692b75bac8e6cb57d98f606466571d49.ppt

- Количество слайдов: 83

Energy Insurance and Risk Management The insurance transaction distribution system The role of the markets The role of the broker A presentation at The University of Houston January 25, 2007 U of H Presentation - January 2007 0

Energy Insurance and Risk Management The insurance transaction distribution system The role of the markets The role of the broker A presentation at The University of Houston January 25, 2007 U of H Presentation - January 2007 0

“Wonderful! Just wonderful!. . . So much for instilling them with a sense of awe. ” U of H Presentation - January 2007 1

“Wonderful! Just wonderful!. . . So much for instilling them with a sense of awe. ” U of H Presentation - January 2007 1

Discussion outline ? Learning is finding out that you already know. Doing is demonstrating that you know it. Teaching is reminding others that they know just as well as you. U of H Presentation - January 2007 2

Discussion outline ? Learning is finding out that you already know. Doing is demonstrating that you know it. Teaching is reminding others that they know just as well as you. U of H Presentation - January 2007 2

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing – The Insurance Transaction & Distribution System U of H Presentation - January 2007 3

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing – The Insurance Transaction & Distribution System U of H Presentation - January 2007 3

Insurance – It’s not just a job, it’s an adventure U of H Presentation - January 2007 4

Insurance – It’s not just a job, it’s an adventure U of H Presentation - January 2007 4

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 <5 minutes 10 minutes <5 minutes ? ? ? 5

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 <5 minutes 10 minutes <5 minutes ? ? ? 5

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 6

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 6

What is “Risk Management? ” • Focus on Hazard risk The Risk Management Process • Identify the Risk • Quantify the Risk – Probability of loss – Severity of loss • • (Ignore the Risk) Avoid the Risk Minimize the Risk Transfer the Risk U of H Presentation - January 2007 7

What is “Risk Management? ” • Focus on Hazard risk The Risk Management Process • Identify the Risk • Quantify the Risk – Probability of loss – Severity of loss • • (Ignore the Risk) Avoid the Risk Minimize the Risk Transfer the Risk U of H Presentation - January 2007 7

Risk Transfer • Contractual risk transfer • Insurance U of H Presentation - January 2007 8

Risk Transfer • Contractual risk transfer • Insurance U of H Presentation - January 2007 8

A fundamental principle of Insurance …Stupidity is an insured peril U of H Presentation - January 2007 9

A fundamental principle of Insurance …Stupidity is an insured peril U of H Presentation - January 2007 9

An example of an insured peril U of H Presentation - January 2007 10

An example of an insured peril U of H Presentation - January 2007 10

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 11

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 11

Why buy insurance? What is insurance? What does insurance do? U of H Presentation - January 2007 12

Why buy insurance? What is insurance? What does insurance do? U of H Presentation - January 2007 12

Why buy insurance? • • Financial “protection” … from what? Inability to absorb loss Contractual requirements Legal/regulatory requirements U of H Presentation - January 2007 13

Why buy insurance? • • Financial “protection” … from what? Inability to absorb loss Contractual requirements Legal/regulatory requirements U of H Presentation - January 2007 13

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 14

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 14

Types of Insurance • Property • Casualty • Control of Well • Management Liability • Marine • Aviation • • • Kidnap & Ransom Environmental Political Risk Patent Infringement Surety U of H Presentation - January 2007 15

Types of Insurance • Property • Casualty • Control of Well • Management Liability • Marine • Aviation • • • Kidnap & Ransom Environmental Political Risk Patent Infringement Surety U of H Presentation - January 2007 15

Types of Insurance • Property – Physical Damage – Business Interruption (a. k. a. “Time element”) • Casualty – – Workers Compensation General Liability (Legal [tort] and Contractual) Auto Liability Employer’s Liability U of H Presentation - January 2007 16

Types of Insurance • Property – Physical Damage – Business Interruption (a. k. a. “Time element”) • Casualty – – Workers Compensation General Liability (Legal [tort] and Contractual) Auto Liability Employer’s Liability U of H Presentation - January 2007 16

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 17

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 17

Insurance Program Structure • Layers – Primary – Excess • Quota Share (a. k. a. “Subscription” or “Participation”) U of H Presentation - January 2007 18

Insurance Program Structure • Layers – Primary – Excess • Quota Share (a. k. a. “Subscription” or “Participation”) U of H Presentation - January 2007 18

Insurance Program Structure ALWAYS starts with: What is the client trying to accomplish? The best process ~ yields ~ the best result U of H Presentation - January 2007 19

Insurance Program Structure ALWAYS starts with: What is the client trying to accomplish? The best process ~ yields ~ the best result U of H Presentation - January 2007 19

Insurance Program Structure Why a “layered” or “quota share” program? • • Client goals & objectives Underwriter preference Pricing considerations Coverage considerations U of H Presentation - January 2007 20

Insurance Program Structure Why a “layered” or “quota share” program? • • Client goals & objectives Underwriter preference Pricing considerations Coverage considerations U of H Presentation - January 2007 20

A successful renewal requires a strong foundation … 1 Week Minimum 4 Weeks 2 -3 Weeks 1 -2 Weeks U of H Presentation - January 2007 Binding & Implementation Broking All Viable Proposals Develop Submission Develop Marketing Strategy Market Tactics (Access) Market Selection Develop Risk Profile 21

A successful renewal requires a strong foundation … 1 Week Minimum 4 Weeks 2 -3 Weeks 1 -2 Weeks U of H Presentation - January 2007 Binding & Implementation Broking All Viable Proposals Develop Submission Develop Marketing Strategy Market Tactics (Access) Market Selection Develop Risk Profile 21

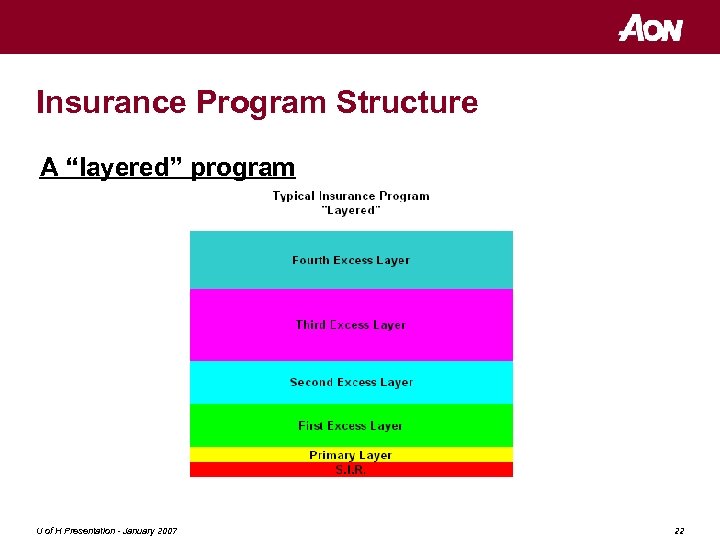

Insurance Program Structure A “layered” program U of H Presentation - January 2007 22

Insurance Program Structure A “layered” program U of H Presentation - January 2007 22

