c3df255482b70b21f4202c3bb606e1d7.ppt

- Количество слайдов: 17

Energy Efficiency Funding Opportunities Jen Muir JKMuir, LLC 860 -367 -3570 Jen. Muir@jkmuir. com Leo H. Le. Boeuf CL&P leboelh@nu. com 860 -665 -5357

Energy Efficiency Funding Opportunities Jen Muir JKMuir, LLC 860 -367 -3570 Jen. Muir@jkmuir. com Leo H. Le. Boeuf CL&P leboelh@nu. com 860 -665 -5357

Funding • Low cost & no cost improvements • CT Energy Efficiency Fund • Fund up to 75% of project cost • $1 M / customer / year • Funding provided as a rebate after project completion • Funding currently available

Funding • Low cost & no cost improvements • CT Energy Efficiency Fund • Fund up to 75% of project cost • $1 M / customer / year • Funding provided as a rebate after project completion • Funding currently available

Incentive Programs What’s eligible Prescriptive rebates (lighting/HVAC) Custom projects Pumps, aeration, VFDs, controls/automation Baseline data Calculating savings (k. W & $) Correspondence with utility

Incentive Programs What’s eligible Prescriptive rebates (lighting/HVAC) Custom projects Pumps, aeration, VFDs, controls/automation Baseline data Calculating savings (k. W & $) Correspondence with utility

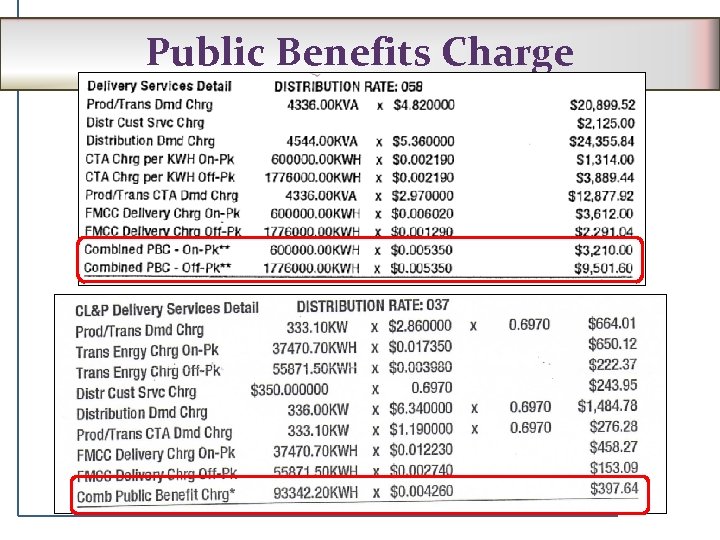

Public Benefits Charge

Public Benefits Charge

What is the Program? • Connecticut Energy Efficiency Fund (CEEF) – 3 mill charge on all electric and gas bills – CL&P and UI Administer the Fund Electric Programs – CL&P Administers the Fund Gas Programs • Incentives to Do the Right Design – Provides funds to promote use of energy saving designs and equipment

What is the Program? • Connecticut Energy Efficiency Fund (CEEF) – 3 mill charge on all electric and gas bills – CL&P and UI Administer the Fund Electric Programs – CL&P Administers the Fund Gas Programs • Incentives to Do the Right Design – Provides funds to promote use of energy saving designs and equipment

The Big Picture • Gas and Electric Projects Eligible • EO - Energy Opportunities – For existing process equipment that are within design life • ECB - Energy Conscious Blueprint – For new designs – For replacement of process equipment beyond design life

The Big Picture • Gas and Electric Projects Eligible • EO - Energy Opportunities – For existing process equipment that are within design life • ECB - Energy Conscious Blueprint – For new designs – For replacement of process equipment beyond design life

EO Projects • Additions to existing equipment that will save energy – VFD on motors – Air Receiver tanks that allow lower pressure – Energy efficient lights – Automated Process controls – Software to shut down unused computers – Will need savings calculations

EO Projects • Additions to existing equipment that will save energy – VFD on motors – Air Receiver tanks that allow lower pressure – Energy efficient lights – Automated Process controls – Software to shut down unused computers – Will need savings calculations

EO Project Incentives (CL&P) • Lesser of – 40% of installed cost or – Greater of • $0. 35/annual k. Wh savings or • $1, 000/ summer peak k. W savings • or – $500 / point for Energy Management System • or – prescriptive $ per unit

EO Project Incentives (CL&P) • Lesser of – 40% of installed cost or – Greater of • $0. 35/annual k. Wh savings or • $1, 000/ summer peak k. W savings • or – $500 / point for Energy Management System • or – prescriptive $ per unit

