f76a74d48340f7e1d5596ecd11dff311.ppt

- Количество слайдов: 35

Entertainment and Media: Markets and Economics The Art Market 5: B - 1(35) Art Market

Entertainment and Media: Markets and Economics The Art Market 5: B - 1(35) Art Market

5: B - 2(35) Art Market

5: B - 2(35) Art Market

$135 Million Klimt, to Ronald Lauder http: //www. nytimes. com/2006/06/19/arts/design/19 klim. html? ex=1308369600&en=37 eb 32381038 a 749&ei =5088&partner=rssnyt&emc=rss 5: B - 3(35) Art Market

$135 Million Klimt, to Ronald Lauder http: //www. nytimes. com/2006/06/19/arts/design/19 klim. html? ex=1308369600&en=37 eb 32381038 a 749&ei =5088&partner=rssnyt&emc=rss 5: B - 3(35) Art Market

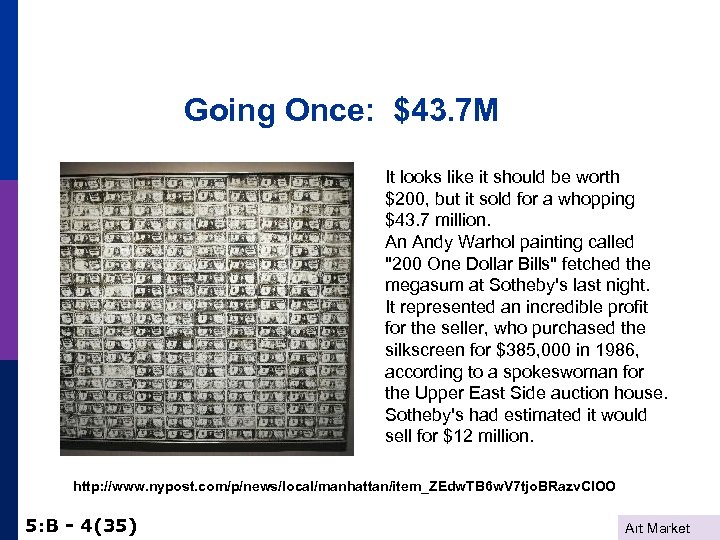

Going Once: $43. 7 M It looks like it should be worth $200, but it sold for a whopping $43. 7 million. An Andy Warhol painting called "200 One Dollar Bills" fetched the megasum at Sotheby's last night. It represented an incredible profit for the seller, who purchased the silkscreen for $385, 000 in 1986, according to a spokeswoman for the Upper East Side auction house. Sotheby's had estimated it would sell for $12 million. http: //www. nypost. com/p/news/local/manhattan/item_ZEdw. TB 6 w. V 7 tjo. BRazv. CIOO 5: B - 4(35) Art Market

Going Once: $43. 7 M It looks like it should be worth $200, but it sold for a whopping $43. 7 million. An Andy Warhol painting called "200 One Dollar Bills" fetched the megasum at Sotheby's last night. It represented an incredible profit for the seller, who purchased the silkscreen for $385, 000 in 1986, according to a spokeswoman for the Upper East Side auction house. Sotheby's had estimated it would sell for $12 million. http: //www. nypost. com/p/news/local/manhattan/item_ZEdw. TB 6 w. V 7 tjo. BRazv. CIOO 5: B - 4(35) Art Market

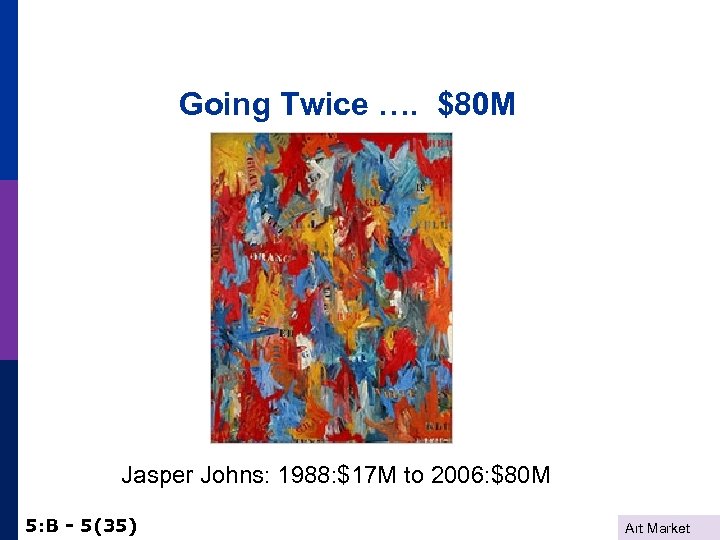

Going Twice …. $80 M Jasper Johns: 1988: $17 M to 2006: $80 M 5: B - 5(35) Art Market

Going Twice …. $80 M Jasper Johns: 1988: $17 M to 2006: $80 M 5: B - 5(35) Art Market

