6854717d2281ede50dcd26f7da4b4dd3.ppt

- Количество слайдов: 97

Enron Briefing Clarkson Centre for Business Ethics & Board Effectiveness—CC(BE)2 & Executive Programs Rotman School of Management March 19, 2002 Rotman School of Management, March 19, 2002

Agenda q Background • Enron • Accounting Disclosure Manipulation q Enron Problems • Structures, activities and disclosures • Control and culture q Lessons • Governance • Accounting standards and profession • Director’s Behaviour q Questions Rotman School of Management, March 19, 2002 2

Rotman Briefing Team q Ramy Elitzur – Accounting, Audit Former Director, MBA Program, elitzur@rotman. utoronto. ca q Irene Wiecek – Accounting, Audit Associate Director, MMPA, wiecek@rotman. utoronto. ca q Eric Kirzner – Finance, Governance Director, Market Regulation Services, + kirzner@rotman. utoronto. ca q Len Brooks – Governance, Ethics, Accounting, Audit Exec. Dir. , The Clarkson Centre for Business Ethics & Board Effectiveness Director , Master of Management & Professional Accounting (MMPA) Director, Diploma in Investigative & Forensic Accounting (DIFA) brooks@rotman. utoronto. ca Rotman School of Management, March 19, 2002 3

The Enron Affair q q q Management was: • out of control, and engaged in self-dealing • manipulating transactions & financial reports Company imploded - Chap. 11 in Dec. 2001 Investors misled, pensions lost Executives plead the 5 th, poor memory, ignorance, incompetence Outrage Auditor savaged, profession to be changed Rotman School of Management, March 19, 2002 4

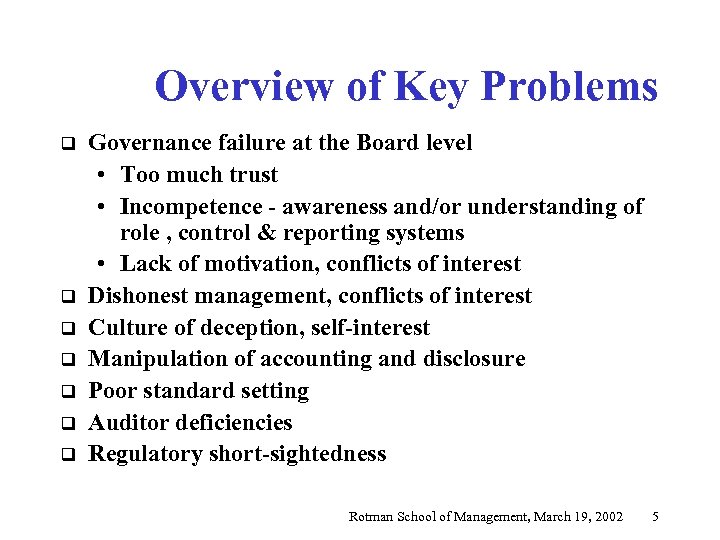

Overview of Key Problems q q q q Governance failure at the Board level • Too much trust • Incompetence - awareness and/or understanding of role , control & reporting systems • Lack of motivation, conflicts of interest Dishonest management, conflicts of interest Culture of deception, self-interest Manipulation of accounting and disclosure Poor standard setting Auditor deficiencies Regulatory short-sightedness Rotman School of Management, March 19, 2002 5

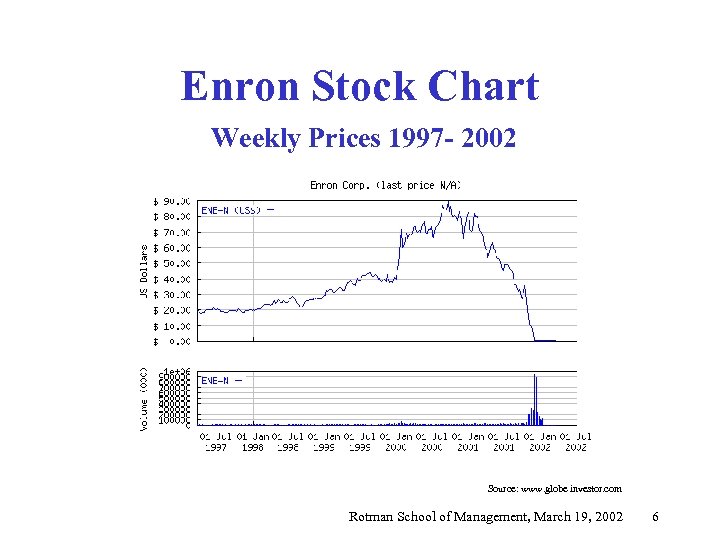

Enron Stock Chart Weekly Prices 1997 - 2002 Source: www. globe investor. com Rotman School of Management, March 19, 2002 6

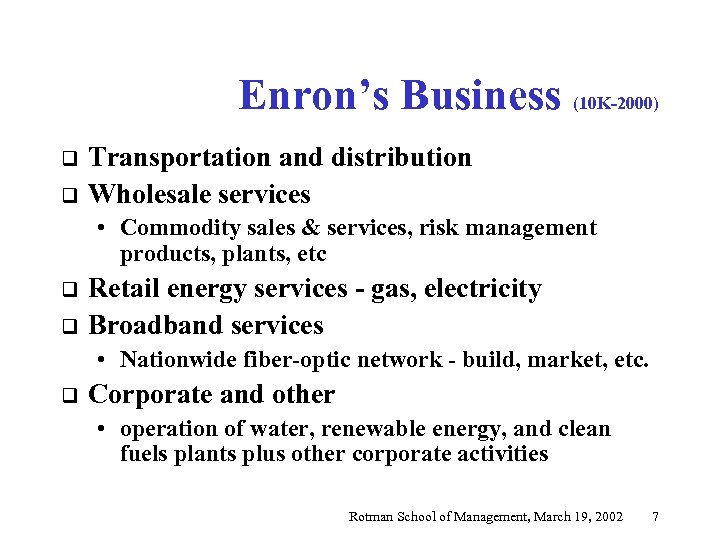

Enron’s Business (10 K-2000) q q Transportation and distribution Wholesale services • Commodity sales & services, risk management products, plants, etc q q Retail energy services - gas, electricity Broadband services • Nationwide fiber-optic network - build, market, etc. q Corporate and other • operation of water, renewable energy, and clean fuels plants plus other corporate activities Rotman School of Management, March 19, 2002 7

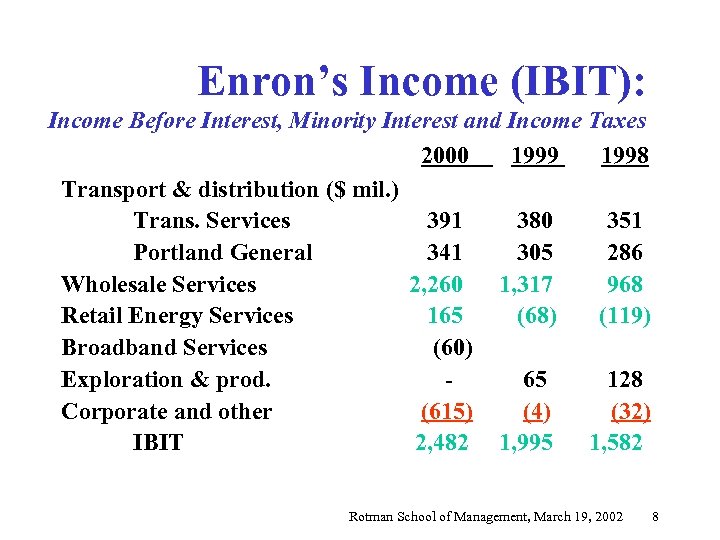

Enron’s Income (IBIT): Income Before Interest, Minority Interest and Income Taxes 2000 1999 1998 Transport & distribution ($ mil. ) Trans. Services 391 380 351 Portland General 341 305 286 Wholesale Services 2, 260 1, 317 968 Retail Energy Services 165 (68) (119) Broadband Services (60) Exploration & prod. 65 128 Corporate and other (615) (4) (32) IBIT 2, 482 1, 995 1, 582 Rotman School of Management, March 19, 2002 8

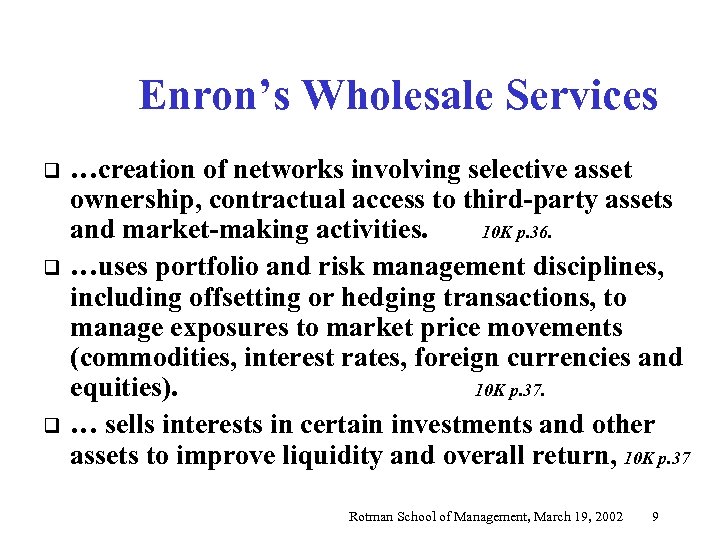

Enron’s Wholesale Services q q q …creation of networks involving selective asset ownership, contractual access to third-party assets and market-making activities. 10 K p. 36. …uses portfolio and risk management disciplines, including offsetting or hedging transactions, to manage exposures to market price movements (commodities, interest rates, foreign currencies and equities). 10 K p. 37. … sells interests in certain investments and other assets to improve liquidity and overall return, 10 K p. 37 Rotman School of Management, March 19, 2002 9

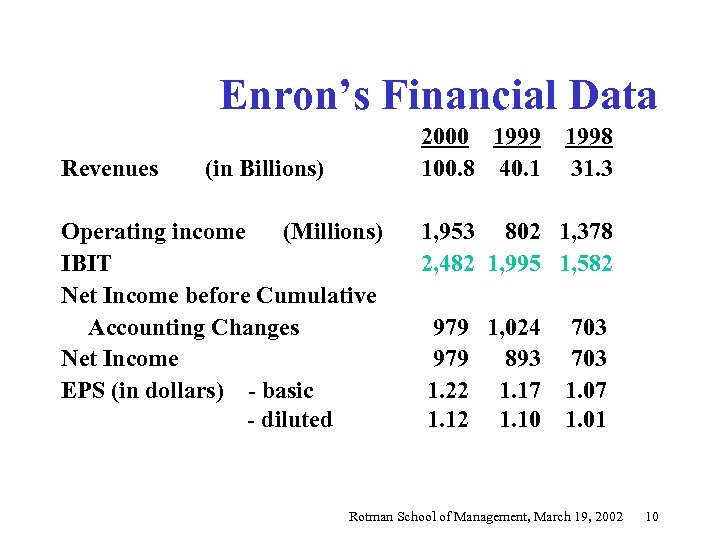

Enron’s Financial Data Revenues (in Billions) 2000 1999 100. 8 40. 1 1998 31. 3 Operating income (Millions) 1, 953 802 1, 378 IBIT 2, 482 1, 995 1, 582 Net Income before Cumulative Accounting Changes 979 1, 024 703 Net Income 979 893 703 EPS (in dollars) - basic 1. 22 1. 17 1. 07 - diluted 1. 12 1. 10 1. 01 Rotman School of Management, March 19, 2002 10

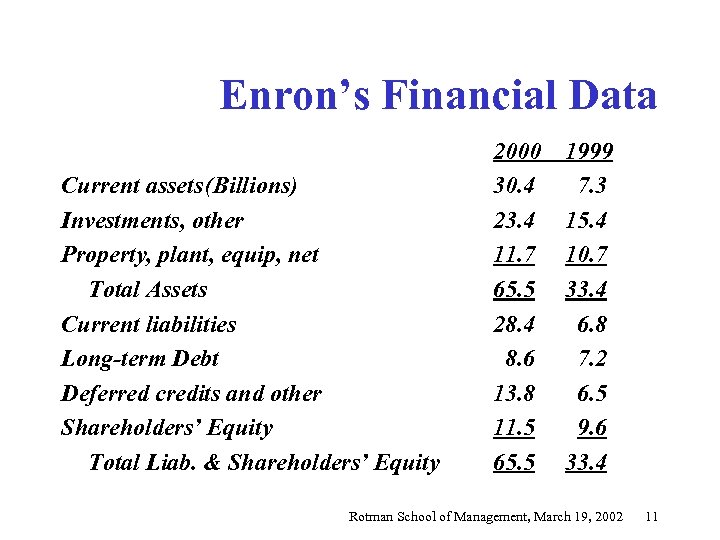

Enron’s Financial Data Current assets(Billions) Investments, other Property, plant, equip, net Total Assets Current liabilities Long-term Debt Deferred credits and other Shareholders’ Equity Total Liab. & Shareholders’ Equity 2000 30. 4 23. 4 11. 7 65. 5 28. 4 8. 6 13. 8 11. 5 65. 5 1999 7. 3 15. 4 10. 7 33. 4 6. 8 7. 2 6. 5 9. 6 33. 4 Rotman School of Management, March 19, 2002 11

