f375bea00a98c61268680f775af1bc41.ppt

- Количество слайдов: 46

EPT 221 Engineering Design Introduction to Engineering Economics

EPT 221 Engineering Design Introduction to Engineering Economics

Introduction o o • • What is engineering economics? A subset of economics for application to engineering projects. Engineers seek solution to problems, and the economic viability of each potential solution is normally considered along with the technical aspects. Scope of lecture: Time value of money Interest Evaluating economic alternatives Breakeven economics

Introduction o o • • What is engineering economics? A subset of economics for application to engineering projects. Engineers seek solution to problems, and the economic viability of each potential solution is normally considered along with the technical aspects. Scope of lecture: Time value of money Interest Evaluating economic alternatives Breakeven economics

Objectives of the chapter: 1. 2. to introduce students to various economic/accounting terms that engineers need to be aware of i. e. time value for money, interest, cash flow diagrams etc to be familiar and apply the various methods available in making decisions on the economic aspects of an engineering project

Objectives of the chapter: 1. 2. to introduce students to various economic/accounting terms that engineers need to be aware of i. e. time value for money, interest, cash flow diagrams etc to be familiar and apply the various methods available in making decisions on the economic aspects of an engineering project

Time value of money (TVM) o o o A very important concept in engineering economics: i. e. money obtained sooner is more valuable than money obtained later, and money spent sooner is more costly than money spent later. Having the money sooner: Provides the ability to invest or otherwise use the money during intervening years Eliminates the risk that the money might not be available next year Eliminating the risk that inflation might reduce the purchasing power of the money during the next year.

Time value of money (TVM) o o o A very important concept in engineering economics: i. e. money obtained sooner is more valuable than money obtained later, and money spent sooner is more costly than money spent later. Having the money sooner: Provides the ability to invest or otherwise use the money during intervening years Eliminates the risk that the money might not be available next year Eliminating the risk that inflation might reduce the purchasing power of the money during the next year.

How TVM effects design choices? o o Designs have: Different purchase prices Different operating and maintenance costs Different expected lifetimes

How TVM effects design choices? o o Designs have: Different purchase prices Different operating and maintenance costs Different expected lifetimes

Interest o What is interest? - a rental amount charged by financial institutions for the use of money Interest = total amount owed – principal amount o 2 types of interest: 1. 2. simple interest compound interest

Interest o What is interest? - a rental amount charged by financial institutions for the use of money Interest = total amount owed – principal amount o 2 types of interest: 1. 2. simple interest compound interest

o o Simple interest: interest on the principal only Interest = Principal amount x number of interest periods x interest rate I = Pni Compound interest: interest on the principal and the unpaid interest

o o Simple interest: interest on the principal only Interest = Principal amount x number of interest periods x interest rate I = Pni Compound interest: interest on the principal and the unpaid interest

Interest rate, i o Interest rate : the percentage of the principal which is paid as the interest over a certain period of time

Interest rate, i o Interest rate : the percentage of the principal which is paid as the interest over a certain period of time

Example: Suppose that RM 50, 000 is borrowed from a bank with an interest rate of 8% per annum. How much would the interest be at the end of 2 years? How much would the borrower have to pay to the bank at the end of the 2 years?

Example: Suppose that RM 50, 000 is borrowed from a bank with an interest rate of 8% per annum. How much would the interest be at the end of 2 years? How much would the borrower have to pay to the bank at the end of the 2 years?

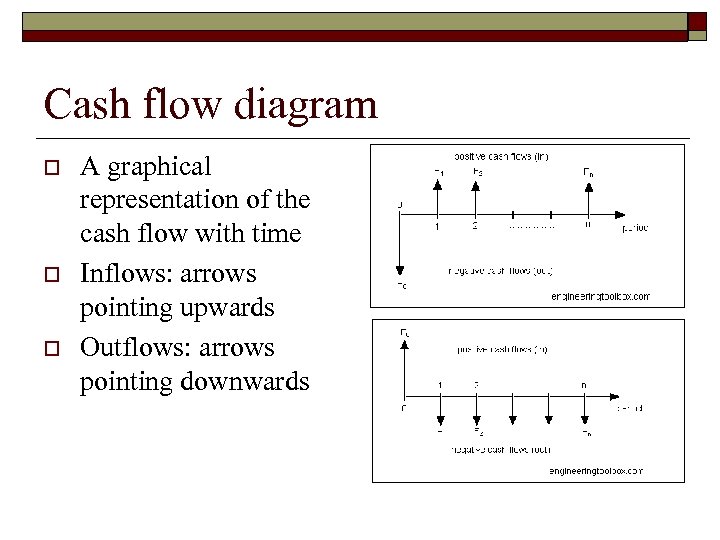

Cash flow diagram o o o A graphical representation of the cash flow with time Inflows: arrows pointing upwards Outflows: arrows pointing downwards

Cash flow diagram o o o A graphical representation of the cash flow with time Inflows: arrows pointing upwards Outflows: arrows pointing downwards

Interest Formulae 1. 2. 3. 4. 5. 6. 7. 8. single payment compound amount single payment present worth uniform series compound amount capital recovery nominal interest uniform series compound amount uniform series sinking fund gradient series

Interest Formulae 1. 2. 3. 4. 5. 6. 7. 8. single payment compound amount single payment present worth uniform series compound amount capital recovery nominal interest uniform series compound amount uniform series sinking fund gradient series

o o o n = number of interest periods i = interest rate period P = monetary values at the present F = monetary value at a future time A = series of monetary amounts, equal in value I = interest earned during an interest period

o o o n = number of interest periods i = interest rate period P = monetary values at the present F = monetary value at a future time A = series of monetary amounts, equal in value I = interest earned during an interest period