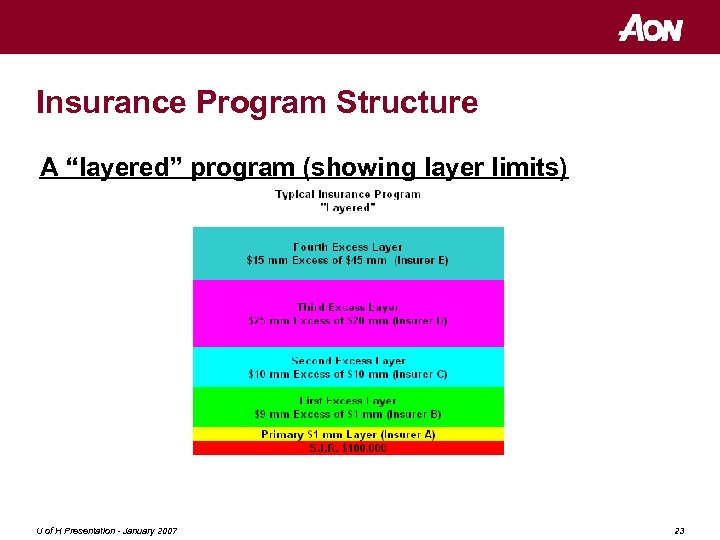

Insurance Program Structure A “layered” program (showing layer limits) U of H Presentation - January 2007 23

Insurance Program Structure A “layered” program (showing layer limits) U of H Presentation - January 2007 23

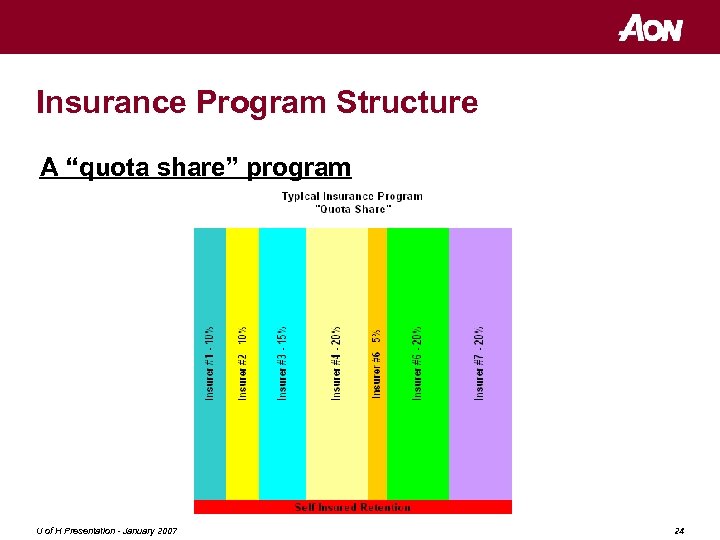

Insurance Program Structure A “quota share” program U of H Presentation - January 2007 24

Insurance Program Structure A “quota share” program U of H Presentation - January 2007 24

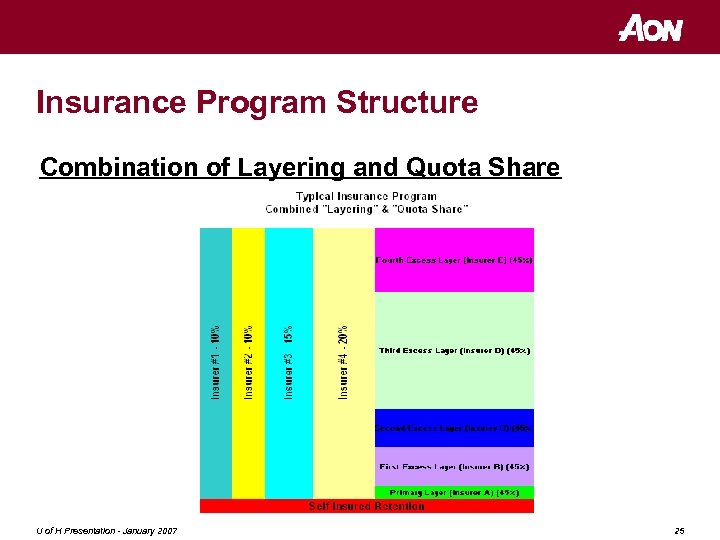

Insurance Program Structure Combination of Layering and Quota Share U of H Presentation - January 2007 25

Insurance Program Structure Combination of Layering and Quota Share U of H Presentation - January 2007 25

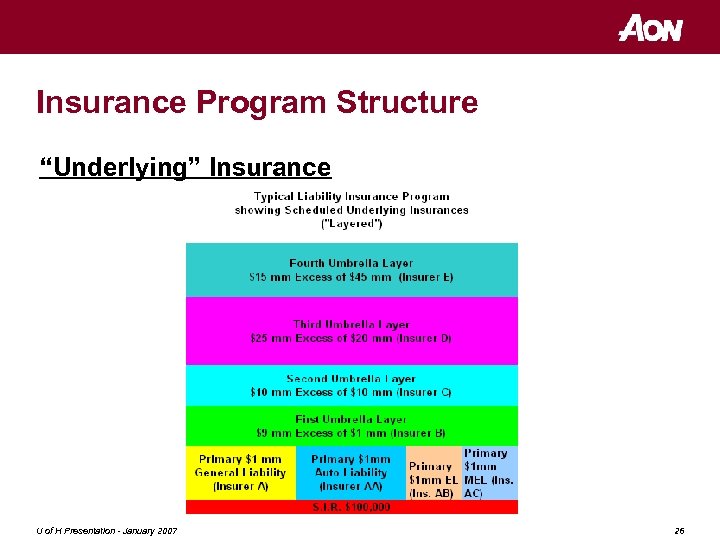

Insurance Program Structure “Underlying” Insurance U of H Presentation - January 2007 26

Insurance Program Structure “Underlying” Insurance U of H Presentation - January 2007 26

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 27

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 27

The purpose of reinsurance • • Spread of risk Increases/supplements capacity Facilitates writing broader coverage Puts capacity in the control of qualified underwriters U of H Presentation - January 2007 28

The purpose of reinsurance • • Spread of risk Increases/supplements capacity Facilitates writing broader coverage Puts capacity in the control of qualified underwriters U of H Presentation - January 2007 28

Types of Reinsurance • Facultative • Treaty • Quota Share • Excess of Loss U of H Presentation - January 2007 29

Types of Reinsurance • Facultative • Treaty • Quota Share • Excess of Loss U of H Presentation - January 2007 29

Other Reinsurance Issues • Risks Attaching vs. Losses Occurring • Natural Catastrophe (“Nat. Cat”) Accumulations • Nat. Cat Risk Modeling U of H Presentation - January 2007 30

Other Reinsurance Issues • Risks Attaching vs. Losses Occurring • Natural Catastrophe (“Nat. Cat”) Accumulations • Nat. Cat Risk Modeling U of H Presentation - January 2007 30

