bff621e594937714dd8fe53849e0086d.ppt

- Количество слайдов: 48

Equity. Compass Portfolio and Stock Selection Insights 2010 Portfolio Management Institute Forum Investment Advisory Services

Equity. Compass Portfolio and Stock Selection Insights 2010 Portfolio Management Institute Forum Investment Advisory Services

Table of Contents I Equity. Compass Overview II Blueprint for Core Investing III Equity. Compass Market Cycle Ratings & Ranks IV Investment Philosophy & Principles for Stock Selection Investment Advisory Services 2

Table of Contents I Equity. Compass Overview II Blueprint for Core Investing III Equity. Compass Market Cycle Ratings & Ranks IV Investment Philosophy & Principles for Stock Selection Investment Advisory Services 2

Equity. Compass Overview Subsidiary of Stifel Financial Full-service brokerage and investment banking firm Firm History u Over the past decade, Equity. Compass has evolved from a pure investment research provider to an investment advisory firm providing quantitative investment portfolios and products on the Stifel Nicolaus platform January 1998 October 2001 Launched as the Portfolio Strategy Group at Legg Mason u SEC Registered Investment Adviser Started publishing stock recommendations and portfolio strategies June 2008 December 2005 • Part of Stifel Nicolaus’ acquisition of Legg Mason Capital Markets • Equity. Compass portfolios first Equity. Compass becomes a subsidiary of Stifel Financial and an SEC Registered Investment Adviser offered on the Stifel platform The investment team is led by Richard Cripps, CIO. u Former Managing Director of Portfolio Strategy at Stifel Nicolaus u Former Chief Market Strategist and Co-chairman of the investment committee at Legg Mason Wood Walker Equity. Compass Current Offerings u Quantitative based Investment portfolios and products u Offered via Stifel Nicolaus as managed accounts and as investment products like structured notes u Partners with institutional clients in the U. S. and Europe to develop investment solutions tailored to specific objectives u Over $350 million under management u u Current offerings include u U. S. – Six managed account portfolios and one equity-linked note on the Stifel Nicolaus platform u Europe – Equity certificate issued via Sociéte Générale Provide investment research, market commentary, and investment tools u Distributed by Stifel Nicolaus to its institutional clients Investment Advisory Services 3

Equity. Compass Overview Subsidiary of Stifel Financial Full-service brokerage and investment banking firm Firm History u Over the past decade, Equity. Compass has evolved from a pure investment research provider to an investment advisory firm providing quantitative investment portfolios and products on the Stifel Nicolaus platform January 1998 October 2001 Launched as the Portfolio Strategy Group at Legg Mason u SEC Registered Investment Adviser Started publishing stock recommendations and portfolio strategies June 2008 December 2005 • Part of Stifel Nicolaus’ acquisition of Legg Mason Capital Markets • Equity. Compass portfolios first Equity. Compass becomes a subsidiary of Stifel Financial and an SEC Registered Investment Adviser offered on the Stifel platform The investment team is led by Richard Cripps, CIO. u Former Managing Director of Portfolio Strategy at Stifel Nicolaus u Former Chief Market Strategist and Co-chairman of the investment committee at Legg Mason Wood Walker Equity. Compass Current Offerings u Quantitative based Investment portfolios and products u Offered via Stifel Nicolaus as managed accounts and as investment products like structured notes u Partners with institutional clients in the U. S. and Europe to develop investment solutions tailored to specific objectives u Over $350 million under management u u Current offerings include u U. S. – Six managed account portfolios and one equity-linked note on the Stifel Nicolaus platform u Europe – Equity certificate issued via Sociéte Générale Provide investment research, market commentary, and investment tools u Distributed by Stifel Nicolaus to its institutional clients Investment Advisory Services 3

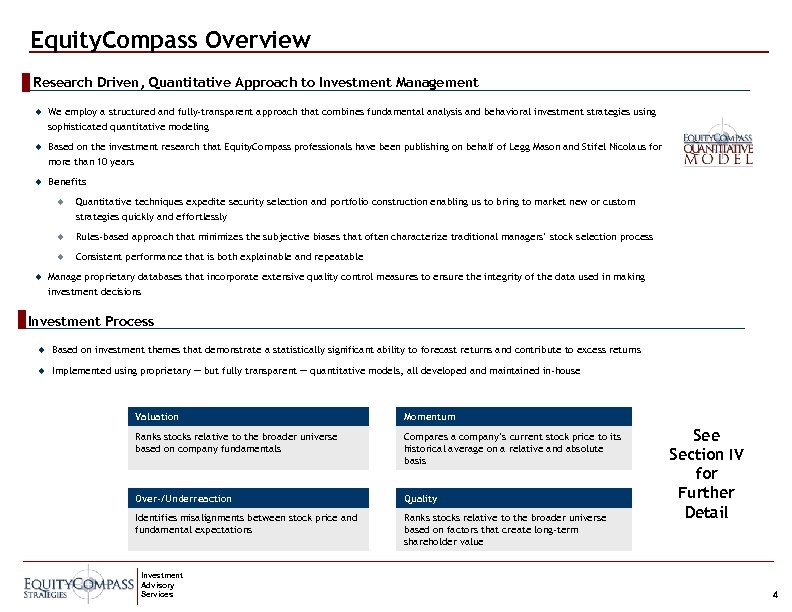

Equity. Compass Overview Research Driven, Quantitative Approach to Investment Management u We employ a structured and fully-transparent approach that combines fundamental analysis and behavioral investment strategies using sophisticated quantitative modeling u Based on the investment research that Equity. Compass professionals have been publishing on behalf of Legg Mason and Stifel Nicolaus for more than 10 years u Benefits u u Rules-based approach that minimizes the subjective biases that often characterize traditional managers’ stock selection process u u Quantitative techniques expedite security selection and portfolio construction enabling us to bring to market new or custom strategies quickly and effortlessly Consistent performance that is both explainable and repeatable Manage proprietary databases that incorporate extensive quality control measures to ensure the integrity of the data used in making investment decisions Investment Process u Based on investment themes that demonstrate a statistically significant ability to forecast returns and contribute to excess returns u Implemented using proprietary — but fully transparent — quantitative models, all developed and maintained in-house Valuation Momentum Ranks stocks relative to the broader universe based on company fundamentals Compares a company’s current stock price to its historical average on a relative and absolute basis Over-/Underreaction Quality Identifies misalignments between stock price and fundamental expectations Ranks stocks relative to the broader universe based on factors that create long-term shareholder value Investment Advisory Services See Section IV for Further Detail 4

Equity. Compass Overview Research Driven, Quantitative Approach to Investment Management u We employ a structured and fully-transparent approach that combines fundamental analysis and behavioral investment strategies using sophisticated quantitative modeling u Based on the investment research that Equity. Compass professionals have been publishing on behalf of Legg Mason and Stifel Nicolaus for more than 10 years u Benefits u u Rules-based approach that minimizes the subjective biases that often characterize traditional managers’ stock selection process u u Quantitative techniques expedite security selection and portfolio construction enabling us to bring to market new or custom strategies quickly and effortlessly Consistent performance that is both explainable and repeatable Manage proprietary databases that incorporate extensive quality control measures to ensure the integrity of the data used in making investment decisions Investment Process u Based on investment themes that demonstrate a statistically significant ability to forecast returns and contribute to excess returns u Implemented using proprietary — but fully transparent — quantitative models, all developed and maintained in-house Valuation Momentum Ranks stocks relative to the broader universe based on company fundamentals Compares a company’s current stock price to its historical average on a relative and absolute basis Over-/Underreaction Quality Identifies misalignments between stock price and fundamental expectations Ranks stocks relative to the broader universe based on factors that create long-term shareholder value Investment Advisory Services See Section IV for Further Detail 4

II Blueprint for Core Investing 5

II Blueprint for Core Investing 5

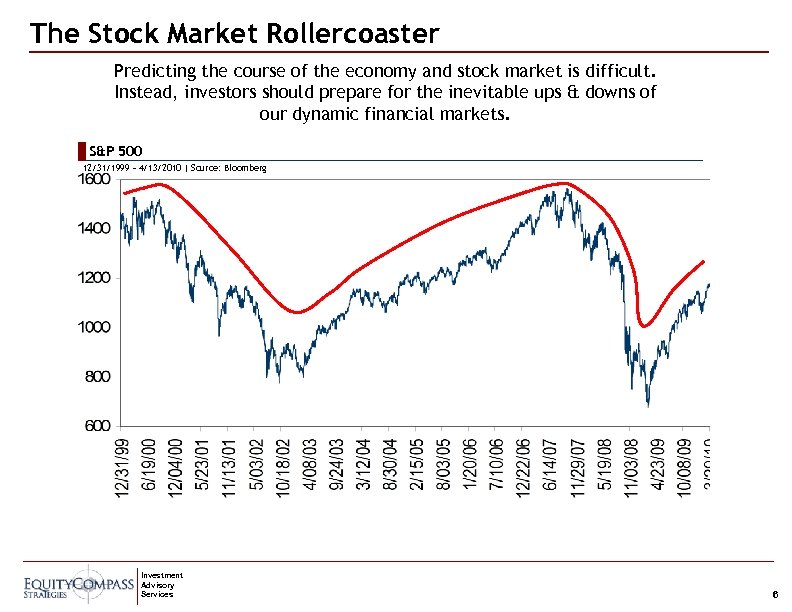

The Stock Market Rollercoaster Predicting the course of the economy and stock market is difficult. Instead, investors should prepare for the inevitable ups & downs of our dynamic financial markets. S&P 500 12/31/1999 – 4/13/2010 | Source: Bloomberg Investment Advisory Services 6

The Stock Market Rollercoaster Predicting the course of the economy and stock market is difficult. Instead, investors should prepare for the inevitable ups & downs of our dynamic financial markets. S&P 500 12/31/1999 – 4/13/2010 | Source: Bloomberg Investment Advisory Services 6

The Ebb & Flow of Equity Market Performance u Since 1928, there have been 92 instances of a market pullback of 10% or more, for an average of 1 every 11 months. Since 1960, the average is 1 in every 15 months. The current market recovery is now in its 13 th month of recovery without a 10% or more market correction. u Market pullbacks are often a correction of investor sentiment or expectations that are ahead of fundamentals. Two-thirds of historical market corrections have been sentiment-related, are relatively brief (average of 2 months), and represent good buying opportunities. u One-third of market pullbacks exceed 20% and are defined as a bear market with deteriorating fundamentals. Bear markets occur, on average, about every 3– 4 years. u The periods from 1990 to 1997 and 2003 to 2008 were the two longest stretches without a 10% or more market pullback. These periods likely lulled investors to complacency and an underestimation as to the risks of equity investing. The complacency exaggerated the emotional impact of the 2008 bear market. u Stocks are an undeniable long-term wealth creator but their path higher is uneven and unpredictable in the short-term. Investment Advisory Services 7

The Ebb & Flow of Equity Market Performance u Since 1928, there have been 92 instances of a market pullback of 10% or more, for an average of 1 every 11 months. Since 1960, the average is 1 in every 15 months. The current market recovery is now in its 13 th month of recovery without a 10% or more market correction. u Market pullbacks are often a correction of investor sentiment or expectations that are ahead of fundamentals. Two-thirds of historical market corrections have been sentiment-related, are relatively brief (average of 2 months), and represent good buying opportunities. u One-third of market pullbacks exceed 20% and are defined as a bear market with deteriorating fundamentals. Bear markets occur, on average, about every 3– 4 years. u The periods from 1990 to 1997 and 2003 to 2008 were the two longest stretches without a 10% or more market pullback. These periods likely lulled investors to complacency and an underestimation as to the risks of equity investing. The complacency exaggerated the emotional impact of the 2008 bear market. u Stocks are an undeniable long-term wealth creator but their path higher is uneven and unpredictable in the short-term. Investment Advisory Services 7

Key Investment Risks u Buying and selling at the wrong time u Poor investment process that does not effectively capture market returns u Staying invested over desired investment horizon Investment Advisory Services 8

Key Investment Risks u Buying and selling at the wrong time u Poor investment process that does not effectively capture market returns u Staying invested over desired investment horizon Investment Advisory Services 8

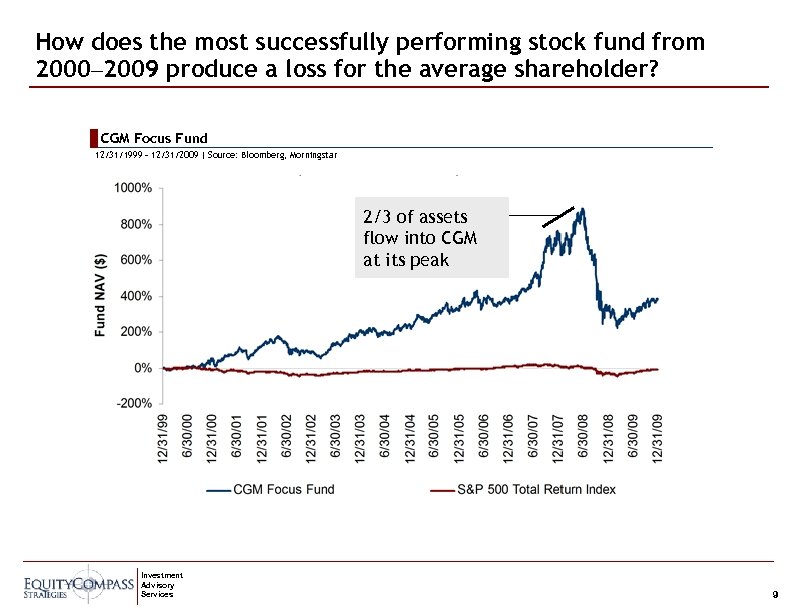

How does the most successfully performing stock fund from 2000– 2009 produce a loss for the average shareholder? CGM Focus Fund 12/31/1999 – 12/31/2009 | Source: Bloomberg, Morningstar 2/3 of assets flow into CGM at its peak Investment Advisory Services 9

How does the most successfully performing stock fund from 2000– 2009 produce a loss for the average shareholder? CGM Focus Fund 12/31/1999 – 12/31/2009 | Source: Bloomberg, Morningstar 2/3 of assets flow into CGM at its peak Investment Advisory Services 9