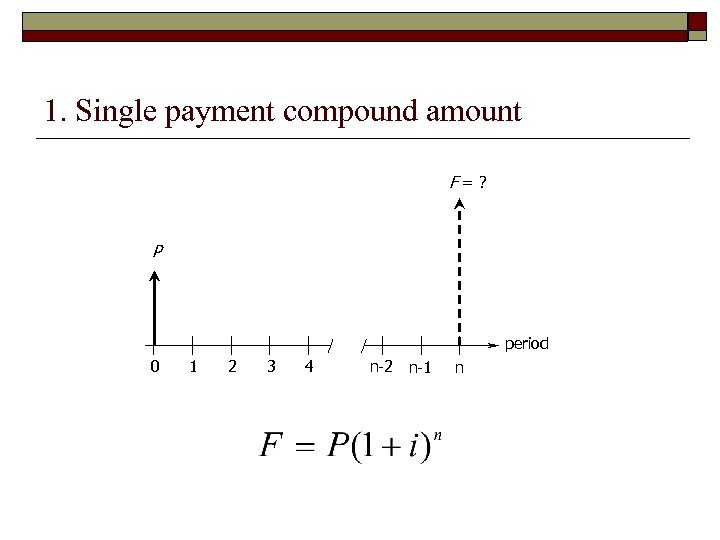

1. Single payment compound amount F=? P period 0 1 2 3 4 n-2 n-1 n

1. Single payment compound amount F=? P period 0 1 2 3 4 n-2 n-1 n

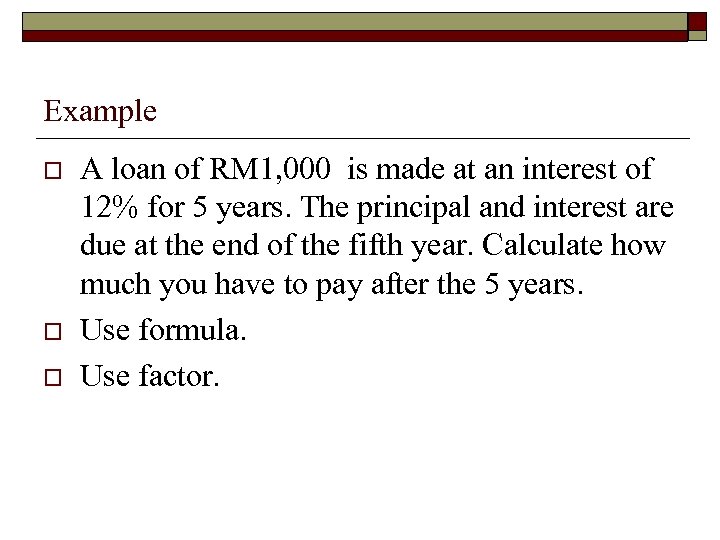

Example o o o A loan of RM 1, 000 is made at an interest of 12% for 5 years. The principal and interest are due at the end of the fifth year. Calculate how much you have to pay after the 5 years. Use formula. Use factor.

Example o o o A loan of RM 1, 000 is made at an interest of 12% for 5 years. The principal and interest are due at the end of the fifth year. Calculate how much you have to pay after the 5 years. Use formula. Use factor.

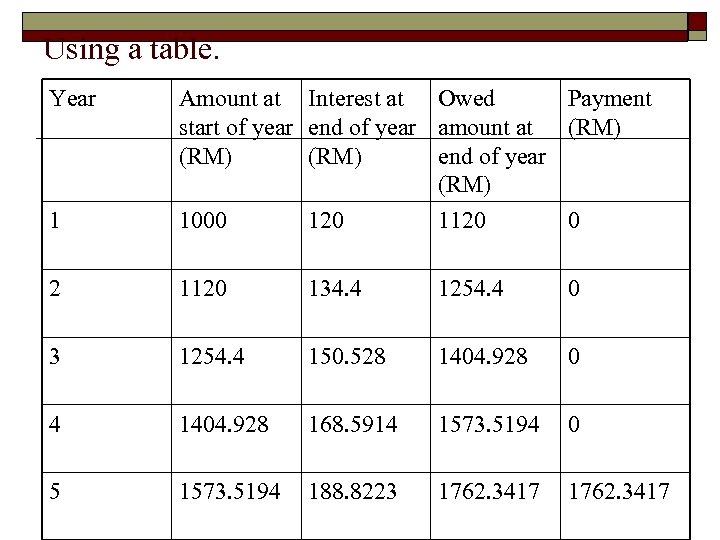

Using a table. Year 1 Amount at Interest at Owed Payment start of year end of year amount at (RM) end of year (RM) 1000 120 1120 0 2 1120 134. 4 1254. 4 0 3 1254. 4 150. 528 1404. 928 0 4 1404. 928 168. 5914 1573. 5194 0 5 1573. 5194 188. 8223 1762. 3417

Using a table. Year 1 Amount at Interest at Owed Payment start of year end of year amount at (RM) end of year (RM) 1000 120 1120 0 2 1120 134. 4 1254. 4 0 3 1254. 4 150. 528 1404. 928 0 4 1404. 928 168. 5914 1573. 5194 0 5 1573. 5194 188. 8223 1762. 3417

