af6a3fa981003035917b9fabfc303356.ppt

- Количество слайдов: 20

Enron. Online Softs

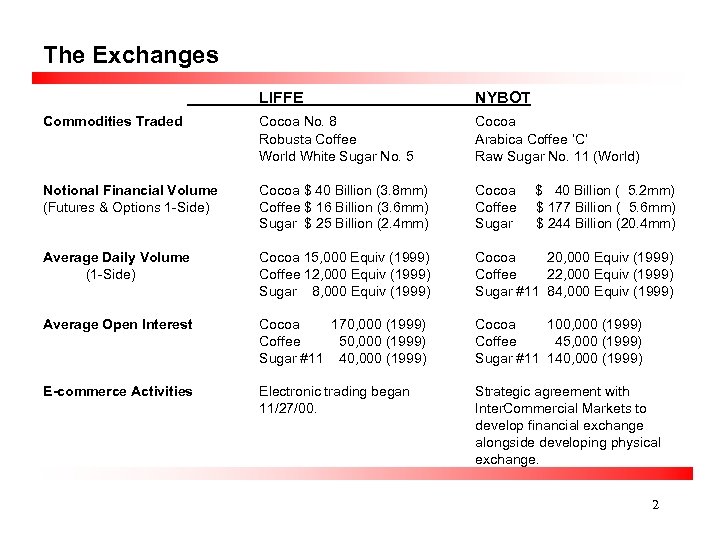

The Exchanges LIFFE NYBOT Commodities Traded Cocoa No. 8 Robusta Coffee World White Sugar No. 5 Cocoa Arabica Coffee ‘C’ Raw Sugar No. 11 (World) Notional Financial Volume (Futures & Options 1 -Side) Cocoa $ 40 Billion (3. 8 mm) Coffee $ 16 Billion (3. 6 mm) Sugar $ 25 Billion (2. 4 mm) Cocoa Coffee Sugar Average Daily Volume (1 -Side) Cocoa 15, 000 Equiv (1999) Coffee 12, 000 Equiv (1999) Sugar 8, 000 Equiv (1999) Cocoa 20, 000 Equiv (1999) Coffee 22, 000 Equiv (1999) Sugar #11 84, 000 Equiv (1999) Average Open Interest Cocoa 170, 000 (1999) Coffee 50, 000 (1999) Sugar #11 40, 000 (1999) Cocoa 100, 000 (1999) Coffee 45, 000 (1999) Sugar #11 140, 000 (1999) E-commerce Activities Electronic trading began 11/27/00. Strategic agreement with Inter. Commercial Markets to develop financial exchange alongside developing physical exchange. $ 40 Billion ( 5. 2 mm) $ 177 Billion ( 5. 6 mm) $ 244 Billion (20. 4 mm) 2

The Enron Softs Group • Brokerage Gross Revenues: £ 2. 1 mm (1999), 700, 000 Contracts Traded • Financing Gross Revenues: £. 6 mm (1999), US$70 mm Peak Originated • Twelve (12) softs-dedicated professionals from Rudolf Wolff – Six (6) brokers with approximately 100 years cumulative experience • Senior trader for each product has 15+ years experience • Long-standing client relationships • Two principals have physical dealing and brokerage experience – Mid- and back-office personnel experienced with settlements and clearing • Grading, tendering and warrant administration services have been regularly performed for lending and brokerage clients – Ex-CFO has significant credit, financial and regulatory experience 3