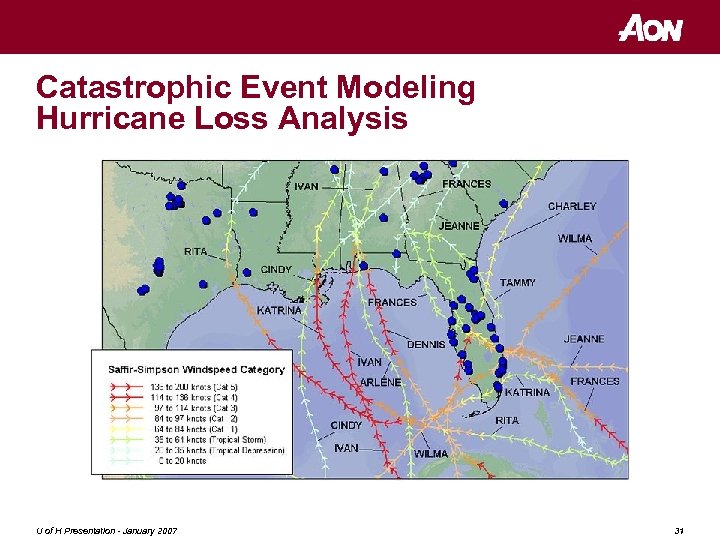

Catastrophic Event Modeling Hurricane Loss Analysis U of H Presentation - January 2007 31

Catastrophic Event Modeling Hurricane Loss Analysis U of H Presentation - January 2007 31

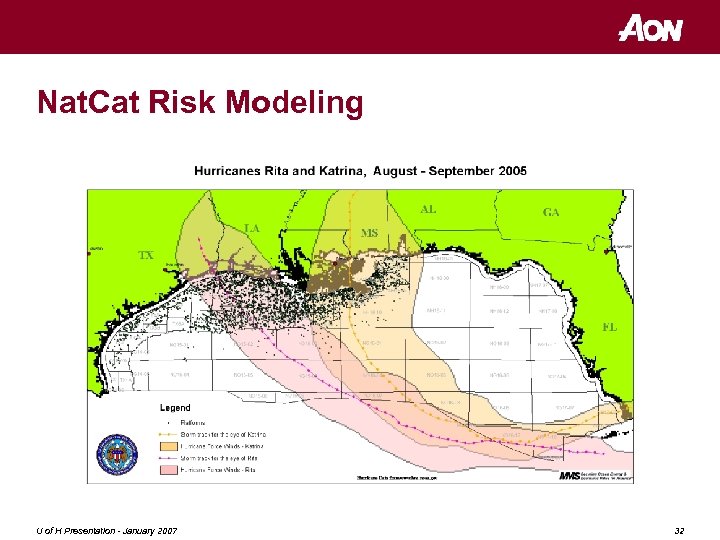

Nat. Cat Risk Modeling U of H Presentation - January 2007 32

Nat. Cat Risk Modeling U of H Presentation - January 2007 32

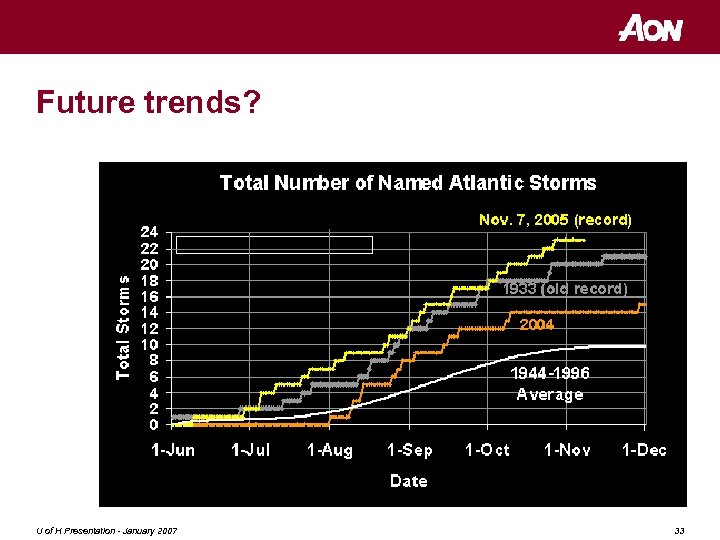

Future trends? U of H Presentation - January 2007 Source: Weatherstreet. com 33

Future trends? U of H Presentation - January 2007 Source: Weatherstreet. com 33

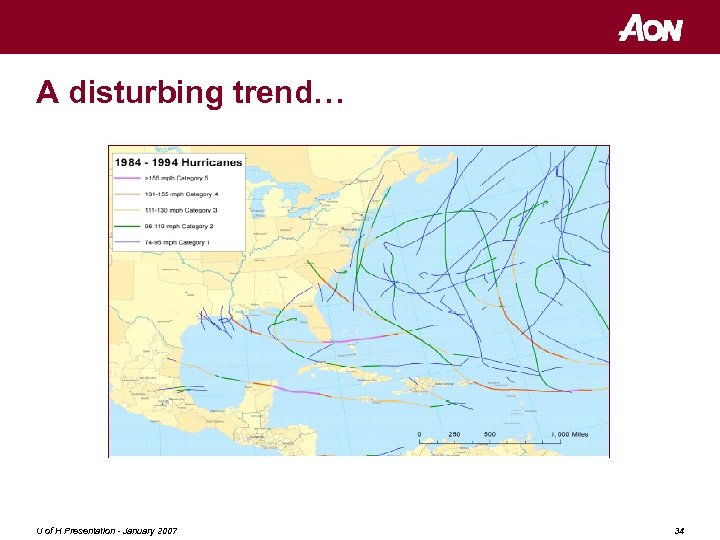

A disturbing trend… U of H Presentation - January 2007 34

A disturbing trend… U of H Presentation - January 2007 34

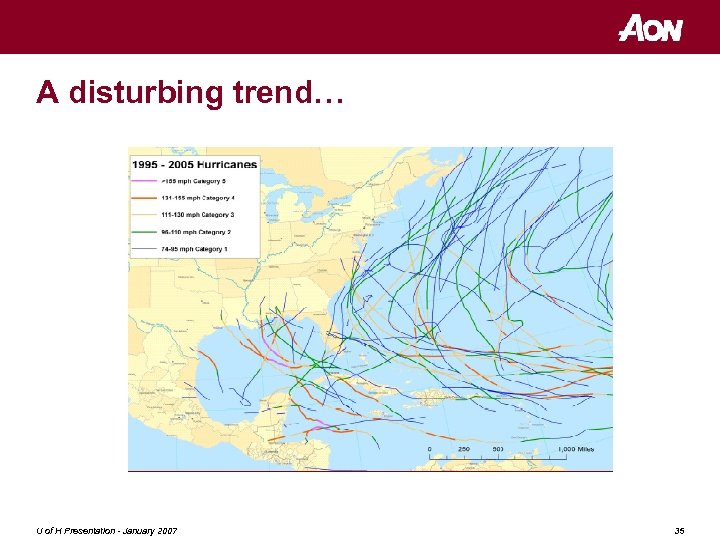

A disturbing trend… U of H Presentation - January 2007 35

A disturbing trend… U of H Presentation - January 2007 35

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 36

Discussion outline • • • What is Risk Management? Why buy insurance? Types of Insurance program structure The purpose of reinsurance Insurance program marketing U of H Presentation - January 2007 36