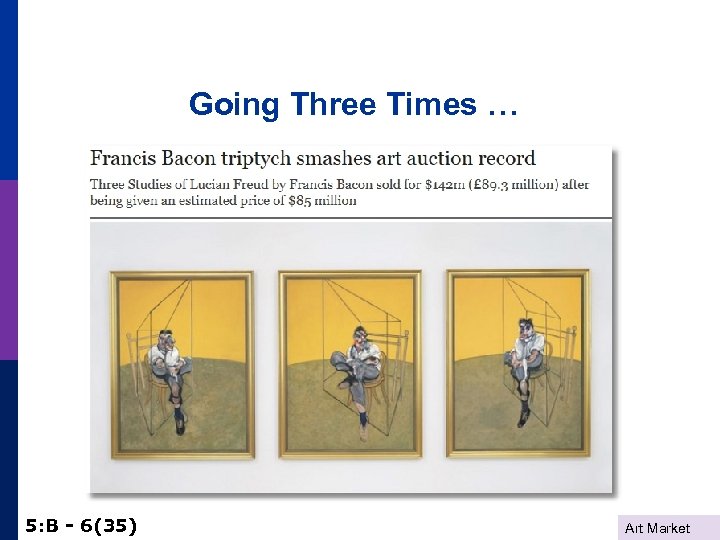

Going Three Times … 5: B - 6(35) Art Market

Going Three Times … 5: B - 6(35) Art Market

Gone! $119. 9 M 5: B - 7(35) Art Market

Gone! $119. 9 M 5: B - 7(35) Art Market

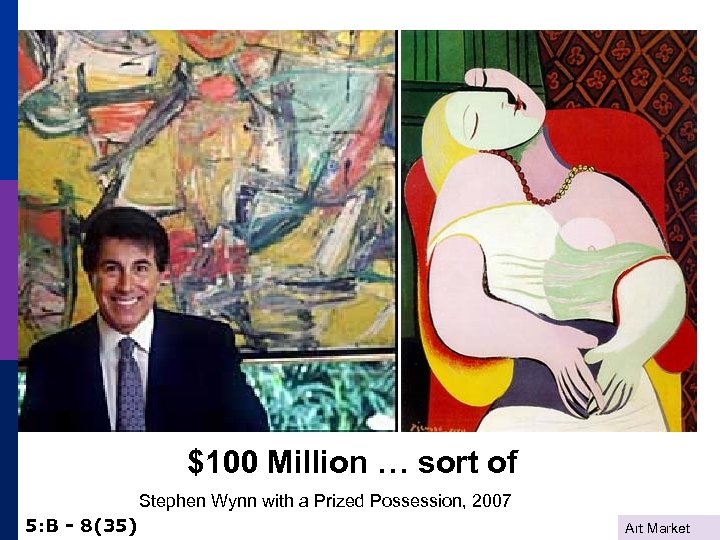

$100 Million … sort of Stephen Wynn with a Prized Possession, 2007 5: B - 8(35) Art Market

$100 Million … sort of Stephen Wynn with a Prized Possession, 2007 5: B - 8(35) Art Market

