8ef220c1a13c5e16da0dc7a2a6a85f02.ppt

- Количество слайдов: 24

Equalization grants International Experience Indonesia’s Options Bert Hofman, World Bank with thanks to Jun Ma, Ehtisham Ahmad

Equalization grants z. Importance of grants z. Rationale for grants z. Types of grants z. Equalization grants z. Examples of equalization grants z. Issues for Indonesia

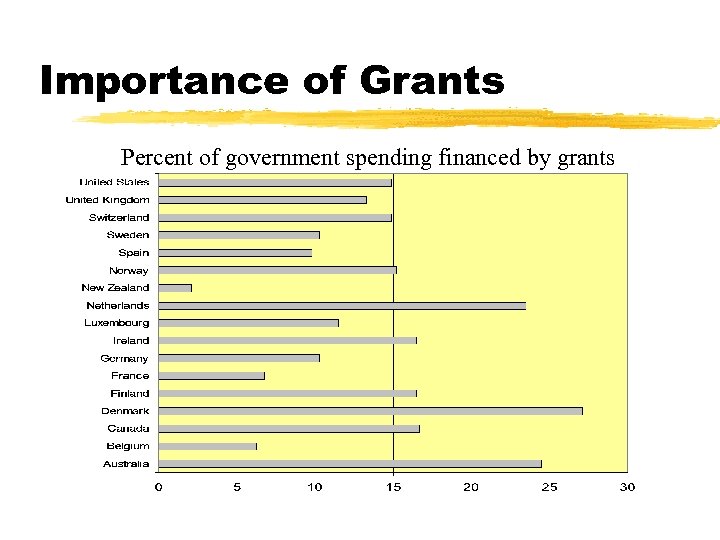

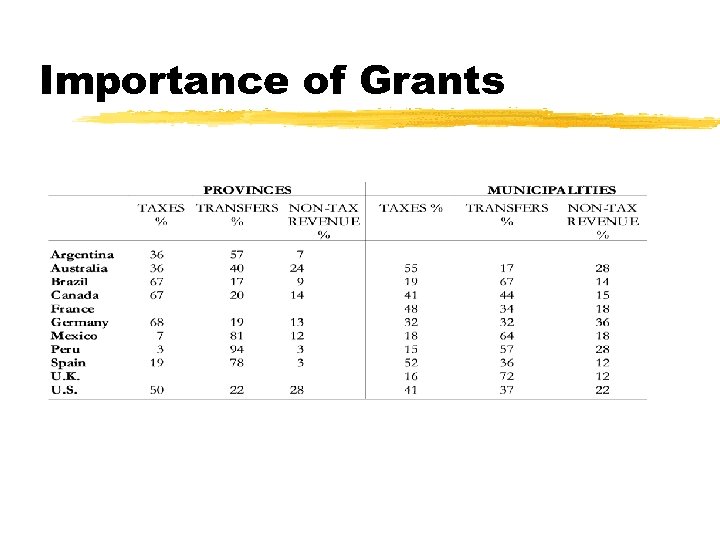

Importance of Grants Percent of government spending financed by grants

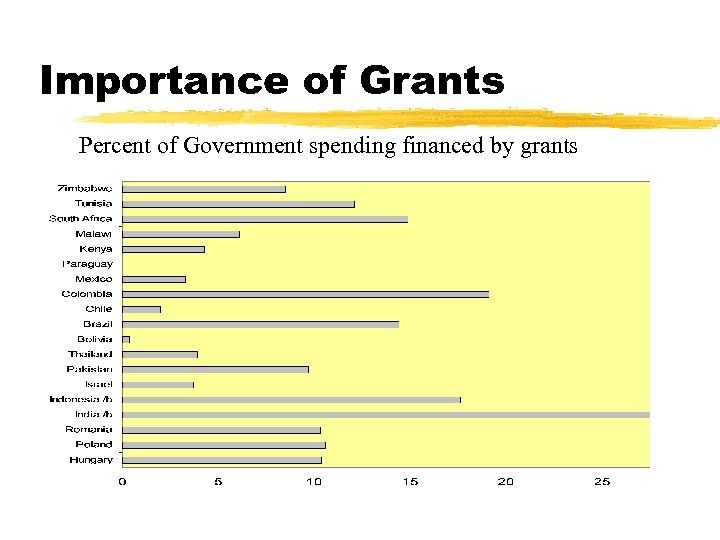

Importance of Grants Percent of Government spending financed by grants

