19ed08bae70d33cf43cb238df8e576d8.ppt

- Количество слайдов: 19

EPI, Consumers’, Producers’ & Net Social Surplus Lecture 8 Dr. Jennifer P. Wissink © 2018 John M. Abowd and Jennifer P. Wissink, all rights reserved. February 21, 2018

EPI, Consumers’, Producers’ & Net Social Surplus Lecture 8 Dr. Jennifer P. Wissink © 2018 John M. Abowd and Jennifer P. Wissink, all rights reserved. February 21, 2018

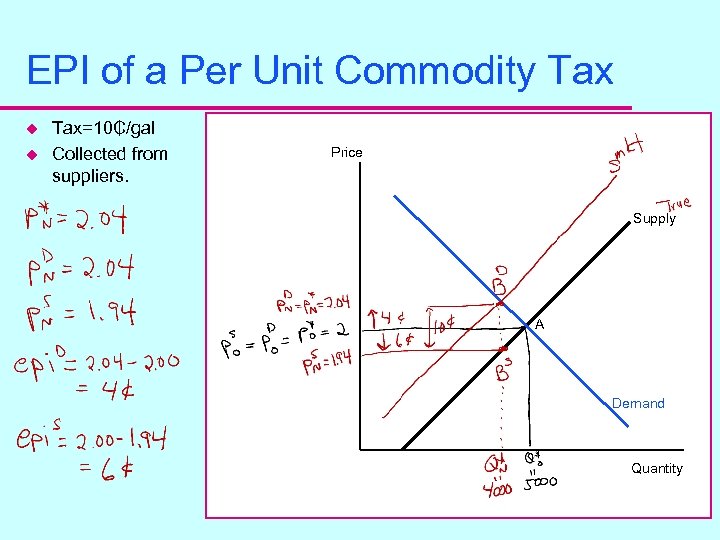

EPI of a Per Unit Commodity Tax u u Tax=10₵/gal Collected from suppliers. Price Supply A Demand Quantity

EPI of a Per Unit Commodity Tax u u Tax=10₵/gal Collected from suppliers. Price Supply A Demand Quantity

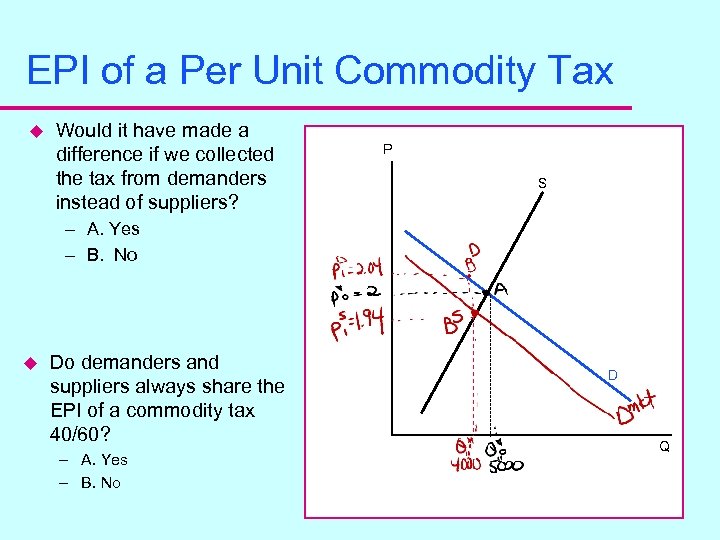

EPI of a Per Unit Commodity Tax u Would it have made a difference if we collected the tax from demanders instead of suppliers? P S – A. Yes – B. No u Do demanders and suppliers always share the EPI of a commodity tax 40/60? – A. Yes – B. No D Q

EPI of a Per Unit Commodity Tax u Would it have made a difference if we collected the tax from demanders instead of suppliers? P S – A. Yes – B. No u Do demanders and suppliers always share the EPI of a commodity tax 40/60? – A. Yes – B. No D Q