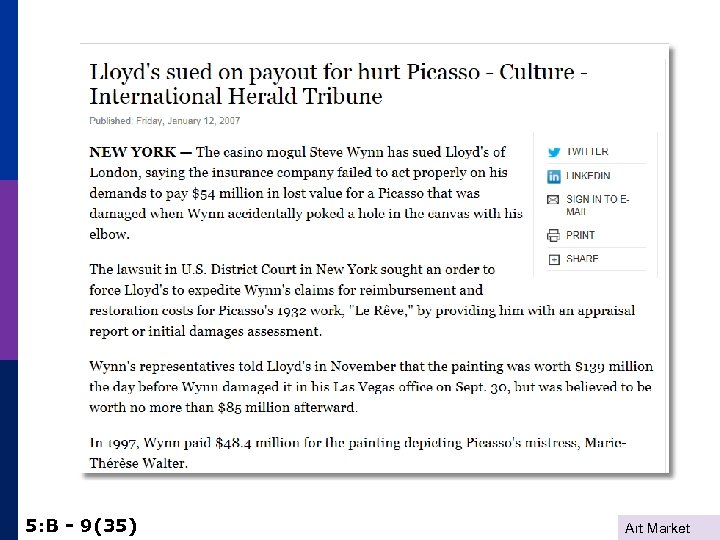

5: B - 9(35) Art Market

5: B - 9(35) Art Market

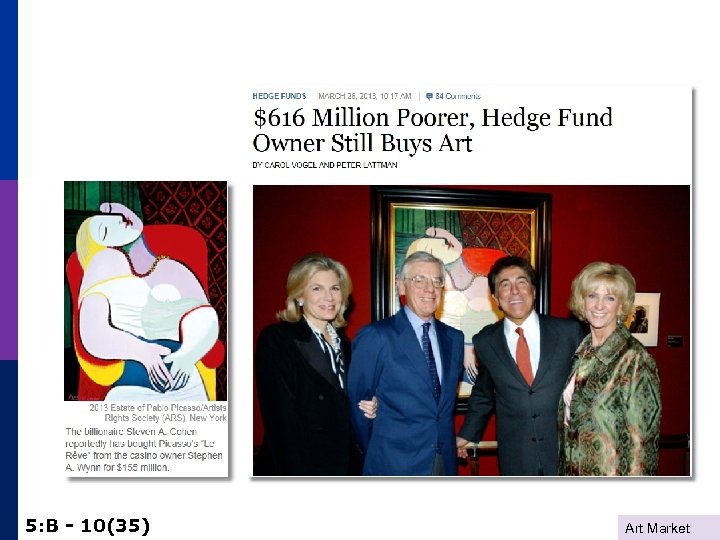

5: B - 10(35) Art Market

5: B - 10(35) Art Market

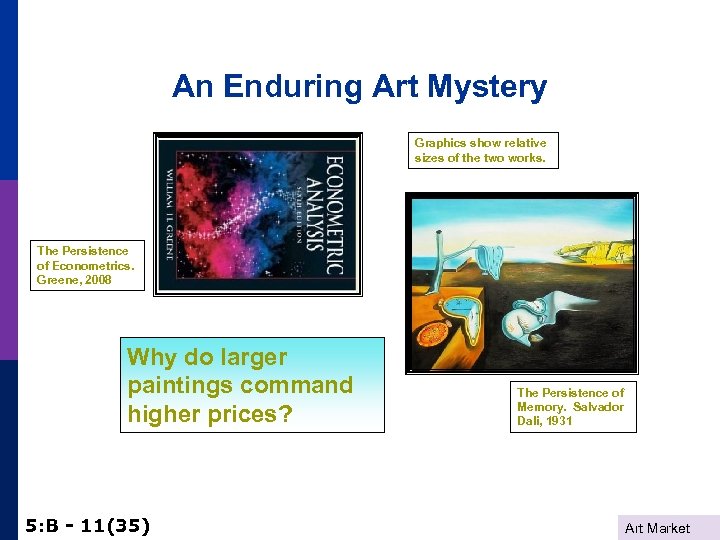

An Enduring Art Mystery Graphics show relative sizes of the two works. The Persistence of Econometrics. Greene, 2008 Why do larger paintings command higher prices? 5: B - 11(35) The Persistence of Memory. Salvador Dali, 1931 Art Market

An Enduring Art Mystery Graphics show relative sizes of the two works. The Persistence of Econometrics. Greene, 2008 Why do larger paintings command higher prices? 5: B - 11(35) The Persistence of Memory. Salvador Dali, 1931 Art Market

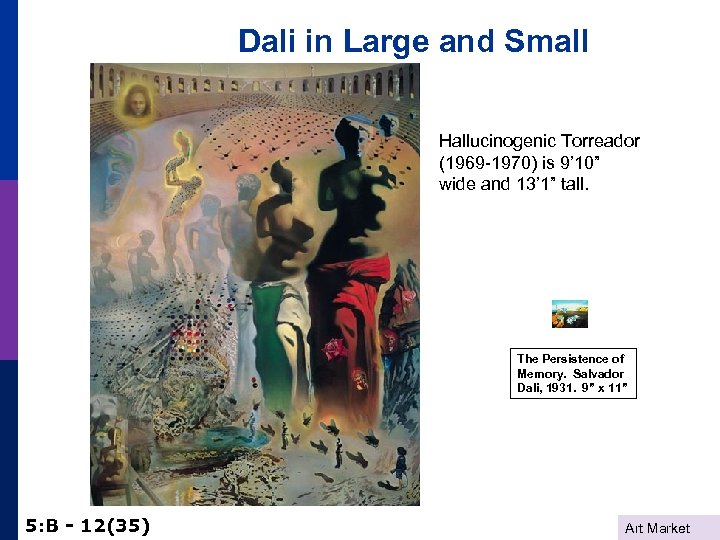

Dali in Large and Small Hallucinogenic Torreador (1969 -1970) is 9’ 10” wide and 13’ 1” tall. The Persistence of Memory. Salvador Dali, 1931. 9” x 11” 5: B - 12(35) Art Market

Dali in Large and Small Hallucinogenic Torreador (1969 -1970) is 9’ 10” wide and 13’ 1” tall. The Persistence of Memory. Salvador Dali, 1931. 9” x 11” 5: B - 12(35) Art Market

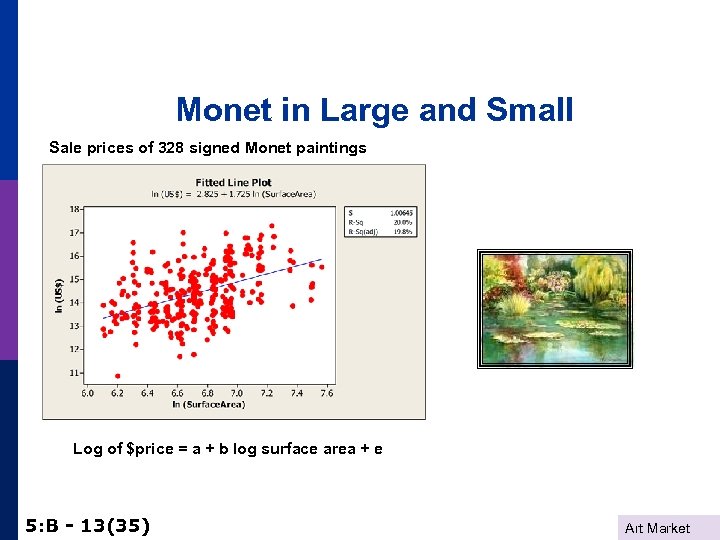

Monet in Large and Small Sale prices of 328 signed Monet paintings Log of $price = a + b log surface area + e 5: B - 13(35) Art Market

