539b6ccc6fd8aa1ad9e4a317440b41fb.ppt

- Количество слайдов: 42

Entrepreneurship So You Want to be an Entrepreneur? Liberty Camp 2007 Andy Eyschen

What is an Entrepreneur? w Word coined by French economist J. B. Say around 1800 w His definition: “The entrepreneur shifts resources out of an area of lower and into an area of higher productivity and greater yield” w Opening another restaurant is not entrepreneurship, but Mc. Donald’s was w Though Mc. Donald’s did not invent anything new, it applied management concepts, standardized the product, designed tools and processes, created customer value

Introduction w Several hundred thousand business ventures get started worldwide every year w Many never get off the ground, many fail after sometimes spectacular starts w What business do you want to be in? w What capabilities would you like to develop? w Why bother?

On the Other Hand w Every large business started off as a small business w Most made their founders very rich w The richest man in the world, Bill Gates, was unheard of until 1980, and started a small company w Every great entrepreneur has a great story to tell w Without new businesses starting, no wealth and no jobs will be created and progress will be limited

Questions to Ask Yourself w Are my goals well defined (both personal and professional)? w Can I handle the risk? w Do I have the right strategy? w Am I starting the right business? w Can I execute the strategy? w Do I have the resources, the strength and the stamina to execute my strategy?

Personal Goals w An entrepreneur has closely linked personal and business goals (this may not be the case with a professional manager in a large firm) w Most entrepreneurs list independence and control of their destiny, apart from getting rich, as their main reasons for starting a business w However, you will need to be more specific

What Do You Really Want? w Rich enough to do what you want to do? What DO you want to do? w An enjoyable lifestyle? What does that mean? w Fame? Immortality by getting your name into the history books, having streets named after you or monuments erected? w Or simply the satisfaction of knowing that you can and have achieved what you set out to achieve, i. e. achieve your objectives? w Leave a fortune for your children?

Are You Prepared? w For the sacrifices? Your time, your dedication, your commitment, your money? w For the risk? Of losing everything you have and maybe losing other people’s money as well? Of losing the confidence other people have in you? Of losing your reputation? Of losing your friends? w To work without a salary? w Do you have the talent? w Do you have what it takes to succeed?

If the Answer is YES! w How will I get there? w The first thing I need is a STRATEGY w A strategy is a plan that is intended to achieve a particular purpose (to win a war, to beat the competition, to be number one in my chosen industry, etc. ) w Formulating a sound strategy is the single most important step

What is a Sound Strategy? w It must be well defined (what needs will the enterprise meet, where will it operate, what technical capabilities will it have, what is its vision and its mission, why does it exist, what values will it uphold, how will decisions be made, what will it not do, etc. ) w It must provide a clear direction for the business enterprise and be able to create profits and growth w It should be bold and reflect the entrepreneur’s (founder’s) aspirations

Is it Sustainable? w Can I earn a satisfactory return on my investment and that of other investors? w What will be my competitive edge or advantage? w Can I really supply something better than what already exists in the market? w Can I charge a high enough price to cover all my costs and still make a profit? w Can I be cheaper than my competitors? How? w Is the market big enough to invest for the long haul?

An Exit Strategy? w How do I know when it’s time to quit? w How will I quit? (Bankruptcy, Public Listing, Selling out, etc. )

Can I Do It? w Great ideas don’t guarantee great performance w Can I sell my ideas? To customers, to investors, to friends and family, to complete strangers, to my Banker? w Key questions: – Do I have the resources? – Do I have the organizational capability – What will be my personal role in the venture?

The Resources w Money, Capital w Talented employees (don’t rely on the capabilities of your friends or family members, no matter how well intentioned they are) w Customers: no customer, no business!

The Organization w w w What infrastructure will I need? What will my organization chart look like? What growth rate do I expect? How can I react if the actual growth rate is different? How much empowerment do I give to my employees? What control mechanisms do I put in place?