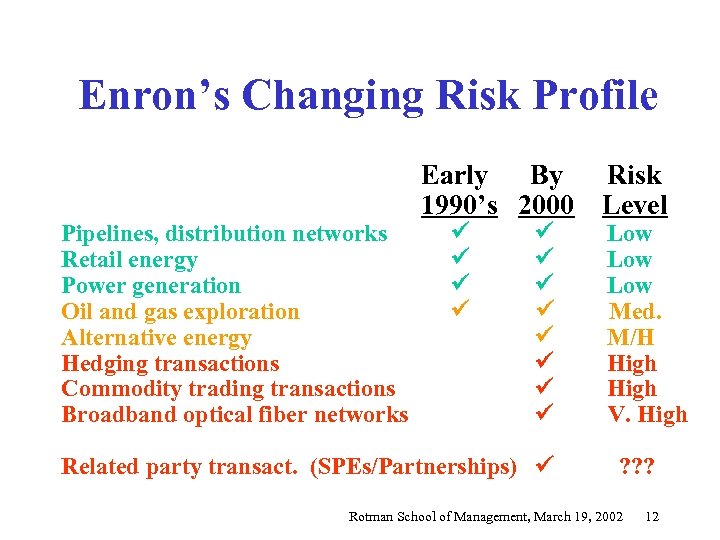

Enron’s Changing Risk Profile Pipelines, distribution networks Retail energy Power generation Oil and gas exploration Alternative energy Hedging transactions Commodity trading transactions Broadband optical fiber networks Early By Risk 1990’s 2000 Level Low Med. M/H High V. High Related party transact. (SPEs/Partnerships) ? ? ? Rotman School of Management, March 19, 2002 12

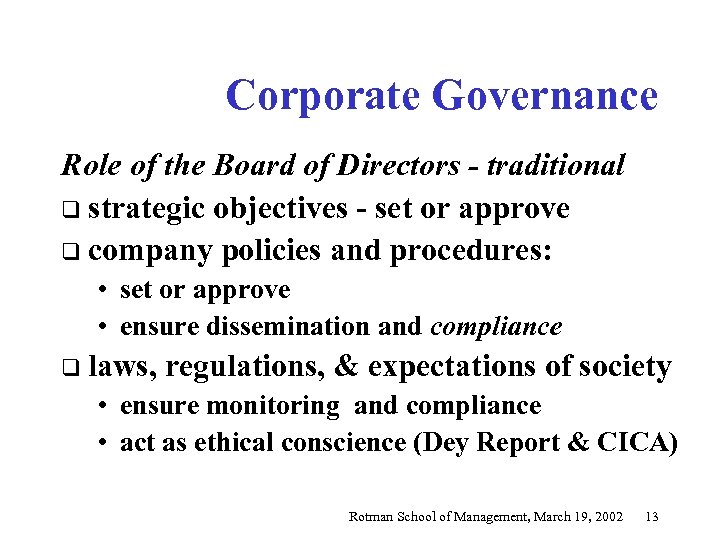

Corporate Governance Role of the Board of Directors - traditional q strategic objectives - set or approve q company policies and procedures: • set or approve • ensure dissemination and compliance q laws, regulations, & expectations of society • ensure monitoring and compliance • act as ethical conscience (Dey Report & CICA) Rotman School of Management, March 19, 2002 13

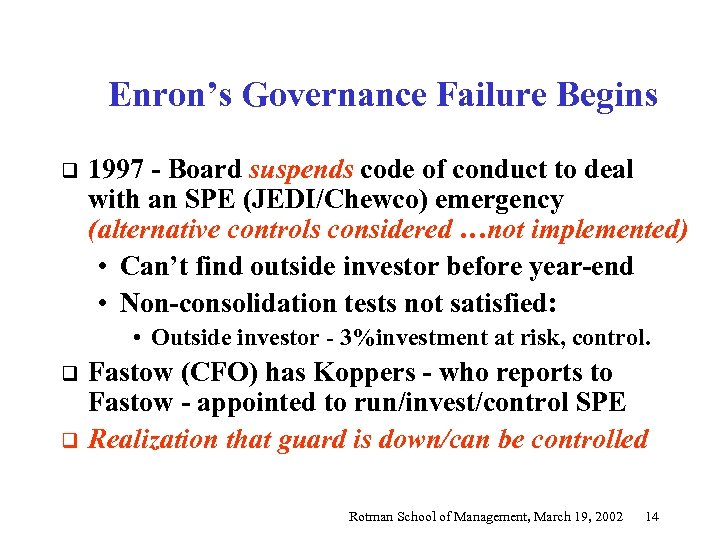

Enron’s Governance Failure Begins q 1997 - Board suspends code of conduct to deal with an SPE (JEDI/Chewco) emergency (alternative controls considered …not implemented) • Can’t find outside investor before year-end • Non-consolidation tests not satisfied: • Outside investor - 3%investment at risk, control. q q Fastow (CFO) has Koppers - who reports to Fastow - appointed to run/invest/control SPE Realization that guard is down/can be controlled Rotman School of Management, March 19, 2002 14

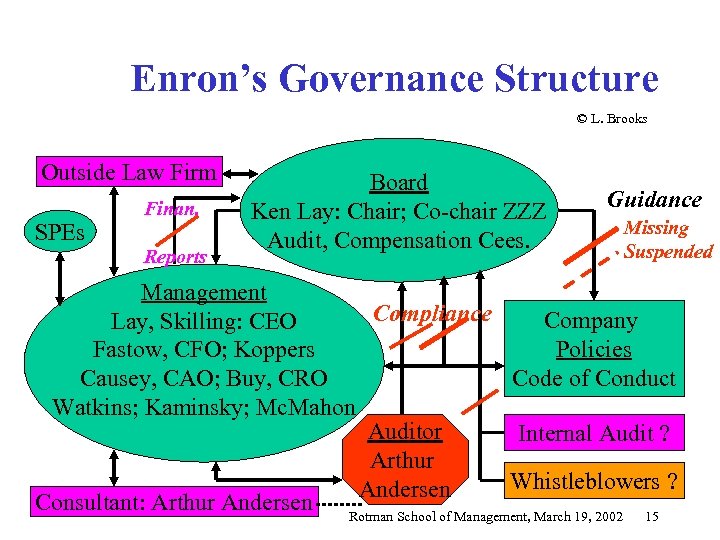

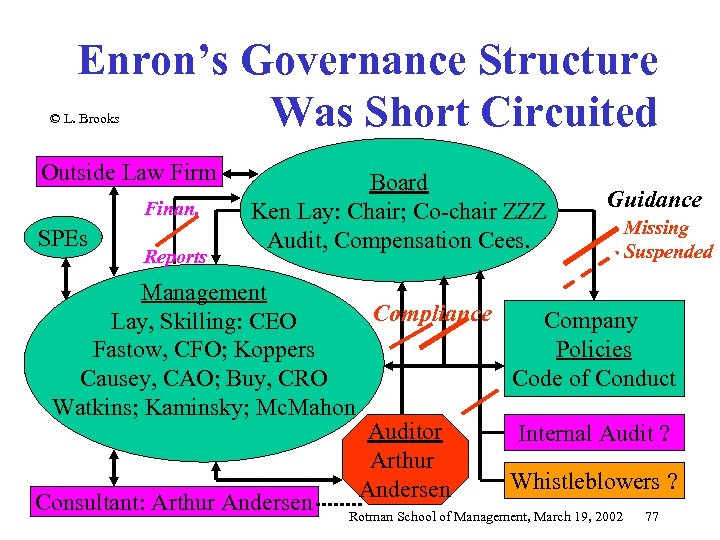

Enron’s Governance Structure © L. Brooks Outside Law Firm SPEs Finan. Reports Board Ken Lay: Chair; Co-chair ZZZ Audit, Compensation Cees. Guidance Missing Suspended Management Compliance Company Lay, Skilling: CEO Policies Fastow, CFO; Koppers Code of Conduct Causey, CAO; Buy, CRO Watkins; Kaminsky; Mc. Mahon Auditor Internal Audit ? Arthur Whistleblowers ? Andersen Consultant: Arthur Andersen Rotman School of Management, March 19, 2002 15

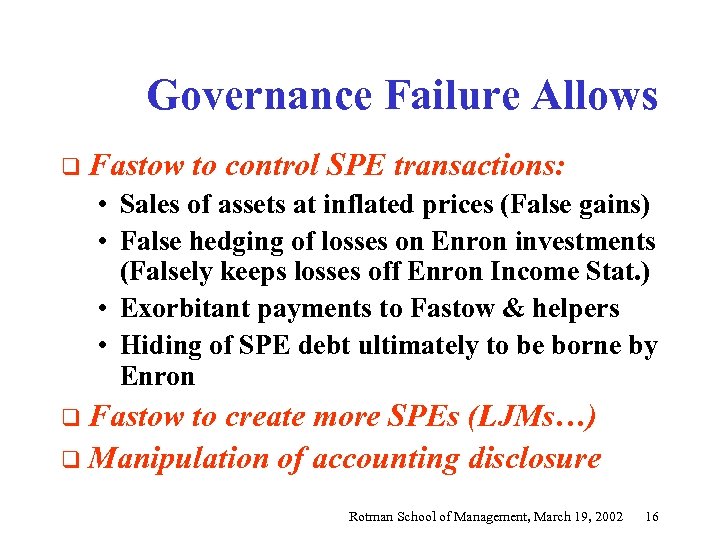

Governance Failure Allows q Fastow to control SPE transactions: • Sales of assets at inflated prices (False gains) • False hedging of losses on Enron investments (Falsely keeps losses off Enron Income Stat. ) • Exorbitant payments to Fastow & helpers • Hiding of SPE debt ultimately to be borne by Enron q Fastow to create more SPEs (LJMs…) q Manipulation of accounting disclosure Rotman School of Management, March 19, 2002 16

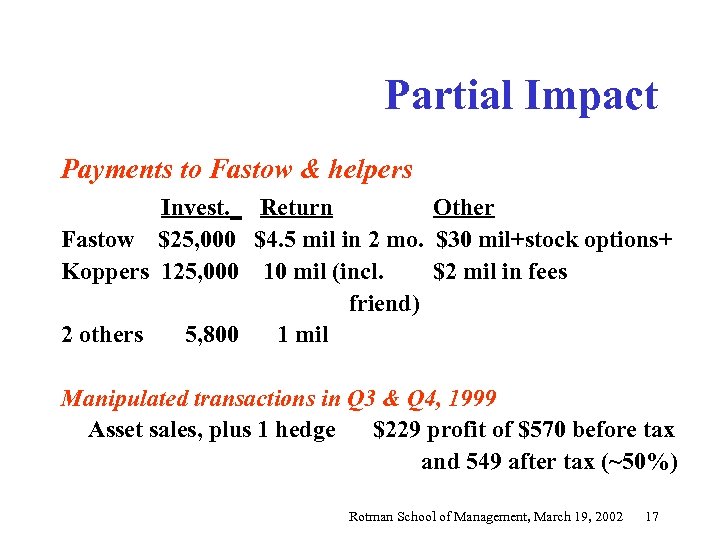

Partial Impact Payments to Fastow & helpers Invest. _ Return Other Fastow $25, 000 $4. 5 mil in 2 mo. $30 mil+stock options+ Koppers 125, 000 10 mil (incl. $2 mil in fees friend) 2 others 5, 800 1 mil Manipulated transactions in Q 3 & Q 4, 1999 Asset sales, plus 1 hedge $229 profit of $570 before tax and 549 after tax (~50%) Rotman School of Management, March 19, 2002 17

Manipulation of Accounting Disclosure A Backgrounder The Accounting Art of War By Ramy Elitzur Rotman School of Management, March 19, 2002 18

The Accounting Art of War “A Strategy of Positioning evades Reality and confronts through Illusion. ” The Art of War by Sun Tzu © R. Elitzur Rotman School of Management, March 19, 2002 19

The Accounting Art of War “Appearance and intention are fundamental to the Art of War. Appearance and intention mean the strategic use of ploys, the use of falsehoods to gain what is real. ” The Book of Family Traditions on The Art of War, Yagyu Munenori © R. Elitzur Rotman School of Management, March 19, 2002 20