Monet in Large and Small Sale prices of 328 signed Monet paintings Log of $price = a + b log surface area + e 5: B - 13(35) Art Market

Entertainment and Media: Markets and Economics Art as a Financial Asset 5: B - 14(35) Art Market

Entertainment and Media: Markets and Economics Art as a Financial Asset 5: B - 14(35) Art Market

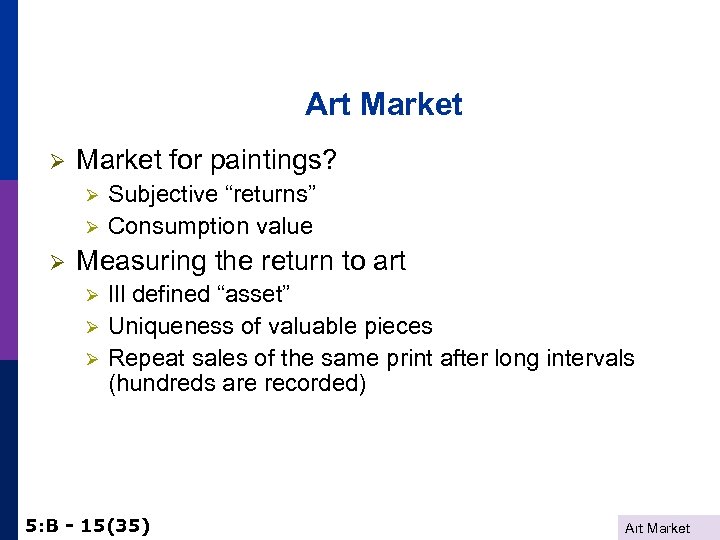

Art Market Ø Market for paintings? Ø Ø Ø Subjective “returns” Consumption value Measuring the return to art Ø Ø Ø Ill defined “asset” Uniqueness of valuable pieces Repeat sales of the same print after long intervals (hundreds are recorded) 5: B - 15(35) Art Market

Art Market Ø Market for paintings? Ø Ø Ø Subjective “returns” Consumption value Measuring the return to art Ø Ø Ø Ill defined “asset” Uniqueness of valuable pieces Repeat sales of the same print after long intervals (hundreds are recorded) 5: B - 15(35) Art Market

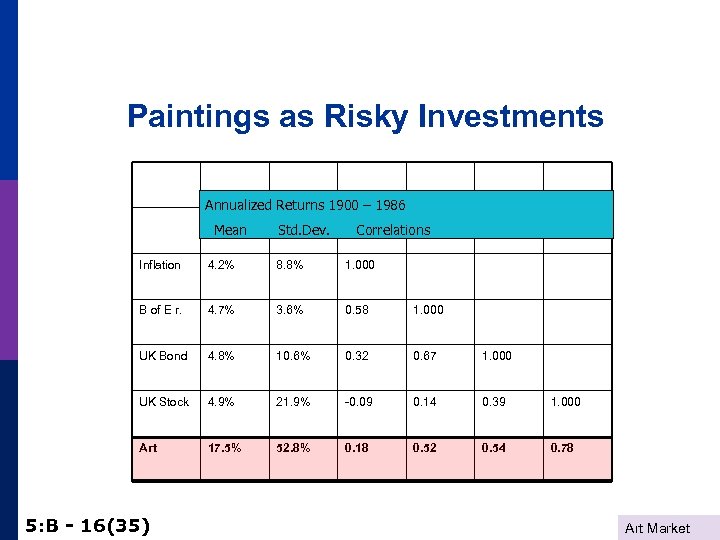

Paintings as Risky Investments Annualized Returns 1900 – 1986 Mean St. Dev. Inflation 4. 2% 8. 8% 1. 000 B of E r. 4. 7% 3. 6% 0. 58 1. 000 UK Bond 4. 8% 10. 6% 0. 32 0. 67 1. 000 UK Stock 4. 9% 21. 9% -0. 09 0. 14 0. 39 1. 000 Art 17. 5% 52. 8% 0. 18 0. 52 0. 54 0. 78 Mean 5: B - 16(35) Std. Dev. Interest Correlations Bond Stock Art Market

Paintings as Risky Investments Annualized Returns 1900 – 1986 Mean St. Dev. Inflation 4. 2% 8. 8% 1. 000 B of E r. 4. 7% 3. 6% 0. 58 1. 000 UK Bond 4. 8% 10. 6% 0. 32 0. 67 1. 000 UK Stock 4. 9% 21. 9% -0. 09 0. 14 0. 39 1. 000 Art 17. 5% 52. 8% 0. 18 0. 52 0. 54 0. 78 Mean 5: B - 16(35) Std. Dev. Interest Correlations Bond Stock Art Market

