c9bb2ed5381747315c68c79ba8f8b658.ppt

- Количество слайдов: 27

ENERVEST MANAGEMENT PARTNERS, LTD. IPAA/TIPRO Luncheon Buying & Selling through the Cycles John B. Walker President and Chief Executive Officer September 14, 2005

Company Overview Ø Approximately $1 billion available for acquisitions and development of oil and gas properties Ø Consistently generated superior returns for its institutional partners across capital market and commodity price cycles Ø 6 partnerships exited with a realized 28. 1% internal rate of return after management fees, back-ins and hedge payments Ø Operate approximately 10, 500 wells in 9 states Ø Experienced management team with extensive network of industry relationships Ø Over 300 employees with headquarters in Houston Ø Recognized in 2003, 2002 and 2001 by the Houston Business Journal as the “Best Place to Work in Houston” (across all industries) 2

Experienced Executive Management Team Ø John B. Walker – President and CEO Ø Ø Ø Co-founder of Ener. Vest Chairman of IPAA Member of National Petroleum Council and Natural Gas Council Former President and COO of Torch Energy Advisors, Inc. Former “All American” Energy Analyst on Wall Street Ø Jon Rex Jones – Chairman Ø Ø Ø Co-founder of Ener. Vest Co-founder of JM Petroleum, Taurus Energy and Global Exploration Former “Oilman of the Year” and “Chief Roughneck” Past Chairman of IPAA National Petroleum Council Member Ø Mark Houser – Executive Vice President and COO Ø Former Vice President, U. S. Operations of Occidental Petroleum (NYSE: OXY) Ø Responsible for $3. 65 Billion Acquisition of Elk Hills Naval Petroleum Reserve Ø Former Vice President of Exploration for Canadian Occidental (NYSE: NXY) Ø Jim Vanderhider – Executive Vice President and CFO Ø Former Executive Vice President and CFO of Torch Energy Ø Former head of Internal Audit (Corporate) of The Coastal Corporation, now a division of El Paso (NYSE: EP) 3

What We Are – What We Are Not Ø What We Are Ø Focused on making money and generating earnings for institutional investors Ø Second largest manager of oil and gas assets for institutional investors Ø Acquisition, exploitation, and operating company focused on: Ø upstream property/corporate acquisitions in North America Ø willingness to sell assets to maximize returns Ø Private company which operates wells and distributes a significant monthly return to investors Ø What We Are Not Ø Financiers/capital providers Ø Explorationists 4