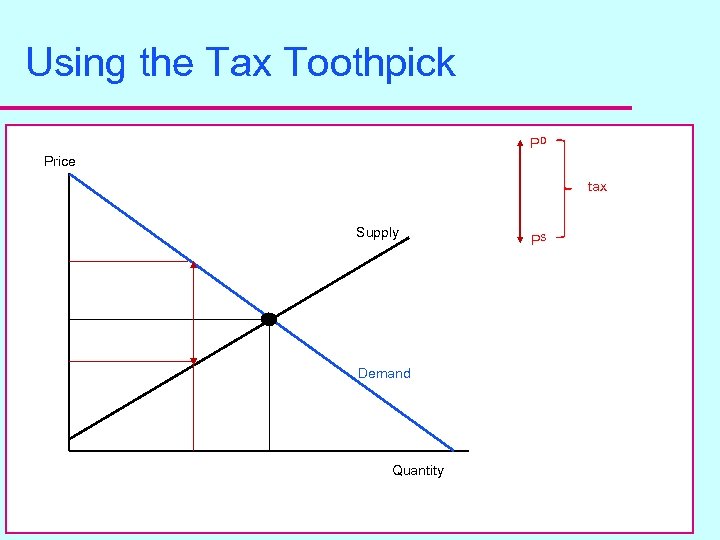

Using the Tax Toothpick PD Price tax Supply Demand Quantity PS

Using the Tax Toothpick PD Price tax Supply Demand Quantity PS

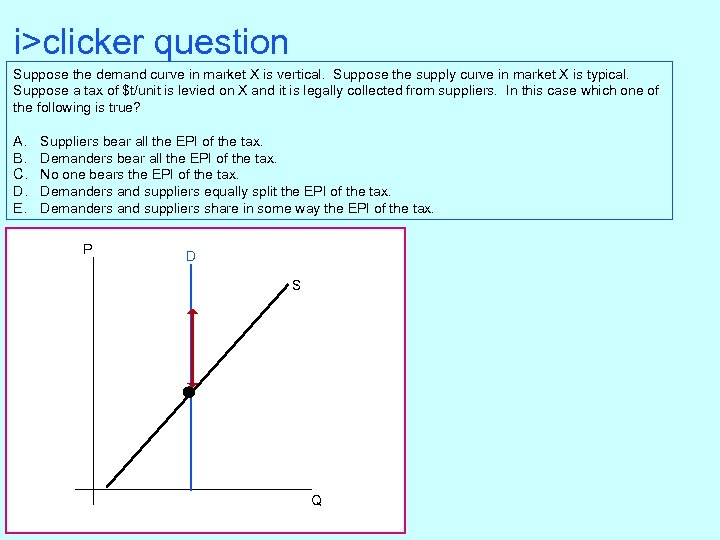

i>clicker question Suppose the demand curve in market X is vertical. Suppose the supply curve in market X is typical. Suppose a tax of $t/unit is levied on X and it is legally collected from suppliers. In this case which one of the following is true? A. B. C. D. E. Suppliers bear all the EPI of the tax. Demanders bear all the EPI of the tax. No one bears the EPI of the tax. Demanders and suppliers equally split the EPI of the tax. Demanders and suppliers share in some way the EPI of the tax. P D S Q

i>clicker question Suppose the demand curve in market X is vertical. Suppose the supply curve in market X is typical. Suppose a tax of $t/unit is levied on X and it is legally collected from suppliers. In this case which one of the following is true? A. B. C. D. E. Suppliers bear all the EPI of the tax. Demanders bear all the EPI of the tax. No one bears the EPI of the tax. Demanders and suppliers equally split the EPI of the tax. Demanders and suppliers share in some way the EPI of the tax. P D S Q