The Accounting Art of War q The accounting art of war incorporates the entire menu of reporting strategies that management employs to manipulate financial statements. q Involves much more than earnings management. © R. Elitzur Rotman School of Management, March 19, 2002 21

The Agency Framework q q q Modern corporations have a separation of ownership and management. As such, there is an inherent conflict of interests between shareholders and managers. Mechanisms to alleviate the agency problem: • Compensation plan (to create goal congruence between shareholders and managers) • Monitoring or auditing, both internal and external. © R. Elitzur Rotman School of Management, March 19, 2002 22

The Agency Framework In The Context of Enron q The Mechanisms to alleviate the agency problem failed in Enron: • The compensation plan: Not only it did not reduce the agency problem but it actually exacerbated it. • Monitoring or auditing, both internal and external failed to bring the accounting problems to light. © R. Elitzur Rotman School of Management, March 19, 2002 23

Tools in The Accounting Art of War q Earnings Management q Revenue Manipulation q Off-Balance-Sheet Liabilities q Sheer Opportunism © R. Elitzur Rotman School of Management, March 19, 2002 24

Tools in The Accounting Art of War Earnings Management Companies may want to: q Increase reported earnings. q Decrease reported earnings. q Smooth earnings. © R. Elitzur Rotman School of Management, March 19, 2002 25

Earnings Management q Merchant (1990) and Merchant and Bruns (1990) find that earnings management is a widespread phenomenon. q Furthermore, the same studies surveyed managers and report that, according to these managers, earnings management is an acceptable practice. Rotman School of Management, March 19, 2002 26

Increasing Reported Earnings q Why? q This could increase bonus and other compensation. © R. Elitzur Rotman School of Management, March 19, 2002 27

Examples q Enron q Waste Management where the company overstated income from 1992 to 1996 by more than US$ 1 billion. q Livent, Inc. © R. Elitzur Rotman School of Management, March 19, 2002 28

Income Decreasing Strategy q Why? q In cases of monopoly because of anti- trust considerations. q Regulated utilities. q ‘Blood Bath’. © R. Elitzur Rotman School of Management, March 19, 2002 29

Example q Microsoft q The issue of capitalization of software development costs. q Does this strategy have a significant impact? © R. Elitzur Rotman School of Management, March 19, 2002 30

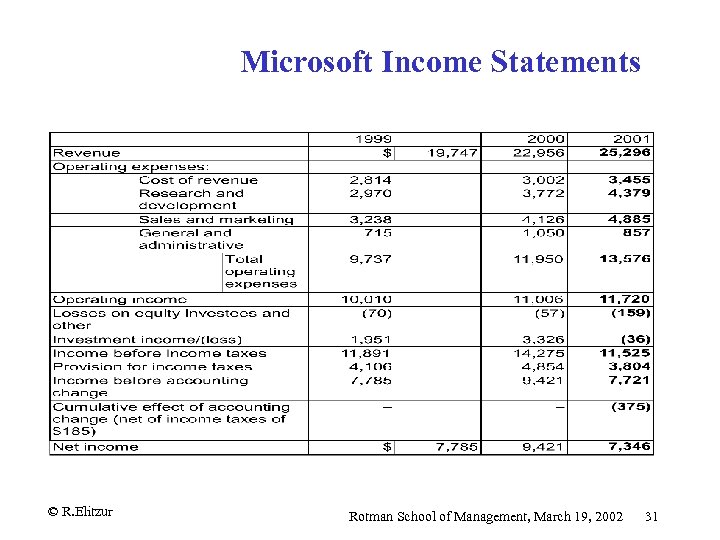

Microsoft Income Statements © R. Elitzur Rotman School of Management, March 19, 2002 31

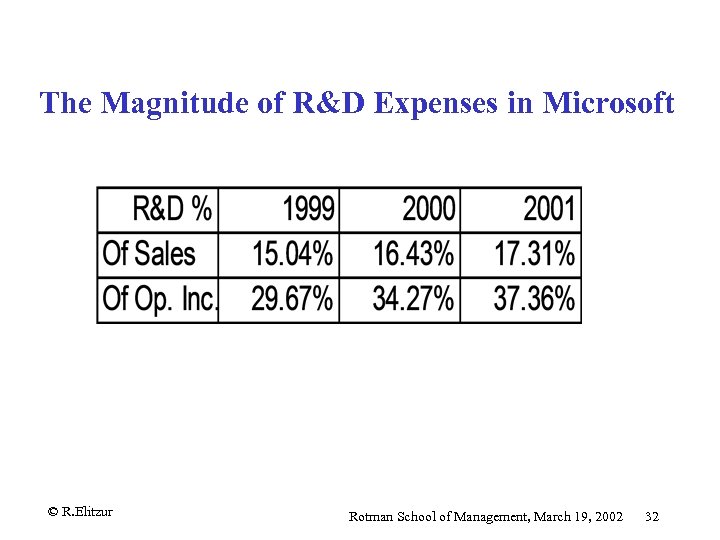

The Magnitude of R&D Expenses in Microsoft © R. Elitzur Rotman School of Management, March 19, 2002 32

The Accounting Art of War (Cont. ) Manipulation of Valuation q Companies may want to increase reported revenues. q Example: Micro. Strategy © R. Elitzur Rotman School of Management, March 19, 2002 33

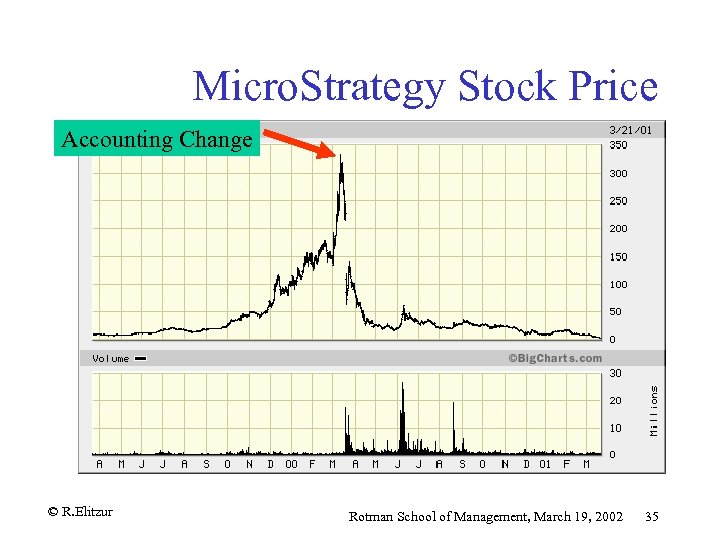

Micro. Strategy q the Securities and Exchange Commission, when moving to crack down on lax accounting standards, in December 2000 has found that Micro. Strategy Inc. , an inventory-management software maker, was prematurely recognizing revenue. © R. Elitzur Rotman School of Management, March 19, 2002 34

Micro. Strategy Stock Price Accounting Change © R. Elitzur Rotman School of Management, March 19, 2002 35

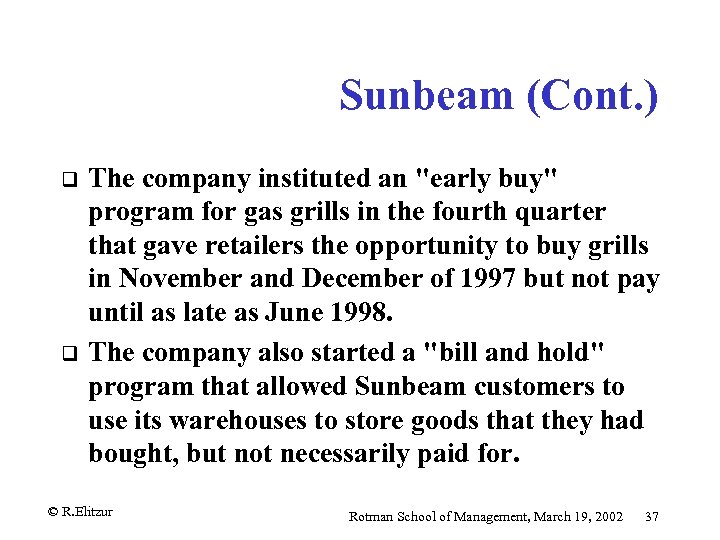

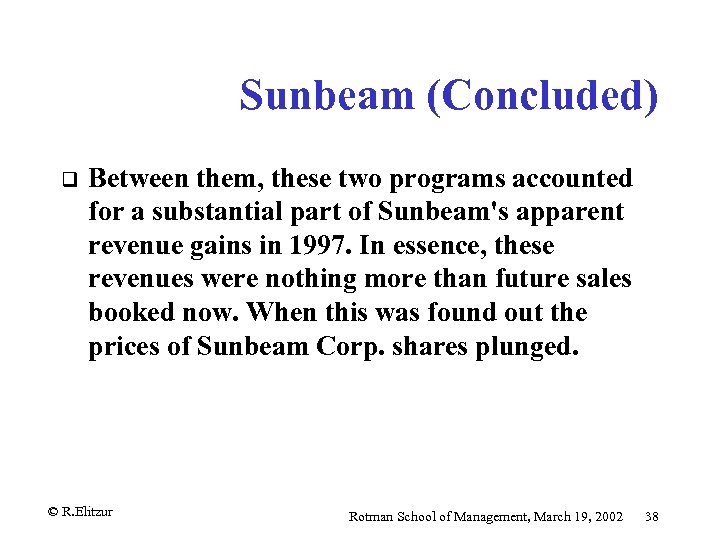

Sunbeam q q A new CEO, "Chainsaw Al" Dunlap, was hired in mid 1996 to turn the company around. A year after he was hired, Al Dunlap declared success in turning Sunbeam Corp. around in terms of profits and revenues. It was later found that the revenue growth came from manipulation of revenues. © R. Elitzur Rotman School of Management, March 19, 2002 36

Sunbeam (Cont. ) q q The company instituted an "early buy" program for gas grills in the fourth quarter that gave retailers the opportunity to buy grills in November and December of 1997 but not pay until as late as June 1998. The company also started a "bill and hold" program that allowed Sunbeam customers to use its warehouses to store goods that they had bought, but not necessarily paid for. © R. Elitzur Rotman School of Management, March 19, 2002 37

Sunbeam (Concluded) q Between them, these two programs accounted for a substantial part of Sunbeam's apparent revenue gains in 1997. In essence, these revenues were nothing more than future sales booked now. When this was found out the prices of Sunbeam Corp. shares plunged. © R. Elitzur Rotman School of Management, March 19, 2002 38

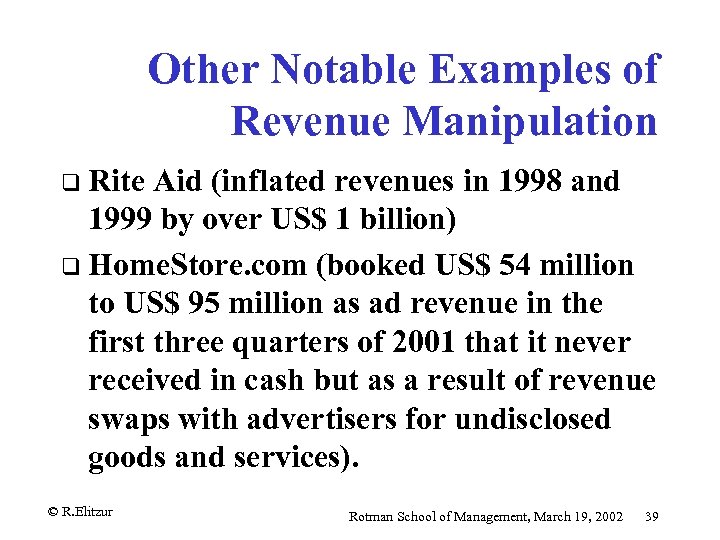

Other Notable Examples of Revenue Manipulation q Rite Aid (inflated revenues in 1998 and 1999 by over US$ 1 billion) q Home. Store. com (booked US$ 54 million to US$ 95 million as ad revenue in the first three quarters of 2001 that it never received in cash but as a result of revenue swaps with advertisers for undisclosed goods and services). © R. Elitzur Rotman School of Management, March 19, 2002 39

Off-Balance-Sheet Financing q Companies may want to omit debt from the balance sheet. © R. Elitzur Rotman School of Management, March 19, 2002 40

