992e296b42ed4e9d1f1c01a8eddb10ef.ppt

- Количество слайдов: 15

EQUIPMENT COSTS Peters Timmerhaus & West

EQUIPMENT COSTS Peters Timmerhaus & West

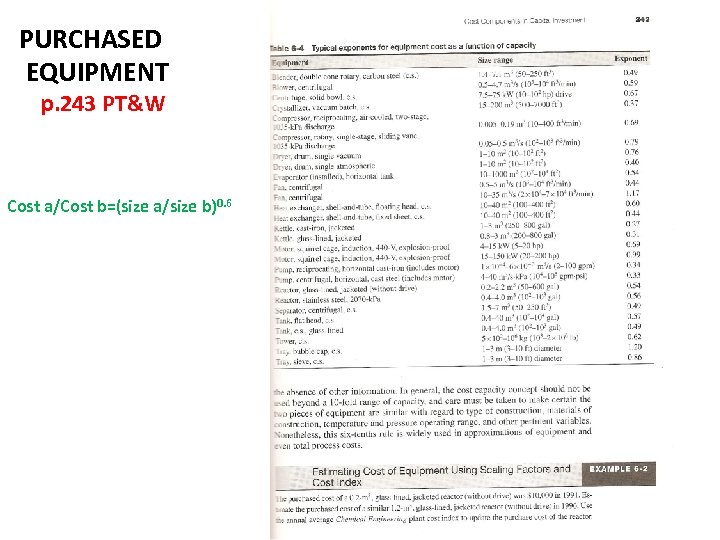

PURCHASED EQUIPMENT p. 243 PT&W Cost a/Cost b=(size a/size b)0. 6

PURCHASED EQUIPMENT p. 243 PT&W Cost a/Cost b=(size a/size b)0. 6

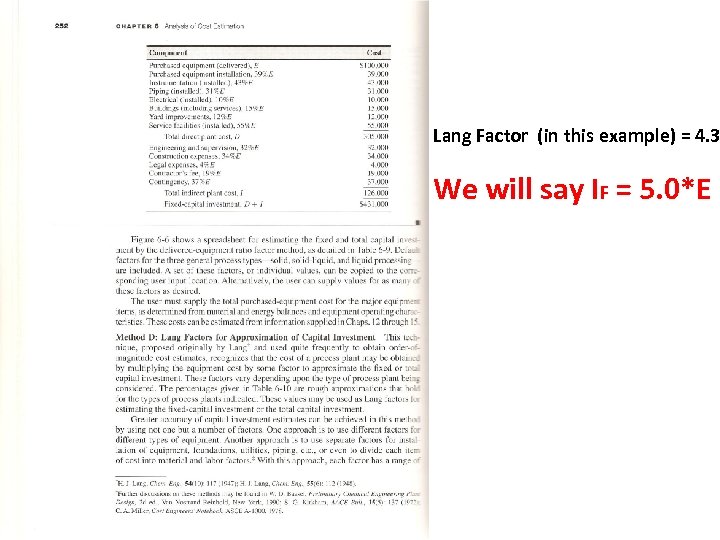

Lang Factor (in this example) = 4. 3 We will say IF = 5. 0*E

Lang Factor (in this example) = 4. 3 We will say IF = 5. 0*E

SHOW ME THE MONEY! CHE 462 “Figures don’t lie, but liars sure can figure!” BECKMAN 2012

SHOW ME THE MONEY! CHE 462 “Figures don’t lie, but liars sure can figure!” BECKMAN 2012