Importance of Grants

Rational for grants z. Vertical imbalance z. Horizontal imbalance z. Spill-overs z. National priorities z. Nation building

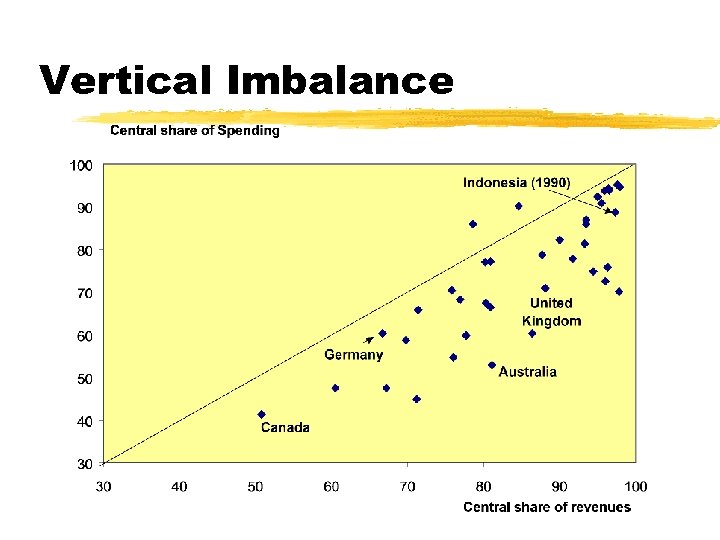

Vertical Imbalance

Types of grants z. General Grants z. Conditional/specific grants y. Matching and Non-matching Grants y. Open Ended and Closed-Ended Grants z. Block grants z. Equalization grants

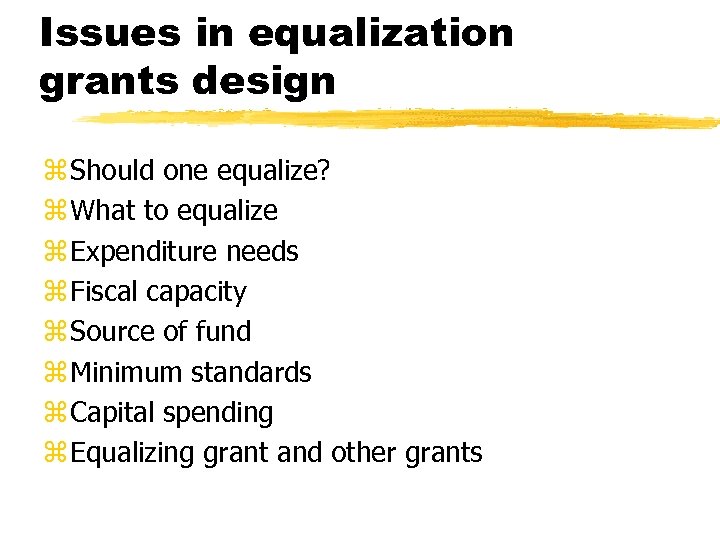

Issues in equalization grants design z Should one equalize? z What to equalize z Expenditure needs z Fiscal capacity z Source of fund z Minimum standards z Capital spending z Equalizing grant and other grants