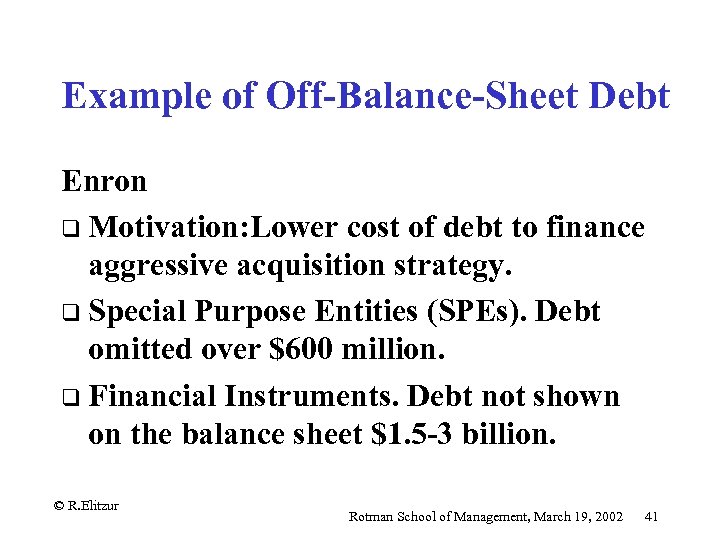

Example of Off-Balance-Sheet Debt Enron q Motivation: Lower cost of debt to finance aggressive acquisition strategy. q Special Purpose Entities (SPEs). Debt omitted over $600 million. q Financial Instruments. Debt not shown on the balance sheet $1. 5 -3 billion. © R. Elitzur Rotman School of Management, March 19, 2002 41

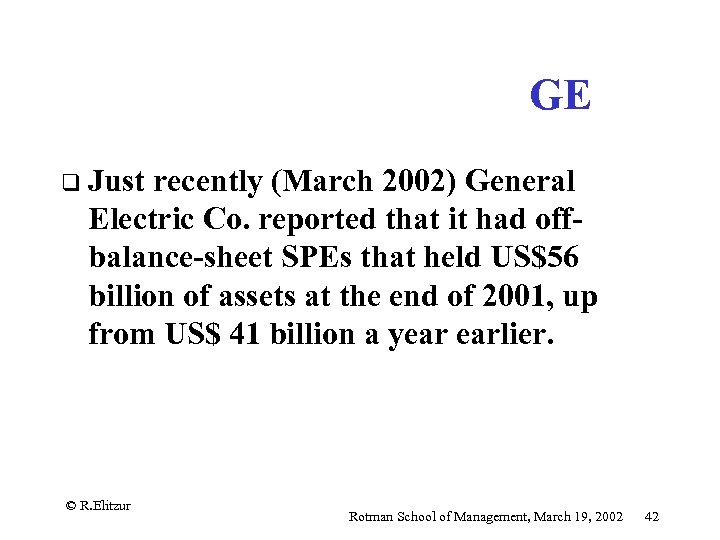

GE q Just recently (March 2002) General Electric Co. reported that it had offbalance-sheet SPEs that held US$56 billion of assets at the end of 2001, up from US$ 41 billion a year earlier. © R. Elitzur Rotman School of Management, March 19, 2002 42

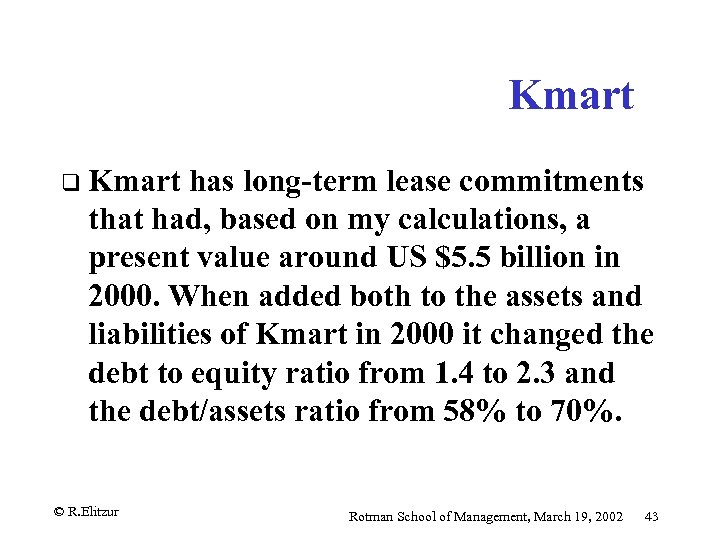

Kmart q Kmart has long-term lease commitments that had, based on my calculations, a present value around US $5. 5 billion in 2000. When added both to the assets and liabilities of Kmart in 2000 it changed the debt to equity ratio from 1. 4 to 2. 3 and the debt/assets ratio from 58% to 70%. © R. Elitzur Rotman School of Management, March 19, 2002 43

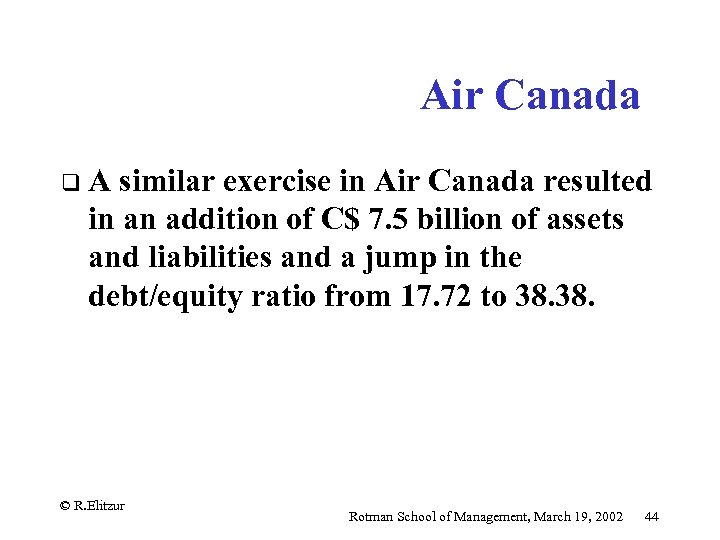

Air Canada q A similar exercise in Air Canada resulted in an addition of C$ 7. 5 billion of assets and liabilities and a jump in the debt/equity ratio from 17. 72 to 38. © R. Elitzur Rotman School of Management, March 19, 2002 44

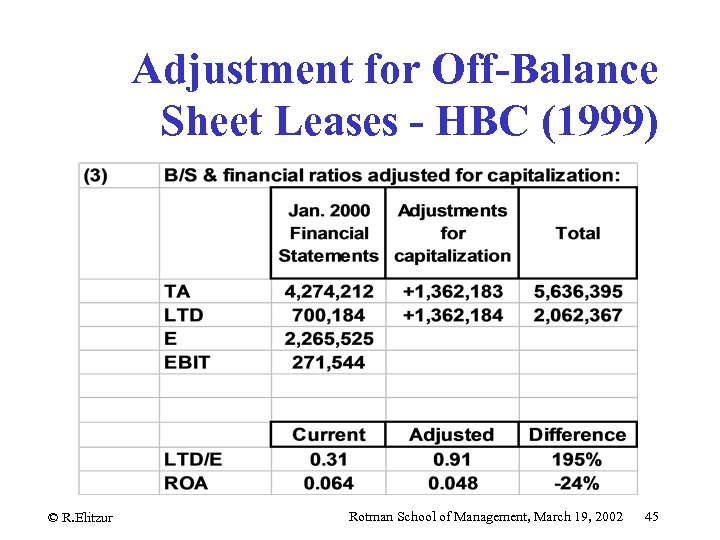

Adjustment for Off-Balance Sheet Leases - HBC (1999) © R. Elitzur Rotman School of Management, March 19, 2002 45

Opportunism q Example: Air Canada © R. Elitzur Rotman School of Management, March 19, 2002 46

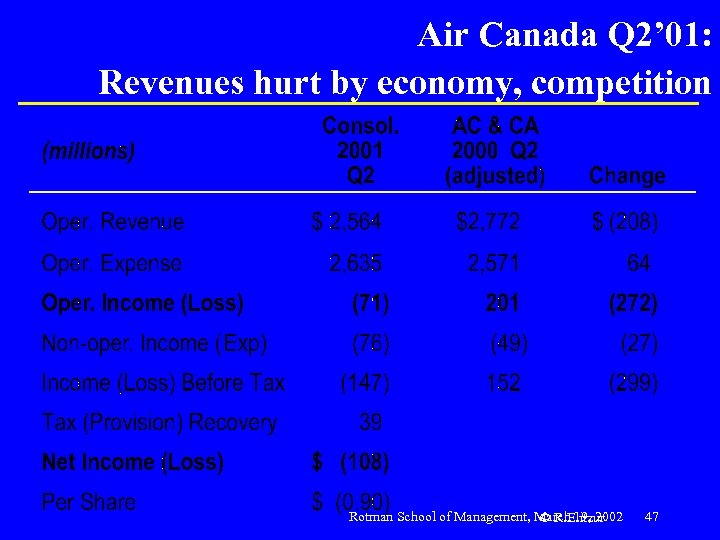

Air Canada Q 2’ 01: Revenues hurt by economy, competition Rotman School of Management, March 19, 2002 © R. Elitzur 47

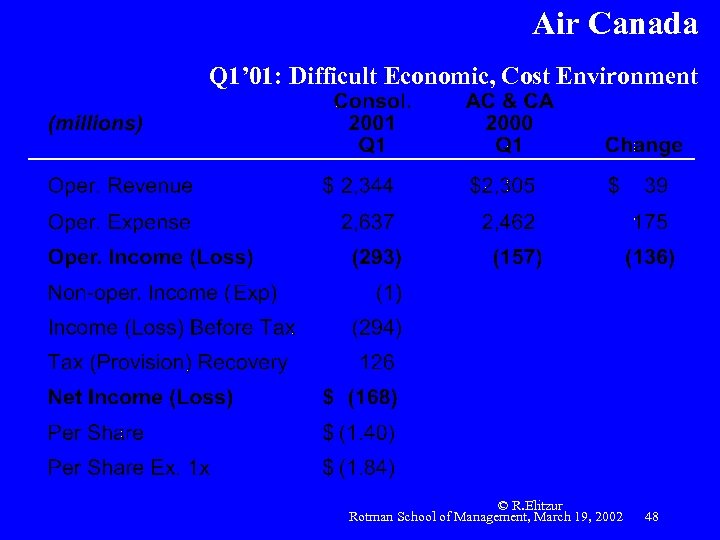

Air Canada Q 1’ 01: Difficult Economic, Cost Environment © R. Elitzur Rotman School of Management, March 19, 2002 48

How Fastow/Enron Misused SPEs To manipulate financial reports and siphon off funds to Fastow & helpers until the company imploded. By Irene Wiecek Rotman School of Management, March 19, 2002 49

Guiding Financial Reporting Principles q q q Economic substance over legal form – portrayal of reality • Which assets and liabilities are part of the company? • When is a transaction a bona fide transaction? • Management intent Arm’s length presumption - party is unrelated and bargaining on its own account – therefore price and terms fairly arrived at. • Versus related party transactions – fiduciary responsibilities Transparency – also a fundamental principle of efficient capital markets The difficulty with Enron lay with sifting through the complexity Rotman School of Management, March 19, 2002 50

Decision making principles q All the relevant information available? q Quality of information i. e. based on reality, numbers reliable? q Understandable? “Enron’s SPEs were a mystery to most people at Enron” Rotman School of Management, March 19, 2002 51

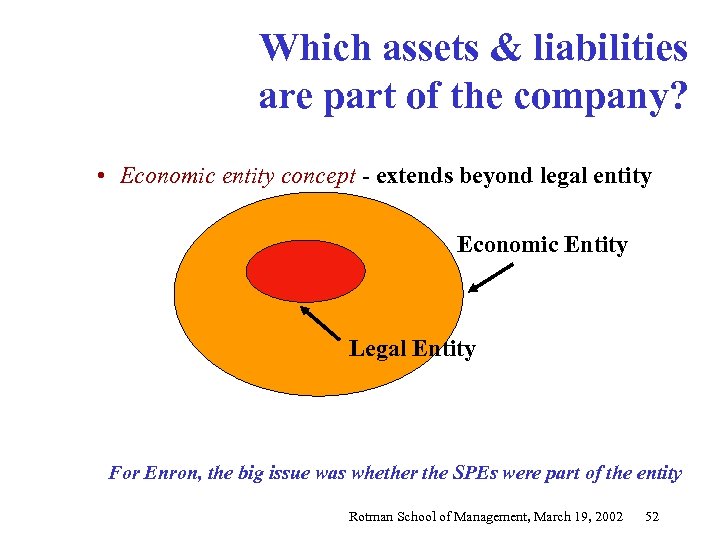

Which assets & liabilities are part of the company? • Economic entity concept - extends beyond legal entity Economic Entity Legal Entity For Enron, the big issue was whether the SPEs were part of the entity Rotman School of Management, March 19, 2002 52

