295cc92342ee852a2292665f208daed3.ppt

- Количество слайдов: 34

Engineering Economic Analysis Chapter 9 Other Analysis Techniques 3/17/2018 1

Engineering Economic Analysis Chapter 9 Other Analysis Techniques 3/17/2018 1

Public Sector Projects Larger investment Longer life 30 to 50+ years (capitalized costs) (A/P, 7% , 30) = 0. 0805864; (AGP, 7%, 50) = 0. 0724598 No profit and Publicly owned Benefit citizenry (undesirable consequences) Lower MARR exempt from taxes called discount rate $ from taxes, bonds, and fees (toll roads), philanthropy Multiple criteria vice Ro. R Politically inclined vice economic Examples: Hospitals, parks and recreation, sports arenas emergency relief, airports, courts, utilities, schools 3/17/2018 2

Public Sector Projects Larger investment Longer life 30 to 50+ years (capitalized costs) (A/P, 7% , 30) = 0. 0805864; (AGP, 7%, 50) = 0. 0724598 No profit and Publicly owned Benefit citizenry (undesirable consequences) Lower MARR exempt from taxes called discount rate $ from taxes, bonds, and fees (toll roads), philanthropy Multiple criteria vice Ro. R Politically inclined vice economic Examples: Hospitals, parks and recreation, sports arenas emergency relief, airports, courts, utilities, schools 3/17/2018 2

Criticisms of B/C Used after the fact for justification rather than evaluation Serious distribution inequities; one group reaps the benefits while the other group incurs the costs The benefits to whosoever they accrue Qualitative information is largely ignored. Public policy generally should favor t the disadvantaged NOT a scientifically unbiased method of analysis 3/17/2018 3

Criticisms of B/C Used after the fact for justification rather than evaluation Serious distribution inequities; one group reaps the benefits while the other group incurs the costs The benefits to whosoever they accrue Qualitative information is largely ignored. Public policy generally should favor t the disadvantaged NOT a scientifically unbiased method of analysis 3/17/2018 3

Benefit/Cost Ratios B/C = PW of benefits = AW of benefits = FW of benefits PW of costs AW of costs FW of costs If B/C 1. 0, accept project; else reject. Conventional B/C ratio = benefits – disbenefits = B - D costs C Modified B/C = benefits – disbenefits – M&O costs initial investment Salvage value is included in the denominator as a negative cost for the modified ratio. Ratios can change, but not the decision. (B D C) = (10 8 8) B – C = 10 – 8 = -6 3/17/2018 4

Benefit/Cost Ratios B/C = PW of benefits = AW of benefits = FW of benefits PW of costs AW of costs FW of costs If B/C 1. 0, accept project; else reject. Conventional B/C ratio = benefits – disbenefits = B - D costs C Modified B/C = benefits – disbenefits – M&O costs initial investment Salvage value is included in the denominator as a negative cost for the modified ratio. Ratios can change, but not the decision. (B D C) = (10 8 8) B – C = 10 – 8 = -6 3/17/2018 4

Benefits. Costs, Disbenefits Build new Convention Center Benefits – improve downtown image, attract conferences, sports franchises, revenue from rental facilities, increased revenue for downtown merchants Costs – Architectural design, construction, design and construction of parking garage, facilities and maintenance, facility insurance Disbenefits -- loss of bike trail, park, nature trail, and pond loss of wildlife habitat in urban area 3/17/2018 5

Benefits. Costs, Disbenefits Build new Convention Center Benefits – improve downtown image, attract conferences, sports franchises, revenue from rental facilities, increased revenue for downtown merchants Costs – Architectural design, construction, design and construction of parking garage, facilities and maintenance, facility insurance Disbenefits -- loss of bike trail, park, nature trail, and pond loss of wildlife habitat in urban area 3/17/2018 5

MIRR for Indeterminate IRR n 0 1 2 3 cf $5 K -7 K 2 K 2 K (cubic 5 -7 2 2) -0. 375 and 2 complex roots Real root -1 Indeterminate IRR not positive By using a reinvestment rate of 15% and borrowing rate of 12% per year the MIRR gives (MIRR '(5 -7 2 2) 12 15) 23. 95% > 15% => good investment. PW(24%) = $2. 81 K 3/17/2018 6

MIRR for Indeterminate IRR n 0 1 2 3 cf $5 K -7 K 2 K 2 K (cubic 5 -7 2 2) -0. 375 and 2 complex roots Real root -1 Indeterminate IRR not positive By using a reinvestment rate of 15% and borrowing rate of 12% per year the MIRR gives (MIRR '(5 -7 2 2) 12 15) 23. 95% > 15% => good investment. PW(24%) = $2. 81 K 3/17/2018 6

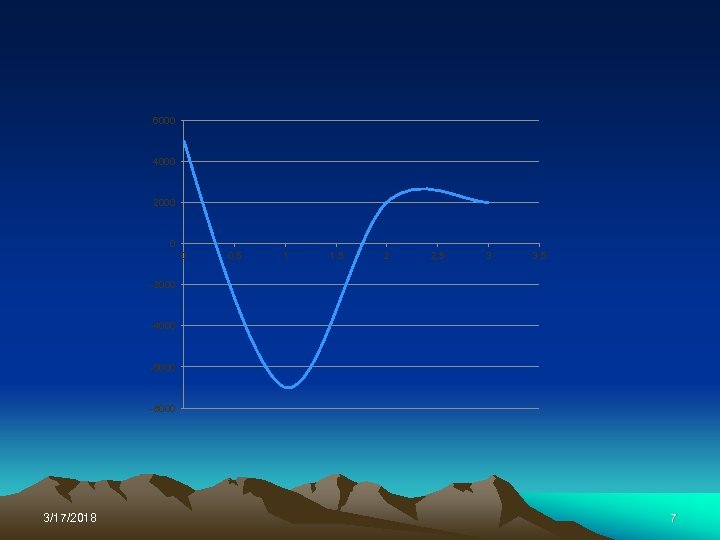

6000 4000 2000 0 0 0. 5 1 1. 5 2 2. 5 3 3. 5 -2000 -4000 -6000 -8000 3/17/2018 7

6000 4000 2000 0 0 0. 5 1 1. 5 2 2. 5 3 3. 5 -2000 -4000 -6000 -8000 3/17/2018 7

Incremental Analysis Consider projects 20 -year life with MARR at 6% A B C D E F 1 st cost $4 K 2 K 6 K 1 K 9 K 10 K PW benefit 7330 4700 8730 1340 9 K 9500 B/C ratio 1. 83 2. 35 1. 46 1. 34 1. 0 0. 95 B-D = 3360/1 K = 3. 36 => B > D A-B = 2630/2 K = 1. 32 => A > B C-A = 1400/2 K = 0. 70 => A > C E-A = 1670/5 K = 0. 33 => A > E and A is best. Notice that B has highest B/C ratio, but not chosen. 3/17/2018 8

Incremental Analysis Consider projects 20 -year life with MARR at 6% A B C D E F 1 st cost $4 K 2 K 6 K 1 K 9 K 10 K PW benefit 7330 4700 8730 1340 9 K 9500 B/C ratio 1. 83 2. 35 1. 46 1. 34 1. 0 0. 95 B-D = 3360/1 K = 3. 36 => B > D A-B = 2630/2 K = 1. 32 => A > B C-A = 1400/2 K = 0. 70 => A > C E-A = 1670/5 K = 0. 33 => A > E and A is best. Notice that B has highest B/C ratio, but not chosen. 3/17/2018 8

Benefits - Disbenefits Benefits of airport runway expansion – reduced delays, taxing time, fuel costs, landing and departure fees, lost earnings from public point of view. Return to the moon? Disbenefits -- Undesirable consequences from a viewpoint May be included or disregarded in the analysis, but can make a distinctive difference in the analysis. 3/17/2018 9