Insurance Distribution System • Insurance companies sell insurance • Insurance company agents sell insurance • Brokers help their clients buy insurance U of H Presentation - January 2007 37

Insurance Distribution System • Insurance companies sell insurance • Insurance company agents sell insurance • Brokers help their clients buy insurance U of H Presentation - January 2007 37

Insurance Distribution System • Insurance companies sell insurance • Insurance company agents sell insurance • Brokers help their clients buy insurance (after first helping them decide whether to buy insurance, and if so, how much to buy) U of H Presentation - January 2007 38

Insurance Distribution System • Insurance companies sell insurance • Insurance company agents sell insurance • Brokers help their clients buy insurance (after first helping them decide whether to buy insurance, and if so, how much to buy) U of H Presentation - January 2007 38

The role of the broker • Transactional • Consultative U of H Presentation - January 2007 39

The role of the broker • Transactional • Consultative U of H Presentation - January 2007 39

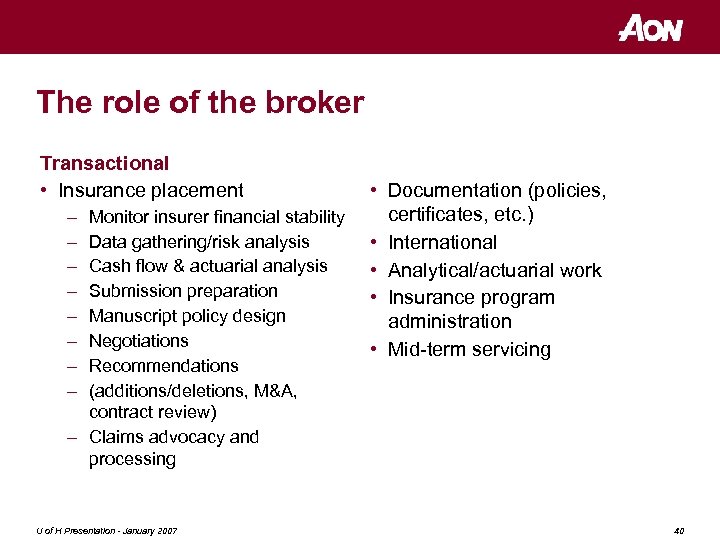

The role of the broker Transactional • Insurance placement – – – – Monitor insurer financial stability Data gathering/risk analysis Cash flow & actuarial analysis Submission preparation Manuscript policy design Negotiations Recommendations (additions/deletions, M&A, contract review) – Claims advocacy and processing U of H Presentation - January 2007 • Documentation (policies, certificates, etc. ) • International • Analytical/actuarial work • Insurance program administration • Mid-term servicing 40

The role of the broker Transactional • Insurance placement – – – – Monitor insurer financial stability Data gathering/risk analysis Cash flow & actuarial analysis Submission preparation Manuscript policy design Negotiations Recommendations (additions/deletions, M&A, contract review) – Claims advocacy and processing U of H Presentation - January 2007 • Documentation (policies, certificates, etc. ) • International • Analytical/actuarial work • Insurance program administration • Mid-term servicing 40

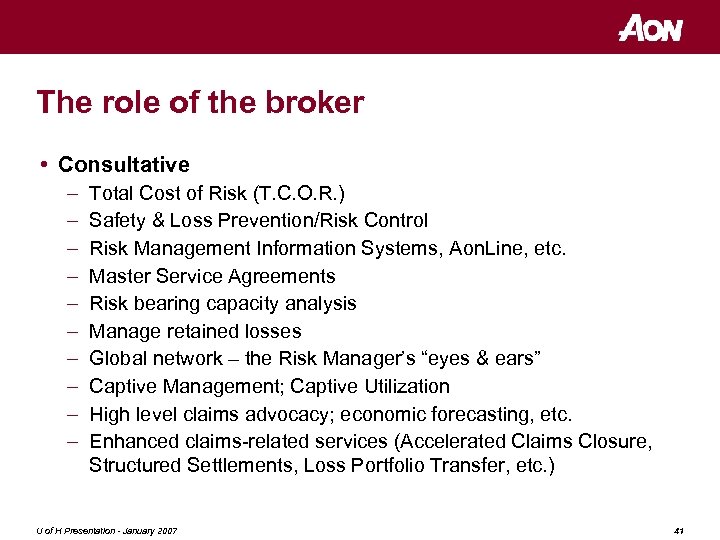

The role of the broker • Consultative – – – – – Total Cost of Risk (T. C. O. R. ) Safety & Loss Prevention/Risk Control Risk Management Information Systems, Aon. Line, etc. Master Service Agreements Risk bearing capacity analysis Manage retained losses Global network – the Risk Manager’s “eyes & ears” Captive Management; Captive Utilization High level claims advocacy; economic forecasting, etc. Enhanced claims-related services (Accelerated Claims Closure, Structured Settlements, Loss Portfolio Transfer, etc. ) U of H Presentation - January 2007 41

The role of the broker • Consultative – – – – – Total Cost of Risk (T. C. O. R. ) Safety & Loss Prevention/Risk Control Risk Management Information Systems, Aon. Line, etc. Master Service Agreements Risk bearing capacity analysis Manage retained losses Global network – the Risk Manager’s “eyes & ears” Captive Management; Captive Utilization High level claims advocacy; economic forecasting, etc. Enhanced claims-related services (Accelerated Claims Closure, Structured Settlements, Loss Portfolio Transfer, etc. ) U of H Presentation - January 2007 41

Broker compensation • Commissions • Fees U of H Presentation - January 2007 42

Broker compensation • Commissions • Fees U of H Presentation - January 2007 42

U of H Presentation - January 2007 43

U of H Presentation - January 2007 43

Insurance Program Marketing Let the fun begin! U of H Presentation - January 2007 44

Insurance Program Marketing Let the fun begin! U of H Presentation - January 2007 44

Why buy insurance? What is insurance? What does insurance do? U of H Presentation - January 2007 45

Why buy insurance? What is insurance? What does insurance do? U of H Presentation - January 2007 45

What is insurance? • CONTRACT • Payment (of premium) in exchange for a promise of payment (of claim) under certain explicitly agreed circumstances • Requires good faith U of H Presentation - January 2007 46

What is insurance? • CONTRACT • Payment (of premium) in exchange for a promise of payment (of claim) under certain explicitly agreed circumstances • Requires good faith U of H Presentation - January 2007 46

Catastrophe Insurance for the Energy Industry U of H Presentation - January 2007 47

Catastrophe Insurance for the Energy Industry U of H Presentation - January 2007 47

Insurance Program Marketing Negotiation Leverage Relationships Trust U of H Presentation - January 2007 48

Insurance Program Marketing Negotiation Leverage Relationships Trust U of H Presentation - January 2007 48