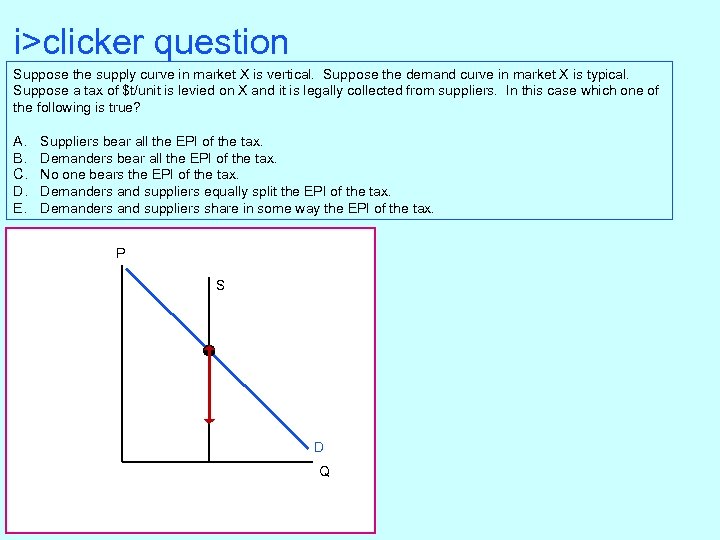

i>clicker question Suppose the supply curve in market X is vertical. Suppose the demand curve in market X is typical. Suppose a tax of $t/unit is levied on X and it is legally collected from suppliers. In this case which one of the following is true? A. B. C. D. E. Suppliers bear all the EPI of the tax. Demanders bear all the EPI of the tax. No one bears the EPI of the tax. Demanders and suppliers equally split the EPI of the tax. Demanders and suppliers share in some way the EPI of the tax. P S D Q

i>clicker question Suppose the supply curve in market X is vertical. Suppose the demand curve in market X is typical. Suppose a tax of $t/unit is levied on X and it is legally collected from suppliers. In this case which one of the following is true? A. B. C. D. E. Suppliers bear all the EPI of the tax. Demanders bear all the EPI of the tax. No one bears the EPI of the tax. Demanders and suppliers equally split the EPI of the tax. Demanders and suppliers share in some way the EPI of the tax. P S D Q

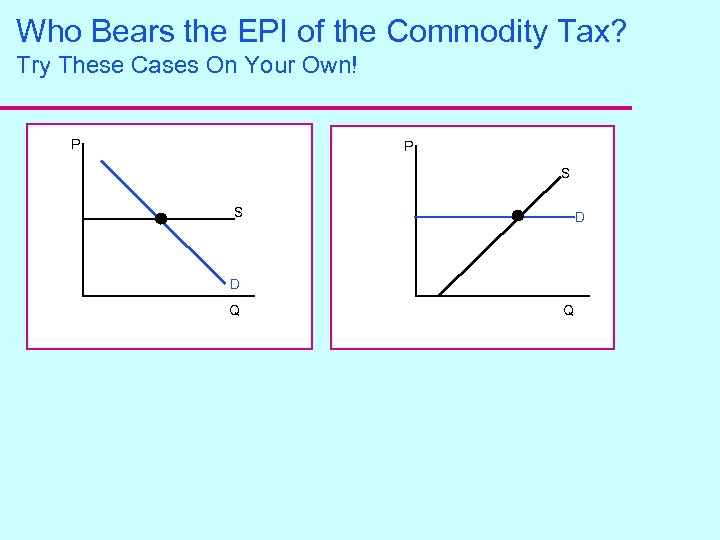

Who Bears the EPI of the Commodity Tax? Try These Cases On Your Own! P P S S D D Q Q

Who Bears the EPI of the Commodity Tax? Try These Cases On Your Own! P P S S D D Q Q