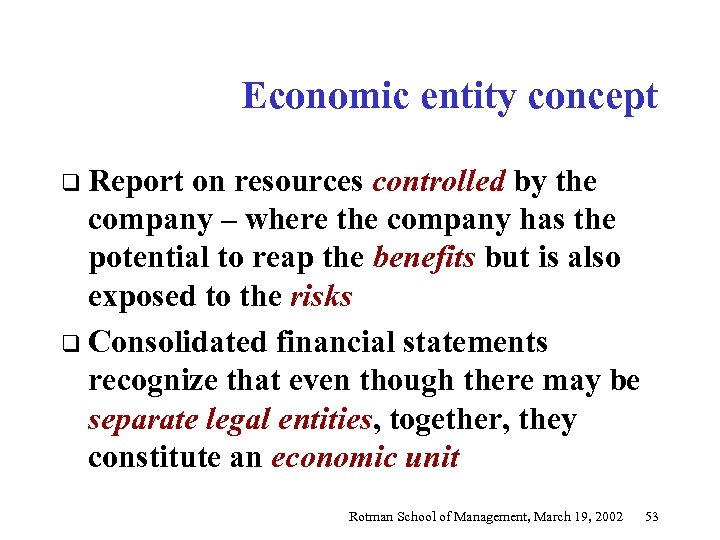

Economic entity concept q Report on resources controlled by the company – where the company has the potential to reap the benefits but is also exposed to the risks q Consolidated financial statements recognize that even though there may be separate legal entities, together, they constitute an economic unit Rotman School of Management, March 19, 2002 53

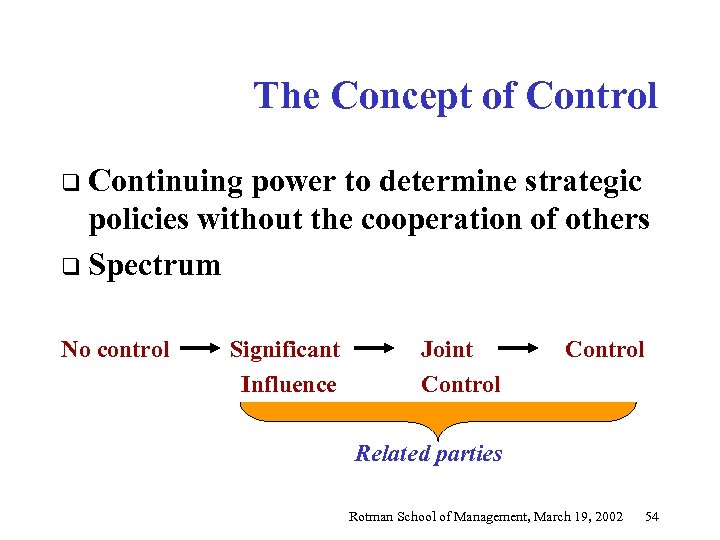

The Concept of Control q Continuing power to determine strategic policies without the cooperation of others q Spectrum No control Significant Influence Joint Control Related parties Rotman School of Management, March 19, 2002 54

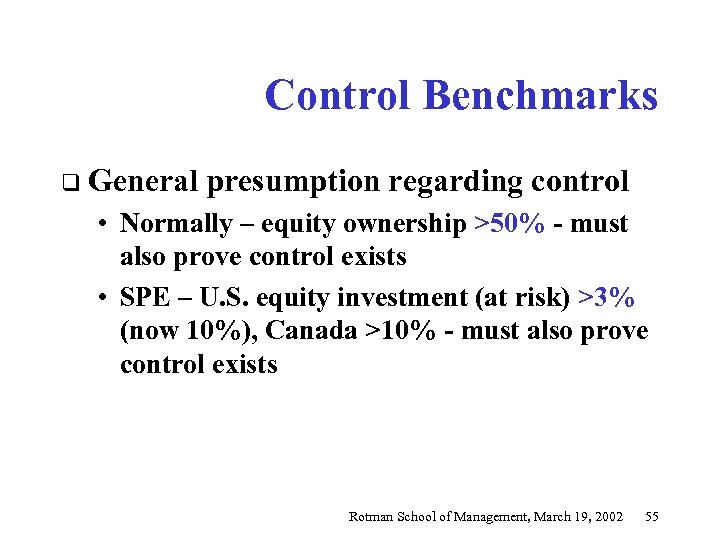

Control Benchmarks q General presumption regarding control • Normally – equity ownership >50% - must also prove control exists • SPE – U. S. equity investment (at risk) >3% (now 10%), Canada >10% - must also prove control exists Rotman School of Management, March 19, 2002 55

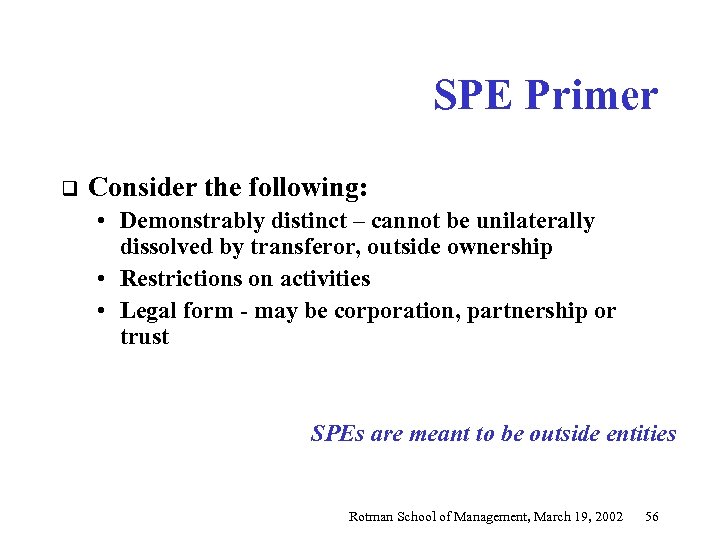

SPE Primer q Consider the following: • Demonstrably distinct – cannot be unilaterally dissolved by transferor, outside ownership • Restrictions on activities • Legal form - may be corporation, partnership or trust SPEs are meant to be outside entities Rotman School of Management, March 19, 2002 56

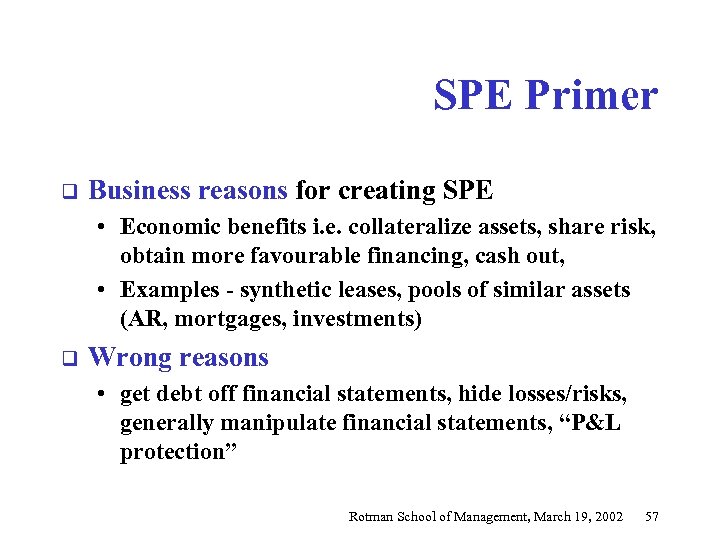

SPE Primer q Business reasons for creating SPE • Economic benefits i. e. collateralize assets, share risk, obtain more favourable financing, cash out, • Examples - synthetic leases, pools of similar assets (AR, mortgages, investments) q Wrong reasons • get debt off financial statements, hide losses/risks, generally manipulate financial statements, “P&L protection” Rotman School of Management, March 19, 2002 57

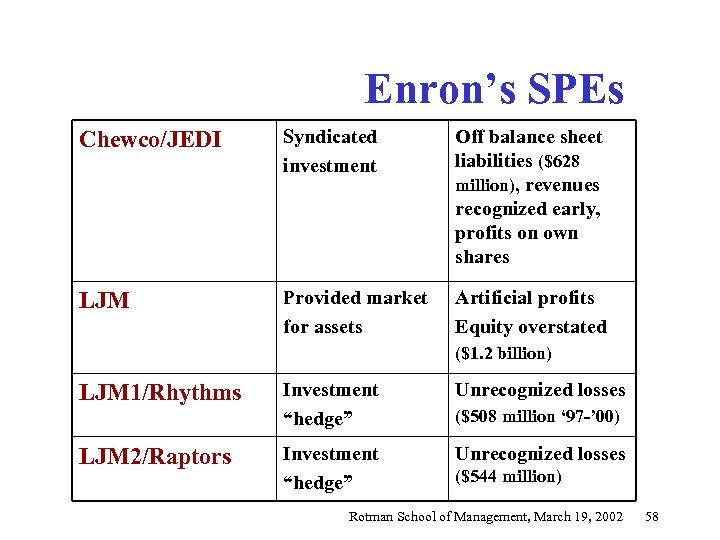

Enron’s SPEs Chewco/JEDI Syndicated investment Off balance sheet liabilities ($628 million), revenues recognized early, profits on own shares LJM Provided market for assets Artificial profits Equity overstated ($1. 2 billion) LJM 1/Rhythms LJM 2/Raptors Investment “hedge” Unrecognized losses ($508 million ‘ 97 -’ 00) ($544 million) Rotman School of Management, March 19, 2002 58

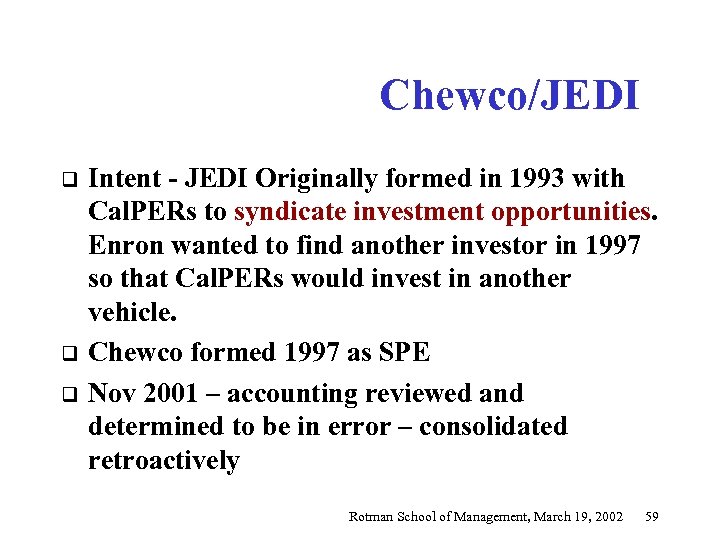

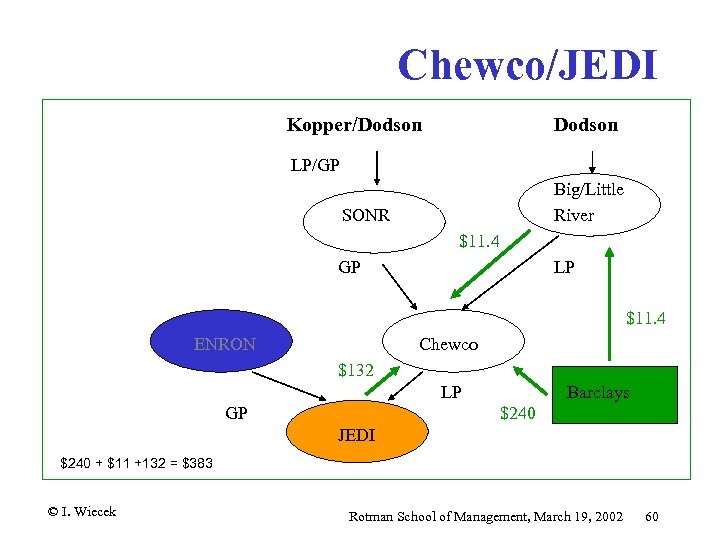

Chewco/JEDI q q q Intent - JEDI Originally formed in 1993 with Cal. PERs to syndicate investment opportunities. Enron wanted to find another investor in 1997 so that Cal. PERs would invest in another vehicle. Chewco formed 1997 as SPE Nov 2001 – accounting reviewed and determined to be in error – consolidated retroactively Rotman School of Management, March 19, 2002 59

Chewco/JEDI Kopper/Dodson LP/GP Big/Little River SONR $11. 4 GP LP $11. 4 ENRON Chewco $132 LP GP Barclays $240 JEDI $240 + $11 +132 = $383 © I. Wiecek Rotman School of Management, March 19, 2002 60