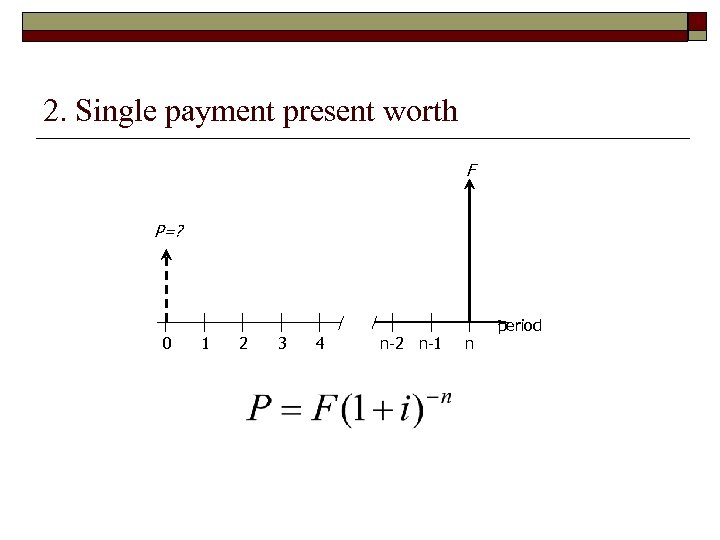

2. Single payment present worth F P=? 0 1 2 3 4 n-2 n-1 n period

2. Single payment present worth F P=? 0 1 2 3 4 n-2 n-1 n period

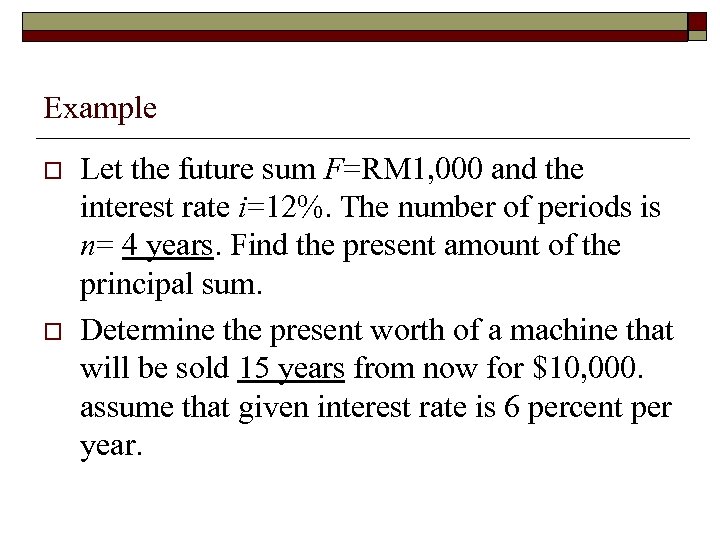

Example o o Let the future sum F=RM 1, 000 and the interest rate i=12%. The number of periods is n= 4 years. Find the present amount of the principal sum. Determine the present worth of a machine that will be sold 15 years from now for $10, 000. assume that given interest rate is 6 percent per year.

Example o o Let the future sum F=RM 1, 000 and the interest rate i=12%. The number of periods is n= 4 years. Find the present amount of the principal sum. Determine the present worth of a machine that will be sold 15 years from now for $10, 000. assume that given interest rate is 6 percent per year.

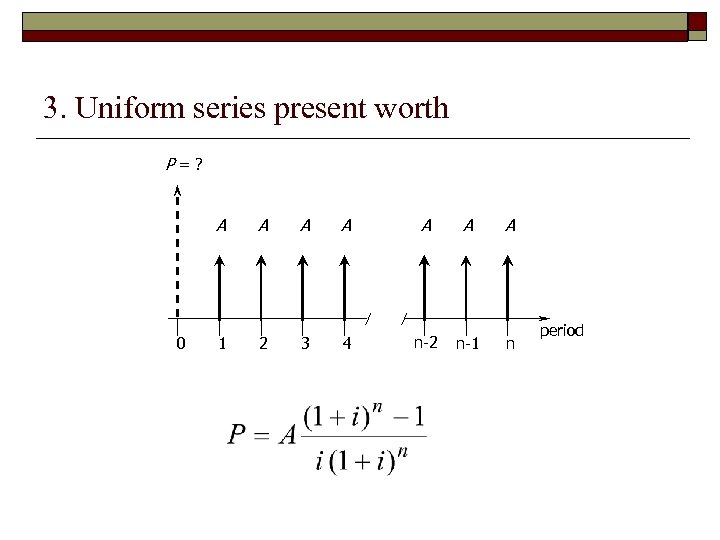

3. Uniform series present worth P=? A 0 A A A 1 2 3 4 n-2 n-1 n period

3. Uniform series present worth P=? A 0 A A A 1 2 3 4 n-2 n-1 n period

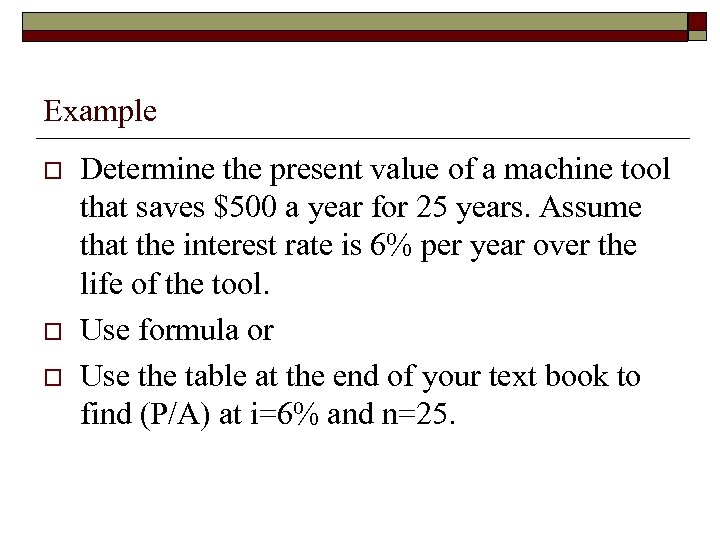

Example o o o Determine the present value of a machine tool that saves $500 a year for 25 years. Assume that the interest rate is 6% per year over the life of the tool. Use formula or Use the table at the end of your text book to find (P/A) at i=6% and n=25.

Example o o o Determine the present value of a machine tool that saves $500 a year for 25 years. Assume that the interest rate is 6% per year over the life of the tool. Use formula or Use the table at the end of your text book to find (P/A) at i=6% and n=25.