Commodity Taxes In The News u Sugar Tax Ireland: Government confirm tax on fizzy drinks will take effect on April 6 here's which brands could be affected – u https: //www. irishmirror. ie/news/irish-news/health-news/sugar-tax-ireland-government-confirm-11996027 The Tax Foundation: State Sales, Gasoline, Cigarette, and Alcohol Taxes – http: //www. taxfoundation. org/taxdata/show/245. html u Top 12 weirdest tax rules around the world – Karis Hustad, Friday, 14 Feb 2014 | 2: 45 PM ETChristian Science Monitor – http: //www. cnbc. com/2014/02/14/top-12 -weirdest-tax-rules-around-the-world. html » 5. Sweden: Baby names need tax agency approval » Choosing a name for your new son or daughter is a difficult decision, one that requires at least the mother and father to be in agreement. In Sweden there is one more necessary party: the Swedish tax agency. » Swedish people are required to have their child's name approved by the Swedish tax agency before the child turns five. If parents fail to do so, they can be fined up to 5, 000 kroner (or $770). The law originally was put in place in 1982, reportedly to prevent citizens from using royal names, but the law states the rationale is that by approving the name the tax agency can protect a child from an offensive or confusing name. » What kind of names are unacceptable? The tax agency has rejected "Ikea" (due to potential confusion) and "Allah" (due to potential religious offense), as well as "Brfxxccxxmnpcccclllmmnprxvclmnckssqlbb 11116", which one child's parents attempted to name their child in protest of the law. However, "Google" and "Lego" were recently allowed.

Commodity Taxes In The News u Sugar Tax Ireland: Government confirm tax on fizzy drinks will take effect on April 6 here's which brands could be affected – u https: //www. irishmirror. ie/news/irish-news/health-news/sugar-tax-ireland-government-confirm-11996027 The Tax Foundation: State Sales, Gasoline, Cigarette, and Alcohol Taxes – http: //www. taxfoundation. org/taxdata/show/245. html u Top 12 weirdest tax rules around the world – Karis Hustad, Friday, 14 Feb 2014 | 2: 45 PM ETChristian Science Monitor – http: //www. cnbc. com/2014/02/14/top-12 -weirdest-tax-rules-around-the-world. html » 5. Sweden: Baby names need tax agency approval » Choosing a name for your new son or daughter is a difficult decision, one that requires at least the mother and father to be in agreement. In Sweden there is one more necessary party: the Swedish tax agency. » Swedish people are required to have their child's name approved by the Swedish tax agency before the child turns five. If parents fail to do so, they can be fined up to 5, 000 kroner (or $770). The law originally was put in place in 1982, reportedly to prevent citizens from using royal names, but the law states the rationale is that by approving the name the tax agency can protect a child from an offensive or confusing name. » What kind of names are unacceptable? The tax agency has rejected "Ikea" (due to potential confusion) and "Allah" (due to potential religious offense), as well as "Brfxxccxxmnpcccclllmmnprxvclmnckssqlbb 11116", which one child's parents attempted to name their child in protest of the law. However, "Google" and "Lego" were recently allowed.

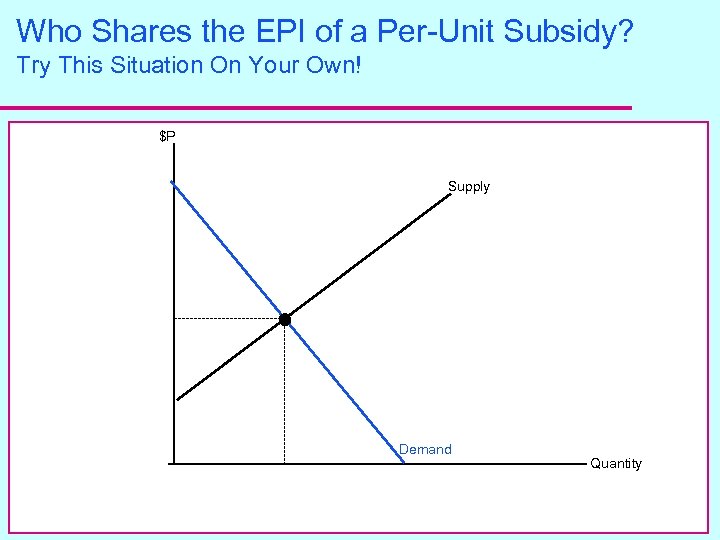

Who Shares the EPI of a Per-Unit Subsidy? Try This Situation On Your Own! $P Supply Demand Quantity

Who Shares the EPI of a Per-Unit Subsidy? Try This Situation On Your Own! $P Supply Demand Quantity

