ea8497ab25677386d52d79b02c9ad4f0.ppt

- Количество слайдов: 32

ENGINEERING ECONOMY Introduction

ENGINEERING ECONOMY Introduction

IMPORTANCE OF ENGINEERING ECONOMY -1 • Individuals, small-business owners, large corporation presidents, and government agency heads are routinely faced with the challenge of making decisions when selecting one alternative over another. • These are decisions of how to best invest the funds, or capital, of the company and its owners.

IMPORTANCE OF ENGINEERING ECONOMY -1 • Individuals, small-business owners, large corporation presidents, and government agency heads are routinely faced with the challenge of making decisions when selecting one alternative over another. • These are decisions of how to best invest the funds, or capital, of the company and its owners.

IMPORTANCE OF ENGINEERING ECONOMY - 2 • Engineering economy, quite simply, is about determining the economic factors and the economic criteria utilized when one or more alternatives are considered for selection. • Another way to define engineering economy is a collection of mathematical techniques that simplify economic comparisons.

IMPORTANCE OF ENGINEERING ECONOMY - 2 • Engineering economy, quite simply, is about determining the economic factors and the economic criteria utilized when one or more alternatives are considered for selection. • Another way to define engineering economy is a collection of mathematical techniques that simplify economic comparisons.

Importance of Engineering Economy - 3 • With the techniques of Engineering Economy, a rational and meaningful approach to evaluating the economic aspects of different methods (alternatives) of accomplishing a given objective can be developed.

Importance of Engineering Economy - 3 • With the techniques of Engineering Economy, a rational and meaningful approach to evaluating the economic aspects of different methods (alternatives) of accomplishing a given objective can be developed.

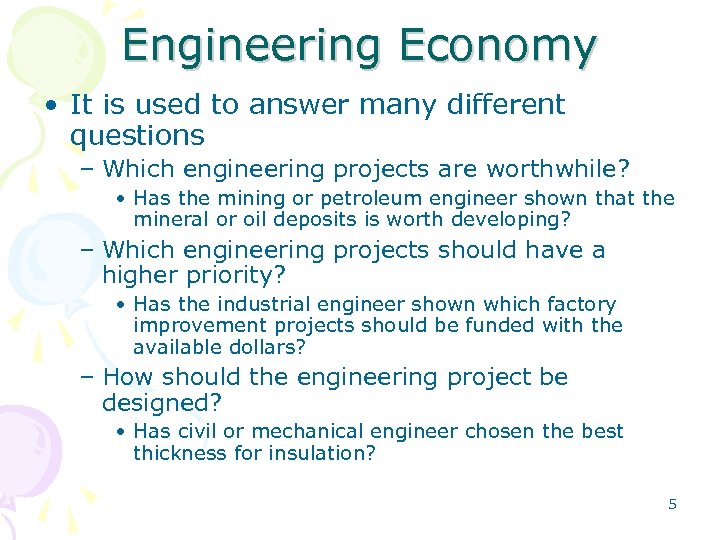

Engineering Economy • It is used to answer many different questions – Which engineering projects are worthwhile? • Has the mining or petroleum engineer shown that the mineral or oil deposits is worth developing? – Which engineering projects should have a higher priority? • Has the industrial engineer shown which factory improvement projects should be funded with the available dollars? – How should the engineering project be designed? • Has civil or mechanical engineer chosen the best thickness for insulation? 5

Engineering Economy • It is used to answer many different questions – Which engineering projects are worthwhile? • Has the mining or petroleum engineer shown that the mineral or oil deposits is worth developing? – Which engineering projects should have a higher priority? • Has the industrial engineer shown which factory improvement projects should be funded with the available dollars? – How should the engineering project be designed? • Has civil or mechanical engineer chosen the best thickness for insulation? 5

ROLE OF ENG. ECONOMY IN DECISION MAKING -1 • Engineering Economy is the application of economic factors and criteria to evaluate alternatives considering the time value of money by computing a specific measure of worth of estimated cashflows over a specific period of time.

ROLE OF ENG. ECONOMY IN DECISION MAKING -1 • Engineering Economy is the application of economic factors and criteria to evaluate alternatives considering the time value of money by computing a specific measure of worth of estimated cashflows over a specific period of time.