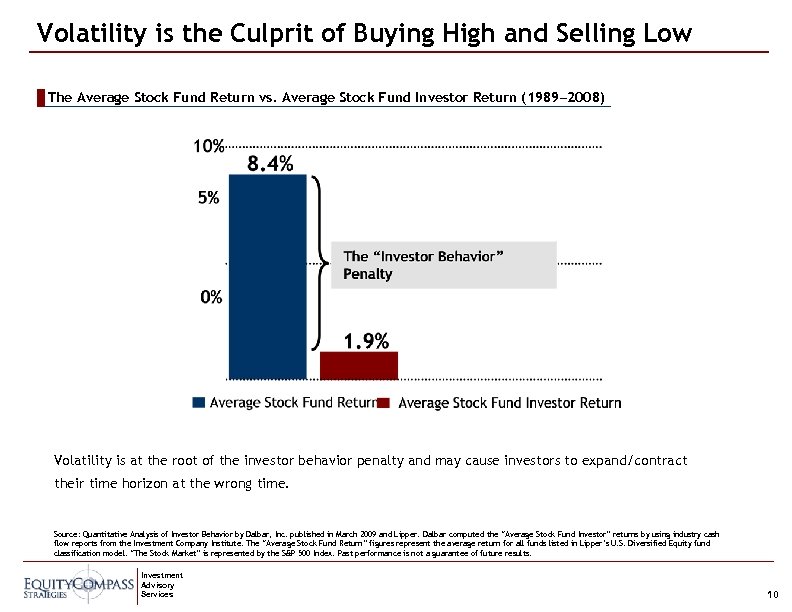

Volatility is the Culprit of Buying High and Selling Low The Average Stock Fund Return vs. Average Stock Fund Investor Return (1989– 2008) Volatility is at the root of the investor behavior penalty and may cause investors to expand/contract their time horizon at the wrong time. Source: Quantitative Analysis of Investor Behavior by Dalbar, Inc. published in March 2009 and Lipper. Dalbar computed the “Average Stock Fund Investor” returns by using industry cash flow reports from the Investment Company Institute. The “Average Stock Fund Return” figures represent the average return for all funds listed in Lipper‘s U. S. Diversified Equity fund classification model. “The Stock Market” is represented by the S&P 500 Index. Past performance is not a guarantee of future results. Investment Advisory Services 10

Volatility is the Culprit of Buying High and Selling Low The Average Stock Fund Return vs. Average Stock Fund Investor Return (1989– 2008) Volatility is at the root of the investor behavior penalty and may cause investors to expand/contract their time horizon at the wrong time. Source: Quantitative Analysis of Investor Behavior by Dalbar, Inc. published in March 2009 and Lipper. Dalbar computed the “Average Stock Fund Investor” returns by using industry cash flow reports from the Investment Company Institute. The “Average Stock Fund Return” figures represent the average return for all funds listed in Lipper‘s U. S. Diversified Equity fund classification model. “The Stock Market” is represented by the S&P 500 Index. Past performance is not a guarantee of future results. Investment Advisory Services 10

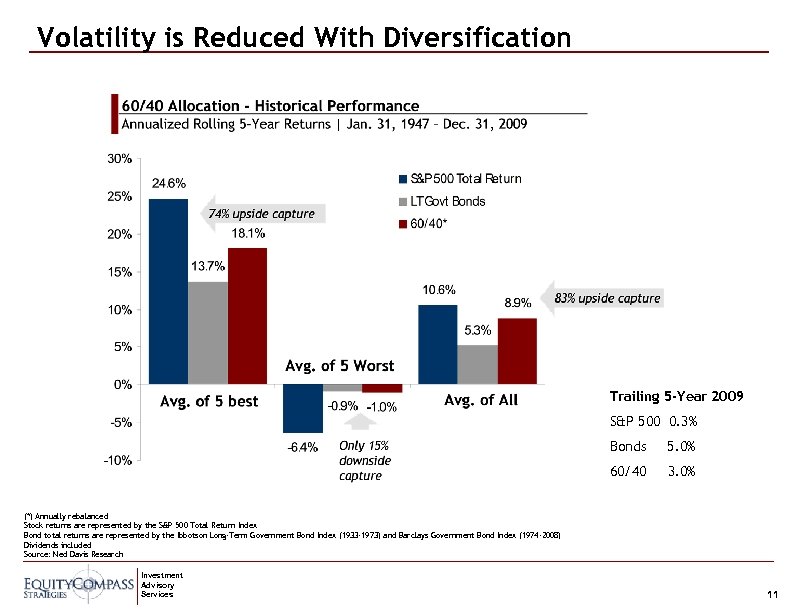

Volatility is Reduced With Diversification Trailing 5 -Year 2009 S&P 500 0. 3% Bonds 5. 0% 60/40 3. 0% (*) Annually rebalanced Stock returns are represented by the S&P 500 Total Return Index Bond total returns are represented by the Ibbotson Long-Term Government Bond Index (1933 -1973) and Barclays Government Bond Index (1974 -2008) Dividends included Source: Ned Davis Research Investment Advisory Services 11

Volatility is Reduced With Diversification Trailing 5 -Year 2009 S&P 500 0. 3% Bonds 5. 0% 60/40 3. 0% (*) Annually rebalanced Stock returns are represented by the S&P 500 Total Return Index Bond total returns are represented by the Ibbotson Long-Term Government Bond Index (1933 -1973) and Barclays Government Bond Index (1974 -2008) Dividends included Source: Ned Davis Research Investment Advisory Services 11

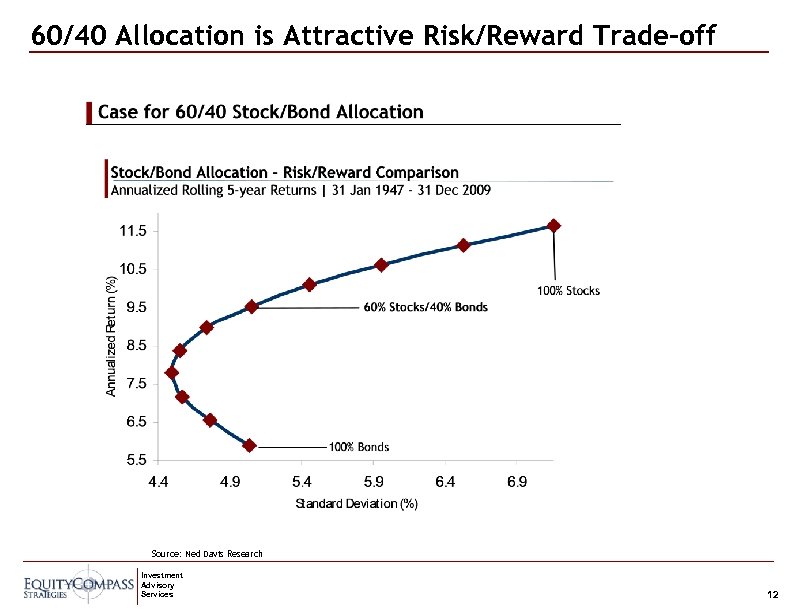

60/40 Allocation is Attractive Risk/Reward Trade-off Source: Ned Davis Research Investment Advisory Services 12

60/40 Allocation is Attractive Risk/Reward Trade-off Source: Ned Davis Research Investment Advisory Services 12

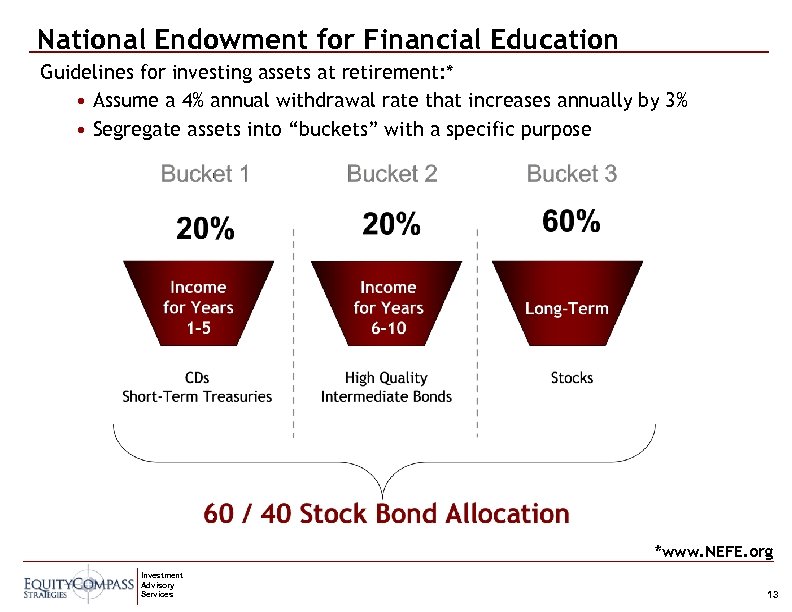

National Endowment for Financial Education Guidelines for investing assets at retirement: * • Assume a 4% annual withdrawal rate that increases annually by 3% • Segregate assets into “buckets” with a specific purpose *www. NEFE. org Investment Advisory Services 13

National Endowment for Financial Education Guidelines for investing assets at retirement: * • Assume a 4% annual withdrawal rate that increases annually by 3% • Segregate assets into “buckets” with a specific purpose *www. NEFE. org Investment Advisory Services 13

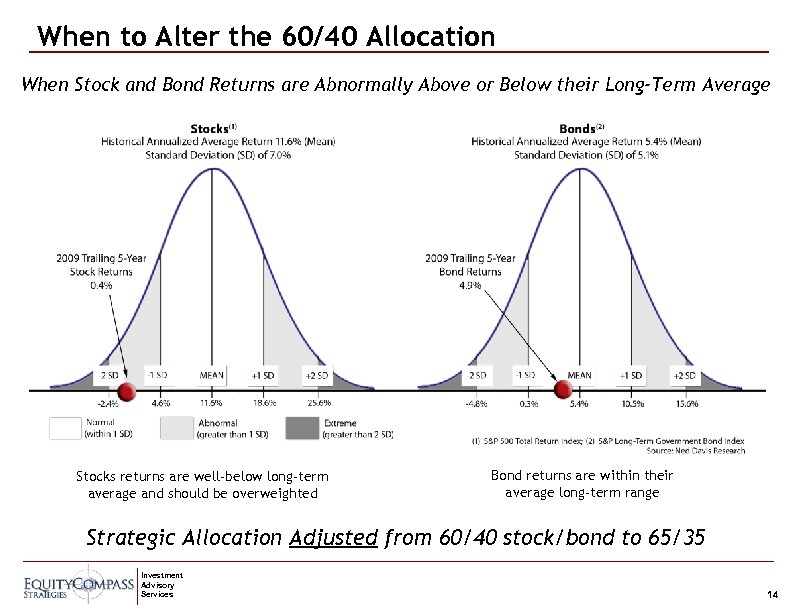

When to Alter the 60/40 Allocation When Stock and Bond Returns are Abnormally Above or Below their Long-Term Average Stocks returns are well-below long-term average and should be overweighted Bond returns are within their average long-term range Strategic Allocation Adjusted from 60/40 stock/bond to 65/35 Investment Advisory Services 14

When to Alter the 60/40 Allocation When Stock and Bond Returns are Abnormally Above or Below their Long-Term Average Stocks returns are well-below long-term average and should be overweighted Bond returns are within their average long-term range Strategic Allocation Adjusted from 60/40 stock/bond to 65/35 Investment Advisory Services 14

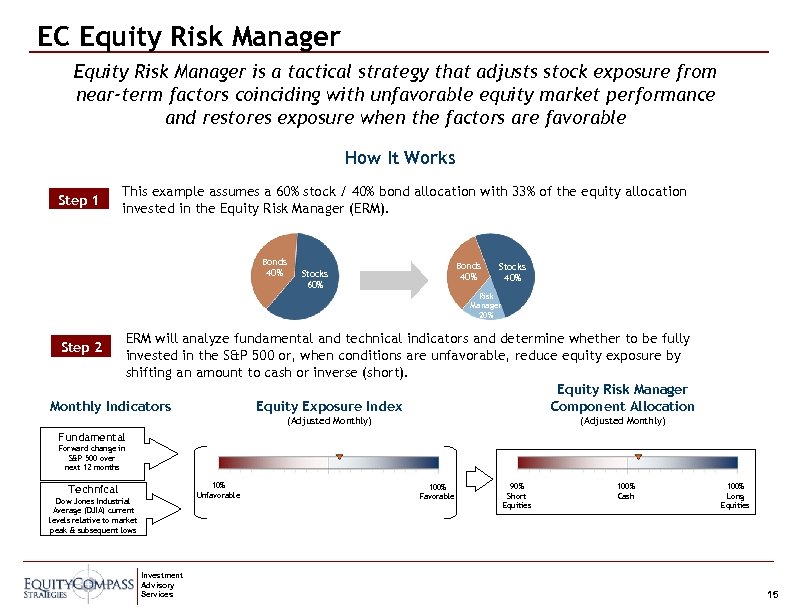

EC Equity Risk Manager is a tactical strategy that adjusts stock exposure from near-term factors coinciding with unfavorable equity market performance and restores exposure when the factors are favorable How It Works Step 1 This example assumes a 60% stock / 40% bond allocation with 33% of the equity allocation invested in the Equity Risk Manager (ERM). Bonds 40% Stocks 60% Stocks 40% Risk Manager 20% ERM will analyze fundamental and technical indicators and determine whether to be fully invested in the S&P 500 or, when conditions are unfavorable, reduce equity exposure by shifting an amount to cash or inverse (short). Equity Risk Manager Component Allocation Monthly Indicators Equity Exposure Index Step 2 (Adjusted Monthly) Fundamental Forward change in S&P 500 over next 12 months 10% Unfavorable Technical Dow Jones Industrial Average (DJIA) current levels relative to market peak & subsequent lows Investment Advisory Services 100% Favorable 90% Short Equities 100% Cash 100% Long Equities 15

EC Equity Risk Manager is a tactical strategy that adjusts stock exposure from near-term factors coinciding with unfavorable equity market performance and restores exposure when the factors are favorable How It Works Step 1 This example assumes a 60% stock / 40% bond allocation with 33% of the equity allocation invested in the Equity Risk Manager (ERM). Bonds 40% Stocks 60% Stocks 40% Risk Manager 20% ERM will analyze fundamental and technical indicators and determine whether to be fully invested in the S&P 500 or, when conditions are unfavorable, reduce equity exposure by shifting an amount to cash or inverse (short). Equity Risk Manager Component Allocation Monthly Indicators Equity Exposure Index Step 2 (Adjusted Monthly) Fundamental Forward change in S&P 500 over next 12 months 10% Unfavorable Technical Dow Jones Industrial Average (DJIA) current levels relative to market peak & subsequent lows Investment Advisory Services 100% Favorable 90% Short Equities 100% Cash 100% Long Equities 15