Take a Break to Reflect

Take a Break to Reflect

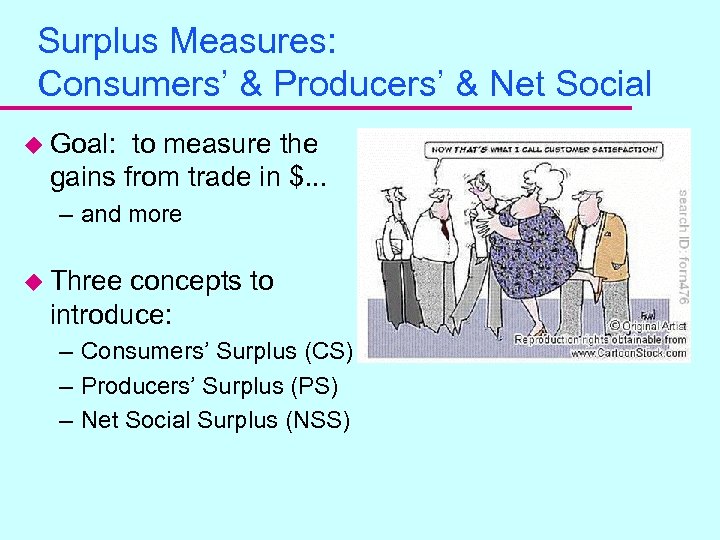

Surplus Measures: Consumers’ & Producers’ & Net Social u Goal: to measure the gains from trade in $. . . – and more u Three concepts to introduce: – Consumers’ Surplus (CS) – Producers’ Surplus (PS) – Net Social Surplus (NSS)

Surplus Measures: Consumers’ & Producers’ & Net Social u Goal: to measure the gains from trade in $. . . – and more u Three concepts to introduce: – Consumers’ Surplus (CS) – Producers’ Surplus (PS) – Net Social Surplus (NSS)

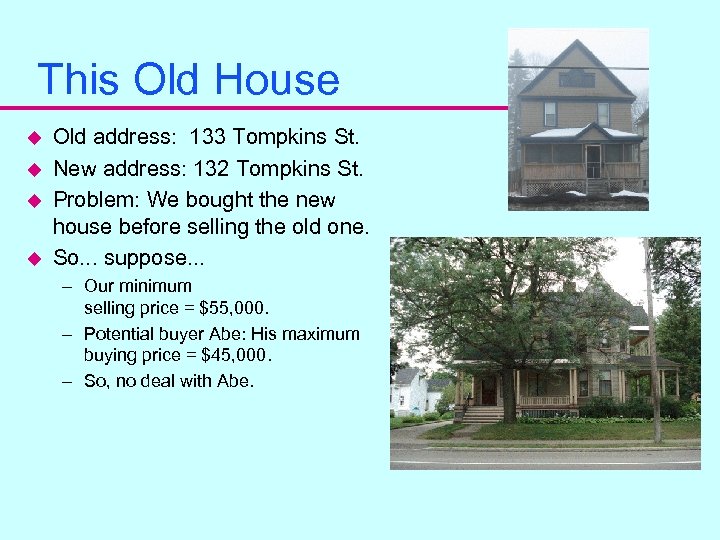

This Old House u u Old address: 133 Tompkins St. New address: 132 Tompkins St. Problem: We bought the new house before selling the old one. So. . . suppose. . . – Our minimum selling price = $55, 000. – Potential buyer Abe: His maximum buying price = $45, 000. – So, no deal with Abe.

This Old House u u Old address: 133 Tompkins St. New address: 132 Tompkins St. Problem: We bought the new house before selling the old one. So. . . suppose. . . – Our minimum selling price = $55, 000. – Potential buyer Abe: His maximum buying price = $45, 000. – So, no deal with Abe.