The insurance profession U of H Presentation - January 2007 49

The insurance profession U of H Presentation - January 2007 49

Insurance Program Marketing The bad news … Insurance (including insurance brokerage) is a highly regulated industry • • Domestic vs. Foreign (“Surplus Lines”) vs. Alien “Locally admitted insurers” U. K. Financial Services Authority Premium tax, Surplus lines tax, Federal Excise tax U of H Presentation - January 2007 50

Insurance Program Marketing The bad news … Insurance (including insurance brokerage) is a highly regulated industry • • Domestic vs. Foreign (“Surplus Lines”) vs. Alien “Locally admitted insurers” U. K. Financial Services Authority Premium tax, Surplus lines tax, Federal Excise tax U of H Presentation - January 2007 50

Insurance Program Marketing The good news … We can work through that. U of H Presentation - January 2007 51

Insurance Program Marketing The good news … We can work through that. U of H Presentation - January 2007 51

Insurance Program Marketing Retail insurance brokers / “Agents” Wholesale brokers / Intermediaries Managing General Agents Insurers/ Underwriters / “Carriers” Coverholders / Facilities U of H Presentation - January 2007 52

Insurance Program Marketing Retail insurance brokers / “Agents” Wholesale brokers / Intermediaries Managing General Agents Insurers/ Underwriters / “Carriers” Coverholders / Facilities U of H Presentation - January 2007 52

Insurance Program Marketing The role of the Broker in the Insurance transaction U of H Presentation - January 2007 53

Insurance Program Marketing The role of the Broker in the Insurance transaction U of H Presentation - January 2007 53

Insurance Program Marketing The role of the Broker in the Insurance transaction • The client’s advocate • Broker vs. Agent U of H Presentation - January 2007 54

Insurance Program Marketing The role of the Broker in the Insurance transaction • The client’s advocate • Broker vs. Agent U of H Presentation - January 2007 54

Insurance Program Marketing The Broker’s use of Leverage in the Insurance transaction U of H Presentation - January 2007 55

Insurance Program Marketing The Broker’s use of Leverage in the Insurance transaction U of H Presentation - January 2007 55

Insurance Program Marketing The importance of Relationships in the Insurance transaction U of H Presentation - January 2007 56

Insurance Program Marketing The importance of Relationships in the Insurance transaction U of H Presentation - January 2007 56

Insurance Program Marketing The (global) energy insurance market • • • North American insurance companies Bermuda insurance companies U. K. and European insurance companies Lloyd’s of London Mutuals Others U of H Presentation - January 2007 57

Insurance Program Marketing The (global) energy insurance market • • • North American insurance companies Bermuda insurance companies U. K. and European insurance companies Lloyd’s of London Mutuals Others U of H Presentation - January 2007 57

Insurance Companies – North America • ACE Global • American Electric & Gas Insurance Services (AEGIS) • American International Group (AIG) • American Offshore Insurance Syndicate (AOIS) • Arch • Chubb • CNA • Commonwealth Ins. U of H Presentation - January 2007 • • • FM Global Houston Casualty Lexington Liberty International Markel Navigators St. Paul/Travelers Starr Companies XL Insurance Zurich Insurance 58

Insurance Companies – North America • ACE Global • American Electric & Gas Insurance Services (AEGIS) • American International Group (AIG) • American Offshore Insurance Syndicate (AOIS) • Arch • Chubb • CNA • Commonwealth Ins. U of H Presentation - January 2007 • • • FM Global Houston Casualty Lexington Liberty International Markel Navigators St. Paul/Travelers Starr Companies XL Insurance Zurich Insurance 58

Insurance Companies – Bermuda • ACE Bermuda • Allied World Assurance co. (AWAC) • Arch Ins. • Axis • Endurance Re • Everest Re • Lancashire • Max. Re • Montpelier U of H Presentation - January 2007 • Starr Excess • XL Insurance • Zurich Insurance 59

Insurance Companies – Bermuda • ACE Bermuda • Allied World Assurance co. (AWAC) • Arch Ins. • Axis • Endurance Re • Everest Re • Lancashire • Max. Re • Montpelier U of H Presentation - January 2007 • Starr Excess • XL Insurance • Zurich Insurance 59

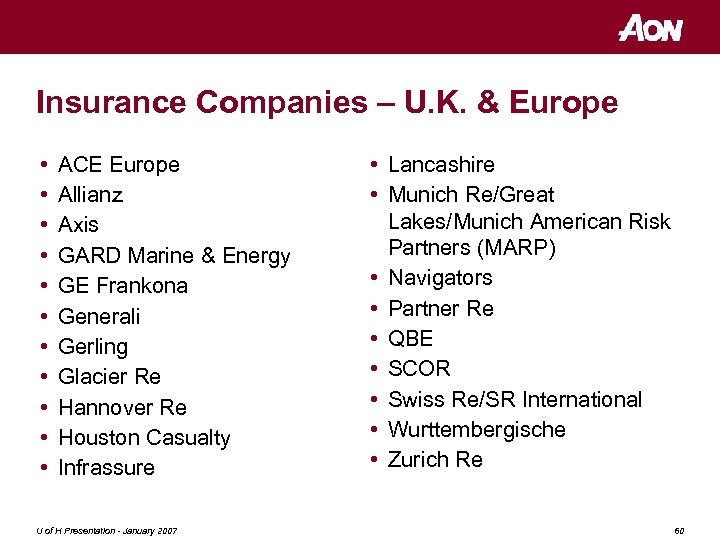

Insurance Companies – U. K. & Europe • • • ACE Europe Allianz Axis GARD Marine & Energy GE Frankona Generali Gerling Glacier Re Hannover Re Houston Casualty Infrassure U of H Presentation - January 2007 • Lancashire • Munich Re/Great Lakes/Munich American Risk Partners (MARP) • Navigators • Partner Re • QBE • SCOR • Swiss Re/SR International • Wurttembergische • Zurich Re 60

Insurance Companies – U. K. & Europe • • • ACE Europe Allianz Axis GARD Marine & Energy GE Frankona Generali Gerling Glacier Re Hannover Re Houston Casualty Infrassure U of H Presentation - January 2007 • Lancashire • Munich Re/Great Lakes/Munich American Risk Partners (MARP) • Navigators • Partner Re • QBE • SCOR • Swiss Re/SR International • Wurttembergische • Zurich Re 60

Insurance Program Marketing Mutuals • Assessable • Non-Assessable U of H Presentation - January 2007 61

Insurance Program Marketing Mutuals • Assessable • Non-Assessable U of H Presentation - January 2007 61