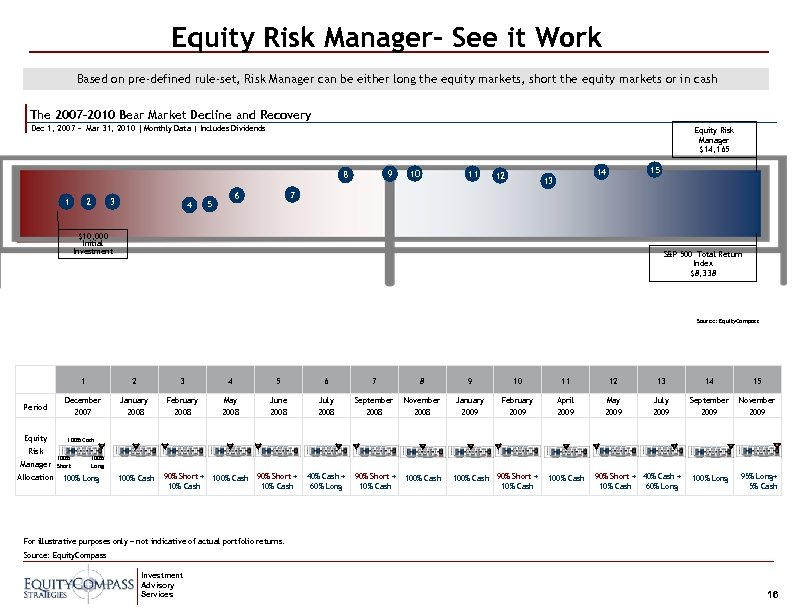

Equity Risk Manager– See it Work Based on pre-defined rule-set, Risk Manager can be either long the equity markets, short the equity markets or in cash The 2007– 2010 Bear Market Decline and Recovery Dec 1, 2007 – Mar 31, 2010 | Monthly Data | Includes Dividends Equity Risk Manager $14, 165 9 8 1 2 3 4 11 12 15 14 13 7 6 5 10 $10, 000 Initial Investment S&P 500 Total Return Index $8, 338 Source: Equity. Compass 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Period December 2007 January 2008 February 2008 May 2008 June 2008 July 2008 September 2008 November 2008 January 2009 February 2009 April 2009 May 2009 July 2009 September 2009 November 2009 Equity 100% Cash 90% Short + 10% Cash 40% Cash + 60% Long 90% Short + 10% Cash 100% Long 95% Long+ 5% Cash Risk Manager Allocation 100% Short 100% Long 100% Cash 90% Short + 100% Cash 90% Short + 10% Cash 100% Cash 90% Short + 40% Cash + 10% Cash 60% Long For illustrative purposes only – not indicative of actual portfolio returns. Source: Equity. Compass Investment Advisory Services 16

Equity Risk Manager– See it Work Based on pre-defined rule-set, Risk Manager can be either long the equity markets, short the equity markets or in cash The 2007– 2010 Bear Market Decline and Recovery Dec 1, 2007 – Mar 31, 2010 | Monthly Data | Includes Dividends Equity Risk Manager $14, 165 9 8 1 2 3 4 11 12 15 14 13 7 6 5 10 $10, 000 Initial Investment S&P 500 Total Return Index $8, 338 Source: Equity. Compass 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Period December 2007 January 2008 February 2008 May 2008 June 2008 July 2008 September 2008 November 2008 January 2009 February 2009 April 2009 May 2009 July 2009 September 2009 November 2009 Equity 100% Cash 90% Short + 10% Cash 40% Cash + 60% Long 90% Short + 10% Cash 100% Long 95% Long+ 5% Cash Risk Manager Allocation 100% Short 100% Long 100% Cash 90% Short + 100% Cash 90% Short + 10% Cash 100% Cash 90% Short + 40% Cash + 10% Cash 60% Long For illustrative purposes only – not indicative of actual portfolio returns. Source: Equity. Compass Investment Advisory Services 16

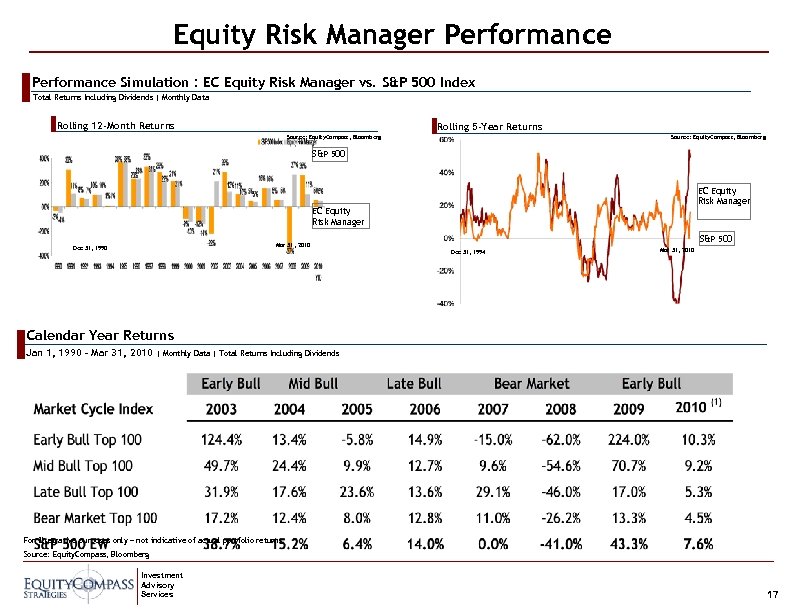

Equity Risk Manager Performance Simulation : EC Equity Risk Manager vs. S&P 500 Index Total Returns Including Dividends | Monthly Data Rolling 12 -Month Returns Rolling 5 -Year Returns Source: Equity. Compass, Bloomberg S&P 500 EC Equity Risk Manager Mar 31, 2010 Dec 31, 1990 S&P 500 Dec 31, 1994 Mar 31, 2010 Calendar Year Returns Jan 1, 1990 – Mar 31, 2010 | Monthly Data | Total Returns Including Dividends For illustrative purposes only – not indicative of actual portfolio returns. Source: Equity. Compass, Bloomberg Investment Advisory Services 17

Equity Risk Manager Performance Simulation : EC Equity Risk Manager vs. S&P 500 Index Total Returns Including Dividends | Monthly Data Rolling 12 -Month Returns Rolling 5 -Year Returns Source: Equity. Compass, Bloomberg S&P 500 EC Equity Risk Manager Mar 31, 2010 Dec 31, 1990 S&P 500 Dec 31, 1994 Mar 31, 2010 Calendar Year Returns Jan 1, 1990 – Mar 31, 2010 | Monthly Data | Total Returns Including Dividends For illustrative purposes only – not indicative of actual portfolio returns. Source: Equity. Compass, Bloomberg Investment Advisory Services 17

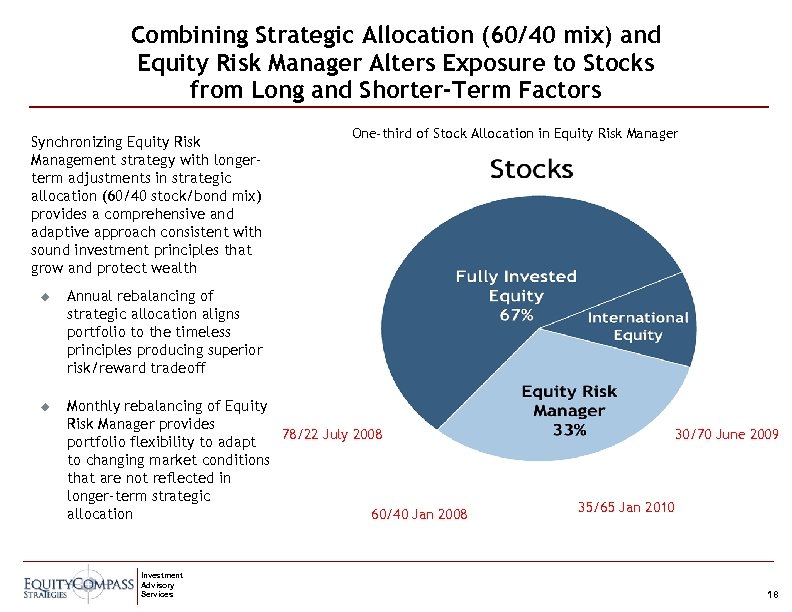

Combining Strategic Allocation (60/40 mix) and Equity Risk Manager Alters Exposure to Stocks from Long and Shorter-Term Factors Synchronizing Equity Risk Management strategy with longerterm adjustments in strategic allocation (60/40 stock/bond mix) provides a comprehensive and adaptive approach consistent with sound investment principles that grow and protect wealth One-third of Stock Allocation in Equity Risk Manager u Annual rebalancing of strategic allocation aligns portfolio to the timeless principles producing superior risk/reward tradeoff u Monthly rebalancing of Equity Risk Manager provides 78/22 July 2008 portfolio flexibility to adapt to changing market conditions that are not reflected in longer-term strategic allocation 60/40 Jan 2008 Investment Advisory Services 30/70 June 2009 35/65 Jan 2010 18

Combining Strategic Allocation (60/40 mix) and Equity Risk Manager Alters Exposure to Stocks from Long and Shorter-Term Factors Synchronizing Equity Risk Management strategy with longerterm adjustments in strategic allocation (60/40 stock/bond mix) provides a comprehensive and adaptive approach consistent with sound investment principles that grow and protect wealth One-third of Stock Allocation in Equity Risk Manager u Annual rebalancing of strategic allocation aligns portfolio to the timeless principles producing superior risk/reward tradeoff u Monthly rebalancing of Equity Risk Manager provides 78/22 July 2008 portfolio flexibility to adapt to changing market conditions that are not reflected in longer-term strategic allocation 60/40 Jan 2008 Investment Advisory Services 30/70 June 2009 35/65 Jan 2010 18

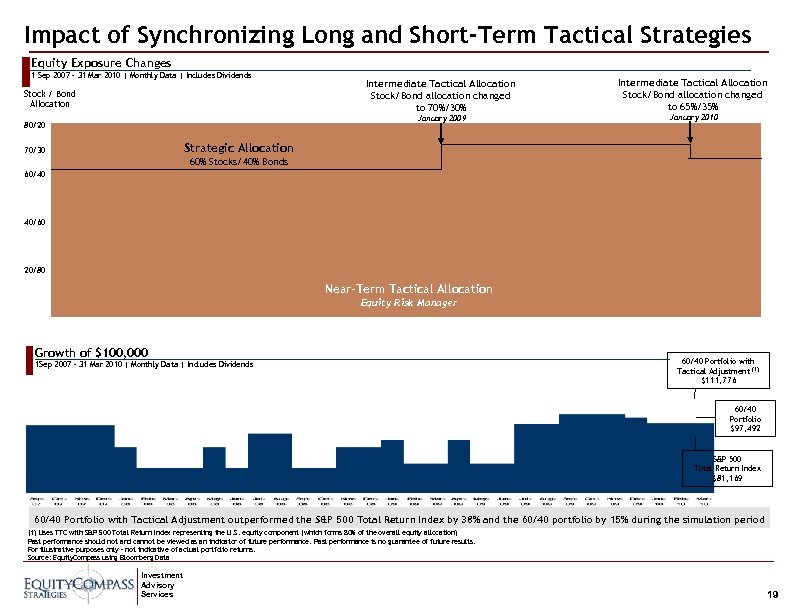

Impact of Synchronizing Long and Short-Term Tactical Strategies Equity Exposure Changes 1 Sep 2007 – 31 Mar 2010 | Monthly Data | Includes Dividends Stock / Bond Allocation Intermediate Tactical Allocation Stock/Bond allocation changed to 70%/30% January 2009 80/20 Intermediate Tactical Allocation Stock/Bond allocation changed to 65%/35% January 2010 Strategic Allocation 70/30 60% Stocks/40% Bonds 60/40 40/60 20/80 Near-Term Tactical Allocation Equity Risk Manager Growth of $100, 000 1 Sep 2007 – 31 Mar 2010 | Monthly Data | Includes Dividends 60/40 Portfolio with Tactical Adjustment (1) $111, 776 60/40 Portfolio $97, 492 S&P 500 Total Return Index $81, 169 60/40 Portfolio with Tactical Adjustment outperformed the S&P 500 Total Return Index by 38% and the 60/40 portfolio by 15% during the simulation period (1) Uses TTC with S&P 500 Total Return Index representing the U. S. equity component (which forms 80% of the overall equity allocation) Past performance should not and cannot be viewed as an indicator of future performance. Past performance is no guarantee of future results. For illustrative purposes only – not indicative of actual portfolio returns. Source: Equity. Compass using Bloomberg Data Investment Advisory Services 19

Impact of Synchronizing Long and Short-Term Tactical Strategies Equity Exposure Changes 1 Sep 2007 – 31 Mar 2010 | Monthly Data | Includes Dividends Stock / Bond Allocation Intermediate Tactical Allocation Stock/Bond allocation changed to 70%/30% January 2009 80/20 Intermediate Tactical Allocation Stock/Bond allocation changed to 65%/35% January 2010 Strategic Allocation 70/30 60% Stocks/40% Bonds 60/40 40/60 20/80 Near-Term Tactical Allocation Equity Risk Manager Growth of $100, 000 1 Sep 2007 – 31 Mar 2010 | Monthly Data | Includes Dividends 60/40 Portfolio with Tactical Adjustment (1) $111, 776 60/40 Portfolio $97, 492 S&P 500 Total Return Index $81, 169 60/40 Portfolio with Tactical Adjustment outperformed the S&P 500 Total Return Index by 38% and the 60/40 portfolio by 15% during the simulation period (1) Uses TTC with S&P 500 Total Return Index representing the U. S. equity component (which forms 80% of the overall equity allocation) Past performance should not and cannot be viewed as an indicator of future performance. Past performance is no guarantee of future results. For illustrative purposes only – not indicative of actual portfolio returns. Source: Equity. Compass using Bloomberg Data Investment Advisory Services 19

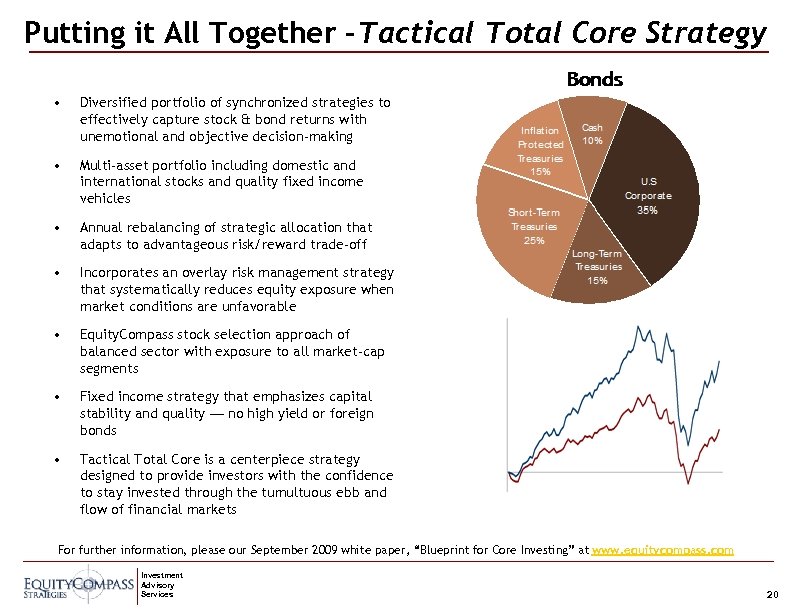

Putting it All Together –Tactical Total Core Strategy • Diversified portfolio of synchronized strategies to effectively capture stock & bond returns with unemotional and objective decision-making • Multi-asset portfolio including domestic and international stocks and quality fixed income vehicles • Annual rebalancing of strategic allocation that adapts to advantageous risk/reward trade-off • Incorporates an overlay risk management strategy that systematically reduces equity exposure when market conditions are unfavorable • Equity. Compass stock selection approach of balanced sector with exposure to all market-cap segments • Fixed income strategy that emphasizes capital stability and quality — no high yield or foreign bonds • Tactical Total Core is a centerpiece strategy designed to provide investors with the confidence to stay invested through the tumultuous ebb and flow of financial markets For further information, please our September 2009 white paper, “Blueprint for Core Investing” at www. equitycompass. com Investment Advisory Services 20