Benefits - Disbenefits Benefits of airport runway expansion – reduced delays, taxing time, fuel costs, landing and departure fees, lost earnings from public point of view. Return to the moon? Disbenefits -- Undesirable consequences from a viewpoint May be included or disregarded in the analysis, but can make a distinctive difference in the analysis. 3/17/2018 9

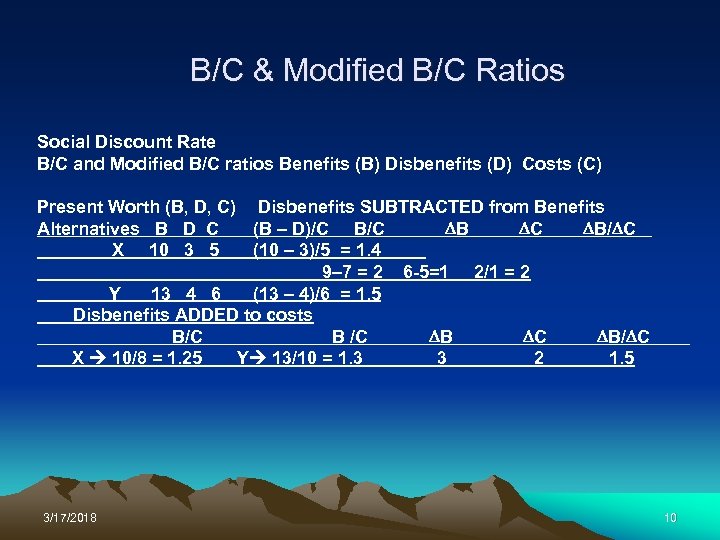

B/C & Modified B/C Ratios Social Discount Rate B/C and Modified B/C ratios Benefits (B) Disbenefits (D) Costs (C) Present Worth (B, D, C) Disbenefits SUBTRACTED from Benefits Alternatives B D C (B – D)/C B C B/ C X 10 3 5 (10 – 3)/5 = 1. 4 9– 7 = 2 6 -5=1 2/1 = 2 Y 13 4 6 (13 – 4)/6 = 1. 5 Disbenefits ADDED to costs B/C B C B/ C X 10/8 = 1. 25 Y 13/10 = 1. 3 3 2 1. 5 3/17/2018 10

B/C & Modified B/C Ratios Social Discount Rate B/C and Modified B/C ratios Benefits (B) Disbenefits (D) Costs (C) Present Worth (B, D, C) Disbenefits SUBTRACTED from Benefits Alternatives B D C (B – D)/C B C B/ C X 10 3 5 (10 – 3)/5 = 1. 4 9– 7 = 2 6 -5=1 2/1 = 2 Y 13 4 6 (13 – 4)/6 = 1. 5 Disbenefits ADDED to costs B/C B C B/ C X 10/8 = 1. 25 Y 13/10 = 1. 3 3 2 1. 5 3/17/2018 10

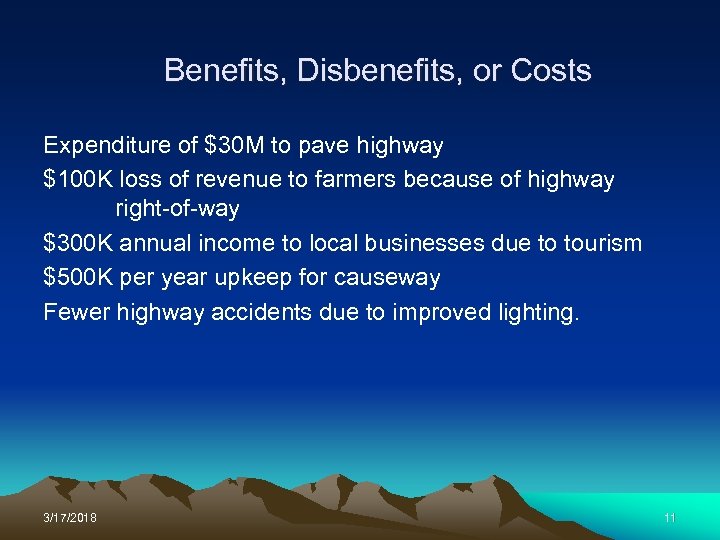

Benefits, Disbenefits, or Costs Expenditure of $30 M to pave highway $100 K loss of revenue to farmers because of highway right-of-way $300 K annual income to local businesses due to tourism $500 K per year upkeep for causeway Fewer highway accidents due to improved lighting. 3/17/2018 11

Benefits, Disbenefits, or Costs Expenditure of $30 M to pave highway $100 K loss of revenue to farmers because of highway right-of-way $300 K annual income to local businesses due to tourism $500 K per year upkeep for causeway Fewer highway accidents due to improved lighting. 3/17/2018 11

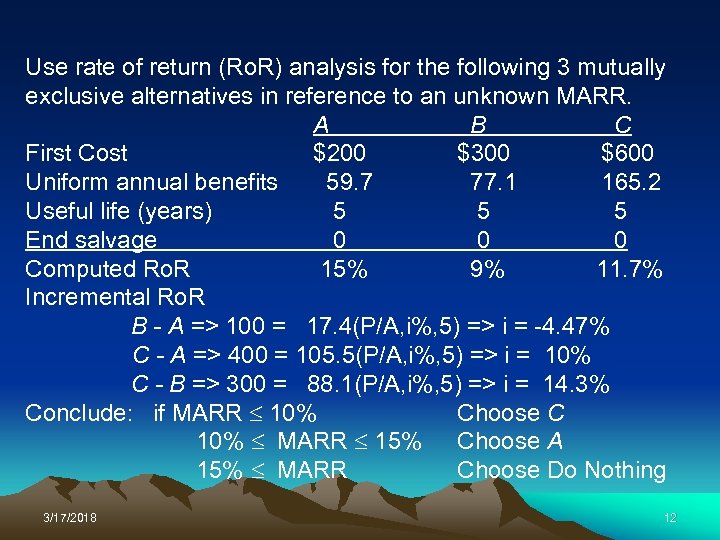

Use rate of return (Ro. R) analysis for the following 3 mutually exclusive alternatives in reference to an unknown MARR. A B C First Cost $200 $300 $600 Uniform annual benefits 59. 7 77. 1 165. 2 Useful life (years) 5 5 5 End salvage 0 0 0 Computed Ro. R 15% 9% 11. 7% Incremental Ro. R B - A => 100 = 17. 4(P/A, i%, 5) => i = -4. 47% C - A => 400 = 105. 5(P/A, i%, 5) => i = 10% C - B => 300 = 88. 1(P/A, i%, 5) => i = 14. 3% Conclude: if MARR 10% Choose C 10% MARR 15% Choose A 15% MARR Choose Do Nothing 3/17/2018 12

Use rate of return (Ro. R) analysis for the following 3 mutually exclusive alternatives in reference to an unknown MARR. A B C First Cost $200 $300 $600 Uniform annual benefits 59. 7 77. 1 165. 2 Useful life (years) 5 5 5 End salvage 0 0 0 Computed Ro. R 15% 9% 11. 7% Incremental Ro. R B - A => 100 = 17. 4(P/A, i%, 5) => i = -4. 47% C - A => 400 = 105. 5(P/A, i%, 5) => i = 10% C - B => 300 = 88. 1(P/A, i%, 5) => i = 14. 3% Conclude: if MARR 10% Choose C 10% MARR 15% Choose A 15% MARR Choose Do Nothing 3/17/2018 12