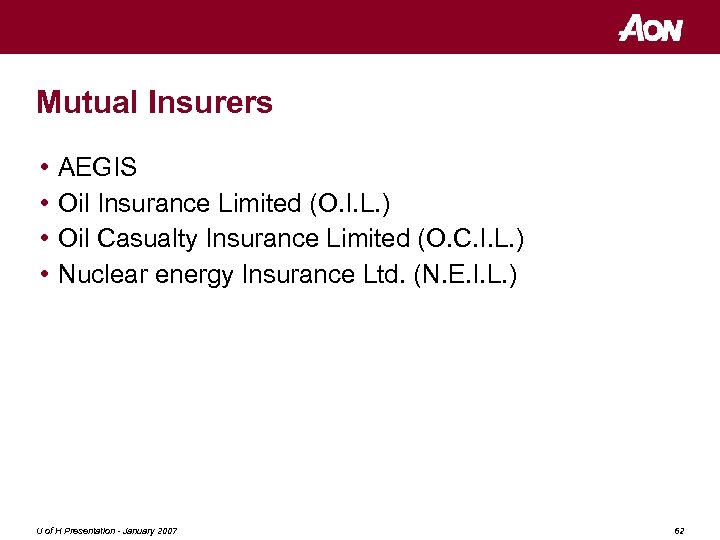

Mutual Insurers • • AEGIS Oil Insurance Limited (O. I. L. ) Oil Casualty Insurance Limited (O. C. I. L. ) Nuclear energy Insurance Ltd. (N. E. I. L. ) U of H Presentation - January 2007 62

Mutual Insurers • • AEGIS Oil Insurance Limited (O. I. L. ) Oil Casualty Insurance Limited (O. C. I. L. ) Nuclear energy Insurance Ltd. (N. E. I. L. ) U of H Presentation - January 2007 62

Insurance Program Marketing U of H Presentation - January 2007 63

Insurance Program Marketing U of H Presentation - January 2007 63

What is Lloyd’s? • A marketplace • First published reference – 1688 • First “breakaway group of professional underwriters – 1769 • First reinsurance contract (C. E. Heath) – 1880 • San Francisco earthquake (1906) – “Pay all our policyholders in full, irrespective of the terms of their policies. ” – C. E. Heath • Central Guarantee Fund – 1925 • LATF – 1939 • GAAP Accounting – 2005 U of H Presentation - January 2007 64

What is Lloyd’s? • A marketplace • First published reference – 1688 • First “breakaway group of professional underwriters – 1769 • First reinsurance contract (C. E. Heath) – 1880 • San Francisco earthquake (1906) – “Pay all our policyholders in full, irrespective of the terms of their policies. ” – C. E. Heath • Central Guarantee Fund – 1925 • LATF – 1939 • GAAP Accounting – 2005 U of H Presentation - January 2007 64

Marketing at Lloyd’s • The Lloyd’s Broker • The Lloyd’s Syndicates • Names – Individual – Corporate • The “Slip” U of H Presentation - January 2007 65

Marketing at Lloyd’s • The Lloyd’s Broker • The Lloyd’s Syndicates • Names – Individual – Corporate • The “Slip” U of H Presentation - January 2007 65

What is Lloyd’s today? • The “Franchisor” (The Managing Agents are the Franchisees) • Franchise Board – Performance Management – Capital Management – Risk Management (RDS) U of H Presentation - January 2007 66

What is Lloyd’s today? • The “Franchisor” (The Managing Agents are the Franchisees) • Franchise Board – Performance Management – Capital Management – Risk Management (RDS) U of H Presentation - January 2007 66

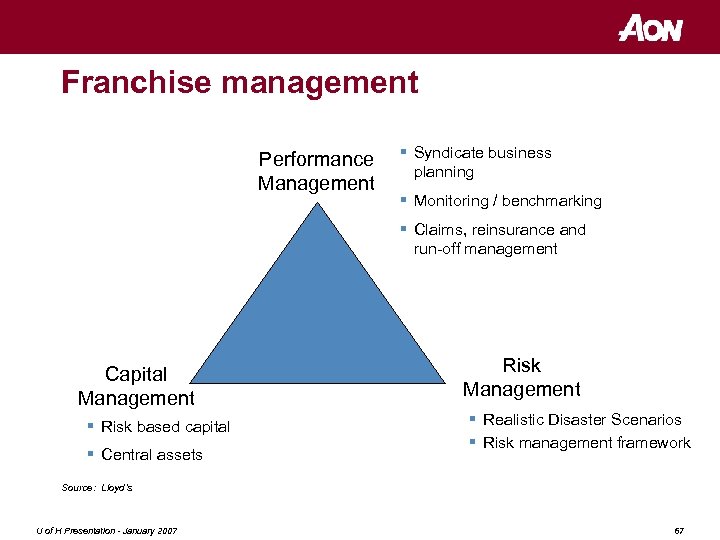

Franchise management Performance Management § Syndicate business planning § Monitoring / benchmarking § Claims, reinsurance and run-off management Capital Management § Risk based capital § Central assets Risk Management § Realistic Disaster Scenarios § Risk management framework Source: Lloyd’s U of H Presentation - January 2007 67

Franchise management Performance Management § Syndicate business planning § Monitoring / benchmarking § Claims, reinsurance and run-off management Capital Management § Risk based capital § Central assets Risk Management § Realistic Disaster Scenarios § Risk management framework Source: Lloyd’s U of H Presentation - January 2007 67

What is Lloyd’s today? • • • Entrepreneurial, Dynamic, Diverse Innovative Consistent & Stable Solvent Global U of H Presentation - January 2007 68

What is Lloyd’s today? • • • Entrepreneurial, Dynamic, Diverse Innovative Consistent & Stable Solvent Global U of H Presentation - January 2007 68

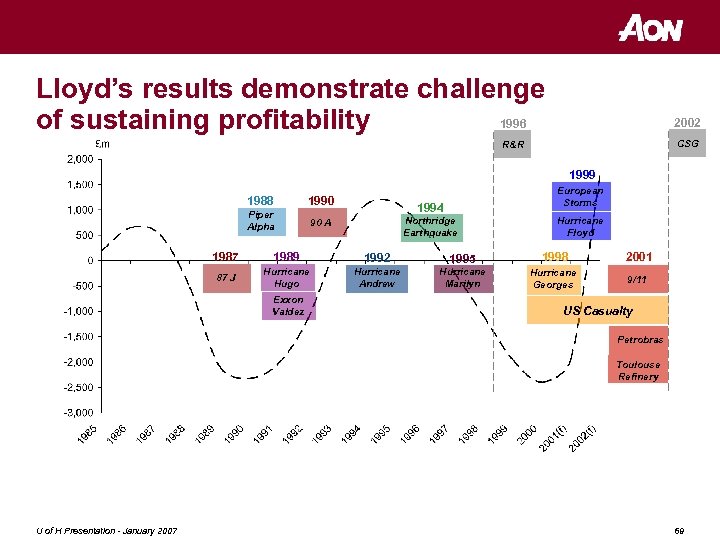

Lloyd’s results demonstrate challenge 1996 of sustaining profitability 2002 CSG R&R 1985 & prior 1999 APH 1988 1990 Piper Alpha European Storms 1994 Northridge Earthquake 90 A Hurricane Floyd 1987 1989 1992 1995 1998 2001 87 J Hurricane Hugo Hurricane Andrew Hurricane Marilyn Hurricane Georges 9/11 Exxon Valdez US Casualty Petrobras Toulouse Refinery (f) = forecast Source: Lloyd’s, results and forecasts under 3 year accounting U of H Presentation - January 2007 69