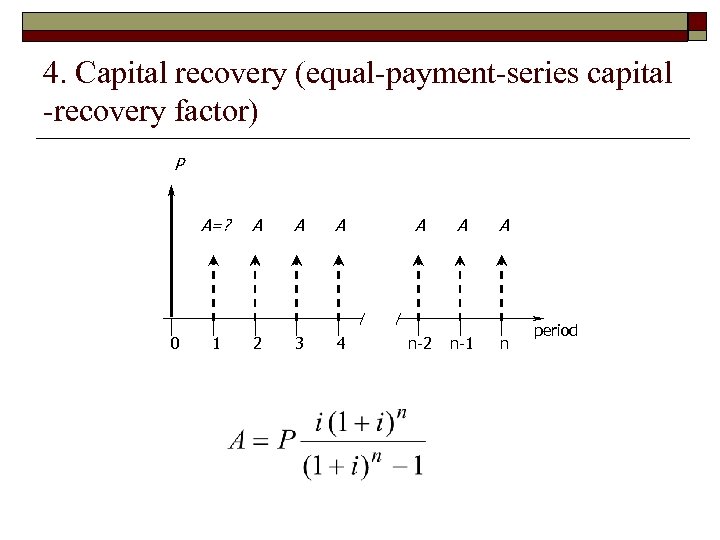

4. Capital recovery (equal-payment-series capital -recovery factor) P A=? 0 A A A 1 2 3 4 n-2 n-1 n period

4. Capital recovery (equal-payment-series capital -recovery factor) P A=? 0 A A A 1 2 3 4 n-2 n-1 n period

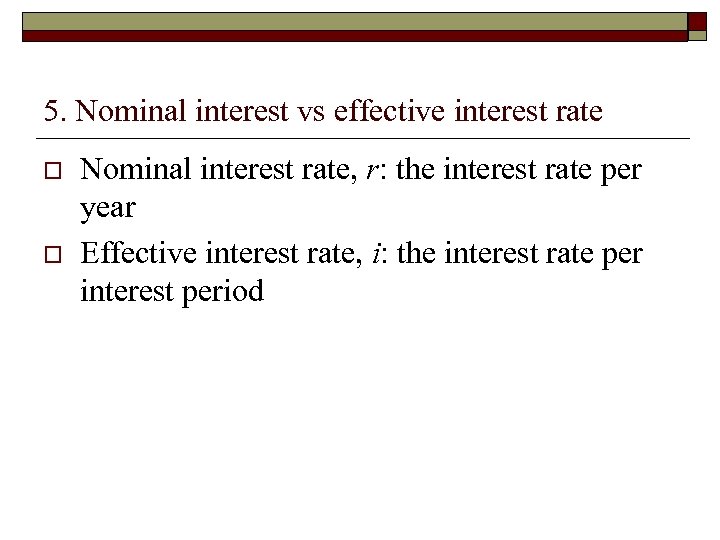

5. Nominal interest vs effective interest rate o o Nominal interest rate, r: the interest rate per year Effective interest rate, i: the interest rate per interest period

5. Nominal interest vs effective interest rate o o Nominal interest rate, r: the interest rate per year Effective interest rate, i: the interest rate per interest period

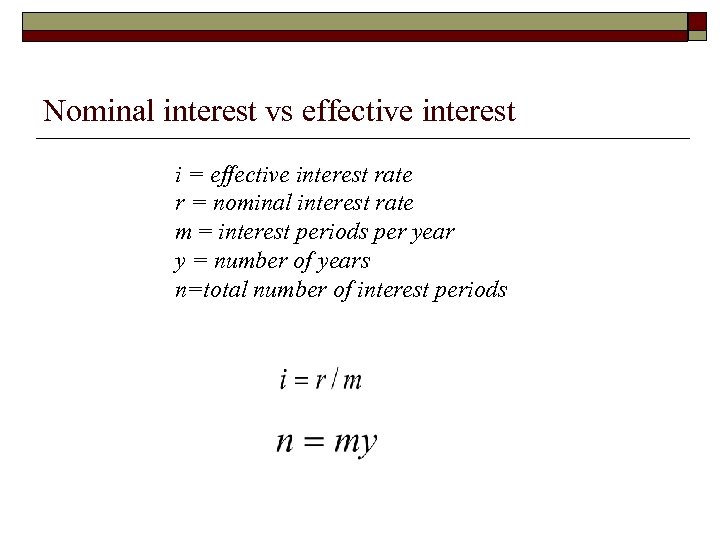

Nominal interest vs effective interest i = effective interest rate r = nominal interest rate m = interest periods per year y = number of years n=total number of interest periods

Nominal interest vs effective interest i = effective interest rate r = nominal interest rate m = interest periods per year y = number of years n=total number of interest periods