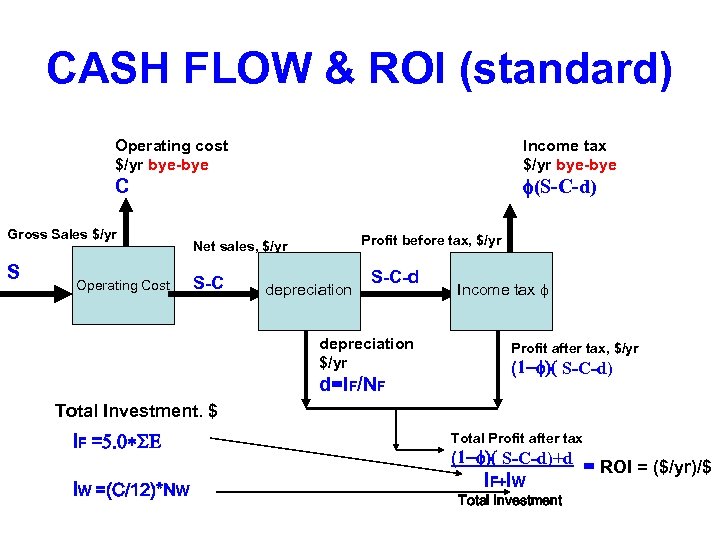

CASH FLOW & ROI (standard) Operating cost $/yr bye-bye Income tax $/yr bye-bye f(S-C-d) C Gross Sales $/yr S Operating Cost Profit before tax, $/yr Net sales, $/yr S-C depreciation S-C-d depreciation $/yr d=IF/NF Income tax f Profit after tax, $/yr (1 -f)( S-C-d) Total Investment. $ IF =5. 0*SE IW =(C/12)*NW Total Profit after tax (1 -f)( S-C-d)+d IF+IW Total Investment = ROI = ($/yr)/$

CASH FLOW & ROI (standard) Operating cost $/yr bye-bye Income tax $/yr bye-bye f(S-C-d) C Gross Sales $/yr S Operating Cost Profit before tax, $/yr Net sales, $/yr S-C depreciation S-C-d depreciation $/yr d=IF/NF Income tax f Profit after tax, $/yr (1 -f)( S-C-d) Total Investment. $ IF =5. 0*SE IW =(C/12)*NW Total Profit after tax (1 -f)( S-C-d)+d IF+IW Total Investment = ROI = ($/yr)/$

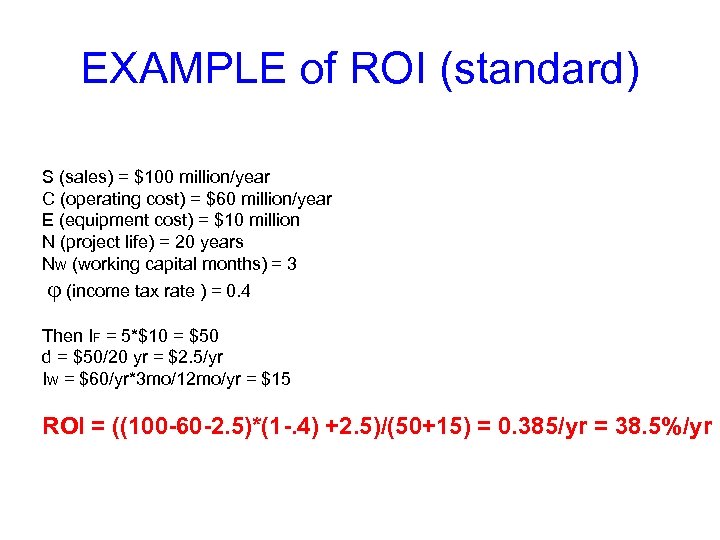

EXAMPLE of ROI (standard) S (sales) = $100 million/year C (operating cost) = $60 million/year E (equipment cost) = $10 million N (project life) = 20 years NW (working capital months) = 3 j (income tax rate ) = 0. 4 Then IF = 5*$10 = $50 d = $50/20 yr = $2. 5/yr IW = $60/yr*3 mo/12 mo/yr = $15 ROI = ((100 -60 -2. 5)*(1 -. 4) +2. 5)/(50+15) = 0. 385/yr = 38. 5%/yr

EXAMPLE of ROI (standard) S (sales) = $100 million/year C (operating cost) = $60 million/year E (equipment cost) = $10 million N (project life) = 20 years NW (working capital months) = 3 j (income tax rate ) = 0. 4 Then IF = 5*$10 = $50 d = $50/20 yr = $2. 5/yr IW = $60/yr*3 mo/12 mo/yr = $15 ROI = ((100 -60 -2. 5)*(1 -. 4) +2. 5)/(50+15) = 0. 385/yr = 38. 5%/yr