Lloyd’s results demonstrate challenge 1996 of sustaining profitability 2002 CSG R&R 1985 & prior 1999 APH 1988 1990 Piper Alpha European Storms 1994 Northridge Earthquake 90 A Hurricane Floyd 1987 1989 1992 1995 1998 2001 87 J Hurricane Hugo Hurricane Andrew Hurricane Marilyn Hurricane Georges 9/11 Exxon Valdez US Casualty Petrobras Toulouse Refinery (f) = forecast Source: Lloyd’s, results and forecasts under 3 year accounting U of H Presentation - January 2007 69

Why is Lloyd’s important? • Second largest “surplus lines” market in the U. S. (after AIG) [42% of Lloyd’s market premium is from U. S. ] • Center of the energy, marine and aviation global insurance markets • 6 th largest reinsurer U of H Presentation - January 2007 70

Why is Lloyd’s important? • Second largest “surplus lines” market in the U. S. (after AIG) [42% of Lloyd’s market premium is from U. S. ] • Center of the energy, marine and aviation global insurance markets • 6 th largest reinsurer U of H Presentation - January 2007 70

Why is Lloyd’s important? • Does business in over 200 countries & territories • Insures – – – 93% of all Dow Jones Industrial Average companies 94% of FTSE 100 companies 85% of Fortune 500 82% of Fortune European Top 50 The top 7 pharmaceuticals The top 20 banks U of H Presentation - January 2007 71

Why is Lloyd’s important? • Does business in over 200 countries & territories • Insures – – – 93% of all Dow Jones Industrial Average companies 94% of FTSE 100 companies 85% of Fortune 500 82% of Fortune European Top 50 The top 7 pharmaceuticals The top 20 banks U of H Presentation - January 2007 71

Marketing at Lloyd’s – How much “CAPACITY” is available? • Capacity to provide limits of insurance • “Stamp” capacity – the ability to accept premium on behalf of “Names” ($31. 4 billion for 2007) U of H Presentation - January 2007 72

Marketing at Lloyd’s – How much “CAPACITY” is available? • Capacity to provide limits of insurance • “Stamp” capacity – the ability to accept premium on behalf of “Names” ($31. 4 billion for 2007) U of H Presentation - January 2007 72

The Lloyd’s Market • 46 Managing Agents • 437 active syndicates in 1980; 62 in 2006 – Underwriters, Claims professionals, Accountants, Attorneys, Support staff, etc. • Average Syndicate stamp capacity $411 million • 163 accredited brokers • 4, 000 people daily U of H Presentation - January 2007 73

The Lloyd’s Market • 46 Managing Agents • 437 active syndicates in 1980; 62 in 2006 – Underwriters, Claims professionals, Accountants, Attorneys, Support staff, etc. • Average Syndicate stamp capacity $411 million • 163 accredited brokers • 4, 000 people daily U of H Presentation - January 2007 73

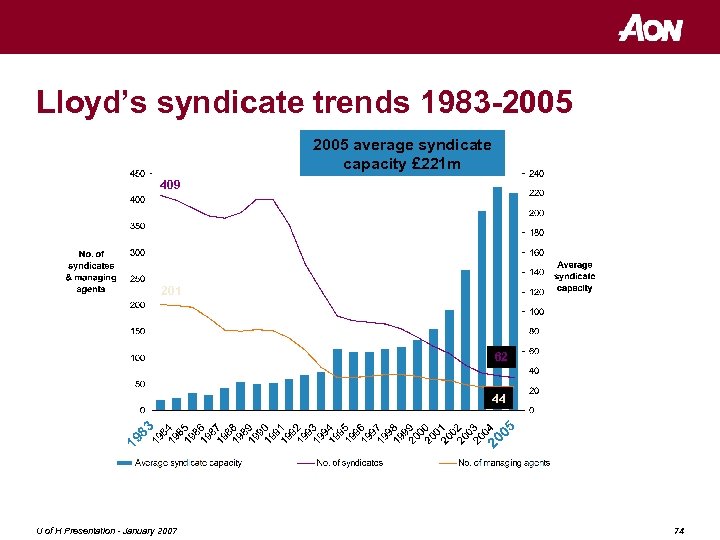

Lloyd’s syndicate trends 1983 -2005 average syndicate capacity £ 221 m £m 409 201 62 44 3 8 19 5 00 2 Source: Lloyd’s U of H Presentation - January 2007 74

Lloyd’s syndicate trends 1983 -2005 average syndicate capacity £ 221 m £m 409 201 62 44 3 8 19 5 00 2 Source: Lloyd’s U of H Presentation - January 2007 74

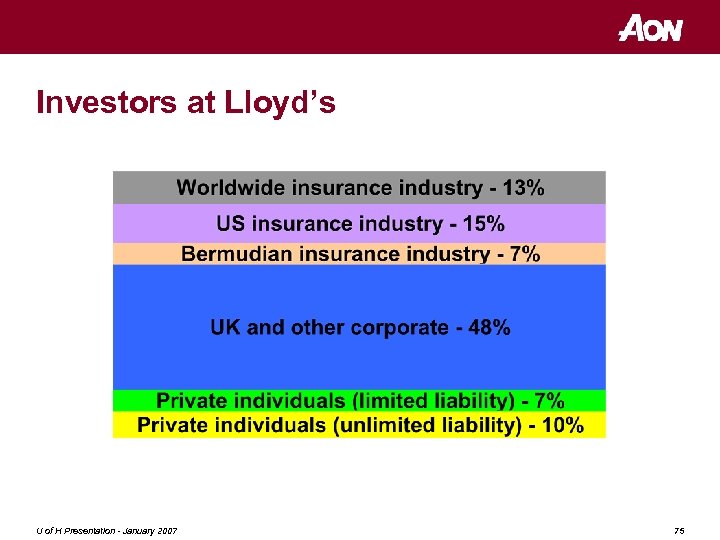

Investors at Lloyd’s U of H Presentation - January 2007 75

Investors at Lloyd’s U of H Presentation - January 2007 75

Investors at Lloyd’s • 111 corporate members • 1, 497 individual (unlimited liability) “Names” • 468 Name Companies (representing limited liability individuals) • 132 Scottish Limited Partnerships U of H Presentation - January 2007 76

Investors at Lloyd’s • 111 corporate members • 1, 497 individual (unlimited liability) “Names” • 468 Name Companies (representing limited liability individuals) • 132 Scottish Limited Partnerships U of H Presentation - January 2007 76

Placing business at Lloyd’s • • • The Lloyd’s broker Negotiations at “the Box” Standing in “the queue” Meetings with clients Contract documentation – The “Slip” – The “Wording” – Con. Cert • Uberrimae fidei • Lloyd’s in the 21 st Century U of H Presentation - January 2007 77