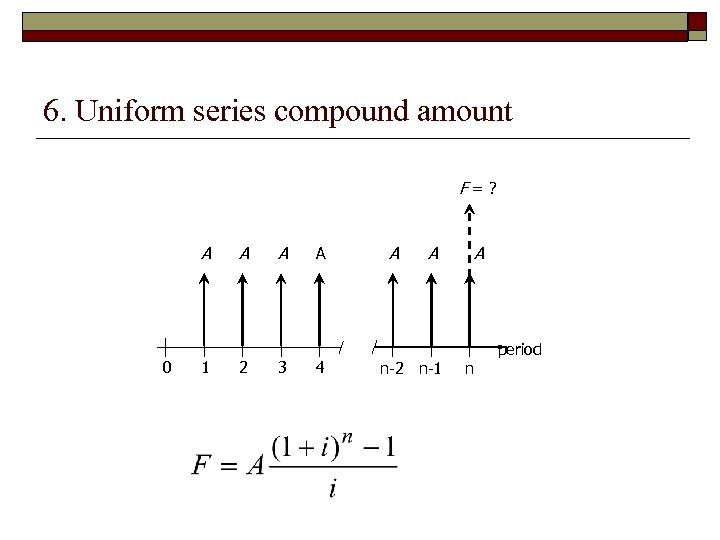

6. Uniform series compound amount F=? A 0 1 A 2 A 3 A 4 A A n-2 n-1 A n period

6. Uniform series compound amount F=? A 0 1 A 2 A 3 A 4 A A n-2 n-1 A n period

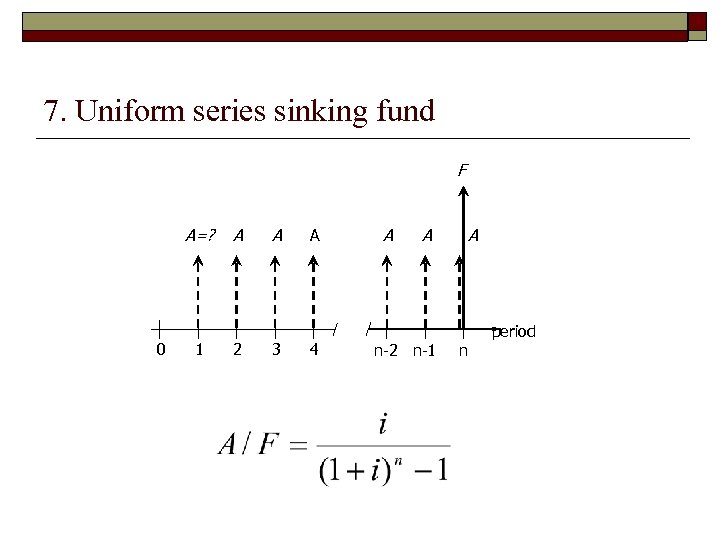

7. Uniform series sinking fund F A=? 0 1 A 2 A 3 A 4 A A n-2 n-1 A n period

7. Uniform series sinking fund F A=? 0 1 A 2 A 3 A 4 A A n-2 n-1 A n period

8. Uniform Gradient Series Factor o o Often periodic payments do not occur in equal amounts and may increase or decrease by constant amounts (eg. RM 10, RM 110, RM 210, etc…. ) The gradient (G) is a value in the cash flow that starts with 0 at the end of year 1, G at the end of year 2, etc.

8. Uniform Gradient Series Factor o o Often periodic payments do not occur in equal amounts and may increase or decrease by constant amounts (eg. RM 10, RM 110, RM 210, etc…. ) The gradient (G) is a value in the cash flow that starts with 0 at the end of year 1, G at the end of year 2, etc.

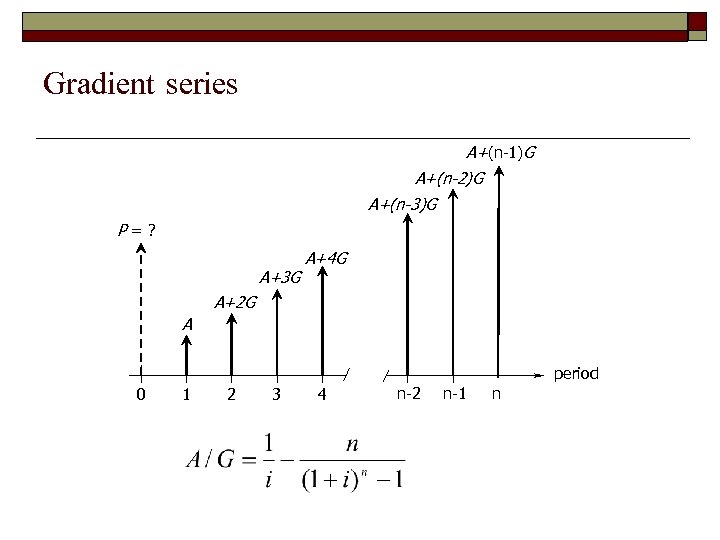

Gradient series A+(n-1)G A+(n-2)G A+(n-3)G P=? A+3 G A+4 G A+2 G A period 0 1 2 3 4 n-2 n-1 n

Gradient series A+(n-1)G A+(n-2)G A+(n-3)G P=? A+3 G A+4 G A+2 G A period 0 1 2 3 4 n-2 n-1 n

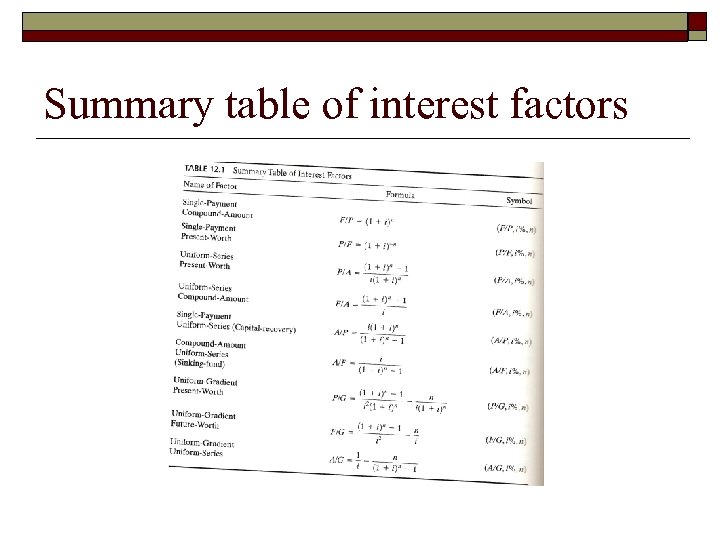

Summary table of interest factors

Summary table of interest factors

Evaluating economic alternatives o 5 methods: 1. 2. 3. 4. 5. present-worth method future worth method equivalent-uniform annual-worth method rate-of-return method payback period

Evaluating economic alternatives o 5 methods: 1. 2. 3. 4. 5. present-worth method future worth method equivalent-uniform annual-worth method rate-of-return method payback period