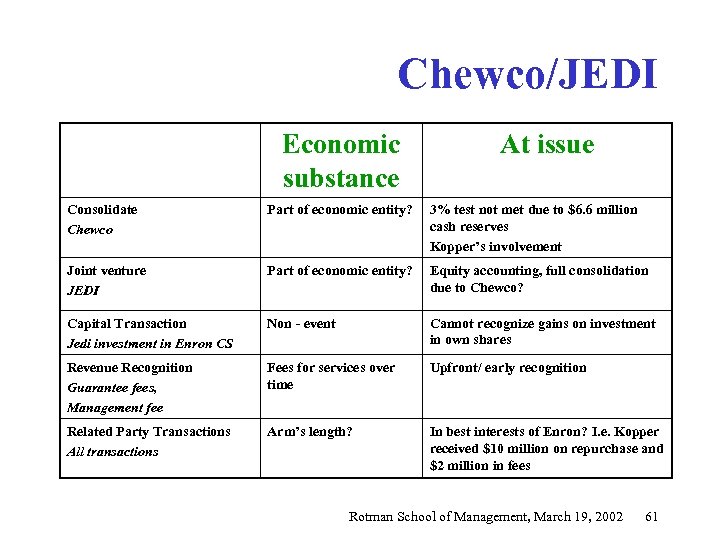

Chewco/JEDI Economic substance At issue Consolidate Chewco Part of economic entity? 3% test not met due to $6. 6 million cash reserves Kopper’s involvement Joint venture JEDI Part of economic entity? Equity accounting, full consolidation due to Chewco? Capital Transaction Jedi investment in Enron CS Non - event Cannot recognize gains on investment in own shares Revenue Recognition Guarantee fees, Management fee Fees for services over time Upfront/ early recognition Related Party Transactions All transactions Arm’s length? In best interests of Enron? I. e. Kopper received $10 million on repurchase and $2 million in fees Rotman School of Management, March 19, 2002 61

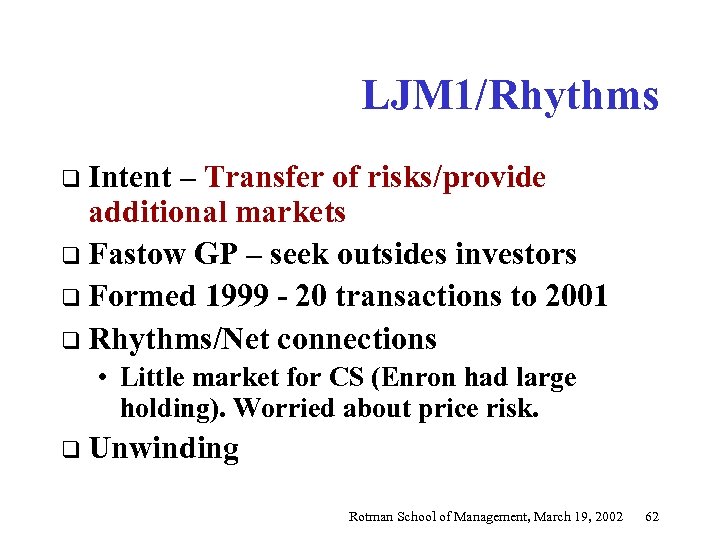

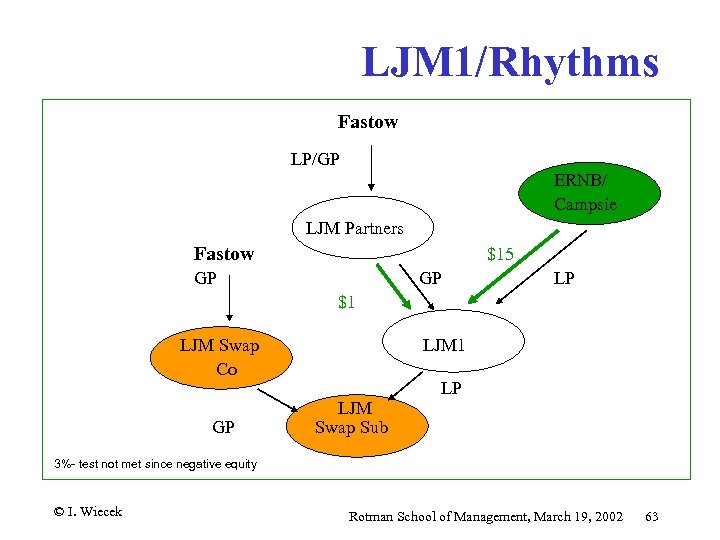

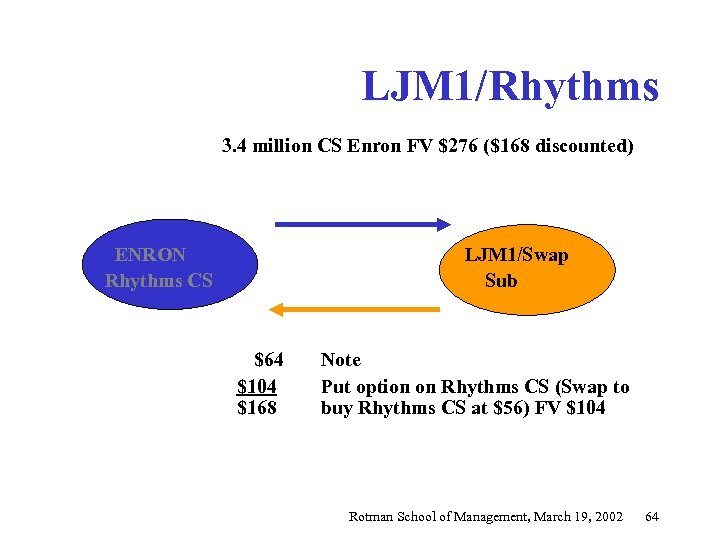

LJM 1/Rhythms q Intent – Transfer of risks/provide additional markets q Fastow GP – seek outsides investors q Formed 1999 - 20 transactions to 2001 q Rhythms/Net connections • Little market for CS (Enron had large holding). Worried about price risk. q Unwinding Rotman School of Management, March 19, 2002 62

LJM 1/Rhythms Fastow LP/GP ERNB/ Campsie LJM Partners Fastow $15 GP GP LP $1 LJM Swap Co GP LJM 1 LJM Swap Sub LP 3%- test not met since negative equity © I. Wiecek Rotman School of Management, March 19, 2002 63

LJM 1/Rhythms 3. 4 million CS Enron FV $276 ($168 discounted) ENRON Rhythms CS $64 $104 $168 LJM 1/Swap Sub Note Put option on Rhythms CS (Swap to buy Rhythms CS at $56) FV $104 Rotman School of Management, March 19, 2002 64

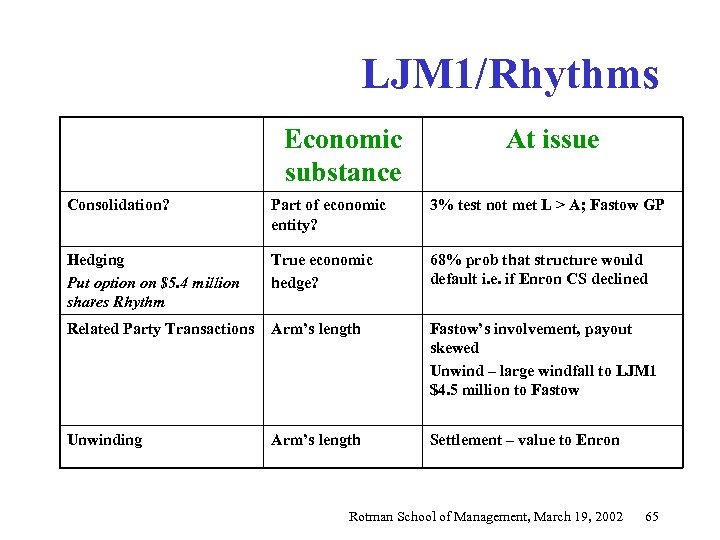

LJM 1/Rhythms Economic substance At issue Consolidation? Part of economic entity? 3% test not met L > A; Fastow GP Hedging Put option on $5. 4 million shares Rhythm True economic hedge? 68% prob that structure would default i. e. if Enron CS declined Related Party Transactions Arm’s length Fastow’s involvement, payout skewed Unwind – large windfall to LJM 1 $4. 5 million to Fastow Unwinding Arm’s length Settlement – value to Enron Rotman School of Management, March 19, 2002 65

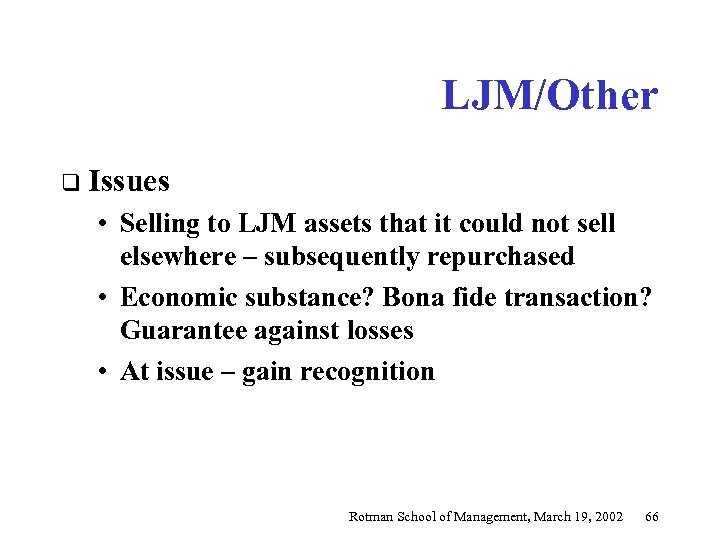

LJM/Other q Issues • Selling to LJM assets that it could not sell elsewhere – subsequently repurchased • Economic substance? Bona fide transaction? Guarantee against losses • At issue – gain recognition Rotman School of Management, March 19, 2002 66

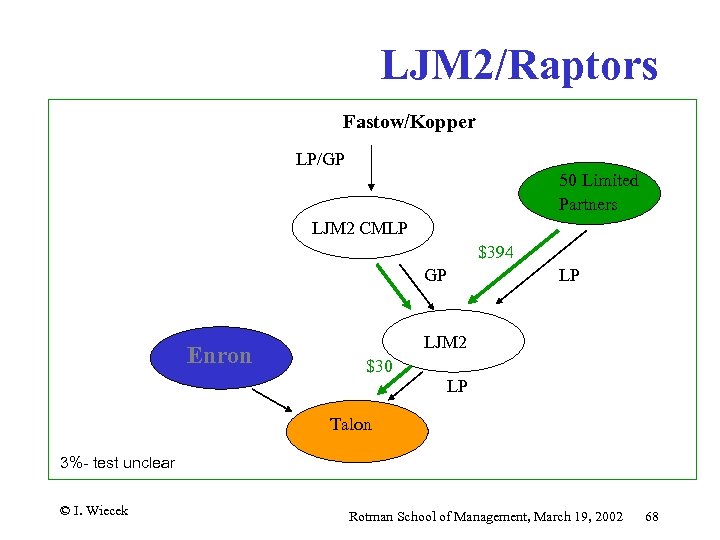

LJM 2/Raptors q Intent • Syndicate capital investments • Hedge • Create markets q Fastow GP- Formed Oct 1999 q Significant contribution to NI $1 billion 3 Q 2000 to 3 Q 2001 q 4 Raptors – 2 of which discussed below Rotman School of Management, March 19, 2002 67

LJM 2/Raptors Fastow/Kopper LP/GP 50 Limited Partners LJM 2 CMLP $394 GP Enron LP LJM 2 $30 LP Talon 3%- test unclear © I. Wiecek Rotman School of Management, March 19, 2002 68

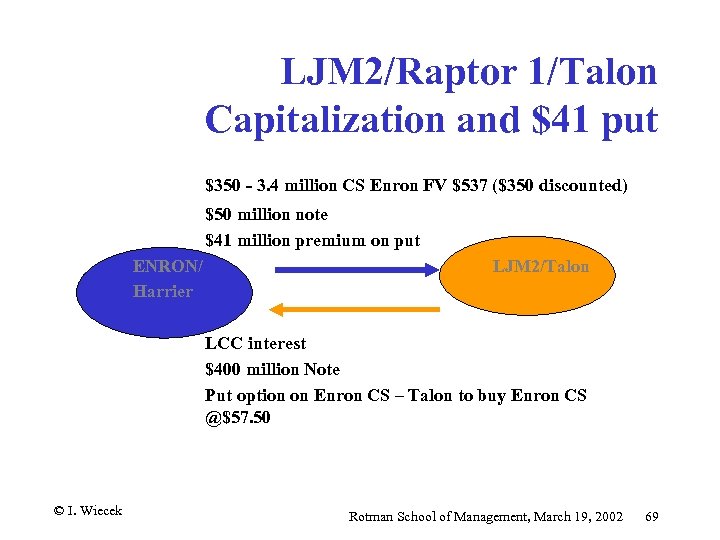

LJM 2/Raptor 1/Talon Capitalization and $41 put $350 - 3. 4 million CS Enron FV $537 ($350 discounted) $50 million note $41 million premium on put ENRON/ Harrier LJM 2/Talon LCC interest $400 million Note Put option on Enron CS – Talon to buy Enron CS @$57. 50 © I. Wiecek Rotman School of Management, March 19, 2002 69