Placing business at Lloyd’s • • • The Lloyd’s broker Negotiations at “the Box” Standing in “the queue” Meetings with clients Contract documentation – The “Slip” – The “Wording” – Con. Cert • Uberrimae fidei • Lloyd’s in the 21 st Century U of H Presentation - January 2007 77

Placing business at Lloyd’s Market dynamics • Subscription market Anti-trust implications? • Leaders & Followers • The (underwriting) decision making process – Coverage (incl. Limits/Retentions) – Price – Line size • Facilities / Lineslips • Information sharing • Choosing a Leader U of H Presentation - January 2007 78

Placing business at Lloyd’s Market dynamics • Subscription market Anti-trust implications? • Leaders & Followers • The (underwriting) decision making process – Coverage (incl. Limits/Retentions) – Price – Line size • Facilities / Lineslips • Information sharing • Choosing a Leader U of H Presentation - January 2007 78

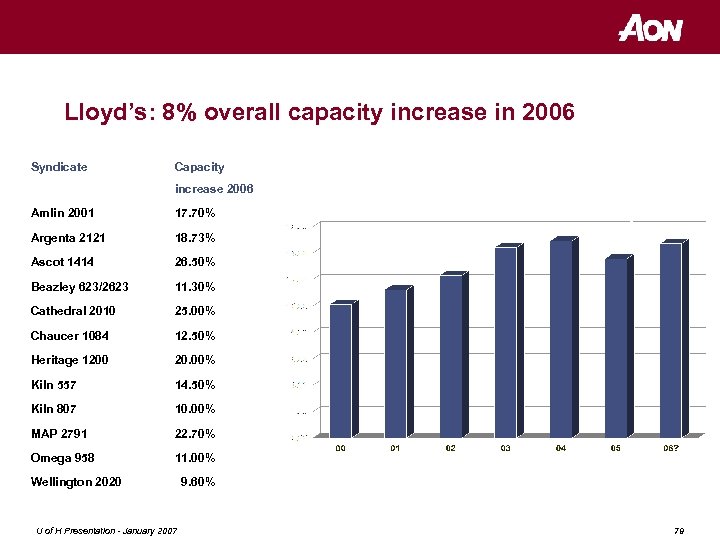

Lloyd’s: 8% overall capacity increase in 2006 Syndicate Capacity increase 2006 Amlin 2001 17. 70% Argenta 2121 26. 50% Beazley 623/2623 11. 30% Cathedral 2010 25. 00% Chaucer 1084 12. 50% Heritage 1200 20. 00% Kiln 557 14. 50% Kiln 807 10. 00% MAP 2791 22. 70% Omega 958 11. 00% (Would have reduced by 8% in absence of hurricanes) 18. 73% Ascot 1414 Capacity (£bn) Wellington 2020 U of H Presentation - January 2007 9. 60% (anticipated) 65% of capacity in the hands of the top 20 direct capital providers Source: Lloyd’s/company announcements 79

Lloyd’s: 8% overall capacity increase in 2006 Syndicate Capacity increase 2006 Amlin 2001 17. 70% Argenta 2121 26. 50% Beazley 623/2623 11. 30% Cathedral 2010 25. 00% Chaucer 1084 12. 50% Heritage 1200 20. 00% Kiln 557 14. 50% Kiln 807 10. 00% MAP 2791 22. 70% Omega 958 11. 00% (Would have reduced by 8% in absence of hurricanes) 18. 73% Ascot 1414 Capacity (£bn) Wellington 2020 U of H Presentation - January 2007 9. 60% (anticipated) 65% of capacity in the hands of the top 20 direct capital providers Source: Lloyd’s/company announcements 79

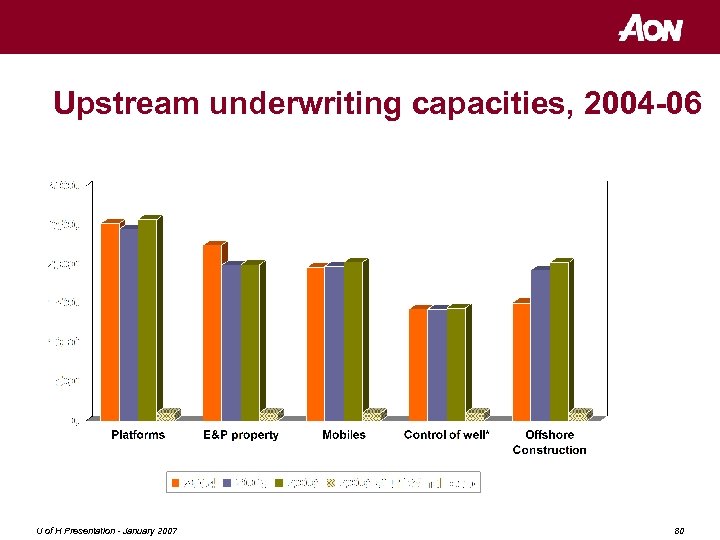

Upstream underwriting capacities, 2004 -06 US$m * max. U of H Presentation - January 2007 OEE limits purchased in commercial market typically US$ 300 m Source: Aon 80 Limited

Upstream underwriting capacities, 2004 -06 US$m * max. U of H Presentation - January 2007 OEE limits purchased in commercial market typically US$ 300 m Source: Aon 80 Limited

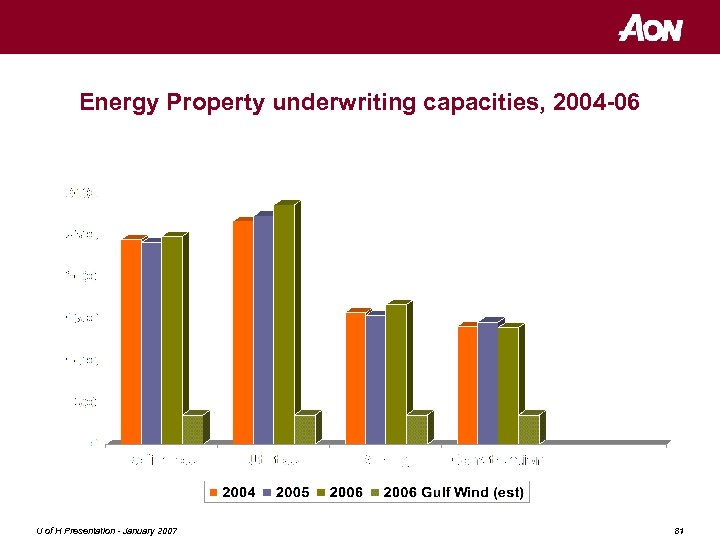

Energy Property underwriting capacities, 2004 -06 US$m U of H Presentation - January 2007 Source: Aon 81 Limited

Energy Property underwriting capacities, 2004 -06 US$m U of H Presentation - January 2007 Source: Aon 81 Limited

Energy Insurance and Risk Management The insurance transaction distribution system The role of the markets The role of the broker A presentation at The University of Houston January 25, 2007 U of H Presentation - January 2007 82

Energy Insurance and Risk Management The insurance transaction distribution system The role of the markets The role of the broker A presentation at The University of Houston January 25, 2007 U of H Presentation - January 2007 82