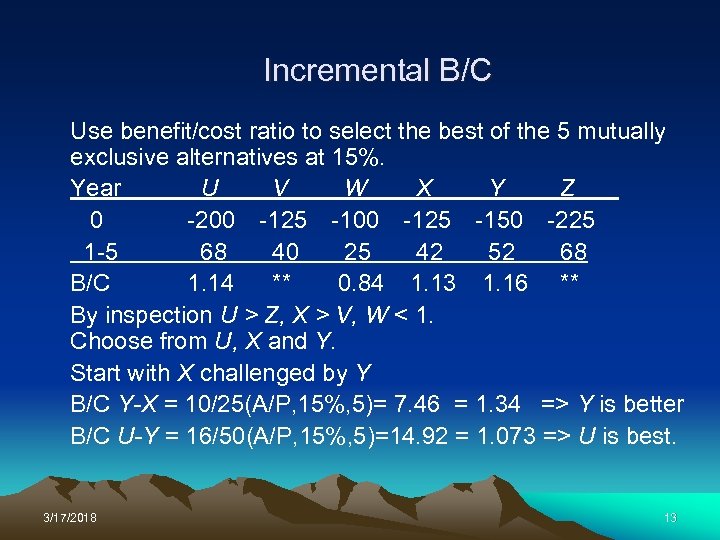

Incremental B/C Use benefit/cost ratio to select the best of the 5 mutually exclusive alternatives at 15%. Year U V W X Y Z 0 -200 -125 -150 -225 1 -5 68 40 25 42 52 68 B/C 1. 14 ** 0. 84 1. 13 1. 16 ** By inspection U > Z, X > V, W < 1. Choose from U, X and Y. Start with X challenged by Y B/C Y-X = 10/25(A/P, 15%, 5)= 7. 46 = 1. 34 => Y is better B/C U-Y = 16/50(A/P, 15%, 5)=14. 92 = 1. 073 => U is best. 3/17/2018 13

Incremental B/C Use benefit/cost ratio to select the best of the 5 mutually exclusive alternatives at 15%. Year U V W X Y Z 0 -200 -125 -150 -225 1 -5 68 40 25 42 52 68 B/C 1. 14 ** 0. 84 1. 13 1. 16 ** By inspection U > Z, X > V, W < 1. Choose from U, X and Y. Start with X challenged by Y B/C Y-X = 10/25(A/P, 15%, 5)= 7. 46 = 1. 34 => Y is better B/C U-Y = 16/50(A/P, 15%, 5)=14. 92 = 1. 073 => U is best. 3/17/2018 13

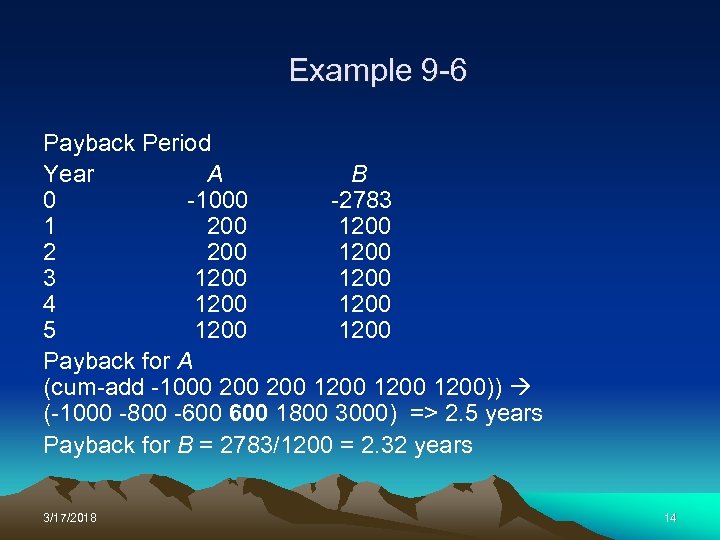

Example 9 -6 Payback Period Year A B 0 -1000 -2783 1 200 1200 2 200 1200 3 1200 4 1200 5 1200 Payback for A (cum-add -1000 200 1200)) (-1000 -800 -600 1800 3000) => 2. 5 years Payback for B = 2783/1200 = 2. 32 years 3/17/2018 14

Example 9 -6 Payback Period Year A B 0 -1000 -2783 1 200 1200 2 200 1200 3 1200 4 1200 5 1200 Payback for A (cum-add -1000 200 1200)) (-1000 -800 -600 1800 3000) => 2. 5 years Payback for B = 2783/1200 = 2. 32 years 3/17/2018 14

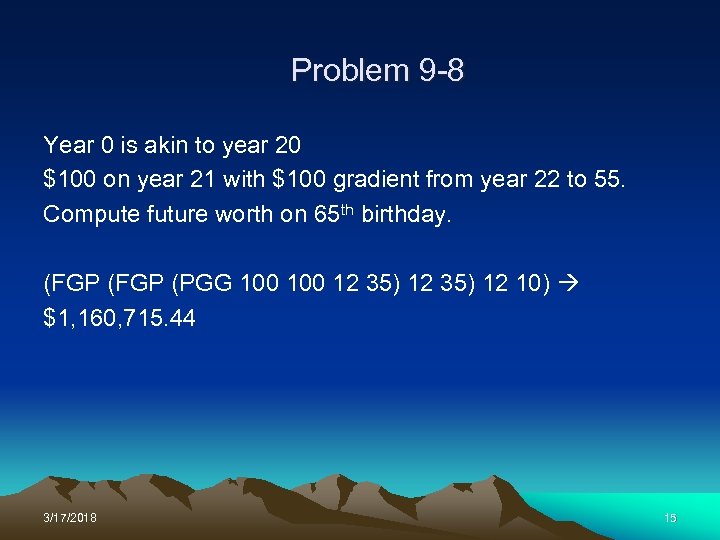

Problem 9 -8 Year 0 is akin to year 20 $100 on year 21 with $100 gradient from year 22 to 55. Compute future worth on 65 th birthday. (FGP (PGG 100 12 35) 12 10) $1, 160, 715. 44 3/17/2018 15

Problem 9 -8 Year 0 is akin to year 20 $100 on year 21 with $100 gradient from year 22 to 55. Compute future worth on 65 th birthday. (FGP (PGG 100 12 35) 12 10) $1, 160, 715. 44 3/17/2018 15

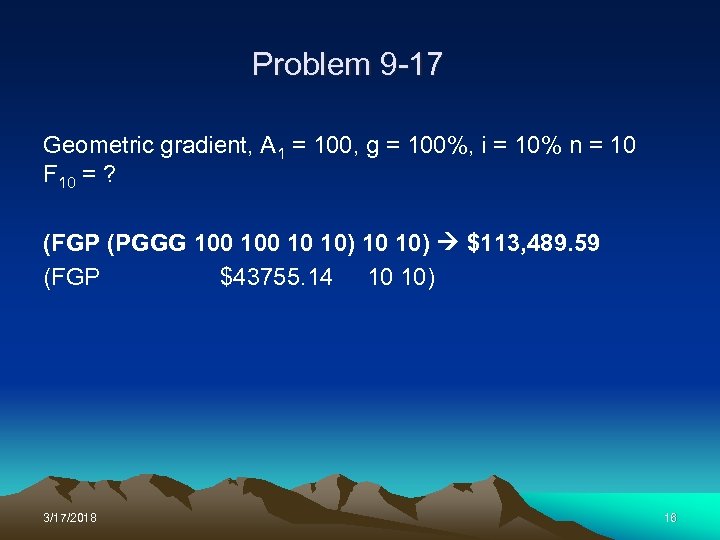

Problem 9 -17 Geometric gradient, A 1 = 100, g = 100%, i = 10% n = 10 F 10 = ? (FGP (PGGG 100 10 10) $113, 489. 59 (FGP $43755. 14 10 10) 3/17/2018 16

Problem 9 -17 Geometric gradient, A 1 = 100, g = 100%, i = 10% n = 10 F 10 = ? (FGP (PGGG 100 10 10) $113, 489. 59 (FGP $43755. 14 10 10) 3/17/2018 16