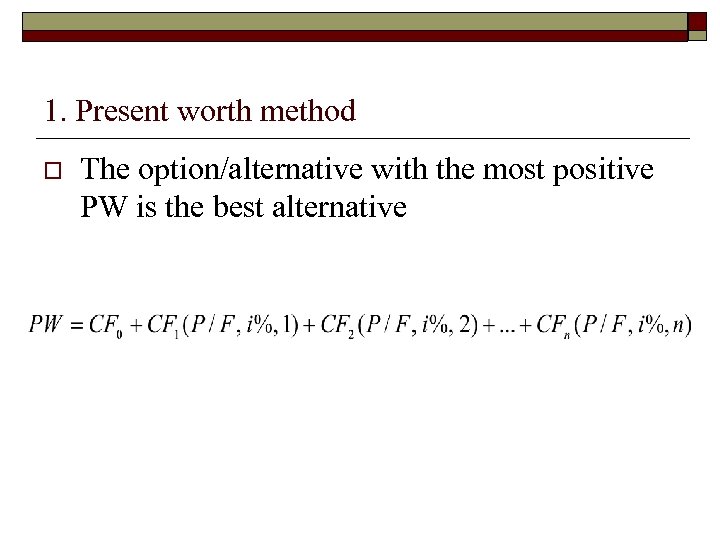

1. Present worth method o The option/alternative with the most positive PW is the best alternative

1. Present worth method o The option/alternative with the most positive PW is the best alternative

Example o Our company has received a vendor quote stipulating that it will supply 5, 000 parts per year for the next 3 years at $25, 000 per year. Our manufacturing engineering department, however estimates that is the company invests in a new machine tool for $10, 000, we can produce the same 5, 000 parts per year for an annual cost of $18, 000 per year. Assume that the interest rate is 8% per year; which alternative is more economical, make or buy?

Example o Our company has received a vendor quote stipulating that it will supply 5, 000 parts per year for the next 3 years at $25, 000 per year. Our manufacturing engineering department, however estimates that is the company invests in a new machine tool for $10, 000, we can produce the same 5, 000 parts per year for an annual cost of $18, 000 per year. Assume that the interest rate is 8% per year; which alternative is more economical, make or buy?

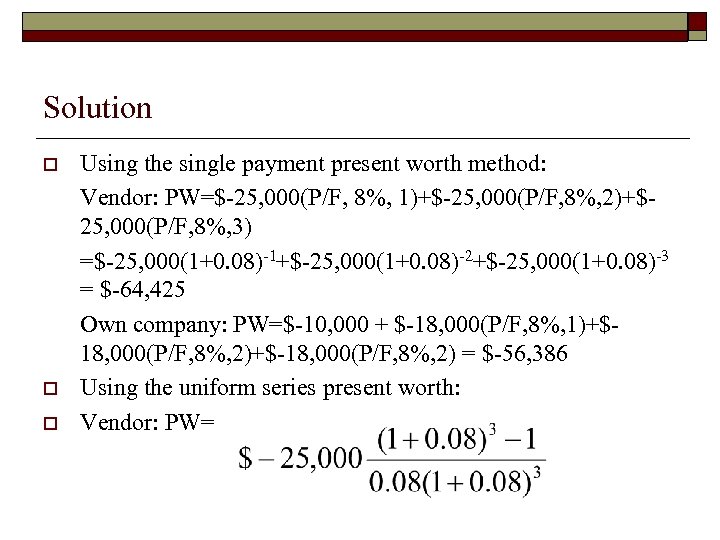

Solution o o o Using the single payment present worth method: Vendor: PW=$-25, 000(P/F, 8%, 1)+$-25, 000(P/F, 8%, 2)+$25, 000(P/F, 8%, 3) =$-25, 000(1+0. 08)-1+$-25, 000(1+0. 08)-2+$-25, 000(1+0. 08)-3 = $-64, 425 Own company: PW=$-10, 000 + $-18, 000(P/F, 8%, 1)+$18, 000(P/F, 8%, 2)+$-18, 000(P/F, 8%, 2) = $-56, 386 Using the uniform series present worth: Vendor: PW=

Solution o o o Using the single payment present worth method: Vendor: PW=$-25, 000(P/F, 8%, 1)+$-25, 000(P/F, 8%, 2)+$25, 000(P/F, 8%, 3) =$-25, 000(1+0. 08)-1+$-25, 000(1+0. 08)-2+$-25, 000(1+0. 08)-3 = $-64, 425 Own company: PW=$-10, 000 + $-18, 000(P/F, 8%, 1)+$18, 000(P/F, 8%, 2)+$-18, 000(P/F, 8%, 2) = $-56, 386 Using the uniform series present worth: Vendor: PW=

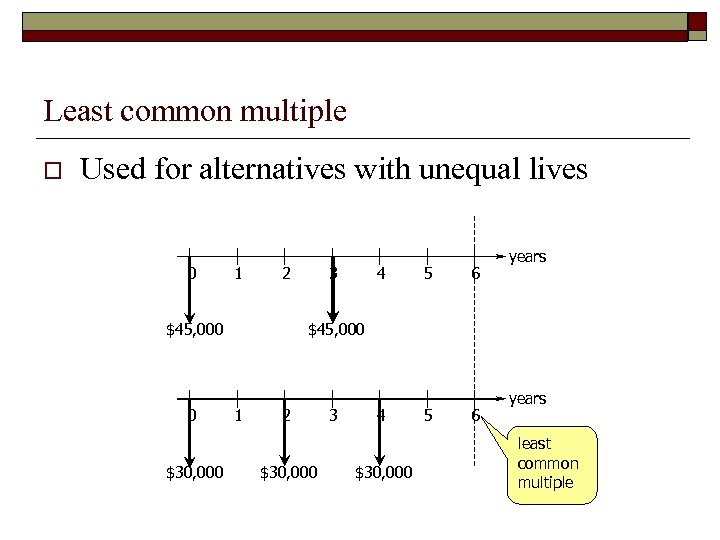

Least common multiple o Used for alternatives with unequal lives 0 1 2 $45, 000 0 $30, 000 3 4 5 6 years $45, 000 1 2 $30, 000 3 4 $30, 000 5 6 years least common multiple

Least common multiple o Used for alternatives with unequal lives 0 1 2 $45, 000 0 $30, 000 3 4 5 6 years $45, 000 1 2 $30, 000 3 4 $30, 000 5 6 years least common multiple

Example o Machine tool A will last 3 years and cost $45, 000 to replace. Machine B costs $30, 000, performs as well as the other machine, but need to be replaced every 2 years. Which machine is better assuming the interest rate is 6% per year?