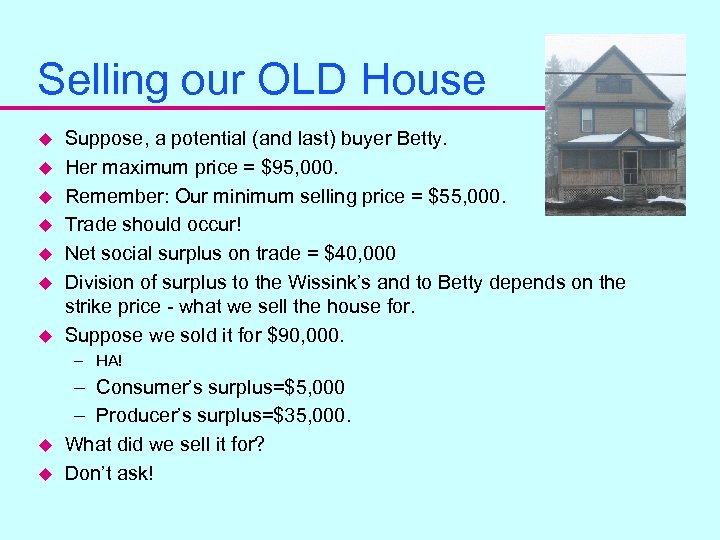

Selling our OLD House u u u u Suppose, a potential (and last) buyer Betty. Her maximum price = $95, 000. Remember: Our minimum selling price = $55, 000. Trade should occur! Net social surplus on trade = $40, 000 Division of surplus to the Wissink’s and to Betty depends on the strike price - what we sell the house for. Suppose we sold it for $90, 000. – HA! u u – Consumer’s surplus=$5, 000 – Producer’s surplus=$35, 000. What did we sell it for? Don’t ask!

Selling our OLD House u u u u Suppose, a potential (and last) buyer Betty. Her maximum price = $95, 000. Remember: Our minimum selling price = $55, 000. Trade should occur! Net social surplus on trade = $40, 000 Division of surplus to the Wissink’s and to Betty depends on the strike price - what we sell the house for. Suppose we sold it for $90, 000. – HA! u u – Consumer’s surplus=$5, 000 – Producer’s surplus=$35, 000. What did we sell it for? Don’t ask!

Surplus Measures: Consumers’ & Producers’ & Net Social u Consumers’ Surplus (CS) on Q units – CS = Total Benefit – Total Consumers’ Expenditure – CS = TB - TE u Producers’ Surplus (PS) on Q units – PS = Total Producers’ Revenue – Total Variable Cost – PS = TR - VC u Net Social Surplus (NSS) on Q units – NSS = Total Benefit – Total Variable Cost – NSS = TB - VC

Surplus Measures: Consumers’ & Producers’ & Net Social u Consumers’ Surplus (CS) on Q units – CS = Total Benefit – Total Consumers’ Expenditure – CS = TB - TE u Producers’ Surplus (PS) on Q units – PS = Total Producers’ Revenue – Total Variable Cost – PS = TR - VC u Net Social Surplus (NSS) on Q units – NSS = Total Benefit – Total Variable Cost – NSS = TB - VC

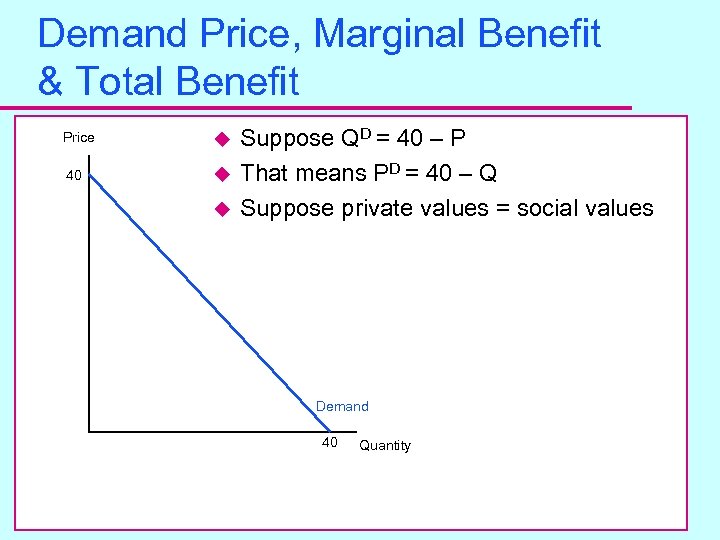

Demand Price, Marginal Benefit & Total Benefit Price u 40 u u Suppose QD = 40 – P That means PD = 40 – Q Suppose private values = social values Demand 40 Quantity