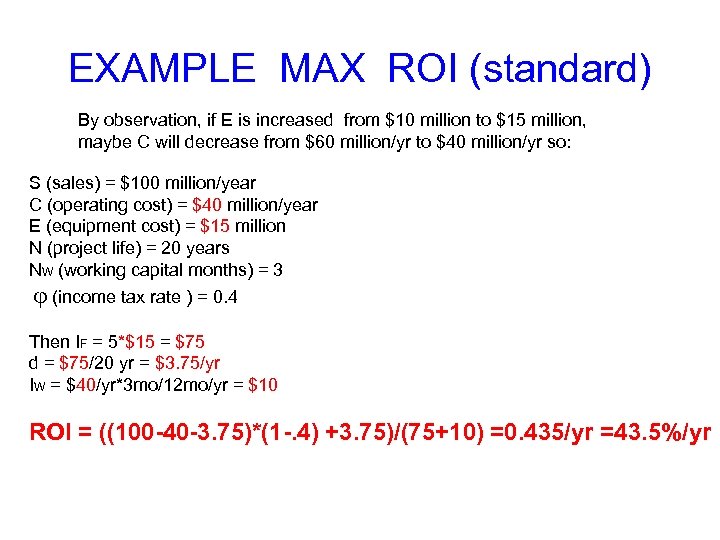

EXAMPLE MAX ROI (standard) By observation, if E is increased from $10 million to $15 million, maybe C will decrease from $60 million/yr to $40 million/yr so: S (sales) = $100 million/year C (operating cost) = $40 million/year E (equipment cost) = $15 million N (project life) = 20 years NW (working capital months) = 3 j (income tax rate ) = 0. 4 Then IF = 5*$15 = $75 d = $75/20 yr = $3. 75/yr IW = $40/yr*3 mo/12 mo/yr = $10 ROI = ((100 -40 -3. 75)*(1 -. 4) +3. 75)/(75+10) =0. 435/yr =43. 5%/yr

EXAMPLE MAX ROI (standard) By observation, if E is increased from $10 million to $15 million, maybe C will decrease from $60 million/yr to $40 million/yr so: S (sales) = $100 million/year C (operating cost) = $40 million/year E (equipment cost) = $15 million N (project life) = 20 years NW (working capital months) = 3 j (income tax rate ) = 0. 4 Then IF = 5*$15 = $75 d = $75/20 yr = $3. 75/yr IW = $40/yr*3 mo/12 mo/yr = $10 ROI = ((100 -40 -3. 75)*(1 -. 4) +3. 75)/(75+10) =0. 435/yr =43. 5%/yr

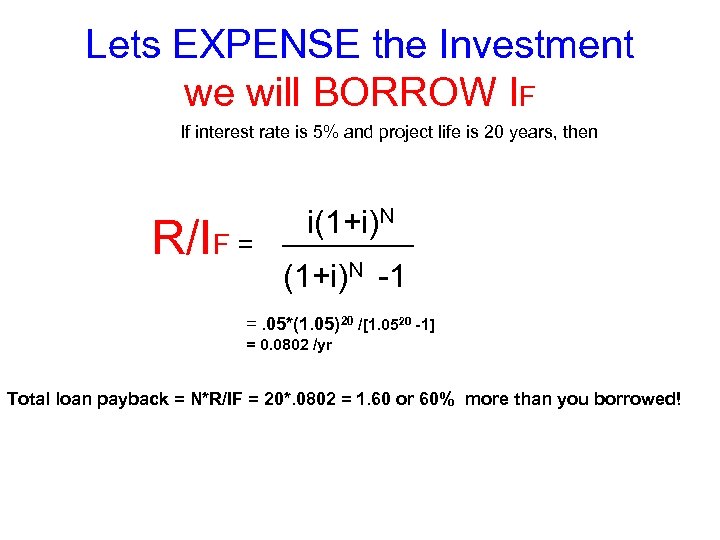

Lets EXPENSE the Investment we will BORROW IF If interest rate is 5% and project life is 20 years, then R/IF = i(1+i)N -1 =. 05*(1. 05)20 /[1. 0520 -1] = 0. 0802 /yr Total loan payback = N*R/IF = 20*. 0802 = 1. 60 or 60% more than you borrowed!

Lets EXPENSE the Investment we will BORROW IF If interest rate is 5% and project life is 20 years, then R/IF = i(1+i)N -1 =. 05*(1. 05)20 /[1. 0520 -1] = 0. 0802 /yr Total loan payback = N*R/IF = 20*. 0802 = 1. 60 or 60% more than you borrowed!