ECB Projects • New Design/ Equipment or Replacement of Equipment > 75% Useful Life – Compare energy efficient equipment to base non energy efficient equipment – Will need $ for base and efficient equipment – Will need calculations for savings

ECB Projects • New Design/ Equipment or Replacement of Equipment > 75% Useful Life – Compare energy efficient equipment to base non energy efficient equipment – Will need $ for base and efficient equipment – Will need calculations for savings

ECB Project Incentives (CL&P) • Lesser of – 75% of incremental (base vs efficient) cost or – Greater of • $0. 50/annual k. Wh savings or • $1, 100/ summer peak k. W savings • or – prescriptive $ per unit • Incentive may vary according to the application and Electric Company

ECB Project Incentives (CL&P) • Lesser of – 75% of incremental (base vs efficient) cost or – Greater of • $0. 50/annual k. Wh savings or • $1, 100/ summer peak k. W savings • or – prescriptive $ per unit • Incentive may vary according to the application and Electric Company

Additional $ Caps (CL&P) • EO – $1, 000 annual cap per Federal Tax ID – http: //www. clp. com/downloads/Retrofit%20 Incentives. pdf? id=4294 986588&dl=t • ECB – $1, 000 annual cap per Federal Tax ID – Gas Projects require PURA approval > $100, 000 – http: //www. clp. com/downloads/ECB%20 Incentives. pdf? id=4294986 560&dl=t

Additional $ Caps (CL&P) • EO – $1, 000 annual cap per Federal Tax ID – http: //www. clp. com/downloads/Retrofit%20 Incentives. pdf? id=4294 986588&dl=t • ECB – $1, 000 annual cap per Federal Tax ID – Gas Projects require PURA approval > $100, 000 – http: //www. clp. com/downloads/ECB%20 Incentives. pdf? id=4294986 560&dl=t

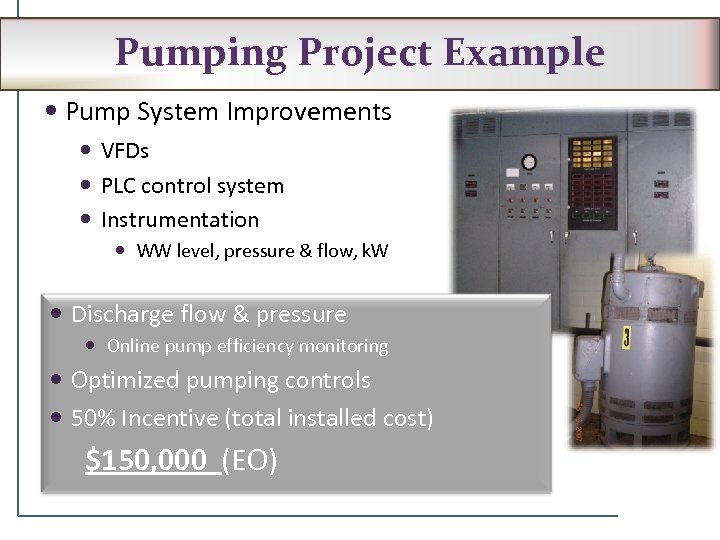

Pumping Project Example Pump System Improvements VFDs PLC control system Instrumentation WW level, pressure & flow, k. W Discharge flow & pressure Online pump efficiency monitoring Optimized pumping controls 50% Incentive (total installed cost) $150, 000 (EO)

Pumping Project Example Pump System Improvements VFDs PLC control system Instrumentation WW level, pressure & flow, k. W Discharge flow & pressure Online pump efficiency monitoring Optimized pumping controls 50% Incentive (total installed cost) $150, 000 (EO)

Aeration System Process modification Dissolved Oxygen controls New instrumentation - Air flow meters & air flow control valves New blower VFDs PLC control panel Expected savings = > 1 million k. Wh/yr Incentive funding $270, 000 (EO)

Aeration System Process modification Dissolved Oxygen controls New instrumentation - Air flow meters & air flow control valves New blower VFDs PLC control panel Expected savings = > 1 million k. Wh/yr Incentive funding $270, 000 (EO)