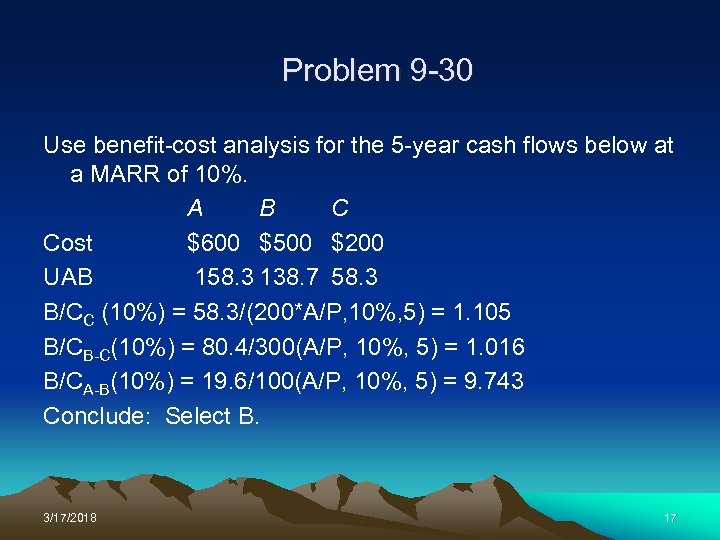

Problem 9 -30 Use benefit-cost analysis for the 5 -year cash flows below at a MARR of 10%. A B C Cost $600 $500 $200 UAB 158. 3 138. 7 58. 3 B/CC (10%) = 58. 3/(200*A/P, 10%, 5) = 1. 105 B/CB-C(10%) = 80. 4/300(A/P, 10%, 5) = 1. 016 B/CA-B(10%) = 19. 6/100(A/P, 10%, 5) = 9. 743 Conclude: Select B. 3/17/2018 17

Problem 9 -30 Use benefit-cost analysis for the 5 -year cash flows below at a MARR of 10%. A B C Cost $600 $500 $200 UAB 158. 3 138. 7 58. 3 B/CC (10%) = 58. 3/(200*A/P, 10%, 5) = 1. 105 B/CB-C(10%) = 80. 4/300(A/P, 10%, 5) = 1. 016 B/CA-B(10%) = 19. 6/100(A/P, 10%, 5) = 9. 743 Conclude: Select B. 3/17/2018 17

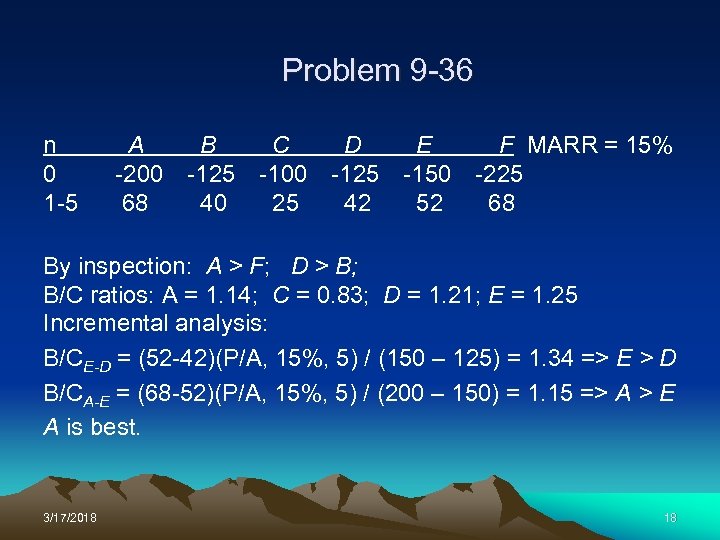

Problem 9 -36 n 0 1 -5 A B C D E F MARR = 15% -200 -125 -150 -225 68 40 25 42 52 68 By inspection: A > F; D > B; B/C ratios: A = 1. 14; C = 0. 83; D = 1. 21; E = 1. 25 Incremental analysis: B/CE-D = (52 -42)(P/A, 15%, 5) / (150 – 125) = 1. 34 => E > D B/CA-E = (68 -52)(P/A, 15%, 5) / (200 – 150) = 1. 15 => A > E A is best. 3/17/2018 18

Problem 9 -36 n 0 1 -5 A B C D E F MARR = 15% -200 -125 -150 -225 68 40 25 42 52 68 By inspection: A > F; D > B; B/C ratios: A = 1. 14; C = 0. 83; D = 1. 21; E = 1. 25 Incremental analysis: B/CE-D = (52 -42)(P/A, 15%, 5) / (150 – 125) = 1. 34 => E > D B/CA-E = (68 -52)(P/A, 15%, 5) / (200 – 150) = 1. 15 => A > E A is best. 3/17/2018 18

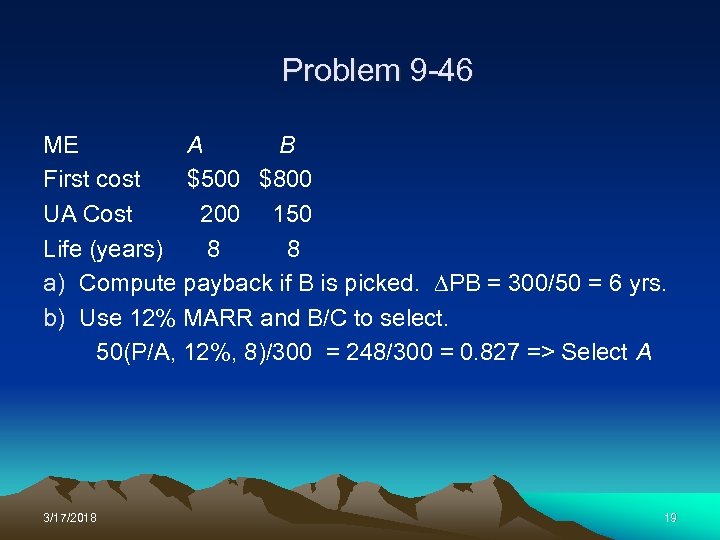

Problem 9 -46 ME A B First cost $500 $800 UA Cost 200 150 Life (years) 8 a) Compute payback if B is picked. PB = 300/50 = 6 yrs. b) Use 12% MARR and B/C to select. 50(P/A, 12%, 8)/300 = 248/300 = 0. 827 => Select A 3/17/2018 19

Problem 9 -46 ME A B First cost $500 $800 UA Cost 200 150 Life (years) 8 a) Compute payback if B is picked. PB = 300/50 = 6 yrs. b) Use 12% MARR and B/C to select. 50(P/A, 12%, 8)/300 = 248/300 = 0. 827 => Select A 3/17/2018 19

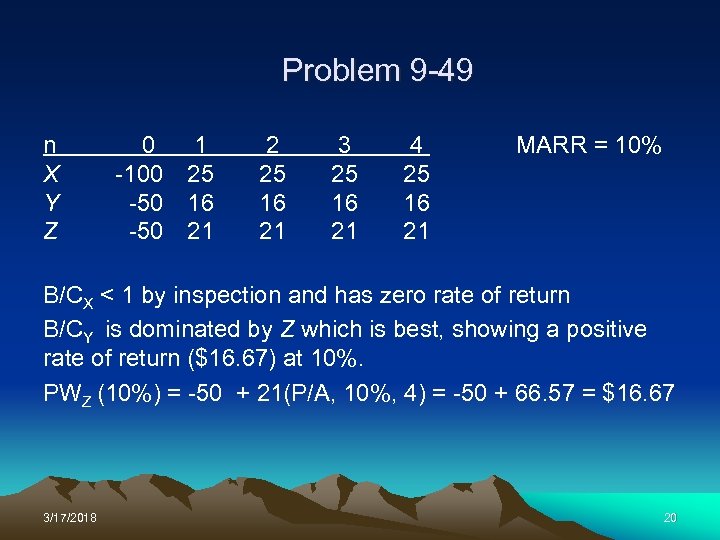

Problem 9 -49 n X Y Z 0 -100 -50 1 25 16 21 2 25 16 21 3 25 16 21 4 MARR = 10% 25 16 21 B/CX < 1 by inspection and has zero rate of return B/CY is dominated by Z which is best, showing a positive rate of return ($16. 67) at 10%. PWZ (10%) = -50 + 21(P/A, 10%, 4) = -50 + 66. 57 = $16. 67 3/17/2018 20