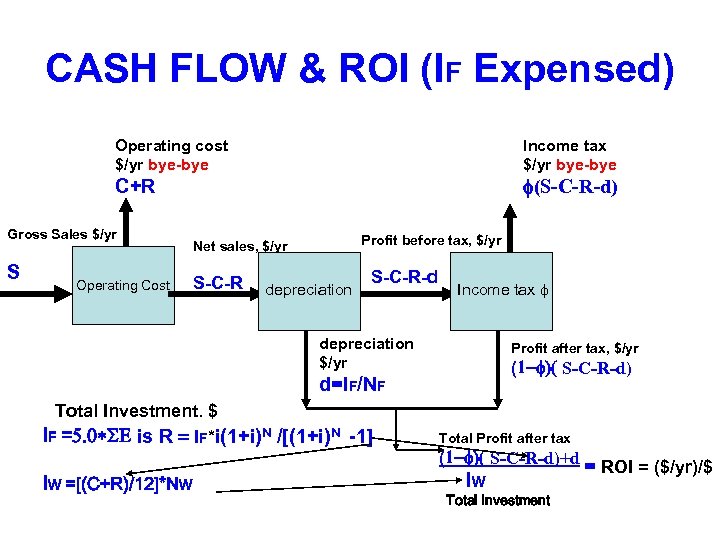

CASH FLOW & ROI (IF Expensed) Operating cost $/yr bye-bye Income tax $/yr bye-bye f(S-C-R-d) C+R Gross Sales $/yr S Operating Cost Profit before tax, $/yr Net sales, $/yr S-C-R depreciation S-C-R-d Income tax f depreciation $/yr Profit after tax, $/yr (1 -f)( S-C-R-d) d=IF/NF Total Investment. $ IF =5. 0*SE is R = IF*i(1+i)N /[(1+i)N -1] IW =[(C+R)/12]*NW Total Profit after tax (1 -f)( S-C-R-d)+d IW Total Investment = ROI = ($/yr)/$

CASH FLOW & ROI (IF Expensed) Operating cost $/yr bye-bye Income tax $/yr bye-bye f(S-C-R-d) C+R Gross Sales $/yr S Operating Cost Profit before tax, $/yr Net sales, $/yr S-C-R depreciation S-C-R-d Income tax f depreciation $/yr Profit after tax, $/yr (1 -f)( S-C-R-d) d=IF/NF Total Investment. $ IF =5. 0*SE is R = IF*i(1+i)N /[(1+i)N -1] IW =[(C+R)/12]*NW Total Profit after tax (1 -f)( S-C-R-d)+d IW Total Investment = ROI = ($/yr)/$

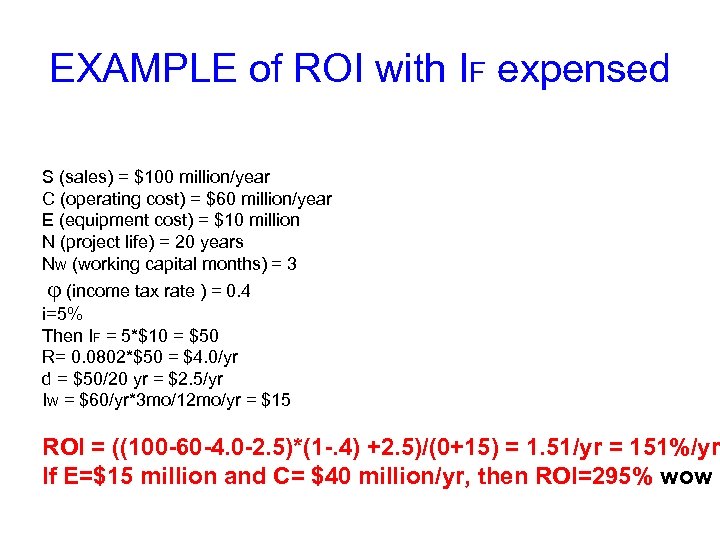

EXAMPLE of ROI with IF expensed S (sales) = $100 million/year C (operating cost) = $60 million/year E (equipment cost) = $10 million N (project life) = 20 years NW (working capital months) = 3 j (income tax rate ) = 0. 4 i=5% Then IF = 5*$10 = $50 R= 0. 0802*$50 = $4. 0/yr d = $50/20 yr = $2. 5/yr IW = $60/yr*3 mo/12 mo/yr = $15 ROI = ((100 -60 -4. 0 -2. 5)*(1 -. 4) +2. 5)/(0+15) = 1. 51/yr = 151%/yr If E=$15 million and C= $40 million/yr, then ROI=295% wow