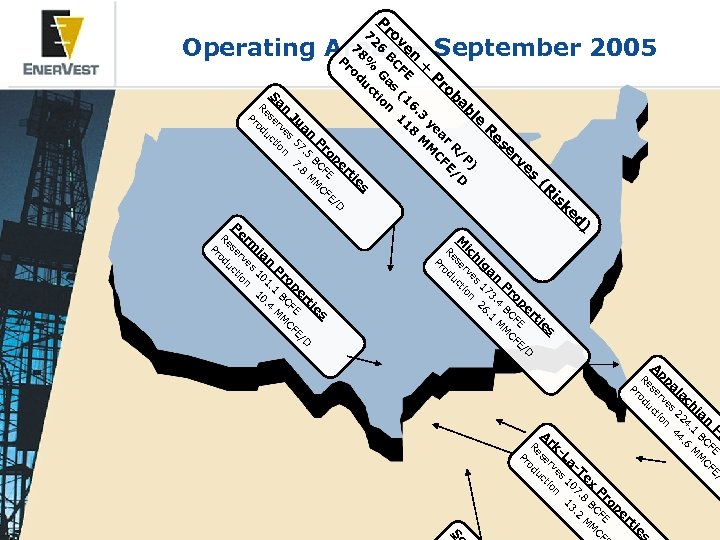

% 8 7 es i rt pe es ti er /D D p E E/ ro CF CF P 4 B MM. an 73. 1 ig 1 26 h s ic rve on M se ucti Re od Pr s ie rt pe FE CFE ro C P 1 B MM n 1. . 4 ia 10 10 m es er rv on P se ucti Re od Pr d) ke D is E/ ro FE F P BC MC M an 7. 5. 8 Ju s 5 7 e an rv on S se ucti Re od Pr ct du ro P (R s ve er es R e ) bl /P D ba R E/ ro ar CF P ye M +. 3 8 M n E 6 ve CF s (1 11 n ro B P 26 Ga io 7 Operating Areas – September 2005 r D P E E/ n CF CF ia B M h. 1 M ac 24 4. 6 al es 2 4 pp rv on A ese ucti R od Pr er op e ti s r P FE CF x BC MM Te 7. 8. 2 a- 10 13 -L es rk rv on A se ucti Re od Pr S

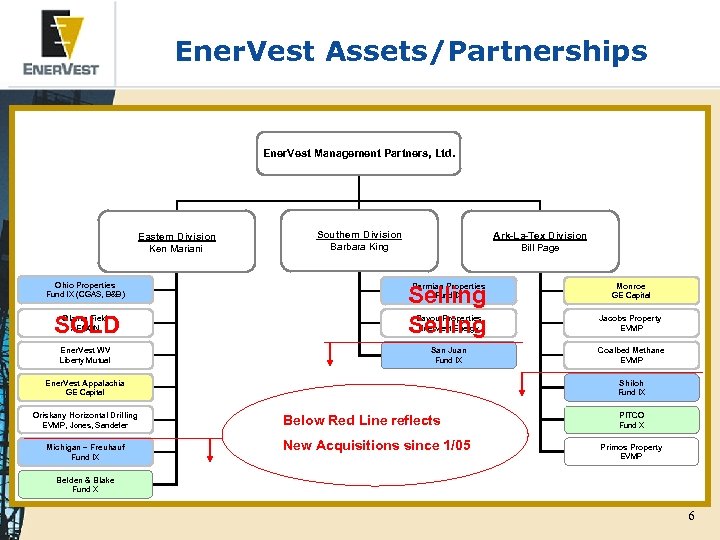

Ener. Vest Assets/Partnerships Ener. Vest Management Partners, Ltd. Eastern Division Ken Mariani Ohio Properties Fund IX (CGAS, B&B) Southern Division Barbara King Ark-La-Tex Division Bill Page SOLD Selling Bayou Properties Ener. Vest Energy Jacobs Property EVMP Ener. Vest WV Liberty Mutual San Juan Fund IX Coalbed Methane EVMP Olanta Field AEGON Permian Properties Fund IX Monroe GE Capital Ener. Vest Appalachia GE Capital Oriskany Horizontal Drilling EVMP, Jones, Sandefer Michigan – Freuhauf Fund IX Shiloh Fund IX Below Red Line reflects New Acquisitions since 1/05 PITCO Fund X Primos Property EVMP Belden & Blake Fund X 6

Bell Ringers 7

2005 – Bell Ringers Ø Successfully Raised $550 Million in Equity for Fund X Ø Raised an additional $47 million equity in an alongside investment Ø Fund X now has approximately $1 billion of potential investment capacity Ø Significant Acquisition Activity since January Ø Closed on 7 transactions totaling >$700 million Ø All in costs - $1. 74/mcfe Ø Includes the largest deal ever done by Ener. Vest Ø 6 of 7 transactions are direct negotiations Ø Significant Divestiture Activity Ø Property in Pennsylvania sold in August Ø Sale of South Louisiana properties pending Ø Sale of all Permian properties announced 8