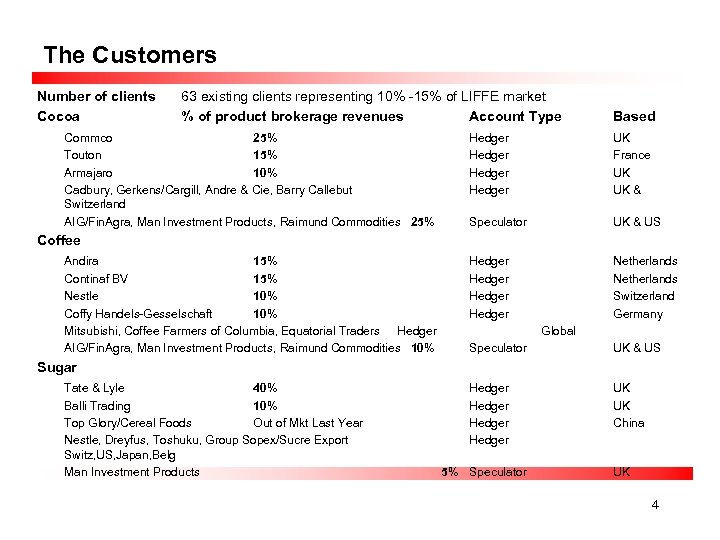

The Customers Number of clients Cocoa 63 existing clients representing 10% -15% of LIFFE market % of product brokerage revenues Account Type Commco 25% Touton 15% Armajaro 10% Cadbury, Gerkens/Cargill, Andre & Cie, Barry Callebut Switzerland AIG/Fin. Agra, Man Investment Products, Raimund Commodities 25% Based Hedger UK France UK UK & Speculator UK & US Hedger Netherlands Switzerland Germany Coffee Andira 15% Continaf BV 15% Nestle 10% Coffy Handels-Gesselschaft 10% Mitsubishi, Coffee Farmers of Columbia, Equatorial Traders Hedger AIG/Fin. Agra, Man Investment Products, Raimund Commodities 10% Global Speculator UK & US Hedger UK UK China Sugar Tate & Lyle 40% Balli Trading 10% Top Glory/Cereal Foods Out of Mkt Last Year Nestle, Dreyfus, Toshuku, Group Sopex/Sucre Export Switz, US, Japan, Belg Man Investment Products 5% Speculator UK 4

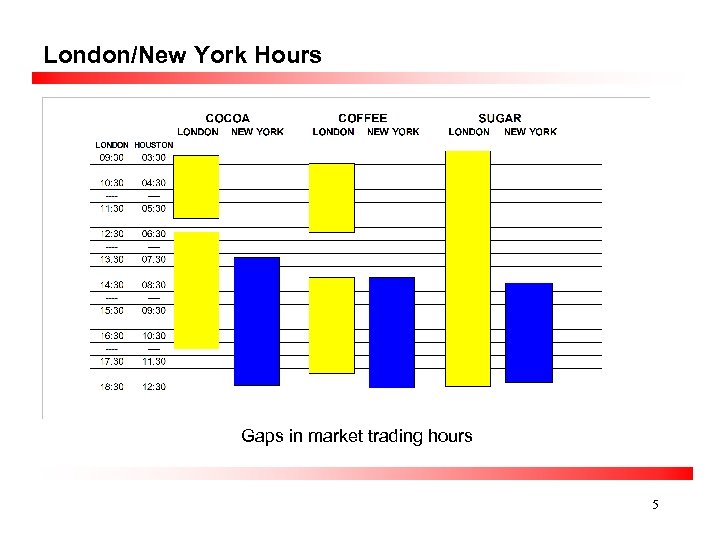

London/New York Hours Gaps in market trading hours 5

Specific EOL Products • • • Current • Non-deliverable look-alike contracts for London and New York in cocoa, coffee and sugar denominated in Euros, GBP, and USD • Basis product for the London-New York differential in cocoa and sugar denominated in Euros, GBP and USD Future Products • Electronic warranting system possible, enabling creation of deliverable contract • Deliverable continental cocoa contract • Basis product for the London-New York differential in coffee denominated in Euros, GBP and USD • Tokyo-London-New York differentials in all commodities in Euros, GBP and USD • Calendar and spread trades • Long-dated financial swap contracts for cocoa, coffee and sugar • Spot, forward and long-dated supply contracts for cocoa Ideas • Swaption products in cocoa, coffee and sugar • Location Basis trades for cocoa, coffee and sugar 6

Product Differences Existing Exchange Products • Current market products are deliverable futures • Clients pay brokerage fees for each contract traded • Clients pay initial margin for each contract traded • Clients pay daily margin for each contract traded • Futures are cash-settled, daily margined products New EOL Products • EOL products will initially be non-deliverable swap products • EOL products do not have any associated transaction fee • EOL products do not have any initial margin • EOL products do not have any daily margin • EOL Softs swap products will (settle) invoice (weekly or) twice monthly • Some products will be completely new and not offered by the exchange 7