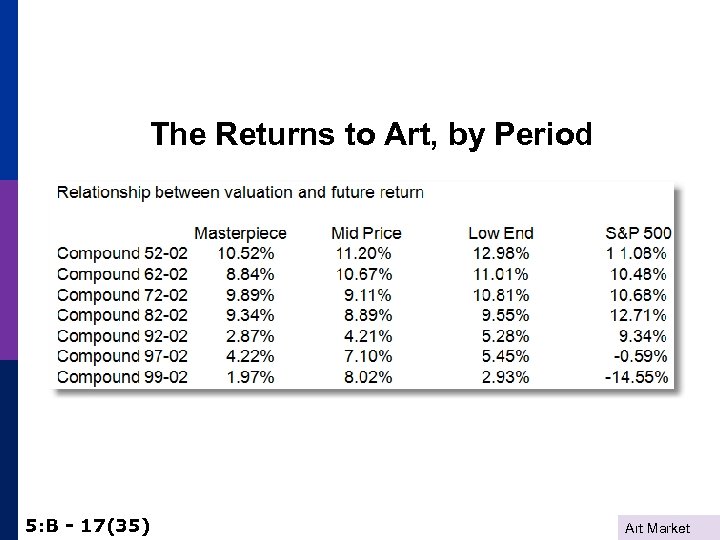

The Returns to Art, by Period 5: B - 17(35) Art Market

The Returns to Art, by Period 5: B - 17(35) Art Market

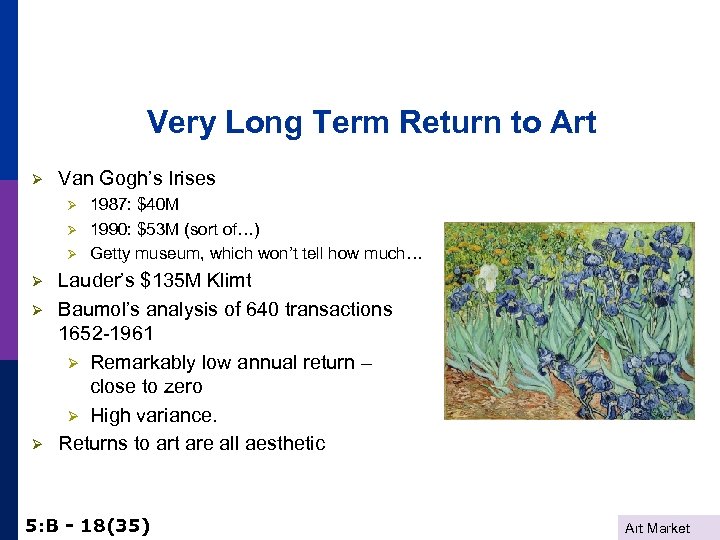

Very Long Term Return to Art Ø Van Gogh’s Irises Ø Ø Ø 1987: $40 M 1990: $53 M (sort of…) Getty museum, which won’t tell how much… Lauder’s $135 M Klimt Baumol’s analysis of 640 transactions 1652 -1961 Ø Remarkably low annual return – close to zero Ø High variance. Returns to art are all aesthetic 5: B - 18(35) Art Market

Very Long Term Return to Art Ø Van Gogh’s Irises Ø Ø Ø 1987: $40 M 1990: $53 M (sort of…) Getty museum, which won’t tell how much… Lauder’s $135 M Klimt Baumol’s analysis of 640 transactions 1652 -1961 Ø Remarkably low annual return – close to zero Ø High variance. Returns to art are all aesthetic 5: B - 18(35) Art Market

Anti-Portfolio Theory (Pesando) Ø Ø Buy one masterpiece for $100, 000, not ten lesser pieces at $10, 000 each. (Wisdom) Conclusions Ø Ø Ø Short run excess returns Masterpiece portfolio does not do better than the market Many price and return anomalies 5: B - 19(35) Art Market

Anti-Portfolio Theory (Pesando) Ø Ø Buy one masterpiece for $100, 000, not ten lesser pieces at $10, 000 each. (Wisdom) Conclusions Ø Ø Ø Short run excess returns Masterpiece portfolio does not do better than the market Many price and return anomalies 5: B - 19(35) Art Market

Crapshoot Theory Ø Ø Baumol: There is no equilibrium and no anchor Why are money and art correlated? Ø Ø A wealth effect. An Intervening effect – the stock market An issue of causation The greater fool theory 5: B - 20(35) Art Market

Crapshoot Theory Ø Ø Baumol: There is no equilibrium and no anchor Why are money and art correlated? Ø Ø A wealth effect. An Intervening effect – the stock market An issue of causation The greater fool theory 5: B - 20(35) Art Market

A few weeks ago, a triptych portrait by the British modernist painter Francis Bacon sold for $142. 4 million, a record for a work of art at auction. The next night, a silk-screen print, “Silver Car Crash (Double Disaster), ” by the American pop artist Andy Warhol brought $105. 4 million. And this week, “Saying Grace, ” by the American illustrator Norman Rockwell, sold for $46. . 1 million. The art market would seem to be going through the roof. But is it? 5: B - 21(35) Art Market

A few weeks ago, a triptych portrait by the British modernist painter Francis Bacon sold for $142. 4 million, a record for a work of art at auction. The next night, a silk-screen print, “Silver Car Crash (Double Disaster), ” by the American pop artist Andy Warhol brought $105. 4 million. And this week, “Saying Grace, ” by the American illustrator Norman Rockwell, sold for $46. . 1 million. The art market would seem to be going through the roof. But is it? 5: B - 21(35) Art Market