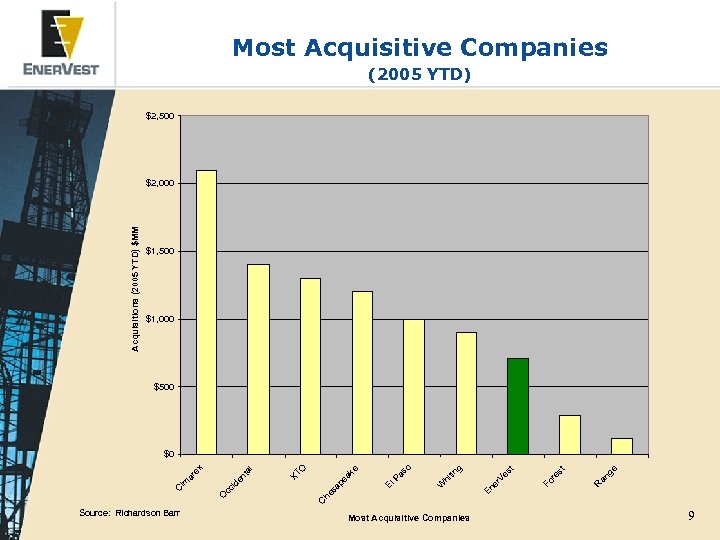

Most Acquisitive Companies (2005 YTD) $2, 500 Acquisitions (2005 YTD) $MM $2, 000 $1, 500 $1, 000 $500 ge R an st re Fo t es er V En W hi tin g so Pa pe sa C he El ak e O XT id cc O C im en ar ta l ex $0 Source: Richardson Barr Most Acquisitive Companies 9

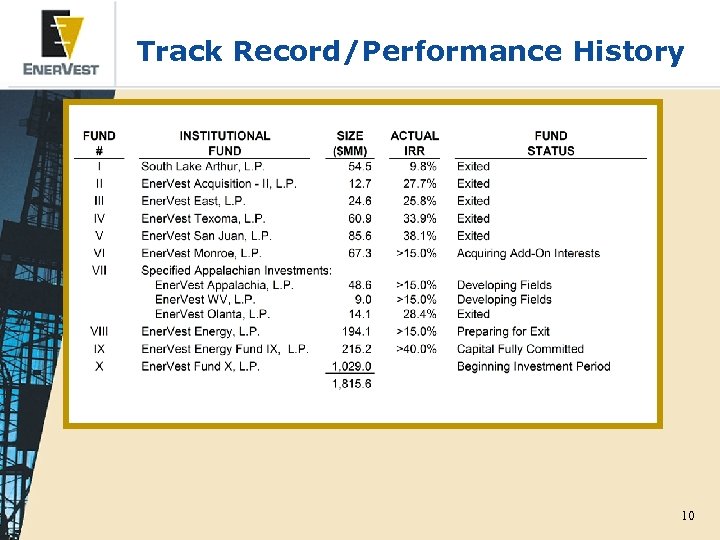

Track Record/Performance History 10

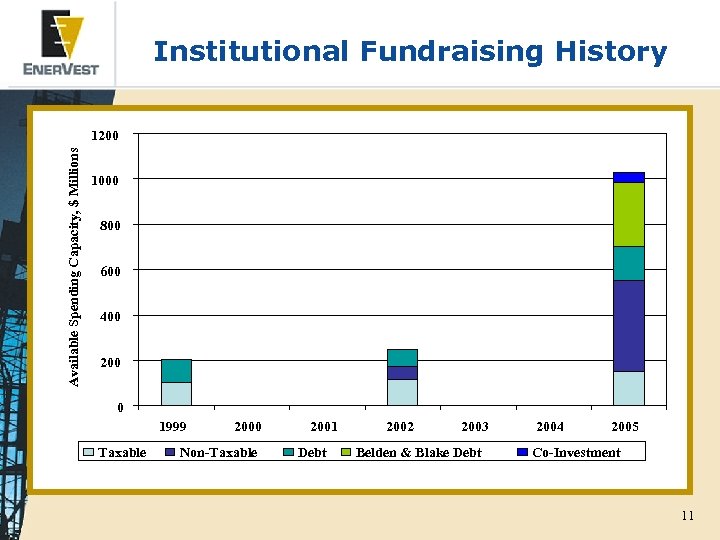

Institutional Fundraising History Available Spending Capacity, $ Millions 1200 1000 800 600 400 200 0 1999 Taxable 2000 Non-Taxable 2001 Debt 2002 2003 Belden & Blake Debt 2004 2005 Co-Investment 11