Example o Machine tool A will last 3 years and cost $45, 000 to replace. Machine B costs $30, 000, performs as well as the other machine, but need to be replaced every 2 years. Which machine is better assuming the interest rate is 6% per year?

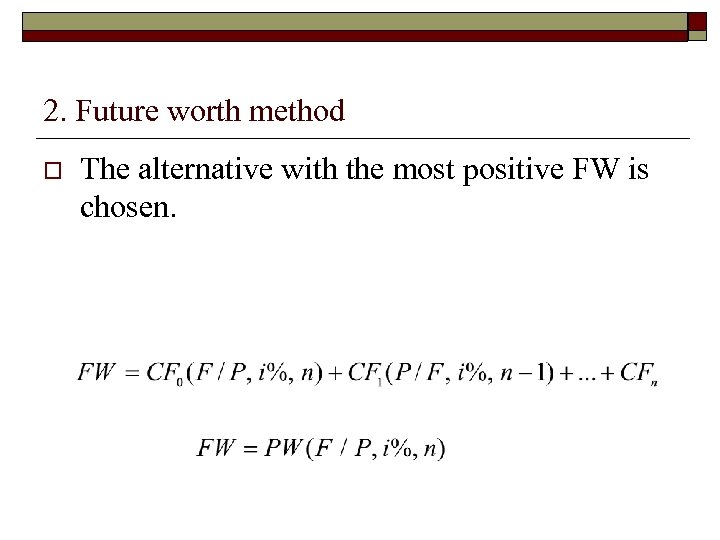

2. Future worth method o The alternative with the most positive FW is chosen.

2. Future worth method o The alternative with the most positive FW is chosen.

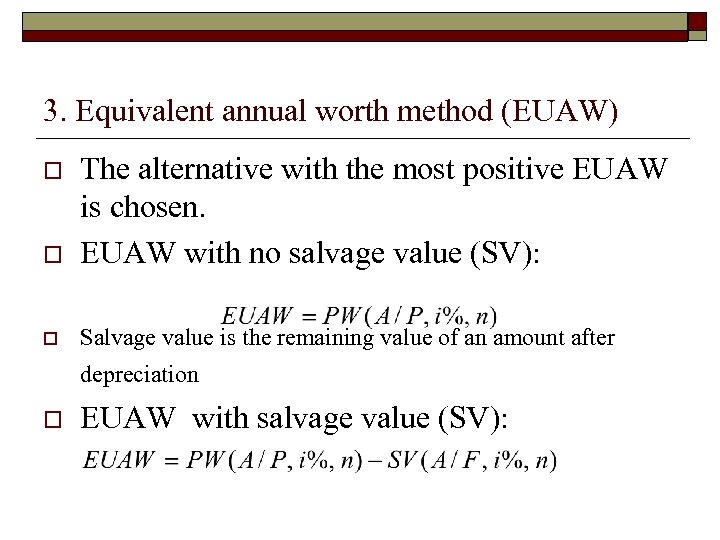

3. Equivalent annual worth method (EUAW) o The alternative with the most positive EUAW is chosen. EUAW with no salvage value (SV): o Salvage value is the remaining value of an amount after o depreciation o EUAW with salvage value (SV):

3. Equivalent annual worth method (EUAW) o The alternative with the most positive EUAW is chosen. EUAW with no salvage value (SV): o Salvage value is the remaining value of an amount after o depreciation o EUAW with salvage value (SV):

o Advantage: alternatives that have different lives do not have to be compared using the least common multiple of the lives.

o Advantage: alternatives that have different lives do not have to be compared using the least common multiple of the lives.

Example o A new machine initially costs $40, 000 and $10, 000 per year to operate. The machine has a 10 -year life and $1000 salvage value. Assume that the interest rate is 10% per year. As an alternative, the company can lease the machine for $7, 500 per year for 10 years. Use the EUAW method to determine which alternative is the most economical.

Example o A new machine initially costs $40, 000 and $10, 000 per year to operate. The machine has a 10 -year life and $1000 salvage value. Assume that the interest rate is 10% per year. As an alternative, the company can lease the machine for $7, 500 per year for 10 years. Use the EUAW method to determine which alternative is the most economical.

4. Rate of return method (ROR) o o o The ratio of money gained or lost on an investment relative to the amount of money invested. The alternative with the greatest return is chosen. Use the ROR to find the special interest rate i* when the present value of the cash flows is zero.

4. Rate of return method (ROR) o o o The ratio of money gained or lost on an investment relative to the amount of money invested. The alternative with the greatest return is chosen. Use the ROR to find the special interest rate i* when the present value of the cash flows is zero.

Example o The redesign of an existing product will require a $50, 000 investment but will return $16, 719 each year for years 1 through 5. The company has a minimum attractive rate of return of 25%. Use ROR method to determine whether to complete the redesign. Solution PW = $-50, 000 + $16, 719(P/A, i*%, 5)=0. 0 P/A because the return is the same throughout the 5 years. So, (P/A, i*%, 5)=$50, 000/$16, 719=2. 991 Go to the tables at the end of the text book, and find what is the i* at P/A = 2. 991 and n=5. i*=20% which is less than the minimum attractive rate of return of 25%. So, is redesigning a viable option or not?

Example o The redesign of an existing product will require a $50, 000 investment but will return $16, 719 each year for years 1 through 5. The company has a minimum attractive rate of return of 25%. Use ROR method to determine whether to complete the redesign. Solution PW = $-50, 000 + $16, 719(P/A, i*%, 5)=0. 0 P/A because the return is the same throughout the 5 years. So, (P/A, i*%, 5)=$50, 000/$16, 719=2. 991 Go to the tables at the end of the text book, and find what is the i* at P/A = 2. 991 and n=5. i*=20% which is less than the minimum attractive rate of return of 25%. So, is redesigning a viable option or not?

