d0b989bc00182713825ba16ddf97e2b3.ppt

- Количество слайдов: 21

Energy Efficiency in District Heating and Joint Implementation Mark van Wees CAP SD Energy and Climate Consultants Moscow, 21 -23 August 2006

Energy Efficiency in District Heating and Joint Implementation Mark van Wees CAP SD Energy and Climate Consultants Moscow, 21 -23 August 2006

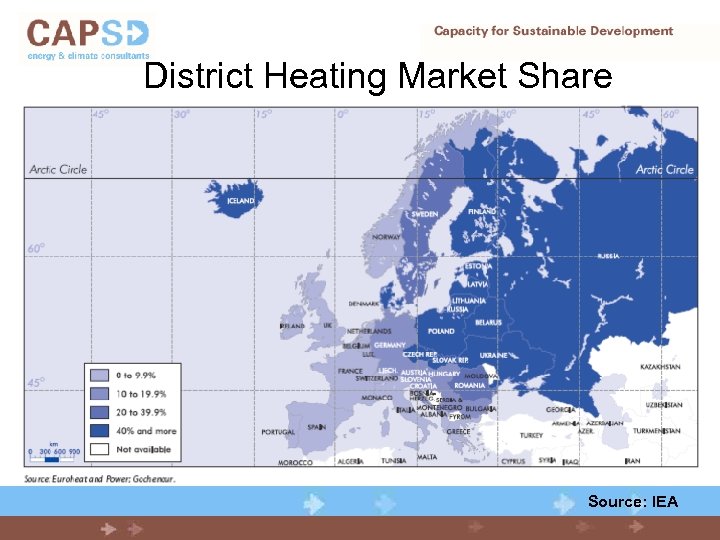

District Heating Market Share Source: IEA

District Heating Market Share Source: IEA

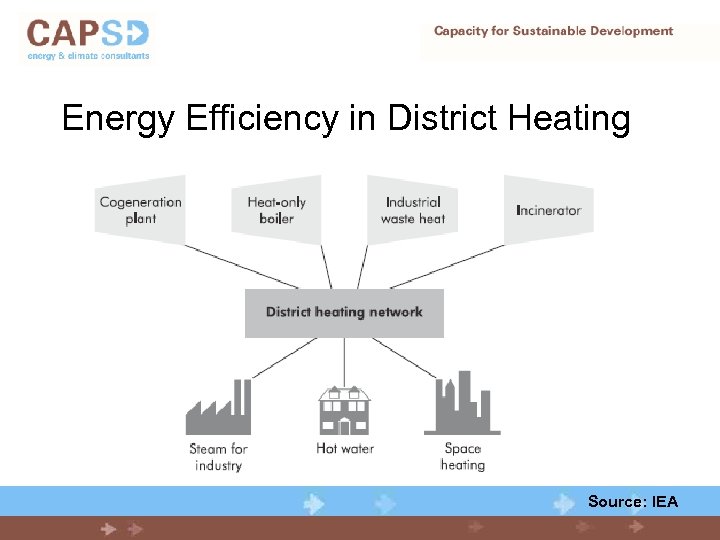

Energy Efficiency in District Heating Source: IEA

Energy Efficiency in District Heating Source: IEA

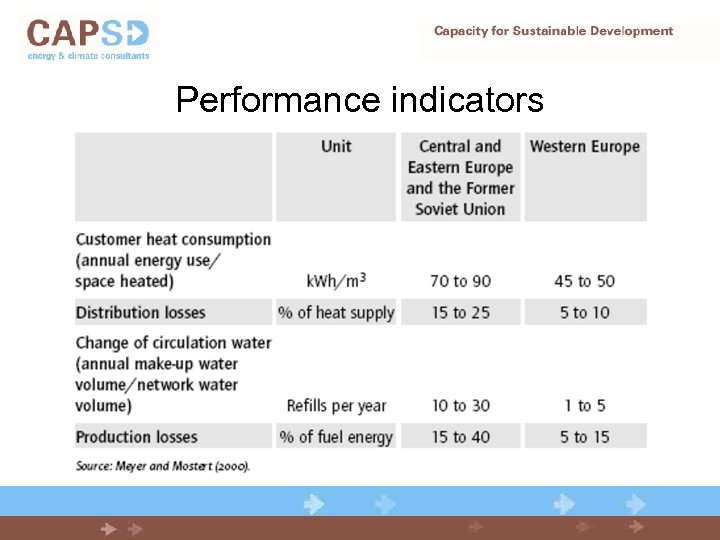

Performance indicators

Performance indicators

1. Promotion of energy efficiency in district heating systems in the EU · Standards and certification – Regulation of boiler efficiency – Energy audits and certification · Benchmarking – Energy efficiency benchmarking in tariff system – Voluntary programmes · Tax incentives – Investments in energy efficiency · R&D · Best practice programmes – Benchmarking, technical expertise, auditing · Financing (by governments) – Project preparation grants and investment subsidies – Guarantees – Carbon financing

1. Promotion of energy efficiency in district heating systems in the EU · Standards and certification – Regulation of boiler efficiency – Energy audits and certification · Benchmarking – Energy efficiency benchmarking in tariff system – Voluntary programmes · Tax incentives – Investments in energy efficiency · R&D · Best practice programmes – Benchmarking, technical expertise, auditing · Financing (by governments) – Project preparation grants and investment subsidies – Guarantees – Carbon financing