Proud Soccer Dad 12

Strategies for the Investment Cycle Ø Acquisition Ø Focus on extensive industry contacts and relationships with majors, independents, and individuals active in the A&D market Ø Constantly monitor the markets and update intelligence database Ø Follow a strict discipline and stay patient Ø Identify assets possessing our desired, pre-defined investment characteristics Ø Engineer all properties in-house Ø Acquire additional interests at higher IRR following the initial investment Ø Operation and Exploitation Ø Reduce field operating costs immediately Ø Conduct engineering and geological field studies Ø Implement exploitation programs quickly and effectively Ø Proactively hedge commodity prices to maximize investment IRR Ø Asset Divestiture Ø Develop an asset exit strategy in connection with the acquisition Ø Constantly assess the market for strategic/momentum buyers Ø Exit assets when capital markets and industry cycles provide premium valuations or where strategic buyers can be located 13

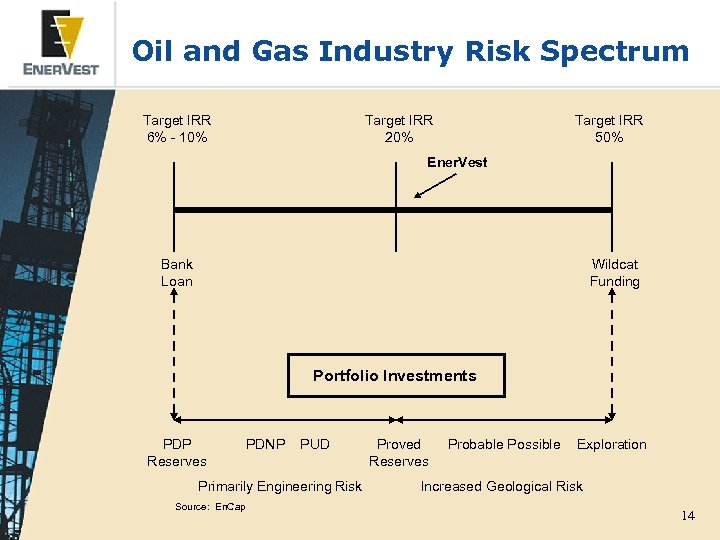

Oil and Gas Industry Risk Spectrum Target IRR 6% - 10% Target IRR 20% Target IRR 50% Ener. Vest Bank Loan Wildcat Funding Portfolio Investments PDP Reserves PDNP PUD Primarily Engineering Risk Source: En. Cap Proved Reserves Probable Possible Exploration Increased Geological Risk 14

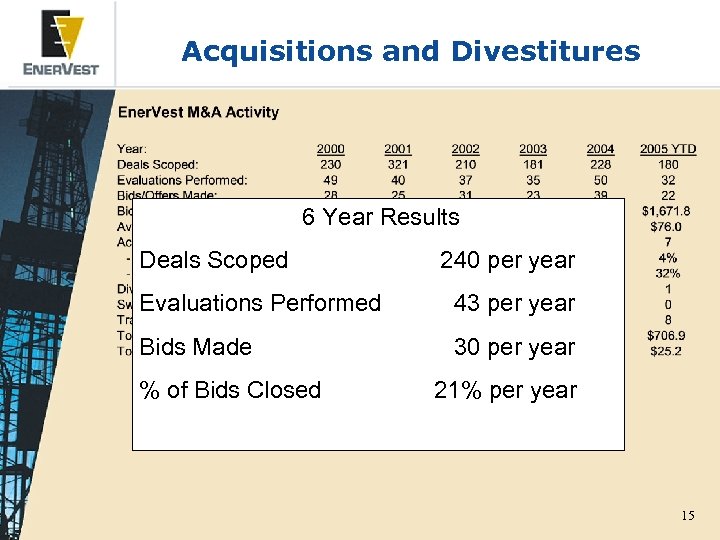

Acquisitions and Divestitures 6 Year Results Deals Scoped 240 per year Evaluations Performed 43 per year Bids Made 30 per year % of Bids Closed 21% per year 15