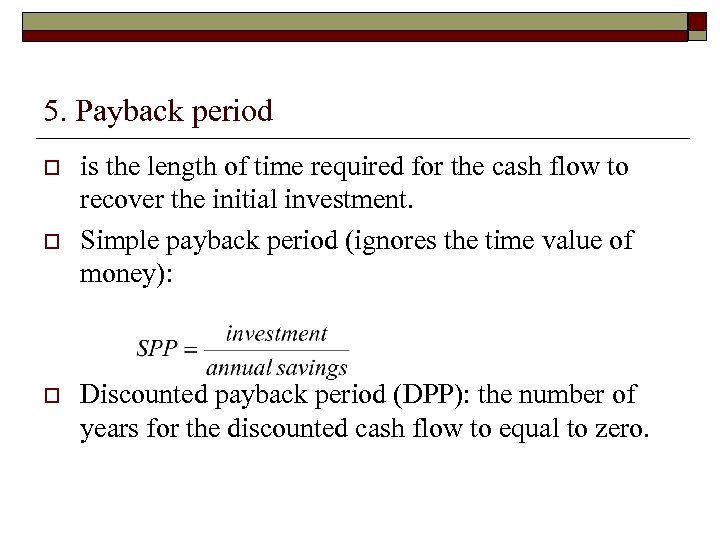

5. Payback period o o o is the length of time required for the cash flow to recover the initial investment. Simple payback period (ignores the time value of money): Discounted payback period (DPP): the number of years for the discounted cash flow to equal to zero.

5. Payback period o o o is the length of time required for the cash flow to recover the initial investment. Simple payback period (ignores the time value of money): Discounted payback period (DPP): the number of years for the discounted cash flow to equal to zero.

Breakeven Economics o o Is used to determine whether a proposed product would be profitable compared to modifying an existing product or just the profitability of a product. Breakeven point, q*: the point at which cost or expenses (loss) and income (profit) are equal i. e. no net loss or gain

Breakeven Economics o o Is used to determine whether a proposed product would be profitable compared to modifying an existing product or just the profitability of a product. Breakeven point, q*: the point at which cost or expenses (loss) and income (profit) are equal i. e. no net loss or gain

o o o o Fixed cost, FC: expenses that do not vary with production. Eg: utility bill, rent, administrative labour, advertising, legal, building depreciation Variable cost, VC: expenses that depends on the amount product manufactured. Eg: raw materials, production labour. Revenue (income), R= Total revenue = rq r = revenue per unit q = quantity of product sold v = variable cost per unit Profit = difference between revenue and costs = R =TC = rq – FC - vq

o o o o Fixed cost, FC: expenses that do not vary with production. Eg: utility bill, rent, administrative labour, advertising, legal, building depreciation Variable cost, VC: expenses that depends on the amount product manufactured. Eg: raw materials, production labour. Revenue (income), R= Total revenue = rq r = revenue per unit q = quantity of product sold v = variable cost per unit Profit = difference between revenue and costs = R =TC = rq – FC - vq

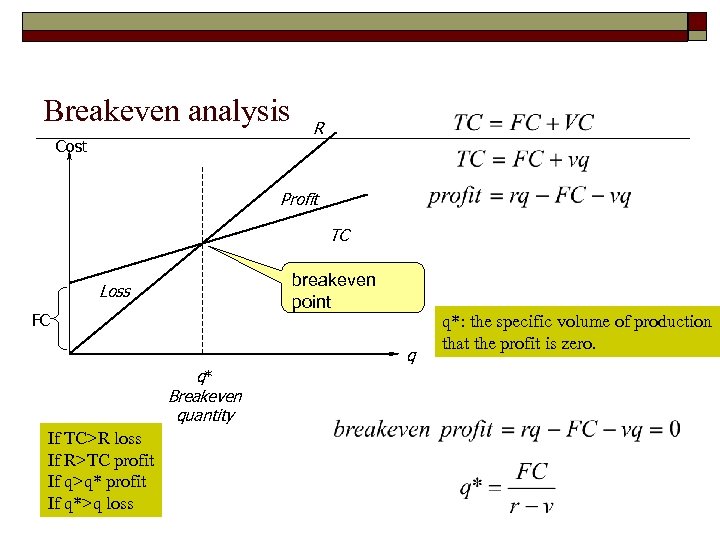

Breakeven analysis Cost R Profit TC breakeven point Loss FC q q* Breakeven quantity If TC>R loss If R>TC profit If q>q* profit If q*>q loss q*: the specific volume of production that the profit is zero.

Breakeven analysis Cost R Profit TC breakeven point Loss FC q q* Breakeven quantity If TC>R loss If R>TC profit If q>q* profit If q*>q loss q*: the specific volume of production that the profit is zero.

Example o The company receives $5 per unit sold and the variable costs to make each unit are $3. 50. Determine the fixed costs such that the company will break even when making 20, 000 units.

Example o The company receives $5 per unit sold and the variable costs to make each unit are $3. 50. Determine the fixed costs such that the company will break even when making 20, 000 units.

Summary § Engineering economic analyses should consider the § § time value of money Interest factor formulas and tables are useful in evaluating alternatives The PW and FW methods can be used to evaluate alternatives having different lives by using the least common multiple of years. The EUAW method is preferred because it has the advantage of not requiring the use of the least common multiple. The breakeven point is that level of production (and sales) that results in a zero profit

Summary § Engineering economic analyses should consider the § § time value of money Interest factor formulas and tables are useful in evaluating alternatives The PW and FW methods can be used to evaluate alternatives having different lives by using the least common multiple of years. The EUAW method is preferred because it has the advantage of not requiring the use of the least common multiple. The breakeven point is that level of production (and sales) that results in a zero profit

o o o Exercise: Due 17 th October 2008 (NO LATE SUBMISSIONS WILL BE ENTERTAINED!!!) Textbook: Rudolph J. Eggert, Engineering Design Question number: 16, 24, 26, 33

o o o Exercise: Due 17 th October 2008 (NO LATE SUBMISSIONS WILL BE ENTERTAINED!!!) Textbook: Rudolph J. Eggert, Engineering Design Question number: 16, 24, 26, 33