Demand Price, Marginal Benefit & Total Benefit Price u 40 u u Suppose QD = 40 – P That means PD = 40 – Q Suppose private values = social values Demand 40 Quantity

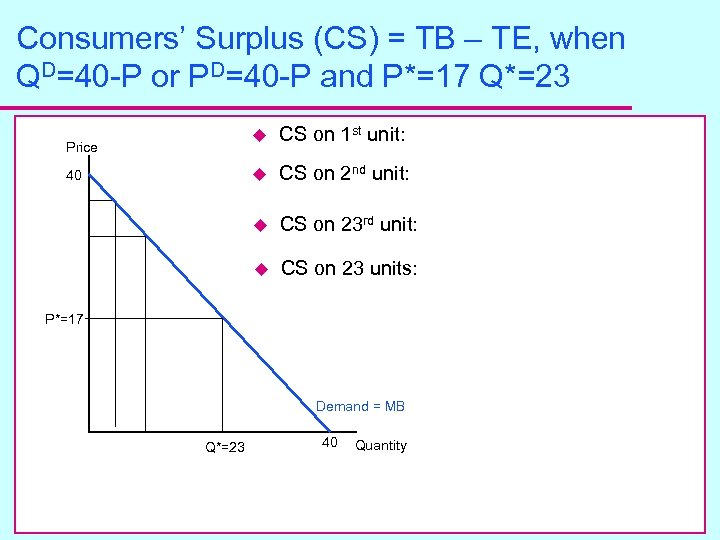

Consumers’ Surplus (CS) = TB – TE, when QD=40 -P or PD=40 -P and P*=17 Q*=23 u u CS on 23 rd unit: u 40 CS on 2 nd unit: u Price CS on 1 st unit: CS on 23 units: P*=17 Demand = MB Q*=23 40 Quantity

Consumers’ Surplus (CS) = TB – TE, when QD=40 -P or PD=40 -P and P*=17 Q*=23 u u CS on 23 rd unit: u 40 CS on 2 nd unit: u Price CS on 1 st unit: CS on 23 units: P*=17 Demand = MB Q*=23 40 Quantity

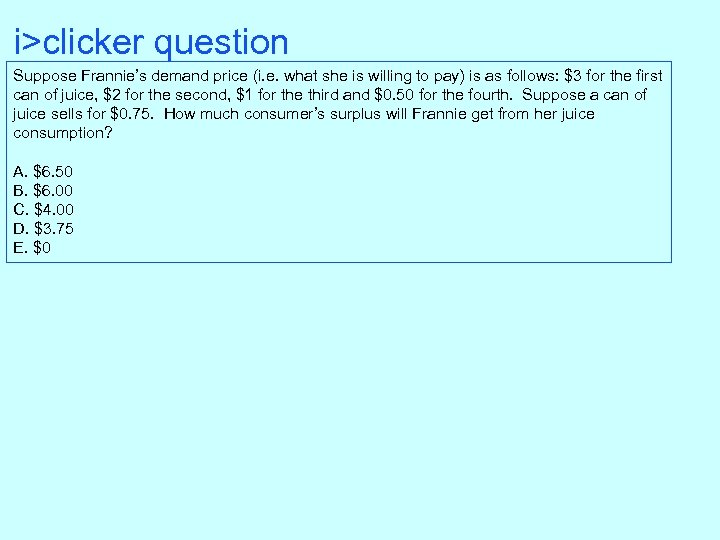

i>clicker question Suppose Frannie’s demand price (i. e. what she is willing to pay) is as follows: $3 for the first can of juice, $2 for the second, $1 for the third and $0. 50 for the fourth. Suppose a can of juice sells for $0. 75. How much consumer’s surplus will Frannie get from her juice consumption? A. $6. 50 B. $6. 00 C. $4. 00 D. $3. 75 E. $0

i>clicker question Suppose Frannie’s demand price (i. e. what she is willing to pay) is as follows: $3 for the first can of juice, $2 for the second, $1 for the third and $0. 50 for the fourth. Suppose a can of juice sells for $0. 75. How much consumer’s surplus will Frannie get from her juice consumption? A. $6. 50 B. $6. 00 C. $4. 00 D. $3. 75 E. $0