EXAMPLE of ROI with IF expensed S (sales) = $100 million/year C (operating cost) = $60 million/year E (equipment cost) = $10 million N (project life) = 20 years NW (working capital months) = 3 j (income tax rate ) = 0. 4 i=5% Then IF = 5*$10 = $50 R= 0. 0802*$50 = $4. 0/yr d = $50/20 yr = $2. 5/yr IW = $60/yr*3 mo/12 mo/yr = $15 ROI = ((100 -60 -4. 0 -2. 5)*(1 -. 4) +2. 5)/(0+15) = 1. 51/yr = 151%/yr If E=$15 million and C= $40 million/yr, then ROI=295% wow

RULE # 1 IN BUSINESS • NEVER BUY something when you can either rent or borrow (or steal? ) !!!!!

RULE # 1 IN BUSINESS • NEVER BUY something when you can either rent or borrow (or steal? ) !!!!!

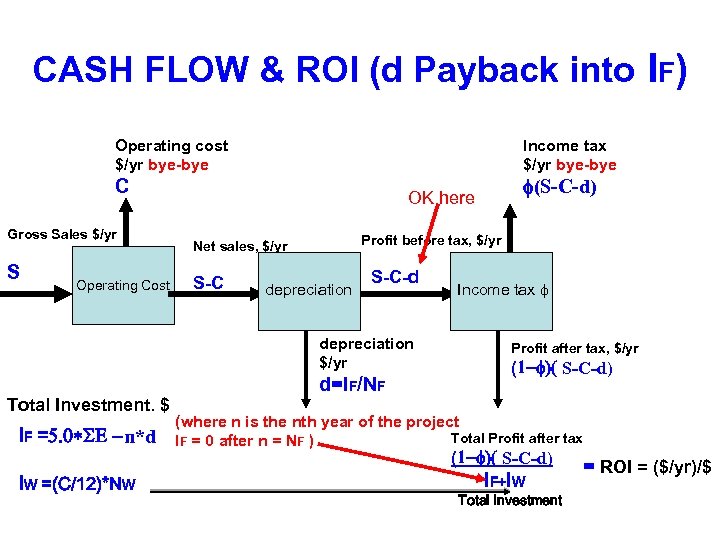

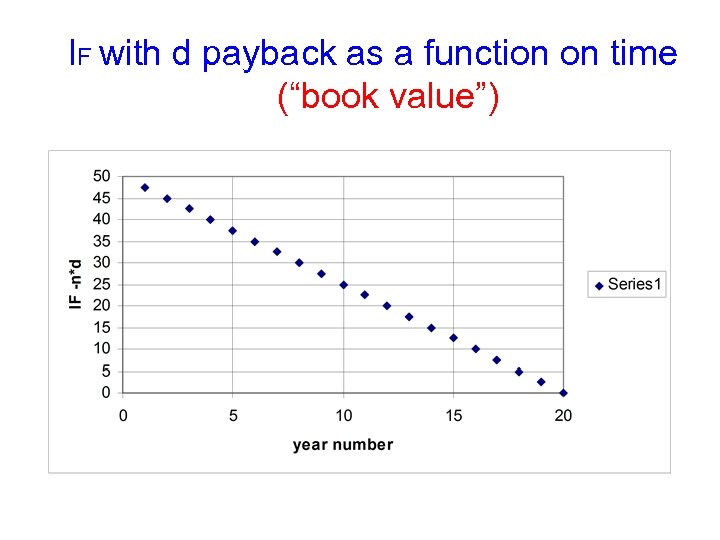

CASH FLOW & ROI (d Payback into IF) Operating cost $/yr bye-bye Income tax $/yr bye-bye C Gross Sales $/yr S Operating Cost Profit before tax, $/yr Net sales, $/yr S-C depreciation S-C-d depreciation $/yr Total Investment. $ IF =5. 0*SE -n*d IW =(C/12)*NW f(S-C-d) OK here d=IF/NF Income tax f Profit after tax, $/yr (1 -f)( S-C-d) (where n is the nth year of the project Total Profit after tax IF = 0 after n = NF ) (1 -f)( S-C-d) IF+IW Total Investment = ROI = ($/yr)/$