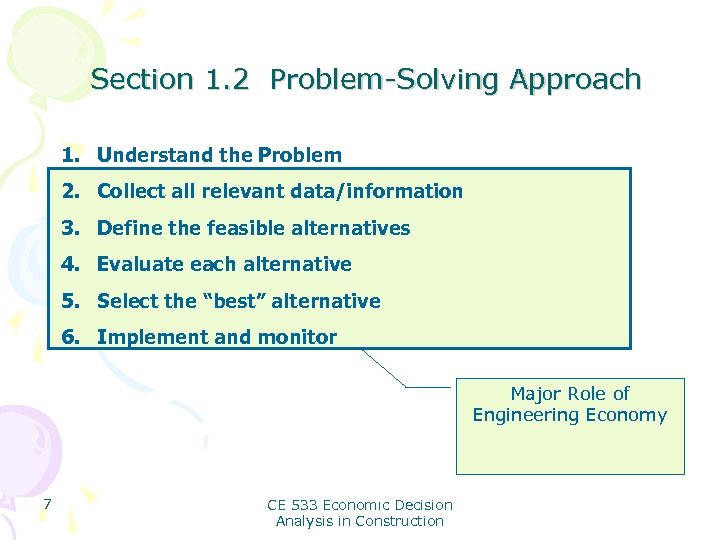

Section 1. 2 Problem-Solving Approach 1. Understand the Problem 2. Collect all relevant data/information 3. Define the feasible alternatives 4. Evaluate each alternative 5. Select the “best” alternative 6. Implement and monitor Major Role of Engineering Economy 7 CE 533 Economıc Decision Analysis in Construction

Section 1. 2 Problem-Solving Approach 1. Understand the Problem 2. Collect all relevant data/information 3. Define the feasible alternatives 4. Evaluate each alternative 5. Select the “best” alternative 6. Implement and monitor Major Role of Engineering Economy 7 CE 533 Economıc Decision Analysis in Construction

Section 1. 2 Problem-Solving Approach 1. Understand the Problem 2. Collect all relevant data/information 3. Define the feasible alternatives 4. Evaluate each alternative 5. Select the “best” alternative 6. Implement and monitor One of the more difficult tasks 8 CE 533 Economıc Decision Analysis in Construction

Section 1. 2 Problem-Solving Approach 1. Understand the Problem 2. Collect all relevant data/information 3. Define the feasible alternatives 4. Evaluate each alternative 5. Select the “best” alternative 6. Implement and monitor One of the more difficult tasks 8 CE 533 Economıc Decision Analysis in Construction

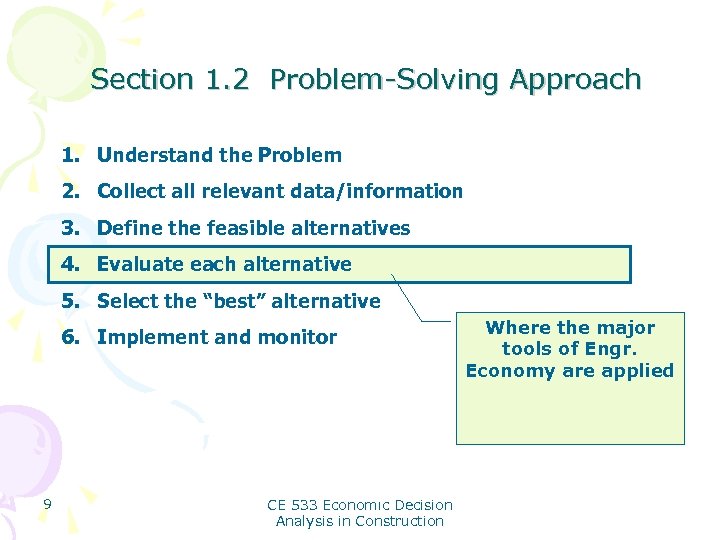

Section 1. 2 Problem-Solving Approach 1. Understand the Problem 2. Collect all relevant data/information 3. Define the feasible alternatives 4. Evaluate each alternative 5. Select the “best” alternative 6. Implement and monitor 9 CE 533 Economıc Decision Analysis in Construction Where the major tools of Engr. Economy are applied