Putting it All Together –Tactical Total Core Strategy • Diversified portfolio of synchronized strategies to effectively capture stock & bond returns with unemotional and objective decision-making • Multi-asset portfolio including domestic and international stocks and quality fixed income vehicles • Annual rebalancing of strategic allocation that adapts to advantageous risk/reward trade-off • Incorporates an overlay risk management strategy that systematically reduces equity exposure when market conditions are unfavorable • Equity. Compass stock selection approach of balanced sector with exposure to all market-cap segments • Fixed income strategy that emphasizes capital stability and quality — no high yield or foreign bonds • Tactical Total Core is a centerpiece strategy designed to provide investors with the confidence to stay invested through the tumultuous ebb and flow of financial markets For further information, please our September 2009 white paper, “Blueprint for Core Investing” at www. equitycompass. com Investment Advisory Services 20

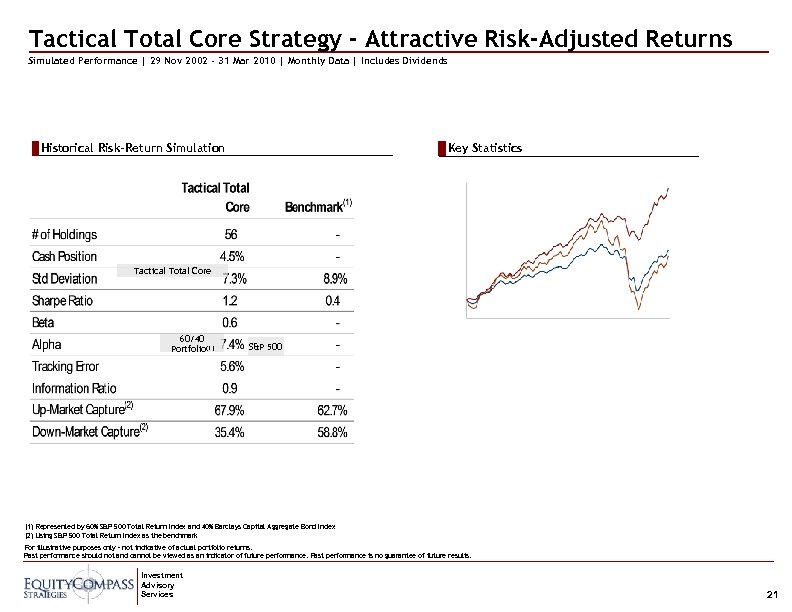

Tactical Total Core Strategy - Attractive Risk-Adjusted Returns Simulated Performance | 29 Nov 2002 - 31 Mar 2010 | Monthly Data | Includes Dividends Historical Risk-Return Simulation Key Statistics Tactical Total Core 60/40 Portfolio (1) S&P 500 (1) Represented by 60% S&P 500 Total Return Index and 40% Barclays Capital Aggregate Bond Index (2) Using S&P 500 Total Return Index as the benchmark For illustrative purposes only – not indicative of actual portfolio returns. Past performance should not and cannot be viewed as an indicator of future performance. Past performance is no guarantee of future results. Investment Advisory Services 21

Tactical Total Core Strategy - Attractive Risk-Adjusted Returns Simulated Performance | 29 Nov 2002 - 31 Mar 2010 | Monthly Data | Includes Dividends Historical Risk-Return Simulation Key Statistics Tactical Total Core 60/40 Portfolio (1) S&P 500 (1) Represented by 60% S&P 500 Total Return Index and 40% Barclays Capital Aggregate Bond Index (2) Using S&P 500 Total Return Index as the benchmark For illustrative purposes only – not indicative of actual portfolio returns. Past performance should not and cannot be viewed as an indicator of future performance. Past performance is no guarantee of future results. Investment Advisory Services 21

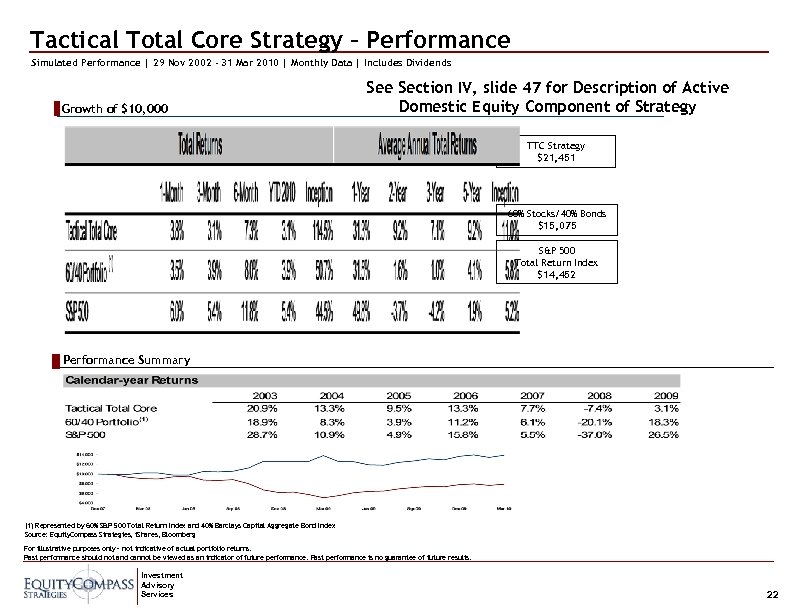

Tactical Total Core Strategy – Performance Simulated Performance | 29 Nov 2002 - 31 Mar 2010 | Monthly Data | Includes Dividends Growth of $10, 000 See Section IV, slide 47 for Description of Active Domestic Equity Component of Strategy TTC Strategy $21, 451 60% Stocks/40% Bonds $15, 075 S&P 500 Total Return Index $14, 452 Performance Summary (1) Represented by 60% S&P 500 Total Return Index and 40% Barclays Capital Aggregate Bond Index Source: Equity. Compass Strategies, i. Shares, Bloomberg For illustrative purposes only – not indicative of actual portfolio returns. Past performance should not and cannot be viewed as an indicator of future performance. Past performance is no guarantee of future results. Investment Advisory Services 22

Tactical Total Core Strategy – Performance Simulated Performance | 29 Nov 2002 - 31 Mar 2010 | Monthly Data | Includes Dividends Growth of $10, 000 See Section IV, slide 47 for Description of Active Domestic Equity Component of Strategy TTC Strategy $21, 451 60% Stocks/40% Bonds $15, 075 S&P 500 Total Return Index $14, 452 Performance Summary (1) Represented by 60% S&P 500 Total Return Index and 40% Barclays Capital Aggregate Bond Index Source: Equity. Compass Strategies, i. Shares, Bloomberg For illustrative purposes only – not indicative of actual portfolio returns. Past performance should not and cannot be viewed as an indicator of future performance. Past performance is no guarantee of future results. Investment Advisory Services 22

“To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework. ” — Warren Buffett Investment Advisory Services 23

“To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insights, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework. ” — Warren Buffett Investment Advisory Services 23

III Equity. Compass Market Cycle Ratings & Ranks 24

III Equity. Compass Market Cycle Ratings & Ranks 24

Equity. Compass Market Phase Ratings & Ranks u Timeless investment principles represent stock attributes that produce attractive risk-adjusted performance over a market cycle while timely insights focus on stock attributes specific to a phase in a market cycle u EC Market Cycle Ratings and Ranks help identify timely opportunities consistent with the current or anticipated market phase u Phases in a stock market cycle are the result of cyclical economic activity and changes in investors’ behavioral risk and reward preferences u Our research shows that better relative performance during each phase of a market cycle is driven by distinct stock attributes u We identified individual stock attributes that measure valuation, technical, and risk characteristics and are the key to outperformance in each of the market phases u We then ranked each of the 3, 000+ U. S. stocks in our coverage universe based on the consistency between their attributes and those that drive performance in each market phase – called EC Market Cycle Rating and Ranking u We also developed indices for each market phase comprising of the top 100 stocks based on the EC Market Cycle Rating and Ranking for that phase of the market cycle u An analysis of the recent index performances suggests that the stock market is currently in the Mid Bull phase of the current market cycle Investment Advisory Services 25

Equity. Compass Market Phase Ratings & Ranks u Timeless investment principles represent stock attributes that produce attractive risk-adjusted performance over a market cycle while timely insights focus on stock attributes specific to a phase in a market cycle u EC Market Cycle Ratings and Ranks help identify timely opportunities consistent with the current or anticipated market phase u Phases in a stock market cycle are the result of cyclical economic activity and changes in investors’ behavioral risk and reward preferences u Our research shows that better relative performance during each phase of a market cycle is driven by distinct stock attributes u We identified individual stock attributes that measure valuation, technical, and risk characteristics and are the key to outperformance in each of the market phases u We then ranked each of the 3, 000+ U. S. stocks in our coverage universe based on the consistency between their attributes and those that drive performance in each market phase – called EC Market Cycle Rating and Ranking u We also developed indices for each market phase comprising of the top 100 stocks based on the EC Market Cycle Rating and Ranking for that phase of the market cycle u An analysis of the recent index performances suggests that the stock market is currently in the Mid Bull phase of the current market cycle Investment Advisory Services 25

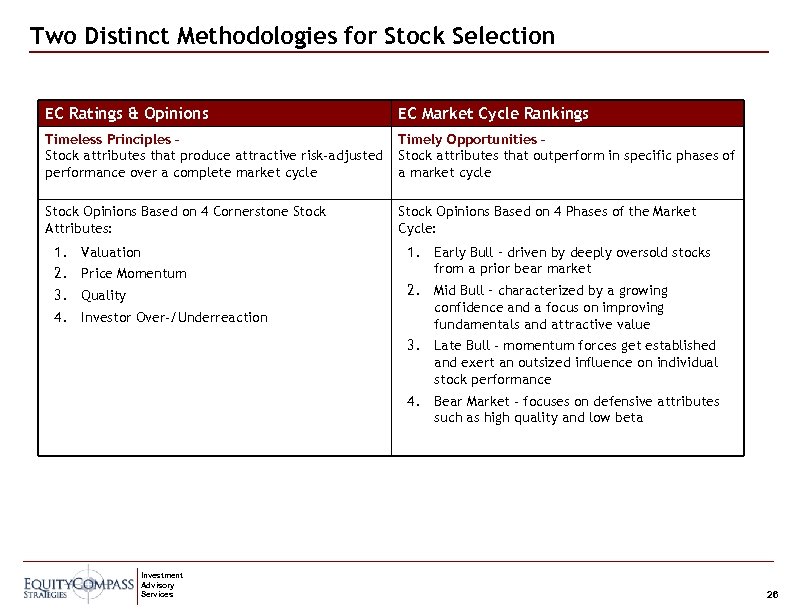

Two Distinct Methodologies for Stock Selection EC Ratings & Opinions EC Market Cycle Rankings Timeless Principles – Stock attributes that produce attractive risk-adjusted performance over a complete market cycle Timely Opportunities – Stock attributes that outperform in specific phases of a market cycle Stock Opinions Based on 4 Cornerstone Stock Attributes: Stock Opinions Based on 4 Phases of the Market Cycle: 1. 2. 3. 4. Valuation Price Momentum Quality Investor Over-/Underreaction Investment Advisory Services 1. Early Bull – driven by deeply oversold stocks from a prior bear market 2. Mid Bull – characterized by a growing confidence and a focus on improving fundamentals and attractive value 3. Late Bull - momentum forces get established and exert an outsized influence on individual stock performance 4. Bear Market - focuses on defensive attributes such as high quality and low beta 26

Two Distinct Methodologies for Stock Selection EC Ratings & Opinions EC Market Cycle Rankings Timeless Principles – Stock attributes that produce attractive risk-adjusted performance over a complete market cycle Timely Opportunities – Stock attributes that outperform in specific phases of a market cycle Stock Opinions Based on 4 Cornerstone Stock Attributes: Stock Opinions Based on 4 Phases of the Market Cycle: 1. 2. 3. 4. Valuation Price Momentum Quality Investor Over-/Underreaction Investment Advisory Services 1. Early Bull – driven by deeply oversold stocks from a prior bear market 2. Mid Bull – characterized by a growing confidence and a focus on improving fundamentals and attractive value 3. Late Bull - momentum forces get established and exert an outsized influence on individual stock performance 4. Bear Market - focuses on defensive attributes such as high quality and low beta 26

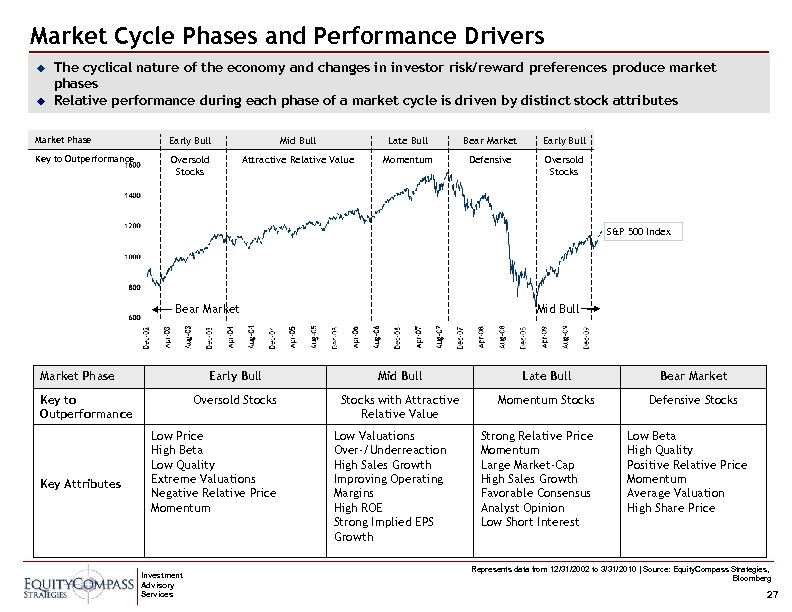

Market Cycle Phases and Performance Drivers u u The cyclical nature of the economy and changes in investor risk/reward preferences produce market phases Relative performance during each phase of a market cycle is driven by distinct stock attributes Market Phase Early Bull Mid Bull Late Bull Bear Market Early Bull Key to Outperformance Oversold Stocks Attractive Relative Value Momentum Defensive Oversold Stocks S&P 500 Index Mid Bull Bear Market Phase Early Bull Key Attributes Late Bull Bear Market Oversold Stocks Key to Outperformance Mid Bull Stocks with Attractive Relative Value Momentum Stocks Defensive Stocks Low Price High Beta Low Quality Extreme Valuations Negative Relative Price Momentum Investment Advisory Services Low Valuations Over-/Underreaction High Sales Growth Improving Operating Margins High ROE Strong Implied EPS Growth Strong Relative Price Momentum Large Market-Cap High Sales Growth Favorable Consensus Analyst Opinion Low Short Interest Low Beta High Quality Positive Relative Price Momentum Average Valuation High Share Price Represents data from 12/31/2002 to 3/31/2010 | Source: Equity. Compass Strategies, Bloomberg 27