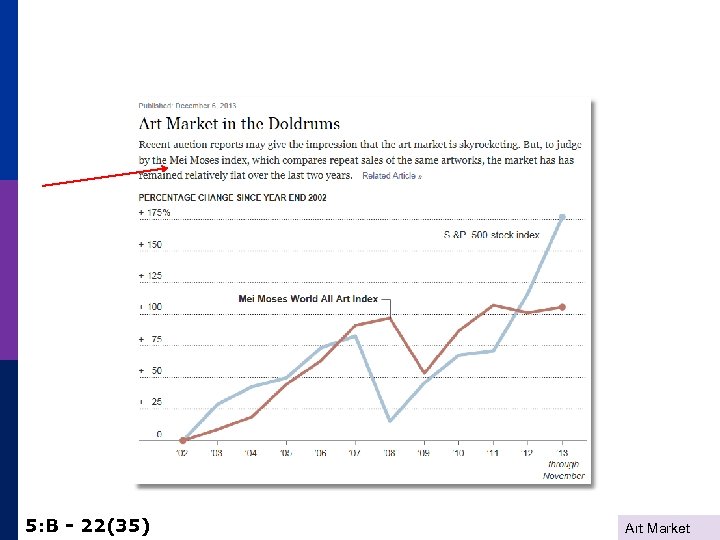

5: B - 22(35) Art Market

5: B - 22(35) Art Market

Mei-Moses Art Index 5: B - 23(35) http: //www. artasanasset. com/main/ (You need to be a member to get past the front page. ) Art Market

Mei-Moses Art Index 5: B - 23(35) http: //www. artasanasset. com/main/ (You need to be a member to get past the front page. ) Art Market

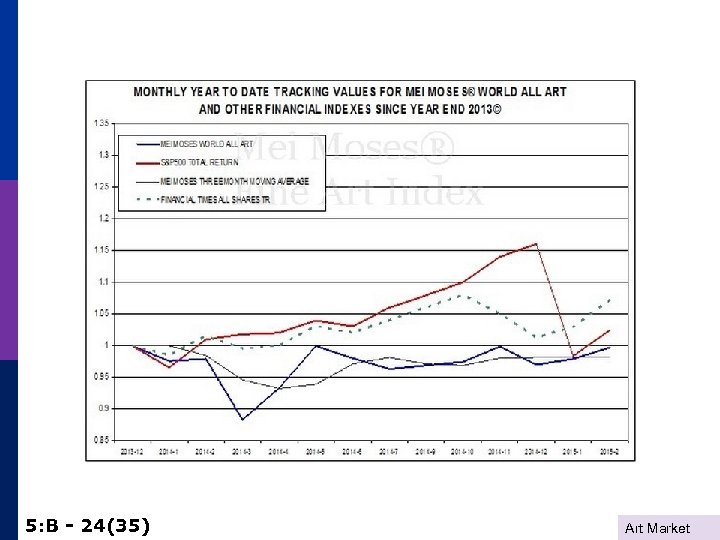

5: B - 24(35) Art Market

5: B - 24(35) Art Market

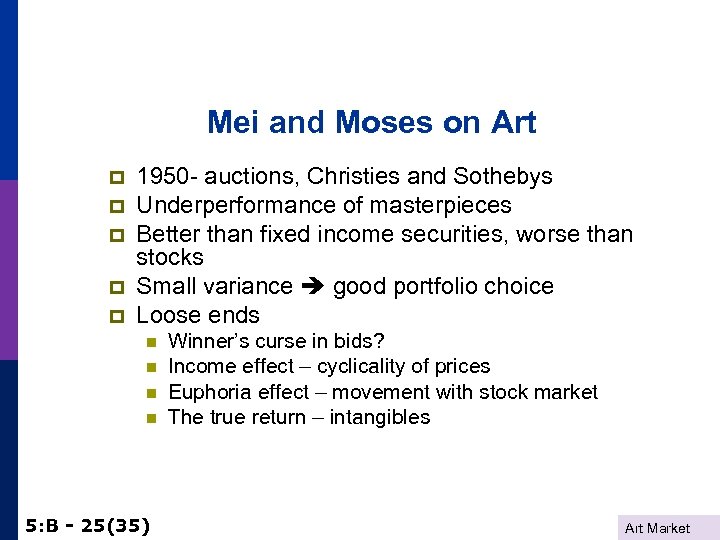

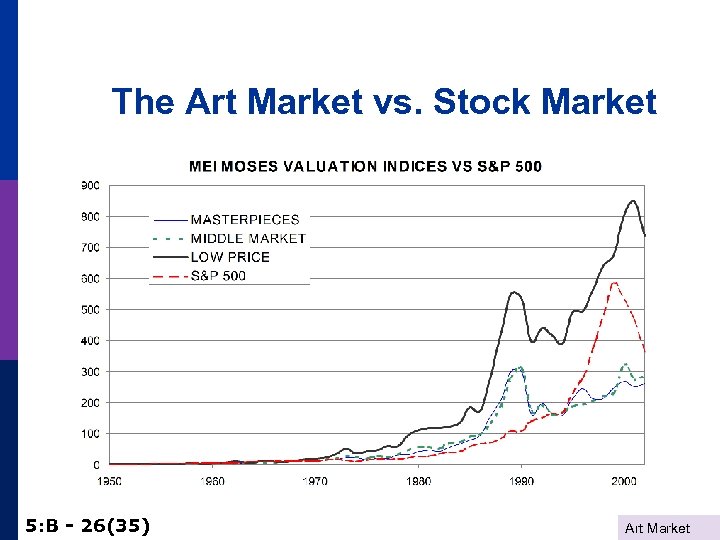

Mei and Moses on Art p p p 1950 - auctions, Christies and Sothebys Underperformance of masterpieces Better than fixed income securities, worse than stocks Small variance good portfolio choice Loose ends n n 5: B - 25(35) Winner’s curse in bids? Income effect – cyclicality of prices Euphoria effect – movement with stock market The true return – intangibles Art Market