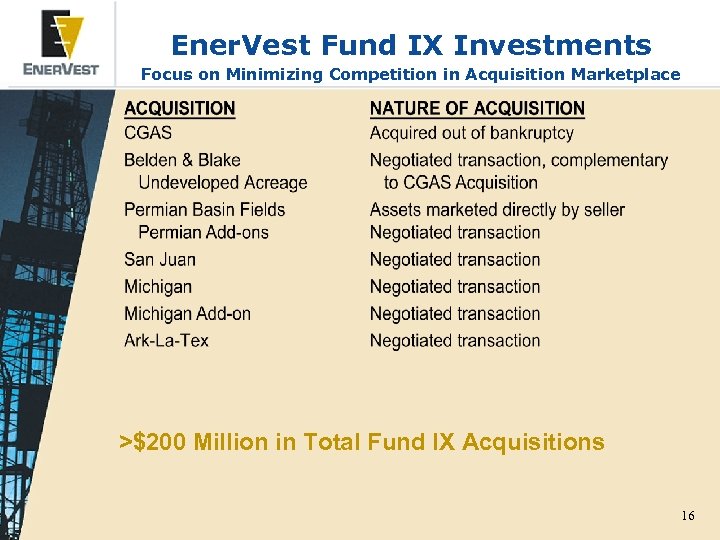

Ener. Vest Fund IX Investments Focus on Minimizing Competition in Acquisition Marketplace >$200 Million in Total Fund IX Acquisitions 16