Problem 9 -49 n X Y Z 0 -100 -50 1 25 16 21 2 25 16 21 3 25 16 21 4 MARR = 10% 25 16 21 B/CX < 1 by inspection and has zero rate of return B/CY is dominated by Z which is best, showing a positive rate of return ($16. 67) at 10%. PWZ (10%) = -50 + 21(P/A, 10%, 4) = -50 + 66. 57 = $16. 67 3/17/2018 20

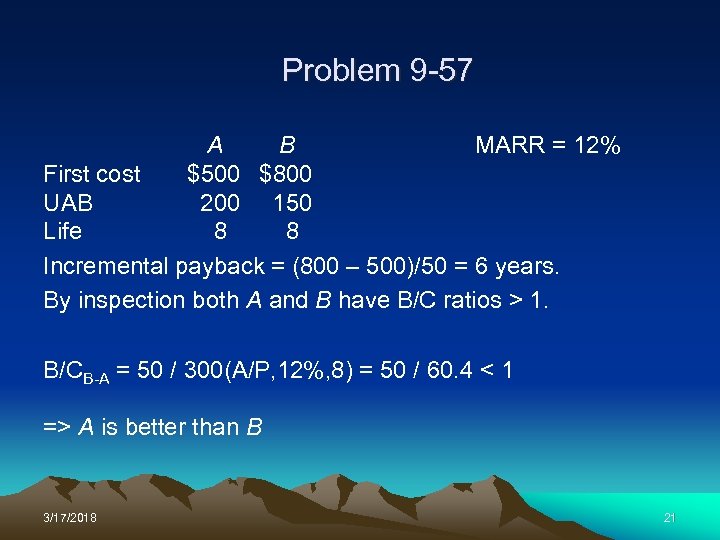

Problem 9 -57 A B MARR = 12% First cost $500 $800 UAB 200 150 Life 8 8 Incremental payback = (800 – 500)/50 = 6 years. By inspection both A and B have B/C ratios > 1. B/CB-A = 50 / 300(A/P, 12%, 8) = 50 / 60. 4 < 1 => A is better than B 3/17/2018 21

Problem 9 -57 A B MARR = 12% First cost $500 $800 UAB 200 150 Life 8 8 Incremental payback = (800 – 500)/50 = 6 years. By inspection both A and B have B/C ratios > 1. B/CB-A = 50 / 300(A/P, 12%, 8) = 50 / 60. 4 < 1 => A is better than B 3/17/2018 21

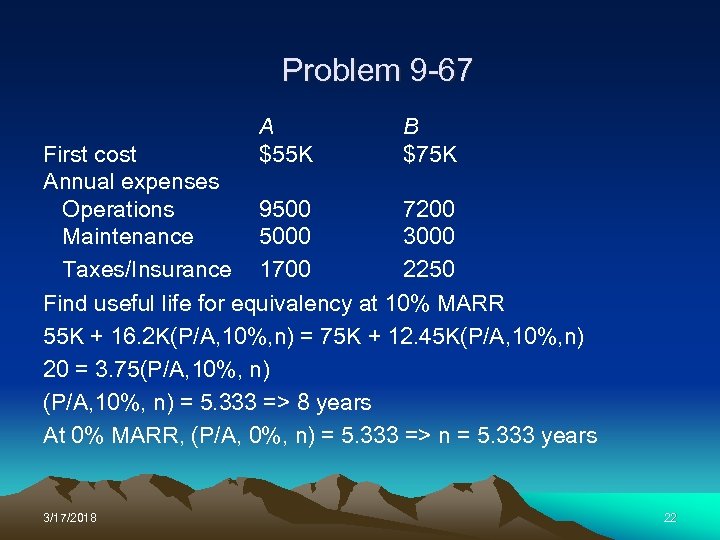

Problem 9 -67 A $55 K B $75 K First cost Annual expenses Operations 9500 7200 Maintenance 5000 3000 Taxes/Insurance 1700 2250 Find useful life for equivalency at 10% MARR 55 K + 16. 2 K(P/A, 10%, n) = 75 K + 12. 45 K(P/A, 10%, n) 20 = 3. 75(P/A, 10%, n) = 5. 333 => 8 years At 0% MARR, (P/A, 0%, n) = 5. 333 => n = 5. 333 years 3/17/2018 22

Problem 9 -67 A $55 K B $75 K First cost Annual expenses Operations 9500 7200 Maintenance 5000 3000 Taxes/Insurance 1700 2250 Find useful life for equivalency at 10% MARR 55 K + 16. 2 K(P/A, 10%, n) = 75 K + 12. 45 K(P/A, 10%, n) 20 = 3. 75(P/A, 10%, n) = 5. 333 => 8 years At 0% MARR, (P/A, 0%, n) = 5. 333 => n = 5. 333 years 3/17/2018 22

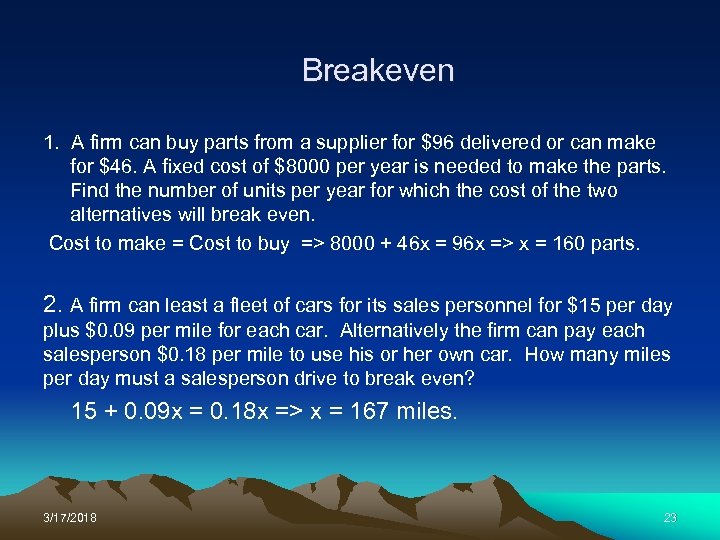

Breakeven 1. A firm can buy parts from a supplier for $96 delivered or can make for $46. A fixed cost of $8000 per year is needed to make the parts. Find the number of units per year for which the cost of the two alternatives will break even. Cost to make = Cost to buy => 8000 + 46 x = 96 x => x = 160 parts. 2. A firm can least a fleet of cars for its sales personnel for $15 per day plus $0. 09 per mile for each car. Alternatively the firm can pay each salesperson $0. 18 per mile to use his or her own car. How many miles per day must a salesperson drive to break even? 15 + 0. 09 x = 0. 18 x => x = 167 miles. 3/17/2018 23

Breakeven 1. A firm can buy parts from a supplier for $96 delivered or can make for $46. A fixed cost of $8000 per year is needed to make the parts. Find the number of units per year for which the cost of the two alternatives will break even. Cost to make = Cost to buy => 8000 + 46 x = 96 x => x = 160 parts. 2. A firm can least a fleet of cars for its sales personnel for $15 per day plus $0. 09 per mile for each car. Alternatively the firm can pay each salesperson $0. 18 per mile to use his or her own car. How many miles per day must a salesperson drive to break even? 15 + 0. 09 x = 0. 18 x => x = 167 miles. 3/17/2018 23