Mei and Moses on Art p p p 1950 - auctions, Christies and Sothebys Underperformance of masterpieces Better than fixed income securities, worse than stocks Small variance good portfolio choice Loose ends n n 5: B - 25(35) Winner’s curse in bids? Income effect – cyclicality of prices Euphoria effect – movement with stock market The true return – intangibles Art Market

The Art Market vs. Stock Market 5: B - 26(35) Art Market

The Art Market vs. Stock Market 5: B - 26(35) Art Market

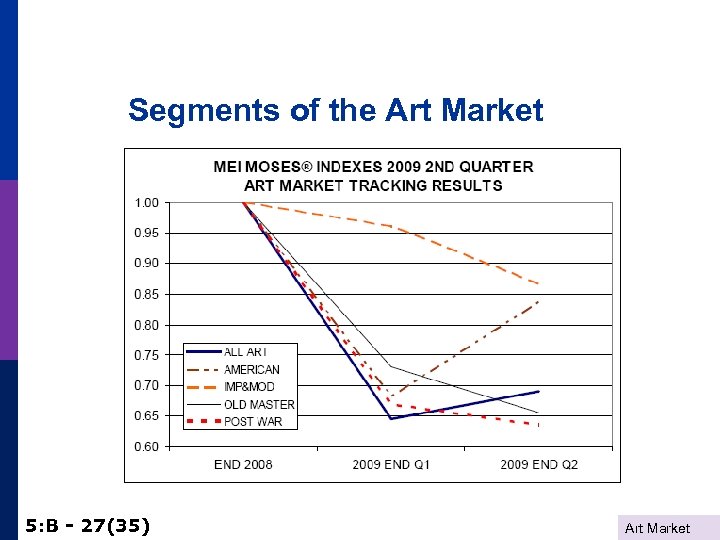

Segments of the Art Market 5: B - 27(35) Art Market

Segments of the Art Market 5: B - 27(35) Art Market

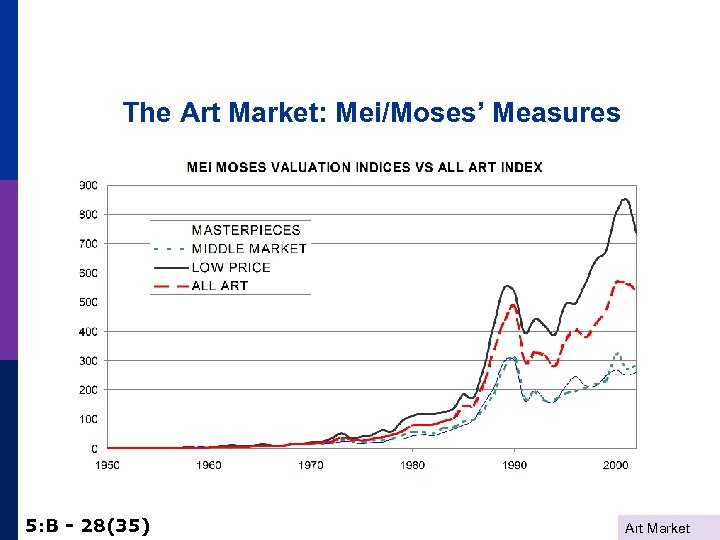

The Art Market: Mei/Moses’ Measures 5: B - 28(35) Art Market

The Art Market: Mei/Moses’ Measures 5: B - 28(35) Art Market

How does art attain value? This article describes a new vault where buyers of high end art can store their assets while they wait for them to become more valuable. 5: B - 29(35) Art Market

How does art attain value? This article describes a new vault where buyers of high end art can store their assets while they wait for them to become more valuable. 5: B - 29(35) Art Market

Entertainment and Media: Markets and Economics Art Auctions and Antitrust 5: B - 30(35) Art Market

Entertainment and Media: Markets and Economics Art Auctions and Antitrust 5: B - 30(35) Art Market

Art, Auctions and Antitrust p Art Auctions n n p Open outcry, English style (ascending) Private information only in valuation (by nature) High end art market dominated (90%) by Sotheby’s and Christies 5: B - 31(35) Art Market

Art, Auctions and Antitrust p Art Auctions n n p Open outcry, English style (ascending) Private information only in valuation (by nature) High end art market dominated (90%) by Sotheby’s and Christies 5: B - 31(35) Art Market

Some History p p p p NY, 1960, dominated by Parke-Bernet Competition from London by Sotheby P-B for sale in 1963, $2 M. S makes a credible threat to enter, drives the price down to $1. 5 M and enters Christies and Phillips enter in 1977 Christies entry did not drive down the value of Sotheby. Entry established NY as a focal point for art sale – drove up the stock value of both companies. S and C acted as a natural duopoly, heavy competition until 1995. Competition suddenly stopped. 1995, conspired to fix commissions. 5: B - 32(35) Art Market