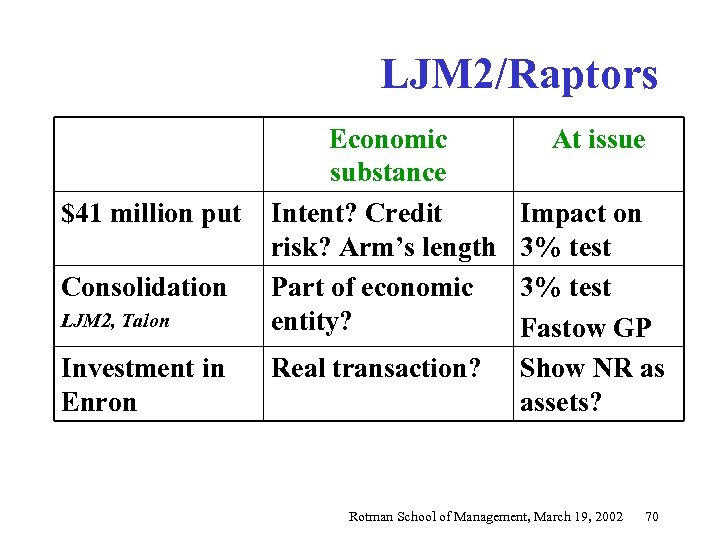

LJM 2/Raptors $41 million put Consolidation LJM 2, Talon Investment in Enron Economic substance Intent? Credit risk? Arm’s length Part of economic entity? Real transaction? At issue Impact on 3% test Fastow GP Show NR as assets? Rotman School of Management, March 19, 2002 70

LJM 2/Raptor 1/Talon Total return swaps q Intent to protect Enron against losses on merchant investments q Enron pay future gains on investments to Talon q Talon pay to Enron future losses on investments q Locked in value on Enron’s books Rotman School of Management, March 19, 2002 71

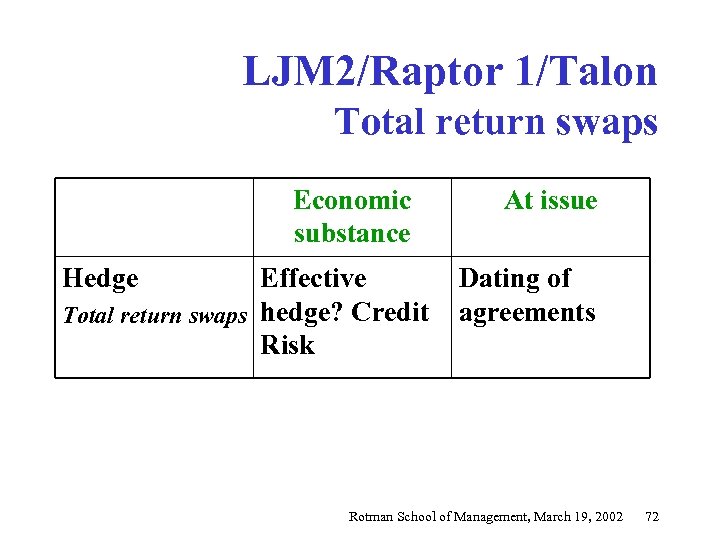

LJM 2/Raptor 1/Talon Total return swaps Economic substance At issue Hedge Effective Dating of Total return swaps hedge? Credit agreements Risk Rotman School of Management, March 19, 2002 72

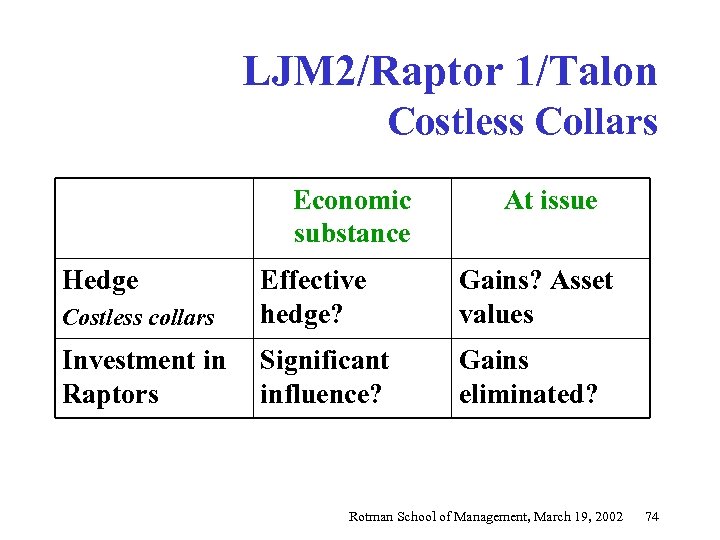

LJM 2/Raptor 1/Talon Costless Collars q Intent to shore up creditworthiness of Talon q If Enron CS fall below $81, Enron pays Talon difference q If Enron CS increases above $116, Talon pays Enron difference q Costless since premiums equal Rotman School of Management, March 19, 2002 73

LJM 2/Raptor 1/Talon Costless Collars Economic substance Hedge Costless collars Effective hedge? Investment in Significant Raptors influence? At issue Gains? Asset values Gains eliminated? Rotman School of Management, March 19, 2002 74

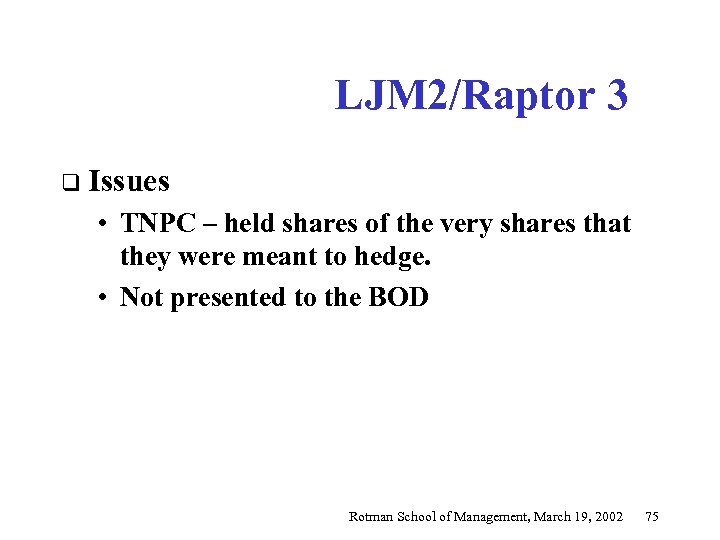

LJM 2/Raptor 3 q Issues • TNPC – held shares of the very shares that they were meant to hedge. • Not presented to the BOD Rotman School of Management, March 19, 2002 75

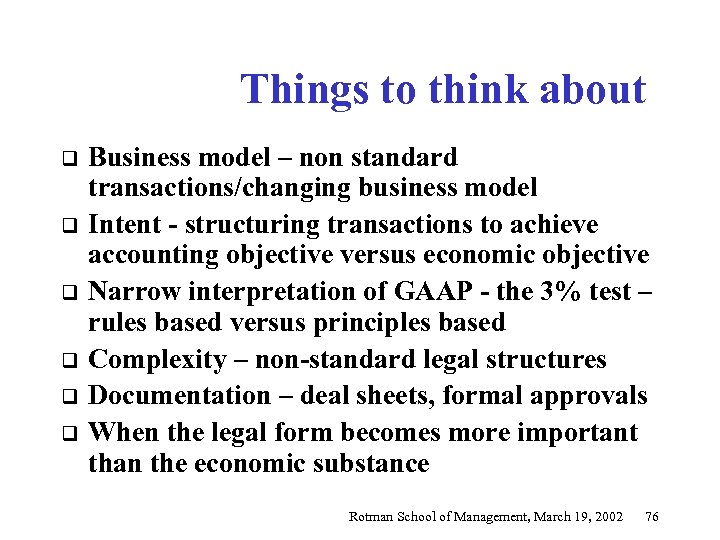

Things to think about q q q Business model – non standard transactions/changing business model Intent - structuring transactions to achieve accounting objective versus economic objective Narrow interpretation of GAAP - the 3% test – rules based versus principles based Complexity – non-standard legal structures Documentation – deal sheets, formal approvals When the legal form becomes more important than the economic substance Rotman School of Management, March 19, 2002 76

Enron’s Governance Structure Was Short Circuited © L. Brooks Outside Law Firm Finan. SPEs Reports Board Ken Lay: Chair; Co-chair ZZZ Audit, Compensation Cees. Guidance Missing Suspended Management Compliance Company Lay, Skilling: CEO Policies Fastow, CFO; Koppers Code of Conduct Causey, CAO; Buy, CRO Watkins; Kaminsky; Mc. Mahon Auditor Internal Audit ? Arthur Whistleblowers ? Andersen Consultant: Arthur Andersen Rotman School of Management, March 19, 2002 77

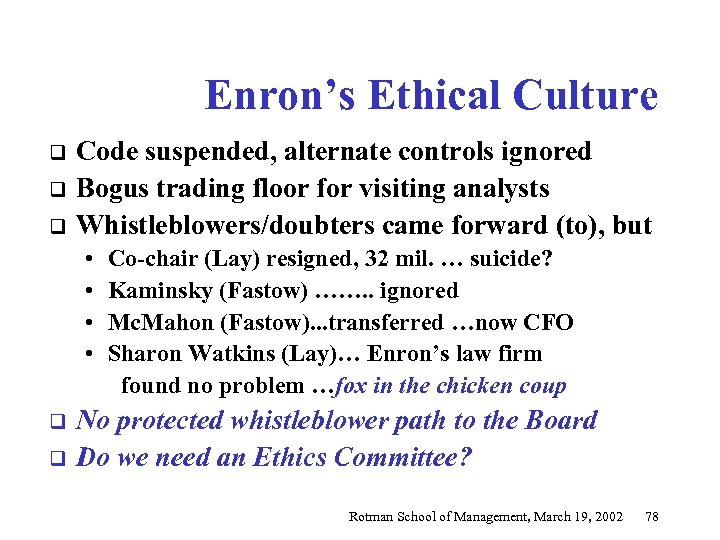

Enron’s Ethical Culture q q q Code suspended, alternate controls ignored Bogus trading floor for visiting analysts Whistleblowers/doubters came forward (to), but • • q q Co-chair (Lay) resigned, 32 mil. … suicide? Kaminsky (Fastow) ……. . ignored Mc. Mahon (Fastow). . . transferred …now CFO Sharon Watkins (Lay)… Enron’s law firm found no problem …fox in the chicken coup No protected whistleblower path to the Board Do we need an Ethics Committee? Rotman School of Management, March 19, 2002 78

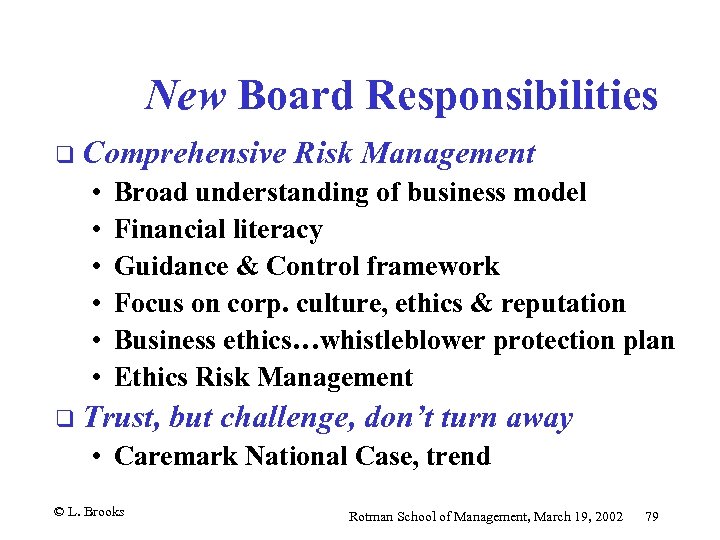

New Board Responsibilities q Comprehensive • • • Risk Management Broad understanding of business model Financial literacy Guidance & Control framework Focus on corp. culture, ethics & reputation Business ethics…whistleblower protection plan Ethics Risk Management q Trust, but challenge, don’t turn away • Caremark National Case, trend © L. Brooks Rotman School of Management, March 19, 2002 79