Market Cycle Phases and Performance Drivers u u The cyclical nature of the economy and changes in investor risk/reward preferences produce market phases Relative performance during each phase of a market cycle is driven by distinct stock attributes Market Phase Early Bull Mid Bull Late Bull Bear Market Early Bull Key to Outperformance Oversold Stocks Attractive Relative Value Momentum Defensive Oversold Stocks S&P 500 Index Mid Bull Bear Market Phase Early Bull Key Attributes Late Bull Bear Market Oversold Stocks Key to Outperformance Mid Bull Stocks with Attractive Relative Value Momentum Stocks Defensive Stocks Low Price High Beta Low Quality Extreme Valuations Negative Relative Price Momentum Investment Advisory Services Low Valuations Over-/Underreaction High Sales Growth Improving Operating Margins High ROE Strong Implied EPS Growth Strong Relative Price Momentum Large Market-Cap High Sales Growth Favorable Consensus Analyst Opinion Low Short Interest Low Beta High Quality Positive Relative Price Momentum Average Valuation High Share Price Represents data from 12/31/2002 to 3/31/2010 | Source: Equity. Compass Strategies, Bloomberg 27

EC Market Cycle Ratings and Ranks u Stocks are ranked based on the consistency between their attributes and those that drive performance in each market phase u u u Ranks range from 0– 100 with the higher ranked stocks considered more attractive Stocks most suited for a certain market phase are the ones with the highest rank for that particular phase EC Market Cycle Ratings and Ranks are updated monthly Investment Advisory Services 28

EC Market Cycle Ratings and Ranks u Stocks are ranked based on the consistency between their attributes and those that drive performance in each market phase u u u Ranks range from 0– 100 with the higher ranked stocks considered more attractive Stocks most suited for a certain market phase are the ones with the highest rank for that particular phase EC Market Cycle Ratings and Ranks are updated monthly Investment Advisory Services 28

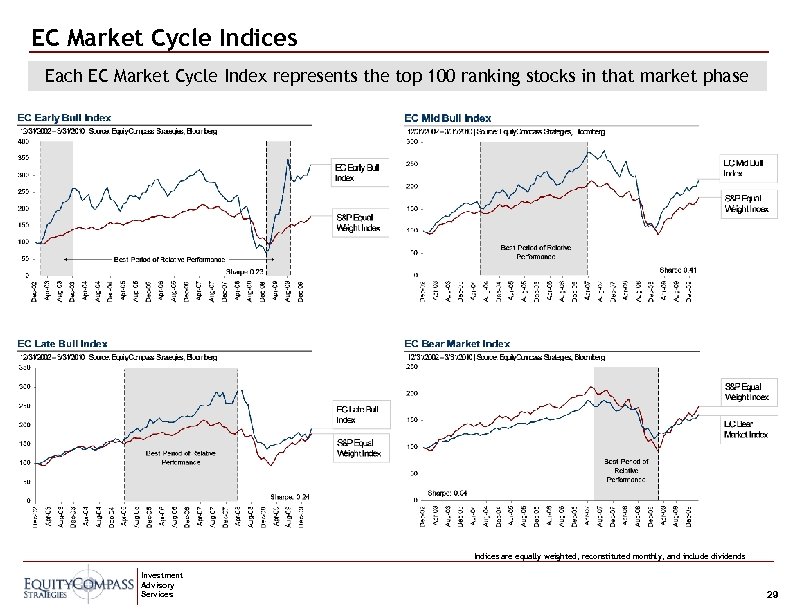

EC Market Cycle Indices Each EC Market Cycle Index represents the top 100 ranking stocks in that market phase Indices are equally weighted, reconstituted monthly, and include dividends Investment Advisory Services 29

EC Market Cycle Indices Each EC Market Cycle Index represents the top 100 ranking stocks in that market phase Indices are equally weighted, reconstituted monthly, and include dividends Investment Advisory Services 29

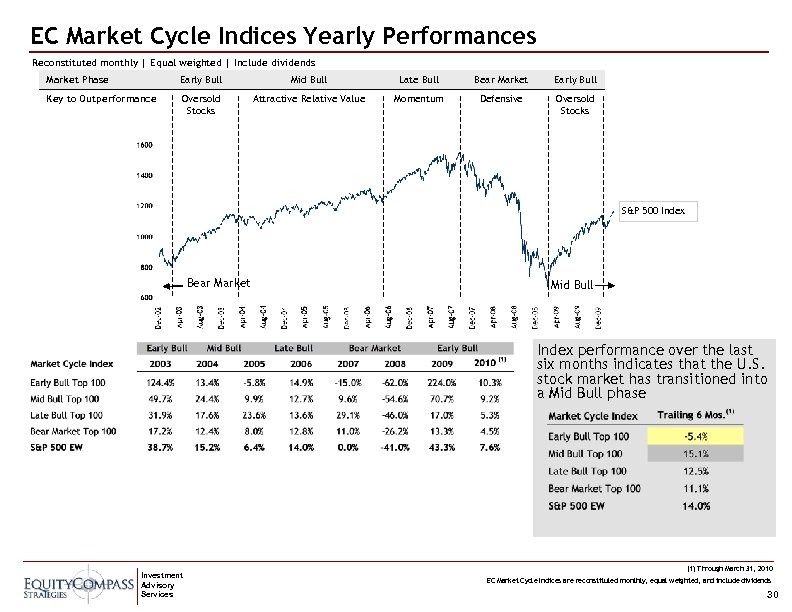

EC Market Cycle Indices Yearly Performances Reconstituted monthly | Equal weighted | Include dividends Market Phase Early Bull Mid Bull Late Bull Bear Market Early Bull Key to Outperformance Oversold Stocks Attractive Relative Value Momentum Defensive Oversold Stocks S&P 500 Index Bear Market Mid Bull Index performance over the last six months indicates that the U. S. stock market has transitioned into a Mid Bull phase Investment Advisory Services (1) Through March 31, 2010 EC Market Cycle Indices are reconstituted monthly, equal weighted, and include dividends 30

EC Market Cycle Indices Yearly Performances Reconstituted monthly | Equal weighted | Include dividends Market Phase Early Bull Mid Bull Late Bull Bear Market Early Bull Key to Outperformance Oversold Stocks Attractive Relative Value Momentum Defensive Oversold Stocks S&P 500 Index Bear Market Mid Bull Index performance over the last six months indicates that the U. S. stock market has transitioned into a Mid Bull phase Investment Advisory Services (1) Through March 31, 2010 EC Market Cycle Indices are reconstituted monthly, equal weighted, and include dividends 30

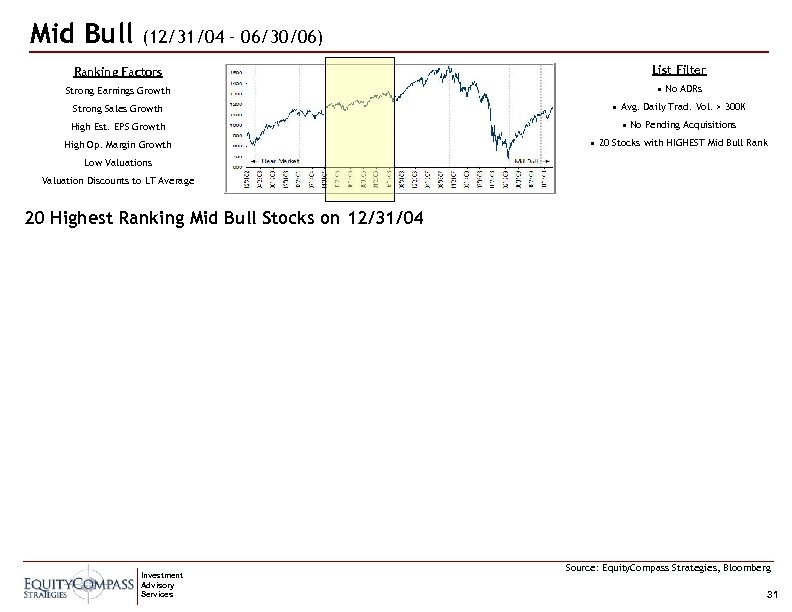

Mid Bull (12/31/04 – 06/30/06) Ranking Factors List Filter Strong Earnings Growth • No ADRs Strong Sales Growth • Avg. Daily Trad. Vol. > 300 K High Est. EPS Growth • No Pending Acquisitions High Op. Margin Growth • 20 Stocks with HIGHEST Mid Bull Rank Low Valuations Valuation Discounts to LT Average 20 Highest Ranking Mid Bull Stocks on 12/31/04 Investment Advisory Services Source: Equity. Compass Strategies, Bloomberg 31

Mid Bull (12/31/04 – 06/30/06) Ranking Factors List Filter Strong Earnings Growth • No ADRs Strong Sales Growth • Avg. Daily Trad. Vol. > 300 K High Est. EPS Growth • No Pending Acquisitions High Op. Margin Growth • 20 Stocks with HIGHEST Mid Bull Rank Low Valuations Valuation Discounts to LT Average 20 Highest Ranking Mid Bull Stocks on 12/31/04 Investment Advisory Services Source: Equity. Compass Strategies, Bloomberg 31

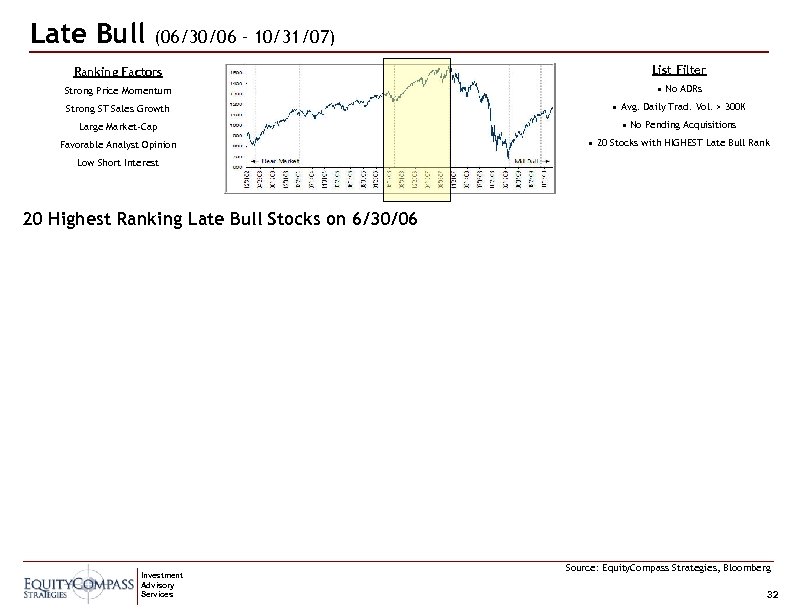

Late Bull (06/30/06 – 10/31/07) Ranking Factors List Filter Strong Price Momentum • No ADRs Strong ST Sales Growth • Avg. Daily Trad. Vol. > 300 K Large Market-Cap • No Pending Acquisitions Favorable Analyst Opinion • 20 Stocks with HIGHEST Late Bull Rank Low Short Interest 20 Highest Ranking Late Bull Stocks on 6/30/06 Investment Advisory Services Source: Equity. Compass Strategies, Bloomberg 32

Late Bull (06/30/06 – 10/31/07) Ranking Factors List Filter Strong Price Momentum • No ADRs Strong ST Sales Growth • Avg. Daily Trad. Vol. > 300 K Large Market-Cap • No Pending Acquisitions Favorable Analyst Opinion • 20 Stocks with HIGHEST Late Bull Rank Low Short Interest 20 Highest Ranking Late Bull Stocks on 6/30/06 Investment Advisory Services Source: Equity. Compass Strategies, Bloomberg 32

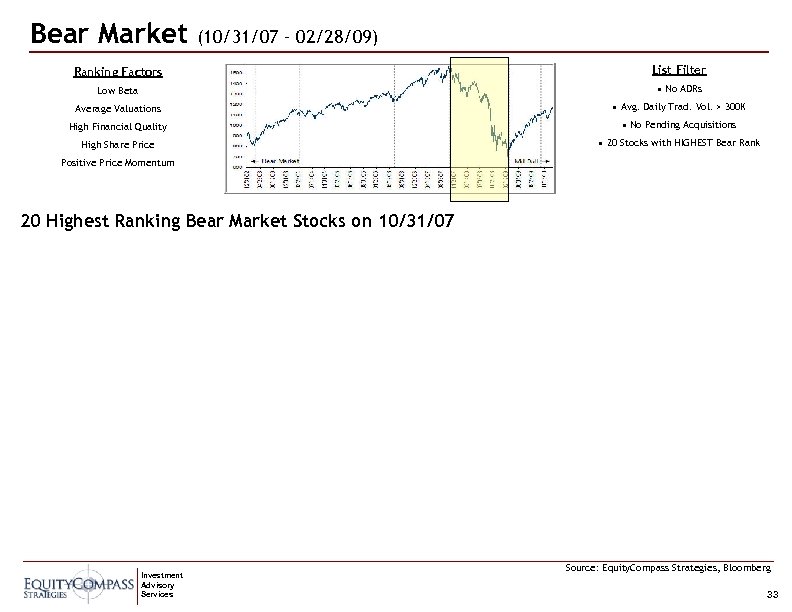

Bear Market (10/31/07 – 02/28/09) Ranking Factors List Filter Low Beta • No ADRs Average Valuations • Avg. Daily Trad. Vol. > 300 K High Financial Quality • No Pending Acquisitions High Share Price • 20 Stocks with HIGHEST Bear Rank Positive Price Momentum 20 Highest Ranking Bear Market Stocks on 10/31/07 Investment Advisory Services Source: Equity. Compass Strategies, Bloomberg 33