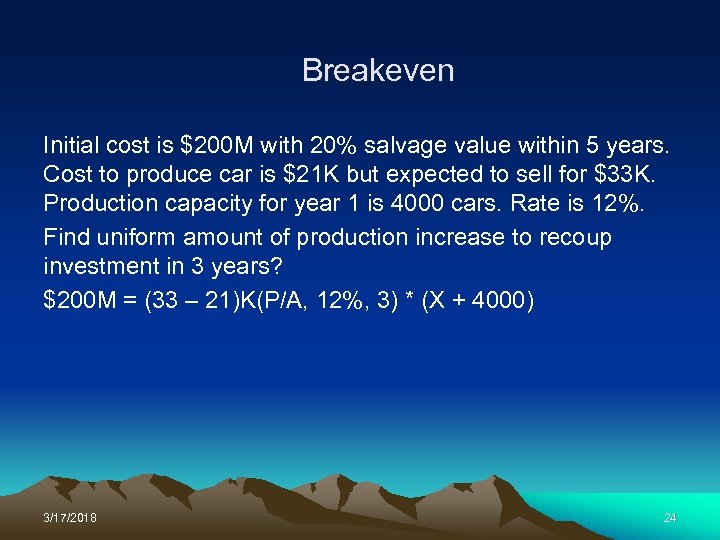

Breakeven Initial cost is $200 M with 20% salvage value within 5 years. Cost to produce car is $21 K but expected to sell for $33 K. Production capacity for year 1 is 4000 cars. Rate is 12%. Find uniform amount of production increase to recoup investment in 3 years? $200 M = (33 – 21)K(P/A, 12%, 3) * (X + 4000) 3/17/2018 24

Breakeven Initial cost is $200 M with 20% salvage value within 5 years. Cost to produce car is $21 K but expected to sell for $33 K. Production capacity for year 1 is 4000 cars. Rate is 12%. Find uniform amount of production increase to recoup investment in 3 years? $200 M = (33 – 21)K(P/A, 12%, 3) * (X + 4000) 3/17/2018 24

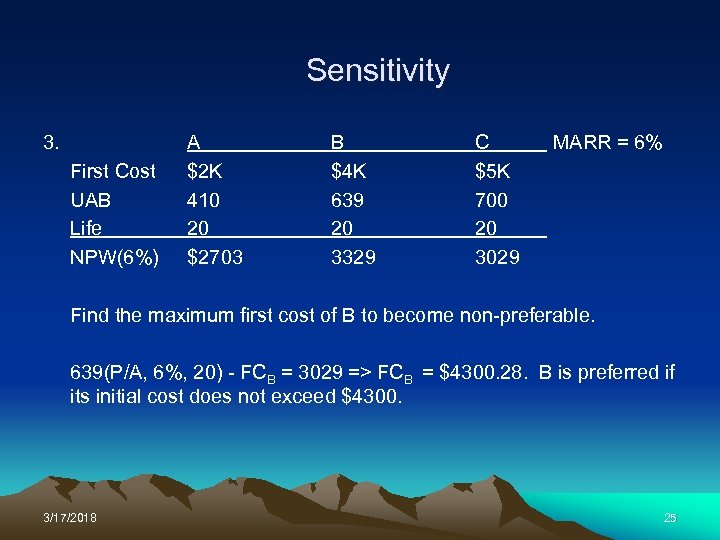

Sensitivity 3. First Cost UAB Life NPW(6%) A $2 K 410 20 $2703 B $4 K 639 20 3329 C $5 K 700 20 3029 MARR = 6% Find the maximum first cost of B to become non-preferable. 639(P/A, 6%, 20) - FCB = 3029 => FCB = $4300. 28. B is preferred if its initial cost does not exceed $4300. 3/17/2018 25

Sensitivity 3. First Cost UAB Life NPW(6%) A $2 K 410 20 $2703 B $4 K 639 20 3329 C $5 K 700 20 3029 MARR = 6% Find the maximum first cost of B to become non-preferable. 639(P/A, 6%, 20) - FCB = 3029 => FCB = $4300. 28. B is preferred if its initial cost does not exceed $4300. 3/17/2018 25

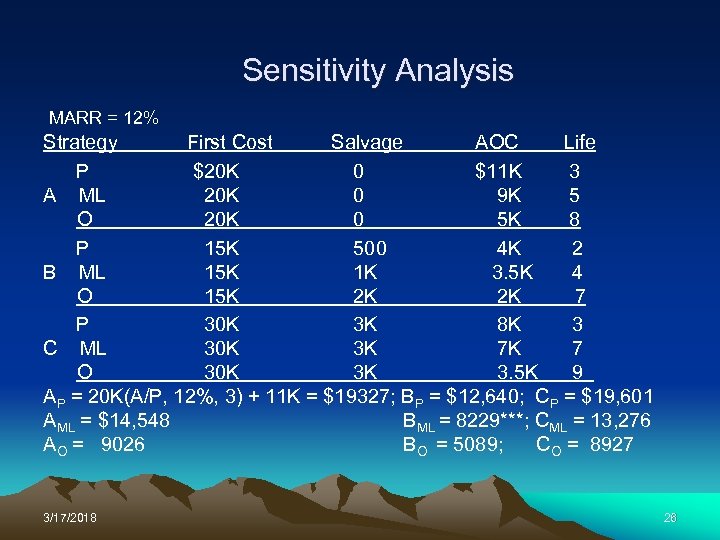

Sensitivity Analysis MARR = 12% Strategy First Cost Salvage AOC Life P $20 K 0 $11 K 3 A ML 20 K 0 9 K 5 O 20 K 0 5 K 8 P 15 K 500 4 K 2 B ML 15 K 1 K 3. 5 K 4 O 15 K 2 K 2 K 7 P 30 K 3 K 8 K 3 C ML 30 K 3 K 7 K 7 O 30 K 3 K 3. 5 K 9 AP = 20 K(A/P, 12%, 3) + 11 K = $19327; BP = $12, 640; CP = $19, 601 AML = $14, 548 BML = 8229***; CML = 13, 276 AO = 9026 BO = 5089; CO = 8927 3/17/2018 26

Sensitivity Analysis MARR = 12% Strategy First Cost Salvage AOC Life P $20 K 0 $11 K 3 A ML 20 K 0 9 K 5 O 20 K 0 5 K 8 P 15 K 500 4 K 2 B ML 15 K 1 K 3. 5 K 4 O 15 K 2 K 2 K 7 P 30 K 3 K 8 K 3 C ML 30 K 3 K 7 K 7 O 30 K 3 K 3. 5 K 9 AP = 20 K(A/P, 12%, 3) + 11 K = $19327; BP = $12, 640; CP = $19, 601 AML = $14, 548 BML = 8229***; CML = 13, 276 AO = 9026 BO = 5089; CO = 8927 3/17/2018 26

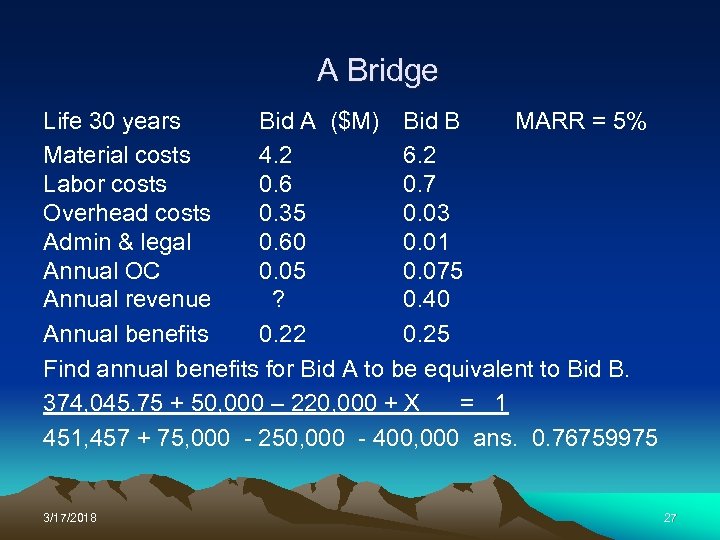

A Bridge Life 30 years Bid A ($M) Bid B MARR = 5% Material costs 4. 2 6. 2 Labor costs 0. 6 0. 7 Overhead costs 0. 35 0. 03 Admin & legal 0. 60 0. 01 Annual OC 0. 05 0. 075 Annual revenue ? 0. 40 Annual benefits 0. 22 0. 25 Find annual benefits for Bid A to be equivalent to Bid B. 374, 045. 75 + 50, 000 – 220, 000 + X = 1 451, 457 + 75, 000 - 250, 000 - 400, 000 ans. 0. 76759975 3/17/2018 27