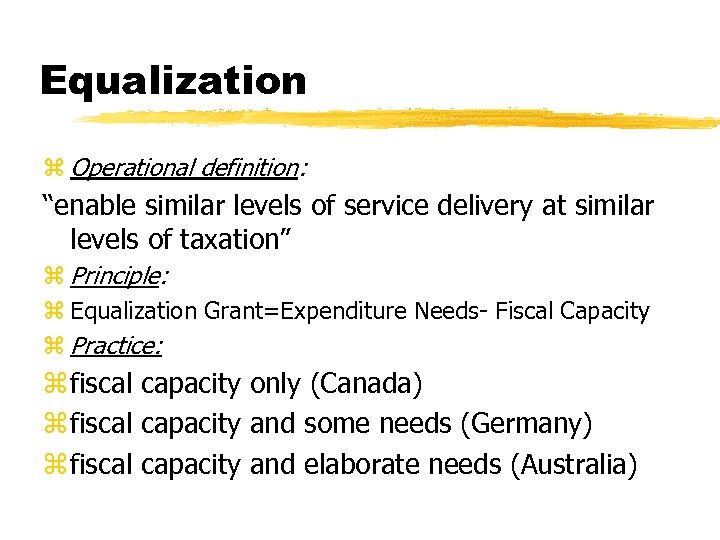

Equalization z Operational definition: “enable similar levels of service delivery at similar levels of taxation” z Principle: z Equalization Grant=Expenditure Needs- Fiscal Capacity z Practice: z fiscal capacity only (Canada) z fiscal capacity and some needs (Germany) z fiscal capacity and elaborate needs (Australia)