My Role w Can I delegate or do I want to do everything myself? Can I “let go”? w How much day-to-day involvement will I have in the running of the business? w Will all decisions be made by me? If not, which decisions will I reserve for myself? w What company culture do I intend to create? w How quickly do I want to move to my next project?

What Kind of Business? w Idea in your head (new product or service) w Seeing opportunity w Solving problems w The vast majority of new business ventures are restaurants, yet the success rate (profitable and still in business after 5 years) is 0. 008% (8 out of 1, 000) w Evaluating the opportunity

Key Questions w Who is my customer? w Why would the customer buy my product or service over my competitor’s? w How compelling is my offering? w Can I price it to attract the majority of my target customers? Is it affordable? w How do I sell my offering and at what cost?

The Business Plan

Importance of the Plan w Single most important document when starting a business, even if you don’t need funding w However, a good plan does not guarantee success w All applications to Venture Capitalists (VCs) must include a Business Plan; a typical VC firm receives over 2, 000 Business Plans a year or about 40 a week or 5 -6 a day w All Business Plans are an act of imagination

What Makes a Good Plan? w They are simple, short and to the point w They are fair to all parties w They emphasize trust rather than legal ties w They don’t fall apart when reality differs slightly from the plan w They don’t include incentives that cause destructive behavior w They include a Proof of Concept (Pilot)

Components of a B. P. w The People w The Opportunity w The Context w Risks and Rewards

The People w Without the right team, the other parts don’t matter w Who are they? w What do they know? w Whom do they know? w How well are they known?

The Opportunity w Focus on 2 questions: – Is the total market for the new venture’s product or service large, rapidly growing or both? – Is the industry now, or can it become, structurally attractive? w It is easier to obtain a share of a large or growing market than to fight incumbents in a mature or stagnant market w Attractive means that the market allows the venture to make money (technology is sometimes “attractive” but does not necessarily make money)

The Context w Opportunities exist in a context: w Macro-economic environment, inflation, exchange rates, interest rates, GDP growth, capital markets w Government rules and regulations (tax policy, licenses, deregulation, etc. ) w Technology (does the new venture exploit technology; is it vulnerable to new technology, etc. ) w Shift in context can turn an attractive idea into an unattractive one and vice versa (emergence of terrorism: airline versus security business)

Risks and Rewards w Start with Risk; it is unavoidable (ideal business takes all the rewards and gives all the risks to others) w All “sane” people want to avoid risk w Identify the risks inherent with the people, the opportunity and the context (all 3 are dynamic and dynamic means risk) w What will you do when these risks actually appear? This activity is called Risk Management w Insurance is a form of risk management

Rewards w How and how soon will the business make money? w How will investors get their money back? w What will be the return on their investment? (ROI) w Is the venture “IPO-able”? w How can profits be sustained?

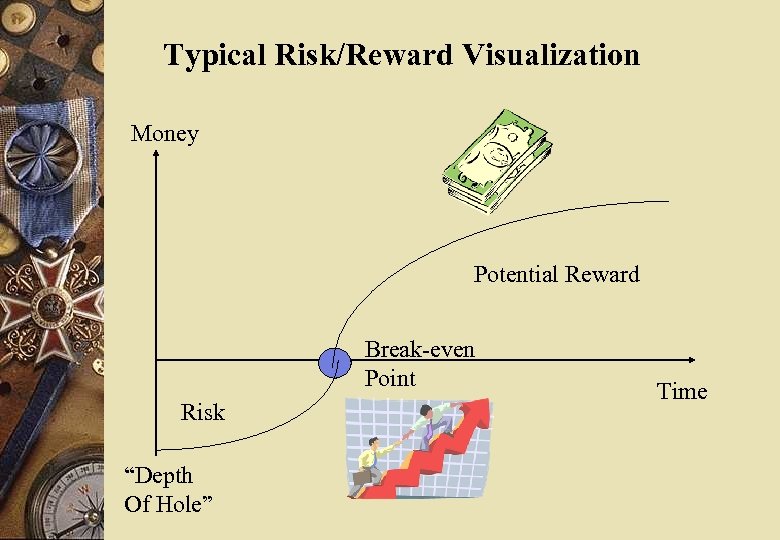

Typical Risk/Reward Visualization Money Potential Reward Break-even Point Risk “Depth Of Hole” Time