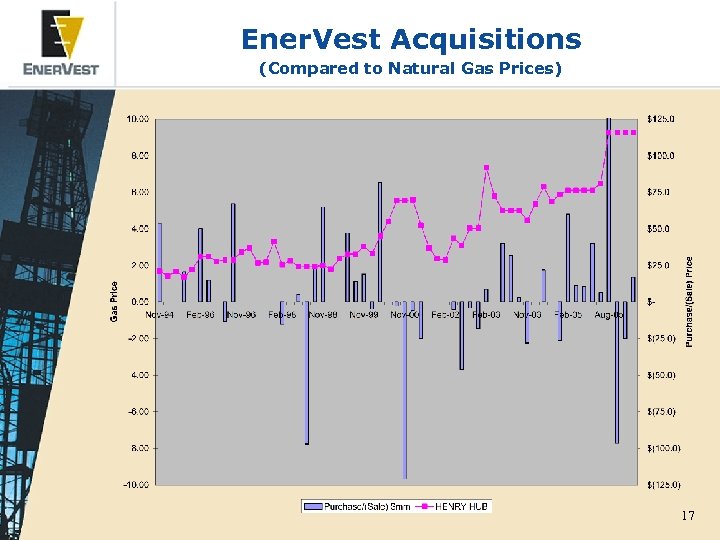

Ener. Vest Acquisitions (Compared to Natural Gas Prices) 17

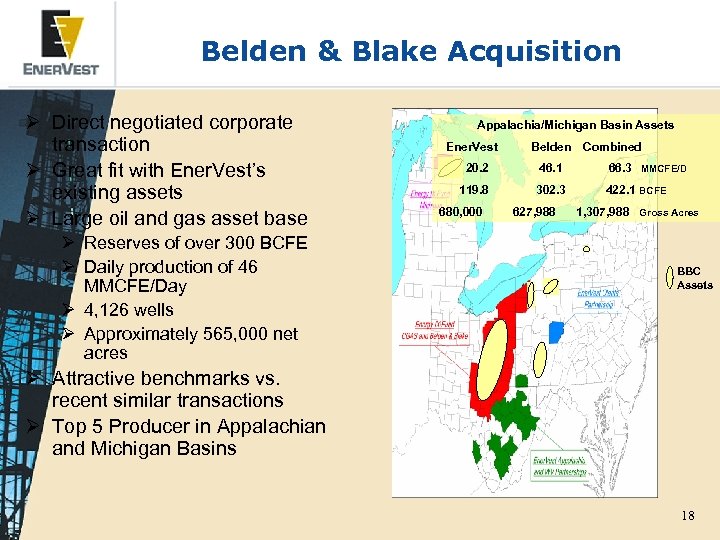

Belden & Blake Acquisition Ø Direct negotiated corporate transaction Ø Great fit with Ener. Vest’s existing assets Ø Large oil and gas asset base Ø Reserves of over 300 BCFE Ø Daily production of 46 MMCFE/Day Ø 4, 126 wells Ø Approximately 565, 000 net acres Appalachia/Michigan Basin Assets Ener. Vest Belden Combined 20. 2 46. 1 66. 3 MMCFE/D 119. 8 302. 3 422. 1 BCFE 680, 000 627, 988 1, 307, 988 Gross Acres BBC Assets Ø Attractive benchmarks vs. recent similar transactions Ø Top 5 Producer in Appalachian and Michigan Basins 18

Where’s Walker? 19

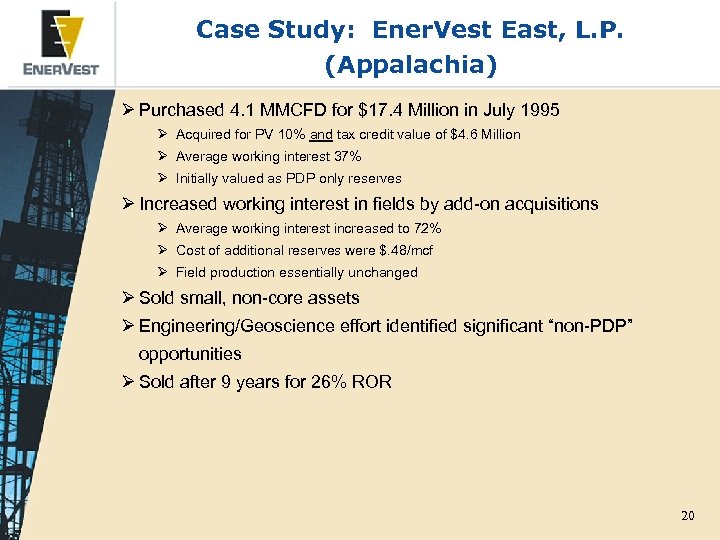

Case Study: Ener. Vest East, L. P. (Appalachia) Ø Purchased 4. 1 MMCFD for $17. 4 Million in July 1995 Ø Acquired for PV 10% and tax credit value of $4. 6 Million Ø Average working interest 37% Ø Initially valued as PDP only reserves Ø Increased working interest in fields by add-on acquisitions Ø Average working interest increased to 72% Ø Cost of additional reserves were $. 48/mcf Ø Field production essentially unchanged Ø Sold small, non-core assets Ø Engineering/Geoscience effort identified significant “non-PDP” opportunities Ø Sold after 9 years for 26% ROR 20

Case Study: Loma Vieja Field, South Texas Ø Overview Ø Seller in lawsuit with mineral owners Ø Purchased for $12 MM in September 2000 Ø Operating Achievements Ø Drilled 1 well Ø Reworked 3 wells Ø Reconfigured compression Ø Increased rate from 8 to 20 MMCF/D Ø Results Ø Capital Spending: $3. 1 MM Ø Net Cashflow: $9. 4 MM Ø March 2002: Sold for $25. 3 MM ($2. 12/mcf) Ø Life-cycle ROR = 77% 21

Case Study: San Juan Ø September, 1996 – Purchased $67 million of properties and tax credits in San Juan Basin Ø 67% of value was attributable to tax credits Ø Operated 48 of 50 wells (95% value) Ø Technical/Land Effort Quadrupled reserves Ø Drilled or performed workovers on 20 wells in 4 years Ø 2 nd Quarter 2000 – received regulatory approval for infill development program, adding extensive value Ø Sold in January 2001 for $121 million (15% tax credits); Ø 38 % IRR 22

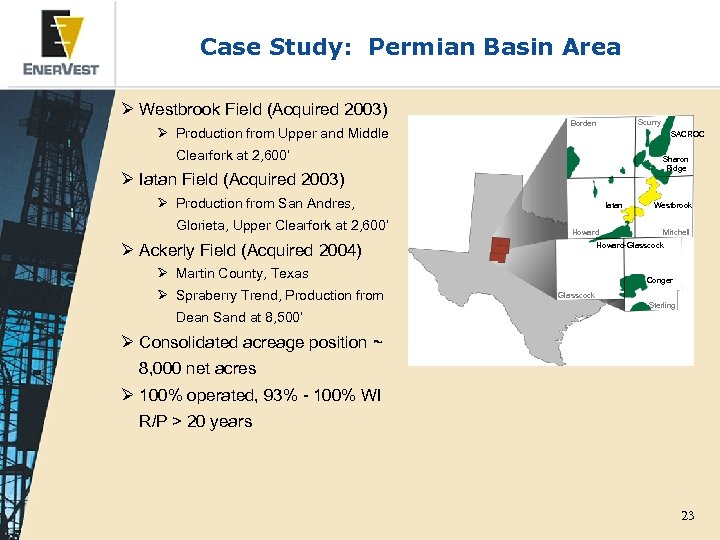

Case Study: Permian Basin Area Ø Westbrook Field (Acquired 2003) Ø Production from Upper and Middle Scurry Borden SACROC Clearfork at 2, 600’ Sharon Ridge Ø Iatan Field (Acquired 2003) Ø Production from San Andres, Glorieta, Upper Clearfork at 2, 600’ Iatan Howard Ø Ackerly Field (Acquired 2004) Dean Sand at 8, 500’ Mitchell Howard-Glasscock Ø Martin County, Texas Ø Spraberry Trend, Production from Westbrook Conger Glasscock Sterling Ø Consolidated acreage position ~ 8, 000 net acres Ø 100% operated, 93% - 100% WI R/P > 20 years 23

Case Study: Permian Basin Area Performed 2 year exploitation program: Ø Returned numerous wells to production Ø Performed 50+ workovers (refrac and add pay) Ø Drilled 27 infill / extension wells Ø 5 distinct reservoirs / zones Ø $13. 1 Million capital spending Ø Increased net production from 1, 050 BOE/D to 1, 790 BOE/D Ø Increased proved and probable reserves to 18. 5 MMBOE 24

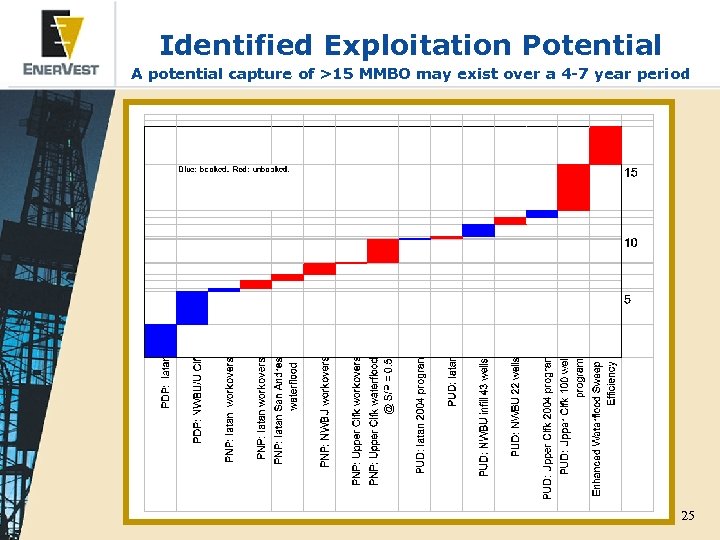

Identified Exploitation Potential A potential capture of >15 MMBO may exist over a 4 -7 year period 25

Future Plans Ø Build on Institutional Franchise Ø Create Basin Dominance in a Few Areas Ø Create a Separate Public Vehicle Ø Be an even Greater Place to Work 26

ENERVEST MANAGEMENT PARTNERS, LTD. IPAA/TIPRO Luncheon Buying & Selling through the Cycles John B. Walker President and Chief Executive Officer September 14, 2005 27

c9bb2ed5381747315c68c79ba8f8b658.ppt