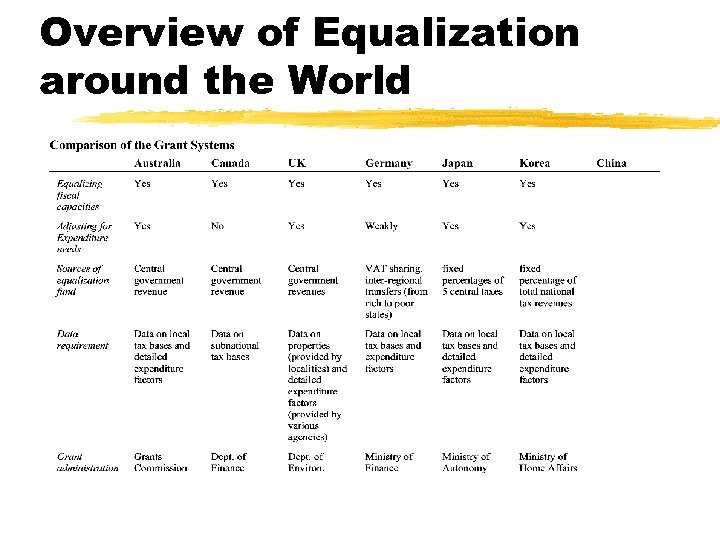

Examples of Equalization z. Australia z. Germany z. Japan z. Korea z. China

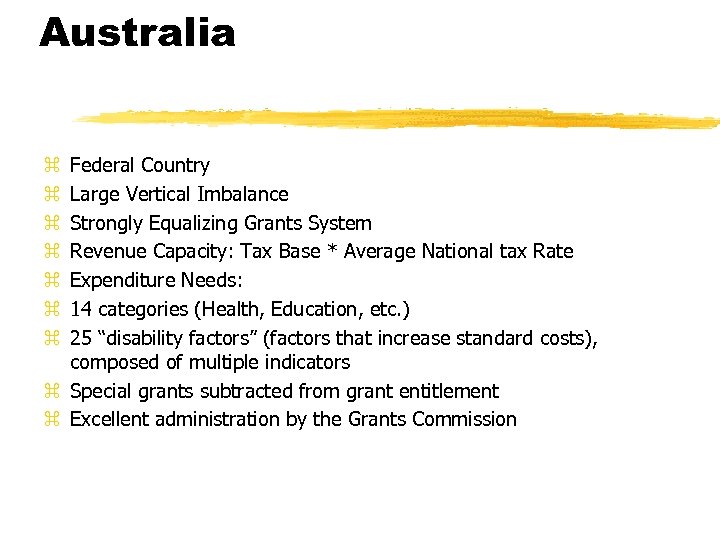

Australia Federal Country Large Vertical Imbalance Strongly Equalizing Grants System Revenue Capacity: Tax Base * Average National tax Rate Expenditure Needs: 14 categories (Health, Education, etc. ) 25 “disability factors” (factors that increase standard costs), composed of multiple indicators z Special grants subtracted from grant entitlement z Excellent administration by the Grants Commission z z z z

Germany Federal country Substantial tax sharing VAT redistributed per capita--provides most of the equalization Fiscal Equalization through Finanzausgleich (Financial Settlement) Principle: equalize needs-adjusted fiscal capacity Needs: “special burdens” for city states Every state obtains at least 95 percent of average revenues “Rich states” are taxed--discourages tax effort y Tax capacity over 110 percent of average tax with 80 percent z Eastern, poor states receive additional grants from central government z z z z

Japan z Unitary country z Large vertical imbalance z Equalization through “Local Allocation Tax”--both provinces and municipalities z Considers fiscal capacity and needs z Needs based on functions assigned to government

Japan Cont. z. Basic need = modification coefficient * unit cost zmodification coefficients examples: z school types z size of region z population density in region z cold area z urbanization of region z MOF Administers

Korea z Unitary country z Similar to Japan’s system z Fiscal capacity and needs z “Fiscal scarcity= standard need - standard revenue” z Needs = standard fiscal need + supplemental need z 29 standard factors z Separate education transfer z Ministry of Home Affairs Administers

China z. See Mr. Zhang’s speech

Overview of Equalization around the World

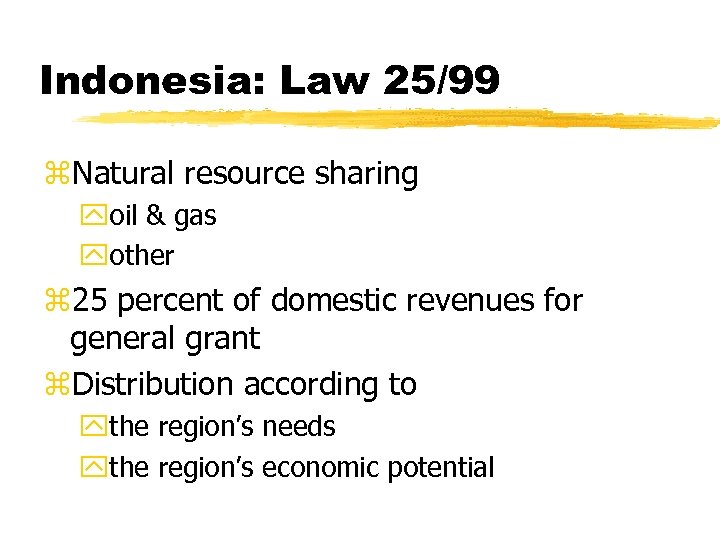

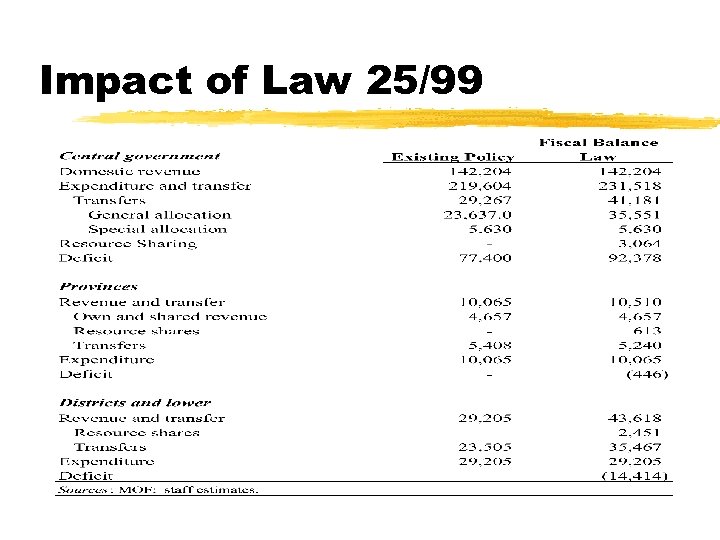

Indonesia: Law 25/99 z. Natural resource sharing yoil & gas yother z 25 percent of domestic revenues for general grant z. Distribution according to ythe region’s needs ythe region’s economic potential

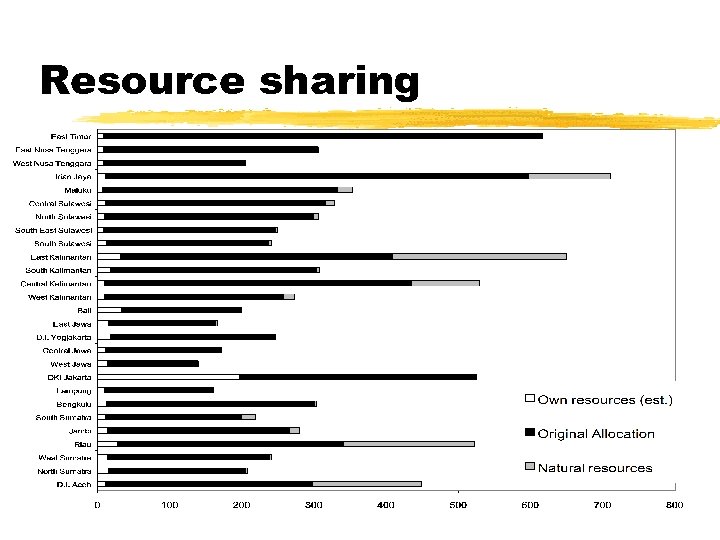

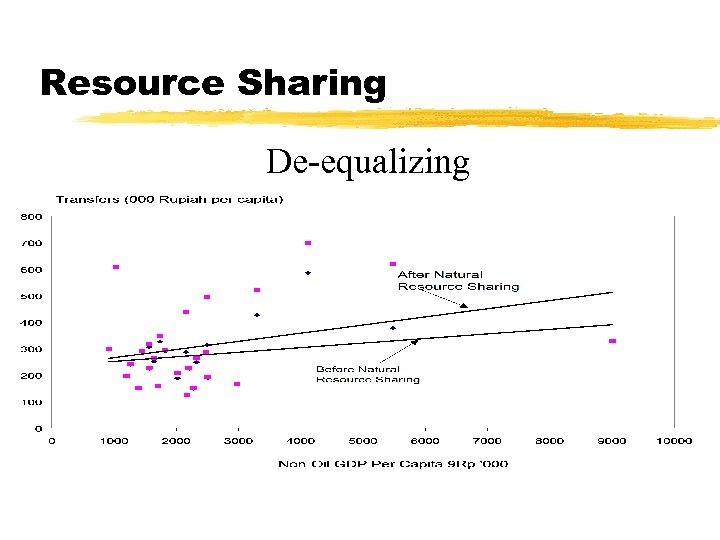

Resource sharing

Resource Sharing De-equalizing

Impact of Law 25/99

Issues in Indonesia’s Equalization Grants Design z Defining Expenditure Needs è Determine expenditure assignments z Defining Revenue Capacity è Local tax base expansion? z How Much Equalization z Data Requirements z Consultation & Discussion z Grants Administration z Transition Arrangements

Goal z. Not z“Make every region happy” z. But z“Make Every Region Reasonably Unhappy”

8ef220c1a13c5e16da0dc7a2a6a85f02.ppt