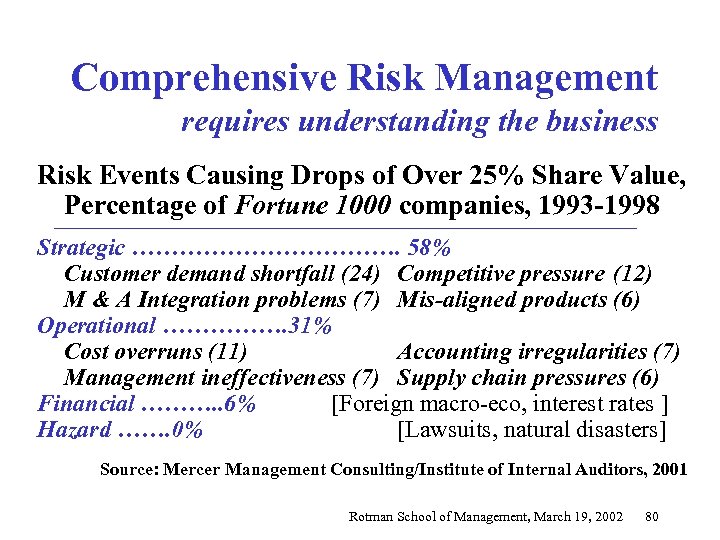

Comprehensive Risk Management requires understanding the business Risk Events Causing Drops of Over 25% Share Value, Percentage of Fortune 1000 companies, 1993 -1998 Strategic ………………. 58% Customer demand shortfall (24) Competitive pressure (12) M & A Integration problems (7) Mis-aligned products (6) Operational ……………. 31% Cost overruns (11) Accounting irregularities (7) Management ineffectiveness (7) Supply chain pressures (6) Financial ………. . 6% [Foreign macro-eco, interest rates ] Hazard ……. 0% [Lawsuits, natural disasters] Source: Mercer Management Consulting/Institute of Internal Auditors, 2001 Rotman School of Management, March 19, 2002 80

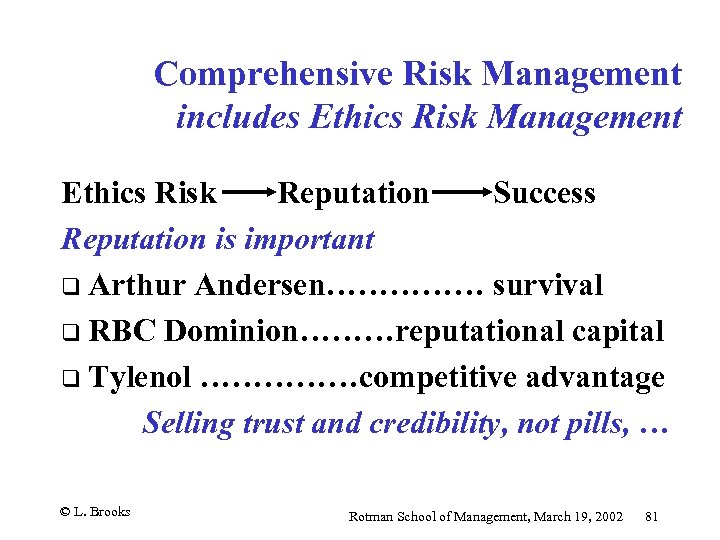

Comprehensive Risk Management includes Ethics Risk Management Ethics Risk Reputation Success Reputation is important q Arthur Andersen…………… survival q RBC Dominion………reputational capital q Tylenol ……………competitive advantage Selling trust and credibility, not pills, … © L. Brooks Rotman School of Management, March 19, 2002 81

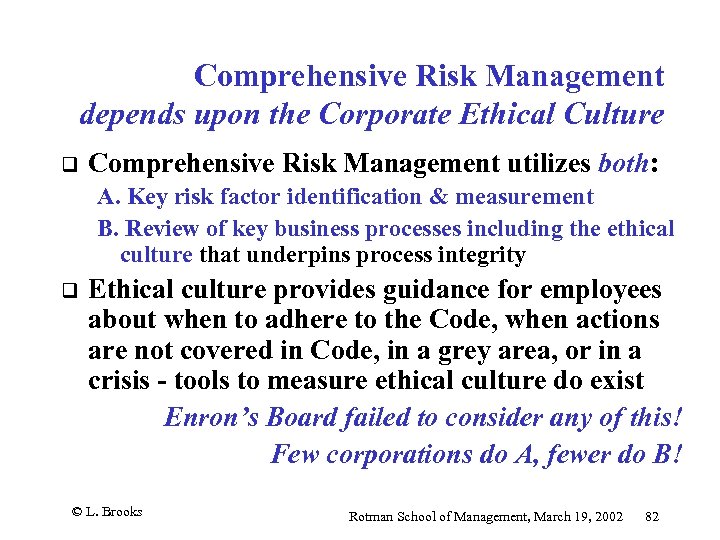

Comprehensive Risk Management depends upon the Corporate Ethical Culture q Comprehensive Risk Management utilizes both: A. Key risk factor identification & measurement B. Review of key business processes including the ethical culture that underpins process integrity q Ethical culture provides guidance for employees about when to adhere to the Code, when actions are not covered in Code, in a grey area, or in a crisis - tools to measure ethical culture do exist Enron’s Board failed to consider any of this! Few corporations do A, fewer do B! © L. Brooks Rotman School of Management, March 19, 2002 82

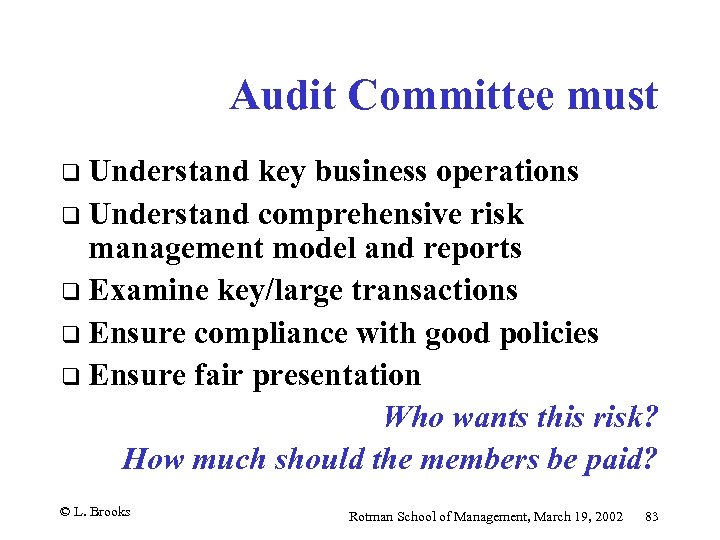

Audit Committee must q Understand key business operations q Understand comprehensive risk management model and reports q Examine key/large transactions q Ensure compliance with good policies q Ensure fair presentation Who wants this risk? How much should the members be paid? © L. Brooks Rotman School of Management, March 19, 2002 83

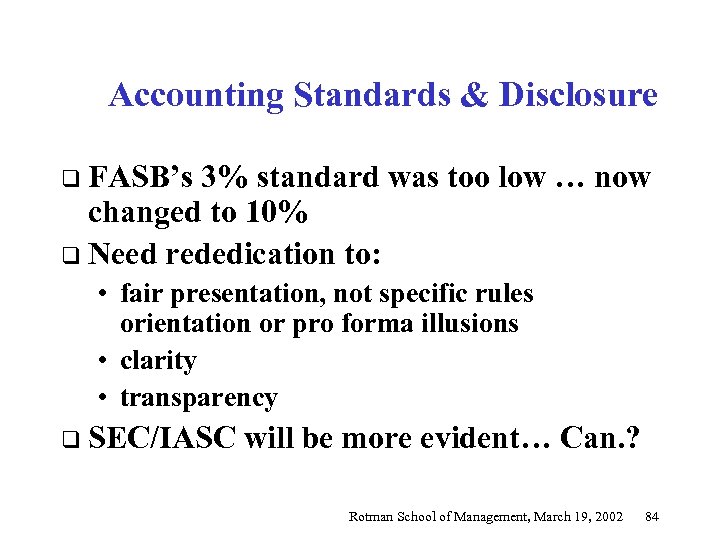

Accounting Standards & Disclosure q FASB’s 3% standard was too low … now changed to 10% q Need rededication to: • fair presentation, not specific rules orientation or pro forma illusions • clarity • transparency q SEC/IASC will be more evident… Can. ? Rotman School of Management, March 19, 2002 84

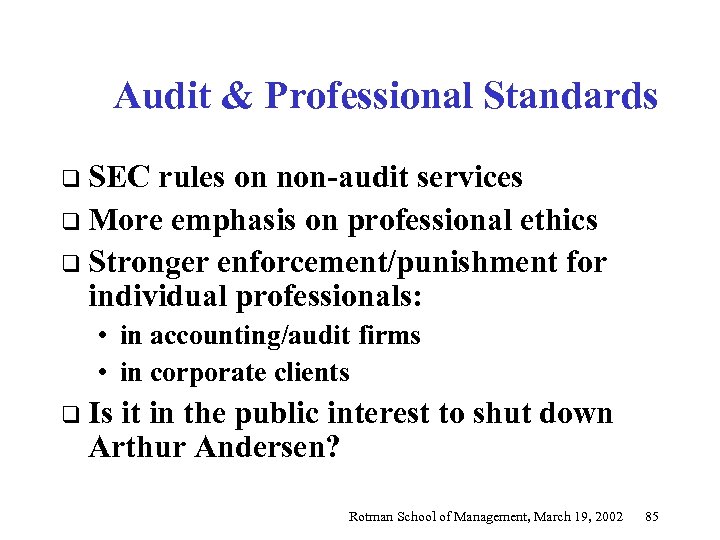

Audit & Professional Standards q SEC rules on non-audit services q More emphasis on professional ethics q Stronger enforcement/punishment for individual professionals: • in accounting/audit firms • in corporate clients q Is it in the public interest to shut down Arthur Andersen? Rotman School of Management, March 19, 2002 85

Eric Kirzner: A Director’s Commentary q An eye-opening example from my experience q My criteria – must be met before I accept a Director’s post. q Tradeoffs a Director must understand q Process steps for a Director to consider Rotman School of Management, March 19, 2002 86

Finance, Governance 1. AME HISTORY q q q Listed Montreal Exchange Board: affinity people; friends of management Going Private transaction • Independent committee • NOBODY: Management; board members understood! Rotman School of Management, March 19, 2002 87

Membership Criteria My criteria for serving: 1. I am an expert in the field 2. The other board members: either experts, or knowledgeable and representing key stakeholders • union reps on pension plans for example 3. No Cronyism Rotman School of Management, March 19, 2002 88

Membership Criteria My criteria for serving: 4. Chair is expert, experienced and understands balance between unfettered debate and accomplishments. Rotman School of Management, March 19, 2002 89

Membership Criteria My criteria for serving: 5. All functions in place q Management; internal audit and external audit q Independence of internal audit and management q Independent directors • 50% plus? ; public governor proxy • Fee for service! Rotman School of Management, March 19, 2002 90

Membership Criteria My criteria for serving: 6. Committee Structure q Governance q HR q Audit and finance q Risk management q Independent directors dominate committees? Rotman School of Management, March 19, 2002 91

Understand Tradeoff Paradigm #1 DIRECTORS TO: “ Act in best interest of…” Company (statutory) OR Shareholders (regulatory) Paradigm #2 q Maximization of Shareholder wealth q q Paradigm #3 Public/ethical responsibility Rotman School of Management, March 19, 2002 92

Process For Board Member A Model 1. • Can you develop checklist of responsibilities • Example: meet CDIC guidelines? 2. Committees • • Audit, HR, finance Appropriate trade-off approval and recommending Rotman School of Management, March 19, 2002 93

Process 3. Board self-assessment • Peer group review • Chair review 4. Independent Directors; Public Directors • Must understand everything • Ultimate sanction of voting with their feet!94 Rotman School of Management, March 19, 2002 94

Comments & Questions q The Last Word • Ramy • Irene q Questions Rotman School of Management, March 19, 2002 95

New Governance Series For directors and senior officers: q Director’s Responsibilities q Financial literacy q Guidance and control systems q Ethics risk management q Comprehensive risk management Rotman School of Management, March 19, 2002 96

Thank You on behalf of the Clarkson Centre for Business Ethics & Board Effectiveness—CC(BE)2 Executive Programs Rotman School of Management, March 19, 2002

6854717d2281ede50dcd26f7da4b4dd3.ppt