Bear Market (10/31/07 – 02/28/09) Ranking Factors List Filter Low Beta • No ADRs Average Valuations • Avg. Daily Trad. Vol. > 300 K High Financial Quality • No Pending Acquisitions High Share Price • 20 Stocks with HIGHEST Bear Rank Positive Price Momentum 20 Highest Ranking Bear Market Stocks on 10/31/07 Investment Advisory Services Source: Equity. Compass Strategies, Bloomberg 33

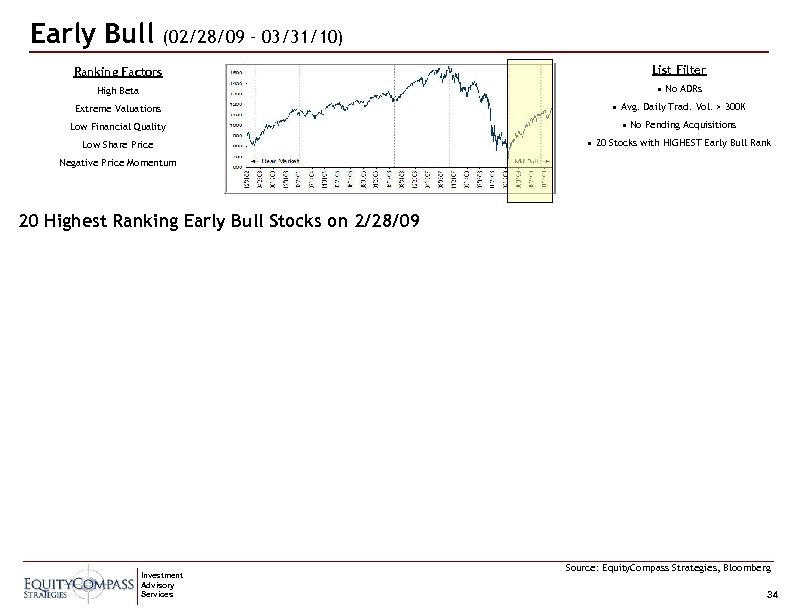

Early Bull (02/28/09 – 03/31/10) Ranking Factors List Filter High Beta • No ADRs Extreme Valuations • Avg. Daily Trad. Vol. > 300 K Low Financial Quality • No Pending Acquisitions Low Share Price • 20 Stocks with HIGHEST Early Bull Rank Negative Price Momentum 20 Highest Ranking Early Bull Stocks on 2/28/09 Investment Advisory Services Source: Equity. Compass Strategies, Bloomberg 34

Early Bull (02/28/09 – 03/31/10) Ranking Factors List Filter High Beta • No ADRs Extreme Valuations • Avg. Daily Trad. Vol. > 300 K Low Financial Quality • No Pending Acquisitions Low Share Price • 20 Stocks with HIGHEST Early Bull Rank Negative Price Momentum 20 Highest Ranking Early Bull Stocks on 2/28/09 Investment Advisory Services Source: Equity. Compass Strategies, Bloomberg 34

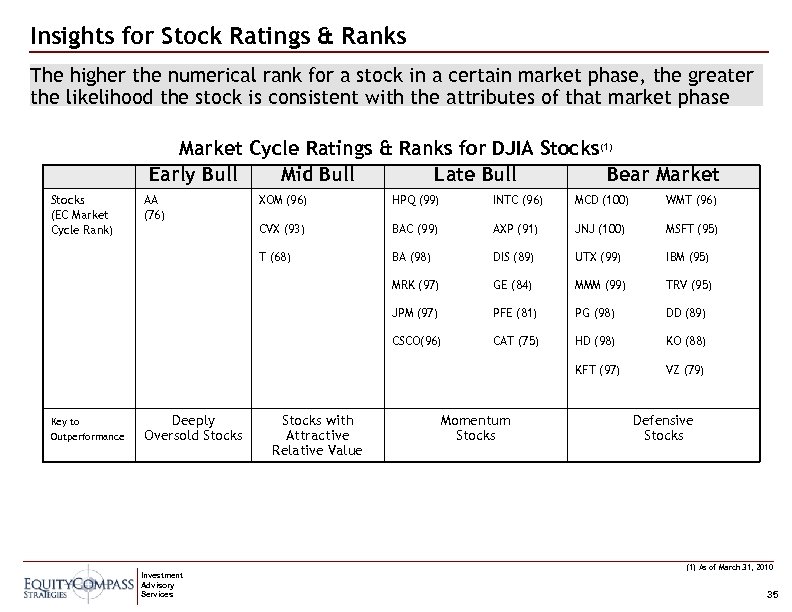

Insights for Stock Ratings & Ranks The higher the numerical rank for a stock in a certain market phase, the greater the likelihood the stock is consistent with the attributes of that market phase Market Cycle Ratings & Ranks for DJIA Stocks(1) Early Bull Mid Bull Late Bull Bear Market Stocks (EC Market Cycle Rank) INTC (96) MCD (100) WMT (96) CVX (93) BAC (99) AXP (91) JNJ (100) MSFT (95) BA (98) DIS (89) UTX (99) IBM (95) GE (84) MMM (99) TRV (95) JPM (97) PFE (81) PG (98) DD (89) CSCO(96) CAT (75) HD (98) KO (88) KFT (97) Investment Advisory Services HPQ (99) MRK (97) Deeply Oversold Stocks XOM (96) T (68) Key to Outperformance AA (76) VZ (79) Stocks with Attractive Relative Value Momentum Stocks Defensive Stocks (1) As of March 31, 2010 35

Insights for Stock Ratings & Ranks The higher the numerical rank for a stock in a certain market phase, the greater the likelihood the stock is consistent with the attributes of that market phase Market Cycle Ratings & Ranks for DJIA Stocks(1) Early Bull Mid Bull Late Bull Bear Market Stocks (EC Market Cycle Rank) INTC (96) MCD (100) WMT (96) CVX (93) BAC (99) AXP (91) JNJ (100) MSFT (95) BA (98) DIS (89) UTX (99) IBM (95) GE (84) MMM (99) TRV (95) JPM (97) PFE (81) PG (98) DD (89) CSCO(96) CAT (75) HD (98) KO (88) KFT (97) Investment Advisory Services HPQ (99) MRK (97) Deeply Oversold Stocks XOM (96) T (68) Key to Outperformance AA (76) VZ (79) Stocks with Attractive Relative Value Momentum Stocks Defensive Stocks (1) As of March 31, 2010 35

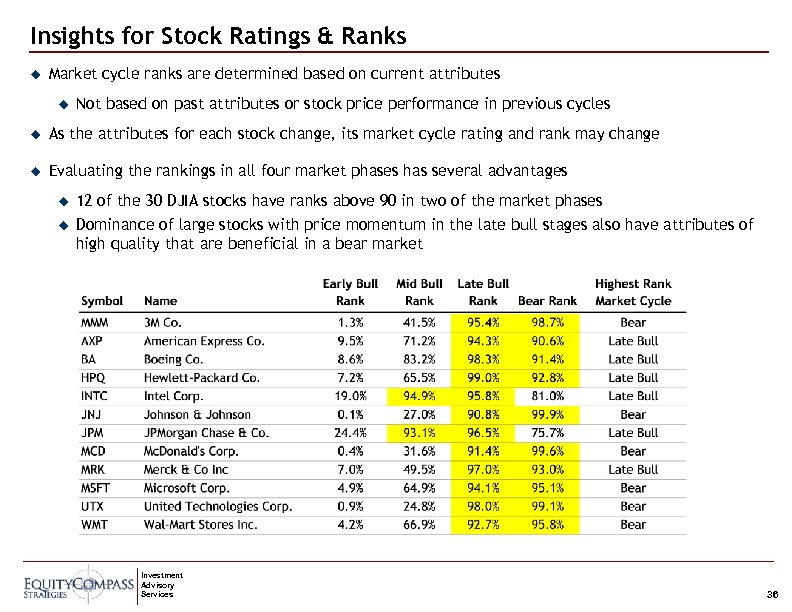

Insights for Stock Ratings & Ranks u Market cycle ranks are determined based on current attributes u Not based on past attributes or stock price performance in previous cycles u As the attributes for each stock change, its market cycle rating and rank may change u Evaluating the rankings in all four market phases has several advantages u 12 of the 30 DJIA stocks have ranks above 90 in two of the market phases u Dominance of large stocks with price momentum in the late bull stages also have attributes of high quality that are beneficial in a bear market Investment Advisory Services 36

Insights for Stock Ratings & Ranks u Market cycle ranks are determined based on current attributes u Not based on past attributes or stock price performance in previous cycles u As the attributes for each stock change, its market cycle rating and rank may change u Evaluating the rankings in all four market phases has several advantages u 12 of the 30 DJIA stocks have ranks above 90 in two of the market phases u Dominance of large stocks with price momentum in the late bull stages also have attributes of high quality that are beneficial in a bear market Investment Advisory Services 36

Insights for Stock Selection and Portfolio Management u Helps identify stocks that have high consistency to the attributes of an anticipated market phase (i. e. , currently Mid or Late Bull) u Augment or challenge current stock selection criteria u Analyze current portfolio allocations based on the consistency of the current holdings with various phases of the market cycle Investment Advisory Services 37

Insights for Stock Selection and Portfolio Management u Helps identify stocks that have high consistency to the attributes of an anticipated market phase (i. e. , currently Mid or Late Bull) u Augment or challenge current stock selection criteria u Analyze current portfolio allocations based on the consistency of the current holdings with various phases of the market cycle Investment Advisory Services 37

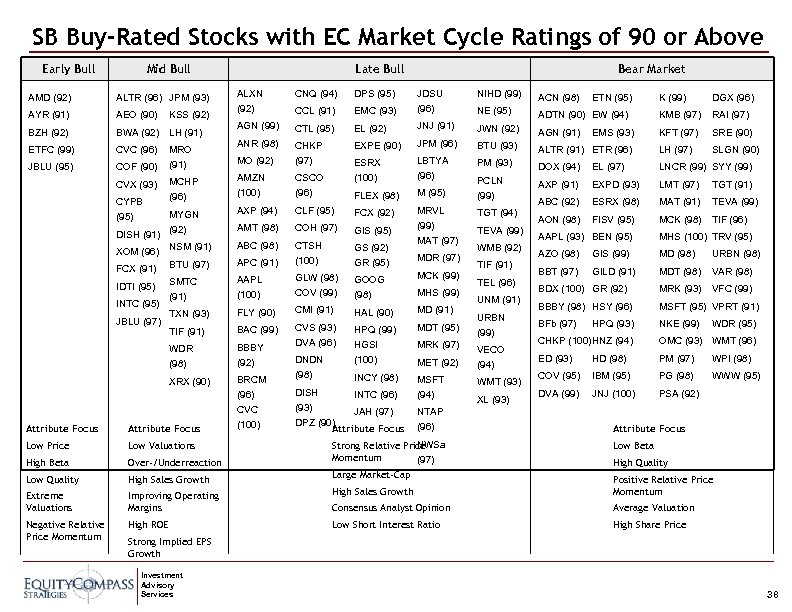

SB Buy-Rated Stocks with EC Market Cycle Ratings of 90 or Above Early Bull AMD (92) AYR (91) ALTR (96) JPM (93) AEO (90) KSS (92) BZH (92) BWA (92) LH (91) ETFC (99) CVC (96) JBLU (95) Late Bull Mid Bull COF (90) MRO (91) CVX (93) MCHP CYPB (96) MYGN (95) DISH (91) (92) XOM (96) NSM (91) ALXN (92) CNQ (94) DPS (95) CCL (91) AGN (99) CTL (95) Bear Market NIHD (99) ACN (98) EMC (93) JDSU (96) NE (95) EL (92) JNJ (91) JWN (92) EXPE (90) BTU (93) MO (92) CHKP (97) JPM (96) ESRX LBTYA PM (93) AMZN CSCO (100) (96) PCLN (100) (96) FLEX (98) M (95) (99) AXP (94) CLF (95) FCX (92) TGT (94) AMT (98) COH (97) GIS (95) ABC (98) GS (92) GR (95) MRVL (99) MAT (97) ANR (98) FCX (91) BTU (97) APC (91) CTSH (100) IDTI (95) SMTC (91) AAPL (100) GLW (98) COV (99) GOOG (98) MCK (99) TXN (93) FLY (90) CMI (91) HAL (90) MD (91) TIF (91) BAC (99) CVS (93) MDT (95) WDR (98) BBBY (92) DVA (96) HPQ (99) HGSI (100) XRX (90) BRCM (96) CVC (100) INCY (98) MSFT (94) INTC (95) JBLU (97) Attribute Focus DNDN (98) DISH INTC (96) (93) JAH (97) DPZ (90) Attribute Focus MDR (97) MHS (99) MRK (97) MET (92) NTAP (96) TEVA (99) WMB (92) TIF (91) TEL (96) UNM (91) URBN (99) VECO (94) WMT (93) XL (93) ETN (95) K (99) DGX (96) ADTN (90) EW (94) KMB (97) RAI (97) AGN (91) KFT (97) SRE (90) ALTR (91) ETR (96) LH (97) SLGN (90) DOX (94) EL (97) LNCR (99) SYY (99) AXP (91) EXPD (93) LMT (97) TGT (91) ABC (92) ESRX (98) MAT (91) TEVA (99) AON (98) FISV (95) MCK (98) TIF (96) EMS (93) AAPL (93) BEN (95) MHS (100) TRV (95) AZO (98) GIS (99) MD (98) URBN (98) BBT (97) GILD (91) MDT (98) VAR (98) BDX (100) GR (92) MRK (93) VFC (99) BBBY (98) HSY (96) MSFT (95) VPRT (91) BFb (97) NKE (99) HPQ (93) WDR (95) CHKP (100)HNZ (94) OMC (93) WMT (96) ED (93) HD (98) PM (97) WPI (98) COV (95) IBM (95) PG (98) WWW (95) DVA (99) JNJ (100) PSA (92) Attribute Focus Low Price Low Valuations High Beta Over-/Underreaction NWSa Strong Relative Price Momentum (97) High Sales Growth Large Market-Cap Extreme Valuations Improving Operating Margins High Sales Growth Positive Relative Price Momentum Consensus Analyst Opinion Average Valuation Negative Relative Price Momentum High ROE Low Short Interest Ratio High Share Price Low Quality Low Beta High Quality Strong Implied EPS Growth Investment Advisory Services 38