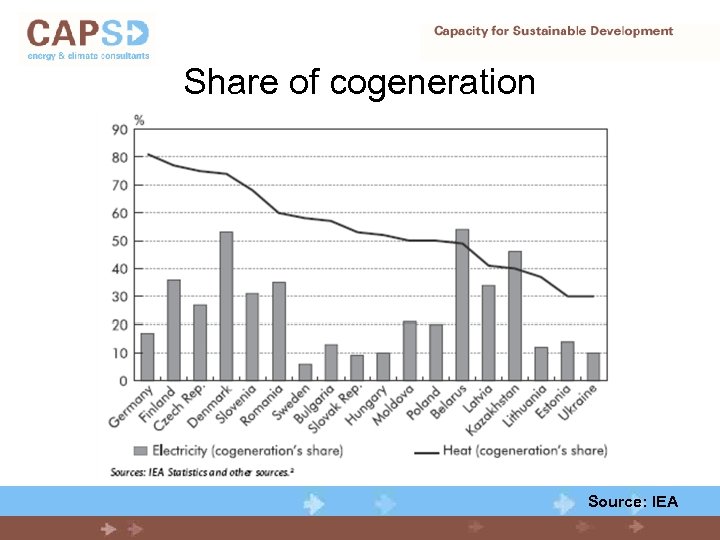

Share of cogeneration Source: IEA

Share of cogeneration Source: IEA

2. Promotion cogeneration in the EU · Fair market conditions (cost sharing between electricity and heat) · Bonus payments and feed-in tariffs · Subsidies/grants for new capacity · Tax incentives – Investments in energy efficiency · R&D · Best practice programmes – Benchmarking, technical expertise, auditing · Financing – Project preparation grants and investment subsidies – Guarantees – Carbon financing (Joint Implementation)

2. Promotion cogeneration in the EU · Fair market conditions (cost sharing between electricity and heat) · Bonus payments and feed-in tariffs · Subsidies/grants for new capacity · Tax incentives – Investments in energy efficiency · R&D · Best practice programmes – Benchmarking, technical expertise, auditing · Financing – Project preparation grants and investment subsidies – Guarantees – Carbon financing (Joint Implementation)

3. Promotion of energy efficiency in end-use of heat (buildings) in EU · · · Metering and control Building energy codes Energy audits and certifications Information campaigns Tax incentives – Investments in energy efficiency · R&D and best practice programmes – Benchmarking, technical expertise, auditing · Financing – Project preparation grants and investment subsidies

3. Promotion of energy efficiency in end-use of heat (buildings) in EU · · · Metering and control Building energy codes Energy audits and certifications Information campaigns Tax incentives – Investments in energy efficiency · R&D and best practice programmes – Benchmarking, technical expertise, auditing · Financing – Project preparation grants and investment subsidies