Section 1. 2 Problem-Solving Approach 1. Understand the Problem 2. Collect all relevant data/information 3. Define the feasible alternatives 4. Evaluate each alternative 5. Select the “best” alternative 6. Implement and monitor 9 CE 533 Economıc Decision Analysis in Construction Where the major tools of Engr. Economy are applied

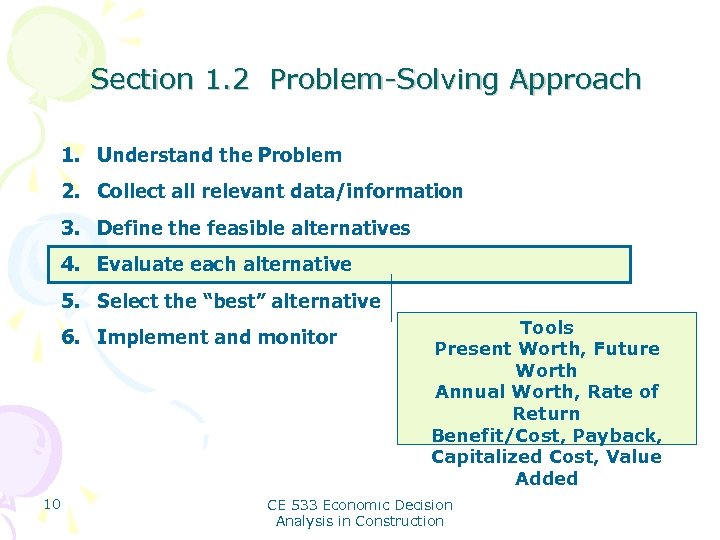

Section 1. 2 Problem-Solving Approach 1. Understand the Problem 2. Collect all relevant data/information 3. Define the feasible alternatives 4. Evaluate each alternative 5. Select the “best” alternative 6. Implement and monitor 10 Tools Present Worth, Future Worth Annual Worth, Rate of Return Benefit/Cost, Payback, Capitalized Cost, Value Added CE 533 Economıc Decision Analysis in Construction

Section 1. 2 Problem-Solving Approach 1. Understand the Problem 2. Collect all relevant data/information 3. Define the feasible alternatives 4. Evaluate each alternative 5. Select the “best” alternative 6. Implement and monitor 10 Tools Present Worth, Future Worth Annual Worth, Rate of Return Benefit/Cost, Payback, Capitalized Cost, Value Added CE 533 Economıc Decision Analysis in Construction

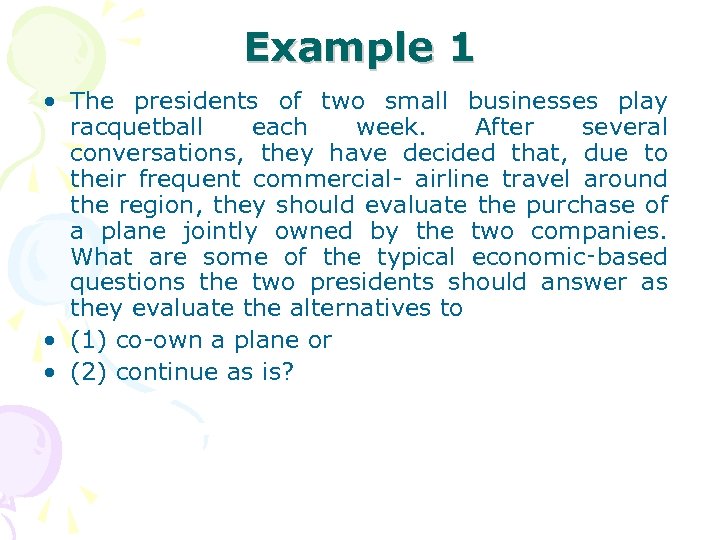

Example 1 • The presidents of two small businesses play racquetball each week. After several conversations, they have decided that, due to their frequent commercial- airline travel around the region, they should evaluate the purchase of a plane jointly owned by the two companies. What are some of the typical economic‑based questions the two presidents should answer as they evaluate the alternatives to • (1) co-own a plane or • (2) continue as is?