SB Buy-Rated Stocks with EC Market Cycle Ratings of 90 or Above Early Bull AMD (92) AYR (91) ALTR (96) JPM (93) AEO (90) KSS (92) BZH (92) BWA (92) LH (91) ETFC (99) CVC (96) JBLU (95) Late Bull Mid Bull COF (90) MRO (91) CVX (93) MCHP CYPB (96) MYGN (95) DISH (91) (92) XOM (96) NSM (91) ALXN (92) CNQ (94) DPS (95) CCL (91) AGN (99) CTL (95) Bear Market NIHD (99) ACN (98) EMC (93) JDSU (96) NE (95) EL (92) JNJ (91) JWN (92) EXPE (90) BTU (93) MO (92) CHKP (97) JPM (96) ESRX LBTYA PM (93) AMZN CSCO (100) (96) PCLN (100) (96) FLEX (98) M (95) (99) AXP (94) CLF (95) FCX (92) TGT (94) AMT (98) COH (97) GIS (95) ABC (98) GS (92) GR (95) MRVL (99) MAT (97) ANR (98) FCX (91) BTU (97) APC (91) CTSH (100) IDTI (95) SMTC (91) AAPL (100) GLW (98) COV (99) GOOG (98) MCK (99) TXN (93) FLY (90) CMI (91) HAL (90) MD (91) TIF (91) BAC (99) CVS (93) MDT (95) WDR (98) BBBY (92) DVA (96) HPQ (99) HGSI (100) XRX (90) BRCM (96) CVC (100) INCY (98) MSFT (94) INTC (95) JBLU (97) Attribute Focus DNDN (98) DISH INTC (96) (93) JAH (97) DPZ (90) Attribute Focus MDR (97) MHS (99) MRK (97) MET (92) NTAP (96) TEVA (99) WMB (92) TIF (91) TEL (96) UNM (91) URBN (99) VECO (94) WMT (93) XL (93) ETN (95) K (99) DGX (96) ADTN (90) EW (94) KMB (97) RAI (97) AGN (91) KFT (97) SRE (90) ALTR (91) ETR (96) LH (97) SLGN (90) DOX (94) EL (97) LNCR (99) SYY (99) AXP (91) EXPD (93) LMT (97) TGT (91) ABC (92) ESRX (98) MAT (91) TEVA (99) AON (98) FISV (95) MCK (98) TIF (96) EMS (93) AAPL (93) BEN (95) MHS (100) TRV (95) AZO (98) GIS (99) MD (98) URBN (98) BBT (97) GILD (91) MDT (98) VAR (98) BDX (100) GR (92) MRK (93) VFC (99) BBBY (98) HSY (96) MSFT (95) VPRT (91) BFb (97) NKE (99) HPQ (93) WDR (95) CHKP (100)HNZ (94) OMC (93) WMT (96) ED (93) HD (98) PM (97) WPI (98) COV (95) IBM (95) PG (98) WWW (95) DVA (99) JNJ (100) PSA (92) Attribute Focus Low Price Low Valuations High Beta Over-/Underreaction NWSa Strong Relative Price Momentum (97) High Sales Growth Large Market-Cap Extreme Valuations Improving Operating Margins High Sales Growth Positive Relative Price Momentum Consensus Analyst Opinion Average Valuation Negative Relative Price Momentum High ROE Low Short Interest Ratio High Share Price Low Quality Low Beta High Quality Strong Implied EPS Growth Investment Advisory Services 38

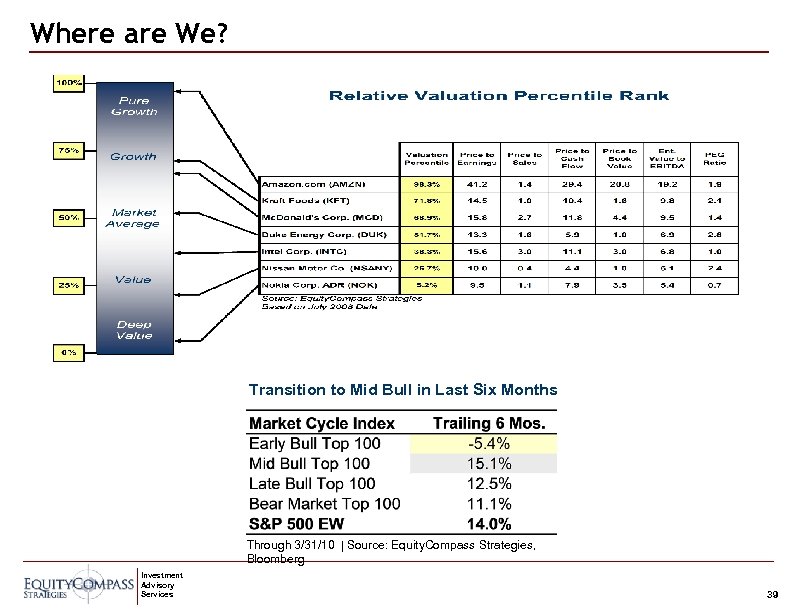

Where are We? Transition to Mid Bull in Last Six Months Through 3/31/10 | Source: Equity. Compass Strategies, Bloomberg Investment Advisory Services 39

Where are We? Transition to Mid Bull in Last Six Months Through 3/31/10 | Source: Equity. Compass Strategies, Bloomberg Investment Advisory Services 39

IV Investment Philosophy & Principles for Stock Selection 40

IV Investment Philosophy & Principles for Stock Selection 40

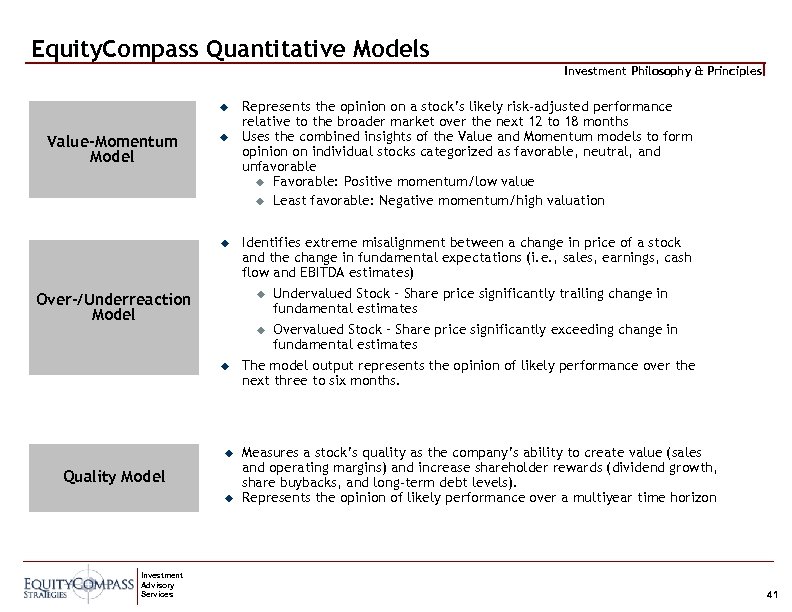

Equity. Compass Quantitative Models Investment Philosophy & Principles u Value-Momentum Model u u Over-/Underreaction Model u u Quality Model u Investment Advisory Services Represents the opinion on a stock’s likely risk-adjusted performance relative to the broader market over the next 12 to 18 months Uses the combined insights of the Value and Momentum models to form opinion on individual stocks categorized as favorable, neutral, and unfavorable u Favorable: Positive momentum/low value u Least favorable: Negative momentum/high valuation Identifies extreme misalignment between a change in price of a stock and the change in fundamental expectations (i. e. , sales, earnings, cash flow and EBITDA estimates) u Undervalued Stock – Share price significantly trailing change in fundamental estimates u Overvalued Stock – Share price significantly exceeding change in fundamental estimates The model output represents the opinion of likely performance over the next three to six months. Measures a stock’s quality as the company’s ability to create value (sales and operating margins) and increase shareholder rewards (dividend growth, share buybacks, and long-term debt levels). Represents the opinion of likely performance over a multiyear time horizon 41

Equity. Compass Quantitative Models Investment Philosophy & Principles u Value-Momentum Model u u Over-/Underreaction Model u u Quality Model u Investment Advisory Services Represents the opinion on a stock’s likely risk-adjusted performance relative to the broader market over the next 12 to 18 months Uses the combined insights of the Value and Momentum models to form opinion on individual stocks categorized as favorable, neutral, and unfavorable u Favorable: Positive momentum/low value u Least favorable: Negative momentum/high valuation Identifies extreme misalignment between a change in price of a stock and the change in fundamental expectations (i. e. , sales, earnings, cash flow and EBITDA estimates) u Undervalued Stock – Share price significantly trailing change in fundamental estimates u Overvalued Stock – Share price significantly exceeding change in fundamental estimates The model output represents the opinion of likely performance over the next three to six months. Measures a stock’s quality as the company’s ability to create value (sales and operating margins) and increase shareholder rewards (dividend growth, share buybacks, and long-term debt levels). Represents the opinion of likely performance over a multiyear time horizon 41

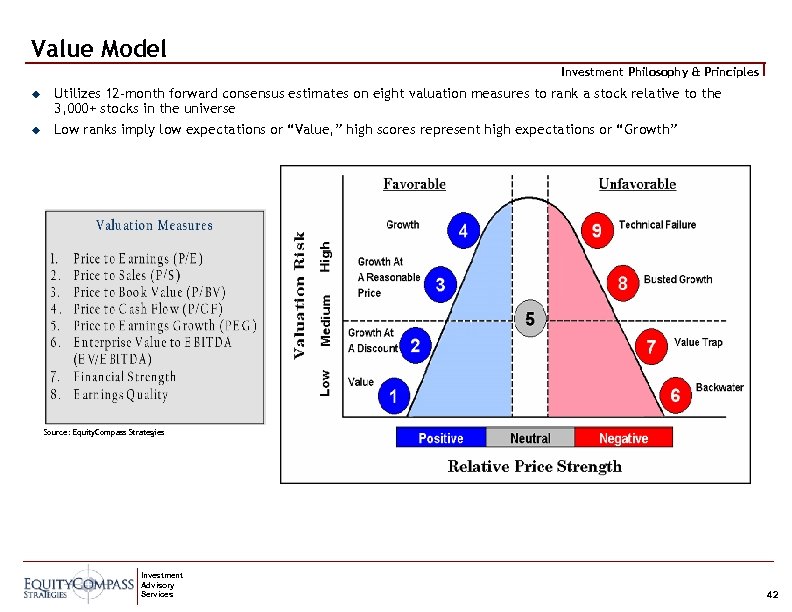

Value Model Investment Philosophy & Principles u u Utilizes 12 -month forward consensus estimates on eight valuation measures to rank a stock relative to the 3, 000+ stocks in the universe Low ranks imply low expectations or “Value, ” high scores represent high expectations or “Growth” Source: Equity. Compass Strategies Investment Advisory Services 42

Value Model Investment Philosophy & Principles u u Utilizes 12 -month forward consensus estimates on eight valuation measures to rank a stock relative to the 3, 000+ stocks in the universe Low ranks imply low expectations or “Value, ” high scores represent high expectations or “Growth” Source: Equity. Compass Strategies Investment Advisory Services 42

Momentum Model u Investment thesis u Investment Philosophy & Principles Stock price trends, whether positive or negative, are the result of an imbalance between supply and demand can be used to predict a future performance bias u The Equity. Compass Momentum model identifies the likely direction of opportunity-seeking capital and possesses the risk discipline necessary to recognize when trends are changing u Through an analysis of each stock’s current price relative to its longer-term average, as well as to that of the broader market, the Momentum model identifies stocks that have a confirmed positive, negative, or neutral longterm relative price momentum u The Momentum Model requires absolute confirmation before signaling a trend change even at the risk of lagging the absolute high and low prices of a stock u On average, stocks within the Equity. Compass coverage universe remain in either a positive or negative price trend for 12– 18 months Investment Advisory Services 43

Momentum Model u Investment thesis u Investment Philosophy & Principles Stock price trends, whether positive or negative, are the result of an imbalance between supply and demand can be used to predict a future performance bias u The Equity. Compass Momentum model identifies the likely direction of opportunity-seeking capital and possesses the risk discipline necessary to recognize when trends are changing u Through an analysis of each stock’s current price relative to its longer-term average, as well as to that of the broader market, the Momentum model identifies stocks that have a confirmed positive, negative, or neutral longterm relative price momentum u The Momentum Model requires absolute confirmation before signaling a trend change even at the risk of lagging the absolute high and low prices of a stock u On average, stocks within the Equity. Compass coverage universe remain in either a positive or negative price trend for 12– 18 months Investment Advisory Services 43

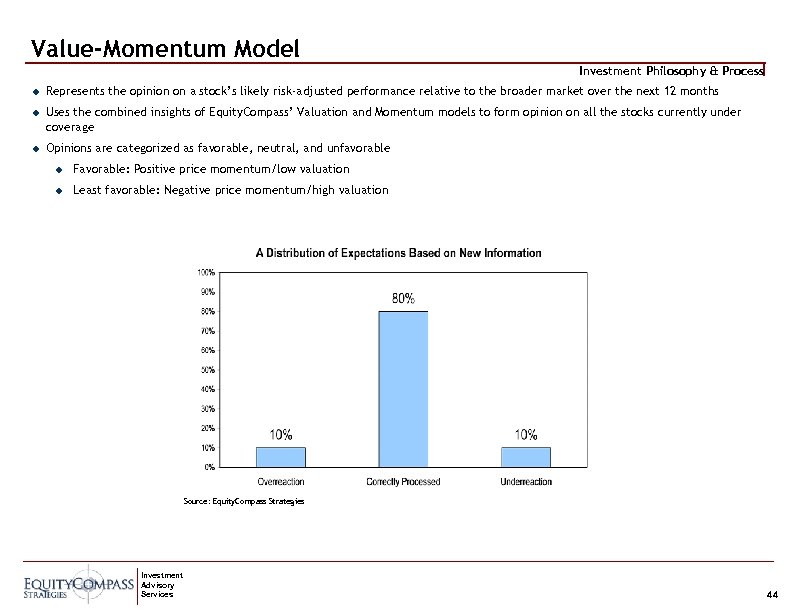

Value-Momentum Model Investment Philosophy & Process u Represents the opinion on a stock’s likely risk-adjusted performance relative to the broader market over the next 12 months u Uses the combined insights of Equity. Compass’ Valuation and Momentum models to form opinion on all the stocks currently under coverage u Opinions are categorized as favorable, neutral, and unfavorable u Favorable: Positive price momentum/low valuation u Least favorable: Negative price momentum/high valuation Source: Equity. Compass Strategies Investment Advisory Services 44

Value-Momentum Model Investment Philosophy & Process u Represents the opinion on a stock’s likely risk-adjusted performance relative to the broader market over the next 12 months u Uses the combined insights of Equity. Compass’ Valuation and Momentum models to form opinion on all the stocks currently under coverage u Opinions are categorized as favorable, neutral, and unfavorable u Favorable: Positive price momentum/low valuation u Least favorable: Negative price momentum/high valuation Source: Equity. Compass Strategies Investment Advisory Services 44