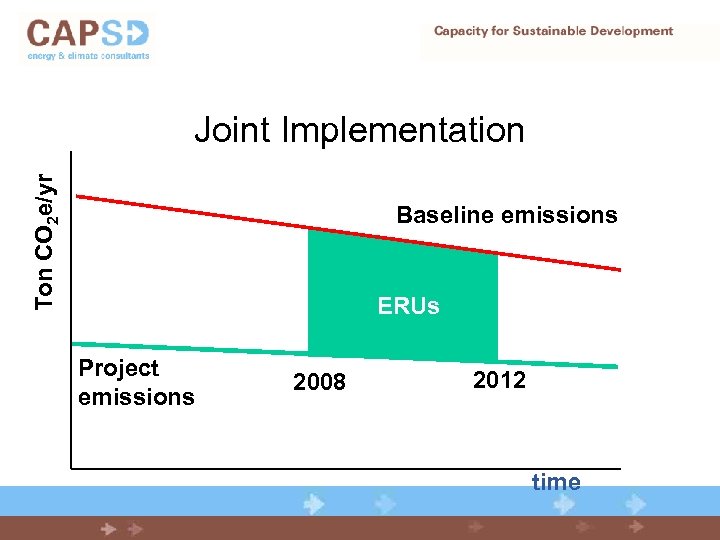

Ton CO 2 e/yr Joint Implementation Baseline emissions ERUs Project emissions 2008 2012 time

Ton CO 2 e/yr Joint Implementation Baseline emissions ERUs Project emissions 2008 2012 time

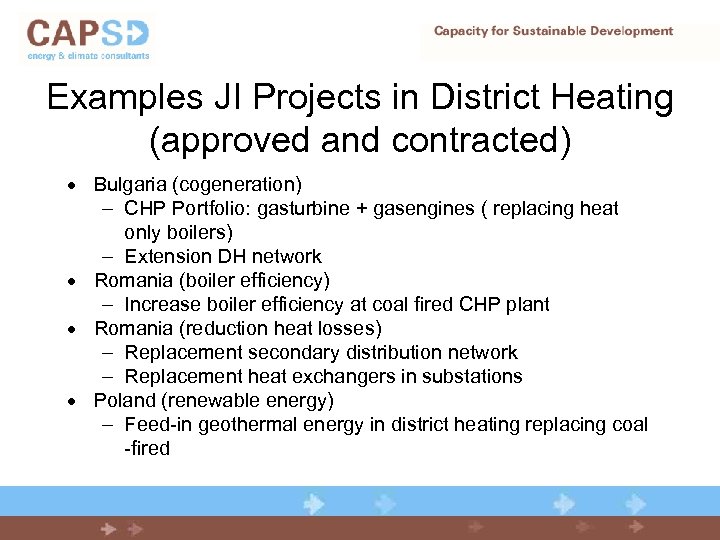

Examples JI Projects in District Heating (approved and contracted) · Bulgaria (cogeneration) – CHP Portfolio: gasturbine + gasengines ( replacing heat only boilers) – Extension DH network · Romania (boiler efficiency) – Increase boiler efficiency at coal fired CHP plant · Romania (reduction heat losses) – Replacement secondary distribution network – Replacement heat exchangers in substations · Poland (renewable energy) – Feed-in geothermal energy in district heating replacing coal -fired

Examples JI Projects in District Heating (approved and contracted) · Bulgaria (cogeneration) – CHP Portfolio: gasturbine + gasengines ( replacing heat only boilers) – Extension DH network · Romania (boiler efficiency) – Increase boiler efficiency at coal fired CHP plant · Romania (reduction heat losses) – Replacement secondary distribution network – Replacement heat exchangers in substations · Poland (renewable energy) – Feed-in geothermal energy in district heating replacing coal -fired