Sources of Funding

Where does Money come from? w Equity versus Debt w Own funds (savings) w Family and friends w Banks w Venture Capitalists w Angels w Stock Market

How much Money? w Compile financial forecast with 3 elements: – Income Statement – Balance Sheet – Cash Flow Statement w Look ahead 5 years w Include 3 scenarios: most likely, most optimistic, most pessimistic

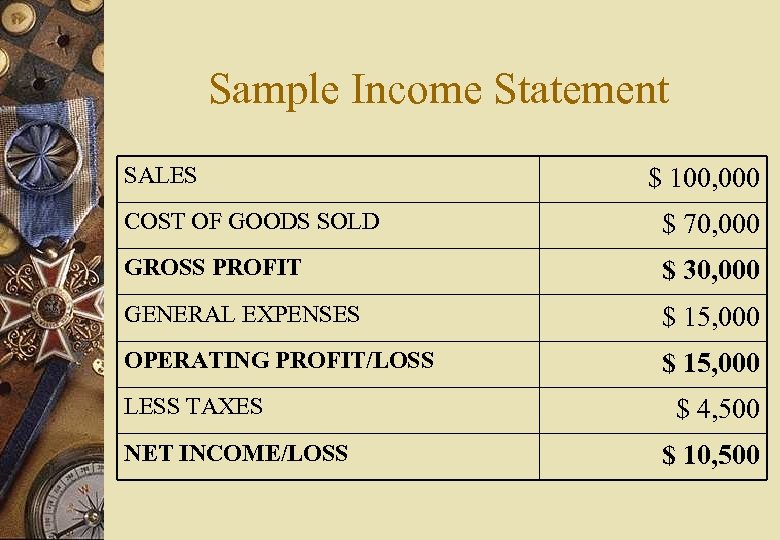

Sample Income Statement SALES $ 100, 000 COST OF GOODS SOLD $ 70, 000 GROSS PROFIT $ 30, 000 GENERAL EXPENSES $ 15, 000 OPERATING PROFIT/LOSS $ 15, 000 LESS TAXES NET INCOME/LOSS $ 4, 500 $ 10, 500

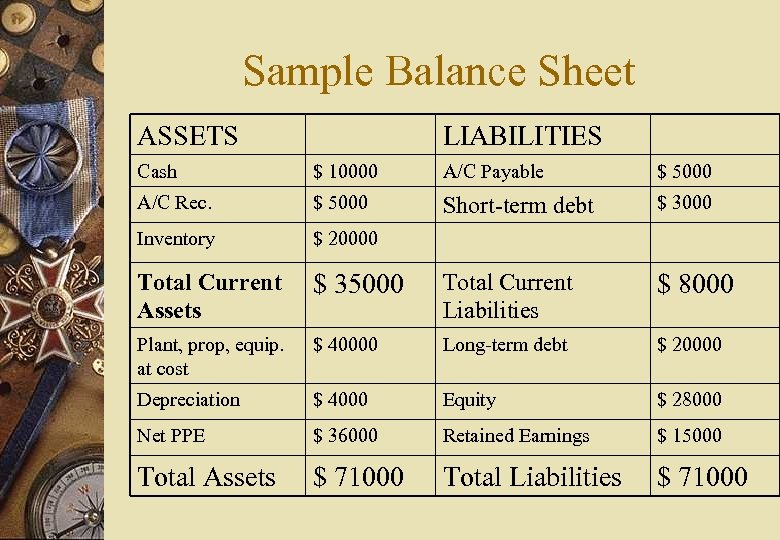

Sample Balance Sheet ASSETS LIABILITIES Cash $ 10000 A/C Payable $ 5000 A/C Rec. $ 5000 Short-term debt $ 3000 Inventory $ 20000 Total Current Assets $ 35000 Total Current Liabilities $ 8000 Plant, prop, equip. at cost $ 40000 Long-term debt $ 20000 Depreciation $ 4000 Equity $ 28000 Net PPE $ 36000 Retained Earnings $ 15000 Total Assets $ 71000 Total Liabilities $ 71000