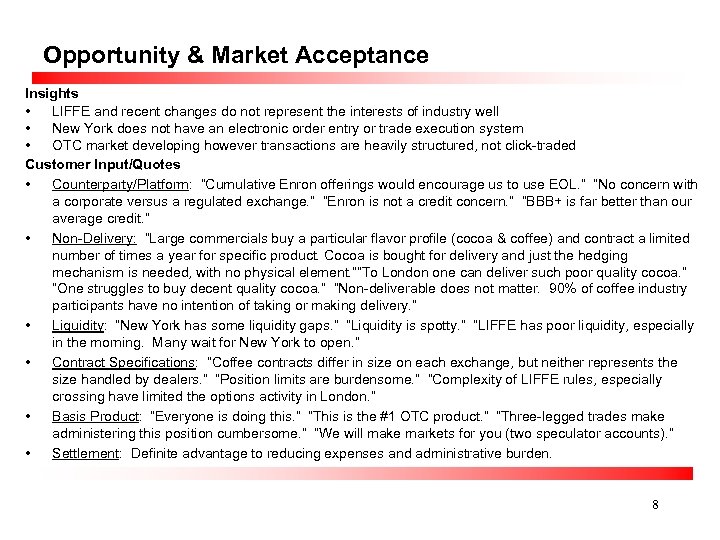

Opportunity & Market Acceptance Insights • LIFFE and recent changes do not represent the interests of industry well • New York does not have an electronic order entry or trade execution system • OTC market developing however transactions are heavily structured, not click-traded Customer Input/Quotes • Counterparty/Platform: “Cumulative Enron offerings would encourage us to use EOL. ” “No concern with a corporate versus a regulated exchange. ” “Enron is not a credit concern. ” “BBB+ is far better than our average credit. ” • Non-Delivery: “Large commercials buy a particular flavor profile (cocoa & coffee) and contract a limited number of times a year for specific product. Cocoa is bought for delivery and just the hedging mechanism is needed, with no physical element. ”“To London one can deliver such poor quality cocoa. ” “One struggles to buy decent quality cocoa. ” “Non-deliverable does not matter. 90% of coffee industry participants have no intention of taking or making delivery. ” • Liquidity: “New York has some liquidity gaps. ” “Liquidity is spotty. ” “LIFFE has poor liquidity, especially in the morning. Many wait for New York to open. ” • Contract Specifications: “Coffee contracts differ in size on each exchange, but neither represents the size handled by dealers. ” “Position limits are burdensome. ” “Complexity of LIFFE rules, especially crossing have limited the options activity in London. ” • Basis Product: “Everyone is doing this. ” “This is the #1 OTC product. ” “Three-legged trades make administering this position cumbersome. ” “We will make markets for you (two speculator accounts). ” • Settlement: Definite advantage to reducing expenses and administrative burden. 8

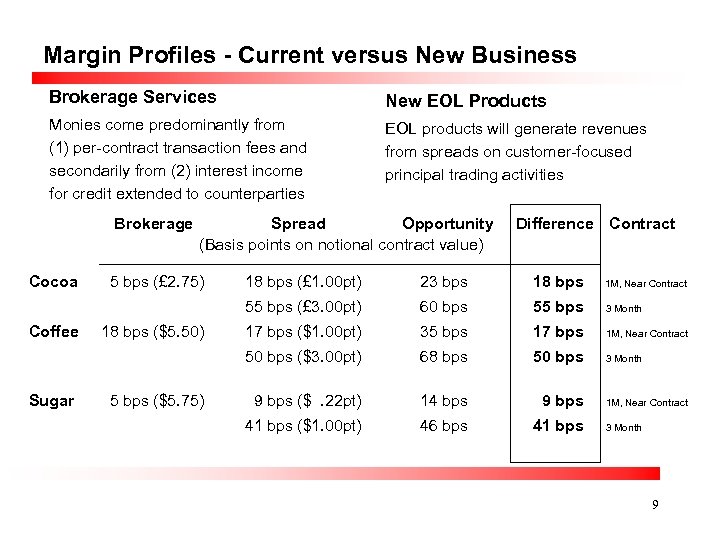

Margin Profiles - Current versus New Business Brokerage Services New EOL Products Monies come predominantly from (1) per-contract transaction fees and secondarily from (2) interest income for credit extended to counterparties EOL products will generate revenues from spreads on customer-focused principal trading activities Brokerage Cocoa Spread Opportunity (Basis points on notional contract value) Sugar 5 bps ($5. 75) 23 bps 18 bps 1 M, Near Contract 60 bps 55 bps 3 Month 17 bps ($1. 00 pt) 35 bps 17 bps 1 M, Near Contract 50 bps ($3. 00 pt) 18 bps ($5. 50) 18 bps (£ 1. 00 pt) 55 bps (£ 3. 00 pt) Coffee 5 bps (£ 2. 75) Difference Contract 68 bps 50 bps 3 Month 9 bps ($. 22 pt) 14 bps 9 bps 41 bps ($1. 00 pt) 46 bps 41 bps 1 M, Near Contract 3 Month 9