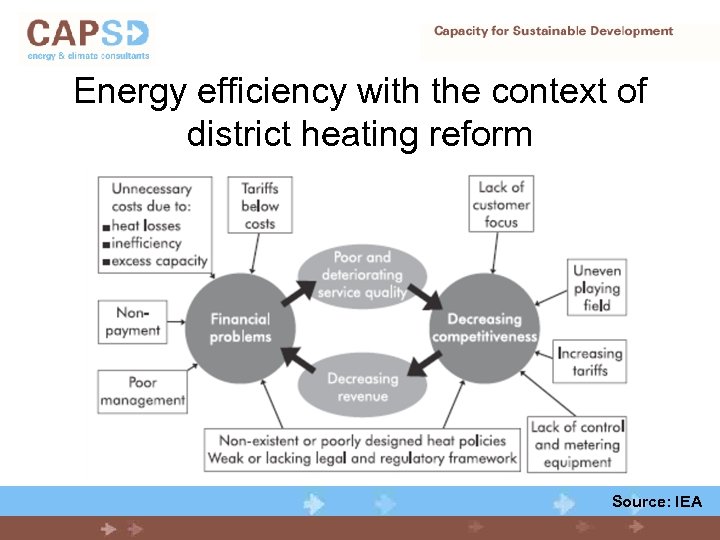

Energy efficiency with the context of district heating reform Source: IEA

Energy efficiency with the context of district heating reform Source: IEA

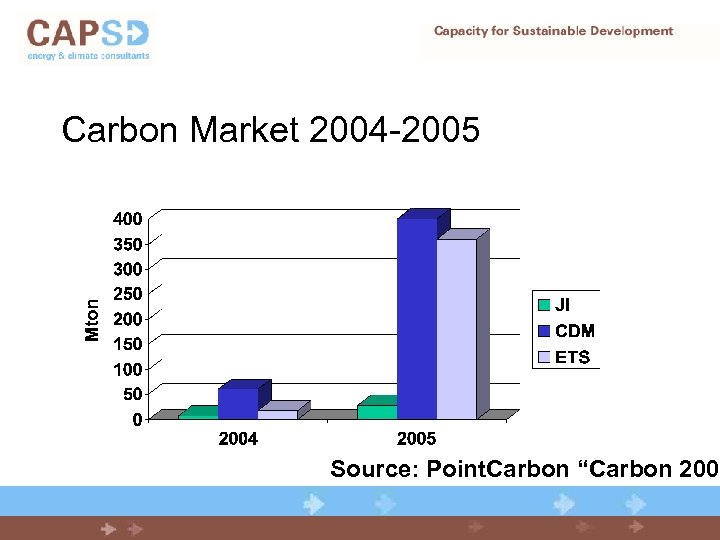

Carbon Market 2004 -2005 Source: Point. Carbon “Carbon 2006

Carbon Market 2004 -2005 Source: Point. Carbon “Carbon 2006

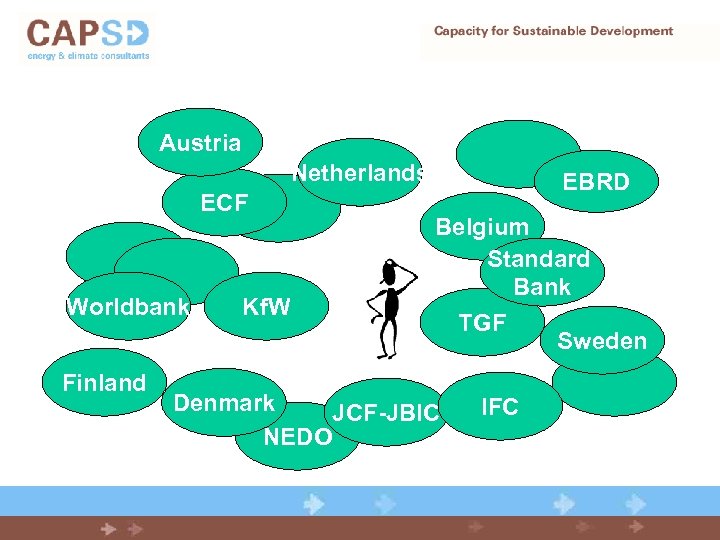

Austria Netherlands ECF Worldbank Finland Kf. W EBRD Belgium Standard Bank TGF Sweden Denmark JCF-JBIC NEDO IFC

Austria Netherlands ECF Worldbank Finland Kf. W EBRD Belgium Standard Bank TGF Sweden Denmark JCF-JBIC NEDO IFC