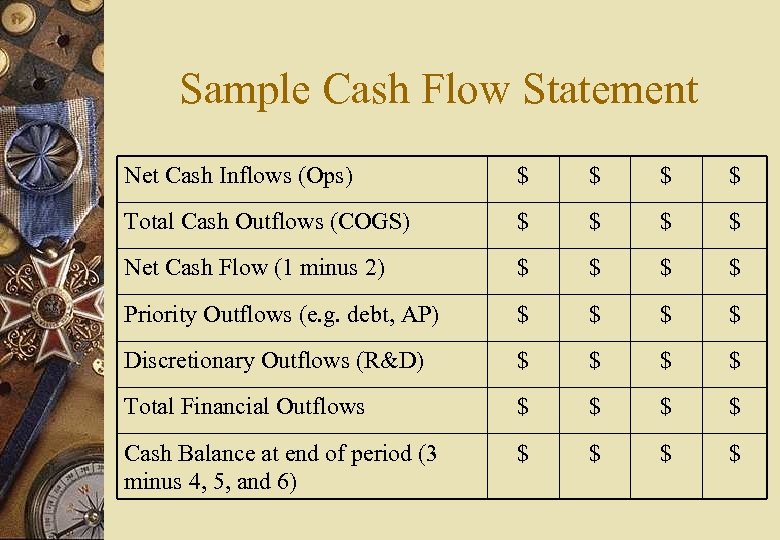

Sample Cash Flow Statement Net Cash Inflows (Ops) $ $ Total Cash Outflows (COGS) $ $ Net Cash Flow (1 minus 2) $ $ Priority Outflows (e. g. debt, AP) $ $ Discretionary Outflows (R&D) $ $ Total Financial Outflows $ $ Cash Balance at end of period (3 minus 4, 5, and 6) $ $

How much Money? w Add up the time periods (months) in which Cash Balance is negative from the beginning: that is minimum capital requirement w It is not unusual for the first 2 years to have negative cash flow, sometimes longer w Once you have positive cash flow, your business is self-sustaining until you need to make a new major purchase (e. g. buy new plant and equipment)

Milestones for Successful Planning

Why Milestones? w New business will encounter many unknowns w Confirm viability of new venture w Avoid costly errors w Opportunity to reevaluate the venture w Opportunity to “re-plan” with growing body of real life facts

10 Milestones w w Product/Concept Test Complete Prototype Start-up Funding Pilot Operation or Plant Test w Market Testing w Production Startup w First major Sale w First competitive action and reaction w First redesign or redirection w First significant price change

Milestone Reviews w Useless unless decisions are made to ensure success or reduce cost of failure w Milestone, millstone or tombstone? w Identify the most important events or actions that must occur in sequential order (critical path milestone chart) and their assumptions w Ensure all assumptions are tested by milestones w After the test, replace assumptions with facts and then review future planned events and evaluate them in light of the new facts

Tips from an Entrepreneur (Michael Masterton) w Start a business that you know! Avoid restaurants, retail shops, travel and enter-tainment outlets! w Choose a business that has these 3 qualities: – An efficient marketing model (cost and time of acquiring a customer) – A substantial profit margin – Considerable “back-end” potential (better and higher priced products and services to existing customers)

Tips from an Entrepreneur (2) w Make sure there is an active market! w Develop a unique selling proposition! w Forget Retail and Glamour business! w Sell first, tweak your product later! w Don’t throw good money after bad!

Final Words of Advice w Be brutally honest with yourself; wishful thinking will get you nowhere; don’t be afraid of the truth! w A great idea won’t make it without great management: hire good people! w Ask how to make the business successful, not how much money will I make! w Use help wherever you can get it; don’t let pride get in the way! You can’t do everything yourself! w Be friendly with your Bank Manager!

539b6ccc6fd8aa1ad9e4a317440b41fb.ppt