Example 1 • The presidents of two small businesses play racquetball each week. After several conversations, they have decided that, due to their frequent commercial- airline travel around the region, they should evaluate the purchase of a plane jointly owned by the two companies. What are some of the typical economic‑based questions the two presidents should answer as they evaluate the alternatives to • (1) co-own a plane or • (2) continue as is?

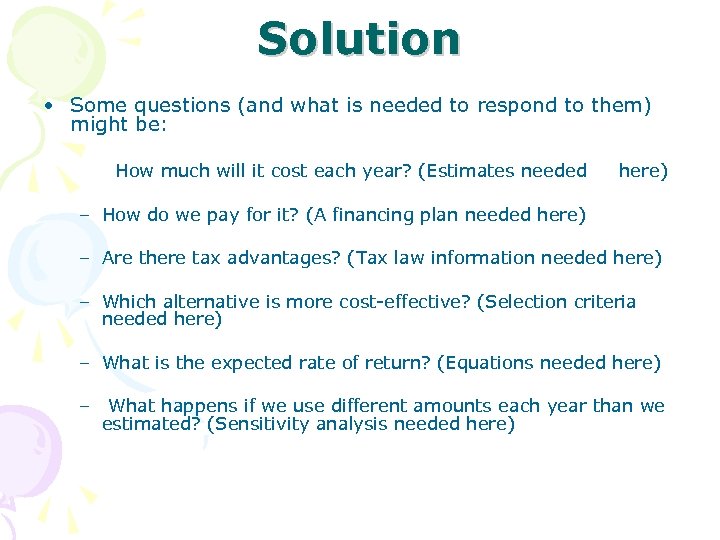

Solution • Some questions (and what is needed to respond to them) might be: How much will it cost each year? (Estimates needed here) – How do we pay for it? (A financing plan needed here) – Are there tax advantages? (Tax law information needed here) – Which alternative is more cost-effective? (Selection criteria needed here) – What is the expected rate of return? (Equations needed here) – What happens if we use different amounts each year than we estimated? (Sensitivity analysis needed here)

Solution • Some questions (and what is needed to respond to them) might be: How much will it cost each year? (Estimates needed here) – How do we pay for it? (A financing plan needed here) – Are there tax advantages? (Tax law information needed here) – Which alternative is more cost-effective? (Selection criteria needed here) – What is the expected rate of return? (Equations needed here) – What happens if we use different amounts each year than we estimated? (Sensitivity analysis needed here)

Step 4 • Step 4: This is the heart of engineering economy. The technique result in numerical values called measures of worth, which inherently consider the time value of money. Some common measures of worth are, • Present worth (PW) Future worth (FW) • Annual worth (AW) Rate of return (ROR) • Benefit/cost ratio (B/C) Capitalised cost (CC)

Step 4 • Step 4: This is the heart of engineering economy. The technique result in numerical values called measures of worth, which inherently consider the time value of money. Some common measures of worth are, • Present worth (PW) Future worth (FW) • Annual worth (AW) Rate of return (ROR) • Benefit/cost ratio (B/C) Capitalised cost (CC)

Solution • Assume that the problem and goal are the same for each president available, reliable transportation which minimizes total cost. • Engineering economy assists in several ways. Using the problem‑solving approach as a framework.

Solution • Assume that the problem and goal are the same for each president available, reliable transportation which minimizes total cost. • Engineering economy assists in several ways. Using the problem‑solving approach as a framework.

Solution - continued • Steps 2 and 3: The framework of estimates necessary for an engineering economy analysis assists in structuring what data should be estimated and collected. • For example, for alternative 1 (buy the plane), these include estimated purchase cost, financing methods and interest rates, annual operating costs, possible increase in annual sales revenue, and income tax deductions.

Solution - continued • Steps 2 and 3: The framework of estimates necessary for an engineering economy analysis assists in structuring what data should be estimated and collected. • For example, for alternative 1 (buy the plane), these include estimated purchase cost, financing methods and interest rates, annual operating costs, possible increase in annual sales revenue, and income tax deductions.