Some History p p p p NY, 1960, dominated by Parke-Bernet Competition from London by Sotheby P-B for sale in 1963, $2 M. S makes a credible threat to enter, drives the price down to $1. 5 M and enters Christies and Phillips enter in 1977 Christies entry did not drive down the value of Sotheby. Entry established NY as a focal point for art sale – drove up the stock value of both companies. S and C acted as a natural duopoly, heavy competition until 1995. Competition suddenly stopped. 1995, conspired to fix commissions. 5: B - 32(35) Art Market

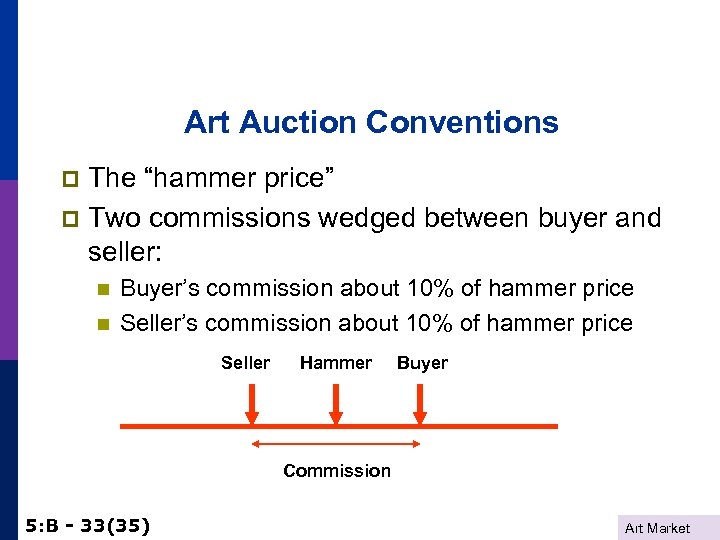

Art Auction Conventions The “hammer price” p Two commissions wedged between buyer and seller: p n n Buyer’s commission about 10% of hammer price Seller Hammer Buyer Commission 5: B - 33(35) Art Market

Art Auction Conventions The “hammer price” p Two commissions wedged between buyer and seller: p n n Buyer’s commission about 10% of hammer price Seller Hammer Buyer Commission 5: B - 33(35) Art Market

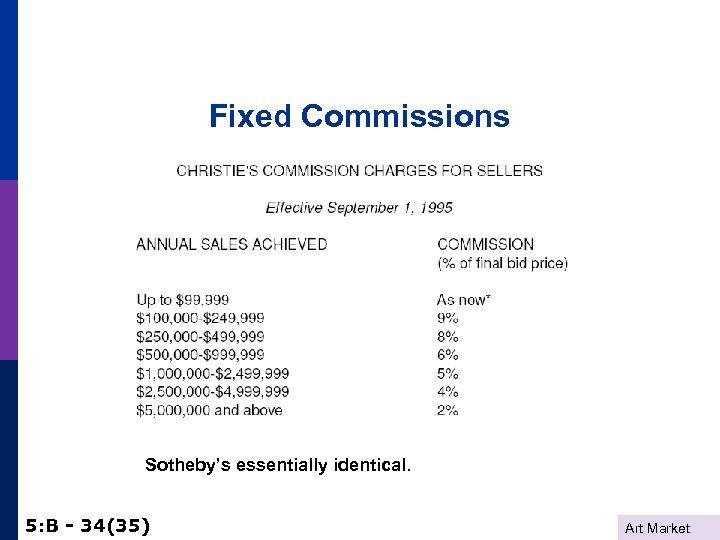

Fixed Commissions Sotheby’s essentially identical. 5: B - 34(35) Art Market

Fixed Commissions Sotheby’s essentially identical. 5: B - 34(35) Art Market

The Civil Settlement n n n About $300 M for each company Some criminal penalties for some conspirators (notably Alfred Taubman who lost a lot - $7. 5 M and 10 months in jail. ) Most $$$ paid (inappropriately) to buyers Theory is unambiguous – buyers will just reduce their bids so that bid+commission will not exceed their reservation price. They were not harmed. A curious incentive – the amnesty rule. The first company to confess gets off (partly) from the criminal prosecution. (Not the civil suit. ) A curious auction: The right to represent the plaintiffs was auctioned to the firm with the highest guess as to the minimum they believed they could win for the plaintiffs. (David Boies et al. ) 5: B - 35(35) Art Market

The Civil Settlement n n n About $300 M for each company Some criminal penalties for some conspirators (notably Alfred Taubman who lost a lot - $7. 5 M and 10 months in jail. ) Most $$$ paid (inappropriately) to buyers Theory is unambiguous – buyers will just reduce their bids so that bid+commission will not exceed their reservation price. They were not harmed. A curious incentive – the amnesty rule. The first company to confess gets off (partly) from the criminal prosecution. (Not the civil suit. ) A curious auction: The right to represent the plaintiffs was auctioned to the firm with the highest guess as to the minimum they believed they could win for the plaintiffs. (David Boies et al. ) 5: B - 35(35) Art Market