Entrepreneurship and business-culture 4 Teacher Sorokina Anastasia Sergeevna

Entrepreneurship and business-culture 4 Teacher Sorokina Anastasia Sergeevna Management and business department KHNEU, 2011

Financing a new business Investments requirements for starting a new business Ways of capital raising

Ways of capital raising Ways of capital raising for a new business: Using entrepreneur’s savings Partners involving Grants Venture capital involving Initial public offering (IPO) Bank credit (credit card) Accounts payable (obligations)

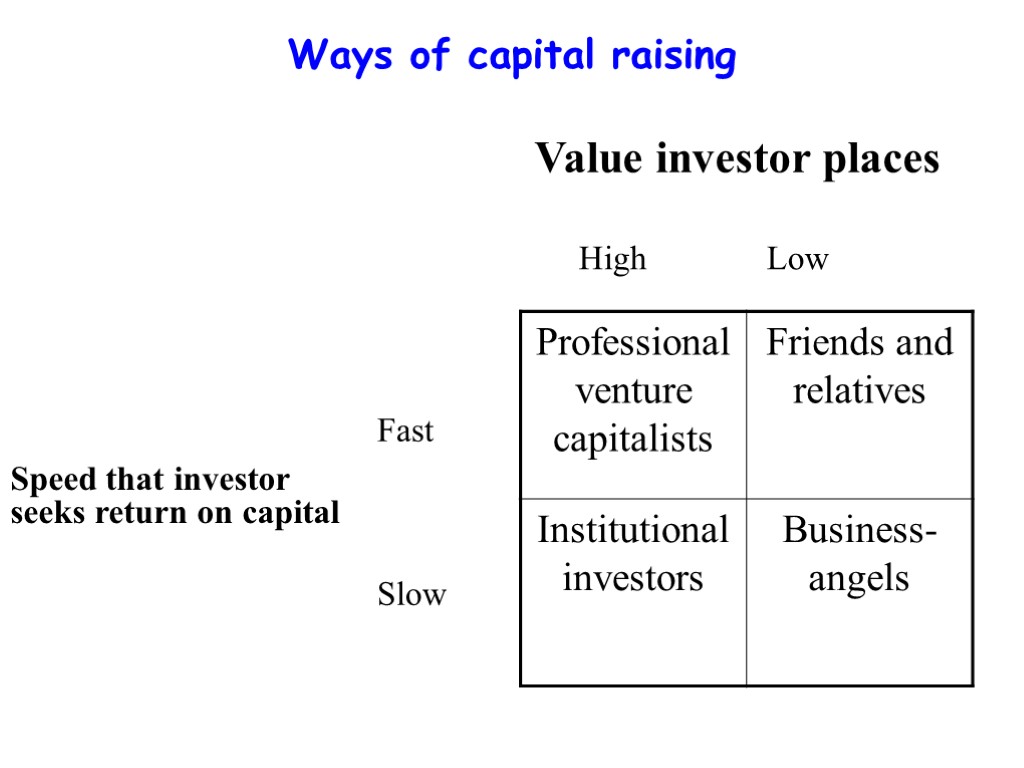

Ways of capital raising Speed that investor seeks return on capital Value investor places Fast Slow High Low

Ways of capital raising Institutional investors are organizations which accumulate large sums of money and invest those sums in companies Institutional investor types: Pension fund Mutual fund Insurance company Investment trust Investment banking Hedge fund

Ways of capital raising A business-angel or angel investor is an individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity. Somtimes angel investors organize themselves into angel groups or angel networks to share research and pool their investment capital.

Ways of capital raising An initial public stock offering (IPO) is a process of issuing of common stock or shares by the company (called the issuer) to the public for the first time. In an IPO the issuer may obtain the assistance of an underwriting firm, which helps it determine what type of security to issue, best offering price and time to bring it to market.

Ways of capital raising Using of bank credit demands: Returning of the credit Specific terms of returning Interest and commission payments Security

Ways of capital raising Rent is a process by which a firm (tenant, lessee) can obtain the use of a certain fixed assets, owned by landlord (lessor), for which firm must pay a series of contractual, periodic payments Short-term Long-term Rent

Ways of capital raising Leasing is a process of long-term obtaining the use of a certain equipment or vehicle. There are 3 sides in th leasing deal: Vendor Leasing company Lessee LEASING Operational Financial

Ways of capital raising Advantages of leasing Leasing is less capital-intensive than purchasing Leasing may provide more flexibility to a business In some cases a lease may be the only practical option. Disadvantages of leasing A net lease may shift some or all of the maintenance costs onto the tenant. If circumstances dictate that a business must change its operations significantly, it may be expensive or otherwise difficult to terminate a lease before the end of the term. If the business is successful, lessors may demand higher rental payments. General expenses are higher comparing with purchasing

entrepreneurship_and_business-culture_4.ppt

- Количество слайдов: 11