Solution - continued • For alternative 2 (maintain the status quo), these include observed and estimated commercial transportation costs, annual sales revenue, and other relevant data. • Note that engineering economy does not specifically include the estimation; it helps determine what estimates and data are needed for the analysis (step 4) and decision (step 5).

Solution - continued • For alternative 2 (maintain the status quo), these include observed and estimated commercial transportation costs, annual sales revenue, and other relevant data. • Note that engineering economy does not specifically include the estimation; it helps determine what estimates and data are needed for the analysis (step 4) and decision (step 5).

Step 5: • For the economic portion of the decision, some criterion based on one of the measures of worth is used to select only one of the alternatives. • Additionally, there are so many noneconomic factors‑social, environmental, legal, political, personal, to name a few‑that the result of the engineering economy analysis may seem, at times, to be used less than the engineer may wish. But this is exactly why the decision-maker must have adequate information for all factors ‑economic and non-economic‑to make an informed selection.

Step 5: • For the economic portion of the decision, some criterion based on one of the measures of worth is used to select only one of the alternatives. • Additionally, there are so many noneconomic factors‑social, environmental, legal, political, personal, to name a few‑that the result of the engineering economy analysis may seem, at times, to be used less than the engineer may wish. But this is exactly why the decision-maker must have adequate information for all factors ‑economic and non-economic‑to make an informed selection.

Solution - continued • In our case, the economic analysis may significantly favor the co‑owned plane (alternative 1). But because of non-economic factors, one or both presidents may decide to remain with the current situation by selecting alternative 2.

Solution - continued • In our case, the economic analysis may significantly favor the co‑owned plane (alternative 1). But because of non-economic factors, one or both presidents may decide to remain with the current situation by selecting alternative 2.

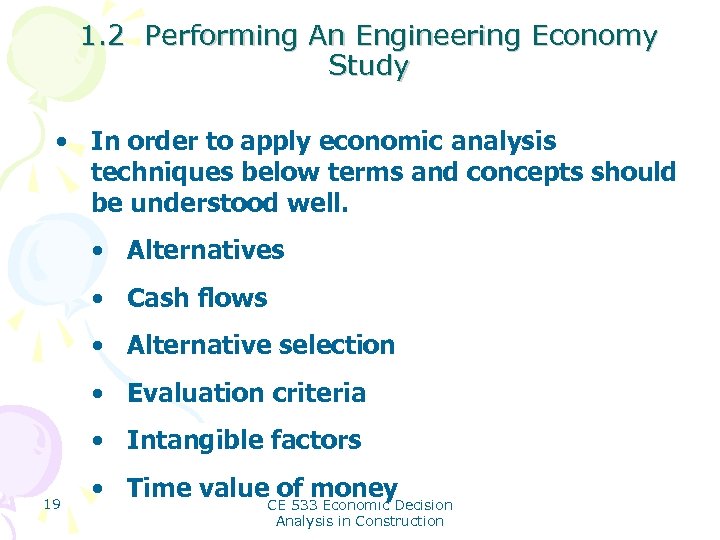

1. 2 Performing An Engineering Economy Study • In order to apply economic analysis techniques below terms and concepts should be understood well. • Alternatives • Cash flows • Alternative selection • Evaluation criteria • Intangible factors 19 • Time value. CE 533 Economıc Decision of money Analysis in Construction

1. 2 Performing An Engineering Economy Study • In order to apply economic analysis techniques below terms and concepts should be understood well. • Alternatives • Cash flows • Alternative selection • Evaluation criteria • Intangible factors 19 • Time value. CE 533 Economıc Decision of money Analysis in Construction

Section 1. 3 Performing a Study • To have a problem, one must have alternatives (two or more ways to solve a problem) • Alternative ways to solve a problem must first be identified • Estimate the cash flows for the alternatives 20 • Analyze the cash flows for each alternative CE 533 Economıc Decision Analysis in Construction

Section 1. 3 Performing a Study • To have a problem, one must have alternatives (two or more ways to solve a problem) • Alternative ways to solve a problem must first be identified • Estimate the cash flows for the alternatives 20 • Analyze the cash flows for each alternative CE 533 Economıc Decision Analysis in Construction