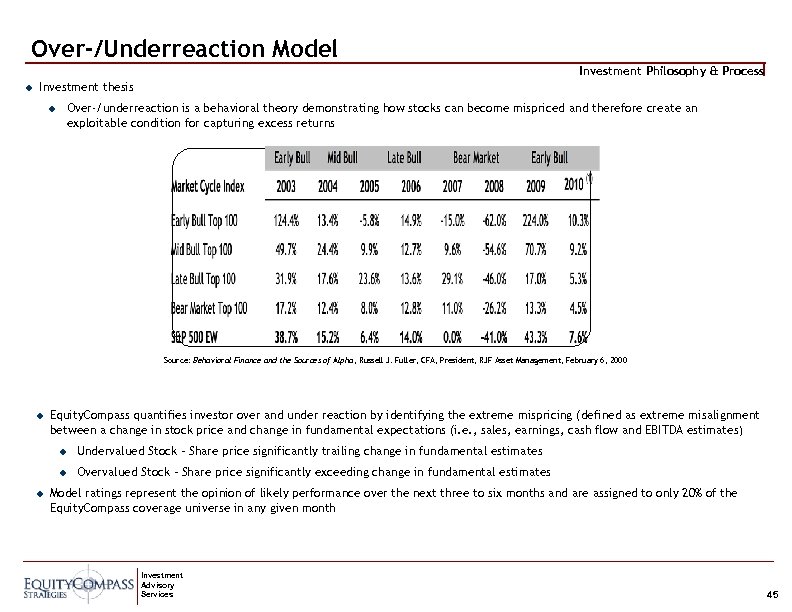

Over-/Underreaction Model Investment Philosophy & Process u Investment thesis u Over-/underreaction is a behavioral theory demonstrating how stocks can become mispriced and therefore create an exploitable condition for capturing excess returns Source: Behavioral Finance and the Sources of Alpha, Russell J. Fuller, CFA, President, RJF Asset Management, February 6, 2000 u Equity. Compass quantifies investor over and under reaction by identifying the extreme mispricing (defined as extreme misalignment between a change in stock price and change in fundamental expectations (i. e. , sales, earnings, cash flow and EBITDA estimates) u u u Undervalued Stock – Share price significantly trailing change in fundamental estimates Overvalued Stock – Share price significantly exceeding change in fundamental estimates Model ratings represent the opinion of likely performance over the next three to six months and are assigned to only 20% of the Equity. Compass coverage universe in any given month Investment Advisory Services 45

Over-/Underreaction Model Investment Philosophy & Process u Investment thesis u Over-/underreaction is a behavioral theory demonstrating how stocks can become mispriced and therefore create an exploitable condition for capturing excess returns Source: Behavioral Finance and the Sources of Alpha, Russell J. Fuller, CFA, President, RJF Asset Management, February 6, 2000 u Equity. Compass quantifies investor over and under reaction by identifying the extreme mispricing (defined as extreme misalignment between a change in stock price and change in fundamental expectations (i. e. , sales, earnings, cash flow and EBITDA estimates) u u u Undervalued Stock – Share price significantly trailing change in fundamental estimates Overvalued Stock – Share price significantly exceeding change in fundamental estimates Model ratings represent the opinion of likely performance over the next three to six months and are assigned to only 20% of the Equity. Compass coverage universe in any given month Investment Advisory Services 45

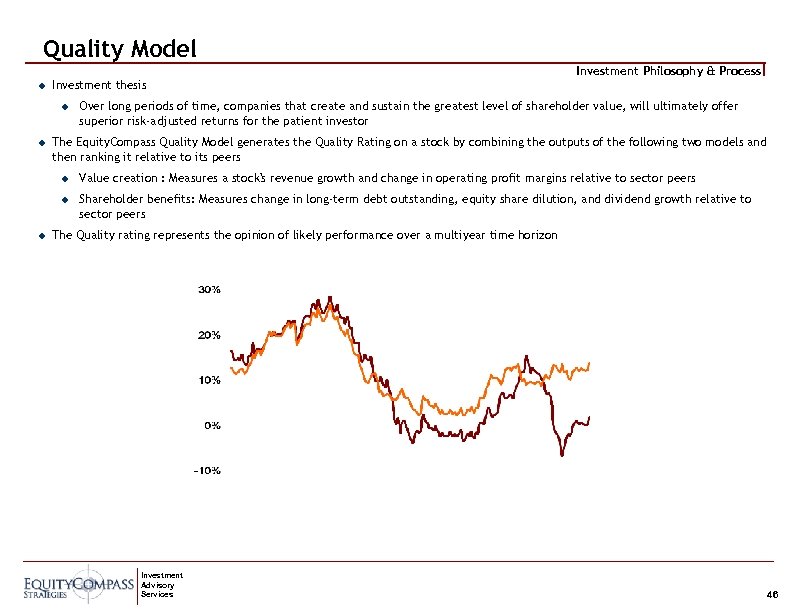

Quality Model Investment Philosophy & Process u Investment thesis u u Over long periods of time, companies that create and sustain the greatest level of shareholder value, will ultimately offer superior risk-adjusted returns for the patient investor The Equity. Compass Quality Model generates the Quality Rating on a stock by combining the outputs of the following two models and then ranking it relative to its peers u u u Value creation : Measures a stock's revenue growth and change in operating profit margins relative to sector peers Shareholder benefits: Measures change in long-term debt outstanding, equity share dilution, and dividend growth relative to sector peers The Quality rating represents the opinion of likely performance over a multiyear time horizon Investment Advisory Services 46

Quality Model Investment Philosophy & Process u Investment thesis u u Over long periods of time, companies that create and sustain the greatest level of shareholder value, will ultimately offer superior risk-adjusted returns for the patient investor The Equity. Compass Quality Model generates the Quality Rating on a stock by combining the outputs of the following two models and then ranking it relative to its peers u u u Value creation : Measures a stock's revenue growth and change in operating profit margins relative to sector peers Shareholder benefits: Measures change in long-term debt outstanding, equity share dilution, and dividend growth relative to sector peers The Quality rating represents the opinion of likely performance over a multiyear time horizon Investment Advisory Services 46

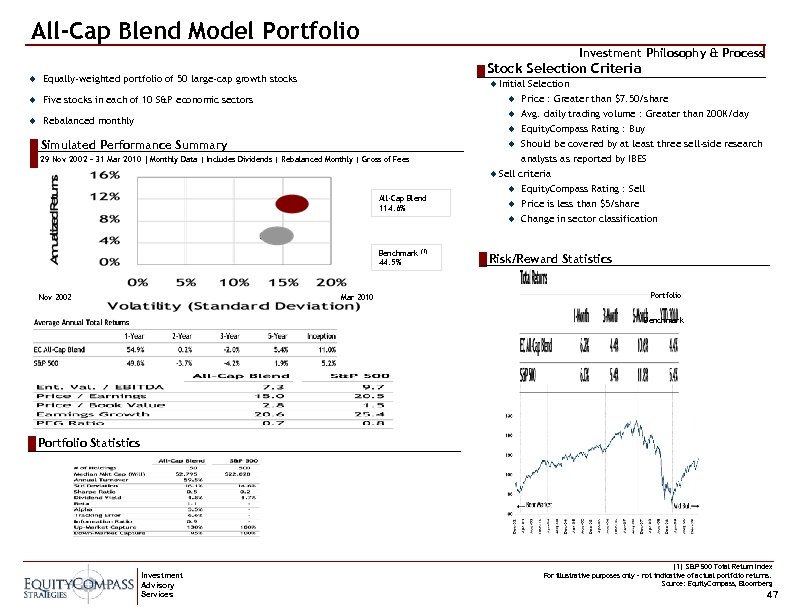

All-Cap Blend Model Portfolio Investment Philosophy & Process u u Five stocks in each of 10 S&P economic sectors u Stock Selection Criteria Equally-weighted portfolio of 50 large-cap growth stocks Rebalanced monthly u Initial u u u Simulated Performance Summary Should be covered by at least three sell-side research analysts as reported by IBES u Sell criteria u Equity. Compass Rating : Sell u 29 Nov 2002 – 31 Mar 2010 | Monthly Data | Includes Dividends | Rebalanced Monthly | Gross of Fees All-Cap Blend 114. 6% u u Benchmark 44. 5% Nov 2002 Selection Price : Greater than $7. 50/share Avg. daily trading volume : Greater than 200 K/day Equity. Compass Rating : Buy Mar 2010 (1) Price is less than $5/share Change in sector classification Risk/Reward Statistics Portfolio Benchmark Portfolio Statistics Investment Advisory Services (1) S&P 500 Total Return Index For illustrative purposes only – not indicative of actual portfolio returns. Source: Equity. Compass, Bloomberg 47

All-Cap Blend Model Portfolio Investment Philosophy & Process u u Five stocks in each of 10 S&P economic sectors u Stock Selection Criteria Equally-weighted portfolio of 50 large-cap growth stocks Rebalanced monthly u Initial u u u Simulated Performance Summary Should be covered by at least three sell-side research analysts as reported by IBES u Sell criteria u Equity. Compass Rating : Sell u 29 Nov 2002 – 31 Mar 2010 | Monthly Data | Includes Dividends | Rebalanced Monthly | Gross of Fees All-Cap Blend 114. 6% u u Benchmark 44. 5% Nov 2002 Selection Price : Greater than $7. 50/share Avg. daily trading volume : Greater than 200 K/day Equity. Compass Rating : Buy Mar 2010 (1) Price is less than $5/share Change in sector classification Risk/Reward Statistics Portfolio Benchmark Portfolio Statistics Investment Advisory Services (1) S&P 500 Total Return Index For illustrative purposes only – not indicative of actual portfolio returns. Source: Equity. Compass, Bloomberg 47

Equity. Compass Strategies 1 South Street, 16 th Floor Baltimore, MD 21202 Phone: (443) 224 -1231 Email: equitycompass@stifel. com www. equitycompass. com Important Disclosures The information contained herein has been prepared from sources believed to be reliable but is not guaranteed and is not a complete summary or statement of all available data nor is it considered an offer to buy or sell any securities referred to herein. Equity. Compass Strategies is a research and investment advisory unit of Choice Financial Partners, Inc. , a wholly owned subsidiary and affiliated SEC registered investment adviser of Stifel Financial Corp. Portfolios based on Equity. Compass Strategies are available exclusively through Stifel, Nicolaus & Company, Incorporated. For information about Stifel Nicolaus’ advisory programs, please contact your Financial Advisor to request a copy of Stifel’s ADV Part II or equivalent disclosure brochure. Affiliates of Equity. Compass Strategies may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. Past performance should not and cannot be viewed as an indicator of future performance. Exchange Traded Funds (ETFs) represent a share of all stocks in a respective index. ETFs trade like stocks and are subject to market risk, including the potential for loss of principal. The value of ETFs will fluctuate with the value of the underlying securities. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of an underlying benchmark. Investing in inverse ETFs is similar to holding various short positions, or using a combination of advanced investment strategies to profit from falling prices. Brokerage commissions will be associated with buying and selling ETFs unless trading occurs in a fee-based account. Investors should review the prospectus and consider the ETF’s investment objectives, risks, charges, and expenses carefully before investing. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. When investing in real estate, it is important to note that property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. Highyield bonds have greater credit risk than higher quality bonds. The S&P 500 Index is a broad market index that tracks the performance of 500 stocks from major industries of the U. S. economy. This index is generally considered representative of the U. S. large capitalization market. A total return index tracks both the capital gains of a group of stocks over time, and assumes that any cash distributions, such as dividends, are reinvested back into the index. Looking at an index's total return displays a more accurate representation of the index's performance. By assuming dividends are reinvested, you effectively have accounted for stocks in an index that do not issue dividends and instead, reinvest their earnings within the underlying company. A total return index does not include adjustments for brokerage, custodian and advisory fees. The Dow Jones Industrial Average (DJIA) is an unmanaged, price-weighted index that consists of 30 blue chip U. S. stocks selected for their history of successful growth and interest among investors. The price-weighted arithmetic average is calculated with the divisor adjusted to reflect stock splits and occasional stock switches in the index. Indices are unmanaged, and it is not possible to invest directly in an index. Additional Information Available Upon Request © 2010 Equity. Compass Strategies, 501 North Broadway, St. Louis, MO 63102. All rights reserved. Investment Advisory Services 48

Equity. Compass Strategies 1 South Street, 16 th Floor Baltimore, MD 21202 Phone: (443) 224 -1231 Email: equitycompass@stifel. com www. equitycompass. com Important Disclosures The information contained herein has been prepared from sources believed to be reliable but is not guaranteed and is not a complete summary or statement of all available data nor is it considered an offer to buy or sell any securities referred to herein. Equity. Compass Strategies is a research and investment advisory unit of Choice Financial Partners, Inc. , a wholly owned subsidiary and affiliated SEC registered investment adviser of Stifel Financial Corp. Portfolios based on Equity. Compass Strategies are available exclusively through Stifel, Nicolaus & Company, Incorporated. For information about Stifel Nicolaus’ advisory programs, please contact your Financial Advisor to request a copy of Stifel’s ADV Part II or equivalent disclosure brochure. Affiliates of Equity. Compass Strategies may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. Past performance should not and cannot be viewed as an indicator of future performance. Exchange Traded Funds (ETFs) represent a share of all stocks in a respective index. ETFs trade like stocks and are subject to market risk, including the potential for loss of principal. The value of ETFs will fluctuate with the value of the underlying securities. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of an underlying benchmark. Investing in inverse ETFs is similar to holding various short positions, or using a combination of advanced investment strategies to profit from falling prices. Brokerage commissions will be associated with buying and selling ETFs unless trading occurs in a fee-based account. Investors should review the prospectus and consider the ETF’s investment objectives, risks, charges, and expenses carefully before investing. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. When investing in real estate, it is important to note that property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. Highyield bonds have greater credit risk than higher quality bonds. The S&P 500 Index is a broad market index that tracks the performance of 500 stocks from major industries of the U. S. economy. This index is generally considered representative of the U. S. large capitalization market. A total return index tracks both the capital gains of a group of stocks over time, and assumes that any cash distributions, such as dividends, are reinvested back into the index. Looking at an index's total return displays a more accurate representation of the index's performance. By assuming dividends are reinvested, you effectively have accounted for stocks in an index that do not issue dividends and instead, reinvest their earnings within the underlying company. A total return index does not include adjustments for brokerage, custodian and advisory fees. The Dow Jones Industrial Average (DJIA) is an unmanaged, price-weighted index that consists of 30 blue chip U. S. stocks selected for their history of successful growth and interest among investors. The price-weighted arithmetic average is calculated with the divisor adjusted to reflect stock splits and occasional stock switches in the index. Indices are unmanaged, and it is not possible to invest directly in an index. Additional Information Available Upon Request © 2010 Equity. Compass Strategies, 501 North Broadway, St. Louis, MO 63102. All rights reserved. Investment Advisory Services 48