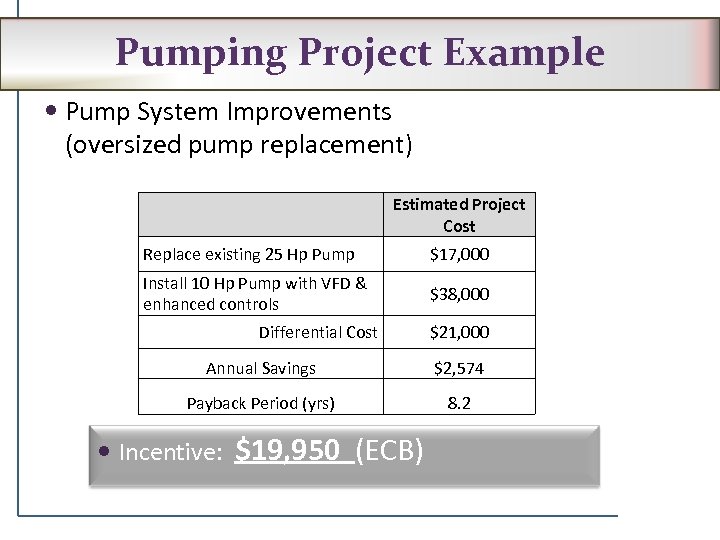

Pumping Project Example Pump System Improvements (oversized pump replacement) Estimated Project Cost Replace existing 25 Hp Pump $17, 000 Install 10 Hp Pump with VFD & enhanced controls $38, 000 Differential Cost $21, 000 Annual Savings $2, 574 Payback Period (yrs) 8. 2 Incentive: $19, 950 (ECB)

Pumping Project Example Pump System Improvements (oversized pump replacement) Estimated Project Cost Replace existing 25 Hp Pump $17, 000 Install 10 Hp Pump with VFD & enhanced controls $38, 000 Differential Cost $21, 000 Annual Savings $2, 574 Payback Period (yrs) 8. 2 Incentive: $19, 950 (ECB)

Aeration System – Blowers & Controls New Blowers High Efficiency units selected instead of standard design/models Enhanced controls also installed Dissolved Oxygen control Air flow meters & flow control valves PLC control panel Expected savings = > 1 million k. Wh/yr Incentive funding $900, 000 (EO & ECB)

Aeration System – Blowers & Controls New Blowers High Efficiency units selected instead of standard design/models Enhanced controls also installed Dissolved Oxygen control Air flow meters & flow control valves PLC control panel Expected savings = > 1 million k. Wh/yr Incentive funding $900, 000 (EO & ECB)

Wastewater Plant Upgrade Multiple measures – part of substantial facility upgrade Pump improvements – VFDs & controls New Blowers – aeration system Expected savings = > 1 million k. Wh/yr Incentive funding $480, 000 (EO & ECB)

Wastewater Plant Upgrade Multiple measures – part of substantial facility upgrade Pump improvements – VFDs & controls New Blowers – aeration system Expected savings = > 1 million k. Wh/yr Incentive funding $480, 000 (EO & ECB)

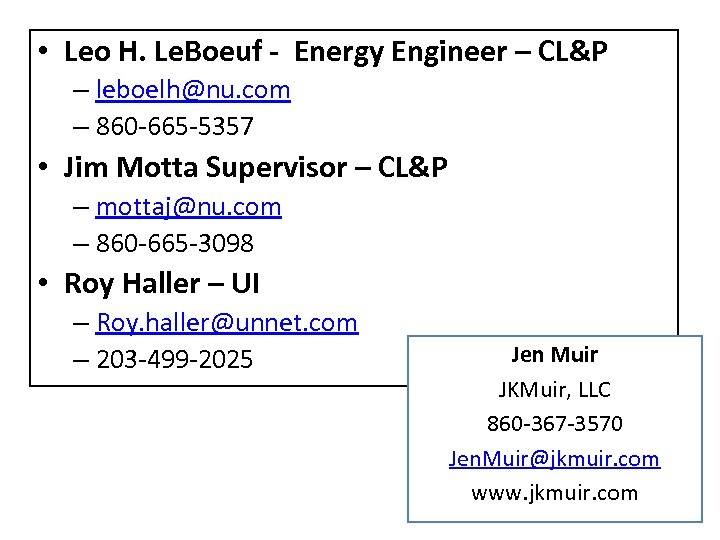

• Leo H. Le. Boeuf - Energy Engineer – CL&P – leboelh@nu. com – 860 -665 -5357 • Jim Motta Supervisor – CL&P – mottaj@nu. com – 860 -665 -3098 • Roy Haller – UI – Roy. haller@unnet. com – 203 -499 -2025 Jen Muir JKMuir, LLC 860 -367 -3570 Jen. Muir@jkmuir. com www. jkmuir. com

• Leo H. Le. Boeuf - Energy Engineer – CL&P – leboelh@nu. com – 860 -665 -5357 • Jim Motta Supervisor – CL&P – mottaj@nu. com – 860 -665 -3098 • Roy Haller – UI – Roy. haller@unnet. com – 203 -499 -2025 Jen Muir JKMuir, LLC 860 -367 -3570 Jen. Muir@jkmuir. com www. jkmuir. com