Section 1. 3 Alternatives • To analyze, one must have: • Concept of the time value of $$ • An Interest Rate • Some measure of economic worth • Evaluate and weigh • Factor in noneconomic parameters • Select, implement, and monitor 21 CE 533 Economıc Decision Analysis in Construction

Section 1. 3 Alternatives • To analyze, one must have: • Concept of the time value of $$ • An Interest Rate • Some measure of economic worth • Evaluate and weigh • Factor in noneconomic parameters • Select, implement, and monitor 21 CE 533 Economıc Decision Analysis in Construction

Section 1. 3 Needed Parameters • First cost (investment amounts) • Estimates of useful or project life • Estimated future cash flows (revenues and expenses and salvage values) • Interest rate • Inflation and tax effects 22 CE 533 Economıc Decision Analysis in Construction

Section 1. 3 Needed Parameters • First cost (investment amounts) • Estimates of useful or project life • Estimated future cash flows (revenues and expenses and salvage values) • Interest rate • Inflation and tax effects 22 CE 533 Economıc Decision Analysis in Construction

Section 1. 3 Cash Flows • Estimate flows of money coming into the firm – revenues salvage values, etc. (magnitude and timing) – positive cash flows • Estimates of investment costs, operating costs, taxes paid – negative cash flows 23 CE 533 Economıc Decision Analysis in Construction

Section 1. 3 Cash Flows • Estimate flows of money coming into the firm – revenues salvage values, etc. (magnitude and timing) – positive cash flows • Estimates of investment costs, operating costs, taxes paid – negative cash flows 23 CE 533 Economıc Decision Analysis in Construction

Section 1. 3 Alternatives • Each problem will have at least one alternative – DO NOTHING • May not be free and may have future costs associated • Do not overlook this option! 24 CE 533 Economıc Decision Analysis in Construction

Section 1. 3 Alternatives • Each problem will have at least one alternative – DO NOTHING • May not be free and may have future costs associated • Do not overlook this option! 24 CE 533 Economıc Decision Analysis in Construction

Section 1. 3 Alternatives • Goal: Define, Evaluate, Select and Execute The Question: Do Nothing 25 Alt. 1 CE 533 Economıc Decision Analysis in Construction Which One do we accept?

Section 1. 3 Alternatives • Goal: Define, Evaluate, Select and Execute The Question: Do Nothing 25 Alt. 1 CE 533 Economıc Decision Analysis in Construction Which One do we accept?

Section 1. 3 Mutually Exclusive • Select One and only one from a set of feasible alternatives • Once an alternative is selected, the remaining alternatives are excluded at that point. 26 CE 533 Economıc Decision Analysis in Construction

Section 1. 3 Mutually Exclusive • Select One and only one from a set of feasible alternatives • Once an alternative is selected, the remaining alternatives are excluded at that point. 26 CE 533 Economıc Decision Analysis in Construction

CASH FLOWS: THEIR ESTIMATION AND DIAGRAMMING Samples of Cash Inflows Revenues (usually incremental due to the alternative). Operating cost reductions (due to the alternative). Asset salvage value. Receipt of loan principal. Income‑tax savings. Receipts from stock and bond sales. Construction and facility cost savings. Savings or return of corporate capital funds.

CASH FLOWS: THEIR ESTIMATION AND DIAGRAMMING Samples of Cash Inflows Revenues (usually incremental due to the alternative). Operating cost reductions (due to the alternative). Asset salvage value. Receipt of loan principal. Income‑tax savings. Receipts from stock and bond sales. Construction and facility cost savings. Savings or return of corporate capital funds.

CASH FLOWS: THEIR ESTIMATION AND DIAGRAMMING • Samples of Cash Outflows First cost of assets (with installation and delivery). Operating costs (annual and incremental). Periodic maintenance and rebuild costs. Loan interest and principal payments. Major, expected upgrade costs. Income taxes. Bond dividends and bond payment. Expenditure of corporate capital funds.

CASH FLOWS: THEIR ESTIMATION AND DIAGRAMMING • Samples of Cash Outflows First cost of assets (with installation and delivery). Operating costs (annual and incremental). Periodic maintenance and rebuild costs. Loan interest and principal payments. Major, expected upgrade costs. Income taxes. Bond dividends and bond payment. Expenditure of corporate capital funds.