A Bridge Life 30 years Bid A ($M) Bid B MARR = 5% Material costs 4. 2 6. 2 Labor costs 0. 6 0. 7 Overhead costs 0. 35 0. 03 Admin & legal 0. 60 0. 01 Annual OC 0. 05 0. 075 Annual revenue ? 0. 40 Annual benefits 0. 22 0. 25 Find annual benefits for Bid A to be equivalent to Bid B. 374, 045. 75 + 50, 000 – 220, 000 + X = 1 451, 457 + 75, 000 - 250, 000 - 400, 000 ans. 0. 76759975 3/17/2018 27

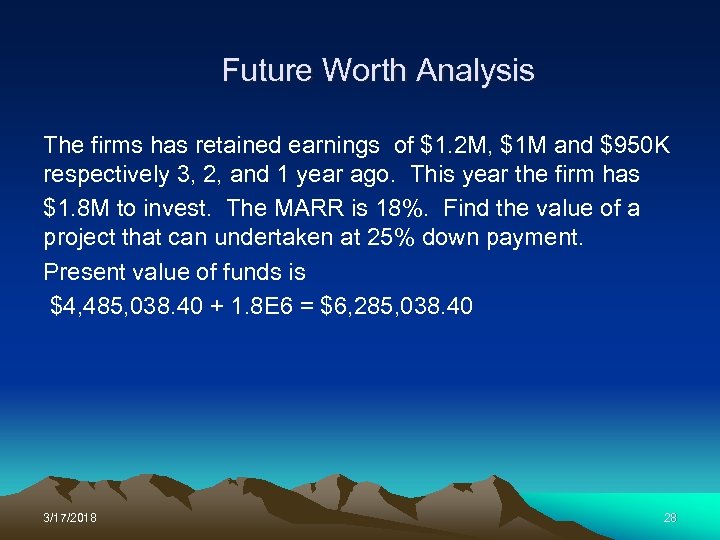

Future Worth Analysis The firms has retained earnings of $1. 2 M, $1 M and $950 K respectively 3, 2, and 1 year ago. This year the firm has $1. 8 M to invest. The MARR is 18%. Find the value of a project that can undertaken at 25% down payment. Present value of funds is $4, 485, 038. 40 + 1. 8 E 6 = $6, 285, 038. 40 3/17/2018 28

Future Worth Analysis The firms has retained earnings of $1. 2 M, $1 M and $950 K respectively 3, 2, and 1 year ago. This year the firm has $1. 8 M to invest. The MARR is 18%. Find the value of a project that can undertaken at 25% down payment. Present value of funds is $4, 485, 038. 40 + 1. 8 E 6 = $6, 285, 038. 40 3/17/2018 28

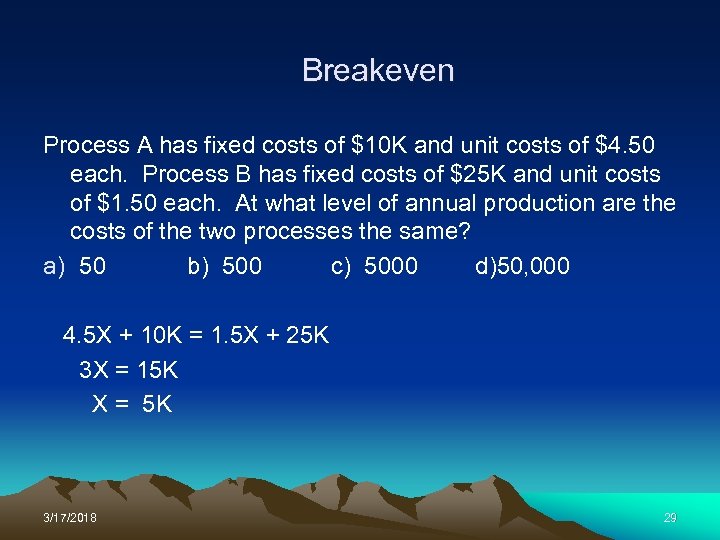

Breakeven Process A has fixed costs of $10 K and unit costs of $4. 50 each. Process B has fixed costs of $25 K and unit costs of $1. 50 each. At what level of annual production are the costs of the two processes the same? a) 50 b) 500 c) 5000 d)50, 000 4. 5 X + 10 K = 1. 5 X + 25 K 3 X = 15 K X = 5 K 3/17/2018 29

Breakeven Process A has fixed costs of $10 K and unit costs of $4. 50 each. Process B has fixed costs of $25 K and unit costs of $1. 50 each. At what level of annual production are the costs of the two processes the same? a) 50 b) 500 c) 5000 d)50, 000 4. 5 X + 10 K = 1. 5 X + 25 K 3 X = 15 K X = 5 K 3/17/2018 29

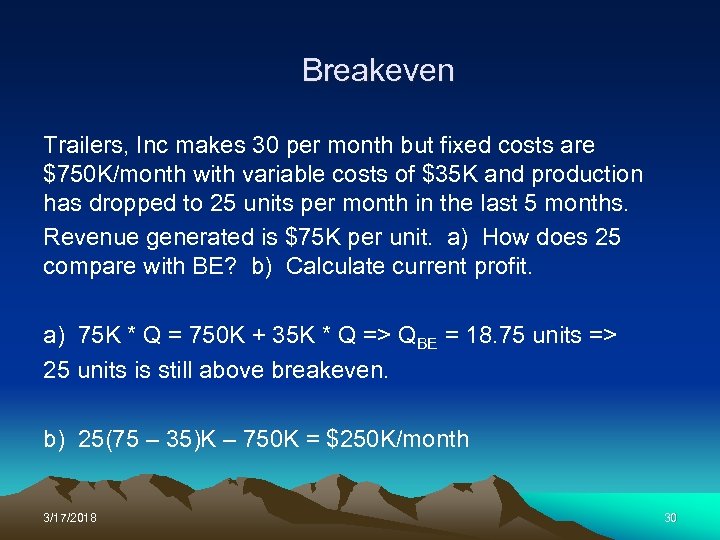

Breakeven Trailers, Inc makes 30 per month but fixed costs are $750 K/month with variable costs of $35 K and production has dropped to 25 units per month in the last 5 months. Revenue generated is $75 K per unit. a) How does 25 compare with BE? b) Calculate current profit. a) 75 K * Q = 750 K + 35 K * Q => QBE = 18. 75 units => 25 units is still above breakeven. b) 25(75 – 35)K – 750 K = $250 K/month 3/17/2018 30

Breakeven Trailers, Inc makes 30 per month but fixed costs are $750 K/month with variable costs of $35 K and production has dropped to 25 units per month in the last 5 months. Revenue generated is $75 K per unit. a) How does 25 compare with BE? b) Calculate current profit. a) 75 K * Q = 750 K + 35 K * Q => QBE = 18. 75 units => 25 units is still above breakeven. b) 25(75 – 35)K – 750 K = $250 K/month 3/17/2018 30

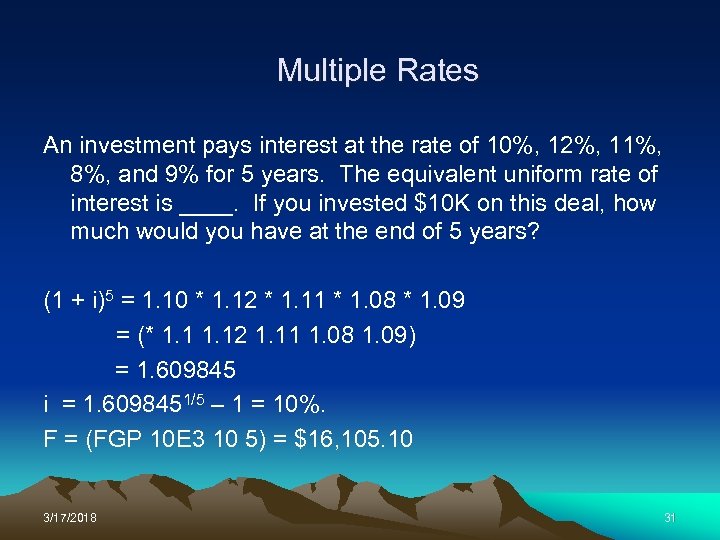

Multiple Rates An investment pays interest at the rate of 10%, 12%, 11%, 8%, and 9% for 5 years. The equivalent uniform rate of interest is ____. If you invested $10 K on this deal, how much would you have at the end of 5 years? (1 + i)5 = 1. 10 * 1. 12 * 1. 11 * 1. 08 * 1. 09 = (* 1. 12 1. 11 1. 08 1. 09) = 1. 609845 i = 1. 6098451/5 – 1 = 10%. F = (FGP 10 E 3 10 5) = $16, 105. 10 3/17/2018 31