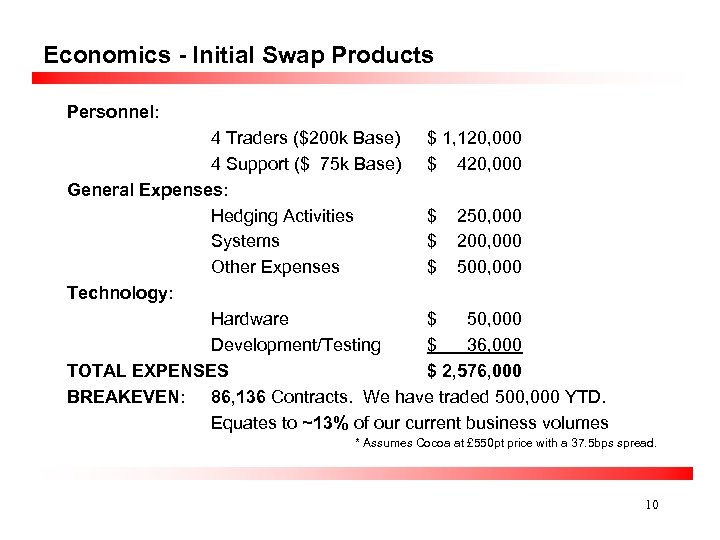

Economics - Initial Swap Products Personnel: 4 Traders ($200 k Base) $ 1, 120, 000 4 Support ($ 75 k Base) $ 420, 000 General Expenses: Hedging Activities $ 250, 000 Systems $ 200, 000 Other Expenses $ 500, 000 Technology: Hardware $ 50, 000 Development/Testing $ 36, 000 TOTAL EXPENSES $ 2, 576, 000 BREAKEVEN: 86, 136 Contracts. We have traded 500, 000 YTD. Equates to ~13% of our current business volumes * Assumes Cocoa at £ 550 pt price with a 37. 5 bps spread. 10

Cocoa Opportunity 1999 London Market Shares 1999 Revenues Cocoa US $1. 8 mm 10. 8% 11