Categories of Buyers 1. Government: buy for Kyoto compliance / risk averse / inflexible in transaction / passive approach to project identification / tenders 2. Private sector: buy for compliance EU ETS / some flexibility in transaction / medium risk / direct project-byproject approach in purchasing 3. Banks/funds/traders: buy for trading / can serve different buyers / balancing risk versus profit / flexible transactions and price structures / active approach to project identification

Categories of Buyers 1. Government: buy for Kyoto compliance / risk averse / inflexible in transaction / passive approach to project identification / tenders 2. Private sector: buy for compliance EU ETS / some flexibility in transaction / medium risk / direct project-byproject approach in purchasing 3. Banks/funds/traders: buy for trading / can serve different buyers / balancing risk versus profit / flexible transactions and price structures / active approach to project identification

Two typical buyers in Russia · Passive buyer: – Now waits for certainty on JI infrastructure (Lo. A) – Limited presence in Russia – New proposals in Russia on the shelf or treated with care – Examples: Belgium, Netherlands · Active buyer: – Invests in new project identification and development – Willing to pursue (conditional) transactions – Strong presence in Russia (agents, existing network) – Examples: EBRD, Denmark, traders

Two typical buyers in Russia · Passive buyer: – Now waits for certainty on JI infrastructure (Lo. A) – Limited presence in Russia – New proposals in Russia on the shelf or treated with care – Examples: Belgium, Netherlands · Active buyer: – Invests in new project identification and development – Willing to pursue (conditional) transactions – Strong presence in Russia (agents, existing network) – Examples: EBRD, Denmark, traders

Differences between buyers? · · · · Interest in Russian market Volume to be purchased Preferred/eligible projects Risk profile Price and other transaction terms Flexibility in contract terms Support in project development – financial, technical, moral · Combination with project finance

Differences between buyers? · · · · Interest in Russian market Volume to be purchased Preferred/eligible projects Risk profile Price and other transaction terms Flexibility in contract terms Support in project development – financial, technical, moral · Combination with project finance

International Financing Schemes offering project+carbon financing · World Bank (IFC) · European Bank for Reconstruction and Development (EBRD) · European Investment Bank (EIB) · Nordic Environment Finance Corporation (NEFCO) + Private sector schemes

International Financing Schemes offering project+carbon financing · World Bank (IFC) · European Bank for Reconstruction and Development (EBRD) · European Investment Bank (EIB) · Nordic Environment Finance Corporation (NEFCO) + Private sector schemes

How to select a buyer? · Status of your project (initial idea or fully developed)? · Your capacity in project development? Required technical and financial support? · Small-scale project? Others? · Combination with project financing necessary? · Risk profile project and host company? · Financial objectives (revenues, price, upfront payments, etc. )?

How to select a buyer? · Status of your project (initial idea or fully developed)? · Your capacity in project development? Required technical and financial support? · Small-scale project? Others? · Combination with project financing necessary? · Risk profile project and host company? · Financial objectives (revenues, price, upfront payments, etc. )?

Marketing your project · · · Market research and orientation Shortlist of buyers Non-exclusive initial discussions with buyers Exclusivity and compensation preparation costs Preparation documentation (PDD) Negotiations on transaction Ø Emission Reduction Purchase Agreement

Marketing your project · · · Market research and orientation Shortlist of buyers Non-exclusive initial discussions with buyers Exclusivity and compensation preparation costs Preparation documentation (PDD) Negotiations on transaction Ø Emission Reduction Purchase Agreement

Finding the right buyer · · New buyers still arrive Others may change their strategy in Russia Some may even leave again New mechanisms in the future Study the market and shop around!

Finding the right buyer · · New buyers still arrive Others may change their strategy in Russia Some may even leave again New mechanisms in the future Study the market and shop around!

Conclusions · Increasing energy efficiency in district heating is important for economic, social and environmental reasons · Potential JI is substantial and demand is still growing · Decision of the Russian government on JI badly needed · Active involvement of the district heating sector in the national and international debate on JI is very important (e. g. National Program) !

Conclusions · Increasing energy efficiency in district heating is important for economic, social and environmental reasons · Potential JI is substantial and demand is still growing · Decision of the Russian government on JI badly needed · Active involvement of the district heating sector in the national and international debate on JI is very important (e. g. National Program) !