Multiple Rates An investment pays interest at the rate of 10%, 12%, 11%, 8%, and 9% for 5 years. The equivalent uniform rate of interest is ____. If you invested $10 K on this deal, how much would you have at the end of 5 years? (1 + i)5 = 1. 10 * 1. 12 * 1. 11 * 1. 08 * 1. 09 = (* 1. 12 1. 11 1. 08 1. 09) = 1. 609845 i = 1. 6098451/5 – 1 = 10%. F = (FGP 10 E 3 10 5) = $16, 105. 10 3/17/2018 31

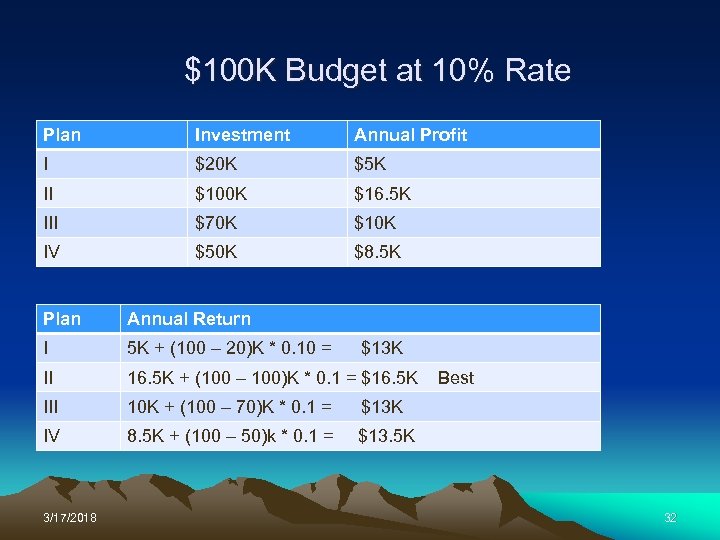

$100 K Budget at 10% Rate Plan Investment Annual Profit I $20 K $5 K II $100 K $16. 5 K III $70 K $10 K IV $50 K $8. 5 K Plan Annual Return I 5 K + (100 – 20)K * 0. 10 = $13 K II 16. 5 K + (100 – 100)K * 0. 1 = $16. 5 K Best III 10 K + (100 – 70)K * 0. 1 = $13 K IV 8. 5 K + (100 – 50)k * 0. 1 = $13. 5 K 3/17/2018 32

$100 K Budget at 10% Rate Plan Investment Annual Profit I $20 K $5 K II $100 K $16. 5 K III $70 K $10 K IV $50 K $8. 5 K Plan Annual Return I 5 K + (100 – 20)K * 0. 10 = $13 K II 16. 5 K + (100 – 100)K * 0. 1 = $16. 5 K Best III 10 K + (100 – 70)K * 0. 1 = $13 K IV 8. 5 K + (100 – 50)k * 0. 1 = $13. 5 K 3/17/2018 32

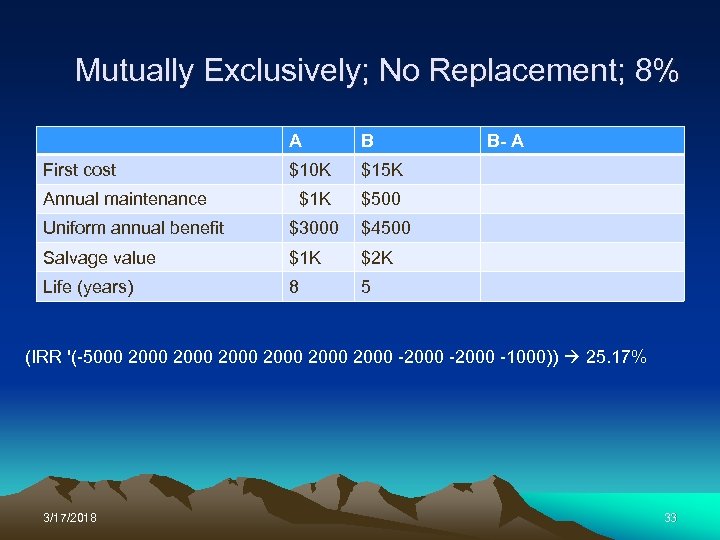

Mutually Exclusively; No Replacement; 8% A B First cost $10 K $15 K Annual maintenance $1 K $500 Uniform annual benefit $3000 $4500 Salvage value $1 K $2 K Life (years) 8 B- A 5 (IRR '(-5000 2000 2000 -2000 -1000)) 25. 17% 3/17/2018 33

Mutually Exclusively; No Replacement; 8% A B First cost $10 K $15 K Annual maintenance $1 K $500 Uniform annual benefit $3000 $4500 Salvage value $1 K $2 K Life (years) 8 B- A 5 (IRR '(-5000 2000 2000 -2000 -1000)) 25. 17% 3/17/2018 33

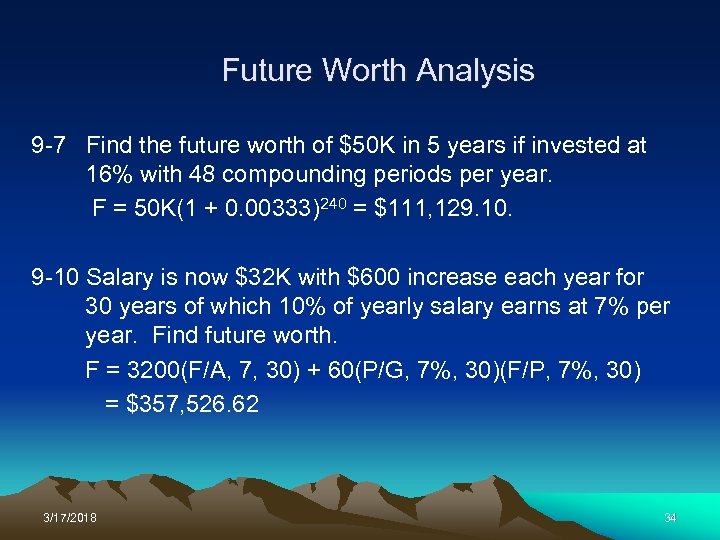

Future Worth Analysis 9 -7 Find the future worth of $50 K in 5 years if invested at 16% with 48 compounding periods per year. F = 50 K(1 + 0. 00333)240 = $111, 129. 10. 9 -10 Salary is now $32 K with $600 increase each year for 30 years of which 10% of yearly salary earns at 7% per year. Find future worth. F = 3200(F/A, 7, 30) + 60(P/G, 7%, 30)(F/P, 7%, 30) = $357, 526. 62 3/17/2018 34

Future Worth Analysis 9 -7 Find the future worth of $50 K in 5 years if invested at 16% with 48 compounding periods per year. F = 50 K(1 + 0. 00333)240 = $111, 129. 10. 9 -10 Salary is now $32 K with $600 increase each year for 30 years of which 10% of yearly salary earns at 7% per year. Find future worth. F = 3200(F/A, 7, 30) + 60(P/G, 7%, 30)(F/P, 7%, 30) = $357, 526. 62 3/17/2018 34