line (volume indicator) • This indicator can be used to find situations in which the indicator is heading in the opposite direction as the price. • For example, downward price trend but upward Acc/Dist line would indicate that on up days volume is high, on down days, volume is low but there are more down days than up days. This suggests a reversal in price in the near term. 82

Accumulation/Distribution Line (volume indicator) • This indicator can be used to find situations in which the indicator is heading in the opposite direction as the price. • For example, downward price trend but upward Acc/Dist line would indicate that on up days volume is high, on down days, volume is low but there are more down days than up days. This suggests a reversal in price in the near term. 82

Readings • RB 6 • RB 16 (pgs. 606 - 612) • RM 4 83

Readings • RB 6 • RB 16 (pgs. 606 - 612) • RM 4 83