CASH FLOWS: THEIR ESTIMATION AND DIAGRAMMING • Net cash flow = receipts ‑ disbursements = cash inflows ‑ cash outflows • end‑of‑period convention is used • A cash‑flow diagram is simply a graphical representation of cash flows drawn on a time scale.

CASH FLOWS: THEIR ESTIMATION AND DIAGRAMMING • Net cash flow = receipts ‑ disbursements = cash inflows ‑ cash outflows • end‑of‑period convention is used • A cash‑flow diagram is simply a graphical representation of cash flows drawn on a time scale.

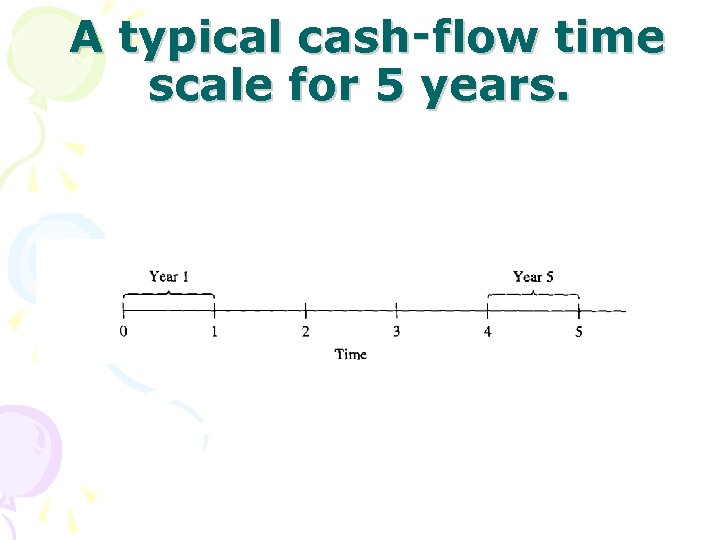

A typical cash‑flow time scale for 5 years.

A typical cash‑flow time scale for 5 years.

CASH FLOWS: THEIR ESTIMATION AND DIAGRAMMING • Make a neat diagram to approximate scale for both time and cash‑flow magnitude. • The direction of the arrows on the cash‑flow diagram is important. Throughout this text, a vertical arrow pointing up will indicate a positive cash flow. Conversely, an arrow pointing down will indicate a negative cash flow.

CASH FLOWS: THEIR ESTIMATION AND DIAGRAMMING • Make a neat diagram to approximate scale for both time and cash‑flow magnitude. • The direction of the arrows on the cash‑flow diagram is important. Throughout this text, a vertical arrow pointing up will indicate a positive cash flow. Conversely, an arrow pointing down will indicate a negative cash flow.

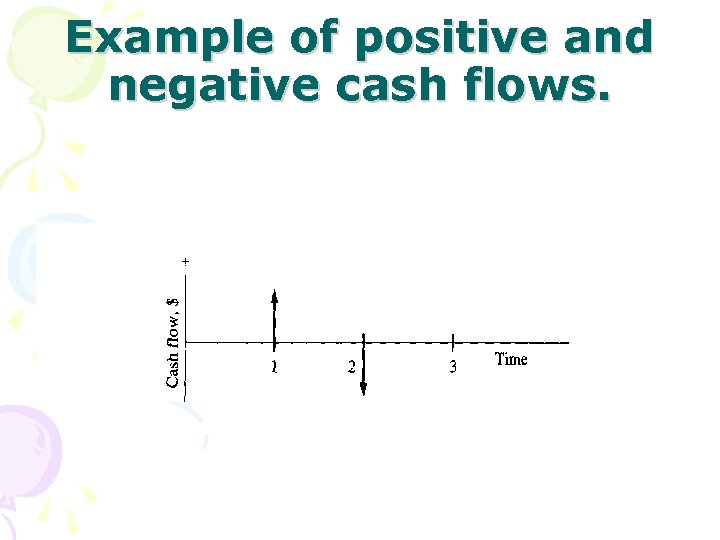

Example of positive and negative cash flows.

Example of positive and negative cash flows.