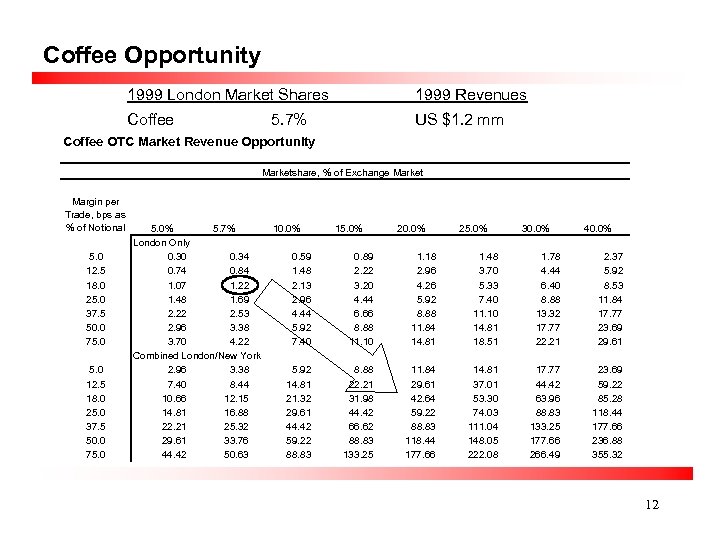

Coffee Opportunity 1999 London Market Shares 1999 Revenues Coffee US $1. 2 mm 5. 7% Coffee OTC Market Revenue Opportunity 10% Marketshare, % of Exchange Market Margin per Trade, bps as % of Notional 5. 0 12. 5 18. 0 25. 0 37. 5 50. 0 75. 0% 5. 7% London Only 0. 30 0. 34 0. 74 0. 84 1. 07 1. 22 1. 48 1. 69 2. 22 2. 53 2. 96 3. 38 3. 70 4. 22 Combined London/New York 2. 96 3. 38 7. 40 8. 44 10. 66 12. 15 14. 81 16. 88 22. 21 25. 32 29. 61 33. 76 44. 42 50. 63 10. 0% 15. 0% 20. 0% 25. 0% 30. 0% 40. 0% 0. 59 1. 48 2. 13 2. 96 4. 44 5. 92 7. 40 0. 89 2. 22 3. 20 4. 44 6. 66 8. 88 11. 10 1. 18 2. 96 4. 26 5. 92 8. 88 11. 84 14. 81 1. 48 3. 70 5. 33 7. 40 11. 10 14. 81 18. 51 1. 78 4. 44 6. 40 8. 88 13. 32 17. 77 22. 21 2. 37 5. 92 8. 53 11. 84 17. 77 23. 69 29. 61 5. 92 14. 81 21. 32 29. 61 44. 42 59. 22 88. 83 8. 88 22. 21 31. 98 44. 42 66. 62 88. 83 133. 25 11. 84 29. 61 42. 64 59. 22 88. 83 118. 44 177. 66 14. 81 37. 01 53. 30 74. 03 111. 04 148. 05 222. 08 17. 77 44. 42 63. 96 88. 83 133. 25 177. 66 266. 49 23. 69 59. 22 85. 28 118. 44 177. 66 236. 88 355. 32 12

Sugar Opportunity 1999 London Market Shares 1999 Revenues Sugar US $. 4 mm 2. 7% 13

Expected Returns Yr 1 Yr 2 This slide is currently being assembled Yr 3 Term Value

Group Structure • • Trade House – – Principal EOL Trading - New York, London and Tokyo Brokerage - London Regulatory Structure for EOL Trading Business – – – Houston entity contracts with all customers as principal. Centralize risk book in one US location (New york), includes centralized risk management, consolidation of credit risk and P&L earnings Remote location(London and Tokyo) will have origination and marketing functions plus limited responsibility for watching home location positions “out of hours” or managing specified subset of overall risk within clearly defined parameters Regulatory issues in Europe need to be looked at further for regulated products

Systems Operational Systems • Brokerage business currently operating on an AS 400 server platform • Enron. Online business will be conducted on existing Enron systems – Available technology resources provide a stable platform for the business – Sufficient systems and support exist and require minimal internal development – An inventory has been conducted to identify the correct system and has additional capabilities to support options • Gas Desk integrates with all accounting and reporting systems Trading Systems • FFast. Fill/LIFFE Connect system successfully launched 27 November – Changed front-end does not affect fulfillment mechanisms – Improved deal capture for real-time credit analysis – Two levels of client service will be available and will be rolled out on an as available basis • Enron. Online will be ready for launch in mid-February – Proven front-end interfaces with internal risk management systems – Stable, fully-functional system can be developed within 9 weeks from the start of development 16

Other Issues Staffing • New principal trading activities will require new EOL traders in New York and London with sufficient product understanding Risk Management • Multiple alternatives are available to layoff risks – – Stack Manager Physical Cocoa Position Current Exchanges, including basis-related trading alternatives and OTC Markets Asian Markets: Low liquidity market on Tokyo Grains Exchange(TGE) for sugar and coffee, however some hedging opportunity in Malaysia cocoa market Product and Service Development • • Curve development for Cocoa storage option Integrated services offering for coffee industry participants Credit • Credit profiling of these counterparties is underway and not yet complete. – Some counterparties may not be of a size that we will want to transact with on EOL 17

Risk Capital Requirements • Risk capital requirements are being identified 18

Transition • Operate existing brokerage business as normal • Develop Enron. Online – Get legal approval on all product contracts – Develop EOL front-end and integrate back office • Hire experienced trading staff • Utilize existing London team for product and platform marketing • Launch Enron. Online – Migrate customer relationships to Enron. Online • Evaluate additional options based on market reception – Continued product development – Electronic clearinghouse development 19

Timeline Nov 27, 2000 LIFFE electronic trading commenced Dec 1, 2000 Legal product development begins Enron. Online vertical page and trading interface development begins Content acquisition and related technology development begins Mid/Back-office development begins Staff recruitment to commence Dec 31, 2000 Initial launch product development completed Vertical page and trading interface development complete Content acquisition concludes Staff recruitment first stage to be completed Jan 15, 2001 Mid/Back-office development complete Thorough EOL testing to be initiated Feb 1, 2001 EOL testing complete Client pre-marketing begins Feb 15, 2000 Enron. Online Softs trading launch 20

af6a3fa981003035917b9fabfc303356.ppt