CASH FLOW & ROI (d Payback into IF) Operating cost $/yr bye-bye Income tax $/yr bye-bye C Gross Sales $/yr S Operating Cost Profit before tax, $/yr Net sales, $/yr S-C depreciation S-C-d depreciation $/yr Total Investment. $ IF =5. 0*SE -n*d IW =(C/12)*NW f(S-C-d) OK here d=IF/NF Income tax f Profit after tax, $/yr (1 -f)( S-C-d) (where n is the nth year of the project Total Profit after tax IF = 0 after n = NF ) (1 -f)( S-C-d) IF+IW Total Investment = ROI = ($/yr)/$

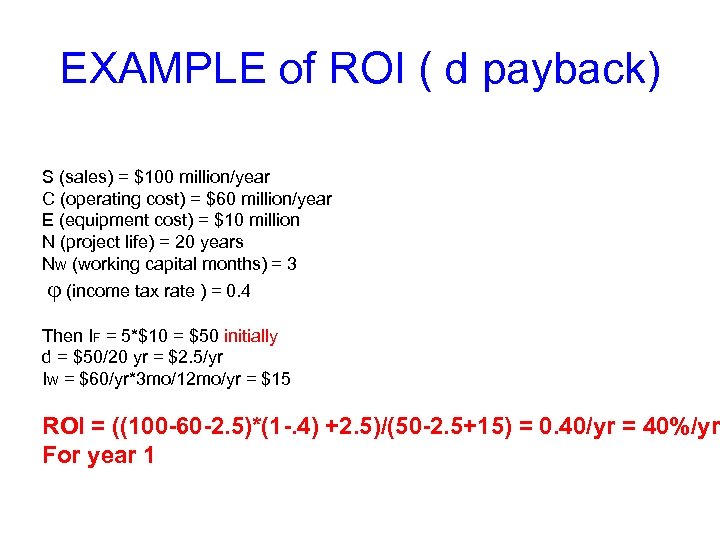

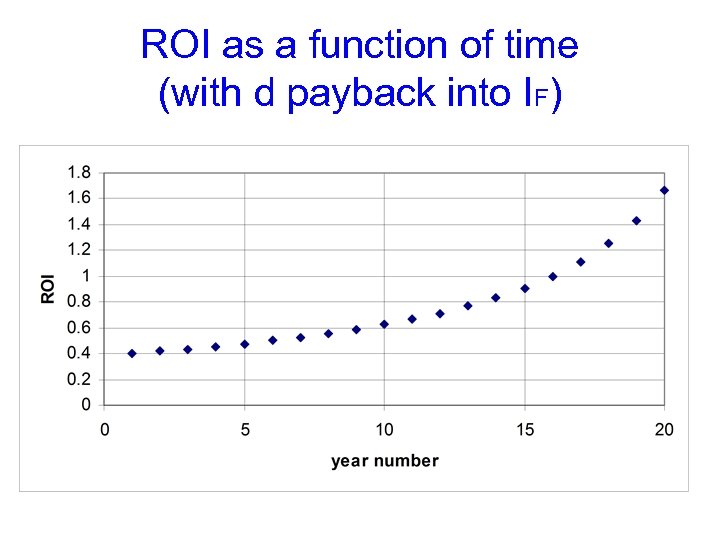

EXAMPLE of ROI ( d payback) S (sales) = $100 million/year C (operating cost) = $60 million/year E (equipment cost) = $10 million N (project life) = 20 years NW (working capital months) = 3 j (income tax rate ) = 0. 4 Then IF = 5*$10 = $50 initially d = $50/20 yr = $2. 5/yr IW = $60/yr*3 mo/12 mo/yr = $15 ROI = ((100 -60 -2. 5)*(1 -. 4) +2. 5)/(50 -2. 5+15) = 0. 40/yr = 40%/yr For year 1

EXAMPLE of ROI ( d payback) S (sales) = $100 million/year C (operating cost) = $60 million/year E (equipment cost) = $10 million N (project life) = 20 years NW (working capital months) = 3 j (income tax rate ) = 0. 4 Then IF = 5*$10 = $50 initially d = $50/20 yr = $2. 5/yr IW = $60/yr*3 mo/12 mo/yr = $15 ROI = ((100 -60 -2. 5)*(1 -. 4) +2. 5)/(50 -2. 5+15) = 0. 40/yr = 40%/yr For year 1

IF with d payback as a function on time (“book value”)

IF with d payback as a function on time (“book value”)

ROI as a function of time (with d payback into IF)

ROI as a function of time (with d payback into IF)