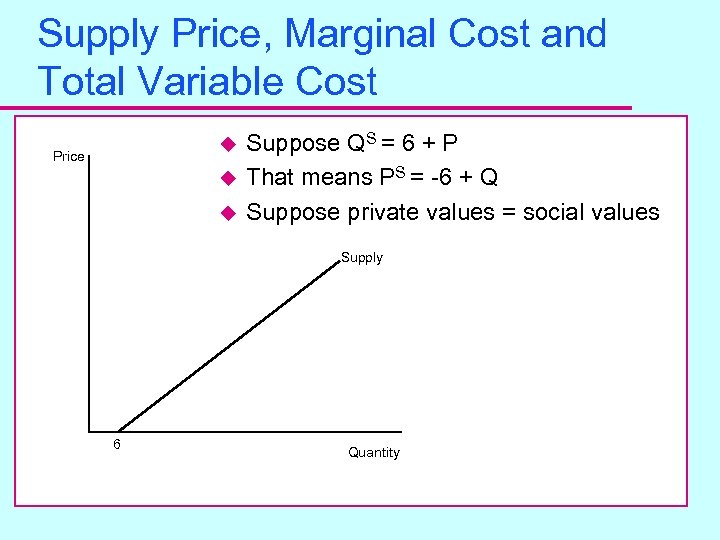

Supply Price, Marginal Cost and Total Variable Cost u Price u u Suppose QS = 6 + P That means PS = -6 + Q Suppose private values = social values Supply 6 Quantity

Supply Price, Marginal Cost and Total Variable Cost u Price u u Suppose QS = 6 + P That means PS = -6 + Q Suppose private values = social values Supply 6 Quantity

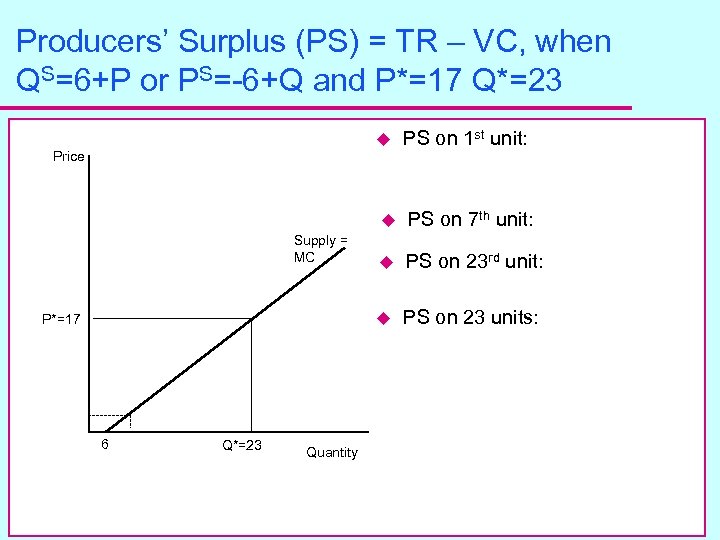

Producers’ Surplus (PS) = TR – VC, when QS=6+P or PS=-6+Q and P*=17 Q*=23 u Price PS on 1 st unit: u P*=17 6 Q*=23 Quantity u PS on 23 rd unit: u Supply = MC PS on 7 th unit: PS on 23 units:

Producers’ Surplus (PS) = TR – VC, when QS=6+P or PS=-6+Q and P*=17 Q*=23 u Price PS on 1 st unit: u P*=17 6 Q*=23 Quantity u PS on 23 rd unit: u Supply = MC PS on 7 th unit: PS on 23 units: